Key Insights

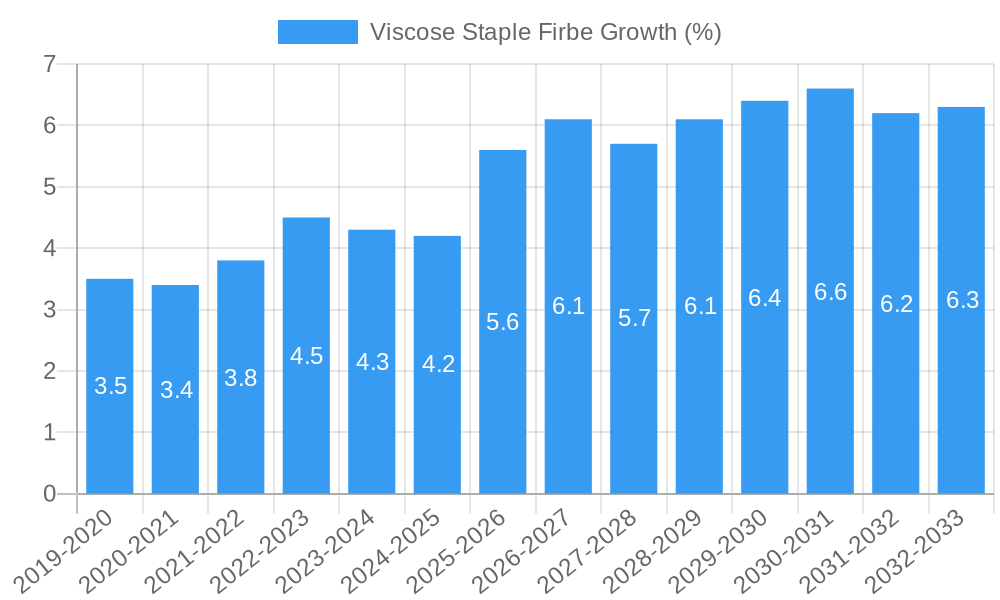

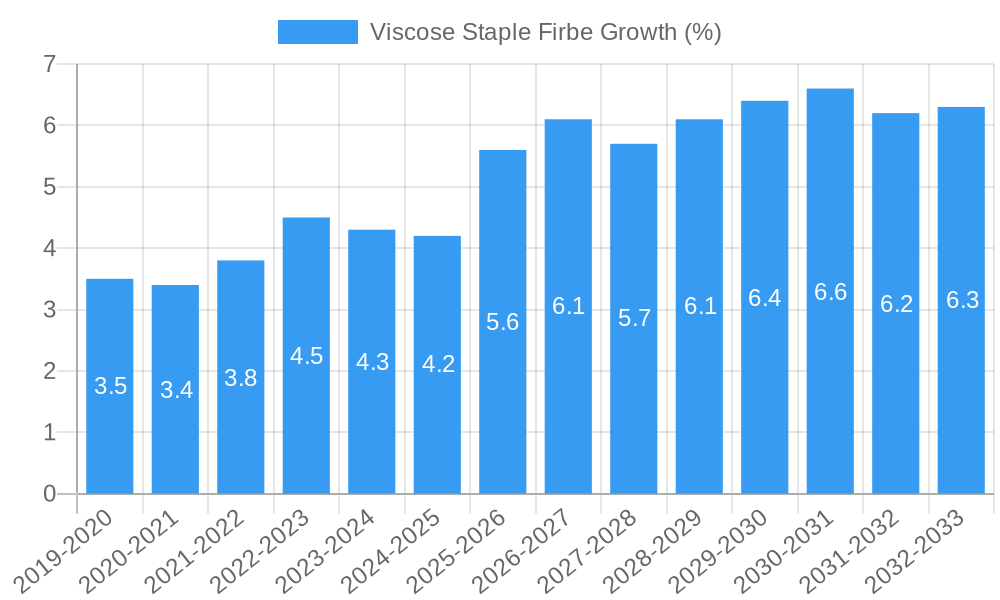

The global Viscose Staple Fiber market is poised for substantial growth, with an estimated market size of $12,500 million in 2025, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This robust expansion is primarily driven by the increasing demand for sustainable and eco-friendly textile alternatives. Viscose staple fiber, derived from renewable wood pulp, offers a biodegradable and recyclable option that resonates with environmentally conscious consumers and brands. The textile industry remains the dominant application segment, leveraging the fiber's versatility, softness, and absorbency for apparel, home furnishings, and industrial fabrics. Furthermore, the transport industry is showing growing interest due to its potential use in automotive interiors. The market is experiencing a significant shift towards naturally derived materials, pushing viscose staple fiber to the forefront as a key alternative to conventional synthetic fibers.

The market's growth trajectory is further bolstered by emerging trends such as innovations in production processes that enhance sustainability and reduce environmental impact, alongside an increasing adoption of regenerated cellulosic fibers by major apparel manufacturers seeking to meet corporate social responsibility goals. However, the market faces certain restraints, including fluctuating raw material prices for wood pulp and increasing competition from other sustainable fibers like Tencel and organic cotton. Despite these challenges, the strong consumer preference for natural and sustainable products, coupled with supportive government initiatives promoting green manufacturing, are expected to propel the viscose staple fiber market forward. Key regions like Asia Pacific, particularly China, are anticipated to lead in both production and consumption, driven by a large manufacturing base and a growing domestic market.

This in-depth report provides an exhaustive analysis of the global Viscose Staple Fibre (VSF) market, covering its structure, dynamics, regional dominance, product innovations, and future prospects. Leveraging millions of data points and expert insights, this report is an essential resource for industry stakeholders seeking to understand market concentration, identify growth drivers, navigate challenges, and capitalize on emerging opportunities. The study encompasses a comprehensive historical analysis from 2019 to 2024, a detailed base year assessment for 2025, and a robust forecast extending to 2033.

Viscose Staple Fibre Market Structure & Innovation Trends

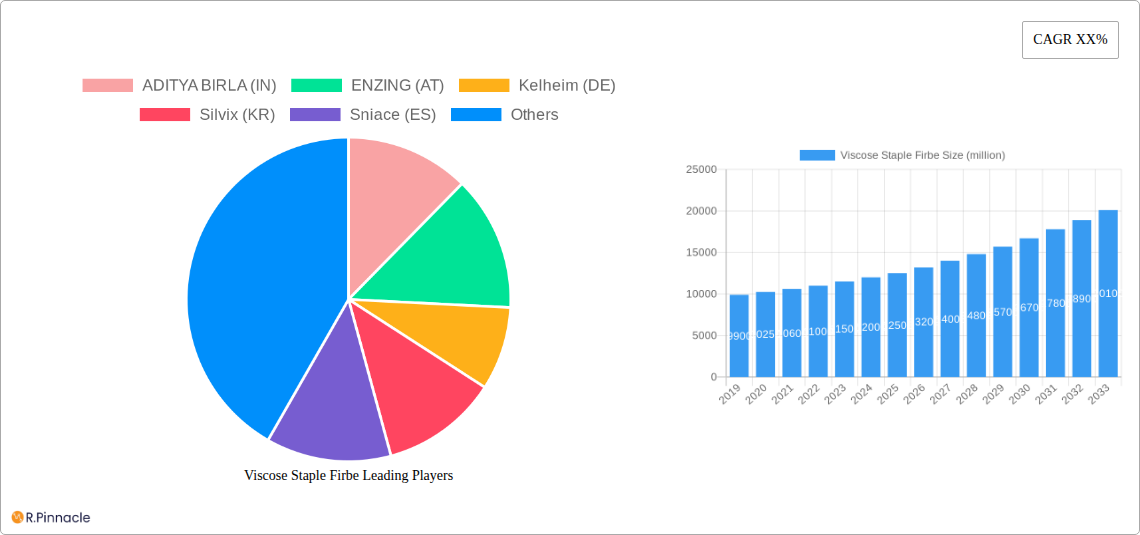

The global Viscose Staple Fibre market exhibits moderate to high concentration, with leading players accounting for a significant share of production. Innovation drivers are primarily focused on enhancing sustainability credentials, improving the performance characteristics of VSF, and developing specialized grades for niche applications. Regulatory frameworks, particularly those concerning environmental impact and chemical usage in VSF manufacturing, are increasingly influencing market dynamics. Product substitutes, such as cotton, polyester, and other regenerated cellulosic fibers, pose a continuous challenge, necessitating continuous innovation and cost-effectiveness from VSF producers. End-user demographics are shifting towards consumers demanding sustainable and biodegradable materials, directly impacting the demand for VSF. Merger and acquisition (M&A) activities are expected to remain a key strategy for market consolidation and expansion, with significant deal values driving industry restructuring. For instance, several strategic partnerships and acquisitions are projected in the forecast period, potentially involving multi-million dollar valuations. Key innovation trends include advancements in closed-loop manufacturing processes, bio-based chemical sourcing, and the development of VSF with enhanced properties like flame retardancy and antimicrobial features.

Viscose Staple Fibre Market Dynamics & Trends

The Viscose Staple Fibre market is experiencing robust growth, driven by a confluence of factors that underscore its increasing relevance in the global textile and industrial landscape. The primary growth driver is the escalating consumer demand for sustainable and eco-friendly textile alternatives. As awareness around the environmental footprint of synthetic fibers grows, VSF, derived from renewable wood pulp, presents a compelling biodegradable and compostable option. This trend is further amplified by stringent environmental regulations and corporate sustainability initiatives, pushing brands and manufacturers towards greener material choices. Technological disruptions are also playing a pivotal role. Innovations in VSF production, including advancements in dissolving pulp processing, closed-loop chemical recovery systems, and the integration of nanotechnologies, are not only enhancing the material's performance characteristics—such as strength, softness, and moisture-wicking capabilities—but also improving the overall eco-efficiency of the manufacturing process. These improvements are crucial for VSF to compete effectively with established fibers like cotton and polyester.

Consumer preferences are rapidly evolving. There is a discernible shift towards natural and renewable materials that offer comfort, breathability, and a soft hand-feel, all of which are inherent qualities of VSF. This is particularly evident in the apparel and home textiles segments. Furthermore, the versatility of VSF allows it to be blended with other fibers, creating fabrics with a wide array of properties, thereby expanding its application spectrum. The global market penetration of VSF is projected to increase significantly as its sustainability narrative gains more traction and as production capacities expand to meet rising demand. The compound annual growth rate (CAGR) for the VSF market is estimated to be robust, fueled by these evolving preferences and the inherent advantages of the fiber.

Competitive dynamics within the VSF sector are characterized by strategic investments in capacity expansion, research and development, and vertical integration. Key players are focusing on differentiating their offerings through specialized VSF types and ensuring supply chain resilience. The increasing focus on traceability and ethical sourcing further influences competitive strategies. The market is poised for sustained expansion as it continues to attract investment and innovation, adapting to the global push for a more circular and sustainable economy. The market size is projected to reach multi-million dollars in the coming years, driven by increased adoption across various industries.

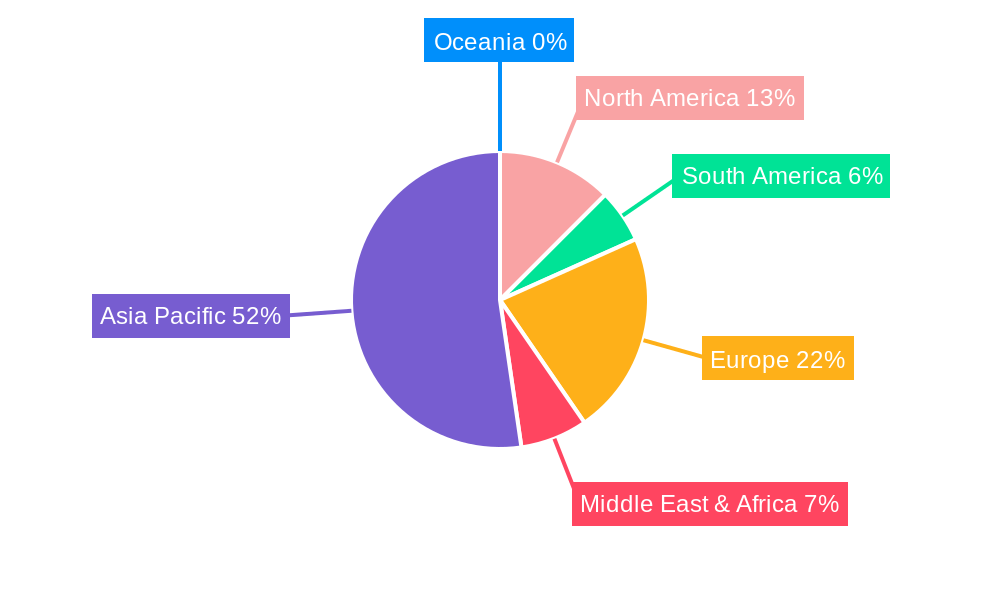

Dominant Regions & Segments in Viscose Staple Fibre

The Asia Pacific region firmly holds its position as the dominant force in the global Viscose Staple Fibre market. This dominance is primarily attributed to the substantial manufacturing base for textiles and apparel within countries like China, India, and Southeast Asian nations. The presence of major VSF producers and a robust downstream industry that consumes vast quantities of VSF for fabric production create a self-reinforcing ecosystem. Economic policies in these regions often favor manufacturing and export-oriented industries, further bolstering VSF production and consumption. Significant investments in infrastructure, including ports and logistics, facilitate the efficient movement of raw materials and finished products, contributing to the region's competitive edge.

Within the Asia Pacific, China stands out as the largest single country market, housing a significant number of key VSF manufacturers and a colossal domestic textile industry. Government support for the textile sector, coupled with a large and growing consumer base, fuels the demand for VSF.

The Textile Industry is unequivocally the largest and most significant application segment for Viscose Staple Fibre. Its widespread adoption in apparel, home furnishings, and technical textiles is a testament to its versatility and desirable properties. The demand for VSF in this segment is driven by its soft texture, excellent drape, breathability, and its ability to be blended with other fibers like cotton and polyester to achieve specific fabric characteristics.

The Clothing Industry, a sub-segment of the broader textile industry, is a major consumer of VSF. The fiber's comfort, aesthetic appeal, and biodegradability align perfectly with the growing trend towards sustainable fashion. From everyday wear to high-fashion garments, VSF offers a desirable alternative to synthetic fibers.

The Wool Type of Viscose Staple Fibre is particularly important for mimicking the feel and performance of natural wool, finding applications in knitwear, outerwear, and carpets. The Cotton Type VSF is widely used in blends with cotton for apparel and home textiles, offering enhanced softness and moisture management at a competitive price point.

While the Textile, Clothing, and Apparel industries represent the lion's share of VSF consumption, the Transport Industry is emerging as a niche but growing application. VSF's absorbency and strength make it suitable for use in automotive interiors, upholstery, and filtration systems. The "Other" application segment encompasses a range of industrial uses, including hygiene products, medical textiles, and specialty paper, further diversifying the market's demand landscape. The continuous innovation in VSF production to cater to these diverse applications underscores its importance and market resilience.

Viscose Staple Fibre Product Innovations

Recent product innovations in Viscose Staple Fibre are strategically enhancing its appeal and expanding its market reach. Key developments include the introduction of VSF grades with improved tenacity and elongation, making them more suitable for demanding textile applications and industrial uses. Furthermore, significant advancements have been made in developing VSF with enhanced sustainability profiles, such as those produced using closed-loop manufacturing processes that minimize chemical discharge and water consumption. These innovations offer competitive advantages by addressing the growing demand for eco-friendly materials and meeting stringent regulatory requirements. Specialized VSF types, designed to mimic the feel of premium natural fibers or to impart specific functionalities like antimicrobial properties, are also gaining traction, allowing manufacturers to cater to niche market segments and command premium pricing. The focus remains on delivering high-performance, sustainable, and cost-effective VSF solutions.

Report Scope & Segmentation Analysis

This report meticulously segments the global Viscose Staple Fibre market to provide granular insights. The market is analyzed across key Applications, including the Textile Industry, which encompasses a vast array of uses in apparel, home textiles, and technical textiles. The Transport Industry represents a growing segment for VSF in automotive interiors and filtration. The Clothing Industry, a significant sub-segment of textiles, is also individually detailed. The Other application category covers diverse industrial and hygiene uses. Furthermore, the report segments VSF by Types, specifically focusing on Wool Type VSF, valued for its soft handle and insulation properties, and Cotton Type VSF, favored for its comfort and blendability. Growth projections, market sizes, and competitive dynamics are analyzed for each of these segments, providing a comprehensive view of their individual performance and future potential.

Key Drivers of Viscose Staple Fibre Growth

The growth of the Viscose Staple Fibre sector is propelled by several interconnected factors. A primary driver is the global shift towards sustainable and eco-friendly materials, fueled by increasing consumer awareness and stringent environmental regulations. VSF's biodegradable and compostable nature, derived from renewable wood pulp, positions it favorably against less sustainable alternatives. Technological advancements in manufacturing processes, including the adoption of closed-loop systems and the development of bio-based chemicals, are enhancing production efficiency and reducing environmental impact, thereby boosting market appeal. The growing demand for comfortable and breathable fabrics in the apparel and home textiles industries, where VSF excels, is another significant contributor. Furthermore, government initiatives and policies promoting circular economy principles and sustainable manufacturing practices indirectly support the VSF market.

Challenges in the Viscose Staple Fibre Sector

Despite its growth potential, the Viscose Staple Fibre sector faces several challenges. Fluctuations in the price and availability of raw materials, particularly wood pulp, can impact production costs and profitability. Stringent environmental regulations related to chemical usage and wastewater discharge in VSF manufacturing necessitate continuous investment in cleaner technologies, which can be capital-intensive. The intense competition from other man-made and natural fibers, such as cotton, polyester, and Lyocell, requires VSF producers to consistently innovate and maintain cost-competitiveness. Supply chain disruptions, as witnessed in recent global events, can affect the reliable delivery of VSF to manufacturers, impacting production schedules. Addressing these challenges is crucial for sustained growth and market leadership.

Emerging Opportunities in Viscose Staple Fibre

Emerging opportunities in the Viscose Staple Fibre market are centered around leveraging its sustainability credentials and expanding its application base. The growing demand for biodegradable and compostable materials across various industries, including packaging and hygiene products, presents a significant avenue for VSF. Advancements in fiber modification and functionalization are opening up new possibilities for VSF in technical textiles, medical applications, and performance wear. The increasing focus on traceability and ethical sourcing in the textile supply chain offers an opportunity for VSF producers to differentiate their products and build consumer trust. Furthermore, the development of innovative blends of VSF with other sustainable fibers can create novel materials with enhanced properties, catering to evolving consumer preferences and expanding market penetration.

Leading Players in the Viscose Staple Fibre Market

- ADITYA BIRLA (IN)

- ENZING (AT)

- Kelheim (DE)

- Silvix (KR)

- Sniace (ES)

- Cosmo (US)

- SanYou (CN)

- FULIDA (CN)

- Sateri (CN)

- Aoyang Technology (CN)

- CHTC Helon (CN)

- Bohi Industry (CN)

- Xiangsheng (CN)

- Xinxiang Bailu (CN)

- Yibin Grace (CN)

- SILVER HAWK (CN)

- Haiyang Fiber (CN)

- Manasi Shunqun (CN)

- Jilin Chem-Fiber (CN)

- Nanjing Chem-Fiber (CN)

- Golden Ring (CN)

- Somet Fiber (CN)

- Sanfangxiang (CN)

Key Developments in Viscose Staple Fibre Industry

- 2023: Increased investment in closed-loop manufacturing processes by major players to enhance sustainability and reduce environmental impact.

- 2023: Launch of new VSF grades with improved tenacity and softness for high-performance apparel applications.

- 2022: Strategic partnerships formed to secure sustainable wood pulp sourcing and ensure supply chain resilience.

- 2021: Significant capacity expansions announced by Chinese manufacturers to meet growing global demand.

- 2020: Increased focus on developing biodegradable VSF for non-textile applications, such as hygiene products and specialty filters.

- 2019: Growing adoption of VSF in blended fabrics to enhance comfort, breathability, and sustainability of conventional textiles.

Future Outlook for Viscose Staple Fibre Market

- 2023: Increased investment in closed-loop manufacturing processes by major players to enhance sustainability and reduce environmental impact.

- 2023: Launch of new VSF grades with improved tenacity and softness for high-performance apparel applications.

- 2022: Strategic partnerships formed to secure sustainable wood pulp sourcing and ensure supply chain resilience.

- 2021: Significant capacity expansions announced by Chinese manufacturers to meet growing global demand.

- 2020: Increased focus on developing biodegradable VSF for non-textile applications, such as hygiene products and specialty filters.

- 2019: Growing adoption of VSF in blended fabrics to enhance comfort, breathability, and sustainability of conventional textiles.

Future Outlook for Viscose Staple Fibre Market

The future outlook for the Viscose Staple Fibre market is overwhelmingly positive, driven by the persistent global trend towards sustainable and renewable materials. As environmental consciousness continues to shape consumer choices and regulatory landscapes, VSF is poised to benefit significantly from its biodegradable and compostable attributes. Innovations in production technologies, particularly those focusing on circularity and reduced environmental footprints, will further enhance its competitive edge. The expanding application spectrum, beyond traditional textiles into areas like technical textiles and sustainable packaging, presents substantial growth accelerators. Strategic investments in capacity expansion and product differentiation by key players will ensure supply meets demand, while a focus on developing specialized VSF grades for niche markets will unlock new revenue streams. The market is expected to witness sustained growth, driven by its alignment with the global imperative for a more circular and sustainable economy.

Viscose Staple Firbe Segmentation

-

1. Application

- 1.1. Textile Industry

- 1.2. Transport Industry

- 1.3. Clothing Industry

- 1.4. Other

-

2. Types

- 2.1. Wool Type

- 2.2. Cotton Type

Viscose Staple Firbe Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Viscose Staple Firbe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Viscose Staple Firbe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Textile Industry

- 5.1.2. Transport Industry

- 5.1.3. Clothing Industry

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Wool Type

- 5.2.2. Cotton Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Viscose Staple Firbe Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Textile Industry

- 6.1.2. Transport Industry

- 6.1.3. Clothing Industry

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Wool Type

- 6.2.2. Cotton Type

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Viscose Staple Firbe Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Textile Industry

- 7.1.2. Transport Industry

- 7.1.3. Clothing Industry

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Wool Type

- 7.2.2. Cotton Type

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Viscose Staple Firbe Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Textile Industry

- 8.1.2. Transport Industry

- 8.1.3. Clothing Industry

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Wool Type

- 8.2.2. Cotton Type

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Viscose Staple Firbe Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Textile Industry

- 9.1.2. Transport Industry

- 9.1.3. Clothing Industry

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Wool Type

- 9.2.2. Cotton Type

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Viscose Staple Firbe Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Textile Industry

- 10.1.2. Transport Industry

- 10.1.3. Clothing Industry

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Wool Type

- 10.2.2. Cotton Type

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ADITYA BIRLA (IN)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ENZING (AT)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kelheim (DE)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Silvix (KR)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sniace (ES)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cosmo (US)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SanYou (CN)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 FULIDA (CN)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sateri (CN)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Aoyang Technology (CN)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 CHTC Helon (CN)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Bohi Industry (CN)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Xiangsheng (CN)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Xinxiang Bailu (CN)

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Yibin Grace (CN)

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 SILVER HAWK (CN)

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Haiyang Fiber (CN)

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Manasi Shunqun (CN)

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Jilin Chem-Fiber (CN)

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Nanjing Chem-Fiber (CN)

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Golden Ring (CN)

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Somet Fiber (CN)

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Sanfangxiang (CN)

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.1 ADITYA BIRLA (IN)

List of Figures

- Figure 1: Global Viscose Staple Firbe Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Viscose Staple Firbe Revenue (million), by Application 2024 & 2032

- Figure 3: North America Viscose Staple Firbe Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Viscose Staple Firbe Revenue (million), by Types 2024 & 2032

- Figure 5: North America Viscose Staple Firbe Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Viscose Staple Firbe Revenue (million), by Country 2024 & 2032

- Figure 7: North America Viscose Staple Firbe Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Viscose Staple Firbe Revenue (million), by Application 2024 & 2032

- Figure 9: South America Viscose Staple Firbe Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Viscose Staple Firbe Revenue (million), by Types 2024 & 2032

- Figure 11: South America Viscose Staple Firbe Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Viscose Staple Firbe Revenue (million), by Country 2024 & 2032

- Figure 13: South America Viscose Staple Firbe Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Viscose Staple Firbe Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Viscose Staple Firbe Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Viscose Staple Firbe Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Viscose Staple Firbe Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Viscose Staple Firbe Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Viscose Staple Firbe Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Viscose Staple Firbe Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Viscose Staple Firbe Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Viscose Staple Firbe Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Viscose Staple Firbe Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Viscose Staple Firbe Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Viscose Staple Firbe Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Viscose Staple Firbe Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Viscose Staple Firbe Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Viscose Staple Firbe Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Viscose Staple Firbe Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Viscose Staple Firbe Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Viscose Staple Firbe Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Viscose Staple Firbe Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Viscose Staple Firbe Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Viscose Staple Firbe Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Viscose Staple Firbe Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Viscose Staple Firbe Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Viscose Staple Firbe Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Viscose Staple Firbe Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Viscose Staple Firbe Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Viscose Staple Firbe Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Viscose Staple Firbe Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Viscose Staple Firbe Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Viscose Staple Firbe Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Viscose Staple Firbe Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Viscose Staple Firbe Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Viscose Staple Firbe Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Viscose Staple Firbe Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Viscose Staple Firbe Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Viscose Staple Firbe Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Viscose Staple Firbe Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Viscose Staple Firbe Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Viscose Staple Firbe?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Viscose Staple Firbe?

Key companies in the market include ADITYA BIRLA (IN), ENZING (AT), Kelheim (DE), Silvix (KR), Sniace (ES), Cosmo (US), SanYou (CN), FULIDA (CN), Sateri (CN), Aoyang Technology (CN), CHTC Helon (CN), Bohi Industry (CN), Xiangsheng (CN), Xinxiang Bailu (CN), Yibin Grace (CN), SILVER HAWK (CN), Haiyang Fiber (CN), Manasi Shunqun (CN), Jilin Chem-Fiber (CN), Nanjing Chem-Fiber (CN), Golden Ring (CN), Somet Fiber (CN), Sanfangxiang (CN).

3. What are the main segments of the Viscose Staple Firbe?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Viscose Staple Firbe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Viscose Staple Firbe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Viscose Staple Firbe?

To stay informed about further developments, trends, and reports in the Viscose Staple Firbe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence