Key Insights

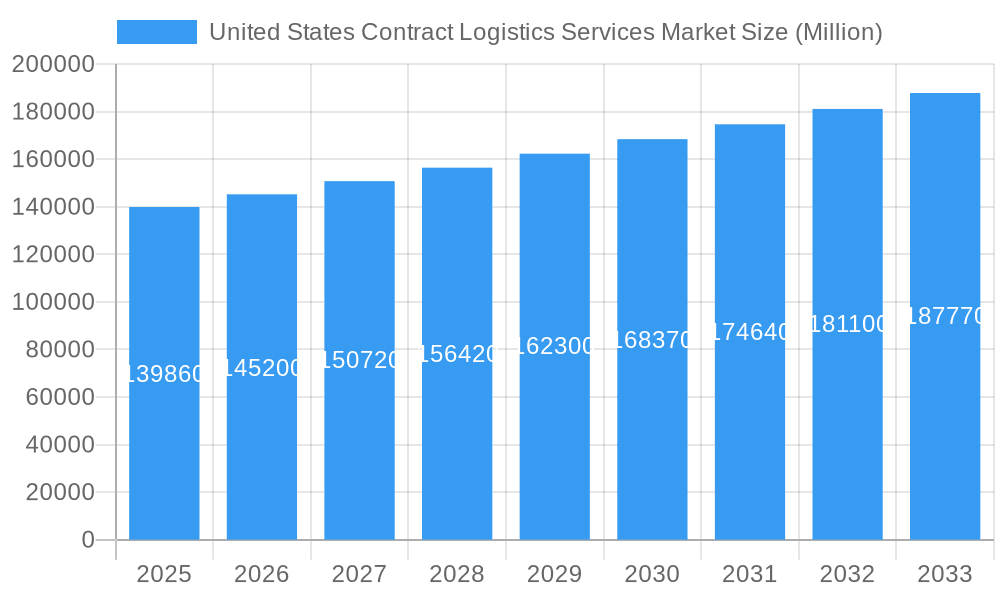

The United States contract logistics services market, valued at $139.86 billion in 2025, is projected to experience robust growth, driven by the increasing adoption of e-commerce, the need for efficient supply chain management, and the rising demand for specialized logistics solutions across various industries. The market's Compound Annual Growth Rate (CAGR) of 3.76% from 2025 to 2033 reflects a steady expansion, fueled by factors such as the growth of manufacturing and automotive sectors, the rise of omnichannel retailing requiring flexible logistics, and the expanding healthcare and pharmaceutical industries with their demanding supply chain needs. Outsourcing of logistics functions continues to be a major trend, with companies seeking to optimize costs and improve efficiency by leveraging the expertise of specialized providers. However, potential restraints include fluctuations in fuel prices, geopolitical instability impacting global trade, and the ongoing challenge of skilled labor shortages within the logistics sector. The segmentation by end-user reveals significant opportunities within manufacturing, automotive, consumer goods and retail, and high-tech, with significant growth also expected in healthcare and pharmaceuticals due to the complex nature of handling temperature-sensitive goods and regulatory compliance.

United States Contract Logistics Services Market Market Size (In Billion)

The market's geographical distribution within the US is likely uneven, with high concentrations in major industrial and population centers. States with strong manufacturing bases and large distribution networks are expected to hold significant market share. The competitive landscape is intensely competitive, with both large multinational players like DHL, FedEx, and UPS, and smaller, specialized providers vying for market share. The key to success lies in offering customized solutions, leveraging advanced technologies such as AI and automation, and demonstrating a strong commitment to sustainability and ethical sourcing. This market is characterized by ongoing consolidation, with larger players acquiring smaller companies to expand their service offerings and geographical reach. The future of the US contract logistics services market hinges on adapting to emerging technologies and meeting the evolving needs of a dynamic and increasingly complex global supply chain.

United States Contract Logistics Services Market Company Market Share

United States Contract Logistics Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Contract Logistics Services Market, offering actionable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market dynamics, segment performance, leading players, and future growth potential. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

United States Contract Logistics Services Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the US contract logistics market. We examine market concentration, identifying key players and their market share, alongside M&A activity and its impact on market structure. The analysis includes an assessment of technological advancements, regulatory frameworks, and the presence of substitute products.

- Market Concentration: The US contract logistics market is moderately concentrated, with key players like DB Schenker, Hellmann Worldwide Logistics, and Burris Logistics holding significant shares. However, numerous mid-sized and smaller players also contribute to the overall market. Precise market share data for each company is available in the full report.

- M&A Activity: The market has witnessed significant M&A activity in recent years, with deal values exceeding xx Million in 2024. These activities reflect the industry's consolidation trend and the pursuit of strategic advantages. Examples include the acquisitions of Taylored Services by Yusen Logistics and S&M Moving Systems West and Global Diversity Logistics by DSV (detailed in the "Key Developments" section).

- Innovation Drivers: Technological advancements, particularly in automation, data analytics, and IoT, are key drivers of innovation. These advancements are enhancing efficiency, visibility, and the overall customer experience. Stringent regulatory compliance needs and growing demand for sustainable logistics solutions also stimulate innovation.

- Regulatory Framework: Federal and state regulations pertaining to transportation, safety, and environmental protection significantly impact the market. The analysis includes a detailed overview of relevant regulations and their influence on market dynamics.

- End-User Demographics: The report segments end-users across various industries including Manufacturing and Automotive, Consumer Goods and Retail, High-tech, Healthcare and Pharmaceuticals, and Other End-Users (Energy, Construction, Aerospace, etc.). The analysis examines their unique needs and preferences impacting the demand for contract logistics services.

United States Contract Logistics Services Market Market Dynamics & Trends

This section explores the key factors driving market growth, technological disruptions, and competitive dynamics. We analyze consumer preferences, market penetration rates, and the impact of macroeconomic factors.

[This section will contain 600 words of detailed analysis on market growth drivers (e.g., e-commerce growth, globalization, supply chain optimization needs), technological disruptions (e.g., automation, AI, blockchain), evolving consumer preferences (e.g., faster delivery, increased transparency), and competitive dynamics (e.g., pricing pressures, service differentiation). Specific metrics such as CAGR and market penetration rates will be provided. The analysis will include a discussion of the impact of external factors like economic fluctuations and geopolitical events.]

Dominant Regions & Segments in United States Contract Logistics Services Market

This section identifies the leading regions and segments within the US contract logistics market. We analyze the factors contributing to their dominance, including economic policies, infrastructure development, and industry-specific demand.

- By Type: Both Insourced and Outsourced contract logistics services are significant segments. The market share of each segment is detailed in the full report.

- By End-User: Manufacturing and Automotive, Consumer Goods and Retail, and High-tech are currently the dominant end-user segments. Detailed analysis of each segment's growth drivers and future potential is included in the full report. [This section will include 600 words of detailed analysis of dominant segments and regions, utilizing bullet points to highlight key drivers and paragraphs for in-depth analysis. For example, the high concentration of manufacturing and automotive companies in specific regions would be a key driver for the dominance of those segments/regions.]

United States Contract Logistics Services Market Product Innovations

The US contract logistics market is characterized by continuous product innovation. Developments focus on enhancing efficiency, transparency, and security through technology integration, such as advanced warehouse management systems (WMS), transportation management systems (TMS), and real-time tracking capabilities. These innovations are crucial for meeting the ever-evolving needs of businesses and improving supply chain resilience. The integration of AI and machine learning is further enhancing predictive capabilities, optimizing operations, and improving decision-making. These innovations are improving overall service quality and competitive advantages.

Report Scope & Segmentation Analysis

This report comprehensively segments the US contract logistics services market by Type (Insourced, Outsourced) and by End-User (Manufacturing and Automotive, Consumer Goods and Retail, High-tech, Healthcare and Pharmaceuticals, Other End-Users). Each segment's growth projections, market sizes, and competitive dynamics are analyzed, providing a granular understanding of market opportunities. [This section will include detailed analysis of each segment as noted. Growth projections and competitive dynamics for each segment will be given.]

Key Drivers of United States Contract Logistics Services Market Growth

Growth in the US contract logistics market is fueled by several key factors. The rise of e-commerce continues to drive demand for efficient and reliable logistics solutions. Increasing globalization and the need for optimized supply chains are also significant factors. Technological advancements, such as automation and data analytics, are enhancing efficiency and driving down costs. Furthermore, government initiatives aimed at improving infrastructure and streamlining logistics processes contribute to market growth.

Challenges in the United States Contract Logistics Services Market Sector

The United States contract logistics market operates within a dynamic and complex environment, presenting several significant hurdles for service providers. Volatile fuel prices continue to be a persistent challenge, directly impacting transportation costs and overall operational expenses. Compounding this, a critical shortage of qualified and available truck drivers strains capacity and escalates labor costs. Furthermore, persistent port congestion at key entry points and throughout domestic networks leads to significant delays and increased demurrage charges. The ever-evolving landscape of regulatory compliance, including environmental standards and driver hours, adds complexity and necessitates ongoing investment in adherence. Supply chain disruptions, as starkly highlighted by recent global events like the pandemic, underscore the inherent vulnerability of the market to external shocks and underscore the critical need for greater resilience and agility. Intense competition among providers creates a highly price-sensitive environment, often pressuring profit margins. The detailed quantification and strategic implications of these challenges are thoroughly explored within the comprehensive report.

Emerging Opportunities in United States Contract Logistics Services Market

Despite the prevailing challenges, the United States contract logistics market is brimming with promising emerging opportunities. The unabated growth of e-commerce remains a primary growth driver, fueling unprecedented demand for sophisticated last-mile delivery solutions and integrated omnichannel fulfillment capabilities. As businesses increasingly prioritize environmental responsibility, the adoption of sustainable logistics practices presents a significant opportunity for providers offering innovative eco-friendly services, including greener fleet options and optimized route planning. Moreover, the escalating requirements for specialized logistics solutions within high-growth sectors such as healthcare and pharmaceuticals, which demand stringent temperature control, regulatory adherence, and product integrity, are opening up new and lucrative avenues for market expansion.

Leading Players in the United States Contract Logistics Services Market Market

- DB Schenker (DB Schenker)

- Hellmann Worldwide Logistics (Hellmann Worldwide Logistics)

- Burris Logistics (Burris Logistics)

- Hub Group

- UPS (UPS)

- GEODIS (GEODIS)

- XPO Logistics (XPO Logistics)

- GXO Logistics (GXO Logistics)

- Ryder Supply Chain Solutions (Ryder Supply Chain Solutions)

- Kuehne + Nagel (Kuehne + Nagel)

- DHL Supply Chain North America (DHL Supply Chain North America)

- GAC United States

- FedEx Logistics (FedEx Logistics)

Key Developments in United States Contract Logistics Services Market Industry

- March 2023: Yusen Logistics strategically acquired Taylored Services, significantly expanding its United States warehouse network and bolstering its comprehensive end-to-end supply chain service offerings.

- March 2023: DSV strengthened its market position through the acquisitions of S&M Moving Systems West and Global Diversity Logistics, enhancing its capabilities within the semiconductor industry and expanding its cross-border services to Latin America.

Future Outlook for United States Contract Logistics Services Market Market

The United States contract logistics market is strategically positioned for sustained and robust growth in the foreseeable future. This expansion will be propelled by the continuous surge in e-commerce penetration, the accelerating adoption of transformative technological advancements, and the ever-increasing imperative for agile and resilient supply chains. Success in this evolving landscape will hinge on strategic and forward-thinking investments in cutting-edge technology, critical infrastructure development, and the integration of sustainable practices. The market is also expected to witness a notable trend of consolidation, as larger, established players strategically acquire smaller competitors to achieve greater economies of scale and enhance their overall market share. Furthermore, the integration of disruptive technologies such as Artificial Intelligence (AI), blockchain, and advanced automation will fundamentally reshape the market dynamics, creating novel and impactful opportunities for innovative and adaptive service providers.

United States Contract Logistics Services Market Segmentation

-

1. Type

- 1.1. Insourced

- 1.2. Outsourced

-

2. End-User

- 2.1. Manufacturing and Automotive

- 2.2. Consumer Goods and Retail

- 2.3. High-tech

- 2.4. Healthcare and Pharmaceuticals

- 2.5. Other En

United States Contract Logistics Services Market Segmentation By Geography

- 1. United States

United States Contract Logistics Services Market Regional Market Share

Geographic Coverage of United States Contract Logistics Services Market

United States Contract Logistics Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost Efficiency and Time Efficiency; Increasing E-commerce Sector

- 3.3. Market Restrains

- 3.3.1. Regulatory Environment; Technical Limitations

- 3.4. Market Trends

- 3.4.1. Growth of Optimized Warehousing Network

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Contract Logistics Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insourced

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Consumer Goods and Retail

- 5.2.3. High-tech

- 5.2.4. Healthcare and Pharmaceuticals

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hellmann Worldwide Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Burris Logistics**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hub Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 UPS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GEODIS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 XPO Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 GXO Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ryder Supply Chain Solutions

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kuehne + Nagel

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DHL Supply Chain North America

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 GAC United States

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 FedEx Logistics

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: United States Contract Logistics Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Contract Logistics Services Market Share (%) by Company 2025

List of Tables

- Table 1: United States Contract Logistics Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: United States Contract Logistics Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: United States Contract Logistics Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United States Contract Logistics Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: United States Contract Logistics Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: United States Contract Logistics Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Contract Logistics Services Market?

The projected CAGR is approximately 3.76%.

2. Which companies are prominent players in the United States Contract Logistics Services Market?

Key companies in the market include DB Schenker, Hellmann Worldwide Logistics, Burris Logistics**List Not Exhaustive, Hub Group, UPS, GEODIS, XPO Logistics, GXO Logistics, Ryder Supply Chain Solutions, Kuehne + Nagel, DHL Supply Chain North America, GAC United States, FedEx Logistics.

3. What are the main segments of the United States Contract Logistics Services Market?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 139.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Cost Efficiency and Time Efficiency; Increasing E-commerce Sector.

6. What are the notable trends driving market growth?

Growth of Optimized Warehousing Network.

7. Are there any restraints impacting market growth?

Regulatory Environment; Technical Limitations.

8. Can you provide examples of recent developments in the market?

March 2023: Yusen Logistics, a leading global supply chain provider, has acquired ownership of Taylored Services, a U.S. multichannel 3PL fulfillment organization. The deal expands Yusen Logistics' Contract Logistics Group's warehouse network in key distribution areas of the United States and further strengthens its end-to-end supply chain portfolio with specialized services, such as omnichannel retail, wholesale, and e-Commerce fulfillment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Contract Logistics Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Contract Logistics Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Contract Logistics Services Market?

To stay informed about further developments, trends, and reports in the United States Contract Logistics Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence