Key Insights

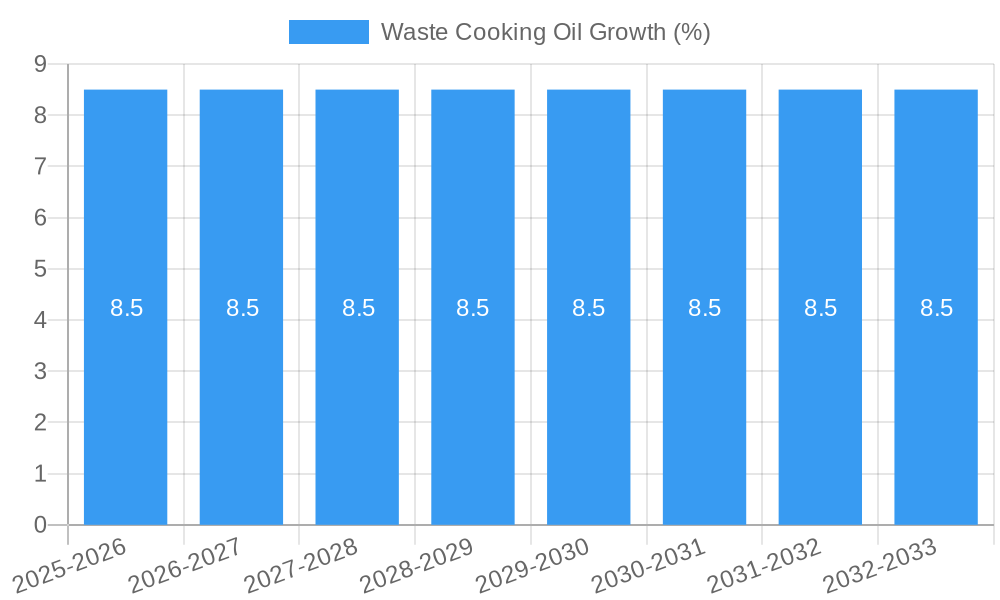

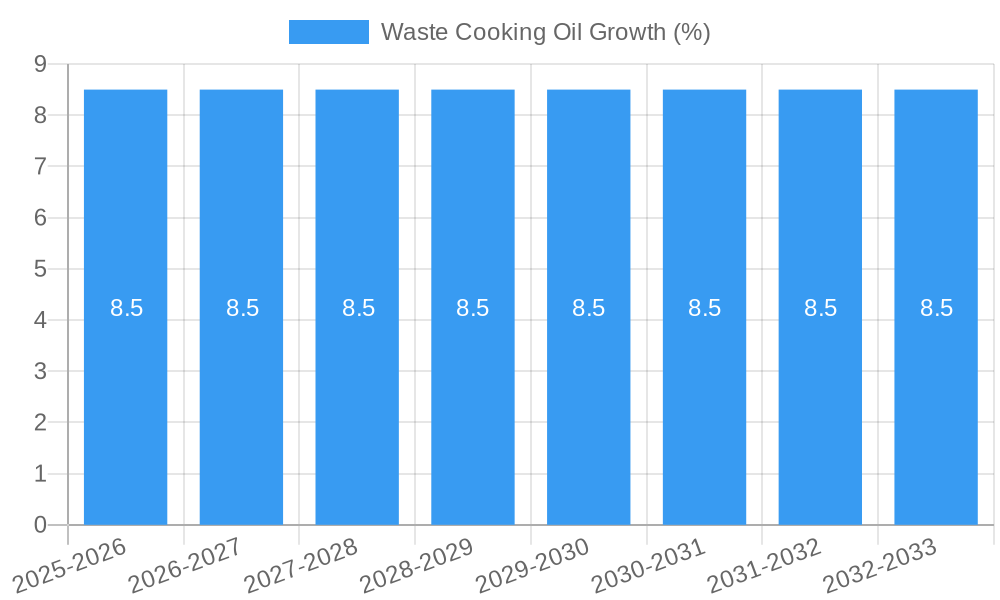

The global Waste Cooking Oil (WCO) market is poised for significant expansion, estimated to reach approximately USD 8,500 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 8.5% through 2033. This robust growth is primarily driven by the escalating demand for sustainable fuel alternatives, particularly biodiesel, Hydrotreated Vegetable Oil (HVO), and Sustainable Aviation Fuel (SAF). Increasing environmental regulations, coupled with a growing awareness of circular economy principles, are compelling industries and consumers to seek out renewable resources. WCO, a readily available and cost-effective feedstock, is at the forefront of this transition, offering a compelling solution to reduce reliance on fossil fuels and mitigate greenhouse gas emissions. The increasing focus on waste valorization and the development of advanced processing technologies are further augmenting market opportunities.

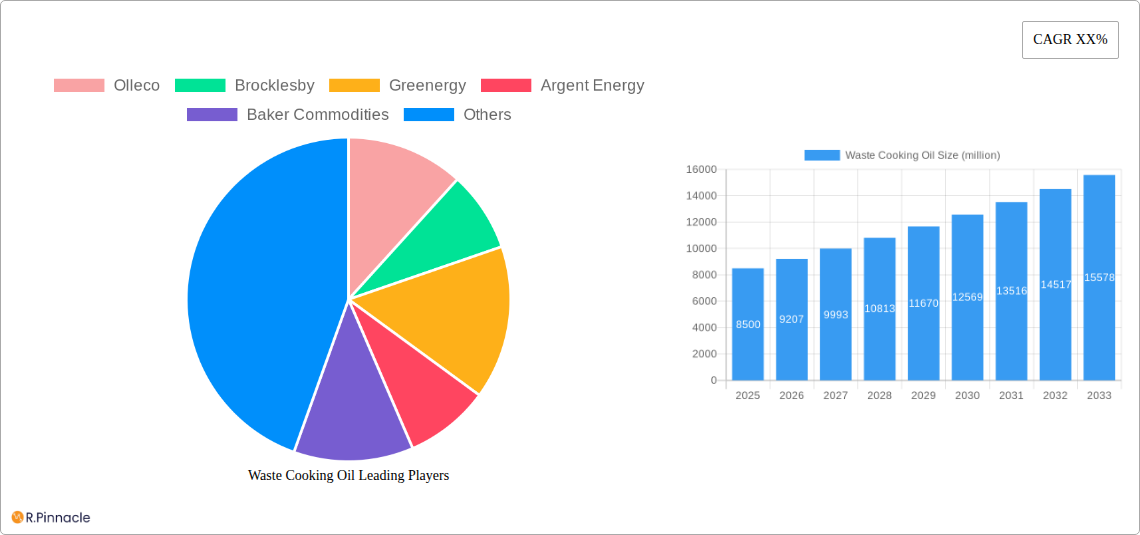

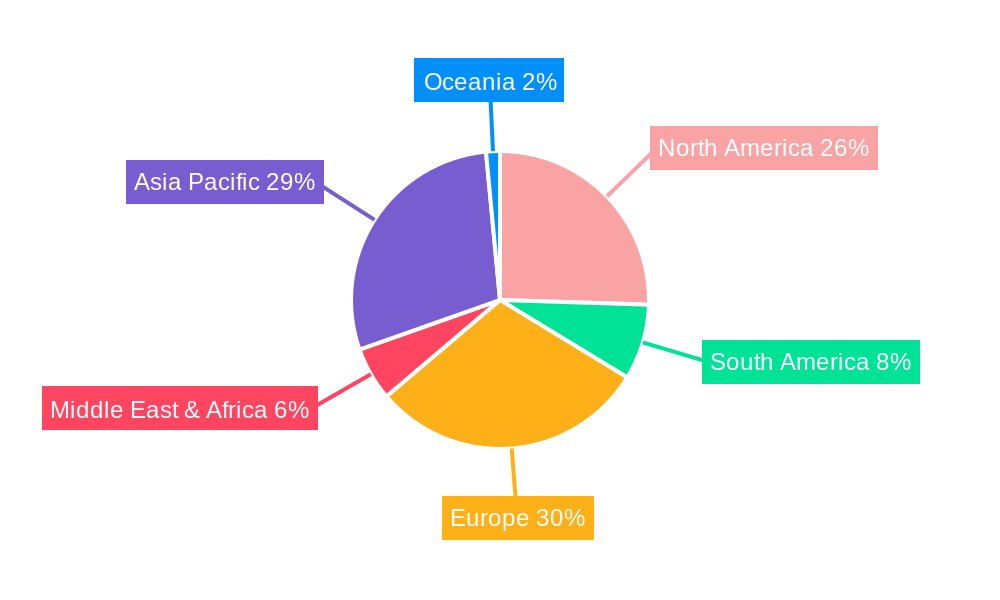

The market is segmented by application, with Biodiesel, HVO Raw Materials, and SAF Raw Materials representing the dominant segments due to their widespread adoption in transportation and aviation sectors. Vegetable oil and animal oil are the primary types of WCO utilized, with blended oil gaining traction as collection and processing infrastructure improves. Geographically, Asia Pacific, led by China and India, is emerging as a key growth region, driven by rapid industrialization, expanding transportation networks, and supportive government policies for biofuels. Europe and North America also hold substantial market share, supported by established biofuel mandates and advanced recycling capabilities. Key players like Olleco, Darling Ingredients, and Greenergy are actively investing in expanding their collection networks, refining capacities, and developing innovative WCO-based fuel solutions to capture this growing market.

Waste Cooking Oil Market Report: Navigating the Future of Sustainable Feedstocks

This comprehensive report offers an in-depth analysis of the global Waste Cooking Oil (WCO) market, exploring its current landscape, growth trajectories, and future potential. With an estimated market size exceeding XX million by 2033, this study provides crucial insights for industry stakeholders seeking to capitalize on the burgeoning demand for sustainable raw materials in the biodiesel, Hydrotreated Vegetable Oil (HVO), and Sustainable Aviation Fuel (SAF) sectors. The report covers the Study Period of 2019–2033, with a Base Year and Estimated Year of 2025, and a Forecast Period of 2025–2033, building upon Historical Period data from 2019–2024.

Waste Cooking Oil Market Structure & Innovation Trends

The Waste Cooking Oil market exhibits a moderate concentration, with leading players like Olleco, Brocklesby, Greenergy, and Argent Energy holding significant market share, estimated to be over XX million in combined revenue. Innovation is primarily driven by advancements in refining technologies to improve WCO quality for advanced biofuel production, such as HVO and SAF. Regulatory frameworks, including mandates for renewable fuel content and circular economy initiatives, are crucial drivers shaping market dynamics. Product substitutes, such as virgin vegetable oils or other waste streams, pose a competitive threat, though WCO's cost-effectiveness and environmental benefits offer a distinct advantage. End-user demographics are increasingly skewed towards large-scale fuel producers and chemical manufacturers seeking sustainable feedstocks. Mergers and acquisitions (M&A) are a significant trend, with recent deals, such as Darling Ingredients' acquisition of Baker Commodities for an estimated XX million, signaling consolidation and strategic expansion. This trend is expected to continue as companies seek to secure feedstock supply chains and expand their processing capabilities. The market is characterized by a growing focus on advanced biochemical conversions and biorefinery integration.

Waste Cooking Oil Market Dynamics & Trends

The global Waste Cooking Oil market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This expansion is fueled by a confluence of factors, including escalating global demand for sustainable biofuels, stringent environmental regulations pushing for reduced carbon emissions, and increasing consumer awareness regarding the benefits of a circular economy. The rising price volatility of fossil fuels further enhances the economic attractiveness of WCO as a viable alternative feedstock for renewable energy production. Technological disruptions, particularly in the areas of WCO pre-treatment and advanced refining processes, are crucial for improving yield and purity, thereby unlocking new applications and enhancing market penetration. For instance, innovations in enzyme-catalyzed esterification and microemulsion technologies are making WCO processing more efficient and cost-effective. Consumer preferences are shifting towards products with a lower carbon footprint, indirectly boosting the demand for biofuels derived from WCO. This trend is evident in the increasing adoption of biodiesel and HVO in the transportation sector across various regions. The competitive landscape is intensifying, with both established players and emerging enterprises vying for market share. Key strategies include vertical integration, strategic partnerships for feedstock collection, and investments in R&D to develop higher-value by-products. The market penetration of WCO-derived biofuels is expected to rise significantly as infrastructure for collection, processing, and distribution continues to expand globally. The estimated market size for WCO is projected to reach XX million by 2033, reflecting its growing importance in the transition to a low-carbon economy.

Dominant Regions & Segments in Waste Cooking Oil

Europe currently dominates the Waste Cooking Oil market, driven by strong government mandates for renewable energy, a well-established network for used cooking oil collection, and significant investments in biofuel production facilities. Countries like the Netherlands, Germany, and the UK are at the forefront, supported by policies such as the Renewable Energy Directive (RED II) and national biofuel targets. The application segment of Biodiesel continues to hold a substantial share, owing to its widespread adoption in the transportation sector and mature production technologies. However, the demand for HVO Raw Materials and SAF Raw Materials is experiencing rapid growth. SAF, in particular, is witnessing accelerated development due to the aviation industry's commitment to decarbonization, with companies like Greenergy and Argent Energy actively involved in SAF feedstock production.

- Europe:

- Key Drivers: Stringent climate policies, favorable subsidies for biofuels, advanced waste management infrastructure, strong consumer demand for sustainable products.

- Dominance: Well-established collection networks and processing capacities for WCO. Leading companies like Olleco and Brocklesby have significant operations.

- North America:

- Key Drivers: Growing biofuel mandates (e.g., Renewable Fuel Standard in the US), increasing investment in biorefineries, and a rising awareness of circular economy principles.

- Dominance: Emerging growth in WCO utilization, particularly for biodiesel and expanding interest in HVO. Companies like Darling Ingredients and Baker Commodities are key players.

- Asia-Pacific:

- Key Drivers: Rapid industrialization, growing energy demand, and increasing government focus on environmental sustainability. China, with companies like Shandong High Speed Renewable Energy Group and Sichuan Jinshang Environmental Protection Technology, is a significant emerging market.

- Dominance: Substantial potential for WCO collection and processing, driven by large populations and extensive food service industries.

- Application Segments:

- Biodiesel: Remains the largest segment due to established infrastructure and demand.

- HVO Raw Materials: Experiencing rapid growth driven by its superior fuel properties and compatibility with existing infrastructure.

- SAF Raw Materials: The fastest-growing segment, spurred by the aviation industry's sustainability goals and technological advancements in SAF production.

- Others: Includes niche applications in oleochemicals and industrial lubricants, contributing to market diversification.

- Type Segments:

- Vegetable Oil: The most abundant type, derived from various sources, forming the backbone of WCO supply.

- Animal Oil: Plays a significant role, especially in regions with substantial meat processing industries, providing a complementary feedstock.

- Blended Oil: Increasingly important as processors optimize feedstock blends to meet specific quality requirements for advanced biofuels.

Waste Cooking Oil Product Innovations

Product innovations in the Waste Cooking Oil sector are primarily focused on enhancing the quality and versatility of processed WCO. Advanced refining techniques are yielding higher purity oils suitable for demanding applications like Sustainable Aviation Fuel (SAF) and Hydrotreated Vegetable Oil (HVO). Companies are developing proprietary catalyst technologies to improve de-gumming, de-acidification, and de-colorization processes, leading to refined oils with reduced impurities and enhanced stability. Competitive advantages are being gained through the development of circular economy models, where WCO is not just a feedstock but also integrated into broader biorefinery concepts, creating value-added by-products. These innovations are critical in meeting stringent industry specifications and driving market adoption.

Report Scope & Segmentation Analysis

This report segment analyzes the global Waste Cooking Oil market across key applications and feedstock types.

- Application: Biodiesel: This segment, driven by existing infrastructure and mandates, is projected to maintain steady growth, contributing significantly to the overall market.

- Application: HVO Raw Materials: This rapidly expanding segment benefits from HVO's superior fuel properties and compatibility with existing diesel engines, showing strong growth potential.

- Application: SAF Raw Materials: The fastest-growing segment, fueled by the aviation industry's decarbonization targets and increasing investment in SAF production technologies.

- Application: Others: This segment encompasses niche uses in oleochemicals and industrial applications, offering diversification and incremental growth.

- Type: Vegetable Oil: Remains the dominant feedstock due to its widespread availability from various food processing activities.

- Type: Animal Oil: A crucial supplementary feedstock, particularly in regions with significant livestock industries, contributing to supply chain diversity.

- Type: Blended Oil: Increasingly important as processors optimize feedstock characteristics to meet the stringent specifications of advanced biofuels, driving innovation in blending techniques.

Key Drivers of Waste Cooking Oil Growth

The Waste Cooking Oil market's growth is propelled by a multifaceted interplay of technological, economic, and regulatory factors. Technologically, advancements in WCO refining and conversion processes are making it more efficient and cost-effective to produce high-quality biofuels like HVO and SAF. Economically, the increasing price volatility of fossil fuels makes WCO-derived biofuels a more attractive and stable alternative. Regulatory drivers, such as government mandates for renewable fuel content and carbon emission reduction targets, are creating a strong and consistent demand for sustainable feedstocks. For example, the European Union's Renewable Energy Directive (RED II) significantly incentivizes the use of WCO in biofuel production.

Challenges in the Waste Cooking Oil Sector

Despite its strong growth potential, the Waste Cooking Oil sector faces several challenges. Regulatory hurdles can arise from varying standards and enforcement across different regions, impacting feedstock traceability and quality control. Supply chain issues, including inconsistent collection volumes, geographical dispersion of sources, and the risk of contamination, can lead to price volatility and impact processing efficiency. Competitive pressures from alternative feedstocks and fluctuating market prices for finished biofuels also present significant restraints. The estimated economic impact of these challenges on market growth could be in the range of XX million annually.

Emerging Opportunities in Waste Cooking Oil

Emerging opportunities in the Waste Cooking Oil sector are significant and diverse. The burgeoning demand for Sustainable Aviation Fuel (SAF) presents a substantial growth avenue, with ongoing research and development focused on optimizing WCO conversion for aviation applications. New geographical markets, particularly in developing economies with expanding food industries and growing environmental awareness, offer untapped potential for WCO collection and processing. Technological advancements in biorefining are enabling the production of higher-value co-products alongside biofuels, creating new revenue streams. Furthermore, increasing consumer and corporate preference for sustainably sourced products is driving demand for WCO-derived materials across various industries.

Leading Players in the Waste Cooking Oil Market

- Olleco

- Brocklesby

- Greenergy

- Argent Energy

- Baker Commodities

- Darling Ingredients

- YM Resources

- Scanline

- Saipol

- Giloil

- Green Oil Inc

- DAR PRO Solutions

- GF Commodities

- Buyofuel

- ASB

- Greenside Solutions

- Shandong High Speed Renewable Energy Group

- Sichuan Jinshang Environmental Protection Technology

- Tanghe Jinhai Biological Technology

- Huaibei Xinxing Royal New Energy Technology

- China Resources

- Shanghai Partner Energy Group

Key Developments in Waste Cooking Oil Industry

- 2023: Olleco announces significant investment in advanced WCO processing facilities to boost HVO feedstock production.

- 2023: Greenergy partners with an airline to supply SAF derived from WCO, showcasing growing aviation sector adoption.

- 2022: Darling Ingredients completes the acquisition of Baker Commodities, consolidating market presence and feedstock sourcing.

- 2021: Argent Energy expands its production capacity for WCO-based biodiesel and HVO to meet increasing demand.

- 2020: Shandong High Speed Renewable Energy Group announces plans for a new biorefinery utilizing WCO as a primary feedstock.

Future Outlook for Waste Cooking Oil Market

The future outlook for the Waste Cooking Oil market is exceptionally positive, characterized by sustained growth and increasing strategic importance. The accelerating global push towards decarbonization across transportation, aviation, and industrial sectors will continue to drive demand for sustainable feedstocks. Technological advancements in processing and conversion are expected to unlock further efficiencies and expand the range of applications for WCO. Emerging economies present significant untapped potential for feedstock collection and biofuel production. Strategic opportunities lie in further vertical integration, fostering stronger partnerships across the value chain, and continued investment in R&D to develop next-generation biofuels and bio-based products, ensuring the long-term relevance and profitability of the WCO market.

Waste Cooking Oil Segmentation

-

1. Application

- 1.1. Biodiesel

- 1.2. HVO Raw Materials

- 1.3. SAF Raw Materials

- 1.4. Others

-

2. Types

- 2.1. Vegetable Oil

- 2.2. Animal Oil

- 2.3. Blended Oil

Waste Cooking Oil Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Waste Cooking Oil REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Waste Cooking Oil Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Biodiesel

- 5.1.2. HVO Raw Materials

- 5.1.3. SAF Raw Materials

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Vegetable Oil

- 5.2.2. Animal Oil

- 5.2.3. Blended Oil

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Waste Cooking Oil Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Biodiesel

- 6.1.2. HVO Raw Materials

- 6.1.3. SAF Raw Materials

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Vegetable Oil

- 6.2.2. Animal Oil

- 6.2.3. Blended Oil

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Waste Cooking Oil Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Biodiesel

- 7.1.2. HVO Raw Materials

- 7.1.3. SAF Raw Materials

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Vegetable Oil

- 7.2.2. Animal Oil

- 7.2.3. Blended Oil

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Waste Cooking Oil Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Biodiesel

- 8.1.2. HVO Raw Materials

- 8.1.3. SAF Raw Materials

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Vegetable Oil

- 8.2.2. Animal Oil

- 8.2.3. Blended Oil

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Waste Cooking Oil Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Biodiesel

- 9.1.2. HVO Raw Materials

- 9.1.3. SAF Raw Materials

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Vegetable Oil

- 9.2.2. Animal Oil

- 9.2.3. Blended Oil

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Waste Cooking Oil Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Biodiesel

- 10.1.2. HVO Raw Materials

- 10.1.3. SAF Raw Materials

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Vegetable Oil

- 10.2.2. Animal Oil

- 10.2.3. Blended Oil

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Olleco

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Brocklesby

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Greenergy

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Argent Energy

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Baker Commodities

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Darling Ingredients

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 YM Resources

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Scanline

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Saipol

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Giloil

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Green Oil Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 DAR PRO Solutions

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 GF Commodities

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Buyofuel

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 ASB

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Greenside Solutions

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Shandong High Speed Renewable Energy Group

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Sichuan Jinshang Environmental Protection Technology

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Tanghe Jinhai Biological Technology

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Huaibei Xinxing Royal New Energy Technology

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 China Resources

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Shanghai Partner Energy Group

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 Olleco

List of Figures

- Figure 1: Global Waste Cooking Oil Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Waste Cooking Oil Revenue (million), by Application 2024 & 2032

- Figure 3: North America Waste Cooking Oil Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Waste Cooking Oil Revenue (million), by Types 2024 & 2032

- Figure 5: North America Waste Cooking Oil Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Waste Cooking Oil Revenue (million), by Country 2024 & 2032

- Figure 7: North America Waste Cooking Oil Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Waste Cooking Oil Revenue (million), by Application 2024 & 2032

- Figure 9: South America Waste Cooking Oil Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Waste Cooking Oil Revenue (million), by Types 2024 & 2032

- Figure 11: South America Waste Cooking Oil Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Waste Cooking Oil Revenue (million), by Country 2024 & 2032

- Figure 13: South America Waste Cooking Oil Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Waste Cooking Oil Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Waste Cooking Oil Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Waste Cooking Oil Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Waste Cooking Oil Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Waste Cooking Oil Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Waste Cooking Oil Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Waste Cooking Oil Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Waste Cooking Oil Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Waste Cooking Oil Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Waste Cooking Oil Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Waste Cooking Oil Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Waste Cooking Oil Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Waste Cooking Oil Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Waste Cooking Oil Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Waste Cooking Oil Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Waste Cooking Oil Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Waste Cooking Oil Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Waste Cooking Oil Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Waste Cooking Oil Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Waste Cooking Oil Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Waste Cooking Oil Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Waste Cooking Oil Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Waste Cooking Oil Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Waste Cooking Oil Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Waste Cooking Oil Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Waste Cooking Oil Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Waste Cooking Oil Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Waste Cooking Oil Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Waste Cooking Oil Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Waste Cooking Oil Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Waste Cooking Oil Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Waste Cooking Oil Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Waste Cooking Oil Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Waste Cooking Oil Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Waste Cooking Oil Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Waste Cooking Oil Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Waste Cooking Oil Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Waste Cooking Oil Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Waste Cooking Oil?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Waste Cooking Oil?

Key companies in the market include Olleco, Brocklesby, Greenergy, Argent Energy, Baker Commodities, Darling Ingredients, YM Resources, Scanline, Saipol, Giloil, Green Oil Inc, DAR PRO Solutions, GF Commodities, Buyofuel, ASB, Greenside Solutions, Shandong High Speed Renewable Energy Group, Sichuan Jinshang Environmental Protection Technology, Tanghe Jinhai Biological Technology, Huaibei Xinxing Royal New Energy Technology, China Resources, Shanghai Partner Energy Group.

3. What are the main segments of the Waste Cooking Oil?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Waste Cooking Oil," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Waste Cooking Oil report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Waste Cooking Oil?

To stay informed about further developments, trends, and reports in the Waste Cooking Oil, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence