Key Insights

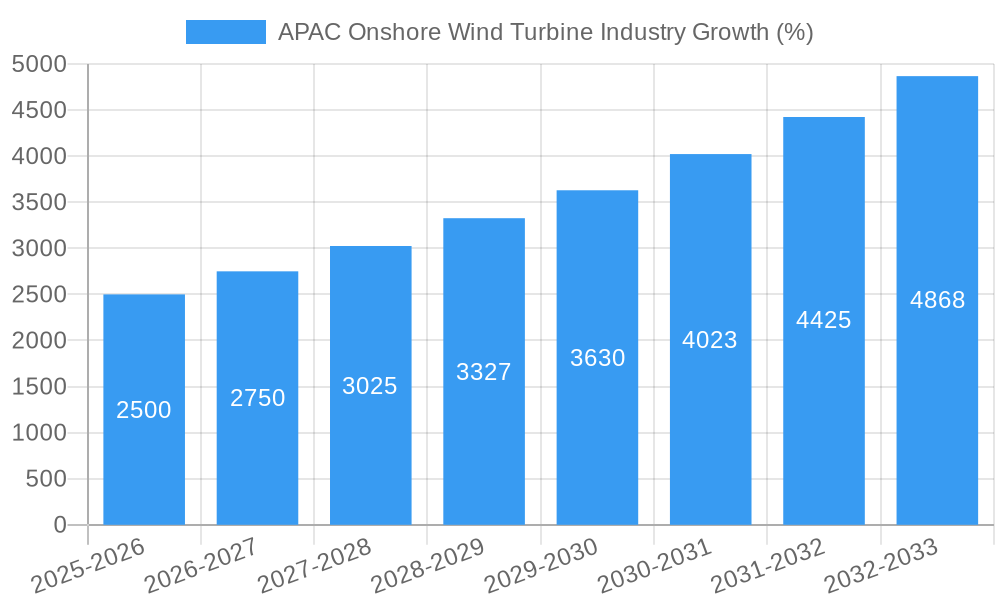

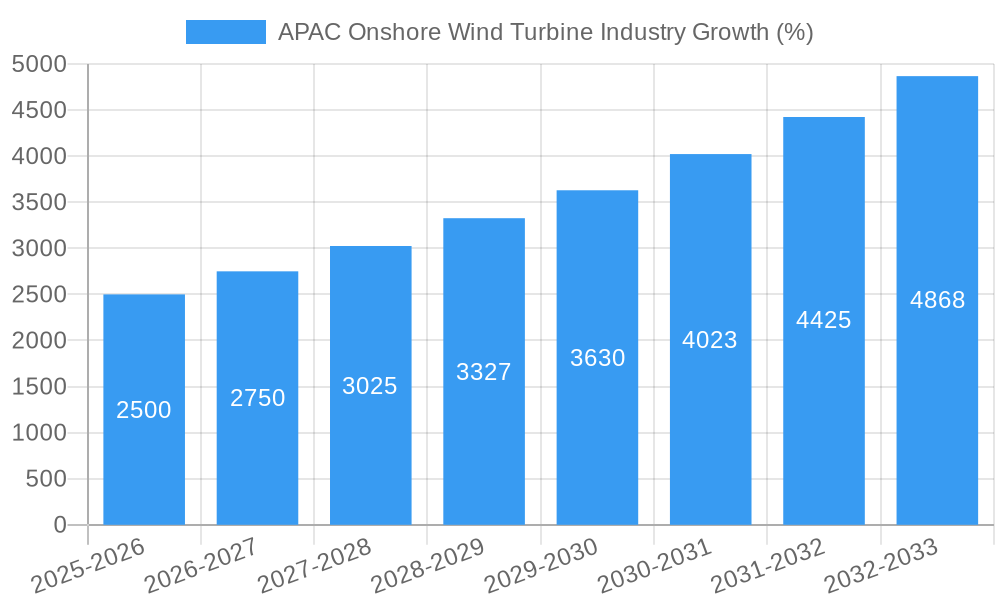

The APAC onshore wind turbine market is experiencing robust growth, driven by increasing energy demands, supportive government policies promoting renewable energy adoption, and decreasing turbine costs. The region's vast land area and strong wind resources present significant untapped potential. Between 2019 and 2024, the market likely saw substantial expansion, given global trends. While precise figures for the historical period aren't provided, a reasonable estimation, based on global onshore wind growth during that time and APAC's significant contribution to that growth, suggests a compound annual growth rate (CAGR) in the range of 10-15%. This implies substantial market expansion over the period. Looking forward, the forecast period of 2025-2033 is projected to witness continued expansion, though perhaps at a slightly moderated pace, as the market matures and some initial hurdles are overcome. Factors such as grid infrastructure development, technological advancements leading to improved turbine efficiency and reduced operational costs, and increasing private sector investment will continue to fuel market growth. However, challenges remain, including land acquisition complexities, environmental concerns related to wildlife impact, and the need for skilled workforce development. Nevertheless, the long-term outlook for the APAC onshore wind turbine market remains highly positive, with considerable opportunities for market players.

The market's growth trajectory is expected to be influenced by several key factors. The increasing commitment to reducing carbon emissions and achieving climate goals across APAC nations will significantly drive demand. Furthermore, advancements in turbine technology, such as larger rotor diameters and improved blade designs, will contribute to increased energy generation and cost-effectiveness. The development of smart grids and energy storage solutions will also enhance the integration of onshore wind power into the existing energy infrastructure, further accelerating market growth. Competitive pricing strategies by turbine manufacturers, coupled with favorable financing options, are also likely to contribute positively to market expansion. However, careful consideration needs to be given to the environmental impact and potential social disruptions that large-scale wind farm installations may entail. Mitigating these potential downsides through sustainable practices and community engagement will be crucial to sustaining the market's positive growth momentum.

This comprehensive report provides an in-depth analysis of the Asia-Pacific (APAC) onshore wind turbine industry, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, and future prospects. Discover key trends, growth drivers, challenges, and emerging opportunities shaping this dynamic sector.

APAC Onshore Wind Turbine Industry Market Structure & Innovation Trends

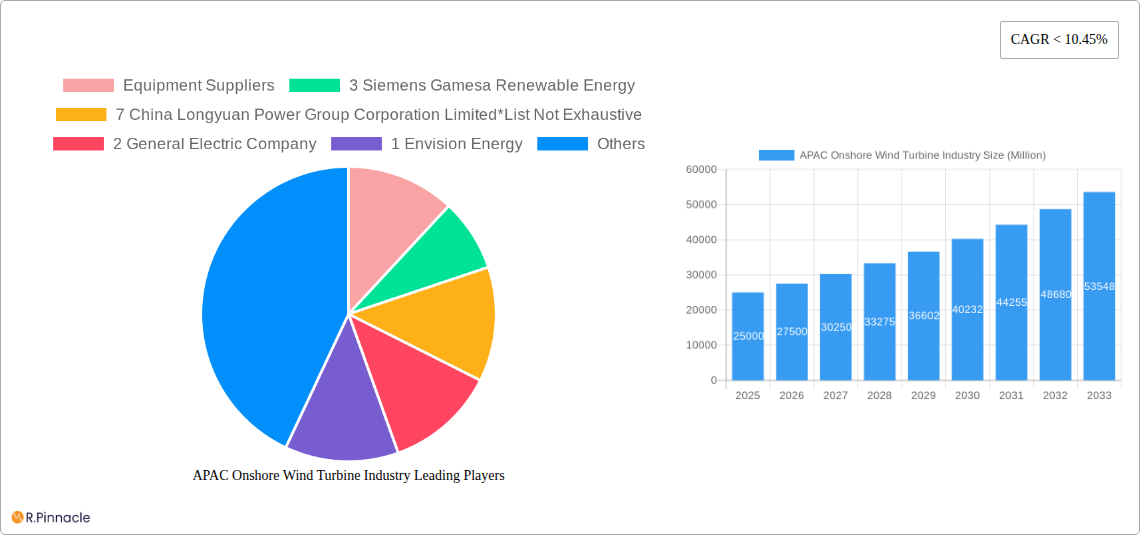

This section analyzes the APAC onshore wind turbine market's competitive landscape, focusing on market concentration, innovation drivers, regulatory frameworks, and M&A activities. The report details the market share held by key players, including Siemens Gamesa Renewable Energy, China Longyuan Power Group Corporation Limited, General Electric Company, Envision Energy, Orsted AS, Suzlon Energy Limited, EDF SA, Xinjiang Goldwind Science & Technology Co Ltd (Goldwind), Vestas Wind Systems AS, and Acciona Energia SA. We examine the impact of mergers and acquisitions (M&A) on market consolidation, quantifying deal values where possible (xx Million USD). The analysis also considers the influence of government regulations, technological advancements (e.g., improved turbine designs, smart grid integration), and the presence of substitute technologies (e.g., solar power) on market structure and innovation. The report includes detailed analysis of end-user demographics (e.g., utility companies, independent power producers) and their evolving energy needs.

APAC Onshore Wind Turbine Industry Market Dynamics & Trends

This section delves into the key factors driving market growth, including increasing demand for renewable energy, supportive government policies, and declining technology costs. We analyze the compound annual growth rate (CAGR) and market penetration of onshore wind turbines in various APAC countries. The report explores technological disruptions, such as advancements in turbine design and manufacturing, digitalization, and the integration of artificial intelligence (AI) and machine learning (ML). The competitive dynamics among leading players are examined, including strategies such as capacity expansion, technology licensing, and strategic partnerships. The report also looks at the impact of consumer preferences for sustainable energy solutions on market growth.

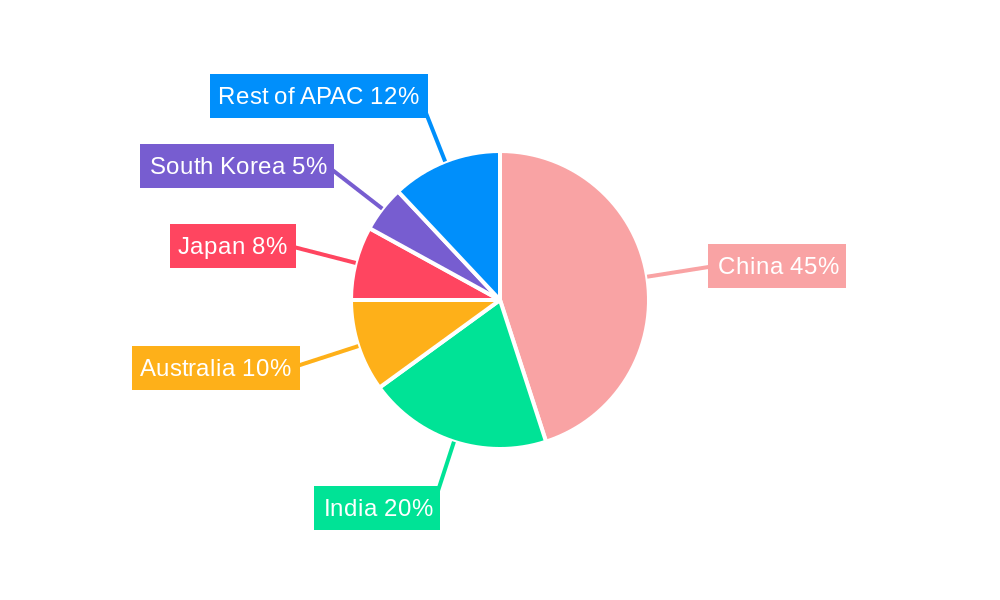

Dominant Regions & Segments in APAC Onshore Wind Turbine Industry

This section identifies the leading regions and segments within the APAC onshore wind turbine market. A detailed analysis focusing on the dominance of specific countries and regions is provided.

- Key Drivers:

- Favorable government policies and incentives (e.g., renewable energy mandates, tax breaks).

- Abundant wind resources in specific locations.

- Development of robust transmission infrastructure.

- Growing private sector investment.

- Technological advancements leading to improved cost-competitiveness.

The dominance analysis assesses the impact of these factors on market share and growth projections for different regions and segments.

APAC Onshore Wind Turbine Industry Product Innovations

This section summarizes recent product developments in onshore wind turbines, including advancements in turbine design, materials, and control systems. The discussion emphasizes the competitive advantages offered by these innovations, focusing on enhanced energy efficiency, reliability, and cost-effectiveness. The report examines how these product innovations address evolving market needs and customer preferences.

Report Scope & Segmentation Analysis

This report segments the APAC onshore wind turbine market by location (Onshore, Offshore).

Onshore: This segment focuses on the onshore wind turbine market, encompassing various turbine types, capacities, and applications. Growth projections, market size estimates, and competitive dynamics are detailed.

Offshore: This segment analyzes the offshore wind turbine market in APAC, including the challenges and opportunities presented by this emerging segment. Growth projections, market sizes, and competitive dynamics are included.

Key Drivers of APAC Onshore Wind Turbine Industry Growth

Several key factors propel the growth of the APAC onshore wind turbine industry. These include supportive government policies promoting renewable energy adoption, the decreasing cost of wind energy technology making it increasingly competitive with traditional fossil fuels, and the increasing awareness of climate change and the need for sustainable energy solutions. Furthermore, the growing demand for electricity across the region, driven by economic growth and rising populations, fuels the need for new renewable energy sources.

Challenges in the APAC Onshore Wind Turbine Industry Sector

The APAC onshore wind turbine industry faces challenges including the high initial capital investment required for wind farm development, the need for reliable and efficient transmission infrastructure to connect wind farms to the grid, and the potential for intermittency in wind resources. The report also discusses the impact of land availability, permitting complexities, and potential environmental concerns, quantifying their impacts on industry growth and market penetration.

Emerging Opportunities in APAC Onshore Wind Turbine Industry

Emerging opportunities include advancements in turbine technology leading to improved efficiency and cost-effectiveness, the expansion of wind farms into new regions with abundant wind resources, and the increasing integration of wind energy into smart grids to enhance grid stability. This section also examines potential opportunities arising from technological advancements in areas like energy storage and grid modernization.

Leading Players in the APAC Onshore Wind Turbine Industry Market

- Siemens Gamesa Renewable Energy

- China Longyuan Power Group Corporation Limited

- General Electric Company

- Envision Energy

- Orsted AS

- Suzlon Energy Limited

- EDF SA

- Xinjiang Goldwind Science & Technology Co Ltd (Goldwind)

- Vestas Wind Systems AS

- Acciona Energia SA

Key Developments in APAC Onshore Wind Turbine Industry Industry

April 2022: Hitachi Energy installed a unique transformer in China's first floating wind turbine, the Sanxia Yinling Hao wind turbine (a 5.5-megawatt turbine installed at Yangjiang wind farm in Guangdong Province). This dry-operated transformer is designed to handle high vibrations and prevent oil spills. This signals advancements in offshore wind technology with implications for onshore turbine design and reliability.

February 2022: Tata Power and RWE partnered to explore joint development of offshore wind power plants in India. This strategic collaboration highlights the growing interest in offshore wind and its potential impact on the overall wind energy market in India and the broader APAC region.

Future Outlook for APAC Onshore Wind Turbine Industry Market

The future of the APAC onshore wind turbine market is exceptionally promising. Continued technological advancements, supportive government policies, and the increasing urgency to reduce carbon emissions are expected to drive significant growth over the forecast period (2025-2033). The market will likely see increased competition, further consolidation through M&A activities, and a shift towards larger, more efficient turbines. The integration of smart grid technologies and advancements in energy storage solutions will play a crucial role in enhancing the reliability and efficiency of wind power systems. This will create significant opportunities for industry players to innovate and capture market share in this rapidly evolving sector.

APAC Onshore Wind Turbine Industry Segmentation

-

1. Location

- 1.1. Onshore

- 1.2. Offshore

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. South Korea

- 2.5. Australia

- 2.6. Rest of Asia-Pacific

APAC Onshore Wind Turbine Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Australia

- 6. Rest of Asia Pacific

APAC Onshore Wind Turbine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 10.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adopting of Alternative Clean Energy Sources (Ex

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Location

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. South Korea

- 5.2.5. Australia

- 5.2.6. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Australia

- 5.3.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Location

- 6. China APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Location

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. South Korea

- 6.2.5. Australia

- 6.2.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Location

- 7. India APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Location

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. South Korea

- 7.2.5. Australia

- 7.2.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Location

- 8. Japan APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Location

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. South Korea

- 8.2.5. Australia

- 8.2.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Location

- 9. South Korea APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Location

- 9.1.1. Onshore

- 9.1.2. Offshore

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. South Korea

- 9.2.5. Australia

- 9.2.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Location

- 10. Australia APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Location

- 10.1.1. Onshore

- 10.1.2. Offshore

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Japan

- 10.2.4. South Korea

- 10.2.5. Australia

- 10.2.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Location

- 11. Rest of Asia Pacific APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Location

- 11.1.1. Onshore

- 11.1.2. Offshore

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. China

- 11.2.2. India

- 11.2.3. Japan

- 11.2.4. South Korea

- 11.2.5. Australia

- 11.2.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Location

- 12. China APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 13. Japan APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 14. India APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 15. South Korea APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 16. Southeast Asia APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 17. Australia APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 18. Indonesia APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 19. Phillipes APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 20. Singapore APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 21. Thailandc APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 22. Rest of Asia Pacific APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 23. Competitive Analysis

- 23.1. Market Share Analysis 2024

- 23.2. Company Profiles

- 23.2.1 Equipment Suppliers

- 23.2.1.1. Overview

- 23.2.1.2. Products

- 23.2.1.3. SWOT Analysis

- 23.2.1.4. Recent Developments

- 23.2.1.5. Financials (Based on Availability)

- 23.2.2 3 Siemens Gamesa Renewable Energy

- 23.2.2.1. Overview

- 23.2.2.2. Products

- 23.2.2.3. SWOT Analysis

- 23.2.2.4. Recent Developments

- 23.2.2.5. Financials (Based on Availability)

- 23.2.3 7 China Longyuan Power Group Corporation Limited*List Not Exhaustive

- 23.2.3.1. Overview

- 23.2.3.2. Products

- 23.2.3.3. SWOT Analysis

- 23.2.3.4. Recent Developments

- 23.2.3.5. Financials (Based on Availability)

- 23.2.4 2 General Electric Company

- 23.2.4.1. Overview

- 23.2.4.2. Products

- 23.2.4.3. SWOT Analysis

- 23.2.4.4. Recent Developments

- 23.2.4.5. Financials (Based on Availability)

- 23.2.5 1 Envision Energy

- 23.2.5.1. Overview

- 23.2.5.2. Products

- 23.2.5.3. SWOT Analysis

- 23.2.5.4. Recent Developments

- 23.2.5.5. Financials (Based on Availability)

- 23.2.6 2 Orsted AS

- 23.2.6.1. Overview

- 23.2.6.2. Products

- 23.2.6.3. SWOT Analysis

- 23.2.6.4. Recent Developments

- 23.2.6.5. Financials (Based on Availability)

- 23.2.7 4 Suzlon Energy Limited

- 23.2.7.1. Overview

- 23.2.7.2. Products

- 23.2.7.3. SWOT Analysis

- 23.2.7.4. Recent Developments

- 23.2.7.5. Financials (Based on Availability)

- 23.2.8 Wind Farm Operators

- 23.2.8.1. Overview

- 23.2.8.2. Products

- 23.2.8.3. SWOT Analysis

- 23.2.8.4. Recent Developments

- 23.2.8.5. Financials (Based on Availability)

- 23.2.9 3 EDF SA

- 23.2.9.1. Overview

- 23.2.9.2. Products

- 23.2.9.3. SWOT Analysis

- 23.2.9.4. Recent Developments

- 23.2.9.5. Financials (Based on Availability)

- 23.2.10 5 Xinjiang Goldwind Science & Technology Co Ltd (Goldwind)

- 23.2.10.1. Overview

- 23.2.10.2. Products

- 23.2.10.3. SWOT Analysis

- 23.2.10.4. Recent Developments

- 23.2.10.5. Financials (Based on Availability)

- 23.2.11 6 Vestas Wind Systems AS

- 23.2.11.1. Overview

- 23.2.11.2. Products

- 23.2.11.3. SWOT Analysis

- 23.2.11.4. Recent Developments

- 23.2.11.5. Financials (Based on Availability)

- 23.2.12 1 Acciona Energia SA

- 23.2.12.1. Overview

- 23.2.12.2. Products

- 23.2.12.3. SWOT Analysis

- 23.2.12.4. Recent Developments

- 23.2.12.5. Financials (Based on Availability)

- 23.2.1 Equipment Suppliers

List of Figures

- Figure 1: APAC Onshore Wind Turbine Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: APAC Onshore Wind Turbine Industry Share (%) by Company 2024

List of Tables

- Table 1: APAC Onshore Wind Turbine Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: APAC Onshore Wind Turbine Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 3: APAC Onshore Wind Turbine Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: APAC Onshore Wind Turbine Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: APAC Onshore Wind Turbine Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China APAC Onshore Wind Turbine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan APAC Onshore Wind Turbine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India APAC Onshore Wind Turbine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea APAC Onshore Wind Turbine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Southeast Asia APAC Onshore Wind Turbine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia APAC Onshore Wind Turbine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Indonesia APAC Onshore Wind Turbine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Phillipes APAC Onshore Wind Turbine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Singapore APAC Onshore Wind Turbine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Thailandc APAC Onshore Wind Turbine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Asia Pacific APAC Onshore Wind Turbine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: APAC Onshore Wind Turbine Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 18: APAC Onshore Wind Turbine Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 19: APAC Onshore Wind Turbine Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: APAC Onshore Wind Turbine Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 21: APAC Onshore Wind Turbine Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: APAC Onshore Wind Turbine Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: APAC Onshore Wind Turbine Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 24: APAC Onshore Wind Turbine Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: APAC Onshore Wind Turbine Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: APAC Onshore Wind Turbine Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 27: APAC Onshore Wind Turbine Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: APAC Onshore Wind Turbine Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: APAC Onshore Wind Turbine Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 30: APAC Onshore Wind Turbine Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 31: APAC Onshore Wind Turbine Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: APAC Onshore Wind Turbine Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 33: APAC Onshore Wind Turbine Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: APAC Onshore Wind Turbine Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Onshore Wind Turbine Industry?

The projected CAGR is approximately < 10.45%.

2. Which companies are prominent players in the APAC Onshore Wind Turbine Industry?

Key companies in the market include Equipment Suppliers, 3 Siemens Gamesa Renewable Energy, 7 China Longyuan Power Group Corporation Limited*List Not Exhaustive, 2 General Electric Company, 1 Envision Energy, 2 Orsted AS, 4 Suzlon Energy Limited, Wind Farm Operators, 3 EDF SA, 5 Xinjiang Goldwind Science & Technology Co Ltd (Goldwind), 6 Vestas Wind Systems AS, 1 Acciona Energia SA.

3. What are the main segments of the APAC Onshore Wind Turbine Industry?

The market segments include Location, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adopting of Alternative Clean Energy Sources (Ex: Solar. Hydro).

8. Can you provide examples of recent developments in the market?

April 2022: Hitachi Energy installed a unique transformer in China's first floating wind turbine, the Sanxia Yinling Hao wind turbine. This 5.5-megawatt wind turbine, installed off the coast of Guangdong Province, was installed in December 2021 at Yangjiang wind farm. Hitachi Energy specifically designs this transformer for floating wind turbines. It can handle high vibrations = and can avoid oil spills due to dry operation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Onshore Wind Turbine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Onshore Wind Turbine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Onshore Wind Turbine Industry?

To stay informed about further developments, trends, and reports in the APAC Onshore Wind Turbine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence