Key Insights

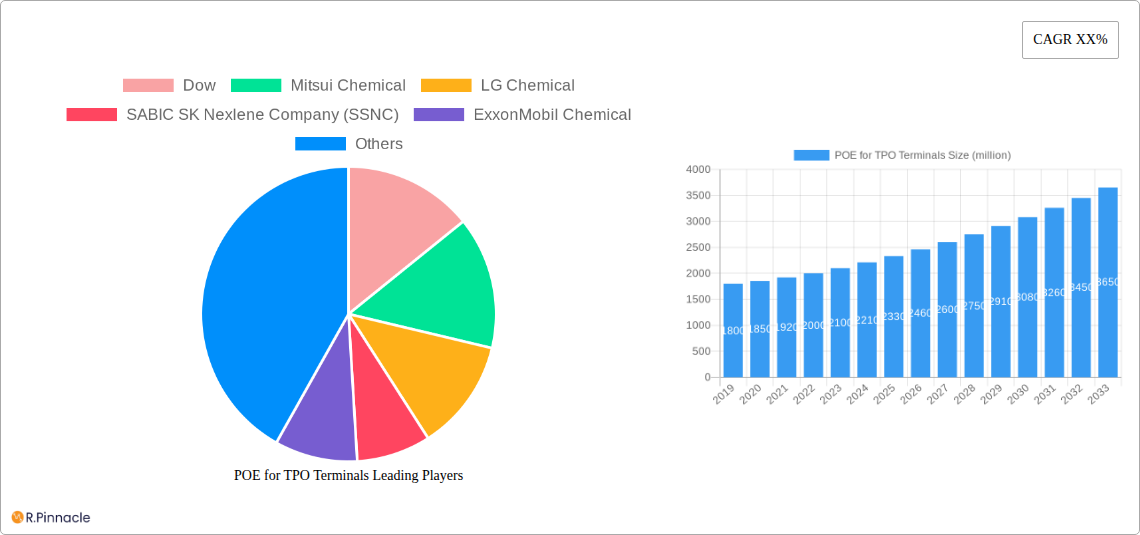

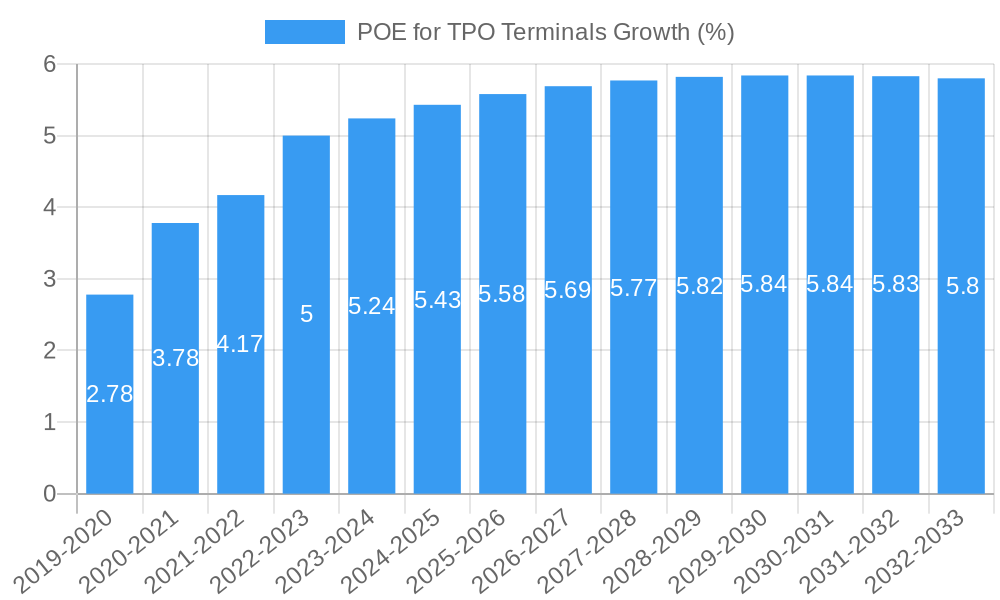

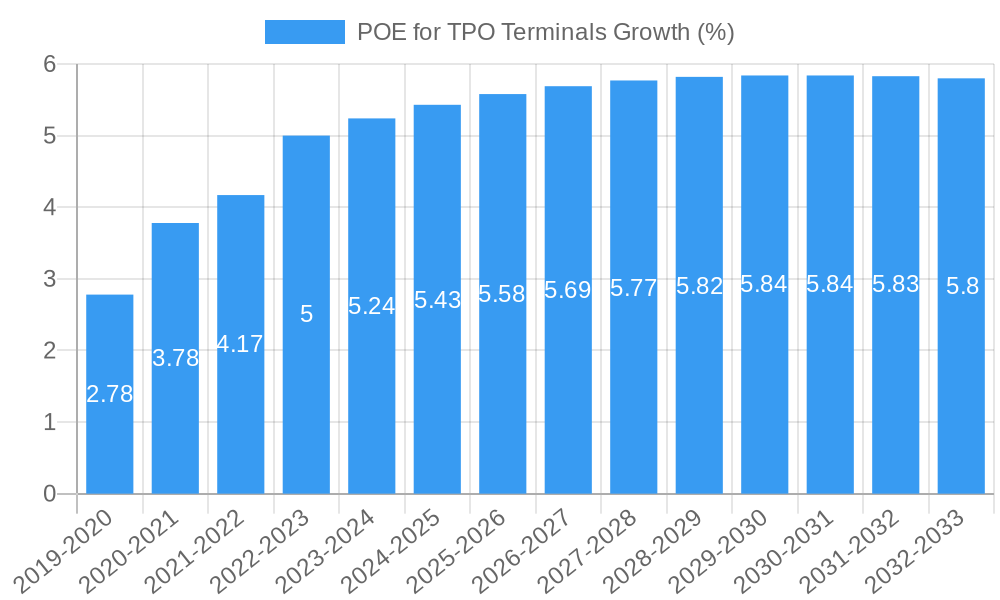

The Polyolefin Elastomers (POE) for Thermoplastic Olefin (TPO) terminals market is poised for significant expansion, projected to reach a valuation of approximately $2,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This growth is primarily fueled by the escalating demand for lightweight and durable materials in the automotive sector, particularly for both passenger car interiors and exteriors, and increasingly for commercial vehicles. POE's superior impact strength, flexibility at low temperatures, and excellent weatherability make it an ideal choice for TPO applications, offering enhanced performance and contributing to improved fuel efficiency in vehicles. The increasing adoption of TPOs in automotive components like bumpers, interior trim, and body panels is a major catalyst, driven by stringent safety regulations and consumer preferences for aesthetically pleasing and resilient vehicle designs.

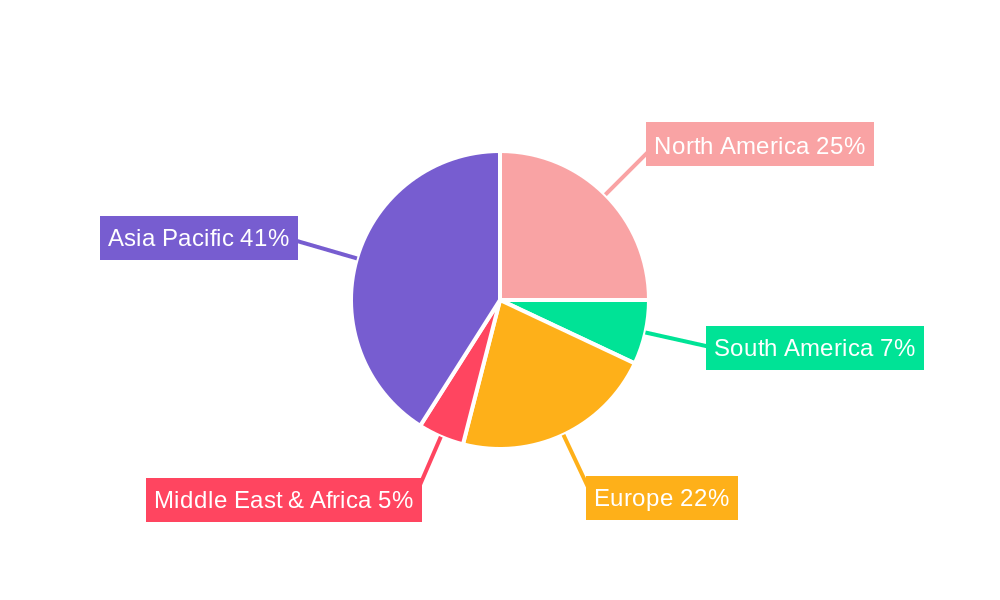

Further amplifying market growth are the continuous advancements in POE technology, leading to improved processing capabilities and a wider range of specialized grades, such as injection and extrusion grades. These innovations cater to evolving manufacturing processes and specific application requirements within the automotive and other emerging industries. While the market enjoys strong drivers, potential restraints include fluctuations in raw material prices, particularly crude oil derivatives, and the competitive landscape presented by alternative materials. However, the ongoing research and development efforts by key players like Dow, Mitsui Chemical, LG Chemical, and SABIC SK Nexlene Company (SSNC) are expected to mitigate these challenges and sustain the upward trajectory of the POE for TPO terminals market throughout the forecast period. The market's geographical distribution shows a strong presence in Asia Pacific, driven by the burgeoning automotive production in China and India, followed by North America and Europe, which have established automotive manufacturing hubs.

This in-depth market research report provides a comprehensive analysis of the Polyolefin Elastomers (POE) for Thermoplastic Olefin (TPO) Terminals market. Covering the historical period from 2019 to 2024, the base year of 2025, and a robust forecast period extending to 2033, this study is an essential resource for industry professionals seeking to understand market dynamics, identify growth opportunities, and navigate the competitive landscape. Leveraging high-ranking keywords, this report is optimized for search visibility and delivers actionable insights for stakeholders across the value chain, including manufacturers, suppliers, automotive OEMs, and research institutions.

POE for TPO Terminals Market Structure & Innovation Trends

The POE for TPO Terminals market exhibits a moderately consolidated structure, with key players like Dow, Mitsui Chemical, LG Chemical, SABIC SK Nexlene Company (SSNC), ExxonMobil Chemical, Borealis, SK, Wison Group, Wanhua Chemical Group, and Shandong Chambroad Petrochemicals holding significant market share, estimated to be approximately 65% collectively. Innovation is primarily driven by the automotive industry's demand for enhanced material performance, including improved impact resistance, flexibility, and weathering properties for passenger car interiors and exteriors, and commercial vehicle interiors and exteriors. Regulatory frameworks, particularly those concerning vehicle safety and environmental sustainability, are increasingly influencing material development and adoption. Product substitutes, such as other thermoplastic elastomers and traditional rubber compounds, pose a competitive threat, necessitating continuous innovation from POE manufacturers. End-user demographics are shifting towards a greater demand for lightweight and durable automotive components, fueling growth in advanced material solutions. Mergers and acquisitions (M&A) are a strategic tool for market players, with recent deal values in the tens of millions to hundreds of millions of dollars, aimed at expanding product portfolios, geographical reach, and technological capabilities.

POE for TPO Terminals Market Dynamics & Trends

The POE for TPO Terminals market is poised for substantial growth, driven by a confluence of technological advancements, evolving consumer preferences, and stringent automotive industry standards. The increasing global demand for automobiles, particularly in emerging economies, directly translates to a higher requirement for advanced TPO compounds enhanced with POE for terminal applications. Technological disruptions, such as the development of novel POE grades with tailored properties for specific automotive components, are acting as significant growth catalysts. These advanced materials offer superior performance characteristics compared to conventional alternatives, including enhanced low-temperature flexibility, excellent impact strength, and improved processability, making them ideal for use in diverse automotive applications like bumpers, interior trim, and exterior body panels. Consumer preferences are increasingly leaning towards vehicles that are lighter, more fuel-efficient, and offer a higher degree of comfort and safety. POE-enhanced TPO solutions contribute significantly to these demands by enabling the production of lighter yet robust automotive parts, thereby improving fuel economy and reducing overall vehicle weight without compromising on structural integrity or passenger safety. The competitive dynamics within the market are intensifying, with established players continuously investing in research and development to maintain their competitive edge and introduce innovative solutions. This includes efforts to develop more sustainable and recyclable POE grades to align with the growing environmental consciousness and regulatory pressures within the automotive sector. The market penetration of POE in TPO terminals is projected to rise, driven by the inherent advantages of these materials and the ongoing push for higher performance and sustainability in automotive manufacturing. The Compound Annual Growth Rate (CAGR) for the POE for TPO Terminals market is estimated to be in the range of 5% to 7% over the forecast period, reflecting a healthy and sustained expansion.

Dominant Regions & Segments in POE for TPO Terminals

North America currently dominates the POE for TPO Terminals market, driven by its established automotive manufacturing base and stringent regulations that favor high-performance and safety-compliant materials. Within North America, the United States leads in consumption and production, fueled by substantial investments in automotive R&D and the presence of major automotive OEMs and their Tier 1 suppliers. The economic policies supporting manufacturing and technological innovation further bolster its dominance.

Dominance in Application Segments:

- Passenger Car Interior and Exterior: This segment holds the largest share due to the widespread use of TPO terminals in a vast array of passenger car components. The demand for aesthetically pleasing, durable, and lightweight interior trims, dashboards, door panels, and exterior parts like bumpers and body claddings directly drives POE consumption.

- Key Drivers: Growing global passenger car production, increasing consumer demand for advanced vehicle features, and stringent safety and aesthetic standards.

- Commercial Vehicle Interior and Exterior: While smaller than the passenger car segment, this area is experiencing robust growth. Commercial vehicles, including trucks and buses, require materials that can withstand harsh operating conditions, demanding high impact resistance and durability.

- Key Drivers: Growth in logistics and transportation industries, increasing fleet sizes, and the need for resilient and long-lasting components.

Dominance in Product Types:

- Injection Grade: This type of POE for TPO terminals is the most prevalent, owing to its superior flow properties and ability to produce complex shapes with high precision, essential for intricate automotive parts.

- Key Drivers: High demand for injection-molded components in automotive interiors and exteriors, enabling intricate designs and efficient manufacturing.

- General Grade: This grade offers a balance of properties suitable for a broad range of TPO terminal applications, making it a widely adopted choice.

- Key Drivers: Versatility and cost-effectiveness for various TPO terminal applications.

- Extrusion Grade: This grade is gaining traction for applications requiring continuous profiles and enhanced flexibility, such as certain sealing components and flexible trim.

- Key Drivers: Growing applications in flexible TPO components and profiles for enhanced functionality.

The Asia-Pacific region is emerging as a significant growth engine, driven by the rapid expansion of its automotive manufacturing sector, particularly in China, India, and South Korea, home to major players like LG Chemical and SK. Government initiatives supporting domestic manufacturing and the increasing disposable income of consumers are contributing to a surge in vehicle production and, consequently, the demand for POE for TPO terminals.

POE for TPO Terminals Product Innovations

Product innovations in POE for TPO terminals are primarily focused on enhancing material performance for demanding automotive applications. Developments include the creation of new POE grades with improved low-temperature impact strength, superior UV and heat resistance, and better processability for intricate designs. These innovations aim to meet the evolving needs of automotive manufacturers seeking lightweight, durable, and aesthetically appealing components for both passenger and commercial vehicles. The competitive advantage lies in tailoring POE properties to specific end-use requirements, enabling greater design freedom and contributing to improved vehicle safety and fuel efficiency.

Report Scope & Segmentation Analysis

This report segments the POE for TPO Terminals market across key application and product type categories.

- Application: Passenger Car Interior and Exterior: This segment is projected to witness significant growth, driven by the increasing production of passenger vehicles globally and the continuous demand for high-performance interior and exterior components. Market size is estimated to reach approximately $5,000 million by 2033.

- Application: Commercial Vehicle Interior and Exterior: This segment, while smaller, is expected to exhibit a strong CAGR, fueled by the expanding logistics and transportation sectors and the need for durable vehicle components. Market size is projected to reach around $1,500 million by 2033.

- Types: Injection Grade: This dominant segment is expected to maintain its leading position due to its suitability for complex automotive parts and efficient manufacturing processes. Market size is estimated to be approximately $4,500 million by 2033.

- Types: General Grade: This versatile segment will continue to see steady demand, catering to a wide array of TPO terminal applications. Market size is projected to reach around $1,000 million by 2033.

- Types: Extrusion Grade: This segment is poised for notable growth as new applications emerge for flexible and profile-based TPO components. Market size is estimated to be around $700 million by 2033.

- Types: Others: This residual segment will encompass specialized grades and niche applications, with its market size estimated to be around $300 million by 2033.

Key Drivers of POE for TPO Terminals Growth

The growth of the POE for TPO Terminals market is primarily propelled by several key factors. The increasing global automotive production, especially in emerging economies, directly fuels the demand for TPO compounds and their POE modifiers. Technological advancements in POE synthesis are leading to the development of grades with superior mechanical properties, such as enhanced impact resistance and flexibility at low temperatures, making them ideal for demanding automotive applications. Furthermore, the automotive industry's continuous pursuit of lightweight materials to improve fuel efficiency and reduce emissions is a significant driver, as POE-enhanced TPO offers a lighter alternative to traditional materials. Stringent automotive safety regulations worldwide also necessitate the use of high-performance materials, further boosting the adoption of POE for TPO terminals. For instance, the demand for improved impact absorption in bumpers and interior components aligns perfectly with the properties offered by POE.

Challenges in the POE for TPO Terminals Sector

Despite its growth prospects, the POE for TPO Terminals sector faces several challenges. Price volatility of raw materials, particularly ethylene and octene, can impact production costs and profit margins, creating a significant barrier for market players. The development of alternative materials and advanced composite technologies poses a competitive threat, requiring continuous innovation and differentiation from POE manufacturers. Furthermore, evolving environmental regulations regarding the recyclability and sustainability of plastics can present compliance challenges and necessitate investments in greener production processes. The global supply chain disruptions, as witnessed in recent years, can also lead to material shortages and increased lead times, affecting production schedules and market stability. For example, a sudden increase in crude oil prices could directly impact the cost of ethylene, a key feedstock for POE.

Emerging Opportunities in POE for TPO Terminals

Emerging opportunities in the POE for TPO Terminals market are centered around sustainable solutions and the expansion into new automotive segments. The growing demand for electric vehicles (EVs) presents a significant opportunity, as EVs often require specialized materials for battery enclosures, interior components, and lightweight structural parts, where POE-enhanced TPO can offer performance advantages. The development of bio-based or recycled POE grades aligns with the increasing consumer and regulatory focus on sustainability, offering a competitive edge to companies investing in this area. Furthermore, the expansion of TPO applications into other industries, such as consumer electronics and industrial goods, where impact resistance and flexibility are crucial, could unlock new market avenues. The increasing emphasis on circular economy principles is also driving innovation in end-of-life solutions for TPO components, presenting opportunities for companies developing advanced recycling technologies.

Leading Players in the POE for TPO Terminals Market

- Dow

- Mitsui Chemical

- LG Chemical

- SABIC SK Nexlene Company (SSNC)

- ExxonMobil Chemical

- Borealis

- SK

- Wison Group

- Wanhua Chemical Group

- Shandong Chambroad Petrochemicals

Key Developments in POE for TPO Terminals Industry

- 2023: Dow announces expansion of its Paxon™ and Engage™ POE portfolio to meet growing automotive demand for enhanced performance and sustainability.

- 2023: Mitsui Chemicals develops new POE grades offering superior low-temperature impact resistance for automotive applications.

- 2022: LG Chemical invests in new production capacity for specialty elastomers, including POE, to cater to the burgeoning EV market.

- 2022: SABIC SK Nexlene Company (SSNC) introduces a new generation of POE for TPO terminals with improved processability and UV stability.

- 2021: ExxonMobil Chemical enhances its Santoprene™ TPV portfolio, offering advanced solutions that complement POE in TPO applications.

- 2020: Borealis launches a new range of POE grades designed for increased recyclability and reduced environmental footprint.

- 2019: SK Global Chemical showcases innovative TPO compounds with POE for next-generation automotive interiors.

Future Outlook for POE for TPO Terminals Market

- 2023: Dow announces expansion of its Paxon™ and Engage™ POE portfolio to meet growing automotive demand for enhanced performance and sustainability.

- 2023: Mitsui Chemicals develops new POE grades offering superior low-temperature impact resistance for automotive applications.

- 2022: LG Chemical invests in new production capacity for specialty elastomers, including POE, to cater to the burgeoning EV market.

- 2022: SABIC SK Nexlene Company (SSNC) introduces a new generation of POE for TPO terminals with improved processability and UV stability.

- 2021: ExxonMobil Chemical enhances its Santoprene™ TPV portfolio, offering advanced solutions that complement POE in TPO applications.

- 2020: Borealis launches a new range of POE grades designed for increased recyclability and reduced environmental footprint.

- 2019: SK Global Chemical showcases innovative TPO compounds with POE for next-generation automotive interiors.

Future Outlook for POE for TPO Terminals Market

The future outlook for the POE for TPO Terminals market is highly optimistic, driven by the sustained growth of the global automotive industry and the increasing demand for high-performance, lightweight, and sustainable materials. The accelerating adoption of electric vehicles will open up new avenues for POE applications, particularly in areas requiring enhanced thermal management, impact protection, and interior comfort. Continued innovation in POE material science, focusing on improved recyclability and the integration of bio-based feedstocks, will be crucial for long-term market success and regulatory compliance. Strategic collaborations and investments in advanced manufacturing technologies will enable market players to meet the evolving needs of automotive OEMs and maintain a competitive edge in this dynamic landscape. The market is expected to witness further consolidation through strategic mergers and acquisitions as companies seek to strengthen their product portfolios and expand their global reach, ultimately shaping a more resilient and technologically advanced future for POE in TPO terminals.

POE for TPO Terminals Segmentation

-

1. Application

- 1.1. Passenger Car Interior and Exterior

- 1.2. Commercial Vehicle Interior and Exterior

-

2. Types

- 2.1. Injection Grade

- 2.2. General Grade

- 2.3. Extrusion Grade

- 2.4. Others

POE for TPO Terminals Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

POE for TPO Terminals REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global POE for TPO Terminals Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Passenger Car Interior and Exterior

- 5.1.2. Commercial Vehicle Interior and Exterior

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Injection Grade

- 5.2.2. General Grade

- 5.2.3. Extrusion Grade

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America POE for TPO Terminals Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Passenger Car Interior and Exterior

- 6.1.2. Commercial Vehicle Interior and Exterior

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Injection Grade

- 6.2.2. General Grade

- 6.2.3. Extrusion Grade

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America POE for TPO Terminals Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Passenger Car Interior and Exterior

- 7.1.2. Commercial Vehicle Interior and Exterior

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Injection Grade

- 7.2.2. General Grade

- 7.2.3. Extrusion Grade

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe POE for TPO Terminals Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Passenger Car Interior and Exterior

- 8.1.2. Commercial Vehicle Interior and Exterior

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Injection Grade

- 8.2.2. General Grade

- 8.2.3. Extrusion Grade

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa POE for TPO Terminals Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Passenger Car Interior and Exterior

- 9.1.2. Commercial Vehicle Interior and Exterior

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Injection Grade

- 9.2.2. General Grade

- 9.2.3. Extrusion Grade

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific POE for TPO Terminals Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Passenger Car Interior and Exterior

- 10.1.2. Commercial Vehicle Interior and Exterior

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Injection Grade

- 10.2.2. General Grade

- 10.2.3. Extrusion Grade

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Dow

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mitsui Chemical

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 LG Chemical

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SABIC SK Nexlene Company (SSNC)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ExxonMobil Chemical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Borealis

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SK

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Wison Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Wanhua Chemical Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Shandong Chambroad Petrochemicals

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Dow

List of Figures

- Figure 1: Global POE for TPO Terminals Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America POE for TPO Terminals Revenue (million), by Application 2024 & 2032

- Figure 3: North America POE for TPO Terminals Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America POE for TPO Terminals Revenue (million), by Types 2024 & 2032

- Figure 5: North America POE for TPO Terminals Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America POE for TPO Terminals Revenue (million), by Country 2024 & 2032

- Figure 7: North America POE for TPO Terminals Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America POE for TPO Terminals Revenue (million), by Application 2024 & 2032

- Figure 9: South America POE for TPO Terminals Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America POE for TPO Terminals Revenue (million), by Types 2024 & 2032

- Figure 11: South America POE for TPO Terminals Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America POE for TPO Terminals Revenue (million), by Country 2024 & 2032

- Figure 13: South America POE for TPO Terminals Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe POE for TPO Terminals Revenue (million), by Application 2024 & 2032

- Figure 15: Europe POE for TPO Terminals Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe POE for TPO Terminals Revenue (million), by Types 2024 & 2032

- Figure 17: Europe POE for TPO Terminals Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe POE for TPO Terminals Revenue (million), by Country 2024 & 2032

- Figure 19: Europe POE for TPO Terminals Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa POE for TPO Terminals Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa POE for TPO Terminals Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa POE for TPO Terminals Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa POE for TPO Terminals Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa POE for TPO Terminals Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa POE for TPO Terminals Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific POE for TPO Terminals Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific POE for TPO Terminals Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific POE for TPO Terminals Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific POE for TPO Terminals Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific POE for TPO Terminals Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific POE for TPO Terminals Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global POE for TPO Terminals Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global POE for TPO Terminals Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global POE for TPO Terminals Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global POE for TPO Terminals Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global POE for TPO Terminals Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global POE for TPO Terminals Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global POE for TPO Terminals Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global POE for TPO Terminals Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global POE for TPO Terminals Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global POE for TPO Terminals Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global POE for TPO Terminals Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global POE for TPO Terminals Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global POE for TPO Terminals Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global POE for TPO Terminals Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global POE for TPO Terminals Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global POE for TPO Terminals Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global POE for TPO Terminals Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global POE for TPO Terminals Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global POE for TPO Terminals Revenue million Forecast, by Country 2019 & 2032

- Table 41: China POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific POE for TPO Terminals Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the POE for TPO Terminals?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the POE for TPO Terminals?

Key companies in the market include Dow, Mitsui Chemical, LG Chemical, SABIC SK Nexlene Company (SSNC), ExxonMobil Chemical, Borealis, SK, Wison Group, Wanhua Chemical Group, Shandong Chambroad Petrochemicals.

3. What are the main segments of the POE for TPO Terminals?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "POE for TPO Terminals," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the POE for TPO Terminals report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the POE for TPO Terminals?

To stay informed about further developments, trends, and reports in the POE for TPO Terminals, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence