Key Insights

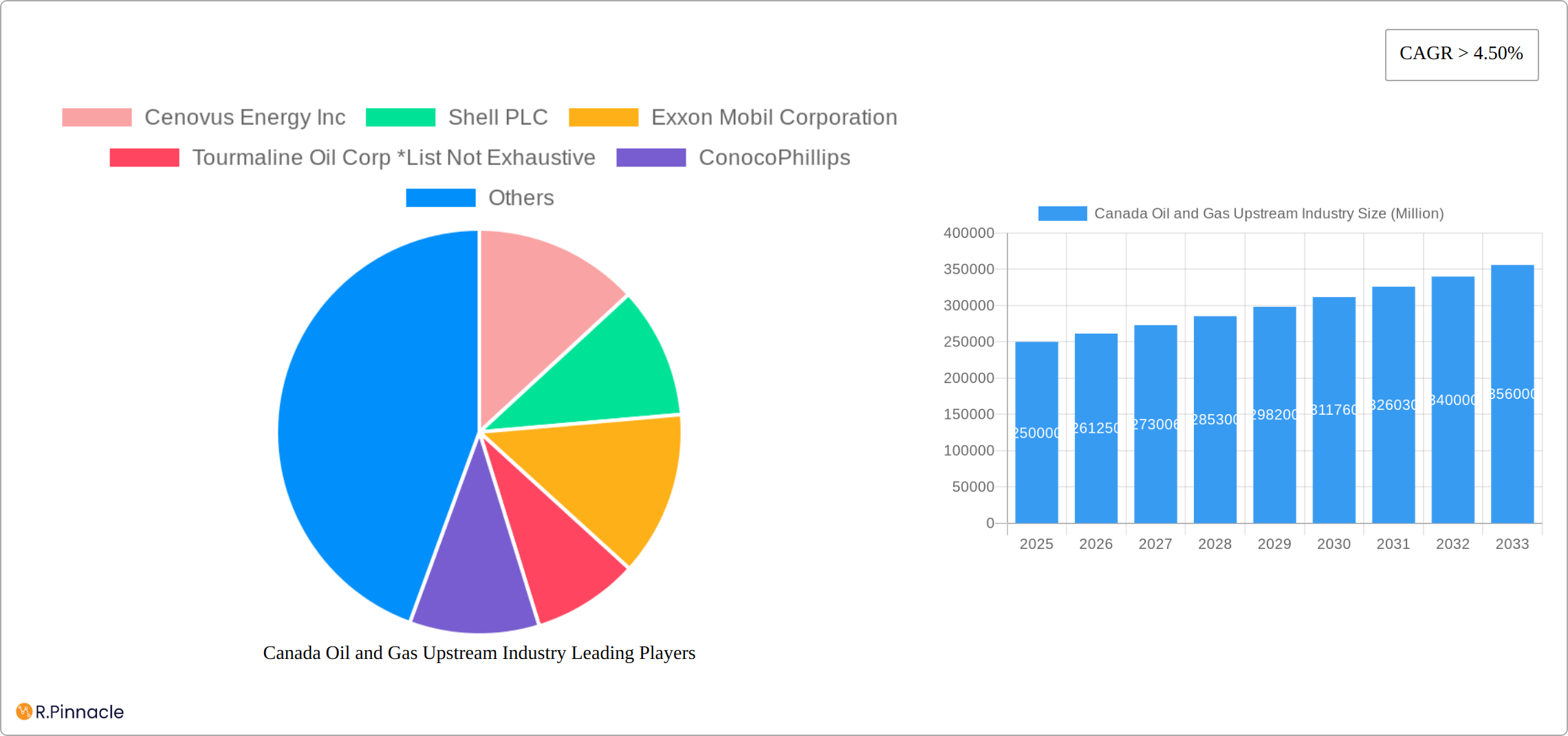

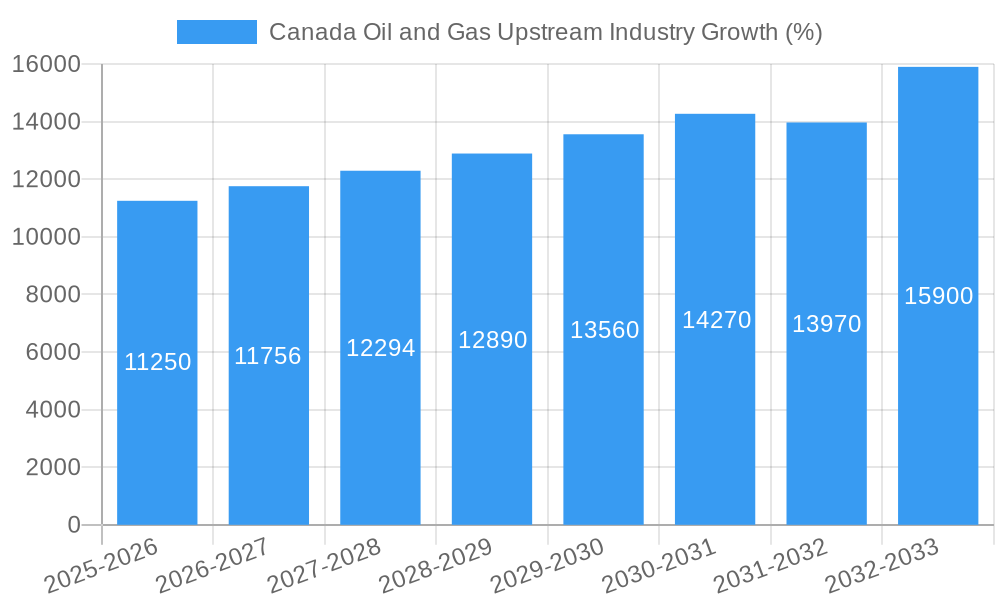

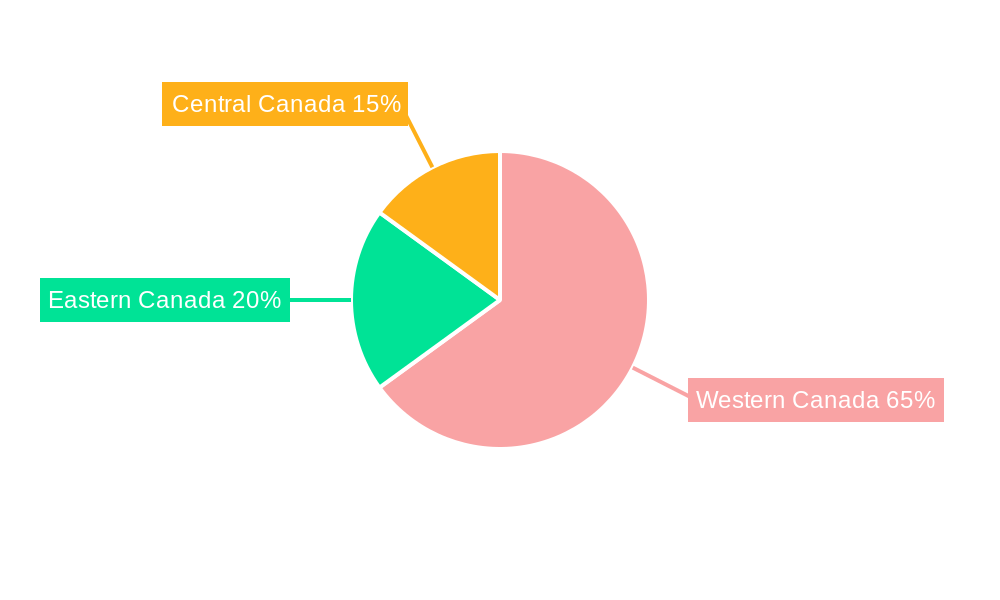

The Canadian oil and gas upstream industry, encompassing activities from exploration to production of crude oil, natural gas, and condensate, is a significant contributor to the nation's economy. Driven by robust global energy demand and strategic government policies aimed at responsible resource extraction, the market exhibits a Compound Annual Growth Rate (CAGR) exceeding 4.50% from 2025 to 2033. This growth is fueled by increasing demand across various applications, including transportation, heating, power generation, and petrochemicals, primarily driven by the industrial and commercial sectors. While environmental concerns and fluctuating global energy prices pose challenges, technological advancements in extraction techniques (e.g., enhanced oil recovery) and exploration in less-explored areas are mitigating these restraints, ensuring continued expansion. The industry is segmented geographically into Eastern, Western, and Central Canada, with Western Canada currently holding the largest share due to established infrastructure and substantial reserves. Major players such as Cenovus Energy, Shell, ExxonMobil, and ConocoPhillips are actively shaping the industry landscape through strategic investments and operational improvements.

Despite potential regulatory changes and global shifts in energy consumption towards renewable sources, the outlook for the Canadian oil and gas upstream sector remains positive. The forecast period (2025-2033) anticipates considerable growth based on existing infrastructure, ongoing exploration efforts targeting new resources, and the continued demand for natural gas as a transition fuel. The dominance of Western Canada is likely to continue, but strategic investments in other regions, coupled with infrastructural developments, could alter regional market shares over the long term. The industry will likely prioritize sustainability initiatives and technological innovation to address environmental concerns and enhance operational efficiency while maintaining profitable production and contributing significantly to the Canadian economy.

This comprehensive report provides an in-depth analysis of the Canadian oil and gas upstream industry, offering valuable insights for industry professionals, investors, and stakeholders. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive data analysis to illuminate market trends, competitive dynamics, and future growth potential. Key players like Cenovus Energy Inc, Shell PLC, Exxon Mobil Corporation, and Tourmaline Oil Corp are analyzed, alongside other significant contributors.

Canada Oil and Gas Upstream Industry Market Structure & Innovation Trends

This section analyzes the Canadian oil and gas upstream market's structure, focusing on market concentration, innovation drivers, regulatory frameworks, and M&A activities. The report examines the market share of key players such as Cenovus Energy Inc., Shell PLC, and Exxon Mobil Corporation, providing a detailed competitive landscape.

- Market Concentration: The report quantifies market share held by major players and assesses the level of competition within different segments (e.g., crude oil, natural gas). xx% of the market is controlled by the top 5 players in 2025.

- Innovation Drivers: The analysis explores factors driving innovation, including technological advancements in exploration and extraction, government incentives for renewable energy integration, and the need for enhanced oil recovery techniques.

- Regulatory Frameworks: The report examines the impact of federal and provincial regulations on exploration and production activities, including environmental protection policies and carbon emission reduction targets.

- Product Substitutes: The analysis evaluates the emergence of renewable energy sources and their potential impact on the demand for oil and gas.

- End-User Demographics: The report assesses the consumption patterns of oil and gas across various end-user segments (industrial, commercial, residential) and their implications for future demand.

- M&A Activities: The report details significant M&A transactions in the historical period (2019-2024), analyzing deal values (in Millions) and their impact on market consolidation. For example, xx Million worth of M&A deals were recorded in 2024.

Canada Oil and Gas Upstream Industry Market Dynamics & Trends

The Canadian oil and gas upstream industry is undergoing a dynamic transformation, shaped by a confluence of robust growth drivers, disruptive technological innovations, evolving consumer preferences, and intense competitive pressures. This section delves into the intricate market dynamics, providing a granular analysis of the industry's Compound Annual Growth Rate (CAGR) and the penetration rates of key market segments. We meticulously assess the profound impact of geopolitical shifts, persistent volatility in global commodity prices, and the increasingly stringent environmental regulatory landscape. These factors collectively contribute to the inherent market volatility, with a projected CAGR of [Insert Specific CAGR Here]% for the upcoming forecast period, underscoring a period of sustained, albeit carefully managed, expansion.

Dominant Regions & Segments in Canada Oil and Gas Upstream Industry

This section meticulously identifies and analyzes the leading geographical regions and the most prominent segments within the Canadian oil and gas upstream market. Our analysis highlights the significant dominance of specific provinces, such as Alberta and Saskatchewan, and key product categories including crude oil, natural gas, and condensate. We further delineate the critical factors underpinning their sustained prominence and growth potential.

- Leading Region: Alberta continues to lead due to its unparalleled reserves of hydrocarbons and a well-established, extensive infrastructure network supporting exploration, extraction, and transportation.

- Dominant Product Type: Crude oil remains the dominant product, primarily driven by insatiable global demand from the transportation sector and its critical role in petrochemical feedstock.

- Key Drivers of Regional & Segmental Dominance:

- Supportive Economic Policies: Proactive government initiatives, including attractive fiscal incentives, tax benefits, and streamlined regulatory frameworks, are crucial in fostering investment in oil and gas exploration and production.

- Advanced Infrastructure: The presence of sophisticated pipeline networks, multimodal transportation systems, and processing facilities is paramount for efficient resource extraction, processing, and distribution to both domestic and international markets.

- Technological Advancements: Continuous innovation in extraction methodologies, including horizontal drilling, hydraulic fracturing, and enhanced oil recovery (EOR) techniques, unlocks access to previously uneconomical or technically challenging reserves, thereby expanding the resource base.

Our comprehensive examination offers invaluable insights into the market share distribution and future growth trajectories of each segment, providing a nuanced understanding of the intricate regional and product-specific dynamics at play within the Canadian oil and gas upstream landscape.

Canada Oil and Gas Upstream Industry Product Innovations

This section summarizes recent product developments and technological advancements within the Canadian oil and gas upstream industry. Focus is placed on new extraction technologies, improved efficiency measures, and environmental mitigation strategies. The analysis assesses the competitive advantages offered by these innovations and their market fit, considering factors such as cost-effectiveness, environmental impact, and regulatory compliance. For instance, the adoption of enhanced oil recovery techniques is increasing efficiency and extending the lifespan of existing fields.

Report Scope & Segmentation Analysis

This report segments the Canadian oil and gas upstream market across various dimensions:

- Product Type: Crude oil, natural gas, condensate (each segment’s market size in Millions, growth projections, and competitive analysis are provided).

- Application: Transportation, heating, power generation, petrochemicals (each segment’s market size in Millions, growth projections, and competitive analysis are provided).

- End User: Industrial, commercial, residential (each segment’s market size in Millions, growth projections, and competitive analysis are provided).

Each segment is analyzed separately, providing growth projections, market sizes (in Millions), and competitive dynamics.

Key Drivers of Canada Oil and Gas Upstream Industry Growth

The sustained growth of the Canadian oil and gas upstream industry is propelled by a multifaceted array of factors. Foremost among these is the robust and persistent global demand for energy, particularly from rapidly developing economies seeking to fuel their industrial and economic expansion. This demand is complemented by proactive government support for domestic resource extraction, manifested through favorable policies and investment frameworks. Furthermore, significant advancements in drilling and extraction technologies are critically enabling access to previously uneconomical or technically challenging reserves, expanding the recoverable resource base. This is further bolstered by substantial and ongoing investments in critical infrastructure, including pipelines, processing facilities, and transportation networks, which are vital for efficient operations and market access.

Challenges in the Canada Oil and Gas Upstream Industry Sector

Despite its strengths, the Canadian oil and gas upstream industry navigates a complex landscape of challenges. Persistent volatility in global commodity prices poses a significant risk to investment and profitability. Stringent and evolving environmental regulations, while necessary, can lead to increased operational costs, complex permitting processes, and potential project delays. Geopolitical uncertainties and global energy market dynamics can introduce unforeseen risks and impact market access. Furthermore, growing public and investor concerns regarding the industry's environmental footprint, including greenhouse gas emissions and land use, can lead to reputational challenges and potentially constrain access to capital and investment. Addressing these multifaceted challenges is crucial for the industry's long-term sustainability and competitiveness.

Emerging Opportunities in Canada Oil and Gas Upstream Industry

Emerging opportunities include the exploration and development of unconventional resources (e.g., shale gas), investments in carbon capture and storage technologies, the growth of liquefied natural gas (LNG) exports, and increasing demand for natural gas as a cleaner-burning alternative to coal in power generation.

Leading Players in the Canada Oil and Gas Upstream Industry Market

- Cenovus Energy Inc

- Shell PLC

- Exxon Mobil Corporation

- Tourmaline Oil Corp

- ConocoPhillips

- Chevron Corporation

- TotalEnergies SE

- BP PLC

Key Developments in Canada Oil and Gas Upstream Industry Industry

- January 2021: Chevron Canada, Equinor Canada, and BHP Petroleum (New Ventures) secured approvals for three offshore drilling projects east of St. John's, Newfoundland and Labrador. This highlights the ongoing exploration activity and investment in offshore oil and gas resources.

Future Outlook for Canada Oil and Gas Upstream Industry Market

The Canadian oil and gas upstream market is poised for continued, albeit moderate, growth, underpinned by the enduring global demand for energy and ongoing investments in innovative technologies. However, the trajectory of this growth is intricately linked to several pivotal factors. The evolution of government policies, particularly those related to emissions reductions and climate change mitigation, will play a crucial role in shaping operational environments and investment decisions. Moreover, the global transition towards cleaner energy sources and the increasing adoption of renewable energy technologies will undoubtedly influence the long-term demand for fossil fuels. Consequently, the future outlook for the industry is increasingly pointing towards a strategic imperative to embrace more sustainable, environmentally conscious practices and to explore opportunities in lower-carbon energy solutions, thereby ensuring its continued relevance and viability in a changing energy landscape.

Canada Oil and Gas Upstream Industry Segmentation

- 1. Onshore

- 2. Offshore

Canada Oil and Gas Upstream Industry Segmentation By Geography

- 1. Canada

Canada Oil and Gas Upstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Solar Panel Costs4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Upfront Cost

- 3.4. Market Trends

- 3.4.1. Offshore Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Oil and Gas Upstream Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 5.2. Market Analysis, Insights and Forecast - by Offshore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 6. Eastern Canada Canada Oil and Gas Upstream Industry Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Oil and Gas Upstream Industry Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Oil and Gas Upstream Industry Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Cenovus Energy Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Shell PLC

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Exxon Mobil Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Tourmaline Oil Corp *List Not Exhaustive

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 ConocoPhillips

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Chevron Corporation

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 TotalEnergies SE

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 BP PLC

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Cenovus Energy Inc

List of Figures

- Figure 1: Canada Oil and Gas Upstream Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Oil and Gas Upstream Industry Share (%) by Company 2024

List of Tables

- Table 1: Canada Oil and Gas Upstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Oil and Gas Upstream Industry Revenue Million Forecast, by Onshore 2019 & 2032

- Table 3: Canada Oil and Gas Upstream Industry Revenue Million Forecast, by Offshore 2019 & 2032

- Table 4: Canada Oil and Gas Upstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Canada Oil and Gas Upstream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Eastern Canada Canada Oil and Gas Upstream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Western Canada Canada Oil and Gas Upstream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Central Canada Canada Oil and Gas Upstream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Oil and Gas Upstream Industry Revenue Million Forecast, by Onshore 2019 & 2032

- Table 10: Canada Oil and Gas Upstream Industry Revenue Million Forecast, by Offshore 2019 & 2032

- Table 11: Canada Oil and Gas Upstream Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Oil and Gas Upstream Industry?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the Canada Oil and Gas Upstream Industry?

Key companies in the market include Cenovus Energy Inc, Shell PLC, Exxon Mobil Corporation, Tourmaline Oil Corp *List Not Exhaustive, ConocoPhillips, Chevron Corporation, TotalEnergies SE, BP PLC.

3. What are the main segments of the Canada Oil and Gas Upstream Industry?

The market segments include Onshore, Offshore.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Solar Panel Costs4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Offshore Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Upfront Cost.

8. Can you provide examples of recent developments in the market?

In January 2021, Chevron Canada, Equinor Canada, and BHP Petroleum (New Ventures) secured approvals from the Environment and Climate Change Minister to conduct drilling at three offshore drilling projects east of St. John's, Newfoundland, and Labrador. The companies have proposed operating offshore platforms like ships and helicopters to conduct exploration drilling and well testing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Oil and Gas Upstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Oil and Gas Upstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Oil and Gas Upstream Industry?

To stay informed about further developments, trends, and reports in the Canada Oil and Gas Upstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence