Key Insights

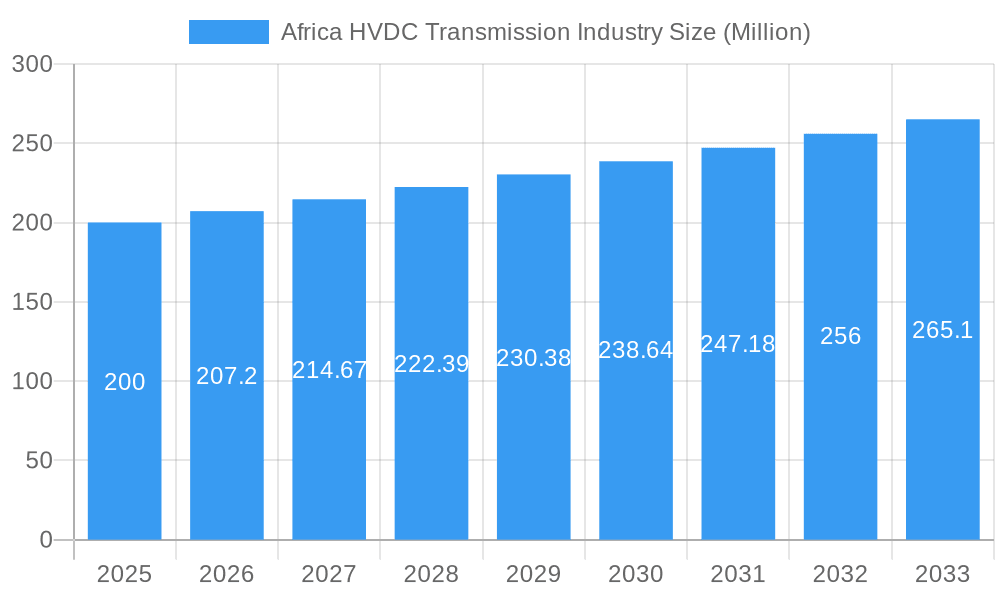

The African HVDC Transmission market is projected to experience significant expansion, driven by escalating electricity demand, the imperative for robust power grids, and the growing integration of renewable energy sources. The market, valued at $12.69 billion in the base year 2025, is forecasted to grow at a Compound Annual Growth Rate (CAGR) of 4.2% through 2033. This growth is underpinned by substantial investments in large-scale infrastructure projects across key African nations. The increasing adoption of renewable energy sources necessitates efficient, long-distance transmission solutions, a role HVDC technology excels at. Submarine HVDC systems are anticipated to see robust growth, particularly in coastal and island regions, enhancing inter-country power sharing and grid stability. Major industry players are strategically expanding their African market presence, fostering innovation and competition.

Africa HVDC Transmission Industry Market Size (In Billion)

Potential growth restraints include the high initial capital expenditure required for HVDC projects and complex regulatory environments. Logistical challenges in deploying infrastructure across diverse terrains also present hurdles. However, the long-term advantages of improved energy access and grid reliability are expected to drive sustained market expansion. Technological advancements in converter stations and transmission media are enhancing efficiency and cost-effectiveness, thereby mitigating initial investment risks. Regional energy cooperation and supportive government policies are critical for realizing the full potential of the African HVDC transmission market.

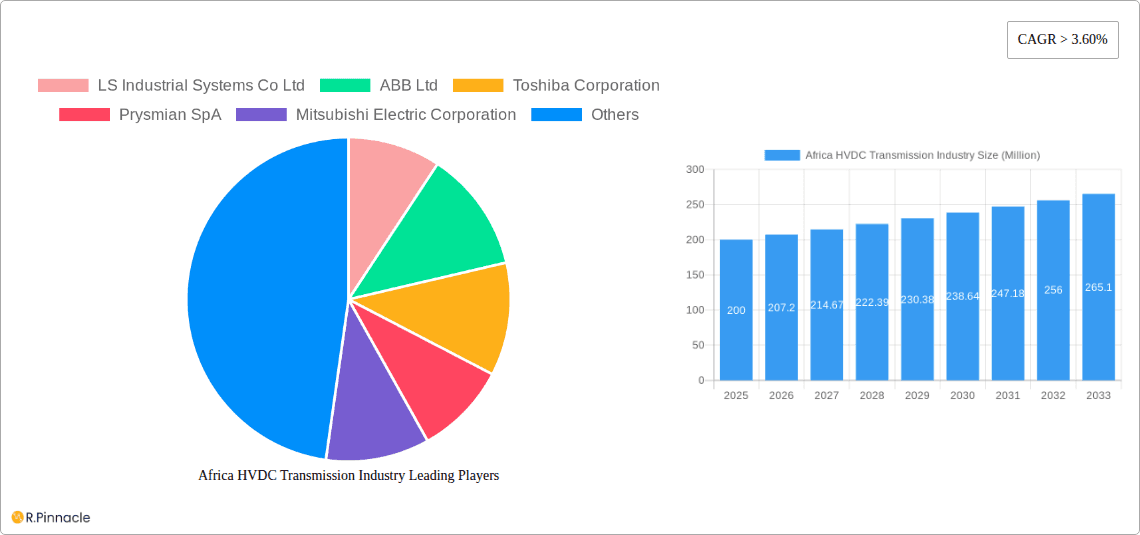

Africa HVDC Transmission Industry Company Market Share

This report offers a comprehensive analysis of the Africa HVDC Transmission industry, providing critical insights for stakeholders. Covering the forecast period, with a focus on the base year 2025, this study delivers detailed market size, growth drivers, challenges, and opportunities. Leveraging extensive research, the report provides actionable intelligence to navigate this dynamic market.

Africa HVDC Transmission Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the African HVDC transmission industry, examining market concentration, innovation drivers, regulatory frameworks, and mergers and acquisitions (M&A) activities. The historical period (2019-2024) and the base year (2025) provide a solid foundation for understanding market dynamics. The forecast period (2025-2033) projects future trends and opportunities.

The market exhibits a moderately concentrated structure with key players like ABB Ltd, Siemens AG, and Mitsubishi Electric Corporation holding significant market share. Precise market share data will be detailed in the full report, but preliminary estimates suggest ABB holds approximately 25%, Siemens 20%, and Mitsubishi 15% of the market in 2025. Smaller players, such as LS Industrial Systems Co Ltd and Toshiba Corporation, collectively account for approximately xx%. The market is characterized by a dynamic interplay of innovation, regulatory changes, and M&A activities.

- Innovation Drivers: Demand for reliable power transmission, government initiatives promoting renewable energy integration, and technological advancements are key drivers of innovation.

- Regulatory Frameworks: The regulatory environment varies across African nations, influencing investment decisions and project timelines.

- Product Substitutes: While HVDC remains the preferred technology for long-distance power transmission, alternative solutions may pose competitive pressures in specific niches.

- End-User Demographics: The primary end-users are national electricity companies and independent power producers (IPPs). The report details market penetration by sector.

- M&A Activities: The report tracks significant M&A activities, including deal values (estimated at $xx Million in total for the period 2019-2024).

Africa HVDC Transmission Industry Market Dynamics & Trends

This section explores the key market dynamics influencing growth within the African HVDC transmission sector. It examines market growth drivers, technological disruptions, evolving consumer preferences, and the complex competitive landscape. The analysis includes quantitative data, such as CAGR and market penetration rates, for specific segments and geographical areas.

The African HVDC transmission market is expected to experience substantial growth during the forecast period (2025-2033), driven primarily by the increasing demand for electricity across the continent, rapid urbanization, and the expansion of renewable energy sources. Several factors contribute to this growth, including government investments in energy infrastructure, regional power integration projects, and rising industrial activity. Furthermore, technological innovations such as advanced converter stations and improved cable technology continuously drive efficiency improvements. Competitive intensity remains relatively high, with leading players vying for market share and engaging in strategic partnerships to secure projects. The CAGR is projected to be xx% between 2025 and 2033. Market penetration, particularly in underserved regions, is expected to increase significantly.

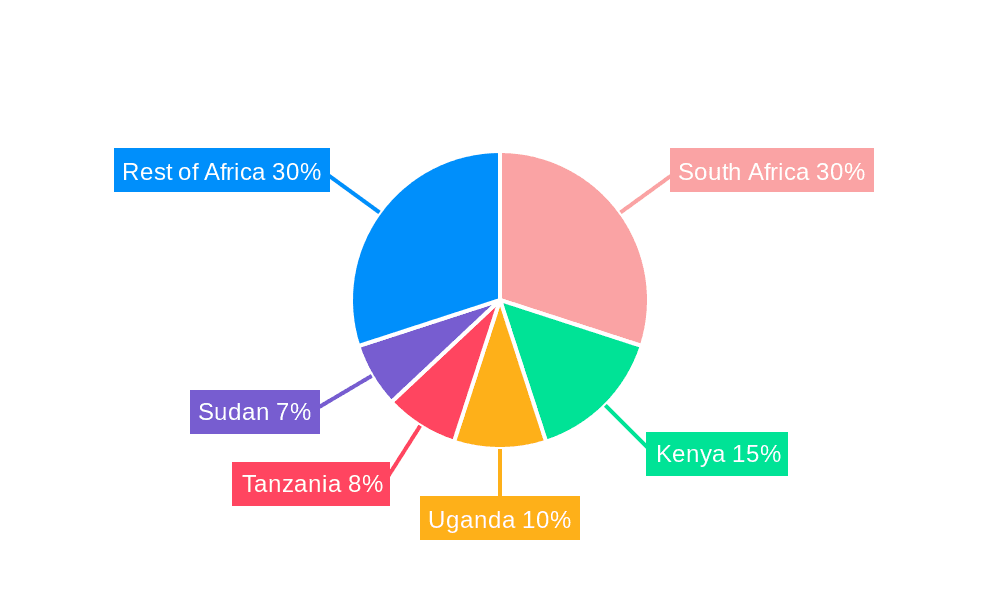

Dominant Regions & Segments in Africa HVDC Transmission Industry

This section identifies the leading regions, countries, and market segments within the African HVDC transmission industry. The analysis delves into the reasons for their dominance, considering factors such as economic policies, infrastructure development, and regulatory frameworks.

- Leading Regions: The Southern Africa region, particularly South Africa, is expected to maintain its dominance due to its established electricity infrastructure and ongoing investments in renewable energy. East Africa is experiencing significant growth, fueled by large-scale infrastructure projects.

- Leading Country: South Africa is expected to be the largest national market due to its advanced electricity grid and the presence of large-scale power generation projects.

- Dominant Transmission Types: HVDC Overhead Transmission Systems are expected to hold the largest market share due to their cost-effectiveness in long-distance transmission.

- Dominant Components: Converter stations represent the largest component market due to their crucial role in HVDC power transmission.

- Key Drivers:

- Economic policies promoting renewable energy and grid modernization.

- Government initiatives to attract investment in power infrastructure.

- Increasing industrialization and urbanization driving electricity demand.

Africa HVDC Transmission Industry Product Innovations

The HVDC transmission sector is characterized by continuous product innovation, driven by the need for enhanced efficiency, reliability, and cost-effectiveness. Recent advances in converter station technology, high-voltage direct current (HVDC) cables, and control systems have led to significant improvements in performance. These innovations are aimed at optimizing power transmission capacity, reducing transmission losses, and enhancing the integration of renewable energy sources.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the African HVDC transmission market, considering various aspects such as transmission type (Submarine HVDC Transmission System, HVDC Overhead Transmission System, HVDC Underground Transmission System) and component type (Converter Stations, Transmission Medium (Cables)). The report includes detailed market size and growth projections for each segment, along with an analysis of competitive dynamics. Market size projections for 2025 and 2033 for each segment are detailed in the full report.

Key Drivers of Africa HVDC Transmission Industry Growth

The growth of the African HVDC transmission industry is propelled by a confluence of factors, including the rising demand for electricity fueled by rapid urbanization and industrialization, significant government investments in energy infrastructure, and the increasing adoption of renewable energy sources. Furthermore, regional power integration projects are crucial for expanding access to electricity and ensuring energy security. The supportive regulatory framework across many African nations also contributes to market expansion.

Challenges in the Africa HVDC Transmission Industry Sector

Despite significant growth potential, the African HVDC transmission industry faces several challenges, including the high upfront capital costs associated with HVDC projects, the complexity of project implementation, and the geographical challenges inherent in deploying transmission lines across vast distances. Regulatory hurdles, limited skilled labor, and supply chain issues pose further obstacles. These challenges contribute to project delays and increase overall costs. The estimated impact of these challenges in delayed project completion is estimated to cost the industry $xx Million annually.

Emerging Opportunities in Africa HVDC Transmission Industry

The African HVDC transmission industry presents significant opportunities for growth, particularly in the expansion of renewable energy integration, grid modernization initiatives, and the development of regional power pools. The increasing adoption of smart grid technologies and advanced control systems offers further prospects for enhancing efficiency and reliability. The development of local manufacturing capabilities and the improvement of the skilled workforce can also boost the sector’s growth.

Leading Players in the Africa HVDC Transmission Industry Market

Key Developments in Africa HVDC Transmission Industry

- 2023: ABB secured an order exceeding $30 Million from SNEL, DRC, to upgrade the Inga-Kolwezi HVDC power transmission link. This highlights the growing demand for upgrades in existing infrastructure.

Future Outlook for Africa HVDC Transmission Industry Market

The African HVDC transmission market is poised for sustained growth, driven by the continent's increasing electricity demand and investments in renewable energy. The integration of smart grid technologies and the expansion of regional power pools will further stimulate market expansion. Strategic partnerships between international players and local companies are expected to play a vital role in driving future growth. Continued innovation in HVDC technologies will ensure the ongoing efficiency and reliability of power transmission across the continent.

Africa HVDC Transmission Industry Segmentation

-

1. Transmission Type

- 1.1. Submarine HVDC Transmission System

- 1.2. HVDC Overhead Transmission System

- 1.3. HVDC Underground Transmission System

-

2. Component

- 2.1. Converter Stations

- 2.2. Transmission Medium (Cables)

-

3. Geography

- 3.1. Kenya

- 3.2. Egypt

- 3.3. Algeria

- 3.4. Rest of Africa

Africa HVDC Transmission Industry Segmentation By Geography

- 1. Kenya

- 2. Egypt

- 3. Algeria

- 4. Rest of Africa

Africa HVDC Transmission Industry Regional Market Share

Geographic Coverage of Africa HVDC Transmission Industry

Africa HVDC Transmission Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 There is a growing emphasis on establishing cross-border power trade agreements with neighboring countries. HVDC systems are ideal for such interconnections

- 3.2.2 as they allow for the efficient transfer of power between grids operating at different frequencies

- 3.2.3 thereby enhancing regional energy security and economic cooperation.

- 3.3. Market Restrains

- 3.3.1 The initial investment required for HVDC transmission systems is substantial

- 3.3.2 which can be a barrier for utilities and governments with limited budgets. However

- 3.3.3 the long-term benefits

- 3.3.4 such as reduced transmission losses and improved grid stability

- 3.3.5 often justify the investment.

- 3.4. Market Trends

- 3.4.1 The market is witnessing advancements in HVDC technology

- 3.4.2 including the development of cost-effective solutions and the adoption of advanced technologies. These innovations aim to improve the efficiency and reliability of HVDC systems

- 3.4.3 making them more accessible and attractive for large-scale deployment.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa HVDC Transmission Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Transmission Type

- 5.1.1. Submarine HVDC Transmission System

- 5.1.2. HVDC Overhead Transmission System

- 5.1.3. HVDC Underground Transmission System

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Converter Stations

- 5.2.2. Transmission Medium (Cables)

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Kenya

- 5.3.2. Egypt

- 5.3.3. Algeria

- 5.3.4. Rest of Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Kenya

- 5.4.2. Egypt

- 5.4.3. Algeria

- 5.4.4. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Transmission Type

- 6. Kenya Africa HVDC Transmission Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Transmission Type

- 6.1.1. Submarine HVDC Transmission System

- 6.1.2. HVDC Overhead Transmission System

- 6.1.3. HVDC Underground Transmission System

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Converter Stations

- 6.2.2. Transmission Medium (Cables)

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Kenya

- 6.3.2. Egypt

- 6.3.3. Algeria

- 6.3.4. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Transmission Type

- 7. Egypt Africa HVDC Transmission Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Transmission Type

- 7.1.1. Submarine HVDC Transmission System

- 7.1.2. HVDC Overhead Transmission System

- 7.1.3. HVDC Underground Transmission System

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Converter Stations

- 7.2.2. Transmission Medium (Cables)

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Kenya

- 7.3.2. Egypt

- 7.3.3. Algeria

- 7.3.4. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Transmission Type

- 8. Algeria Africa HVDC Transmission Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Transmission Type

- 8.1.1. Submarine HVDC Transmission System

- 8.1.2. HVDC Overhead Transmission System

- 8.1.3. HVDC Underground Transmission System

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Converter Stations

- 8.2.2. Transmission Medium (Cables)

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Kenya

- 8.3.2. Egypt

- 8.3.3. Algeria

- 8.3.4. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Transmission Type

- 9. Rest of Africa Africa HVDC Transmission Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Transmission Type

- 9.1.1. Submarine HVDC Transmission System

- 9.1.2. HVDC Overhead Transmission System

- 9.1.3. HVDC Underground Transmission System

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Converter Stations

- 9.2.2. Transmission Medium (Cables)

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Kenya

- 9.3.2. Egypt

- 9.3.3. Algeria

- 9.3.4. Rest of Africa

- 9.1. Market Analysis, Insights and Forecast - by Transmission Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 LS Industrial Systems Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 ABB Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Toshiba Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Prysmian SpA

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mitsubishi Electric Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Siemens AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Schneider Electric SE

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Doble Engineering Co.

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 General Electric Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 LS Industrial Systems Co Ltd

List of Figures

- Figure 1: Africa HVDC Transmission Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Africa HVDC Transmission Industry Share (%) by Company 2025

List of Tables

- Table 1: Africa HVDC Transmission Industry Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 2: Africa HVDC Transmission Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 3: Africa HVDC Transmission Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Africa HVDC Transmission Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Africa HVDC Transmission Industry Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 6: Africa HVDC Transmission Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 7: Africa HVDC Transmission Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Africa HVDC Transmission Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Africa HVDC Transmission Industry Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 10: Africa HVDC Transmission Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 11: Africa HVDC Transmission Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Africa HVDC Transmission Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Africa HVDC Transmission Industry Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 14: Africa HVDC Transmission Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 15: Africa HVDC Transmission Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Africa HVDC Transmission Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Africa HVDC Transmission Industry Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 18: Africa HVDC Transmission Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 19: Africa HVDC Transmission Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Africa HVDC Transmission Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa HVDC Transmission Industry?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Africa HVDC Transmission Industry?

Key companies in the market include LS Industrial Systems Co Ltd, ABB Ltd, Toshiba Corporation, Prysmian SpA, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Doble Engineering Co., General Electric Company.

3. What are the main segments of the Africa HVDC Transmission Industry?

The market segments include Transmission Type, Component, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.69 billion as of 2022.

5. What are some drivers contributing to market growth?

There is a growing emphasis on establishing cross-border power trade agreements with neighboring countries. HVDC systems are ideal for such interconnections. as they allow for the efficient transfer of power between grids operating at different frequencies. thereby enhancing regional energy security and economic cooperation..

6. What are the notable trends driving market growth?

The market is witnessing advancements in HVDC technology. including the development of cost-effective solutions and the adoption of advanced technologies. These innovations aim to improve the efficiency and reliability of HVDC systems. making them more accessible and attractive for large-scale deployment..

7. Are there any restraints impacting market growth?

The initial investment required for HVDC transmission systems is substantial. which can be a barrier for utilities and governments with limited budgets. However. the long-term benefits. such as reduced transmission losses and improved grid stability. often justify the investment..

8. Can you provide examples of recent developments in the market?

ABB secured an order exceeding $30 million from Société nationale d'électricité (SNEL), the DRC's national electricity company, to partially upgrade the Inga-Kolwezi HVDC power transmission link

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa HVDC Transmission Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa HVDC Transmission Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa HVDC Transmission Industry?

To stay informed about further developments, trends, and reports in the Africa HVDC Transmission Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence