Key Insights

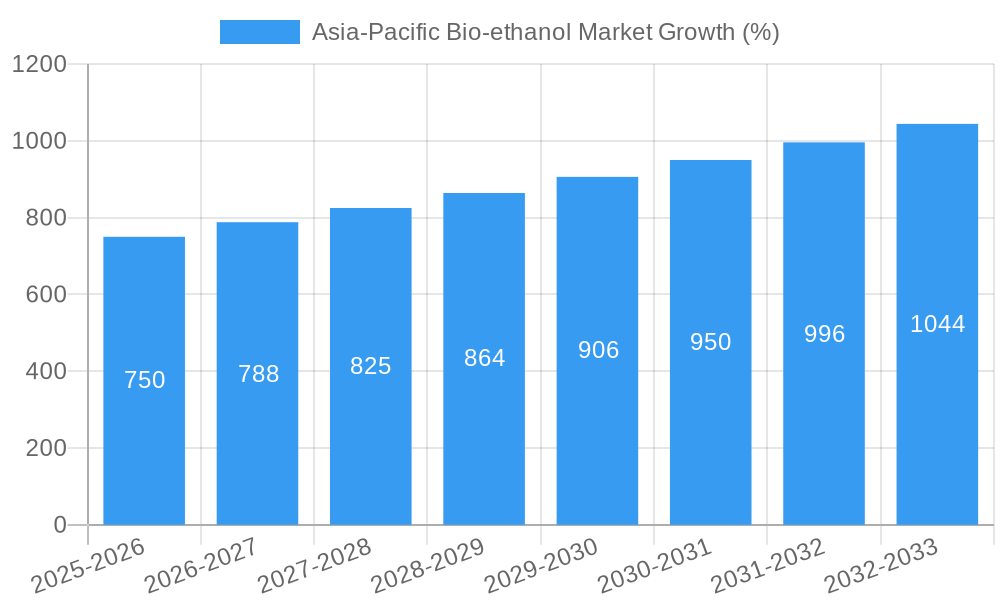

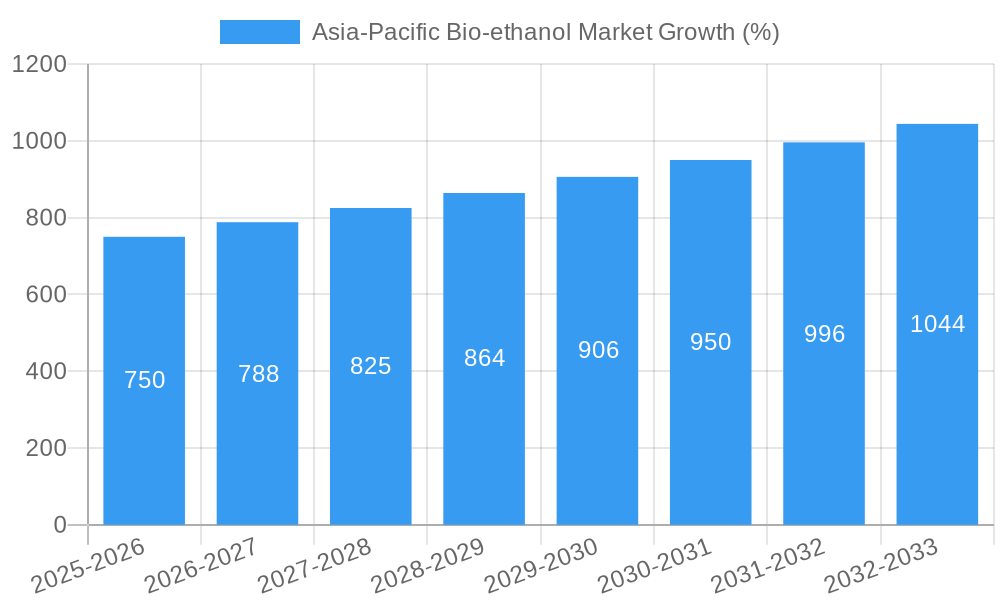

The Asia-Pacific bio-ethanol market, currently valued at approximately $XX million (assuming a reasonable market size based on global trends and regional growth), is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is primarily driven by increasing demand for renewable fuels, stringent government regulations promoting biofuel adoption to mitigate carbon emissions, and the rising popularity of flex-fuel vehicles across the region. Significant growth drivers include the burgeoning automotive and transportation sectors in rapidly developing economies like India and China, coupled with a growing food and beverage industry leveraging bio-ethanol for diverse applications. Furthermore, the expanding pharmaceutical and cosmetic sectors are increasingly adopting bio-ethanol as a sustainable and versatile ingredient. While the market faces potential restraints such as fluctuations in feedstock prices (sugarcane, corn, wheat, and other feedstocks) and competition from conventional fuels, these challenges are likely to be offset by supportive government policies and the continuous technological advancements enhancing bio-ethanol production efficiency. Key players like ADM, POET LLC, and Green Plains Inc., alongside regional giants like Henan Tianguan Group Co Ltd and Jilin Fuel Ethanol Co Ltd (CNPC), are actively shaping market dynamics through strategic investments and expansion.

The regional breakdown within Asia-Pacific reveals that China, India, and Japan are expected to be the dominant markets, fueled by their large populations, substantial automotive sectors, and proactive government support for renewable energy initiatives. Other countries in the region, such as South Korea, Taiwan, and Australia, are also poised for significant growth, albeit at a potentially slower pace. The market segmentation by feedstock type and application further highlights the diverse nature of bio-ethanol utilization across the region, with sugarcane and corn likely dominating feedstock usage based on existing agricultural practices and regional suitability. The forecast period of 2025-2033 presents significant opportunities for investors and industry players alike, with the market projected to reach a substantial value by 2033, driven by the confluence of factors outlined above. The competitive landscape is expected to remain dynamic, with existing players consolidating their market share and new entrants emerging with innovative technologies and sustainable practices.

Asia-Pacific Bio-ethanol Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific bio-ethanol market, offering crucial insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, dominant segments, and future trajectory. The study period is 2019-2033, the base year is 2025, and the forecast period is 2025-2033, with a historical period covering 2019-2024.

Asia-Pacific Bio-ethanol Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the Asia-Pacific bio-ethanol market. We delve into market concentration, assessing the market share held by key players like ADM, Henan Tianguan Group Co Ltd, POET LLC, Green Plains Inc, and others. The report also examines innovation trends, including advancements in feedstock utilization and production technologies. Furthermore, we explore the impact of regulatory frameworks on market growth and the role of mergers and acquisitions (M&A) activities.

- Market Concentration: The market exhibits a [xx]% concentration ratio, indicating a [highly concentrated/moderately concentrated/fragmented] market structure. [Insert analysis on market share of top 5 players – use predicted values if necessary].

- Innovation Drivers: Government incentives for renewable energy, advancements in enzyme technology for efficient conversion, and the development of next-generation bio-ethanol production processes are key drivers of innovation.

- Regulatory Frameworks: Government policies promoting biofuel blending mandates and carbon emission reduction targets significantly influence market dynamics. Variations in regulations across different Asia-Pacific countries are analyzed.

- Product Substitutes: The primary substitutes include gasoline and other conventional fuels. The report examines the competitive pressure from these substitutes and their impact on bio-ethanol demand.

- End-User Demographics: The primary end-users are automotive and transportation, followed by food and beverage, pharmaceutical, and cosmetic industries. The report details the consumption patterns of each sector.

- M&A Activities: The report documents recent M&A activities, including deal values and their impact on market consolidation. [Insert data on deal values if available. Otherwise, indicate lack of data and rationale].

Asia-Pacific Bio-ethanol Market Dynamics & Trends

This section explores the key factors driving market growth, technological disruptions, evolving consumer preferences, and the competitive landscape. The report quantifies market growth using CAGR and assesses market penetration rates for different applications. Factors such as rising fuel demand, government support for biofuels, increasing environmental concerns, and technological advancements are analyzed in detail to estimate a [xx]% CAGR for the forecast period. The competitive intensity is analyzed considering pricing strategies, brand positioning, and technological capabilities of key players.

Dominant Regions & Segments in Asia-Pacific Bio-ethanol Market

This section identifies the leading regions and segments within the Asia-Pacific bio-ethanol market. We analyze market dominance based on factors such as feedstock availability, government policies, and industrial infrastructure.

Dominant Feedstock Type:

- Sugarcane: [Insert analysis of sugarcane dominance, including reasons, e.g., high yield in specific regions, existing sugarcane industry infrastructure. Include quantitative data if available, otherwise use descriptive analysis].

- Corn: [Similar analysis for corn, focusing on regions with significant corn production].

- Wheat: [Similar analysis for wheat].

- Other Feedstocks: [Similar analysis for other feedstocks, e.g., cassava, sorghum].

Dominant Application:

- Automotive and Transportation: [Insert detailed analysis of this segment, highlighting its market share and growth drivers, linking it to biofuel blending mandates and automotive industry trends].

- Food and Beverage: [Analysis of its market share and growth drivers, highlighting its applications in food processing and brewing].

- Pharmaceutical, Cosmetics and Personal Care: [Analysis of its role, emphasizing the use of ethanol as a solvent and ingredient].

- Other Applications: [Analysis of less prominent applications].

Asia-Pacific Bio-ethanol Market Product Innovations

The Asia-Pacific bio-ethanol market is witnessing a surge in product innovations aimed at revolutionizing production efficiency, slashing costs, and diversifying feedstock utilization. Breakthroughs in enzyme engineering are accelerating biomass breakdown, while advancements in fermentation techniques, including the development of robust microbial strains and optimized bioreactor designs, are leading to higher ethanol yields. Downstream processing technologies are also evolving, with innovative separation and purification methods reducing energy consumption and environmental impact. Beyond traditional fuel applications, bio-ethanol's potential as a versatile building block for a wide array of bio-based chemicals, pharmaceuticals, and advanced materials is being actively explored. These innovations are not only bolstering bio-ethanol's competitiveness against fossil fuels but are also paving the way for its integration into a broader sustainable chemical industry.

Report Scope & Segmentation Analysis

This comprehensive report meticulously segments the Asia-Pacific bio-ethanol market, offering in-depth analysis across key categories: Feedstock Type and Application. Each segment is thoroughly examined for its market size, projected growth trajectories, and the prevailing competitive landscape.

- Feedstock Type: The market is analyzed by primary feedstocks including sugarcane, corn, wheat, and other emerging feedstocks.

- Application: Key applications covered encompass automotive and transportation (fuel blending), food and beverage (ingredients and preservatives), pharmaceutical (solvents and intermediates), cosmetics and personal care (emollients and solvents), and other niche industrial applications.

Feedstock Segment Highlights:

- The sugarcane-based bio-ethanol segment is projected to maintain a dominant market share, underpinned by its inherent cost-effectiveness and the widespread availability of sugarcane cultivation across numerous Asia-Pacific nations, particularly Brazil (a significant player in the global bio-ethanol market, influencing Asia-Pacific dynamics through trade and technology) and parts of Southeast Asia. Growth is anticipated to be significantly propelled by supportive government mandates promoting higher biofuel blending ratios in transportation fuels and initiatives aimed at diversifying agricultural output.

- The corn-based bio-ethanol segment, while facing some competition from food-versus-fuel debates, continues to be a vital contributor, especially in countries with significant corn production. Innovations in corn dry-grind and wet-milling processes are enhancing efficiency.

- Wheat-based bio-ethanol is gaining traction in regions with abundant wheat cultivation, offering a viable alternative feedstock with improving conversion technologies.

- Other feedstocks, encompassing a range of agricultural residues, waste biomass, and potentially algae, represent a rapidly growing segment. Advancements in cellulosic ethanol production are crucial here, promising to unlock vast quantities of non-food biomass, thereby mitigating land-use conflicts and enhancing sustainability.

Application Segment Highlights:

- The automotive and transportation sector remains the largest consumer of bio-ethanol, driven by global efforts to reduce greenhouse gas emissions and energy security concerns. Government-mandated blending programs and the increasing adoption of flex-fuel vehicles are key growth drivers.

- In the food and beverage industry, bio-ethanol finds application as a solvent, preservative, and ingredient in certain products, with a growing preference for bio-based sourcing.

- The pharmaceutical sector utilizes bio-ethanol as a high-purity solvent and disinfectant, with demand expected to rise with the expansion of the pharmaceutical manufacturing base in the region.

- The cosmetics and personal care segment is increasingly incorporating bio-ethanol as an ingredient due to its eco-friendly profile and versatile properties as a solvent and humectant.

Key Drivers of Asia-Pacific Bio-ethanol Market Growth

The growth of the Asia-Pacific bio-ethanol market is driven by several factors. Government policies promoting renewable energy sources, increasing demand for biofuels to meet stringent emission standards, and technological advancements that enhance production efficiency are key drivers. The rising cost of fossil fuels also increases the competitiveness of bio-ethanol.

Challenges in the Asia-Pacific Bio-ethanol Market Sector

The Asia-Pacific bio-ethanol market navigates a complex terrain of challenges. Volatile feedstock prices, often influenced by global agricultural commodity markets and weather patterns, present a significant hurdle to consistent production costs. Intense competition from conventional fossil fuels, bolstered by fluctuating crude oil prices and established infrastructure, necessitates continuous efforts to improve bio-ethanol's cost-competitiveness. The development and upkeep of adequate infrastructure, including storage, transportation, and dispensing facilities, require substantial capital investment. Navigating diverse and evolving regulatory landscapes across different countries, along with the need for stable and predictable government support, can also impede market expansion. Furthermore, concerns surrounding land use competition with food production and potential environmental impacts associated with large-scale monoculture feedstock cultivation, such as water usage and soil degradation, remain critical considerations that require careful management and sustainable practices.

Emerging Opportunities in Asia-Pacific Bio-ethanol Market

The Asia-Pacific bio-ethanol market is poised for significant expansion driven by a range of exciting emerging opportunities. The development and commercialization of advanced bio-ethanol technologies utilizing cellulosic biomass, such as agricultural residues and non-food energy crops, represent a transformative frontier. This approach promises to unlock vast, sustainable feedstock potential, circumventing food-versus-fuel debates and significantly enhancing the environmental credentials of bio-ethanol. The exploration of new and diverse applications beyond transportation fuels, particularly in the burgeoning bio-based chemical industry, offers substantial growth avenues. Bio-ethanol can serve as a precursor for a wide range of valuable chemicals, plastics, and materials. Furthermore, the fostering of innovative business models, such as strategic alliances with waste management companies for the co-processing of organic waste streams into bio-ethanol, presents a dual benefit of waste reduction and sustainable energy production. Increased government support for research and development, coupled with a growing regional and global awareness of sustainability and the urgent need for decarbonization, are powerful catalysts creating fertile ground for market growth and technological advancement.

Leading Players in the Asia-Pacific Bio-ethanol Market Market

- ADM

- Henan Tianguan Group Co Ltd

- POET LLC

- Green Plains Inc

- Ethanol Technologies

- Abengoa

- GranBio Investimentos SA

- Jilin Fuel Ethanol Co Ltd (CNPC)

- Cenovus Energy

- Valero *List Not Exhaustive

Key Developments in Asia-Pacific Bio-ethanol Market Industry

- November 2022: Andhra Pradesh, India, received a bioethanol facility worth USD 32.67 Million, boosting local production and employment.

- August 2021: VERBIO AG and Indian Oil Corporation Ltd. signed an MOU to establish biofuel projects, signifying collaborative efforts to expand biofuel production and distribution.

Future Outlook for Asia-Pacific Bio-ethanol Market Market

The Asia-Pacific bio-ethanol market exhibits significant growth potential, driven by supportive government policies, increasing demand for renewable energy, and technological advancements. Strategic partnerships, investments in research and development, and exploration of new feedstock sources will further shape the market's trajectory. The market is expected to experience substantial growth in the coming years, driven by the factors mentioned above.

Asia-Pacific Bio-ethanol Market Segmentation

-

1. Feedstock Type

- 1.1. Sugarcane

- 1.2. Corn

- 1.3. Wheat

- 1.4. Other Feedstocks

-

2. Application

- 2.1. Automotive and Transportation

- 2.2. Food and Beverage

- 2.3. Pharmaceutical

- 2.4. Cosmetics and Personal Care

- 2.5. Other Applications

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia-Pacific

Asia-Pacific Bio-ethanol Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia-Pacific Bio-ethanol Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Favorable Initiatives and Blending Mandates by Regulatory Bodies; Growing Environmental Concerns due to the Use of Fossil Fuels and the Need for Biofuels

- 3.3. Market Restrains

- 3.3.1. Phasing out of Fuel-based Vehicles Due to Rising Demand for Electric Vehicles; Shifting Focus to Bio-butanol

- 3.4. Market Trends

- 3.4.1. Automotive and Transportation Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 5.1.1. Sugarcane

- 5.1.2. Corn

- 5.1.3. Wheat

- 5.1.4. Other Feedstocks

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive and Transportation

- 5.2.2. Food and Beverage

- 5.2.3. Pharmaceutical

- 5.2.4. Cosmetics and Personal Care

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 6. China Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 6.1.1. Sugarcane

- 6.1.2. Corn

- 6.1.3. Wheat

- 6.1.4. Other Feedstocks

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Automotive and Transportation

- 6.2.2. Food and Beverage

- 6.2.3. Pharmaceutical

- 6.2.4. Cosmetics and Personal Care

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 7. India Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 7.1.1. Sugarcane

- 7.1.2. Corn

- 7.1.3. Wheat

- 7.1.4. Other Feedstocks

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Automotive and Transportation

- 7.2.2. Food and Beverage

- 7.2.3. Pharmaceutical

- 7.2.4. Cosmetics and Personal Care

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 8. Japan Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 8.1.1. Sugarcane

- 8.1.2. Corn

- 8.1.3. Wheat

- 8.1.4. Other Feedstocks

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Automotive and Transportation

- 8.2.2. Food and Beverage

- 8.2.3. Pharmaceutical

- 8.2.4. Cosmetics and Personal Care

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 9. South Korea Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 9.1.1. Sugarcane

- 9.1.2. Corn

- 9.1.3. Wheat

- 9.1.4. Other Feedstocks

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Automotive and Transportation

- 9.2.2. Food and Beverage

- 9.2.3. Pharmaceutical

- 9.2.4. Cosmetics and Personal Care

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 10. Rest of Asia Pacific Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 10.1.1. Sugarcane

- 10.1.2. Corn

- 10.1.3. Wheat

- 10.1.4. Other Feedstocks

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Automotive and Transportation

- 10.2.2. Food and Beverage

- 10.2.3. Pharmaceutical

- 10.2.4. Cosmetics and Personal Care

- 10.2.5. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 11. China Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 12. Japan Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 13. India Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 15. Taiwan Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 16. Australia Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Asia-Pacific Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 ADM

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Henan Tianguan Group Co Ltd

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 POET LLC

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Green Plains Inc

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Ethanol Technologies

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Abengoa

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 GranBio Investimentos SA

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Jilin Fuel Ethanol Co Ltd (CNPC)

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Cenovus Energy

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Valero*List Not Exhaustive

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 ADM

List of Figures

- Figure 1: Asia-Pacific Bio-ethanol Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Bio-ethanol Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Feedstock Type 2019 & 2032

- Table 3: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia-Pacific Bio-ethanol Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia-Pacific Bio-ethanol Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia-Pacific Bio-ethanol Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia-Pacific Bio-ethanol Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia-Pacific Bio-ethanol Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia-Pacific Bio-ethanol Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia-Pacific Bio-ethanol Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Feedstock Type 2019 & 2032

- Table 15: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Feedstock Type 2019 & 2032

- Table 19: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Feedstock Type 2019 & 2032

- Table 23: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Feedstock Type 2019 & 2032

- Table 27: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Feedstock Type 2019 & 2032

- Table 31: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Bio-ethanol Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Asia-Pacific Bio-ethanol Market?

Key companies in the market include ADM, Henan Tianguan Group Co Ltd, POET LLC, Green Plains Inc, Ethanol Technologies, Abengoa, GranBio Investimentos SA, Jilin Fuel Ethanol Co Ltd (CNPC), Cenovus Energy, Valero*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Bio-ethanol Market?

The market segments include Feedstock Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Favorable Initiatives and Blending Mandates by Regulatory Bodies; Growing Environmental Concerns due to the Use of Fossil Fuels and the Need for Biofuels.

6. What are the notable trends driving market growth?

Automotive and Transportation Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Phasing out of Fuel-based Vehicles Due to Rising Demand for Electric Vehicles; Shifting Focus to Bio-butanol.

8. Can you provide examples of recent developments in the market?

In November 2022, Andhra Pradesh received a bioethanol facility worth Rs 270 crore (USD 32.67 million). Chief Minister YS Jagan Mohan Reddy laid the foundation stone at Gummalladoddi village of East Godavari district. The facility will be built by Assago Industrial Private Limited and employ 300 people directly and 400 indirectly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Bio-ethanol Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Bio-ethanol Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Bio-ethanol Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Bio-ethanol Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence