Key Insights

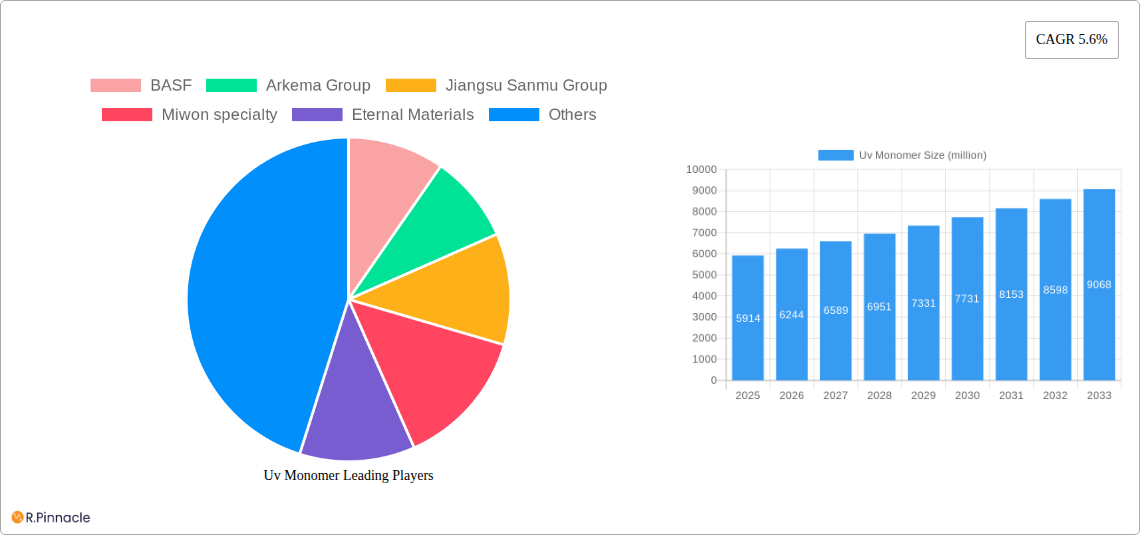

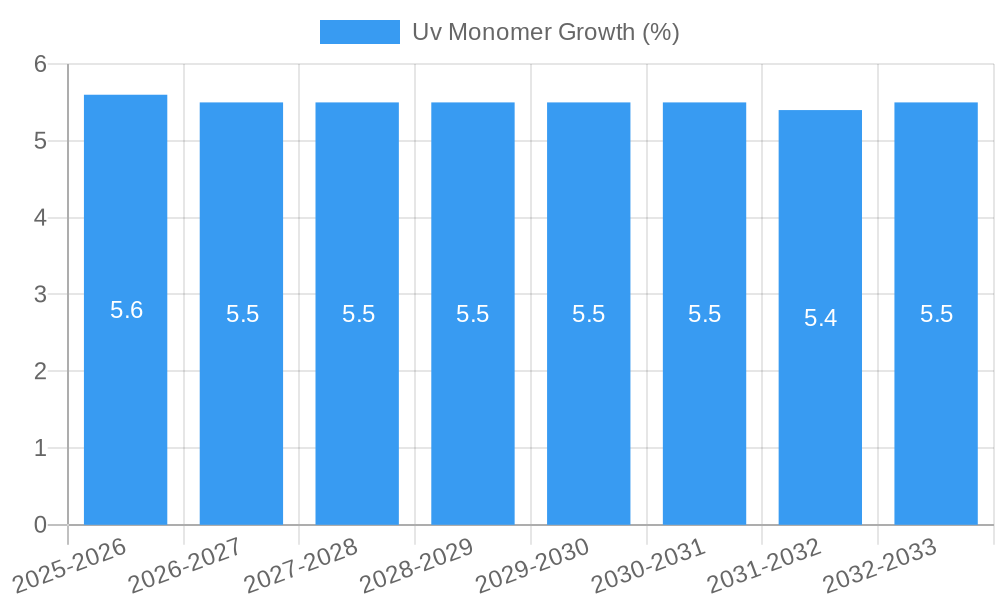

The global UV monomer market is poised for robust growth, projected to reach a substantial market size of USD 5914 million, driven by a Compound Annual Growth Rate (CAGR) of 5.6% from 2025 to 2033. This expansion is primarily fueled by the escalating demand across diverse applications, most notably in paints, inks, and adhesives. The inherent advantages of UV-curable technologies, such as rapid curing times, reduced VOC emissions, and enhanced durability, are compelling manufacturers to adopt these solutions, thereby propelling market momentum. Furthermore, continuous innovation in monomer formulations, leading to improved performance characteristics like scratch resistance and flexibility, is broadening their applicability and attracting new end-users. The market is segmented into monofunctional, difunctional, and multifunctional acrylate and methacrylate monomers, each catering to specific performance requirements and end-use industries. This diversification of product offerings, coupled with a growing emphasis on sustainable and eco-friendly industrial processes, positions the UV monomer market for sustained and significant advancement in the coming years.

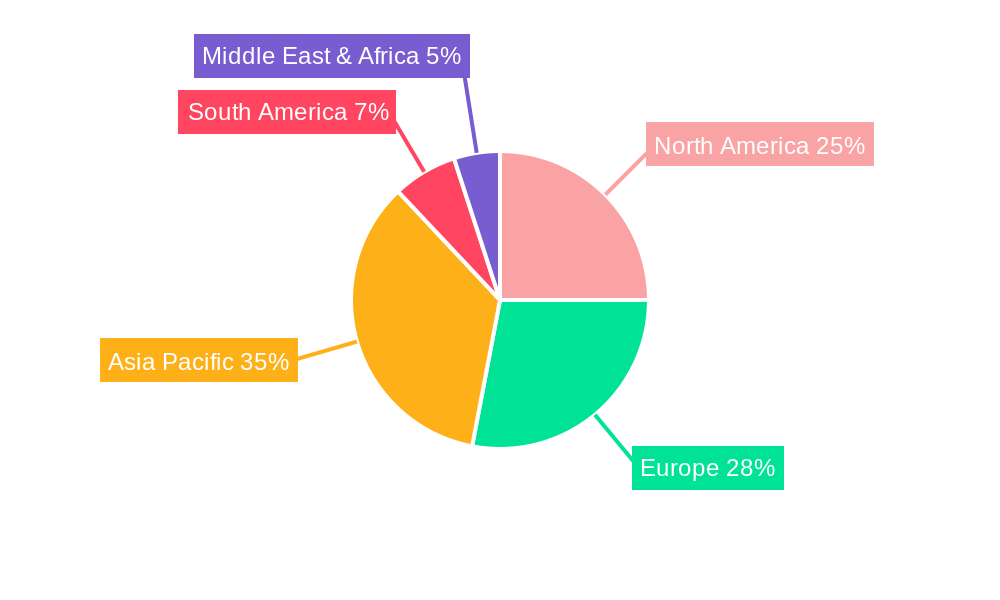

The market dynamics are further shaped by key trends and drivers that underscore its upward trajectory. The increasing adoption of UV-curable coatings in industries such as automotive, electronics, and wood finishing, owing to their superior aesthetic and protective qualities, acts as a significant growth catalyst. Advancements in UV LED curing technology, offering energy efficiency and extended lifespan, are also contributing to the market's positive outlook. While the market enjoys strong growth, potential restraints include the initial investment costs associated with UV curing equipment and the need for specialized handling and safety protocols for certain monomers. However, the long-term benefits in terms of operational efficiency and product performance are expected to outweigh these challenges. Geographically, Asia Pacific, led by China and India, is anticipated to be a major growth engine due to its burgeoning manufacturing sector and increasing industrialization. North America and Europe are also expected to maintain steady growth, driven by stringent environmental regulations and a strong demand for high-performance coatings.

Unlocking the Future of UV Monomers: A Comprehensive Market Report (2019-2033)

This in-depth report provides a definitive analysis of the global UV monomer market, offering critical insights for industry professionals, researchers, and strategic planners. Spanning from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025-2033, this study meticulously examines market dynamics, innovation trends, regional dominance, and future growth trajectories. Discover the driving forces behind the expansion of UV monomers in essential applications such as paints, inks, and adhesives, and understand the impact of technological advancements and evolving consumer demands. With a robust segmentation covering Monofunctional Acrylate Monomers, Difunctional Acrylate Monomers, Multifunctional Acrylate Monomer, Monofunctional Methacrylate Monomers, Difunctional Methacrylate Monomers, and Multifunctional Methacrylate Monomers, this report delivers actionable intelligence for navigating this dynamic and expanding sector.

UV Monomer Market Structure & Innovation Trends

The global UV monomer market exhibits a moderately concentrated structure, with a few key players holding significant market share. Innovation is primarily driven by the demand for enhanced performance characteristics, such as improved scratch resistance, faster curing times, and reduced VOC emissions. Regulatory frameworks, particularly concerning environmental sustainability and health safety, are increasingly influencing product development and market access. While direct product substitutes are limited, advancements in alternative curing technologies and bio-based materials present potential long-term competitive pressures. End-user demographics are diverse, encompassing industrial manufacturers, printing houses, and coatings producers, each with evolving specifications. Mergers and acquisitions (M&A) activity, valued at an estimated $500 million annually, has been observed as companies seek to consolidate market positions, expand product portfolios, and gain access to new technologies and geographies.

UV Monomer Market Dynamics & Trends

The UV monomer market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of xx%, driven by a confluence of technological advancements and expanding application horizons. A primary growth driver is the increasing adoption of UV-curable coatings, inks, and adhesives across various industries, propelled by their inherent advantages over traditional solvent-based systems. These advantages include rapid curing, reduced energy consumption, lower VOC emissions, and superior performance properties like enhanced durability and chemical resistance. The burgeoning demand for environmentally friendly and sustainable solutions further fuels market expansion, as UV-curable technologies align with global sustainability initiatives. Technological disruptions, such as the development of novel UV lamp technologies and the formulation of specialized UV monomers with tailored properties (e.g., flexibility, adhesion, low viscosity), are continuously enhancing product performance and opening up new application possibilities.

Consumer preferences are increasingly shifting towards high-performance, aesthetically pleasing, and durable finishes, which UV-curable materials readily provide. For instance, in the automotive sector, UV coatings offer excellent scratch and weather resistance, while in the electronics industry, they are utilized for protective coatings and encapsulants. The packaging industry benefits from fast-curing UV inks for high-speed printing and sustainable packaging solutions. The competitive landscape is characterized by intense innovation and strategic collaborations among major players aiming to capture market share through differentiated product offerings and cost leadership. The market penetration of UV-curable technologies is steadily increasing, particularly in emerging economies where industrialization and infrastructure development are on the rise. The versatility of UV monomers in applications ranging from wood coatings and graphic arts to 3D printing and advanced composites underscores their pivotal role in modern manufacturing. The ongoing research and development efforts focused on bio-based and renewable UV monomers are poised to further shape the market's future, catering to the growing demand for sustainable chemical solutions. The overall market trajectory is strongly positive, with significant potential for continued expansion driven by innovation, sustainability, and the ever-evolving needs of end-use industries.

Dominant Regions & Segments in UV Monomer

The Asia-Pacific region currently dominates the global UV monomer market, driven by rapid industrialization, robust manufacturing capabilities, and significant investments in infrastructure development across key economies like China, India, and South Korea. Within this region, China stands out as a pivotal market, benefiting from a vast domestic demand for paints, inks, and adhesives, coupled with its position as a global manufacturing hub.

Key Drivers of Dominance in Asia-Pacific:

- Economic Policies & Industrial Growth: Supportive government policies promoting manufacturing and export-oriented industries have fostered substantial growth in sectors that extensively utilize UV monomers.

- Infrastructure Development: Extensive investments in construction, automotive, and electronics sectors necessitate advanced coatings and adhesives, driving the demand for UV-curable solutions.

- Cost-Effectiveness & Scalability: The presence of a large manufacturing base and competitive pricing makes the region an attractive production and consumption hub.

- Growing Consumer Demand: An expanding middle class and increasing disposable incomes in countries like India are fueling demand for higher-quality consumer goods, which often incorporate UV-cured finishes.

In terms of product segments, Multifunctional Acrylate Monomers are leading the market due to their ability to impart superior crosslinking density, hardness, and chemical resistance, making them indispensable in high-performance applications. These monomers are crucial for achieving fast cure speeds and excellent physical properties in demanding environments.

- Paints: Multifunctional acrylate monomers are vital for high-solids, low-VOC UV-curable coatings used in automotive refinishing, wood furniture, and industrial coatings, offering enhanced durability and aesthetic appeal. The estimated market size for UV-curable paints is $15 billion.

- Inks: In the printing industry, these monomers are essential for UV-curable inks used in packaging, labels, and commercial printing, enabling high-speed printing, excellent adhesion, and vibrant color reproduction. The UV ink market is valued at $10 billion.

- Adhesives: Multifunctional acrylate monomers are used in UV-curable adhesives for electronics assembly, medical devices, and automotive applications, where rapid bonding and high strength are critical. The UV adhesive market is worth $8 billion.

Among the methacrylate monomer types, Multifunctional Methacrylate Monomers are also experiencing significant demand for their contributions to hardness, scratch resistance, and thermal stability.

The rapid adoption of UV-curing technology, driven by environmental regulations and the need for efficient production processes, underpins the dominance of these segments. The continuous innovation in monomer formulations to meet specific performance requirements further solidifies their market leadership. The estimated total market size for UV monomers is $40 billion.

UV Monomer Product Innovations

Recent product innovations in UV monomers focus on developing high-performance, eco-friendly, and specialized formulations. Companies are actively introducing low-viscosity monomers for improved processing, bio-based monomers derived from renewable resources to meet sustainability demands, and monomers with enhanced adhesion to challenging substrates. These innovations aim to broaden the application scope of UV-curable technologies into new areas like 3D printing and advanced composites, offering competitive advantages through superior cure speed, excellent mechanical properties, and reduced environmental impact.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global UV monomer market, segmented by application and type.

Application Segments:

- Paints: This segment encompasses UV-curable coatings for industrial, architectural, automotive, and wood finishing applications. Market size is projected to reach $20 billion by 2033.

- Inks: Includes UV-curable inks for packaging, graphic arts, labels, and digital printing. Estimated market size is $15 billion.

- Adhesives: Covers UV-curable adhesives used in electronics, medical devices, automotive, and general assembly. Market size is estimated at $12 billion.

Type Segments:

- Monofunctional Acrylate Monomers: These are essential for controlling viscosity and enhancing flexibility. Projected market size of $10 billion.

- Difunctional Acrylate Monomers: Crucial for balancing flexibility and hardness. Estimated market size of $15 billion.

- Multifunctional Acrylate Monomer: Key for high crosslinking density and fast cure speeds. Market size estimated at $20 billion.

- Monofunctional Methacrylate Monomers: Offer good adhesion and weatherability. Projected market size of $8 billion.

- Difunctional Methacrylate Monomers: Provide a balance of hardness and flexibility. Estimated market size of $12 billion.

- Multifunctional Methacrylate Monomers: Impart excellent hardness and thermal resistance. Market size estimated at $18 billion.

The competitive dynamics within each segment are influenced by product performance, cost-effectiveness, and technological innovation.

Key Drivers of UV Monomer Growth

The UV monomer market's growth is propelled by several key factors. Environmentally driven demand for low-VOC and solvent-free curing technologies is a significant catalyst, aligning with global sustainability initiatives. Technological advancements in UV-LED curing systems enable faster processing, lower energy consumption, and enhanced curing control, making UV technology more accessible and efficient. The expansion of end-use industries, particularly in emerging economies, such as automotive, electronics, packaging, and construction, directly correlates with increased demand for high-performance coatings, inks, and adhesives. Furthermore, the inherent advantages of UV-curable materials, including rapid cure times, superior durability, and excellent finish quality, continue to drive their adoption over conventional alternatives.

Challenges in the UV Monomer Sector

Despite its strong growth trajectory, the UV monomer sector faces several challenges. Stringent regulatory compliance, particularly concerning REACH regulations and health hazard classifications of certain monomers, requires ongoing product reformulation and investment in safer alternatives. Fluctuations in raw material prices, often tied to petrochemical feedstocks, can impact production costs and market competitiveness. The development of effective UV-curable solutions for highly challenging substrates or complex geometries still presents technical hurdles. Moreover, the initial capital investment required for UV curing equipment can be a barrier for smaller enterprises, limiting market penetration in some regions.

Emerging Opportunities in UV Monomer

Emerging opportunities in the UV monomer market lie in the burgeoning field of 3D printing, where UV-curable resins are crucial for additive manufacturing processes. The development of bio-based and sustainable UV monomers derived from renewable sources represents a significant growth avenue, catering to increasing environmental consciousness. Advancements in functional monomers that impart specific properties like anti-microbial resistance, self-healing capabilities, or enhanced conductivity open up new niche applications. The growing demand for advanced packaging solutions, particularly in the food and beverage sector, is also creating opportunities for specialized UV inks and coatings offering improved barrier properties and visual appeal.

Leading Players in the UV Monomer Market

- BASF

- Arkema Group

- Jiangsu Sanmu Group

- Miwon specialty

- Eternal Materials

- Syensqo (Solvay)

- IGM Resins

- Jiangsu Litian Technology

- Green Chemical

- GEO

- Covestro AG

- NIPPON SHOKUBAI

- Jiangsu Kailin Ruiyang Chemical

- Osaka Organic Chemical

- Evonik Industries

- Qianyou Chemical

- KJ Chemicals Corporation

- Shandong Rbl Chemicals

- Allnex Group

- TIANJIAO RADIATION CURING MATERIAL

- Tianjin Jiuri New Materials

- Double Bond Chemical

Key Developments in UV Monomer Industry

- 2023: Launch of new bio-based acrylate monomers by Arkema, enhancing sustainability offerings.

- 2023: BASF announces significant investment in expanding its UV monomer production capacity in Asia.

- 2024: IGM Resins introduces a new range of photoinitiators designed for UV-LED curing applications.

- 2024: Syensqo (Solvay) collaborates with a 3D printing resin manufacturer to develop advanced UV-curable materials.

- 2024: Miwon specialty expands its portfolio with novel multifunctional monomers for high-performance coatings.

- 2024: Eternal Materials launches a series of UV-curable resins for flexible electronics.

- 2024: Covestro AG focuses on developing UV-curable solutions for the automotive and industrial coatings sectors.

Future Outlook for UV Monomer Market

The future outlook for the UV monomer market is exceptionally bright, poised for sustained and accelerated growth. The ongoing global drive towards sustainability and reduced environmental impact will continue to favor UV-curable technologies due to their low VOC emissions and energy efficiency. Innovations in UV-LED curing will further enhance their competitive edge, making them more adaptable to a wider range of manufacturing processes and materials. The expansion of 3D printing and the development of smart materials with embedded functionalities will unlock significant new markets for specialized UV monomers. Furthermore, the increasing demand for high-performance and aesthetically superior products across diverse sectors like automotive, electronics, and packaging will ensure a consistent demand for advanced UV monomer formulations. Strategic investments in R&D, capacity expansion, and exploration of bio-based alternatives will be crucial for market leaders to capitalize on these burgeoning opportunities.

Uv Monomer Segmentation

-

1. Application

- 1.1. Paints

- 1.2. Inks

- 1.3. Adhesives

-

2. Type

- 2.1. Monofunctional Acrylate Monomers

- 2.2. Difunctional Acrylate Monomers

- 2.3. Multifunctional Acrylate Monomer

- 2.4. Monofunctional Methacrylate Monomers

- 2.5. Difunctional Methacrylate Monomers

- 2.6. Multifunctional Methacrylate Monomers

Uv Monomer Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Uv Monomer REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Uv Monomer Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Paints

- 5.1.2. Inks

- 5.1.3. Adhesives

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Monofunctional Acrylate Monomers

- 5.2.2. Difunctional Acrylate Monomers

- 5.2.3. Multifunctional Acrylate Monomer

- 5.2.4. Monofunctional Methacrylate Monomers

- 5.2.5. Difunctional Methacrylate Monomers

- 5.2.6. Multifunctional Methacrylate Monomers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Uv Monomer Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Paints

- 6.1.2. Inks

- 6.1.3. Adhesives

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Monofunctional Acrylate Monomers

- 6.2.2. Difunctional Acrylate Monomers

- 6.2.3. Multifunctional Acrylate Monomer

- 6.2.4. Monofunctional Methacrylate Monomers

- 6.2.5. Difunctional Methacrylate Monomers

- 6.2.6. Multifunctional Methacrylate Monomers

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Uv Monomer Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Paints

- 7.1.2. Inks

- 7.1.3. Adhesives

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Monofunctional Acrylate Monomers

- 7.2.2. Difunctional Acrylate Monomers

- 7.2.3. Multifunctional Acrylate Monomer

- 7.2.4. Monofunctional Methacrylate Monomers

- 7.2.5. Difunctional Methacrylate Monomers

- 7.2.6. Multifunctional Methacrylate Monomers

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Uv Monomer Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Paints

- 8.1.2. Inks

- 8.1.3. Adhesives

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Monofunctional Acrylate Monomers

- 8.2.2. Difunctional Acrylate Monomers

- 8.2.3. Multifunctional Acrylate Monomer

- 8.2.4. Monofunctional Methacrylate Monomers

- 8.2.5. Difunctional Methacrylate Monomers

- 8.2.6. Multifunctional Methacrylate Monomers

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Uv Monomer Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Paints

- 9.1.2. Inks

- 9.1.3. Adhesives

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Monofunctional Acrylate Monomers

- 9.2.2. Difunctional Acrylate Monomers

- 9.2.3. Multifunctional Acrylate Monomer

- 9.2.4. Monofunctional Methacrylate Monomers

- 9.2.5. Difunctional Methacrylate Monomers

- 9.2.6. Multifunctional Methacrylate Monomers

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Uv Monomer Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Paints

- 10.1.2. Inks

- 10.1.3. Adhesives

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Monofunctional Acrylate Monomers

- 10.2.2. Difunctional Acrylate Monomers

- 10.2.3. Multifunctional Acrylate Monomer

- 10.2.4. Monofunctional Methacrylate Monomers

- 10.2.5. Difunctional Methacrylate Monomers

- 10.2.6. Multifunctional Methacrylate Monomers

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BASF

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Arkema Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Jiangsu Sanmu Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Miwon specialty

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eternal Materials

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Syensqo (Solvay)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 IGM Resins

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Jiangsu Litian Technology

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Green Chemical

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 GEO

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Covestro AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 NIPPON SHOKUBAI

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Jiangsu Kailin Ruiyang Chemical

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Osaka Organic Chemical

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Evonik Industries

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Qianyou Chemical

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 KJ Chemicals Corporation

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Shandong Rbl Chemicals

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Allnex Group

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 TIANJIAO RADIATION CURING MATERIAL

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Tianjin Jiuri New Materials

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Double Bond Chemical

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 BASF

List of Figures

- Figure 1: Global Uv Monomer Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Uv Monomer Revenue (million), by Application 2024 & 2032

- Figure 3: North America Uv Monomer Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Uv Monomer Revenue (million), by Type 2024 & 2032

- Figure 5: North America Uv Monomer Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Uv Monomer Revenue (million), by Country 2024 & 2032

- Figure 7: North America Uv Monomer Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Uv Monomer Revenue (million), by Application 2024 & 2032

- Figure 9: South America Uv Monomer Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Uv Monomer Revenue (million), by Type 2024 & 2032

- Figure 11: South America Uv Monomer Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Uv Monomer Revenue (million), by Country 2024 & 2032

- Figure 13: South America Uv Monomer Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Uv Monomer Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Uv Monomer Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Uv Monomer Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Uv Monomer Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Uv Monomer Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Uv Monomer Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Uv Monomer Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Uv Monomer Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Uv Monomer Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Uv Monomer Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Uv Monomer Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Uv Monomer Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Uv Monomer Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Uv Monomer Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Uv Monomer Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Uv Monomer Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Uv Monomer Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Uv Monomer Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Uv Monomer Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Uv Monomer Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Uv Monomer Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Uv Monomer Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Uv Monomer Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Uv Monomer Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Uv Monomer Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Uv Monomer Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Uv Monomer Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Uv Monomer Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Uv Monomer Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Uv Monomer Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Uv Monomer Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Uv Monomer Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Uv Monomer Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Uv Monomer Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Uv Monomer Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Uv Monomer Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Uv Monomer Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Uv Monomer Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Uv Monomer?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Uv Monomer?

Key companies in the market include BASF, Arkema Group, Jiangsu Sanmu Group, Miwon specialty, Eternal Materials, Syensqo (Solvay), IGM Resins, Jiangsu Litian Technology, Green Chemical, GEO, Covestro AG, NIPPON SHOKUBAI, Jiangsu Kailin Ruiyang Chemical, Osaka Organic Chemical, Evonik Industries, Qianyou Chemical, KJ Chemicals Corporation, Shandong Rbl Chemicals, Allnex Group, TIANJIAO RADIATION CURING MATERIAL, Tianjin Jiuri New Materials, Double Bond Chemical.

3. What are the main segments of the Uv Monomer?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5914 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Uv Monomer," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Uv Monomer report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Uv Monomer?

To stay informed about further developments, trends, and reports in the Uv Monomer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence