Key Insights

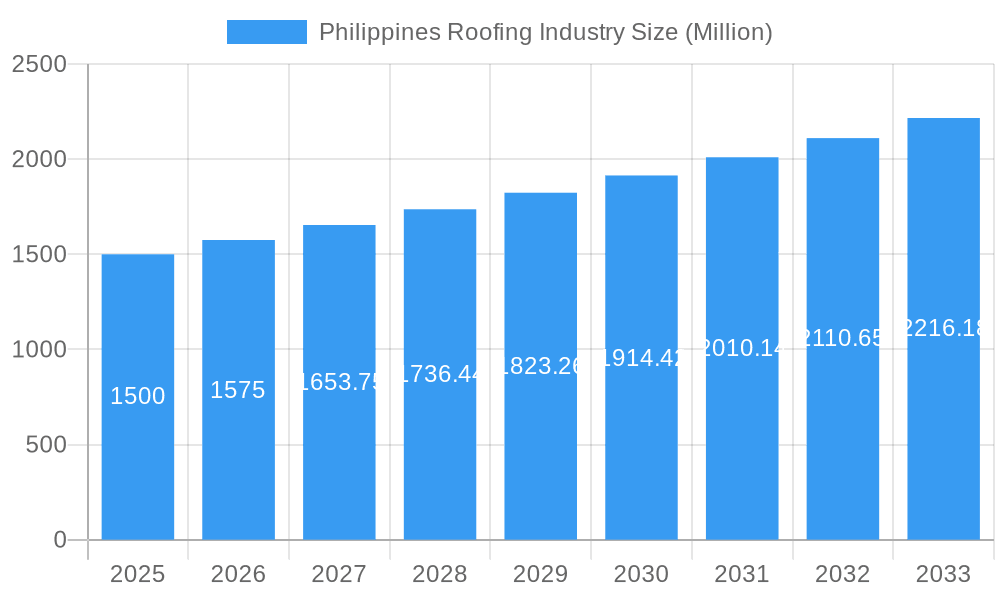

The Philippines roofing market, valued at 230 million in 2024, is poised for substantial growth. This expansion is propelled by a dynamic construction sector, escalating urbanization, and a heightened demand for superior housing quality. The projected Compound Annual Growth Rate (CAGR) of 6.1% indicates sustained development from 2024 to 2033, with the market anticipated to reach a significant valuation by the end of the forecast period. Key drivers include a robust real estate market, particularly in residential development, government-led infrastructure initiatives, and a growing consumer preference for durable and aesthetically appealing roofing materials. Asphalt shingles, metal roofing, and tile roofing are dominant segments, addressing diverse budgetary and architectural needs. While the residential sector forms a substantial market share, non-residential construction, encompassing commercial and industrial facilities, also contributes to market expansion. Potential challenges encompass material price volatility, supply chain vulnerabilities, and the necessity for skilled labor for optimal installation. Nevertheless, the overall market outlook remains optimistic, presenting considerable opportunities for both established entities such as Jacinto Color Steel Inc., Metalink, and Puyat Steel Corporation, alongside emerging market entrants.

Philippines Roofing Industry Market Size (In Million)

The competitive arena features a blend of domestic and international participants, each offering a varied range of products and services. Industry players are prioritizing innovation, focusing on developing energy-efficient and environmentally conscious roofing solutions to meet the rising consumer demand for sustainable options. Strategic alliances, mergers, and acquisitions are expected to further influence industry dynamics. Moreover, government commitments to infrastructure development and affordable housing programs will be instrumental in fostering market growth. The increasing integration of advanced manufacturing and installation technologies is anticipated to boost efficiency and elevate the quality of available roofing solutions. To maximize market reach, companies are actively broadening their distribution networks and investing in targeted marketing campaigns.

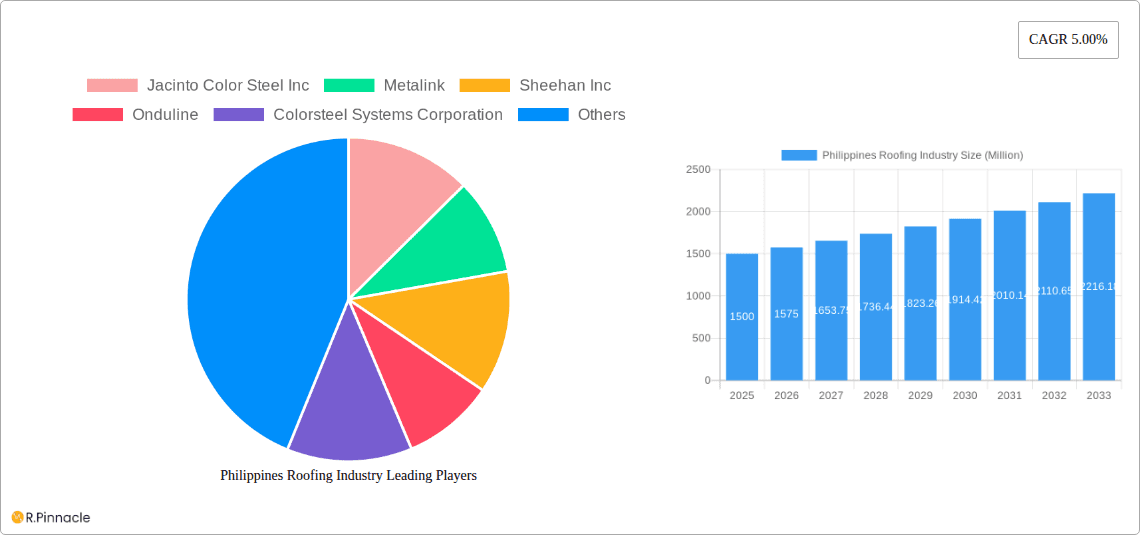

Philippines Roofing Industry Company Market Share

This comprehensive report delivers an in-depth analysis of the Philippines roofing industry, offering valuable intelligence for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with 2024 as the base and estimated year, this report illuminates prevailing market trends, competitive landscapes, and future growth prospects. The historical analysis spans 2019-2024, with the forecast period extending from 2024 to 2033. Expect detailed segmentation analysis across key product categories, including Asphalt Shingles, Tile Roofing, Metal Roofing, and Other Product Types, serving both Residential and Non-residential end-user segments.

Philippines Roofing Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Philippines roofing industry, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and merger & acquisition (M&A) activities. The market is characterized by a mix of large multinational corporations and local players. Key players include Jacinto Color Steel Inc, Metalink, Sheehan Inc, Onduline, Colorsteel Systems Corporation, Sanlex Roofmaster Center Co Inc, DN Steel, Puyat Steel Corporation, TERREAL, Alpha Pro Steel Makers, Marusugi Co Ltd, BP Canada, Union Galvasteel Corporation, Philsteel Holdings Corporation (list not exhaustive). Market share data suggests a moderately concentrated market with the top 5 players holding an estimated xx% of the market share in 2025. M&A activity in the period 2019-2024 totaled approximately $xx Million, driven primarily by consolidation efforts and expansion into new product segments. Innovation is driven by the need for durable, cost-effective, and aesthetically pleasing roofing solutions, particularly given the country's susceptibility to typhoons. Regulatory frameworks, including building codes and environmental regulations, significantly impact material choices and manufacturing processes. The key substitute for traditional roofing materials is increasingly seen in the emergence of eco-friendly and sustainable roofing options. The residential segment dominates the end-user market, driven by a growing housing construction sector and renovation activities. Demographic shifts towards urbanization and a rising middle class further fuel market demand.

Philippines Roofing Industry Market Dynamics & Trends

This section delves into the dynamic forces shaping the Philippines roofing market, including growth drivers, technological advancements, evolving consumer preferences, and competitive strategies. The market is experiencing a steady growth trajectory, with a Compound Annual Growth Rate (CAGR) projected at xx% during the forecast period (2025-2033). Key drivers include robust infrastructure development, increasing disposable incomes, rising construction activity (both residential and non-residential), and government initiatives to improve housing conditions. Technological disruptions are manifested through the introduction of advanced materials like lightweight and high-strength metal roofing, energy-efficient tiles, and improved manufacturing techniques. Consumer preferences are shifting towards aesthetically pleasing, long-lasting, and environmentally friendly roofing solutions. Market penetration of metal roofing is particularly notable, driven by its durability and cost-effectiveness, while the adoption of solar-ready roofing systems is gathering pace. Competitive dynamics are characterized by both price competition and product differentiation strategies.

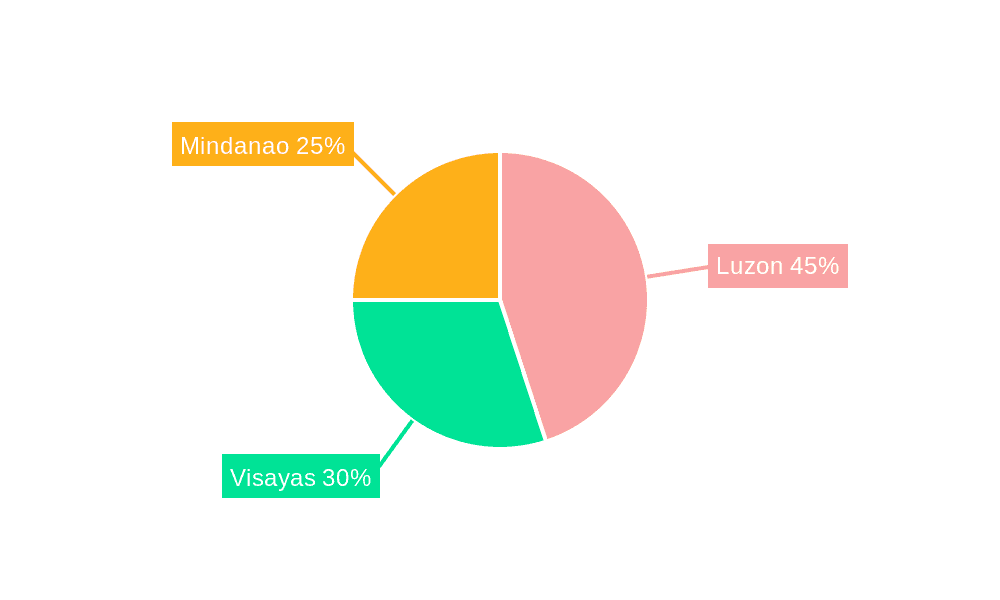

Dominant Regions & Segments in Philippines Roofing Industry

This section identifies the leading regions and segments within the Philippines roofing industry. The National Capital Region (NCR) and other highly urbanized areas consistently exhibit the highest demand due to concentrated construction activity and higher disposable incomes. Within product types, metal roofing enjoys the largest market share, followed by tile roofing and asphalt shingles. The residential segment represents the largest end-user market, followed by the non-residential sector (commercial, industrial, etc.).

- Key Drivers for NCR Dominance: High population density, robust infrastructure development, concentration of construction projects, and higher purchasing power.

- Key Drivers for Metal Roofing Segment Dominance: Durability, cost-effectiveness, longevity, ease of installation, and availability of various styles and colors.

- Key Drivers for Residential Segment Dominance: Increasing household formations, rising middle class, government initiatives to promote homeownership.

The dominance of specific regions and segments is further analyzed in detail, considering factors such as economic policies, infrastructural development, and regional disparities.

Philippines Roofing Industry Product Innovations

Recent product innovations focus on enhancing durability, energy efficiency, and aesthetic appeal. Lightweight, high-strength metal roofing systems with advanced coatings offer superior protection against extreme weather conditions. Innovative tile designs incorporate enhanced insulation properties to reduce energy consumption. The integration of solar panels into roofing systems is gaining traction, offering both energy generation and cost savings. The market is witnessing increased adoption of eco-friendly and sustainable materials, such as recycled materials and materials with lower carbon footprints, aligning with growing environmental consciousness. These innovations cater to both the functional and aesthetic demands of the consumers and position themselves to gain a strong foothold in the market.

Report Scope & Segmentation Analysis

This report segments the Philippines roofing market based on product type (Asphalt Shingles, Tile Roofing, Metal Roofing, Other Product Types) and end-user industry (Residential, Non-residential). Each segment is analyzed with respect to its market size, growth projections, and competitive dynamics. Detailed growth projections for each segment are provided for the forecast period (2025-2033). The competitive landscape varies across segments, with different companies specializing in specific product types or end-user industries. Overall, the market is characterized by a mixture of established players and emerging companies.

Key Drivers of Philippines Roofing Industry Growth

Several factors propel the growth of the Philippines roofing industry. Firstly, robust economic growth and rising disposable incomes drive higher construction activity, fueling demand for new roofing materials. Secondly, government initiatives to improve housing conditions and infrastructure development contribute significantly to market expansion. Thirdly, technological advancements, like the introduction of high-performance, durable, and energy-efficient roofing solutions, cater to consumer needs and preference. Finally, favorable demographics (population growth and urbanization) add to the increasing demand for roofing solutions.

Challenges in the Philippines Roofing Industry Sector

The Philippines roofing industry faces several challenges. Import dependency on raw materials and potential supply chain disruptions represent a significant concern. Fluctuations in raw material prices and exchange rates can affect profitability. Stringent building codes and environmental regulations necessitate compliance, posing challenges to certain manufacturers. Intense competition among established and new players can lead to price wars and margin compression. Finally, natural disasters, such as typhoons, can disrupt construction activity and damage existing roofing installations.

Emerging Opportunities in Philippines Roofing Industry

The Philippines roofing industry presents significant emerging opportunities. The growing adoption of eco-friendly and sustainable roofing solutions provides immense scope for environmentally conscious manufacturers. The integration of smart technologies in roofing systems, such as solar panels and weather monitoring sensors, unlocks new avenues for growth. Expansion into underserved rural areas and the development of affordable roofing solutions for low-income populations offer further potential. Finally, increased focus on building resilience to natural disasters provides a market opportunity for robust and disaster-resistant roofing products.

Leading Players in the Philippines Roofing Industry Market

- Jacinto Color Steel Inc

- Metalink

- Sheehan Inc

- Onduline

- Colorsteel Systems Corporation

- Sanlex Roofmaster Center Co Inc

- DN Steel

- Puyat Steel Corporation

- TERREAL

- Alpha Pro Steel Makers

- Marusugi Co Ltd

- BP Canada

- Union Galvasteel Corporation

- Philsteel Holdings Corporation

Key Developments in Philippines Roofing Industry

- 2022 Q4: Introduction of a new, lightweight metal roofing system by Jacinto Color Steel Inc.

- 2023 Q1: Merger between two smaller roofing tile manufacturers.

- 2023 Q3: Launch of a government initiative promoting energy-efficient roofing solutions. (Further developments will be included in the final report)

Future Outlook for Philippines Roofing Industry Market

The future of the Philippines roofing industry appears bright, driven by sustained economic growth, expanding infrastructure development, rising urbanization, and increasing awareness of the importance of durable and energy-efficient roofing solutions. Strategic opportunities lie in the adoption of sustainable practices, technological innovation, and expansion into new market segments. The market is poised for continued growth, with the potential for significant expansion in both the residential and non-residential sectors.

Philippines Roofing Industry Segmentation

-

1. Product Type

- 1.1. Asphalt Shingles

- 1.2. Tile Roofing

- 1.3. Metal Roofing

- 1.4. Other Product Types

-

2. End-user Industry

- 2.1. Residential

- 2.2. Non-residential

Philippines Roofing Industry Segmentation By Geography

- 1. Philippines

Philippines Roofing Industry Regional Market Share

Geographic Coverage of Philippines Roofing Industry

Philippines Roofing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Construction Activities in the Country; Gain in the Trend of Green Buildings

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Conditions Arising due to the Impact of COVID-19; Other Restraints

- 3.4. Market Trends

- 3.4.1. Metal Roofing to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines Roofing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Asphalt Shingles

- 5.1.2. Tile Roofing

- 5.1.3. Metal Roofing

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Residential

- 5.2.2. Non-residential

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Jacinto Color Steel Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Metalink

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sheehan Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Onduline

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Colorsteel Systems Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sanlex Roofmaster Center Co Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DN Steel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Puyat Steel Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TERREAL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Alpha Pro Steel Makers

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Marusugi Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 BP Canada

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Union Galvasteel Corporation*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Philsteel Holdings Corporation

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Jacinto Color Steel Inc

List of Figures

- Figure 1: Philippines Roofing Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Philippines Roofing Industry Share (%) by Company 2025

List of Tables

- Table 1: Philippines Roofing Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Philippines Roofing Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 3: Philippines Roofing Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Philippines Roofing Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 5: Philippines Roofing Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 6: Philippines Roofing Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines Roofing Industry?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the Philippines Roofing Industry?

Key companies in the market include Jacinto Color Steel Inc, Metalink, Sheehan Inc, Onduline, Colorsteel Systems Corporation, Sanlex Roofmaster Center Co Inc, DN Steel, Puyat Steel Corporation, TERREAL, Alpha Pro Steel Makers, Marusugi Co Ltd, BP Canada, Union Galvasteel Corporation*List Not Exhaustive, Philsteel Holdings Corporation.

3. What are the main segments of the Philippines Roofing Industry?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 230 million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Construction Activities in the Country; Gain in the Trend of Green Buildings.

6. What are the notable trends driving market growth?

Metal Roofing to Dominate the Market.

7. Are there any restraints impacting market growth?

; Unfavorable Conditions Arising due to the Impact of COVID-19; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines Roofing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines Roofing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines Roofing Industry?

To stay informed about further developments, trends, and reports in the Philippines Roofing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence