Key Insights

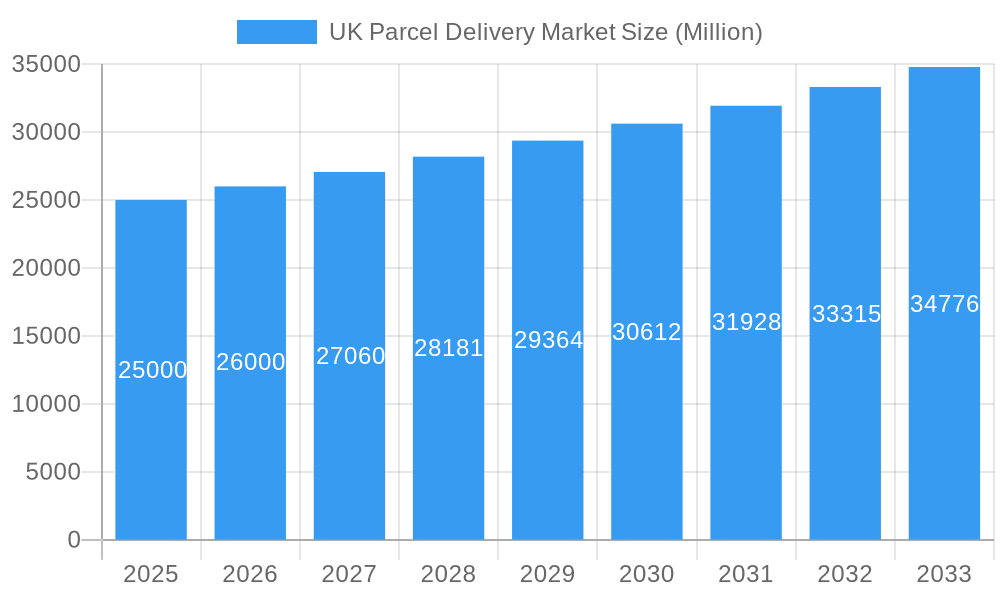

The UK parcel delivery market, projected to reach $500.13 billion by 2025, is experiencing significant expansion at a compound annual growth rate (CAGR) of 12.2% through 2033. This growth is primarily driven by the continued surge in e-commerce, with a notable increase in B2C deliveries. Key contributing sectors include healthcare and financial services, alongside a growing consumer preference for express delivery. The market is segmented by transport mode (air, road), end-user industry (e-commerce, BFSI, healthcare), destination (domestic, international), delivery speed (express, standard), and shipment weight. Intense competition exists among major players like DHL, FedEx, UPS, and Royal Mail, as well as specialized carriers. The B2C segment is expected to outpace B2B growth due to consumer spending trends, with higher demand anticipated in densely populated regions.

UK Parcel Delivery Market Market Size (In Billion)

Key challenges include fuel price volatility and potential driver shortages, impacting operational costs and delivery times. Increasing environmental regulations are also driving investment in sustainable logistics solutions, presenting both challenges and opportunities. The market's future is expected to be shaped by evolving e-commerce trends, advancements in logistics technology, and increasing consumer demand for faster and more cost-effective delivery. The demand for same-day and next-day deliveries, especially in urban areas, is a critical trend influencing strategic investments and service development. Consolidation through partnerships and acquisitions is anticipated as companies aim to enhance their market presence and service portfolios.

UK Parcel Delivery Market Company Market Share

UK Parcel Delivery Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the UK parcel delivery market, offering valuable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report leverages extensive data analysis and expert insights to provide a clear picture of market size, growth drivers, challenges, and future opportunities. Key players such as Otto GmbH & Co KG, DHL Group, Yodel, GEODIS, Rapid Parcel, FedEx, UPS, La Poste Group, APC Overnight, and International Distributions Services (including Royal Mail) are analyzed in detail.

UK Parcel Delivery Market Market Structure & Innovation Trends

The UK parcel delivery market is characterized by a dynamic interplay of established players and emerging competitors. Market concentration is moderate, with a few dominant players holding significant market share, while numerous smaller companies cater to niche segments. The market share of the top 5 players is estimated at xx%. Recent years have witnessed significant M&A activity, with deal values exceeding £xx Million in the past five years. These mergers and acquisitions reflect the increasing consolidation trend within the sector.

Key Market Structure Aspects:

- High Competition: Intense competition among established players and new entrants.

- Technological Disruption: Automation, AI, and data analytics are transforming operations.

- Regulatory Landscape: Stringent regulations concerning delivery times, environmental impact, and data privacy.

- Substitutes: Limited direct substitutes; however, alternative delivery models (e.g., crowd-sourced delivery) are emerging.

- End-User Demographics: The market is driven by the growth of e-commerce and increasing consumer demand for faster and more convenient delivery options. The age demographics are evenly distributed across all age groups.

UK Parcel Delivery Market Market Dynamics & Trends

The UK parcel delivery market exhibits robust growth, driven by the booming e-commerce sector, the expansion of online retail, and the increasing demand for faster and more reliable delivery services. The market is expected to register a CAGR of xx% during the forecast period (2025-2033). Technological advancements, such as automation, artificial intelligence, and drone delivery, are reshaping the industry landscape. Consumer preference shifts towards same-day delivery and flexible delivery options are influencing market dynamics. Competition remains fierce, prompting companies to adopt innovative strategies to gain a competitive edge. Market penetration for express delivery services is estimated at xx%, showcasing strong growth potential.

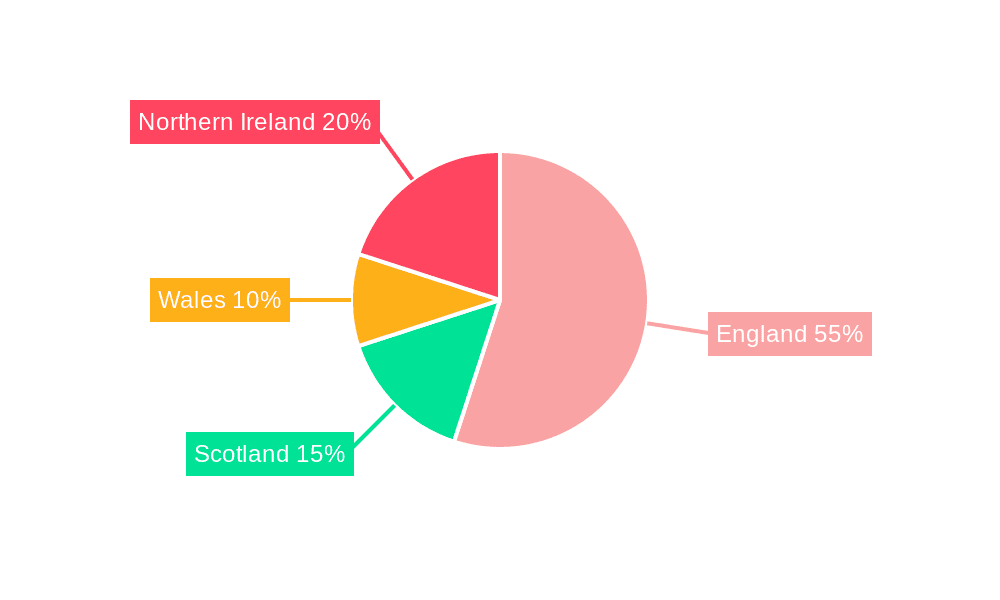

Dominant Regions & Segments in UK Parcel Delivery Market

The UK parcel delivery market is geographically dispersed, with significant activity across all regions. However, urban centers experience higher parcel volumes due to high population density and e-commerce hubs. The road segment dominates the mode of transport, accounting for xx% of the market share, given its extensive network and cost-effectiveness. E-commerce is the largest end-user industry, contributing to xx% of the market value, driven by the surge in online shopping. Domestic deliveries constitute the largest destination segment, capturing xx% of total volume. The B2C model is the most dominant, driven by the expanding e-commerce market, comprising xx% of the market share. Medium weight shipments (1-20kg) currently represent the largest shipment weight segment.

Key Drivers by Segment:

- Mode of Transport: Road – Extensive infrastructure; Air – Speed for long distances; Others – Niche applications (rail, sea).

- End User Industry: E-commerce – Online shopping boom; Wholesale and Retail Trade (Offline) – Traditional businesses leveraging delivery services; Healthcare – Pharmaceuticals and medical supplies.

- Destination: Domestic – High volume due to strong domestic e-commerce; International – Growing due to globalization of trade.

- Speed of Delivery: Express – Premium pricing, time-sensitive goods; Non-Express – Cost-effective for less urgent items.

- Model: B2C – Largest segment driven by online shopping; B2B – Supply chain logistics; C2C – Peer-to-peer marketplaces.

- Shipment Weight: Medium Weight Shipments – Most common package sizes.

UK Parcel Delivery Market Product Innovations

The UK parcel delivery market is experiencing a rapid evolution, fueled by groundbreaking product innovations designed to elevate efficiency, customer experience, and sustainability. Advanced technologies such as Artificial Intelligence (AI) and Machine Learning are revolutionizing route optimization, enabling dynamic adjustments to minimize transit times and fuel consumption. Predictive analytics are becoming increasingly sophisticated, providing more accurate delivery time estimates and proactive notifications to customers, thereby enhancing transparency and satisfaction. The exploration and integration of autonomous vehicles, including delivery robots and drones, are actively transforming last-mile logistics, promising faster, more accessible, and potentially cost-effective deliveries, especially in challenging urban environments. Beyond operational enhancements, there's a strong focus on innovative packaging solutions that not only ensure superior product protection during transit but also champion environmental responsibility through the use of recyclable, biodegradable, or reusable materials, directly addressing the growing consumer demand for eco-conscious services.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation analysis across various parameters:

- Mode of Transport: Air, Road, Others (Market size for each mode of transport is projected to reach £xx Million by 2033).

- End User Industry: E-commerce, BFSI, Healthcare, Manufacturing, Primary Industry, Wholesale and Retail Trade (Offline), Others (E-commerce will dominate with £xx Million in 2033).

- Destination: Domestic, International (Domestic deliveries will remain the largest segment).

- Speed of Delivery: Express, Non-Express (Express delivery will continue growing at a faster pace).

- Model: B2B, B2C, C2C (B2C will remain the dominant segment).

- Shipment Weight: Light Weight, Medium Weight, Heavy Weight Shipments (Medium weight shipments will continue to dominate).

Key Drivers of UK Parcel Delivery Market Growth

Several factors drive the growth of the UK parcel delivery market: the rapid expansion of e-commerce, increasing consumer demand for faster and more convenient delivery options, technological advancements in logistics and delivery technology, and government initiatives to improve infrastructure and logistics efficiency. Investment in infrastructure, such as improved road networks and logistics hubs, is also crucial. Furthermore, the growth of the online retail sector and increasing consumer expectations regarding delivery times are key drivers.

Challenges in the UK Parcel Delivery Market Sector

The UK parcel delivery market navigates a complex landscape of persistent challenges that significantly influence operational efficiency and profitability. The escalating costs of fuel remain a critical concern, directly impacting the economic viability of deliveries. A persistent shortage of qualified drivers, coupled with rising labor costs, poses a substantial hurdle, intensifying competition for skilled personnel and driving up operational expenses. The intricate nature of urban deliveries, characterized by traffic congestion, parking restrictions, and diverse delivery addresses, adds another layer of complexity. Maintaining resilient and agile supply chains amidst global uncertainties, including geopolitical events and unforeseen disruptions, is a paramount challenge. Furthermore, the increasing stringency of environmental regulations and the societal imperative for sustainable delivery solutions necessitate significant investment in greener fleet technologies and optimized operational strategies, adding further complexity and cost to the sector.

Emerging Opportunities in UK Parcel Delivery Market

The UK parcel delivery market is abuzz with emerging opportunities, signaling a dynamic period of growth and innovation. The ongoing expansion of e-commerce, coupled with evolving consumer expectations for speed and convenience, is driving significant growth in last-mile delivery solutions, creating demand for specialized and agile services. The increasing adoption of drone delivery technology, moving from experimental phases to commercial application, presents a transformative opportunity for rapid and efficient deliveries, particularly in remote or difficult-to-access areas. Strategic expansion into rural areas, where delivery penetration has historically been lower, offers a vast untapped market potential. The development of innovative, sustainable delivery models, such as electric vehicle fleets, consolidation hubs, and carbon-neutral delivery options, aligns with growing environmental consciousness and regulatory pressures, creating a competitive advantage. Moreover, the proliferation of omnichannel retail strategies is accelerating the need for seamlessly integrated delivery solutions that bridge the gap between online and physical shopping experiences, fostering new partnerships and service offerings.

Leading Players in the UK Parcel Delivery Market Market

Key Developments in UK Parcel Delivery Market Industry

November 2023: GEODIS opened a new 7,000 sq. m e-logistics platform in the UK, capable of storing over 500,000 SKUs and processing 5,000 orders daily. This expansion strengthens GEODIS's position in the UK market and enhances its e-commerce fulfillment capabilities.

November 2023: Yodel launched a six-month trial of parcel lockers in Northern Ireland in partnership with PayPoint, offering customers convenient contactless pickup options. This trial expands Yodel's delivery options and enhances its customer reach.

September 2023: The Otto Group plans to deploy Covariant robots in its fulfillment centers to improve operational efficiency, address labor market challenges, and enhance workplace quality. This technological investment demonstrates Otto Group's commitment to automation and process optimization.

Future Outlook for UK Parcel Delivery Market Market

The UK parcel delivery market is poised for continued growth, driven by the ongoing expansion of e-commerce, technological advancements, and changing consumer preferences. The increasing adoption of sustainable delivery practices and the emergence of new delivery models will further shape market dynamics. The market's future growth will depend on investments in infrastructure, technological innovations, and the ability to adapt to evolving regulatory frameworks. The market is expected to continue expanding, creating new opportunities for businesses and investment within this dynamic sector.

UK Parcel Delivery Market Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International

-

2. Speed Of Delivery

- 2.1. Express

- 2.2. Non-Express

-

3. Model

- 3.1. Business-to-Business (B2B)

- 3.2. Business-to-Consumer (B2C)

- 3.3. Consumer-to-Consumer (C2C)

-

4. Shipment Weight

- 4.1. Heavy Weight Shipments

- 4.2. Light Weight Shipments

- 4.3. Medium Weight Shipments

-

5. Mode Of Transport

- 5.1. Air

- 5.2. Road

- 5.3. Others

-

6. End User Industry

- 6.1. E-Commerce

- 6.2. Financial Services (BFSI)

- 6.3. Healthcare

- 6.4. Manufacturing

- 6.5. Primary Industry

- 6.6. Wholesale and Retail Trade (Offline)

- 6.7. Others

UK Parcel Delivery Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Parcel Delivery Market Regional Market Share

Geographic Coverage of UK Parcel Delivery Market

UK Parcel Delivery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle

- 3.3. Market Restrains

- 3.3.1. Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Parcel Delivery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 5.2.1. Express

- 5.2.2. Non-Express

- 5.3. Market Analysis, Insights and Forecast - by Model

- 5.3.1. Business-to-Business (B2B)

- 5.3.2. Business-to-Consumer (B2C)

- 5.3.3. Consumer-to-Consumer (C2C)

- 5.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.4.1. Heavy Weight Shipments

- 5.4.2. Light Weight Shipments

- 5.4.3. Medium Weight Shipments

- 5.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.5.1. Air

- 5.5.2. Road

- 5.5.3. Others

- 5.6. Market Analysis, Insights and Forecast - by End User Industry

- 5.6.1. E-Commerce

- 5.6.2. Financial Services (BFSI)

- 5.6.3. Healthcare

- 5.6.4. Manufacturing

- 5.6.5. Primary Industry

- 5.6.6. Wholesale and Retail Trade (Offline)

- 5.6.7. Others

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. North America

- 5.7.2. South America

- 5.7.3. Europe

- 5.7.4. Middle East & Africa

- 5.7.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. North America UK Parcel Delivery Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Destination

- 6.1.1. Domestic

- 6.1.2. International

- 6.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 6.2.1. Express

- 6.2.2. Non-Express

- 6.3. Market Analysis, Insights and Forecast - by Model

- 6.3.1. Business-to-Business (B2B)

- 6.3.2. Business-to-Consumer (B2C)

- 6.3.3. Consumer-to-Consumer (C2C)

- 6.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 6.4.1. Heavy Weight Shipments

- 6.4.2. Light Weight Shipments

- 6.4.3. Medium Weight Shipments

- 6.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 6.5.1. Air

- 6.5.2. Road

- 6.5.3. Others

- 6.6. Market Analysis, Insights and Forecast - by End User Industry

- 6.6.1. E-Commerce

- 6.6.2. Financial Services (BFSI)

- 6.6.3. Healthcare

- 6.6.4. Manufacturing

- 6.6.5. Primary Industry

- 6.6.6. Wholesale and Retail Trade (Offline)

- 6.6.7. Others

- 6.1. Market Analysis, Insights and Forecast - by Destination

- 7. South America UK Parcel Delivery Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Destination

- 7.1.1. Domestic

- 7.1.2. International

- 7.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 7.2.1. Express

- 7.2.2. Non-Express

- 7.3. Market Analysis, Insights and Forecast - by Model

- 7.3.1. Business-to-Business (B2B)

- 7.3.2. Business-to-Consumer (B2C)

- 7.3.3. Consumer-to-Consumer (C2C)

- 7.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 7.4.1. Heavy Weight Shipments

- 7.4.2. Light Weight Shipments

- 7.4.3. Medium Weight Shipments

- 7.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 7.5.1. Air

- 7.5.2. Road

- 7.5.3. Others

- 7.6. Market Analysis, Insights and Forecast - by End User Industry

- 7.6.1. E-Commerce

- 7.6.2. Financial Services (BFSI)

- 7.6.3. Healthcare

- 7.6.4. Manufacturing

- 7.6.5. Primary Industry

- 7.6.6. Wholesale and Retail Trade (Offline)

- 7.6.7. Others

- 7.1. Market Analysis, Insights and Forecast - by Destination

- 8. Europe UK Parcel Delivery Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Destination

- 8.1.1. Domestic

- 8.1.2. International

- 8.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 8.2.1. Express

- 8.2.2. Non-Express

- 8.3. Market Analysis, Insights and Forecast - by Model

- 8.3.1. Business-to-Business (B2B)

- 8.3.2. Business-to-Consumer (B2C)

- 8.3.3. Consumer-to-Consumer (C2C)

- 8.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 8.4.1. Heavy Weight Shipments

- 8.4.2. Light Weight Shipments

- 8.4.3. Medium Weight Shipments

- 8.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 8.5.1. Air

- 8.5.2. Road

- 8.5.3. Others

- 8.6. Market Analysis, Insights and Forecast - by End User Industry

- 8.6.1. E-Commerce

- 8.6.2. Financial Services (BFSI)

- 8.6.3. Healthcare

- 8.6.4. Manufacturing

- 8.6.5. Primary Industry

- 8.6.6. Wholesale and Retail Trade (Offline)

- 8.6.7. Others

- 8.1. Market Analysis, Insights and Forecast - by Destination

- 9. Middle East & Africa UK Parcel Delivery Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Destination

- 9.1.1. Domestic

- 9.1.2. International

- 9.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 9.2.1. Express

- 9.2.2. Non-Express

- 9.3. Market Analysis, Insights and Forecast - by Model

- 9.3.1. Business-to-Business (B2B)

- 9.3.2. Business-to-Consumer (B2C)

- 9.3.3. Consumer-to-Consumer (C2C)

- 9.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 9.4.1. Heavy Weight Shipments

- 9.4.2. Light Weight Shipments

- 9.4.3. Medium Weight Shipments

- 9.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 9.5.1. Air

- 9.5.2. Road

- 9.5.3. Others

- 9.6. Market Analysis, Insights and Forecast - by End User Industry

- 9.6.1. E-Commerce

- 9.6.2. Financial Services (BFSI)

- 9.6.3. Healthcare

- 9.6.4. Manufacturing

- 9.6.5. Primary Industry

- 9.6.6. Wholesale and Retail Trade (Offline)

- 9.6.7. Others

- 9.1. Market Analysis, Insights and Forecast - by Destination

- 10. Asia Pacific UK Parcel Delivery Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Destination

- 10.1.1. Domestic

- 10.1.2. International

- 10.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 10.2.1. Express

- 10.2.2. Non-Express

- 10.3. Market Analysis, Insights and Forecast - by Model

- 10.3.1. Business-to-Business (B2B)

- 10.3.2. Business-to-Consumer (B2C)

- 10.3.3. Consumer-to-Consumer (C2C)

- 10.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 10.4.1. Heavy Weight Shipments

- 10.4.2. Light Weight Shipments

- 10.4.3. Medium Weight Shipments

- 10.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 10.5.1. Air

- 10.5.2. Road

- 10.5.3. Others

- 10.6. Market Analysis, Insights and Forecast - by End User Industry

- 10.6.1. E-Commerce

- 10.6.2. Financial Services (BFSI)

- 10.6.3. Healthcare

- 10.6.4. Manufacturing

- 10.6.5. Primary Industry

- 10.6.6. Wholesale and Retail Trade (Offline)

- 10.6.7. Others

- 10.1. Market Analysis, Insights and Forecast - by Destination

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Otto GmbH & Co KG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DHL Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Yode

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GEODIS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Rapid Parcel

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 FedEx

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 United Parcel Service of America Inc (UPS)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 La Poste Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 APC Overnight

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 International Distributions Services (including Royal Mail)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Otto GmbH & Co KG

List of Figures

- Figure 1: Global UK Parcel Delivery Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UK Parcel Delivery Market Revenue (billion), by Destination 2025 & 2033

- Figure 3: North America UK Parcel Delivery Market Revenue Share (%), by Destination 2025 & 2033

- Figure 4: North America UK Parcel Delivery Market Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 5: North America UK Parcel Delivery Market Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 6: North America UK Parcel Delivery Market Revenue (billion), by Model 2025 & 2033

- Figure 7: North America UK Parcel Delivery Market Revenue Share (%), by Model 2025 & 2033

- Figure 8: North America UK Parcel Delivery Market Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 9: North America UK Parcel Delivery Market Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 10: North America UK Parcel Delivery Market Revenue (billion), by Mode Of Transport 2025 & 2033

- Figure 11: North America UK Parcel Delivery Market Revenue Share (%), by Mode Of Transport 2025 & 2033

- Figure 12: North America UK Parcel Delivery Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 13: North America UK Parcel Delivery Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 14: North America UK Parcel Delivery Market Revenue (billion), by Country 2025 & 2033

- Figure 15: North America UK Parcel Delivery Market Revenue Share (%), by Country 2025 & 2033

- Figure 16: South America UK Parcel Delivery Market Revenue (billion), by Destination 2025 & 2033

- Figure 17: South America UK Parcel Delivery Market Revenue Share (%), by Destination 2025 & 2033

- Figure 18: South America UK Parcel Delivery Market Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 19: South America UK Parcel Delivery Market Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 20: South America UK Parcel Delivery Market Revenue (billion), by Model 2025 & 2033

- Figure 21: South America UK Parcel Delivery Market Revenue Share (%), by Model 2025 & 2033

- Figure 22: South America UK Parcel Delivery Market Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 23: South America UK Parcel Delivery Market Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 24: South America UK Parcel Delivery Market Revenue (billion), by Mode Of Transport 2025 & 2033

- Figure 25: South America UK Parcel Delivery Market Revenue Share (%), by Mode Of Transport 2025 & 2033

- Figure 26: South America UK Parcel Delivery Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 27: South America UK Parcel Delivery Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 28: South America UK Parcel Delivery Market Revenue (billion), by Country 2025 & 2033

- Figure 29: South America UK Parcel Delivery Market Revenue Share (%), by Country 2025 & 2033

- Figure 30: Europe UK Parcel Delivery Market Revenue (billion), by Destination 2025 & 2033

- Figure 31: Europe UK Parcel Delivery Market Revenue Share (%), by Destination 2025 & 2033

- Figure 32: Europe UK Parcel Delivery Market Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 33: Europe UK Parcel Delivery Market Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 34: Europe UK Parcel Delivery Market Revenue (billion), by Model 2025 & 2033

- Figure 35: Europe UK Parcel Delivery Market Revenue Share (%), by Model 2025 & 2033

- Figure 36: Europe UK Parcel Delivery Market Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 37: Europe UK Parcel Delivery Market Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 38: Europe UK Parcel Delivery Market Revenue (billion), by Mode Of Transport 2025 & 2033

- Figure 39: Europe UK Parcel Delivery Market Revenue Share (%), by Mode Of Transport 2025 & 2033

- Figure 40: Europe UK Parcel Delivery Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 41: Europe UK Parcel Delivery Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 42: Europe UK Parcel Delivery Market Revenue (billion), by Country 2025 & 2033

- Figure 43: Europe UK Parcel Delivery Market Revenue Share (%), by Country 2025 & 2033

- Figure 44: Middle East & Africa UK Parcel Delivery Market Revenue (billion), by Destination 2025 & 2033

- Figure 45: Middle East & Africa UK Parcel Delivery Market Revenue Share (%), by Destination 2025 & 2033

- Figure 46: Middle East & Africa UK Parcel Delivery Market Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 47: Middle East & Africa UK Parcel Delivery Market Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 48: Middle East & Africa UK Parcel Delivery Market Revenue (billion), by Model 2025 & 2033

- Figure 49: Middle East & Africa UK Parcel Delivery Market Revenue Share (%), by Model 2025 & 2033

- Figure 50: Middle East & Africa UK Parcel Delivery Market Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 51: Middle East & Africa UK Parcel Delivery Market Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 52: Middle East & Africa UK Parcel Delivery Market Revenue (billion), by Mode Of Transport 2025 & 2033

- Figure 53: Middle East & Africa UK Parcel Delivery Market Revenue Share (%), by Mode Of Transport 2025 & 2033

- Figure 54: Middle East & Africa UK Parcel Delivery Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 55: Middle East & Africa UK Parcel Delivery Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 56: Middle East & Africa UK Parcel Delivery Market Revenue (billion), by Country 2025 & 2033

- Figure 57: Middle East & Africa UK Parcel Delivery Market Revenue Share (%), by Country 2025 & 2033

- Figure 58: Asia Pacific UK Parcel Delivery Market Revenue (billion), by Destination 2025 & 2033

- Figure 59: Asia Pacific UK Parcel Delivery Market Revenue Share (%), by Destination 2025 & 2033

- Figure 60: Asia Pacific UK Parcel Delivery Market Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 61: Asia Pacific UK Parcel Delivery Market Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 62: Asia Pacific UK Parcel Delivery Market Revenue (billion), by Model 2025 & 2033

- Figure 63: Asia Pacific UK Parcel Delivery Market Revenue Share (%), by Model 2025 & 2033

- Figure 64: Asia Pacific UK Parcel Delivery Market Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 65: Asia Pacific UK Parcel Delivery Market Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 66: Asia Pacific UK Parcel Delivery Market Revenue (billion), by Mode Of Transport 2025 & 2033

- Figure 67: Asia Pacific UK Parcel Delivery Market Revenue Share (%), by Mode Of Transport 2025 & 2033

- Figure 68: Asia Pacific UK Parcel Delivery Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 69: Asia Pacific UK Parcel Delivery Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 70: Asia Pacific UK Parcel Delivery Market Revenue (billion), by Country 2025 & 2033

- Figure 71: Asia Pacific UK Parcel Delivery Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Parcel Delivery Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 2: Global UK Parcel Delivery Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 3: Global UK Parcel Delivery Market Revenue billion Forecast, by Model 2020 & 2033

- Table 4: Global UK Parcel Delivery Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 5: Global UK Parcel Delivery Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 6: Global UK Parcel Delivery Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 7: Global UK Parcel Delivery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global UK Parcel Delivery Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 9: Global UK Parcel Delivery Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 10: Global UK Parcel Delivery Market Revenue billion Forecast, by Model 2020 & 2033

- Table 11: Global UK Parcel Delivery Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 12: Global UK Parcel Delivery Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 13: Global UK Parcel Delivery Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 14: Global UK Parcel Delivery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United States UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global UK Parcel Delivery Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 19: Global UK Parcel Delivery Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 20: Global UK Parcel Delivery Market Revenue billion Forecast, by Model 2020 & 2033

- Table 21: Global UK Parcel Delivery Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 22: Global UK Parcel Delivery Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 23: Global UK Parcel Delivery Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 24: Global UK Parcel Delivery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Brazil UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Argentina UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of South America UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global UK Parcel Delivery Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 29: Global UK Parcel Delivery Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 30: Global UK Parcel Delivery Market Revenue billion Forecast, by Model 2020 & 2033

- Table 31: Global UK Parcel Delivery Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 32: Global UK Parcel Delivery Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 33: Global UK Parcel Delivery Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 34: Global UK Parcel Delivery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 35: United Kingdom UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Germany UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: France UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Italy UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Spain UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Russia UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Benelux UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Nordics UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: Rest of Europe UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Global UK Parcel Delivery Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 45: Global UK Parcel Delivery Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 46: Global UK Parcel Delivery Market Revenue billion Forecast, by Model 2020 & 2033

- Table 47: Global UK Parcel Delivery Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 48: Global UK Parcel Delivery Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 49: Global UK Parcel Delivery Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 50: Global UK Parcel Delivery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 51: Turkey UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Israel UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: GCC UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: North Africa UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Africa UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Rest of Middle East & Africa UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Global UK Parcel Delivery Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 58: Global UK Parcel Delivery Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 59: Global UK Parcel Delivery Market Revenue billion Forecast, by Model 2020 & 2033

- Table 60: Global UK Parcel Delivery Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 61: Global UK Parcel Delivery Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 62: Global UK Parcel Delivery Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 63: Global UK Parcel Delivery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 64: China UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 65: India UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Japan UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 67: South Korea UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: ASEAN UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 69: Oceania UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: Rest of Asia Pacific UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Parcel Delivery Market?

The projected CAGR is approximately 12.2%.

2. Which companies are prominent players in the UK Parcel Delivery Market?

Key companies in the market include Otto GmbH & Co KG, DHL Group, Yode, GEODIS, Rapid Parcel, FedEx, United Parcel Service of America Inc (UPS), La Poste Group, APC Overnight, International Distributions Services (including Royal Mail).

3. What are the main segments of the UK Parcel Delivery Market?

The market segments include Destination, Speed Of Delivery, Model, Shipment Weight, Mode Of Transport, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 500.13 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits.

8. Can you provide examples of recent developments in the market?

November 2023: GEODIS announced the opening of a new e-logistics platform in the United Kingdom. This 7,000-sq. m site is located strategically, allowing rapid distribution of products to good transport links. It can store more than 500,000 SKUs and process up to 5,000 orders per day.November 2023: Yodel has started a six-month trial of parcel lockers at sites in Northern Ireland in partnership with PayPoint via its Collect+ network. The trial intends to see the independent parcel carrier initially utilize self-service parcel lockers from OOHPod at nine locations, including Lidl stores in Castlereagh, Newtownards, Shore Road Belfast, and Lisburn. The parcel lockers, which provide contactless access for customers to pick up online deliveries at their convenience, will be available as a click & collect option to select via retailer’s store locators.September 2023: The Otto Group plans to deploy Covariant robots to increase operational efficiency, build resilience against labor market challenges, and improve the overall quality of work within their fulfillment centers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Parcel Delivery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Parcel Delivery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Parcel Delivery Market?

To stay informed about further developments, trends, and reports in the UK Parcel Delivery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence