Key Insights

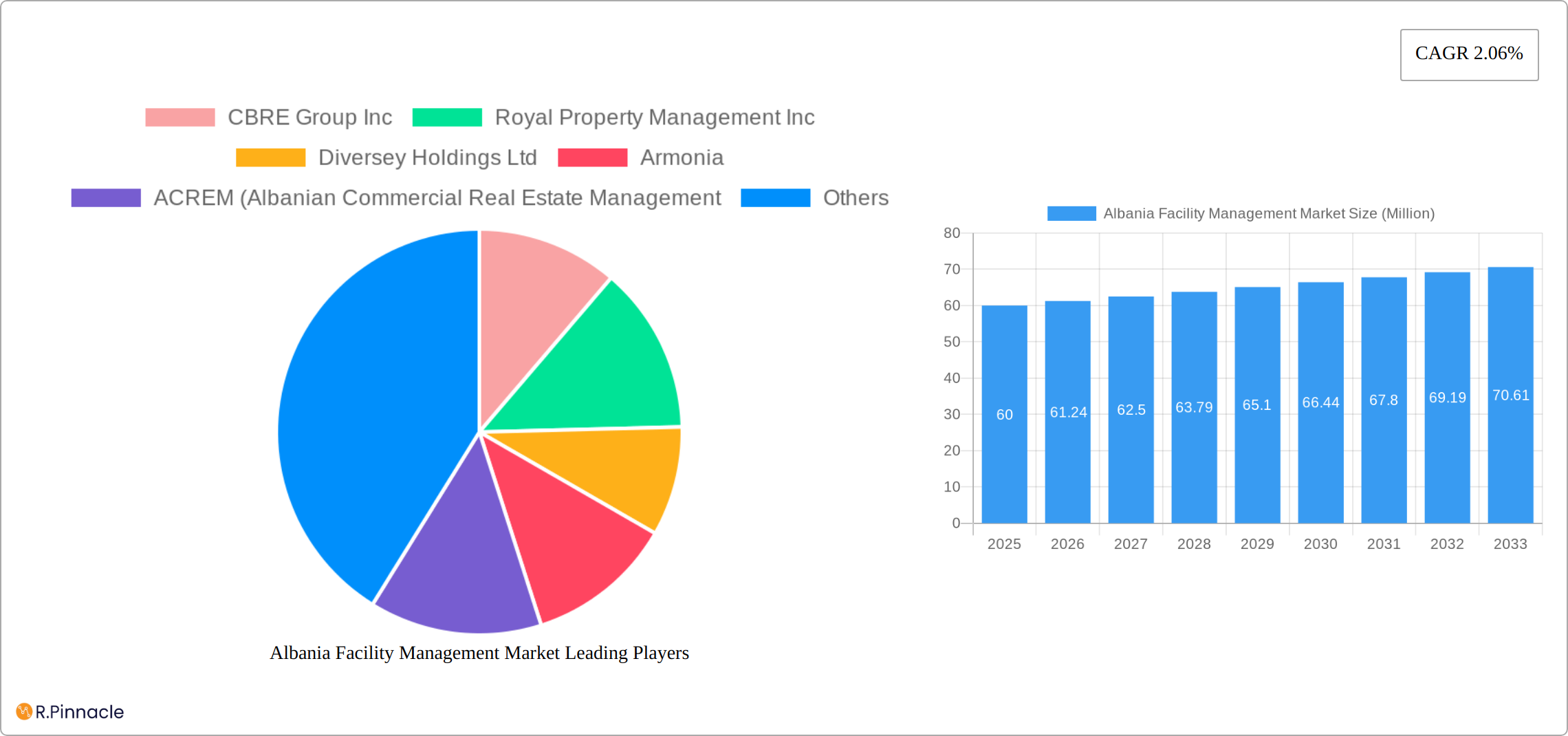

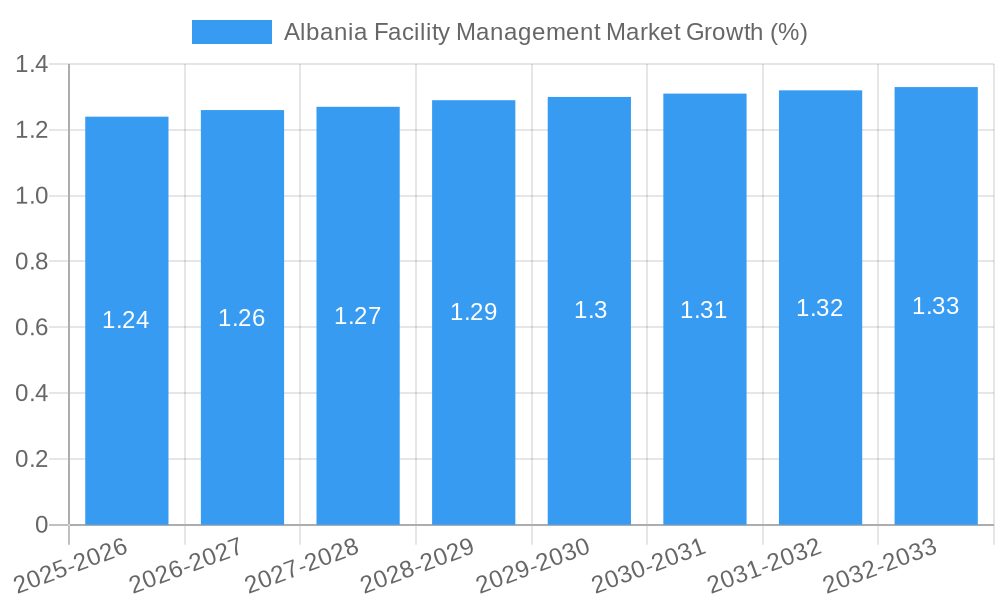

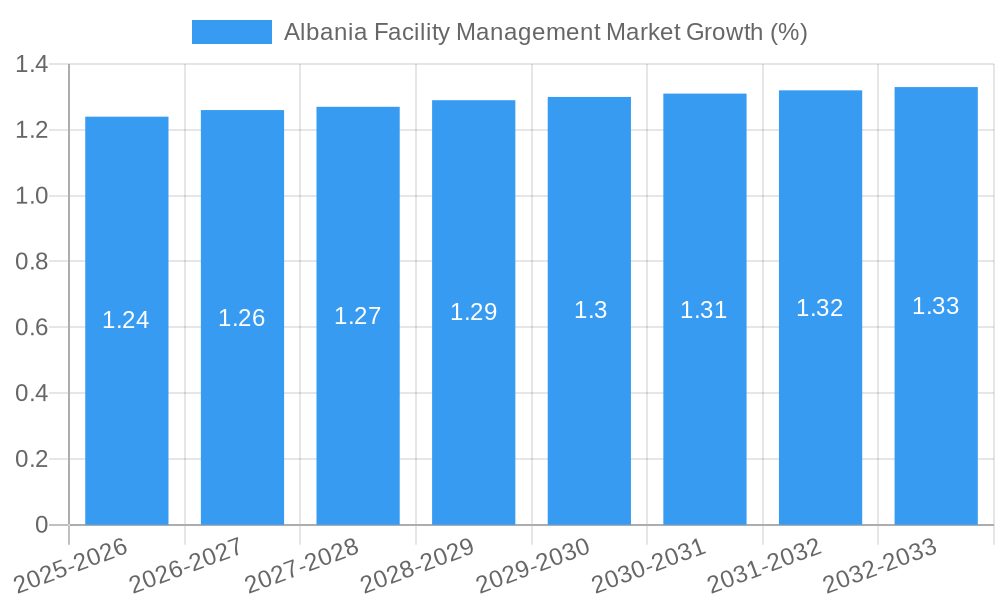

The Albanian Facility Management (FM) market, while relatively nascent compared to more mature economies, exhibits promising growth potential. Driven by increasing urbanization, a burgeoning commercial real estate sector, and rising awareness of the efficiency gains offered by professional FM services, the market is projected to experience steady expansion over the forecast period (2025-2033). The 2.06% CAGR indicates a moderate but consistent growth trajectory, suggesting a gradual but sustained increase in market value. While precise market size figures for Albania are not readily available, considering similar markets in the Balkan region and the provided 2.06% CAGR, a reasonable estimation for the 2025 market size might be in the range of $50 million to $75 million. This range considers the developmental stage of Albania's economy and the likely penetration of outsourced FM services. The market is segmented by facility management type (in-house vs. outsourced), offerings (hard FM, encompassing maintenance and repairs, and soft FM, including cleaning and security), and end-user sectors (commercial, institutional, public/infrastructure, industrial). The outsourced segment is likely to experience higher growth, reflecting the increasing preference for specialized expertise and cost-effectiveness. Hard FM is anticipated to maintain a larger market share due to the fundamental need for building maintenance and repairs. The commercial sector currently dominates, but growth in other sectors, especially infrastructure development, could lead to market diversification.

Challenges facing the Albanian FM market include the relatively small size of the overall economy, potential skill shortages within the industry, and the need for greater awareness among businesses of the value proposition of professional facility management services. However, ongoing infrastructural investment, foreign direct investment, and the growing presence of international companies are key drivers, supporting the long-term growth outlook. Companies like CBRE Group Inc and others are likely to increase their focus on the Albanian market, leading to intensified competition and improved service offerings. The trend toward sustainable and smart building technologies will also present new opportunities for innovative FM providers. Overall, while the Albanian FM market is relatively small, its growth trajectory shows positive potential for investors and service providers.

Albania Facility Management Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Albania Facility Management Market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, and future potential. The study encompasses key segments, leading players, and emerging trends, equipping readers with actionable intelligence to navigate this dynamic market.

Albania Facility Management Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Albanian facility management market, encompassing market concentration, innovation drivers, regulatory frameworks, and mergers & acquisitions (M&A) activity. The market is characterized by a mix of international players and local firms, with market share largely dominated by a few key players. While precise market share figures for each company are not publicly available, we estimate that the top 5 players account for approximately 60% of the market in 2025. Innovation is driven by the increasing demand for sustainable and technologically advanced facility management solutions. The regulatory framework is evolving to support growth, focusing on environmental standards and safety regulations. M&A activity is expected to increase due to market consolidation and the desire for expansion. We estimate the total value of M&A deals in the sector between 2019 and 2024 to be approximately xx Million.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Drivers: Sustainability, technological advancements (e.g., smart building technologies).

- Regulatory Framework: Evolving to promote growth and sustainability.

- Product Substitutes: Limited direct substitutes, but alternative service providers exist.

- End-User Demographics: Predominantly commercial and institutional, with growing public sector involvement.

- M&A Activity: Expected increase in M&A activity driven by market consolidation and expansion strategies.

Albania Facility Management Market Dynamics & Trends

The Albanian facility management market is experiencing significant growth, driven by increasing urbanization, infrastructural development, and rising demand for outsourced services. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Technological disruptions, particularly in areas like smart building technologies and IoT (Internet of Things) integration are transforming industry operations, leading to increased efficiency and cost savings. Consumer preferences are shifting towards sustainable and technologically advanced facility management solutions, further driving innovation and market expansion. Competitive dynamics are shaped by the entry of new players and the consolidation efforts of existing players. Market penetration of outsourced facility management services is expected to reach approximately xx% by 2033.

Dominant Regions & Segments in Albania Facility Management Market

The Tirana region remains the dominant force in Albania's facility management market, fueled by its high concentration of commercial and institutional buildings. However, growth is also evident in other urban centers as the country's economy expands. A detailed segment analysis reveals the following trends:

By Facility Management Type: Outsourced facility management continues its rapid expansion, driven by businesses seeking specialized expertise, cost optimization, and enhanced operational efficiency. This trend is particularly noticeable in the commercial sector.

By Offerings: While Hard FM (hardware maintenance and repairs) currently holds a larger market share, Soft FM (software solutions, business support services, and sustainability initiatives) is experiencing exponential growth, reflecting a shift toward holistic facility management strategies.

By End-User: The Commercial sector consistently accounts for the largest share of the market, indicating robust activity in the business and retail spaces of Albania's major cities. The Institutional and Public/Infrastructure segments are experiencing significant growth, driven by governmental investments and an increasing focus on modernizing public facilities. This includes substantial opportunities in the education and healthcare sectors.

Key Drivers (Beyond Tirana): While Tirana remains central, growth is propelled by expanding urban centers such as Durres and Shkodra, showcasing increased demand for facility management services across the country. Key factors driving this growth include:

- Significant investments in infrastructure development, particularly transportation links and utilities.

- Rising foreign direct investment (FDI) stimulating the construction and development of commercial properties and industrial parks.

- Increased focus on sustainable building practices and energy efficiency improvements.

- Government initiatives designed to attract and support both domestic and international investment in Albania's real estate sector.

Albania Facility Management Market Product Innovations

Recent innovations in the Albanian facility management market include the integration of smart building technologies, such as energy management systems and security systems, alongside improvements in facility maintenance software, providing real-time data and predictive maintenance capabilities. These advancements enhance operational efficiency, cost optimization, and overall sustainability of managed facilities. This reflects a growing trend towards data-driven decision-making and proactive maintenance strategies within the industry.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation of the Albania Facility Management Market by facility management type (In-House, Outsourced), offerings (Hard FM, Soft FM), and end-user (Commercial, Institutional, Public/Infrastructure, Industrial, Others). Each segment is analyzed, considering growth projections, market size, and competitive dynamics, allowing for a granular understanding of the market structure. The market size for each segment in 2025 is estimated as follows: Outsourced Facility Management – xx Million, In-House Facility Management – xx Million; Hard FM – xx Million, Soft FM – xx Million; Commercial - xx Million, Institutional - xx Million, Public/Infrastructure – xx Million, Industrial – xx Million, Others – xx Million.

Key Drivers of Albania Facility Management Market Growth

The Albanian facility management market's robust growth is a result of several converging factors. Rapid urbanization is creating a surge in demand for commercial and residential spaces, while significant infrastructural development generates ongoing opportunities for property and facility management services. The rising adoption of technology, such as smart building solutions and integrated facility management (IFM) systems, is enhancing operational efficiency and reducing costs. Furthermore, government initiatives promoting sustainable development and energy efficiency within the construction and real estate sectors are actively contributing to market expansion. These intertwined trends are creating a dynamic and rapidly evolving market.

Challenges in the Albania Facility Management Market Sector

Challenges facing the Albanian facility management market include skill shortages within the workforce, the need for enhanced regulatory frameworks, and competition from international players. These factors can impact operational efficiency, service quality, and overall market growth, highlighting the need for proactive strategies to mitigate potential issues.

Emerging Opportunities in Albania Facility Management Market

Several promising opportunities are shaping the future of Albania's facility management market. The increasing adoption of green building technologies and sustainable practices presents significant potential. The demand for integrated facility management (IFM) solutions, which provide a holistic approach to facility operations, is rapidly expanding. Furthermore, ongoing and planned investments in large-scale public infrastructure projects, including transportation networks, healthcare facilities, and educational institutions, will continue to generate substantial demand for specialized facility management services. These factors collectively position the Albanian market for considerable expansion and innovation in the coming years.

Leading Players in the Albania Facility Management Market

- CBRE Group Inc

- Royal Property Management Inc

- Diversey Holdings Ltd

- Armonia

- ACREM (Albanian Commercial Real Estate Management)

- Mott Macdonald

- Globe William International

- [Add other relevant local and international players]

Key Developments in Albania Facility Management Market Industry

- April 2021: The opening of Albania's second international airport in Kukes significantly boosted regional development and created substantial demand for facility management services in the surrounding area.

- February 2021: Significant infrastructure upgrades, supported by the European Bank for Reconstruction and Development (EBRD) and the European Union (EU), including railway improvements connecting Tirana with Durres port and the airport, created substantial ongoing demand for facility management services. These projects continue to drive growth.

- [Add other recent significant developments, including new construction projects, policy changes, or major contracts awarded]

Future Outlook for Albania Facility Management Market

The Albanian facility management market is poised for strong growth fueled by continued infrastructural development, increasing urbanization, and rising demand for sustainable and technologically advanced solutions. Strategic partnerships and investments in technological upgrades will be crucial for maintaining a competitive edge in this expanding market. The market is expected to reach xx Million by 2033.

Albania Facility Management Market Segmentation

-

1. Facility Management Type

- 1.1. In-House Facility Management

-

1.2. Outsourced Facility Management

- 1.2.1. Single FM

- 1.2.2. Bundled FM

- 1.2.3. Integrated FM

-

2. Offerings

- 2.1. Hard FM

- 2.2. Soft FM

-

3. End-User

- 3.1. Commercial

- 3.2. Institutional

- 3.3. Public/Infrastructure

- 3.4. Industrial

- 3.5. Others

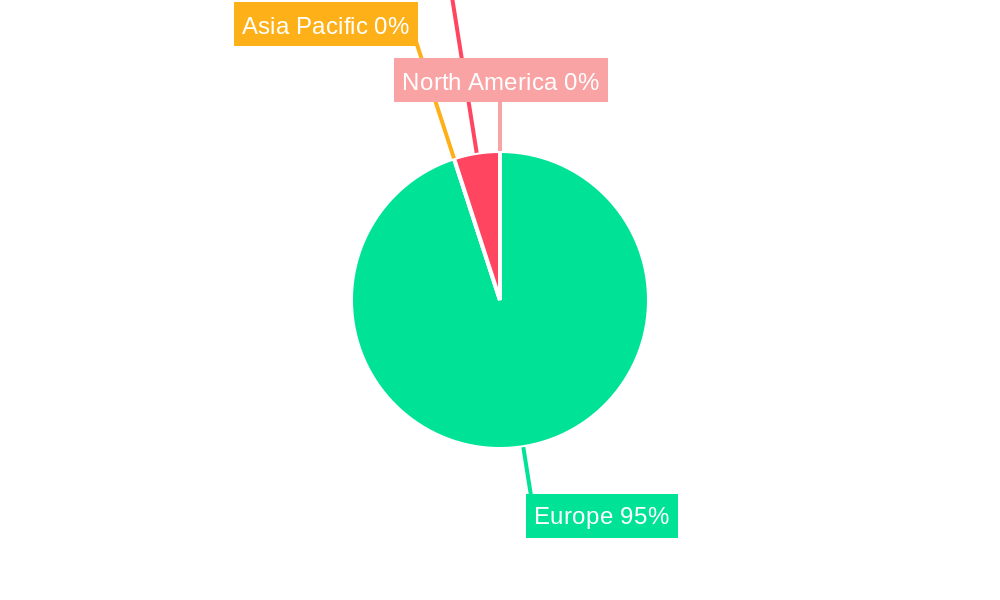

Albania Facility Management Market Segmentation By Geography

- 1. Albania

Albania Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.06% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. increase in Construction and Trade in the Region; Increasing Trends in Real State Sector

- 3.3. Market Restrains

- 3.3.1. Geopolitical situation and Ongoing Changes in Macro-environment

- 3.4. Market Trends

- 3.4.1. Trade and construction will hold the major market share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Albania Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 5.1.1. In-House Facility Management

- 5.1.2. Outsourced Facility Management

- 5.1.2.1. Single FM

- 5.1.2.2. Bundled FM

- 5.1.2.3. Integrated FM

- 5.2. Market Analysis, Insights and Forecast - by Offerings

- 5.2.1. Hard FM

- 5.2.2. Soft FM

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Commercial

- 5.3.2. Institutional

- 5.3.3. Public/Infrastructure

- 5.3.4. Industrial

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Albania

- 5.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 6. North America Albania Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe Albania Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific Albania Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Rest of the World Albania Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 CBRE Group Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Royal Property Management Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Diversey Holdings Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Armonia

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ACREM (Albanian Commercial Real Estate Management

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Mott Macdonald

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Globe William International

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 CBRE Group Inc

List of Figures

- Figure 1: Albania Facility Management Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Albania Facility Management Market Share (%) by Company 2024

List of Tables

- Table 1: Albania Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Albania Facility Management Market Revenue Million Forecast, by Facility Management Type 2019 & 2032

- Table 3: Albania Facility Management Market Revenue Million Forecast, by Offerings 2019 & 2032

- Table 4: Albania Facility Management Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Albania Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Albania Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Albania Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Albania Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Albania Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Albania Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Albania Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Albania Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Albania Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Albania Facility Management Market Revenue Million Forecast, by Facility Management Type 2019 & 2032

- Table 15: Albania Facility Management Market Revenue Million Forecast, by Offerings 2019 & 2032

- Table 16: Albania Facility Management Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 17: Albania Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Albania Facility Management Market?

The projected CAGR is approximately 2.06%.

2. Which companies are prominent players in the Albania Facility Management Market?

Key companies in the market include CBRE Group Inc, Royal Property Management Inc, Diversey Holdings Ltd, Armonia, ACREM (Albanian Commercial Real Estate Management, Mott Macdonald, Globe William International.

3. What are the main segments of the Albania Facility Management Market?

The market segments include Facility Management Type, Offerings, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

increase in Construction and Trade in the Region; Increasing Trends in Real State Sector.

6. What are the notable trends driving market growth?

Trade and construction will hold the major market share.

7. Are there any restraints impacting market growth?

Geopolitical situation and Ongoing Changes in Macro-environment.

8. Can you provide examples of recent developments in the market?

In April 2021, Albania opened its second International Airport in Kukes in the northeast. The airport was built in 2006 but was not made operational until now. New progress has been made in the past year toward building other airports.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Albania Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Albania Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Albania Facility Management Market?

To stay informed about further developments, trends, and reports in the Albania Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence