Key Insights

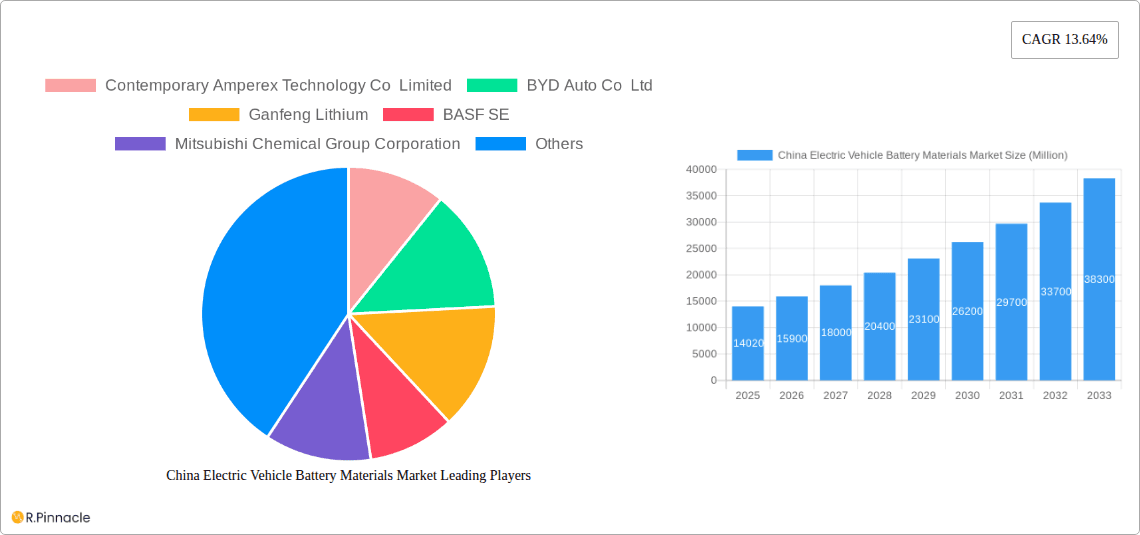

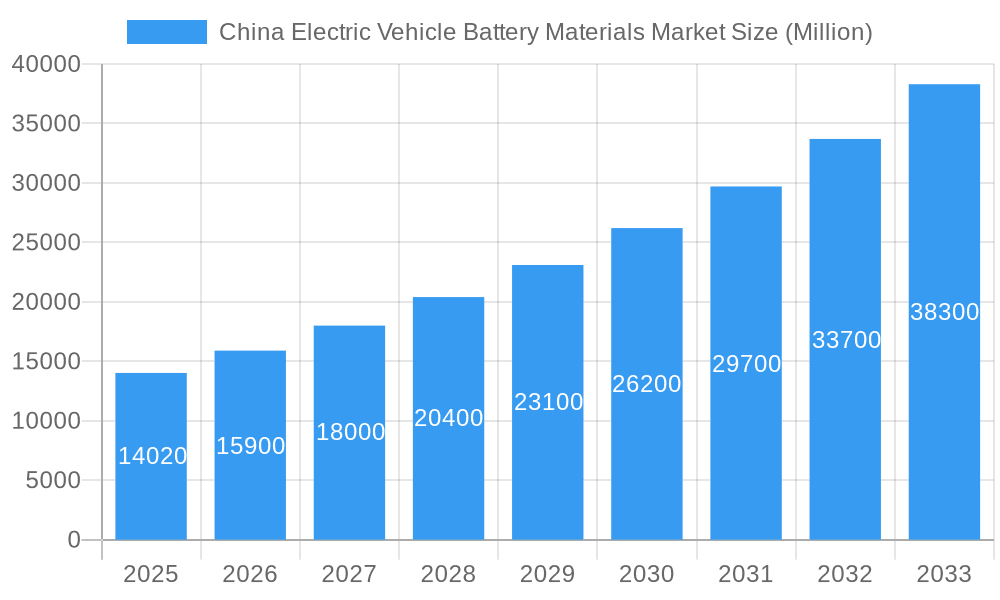

The China electric vehicle (EV) battery materials market is experiencing robust growth, fueled by the nation's aggressive push towards electric mobility and stringent emission regulations. The market, valued at approximately $14.02 billion in 2025, is projected to expand at a compound annual growth rate (CAGR) of 13.64% from 2025 to 2033. This surge is driven by several factors, including increasing EV sales, government incentives promoting EV adoption, and advancements in battery technology leading to higher energy density and longer lifespans. Key players like Contemporary Amperex Technology Co Limited (CATL), BYD Auto Co Ltd, and Ganfeng Lithium are capitalizing on this expansion, investing heavily in research and development and expanding their production capacities to meet the rising demand. The market segmentation likely includes key materials like lithium, cobalt, nickel, manganese, and graphite, each with its own growth trajectory influenced by supply chain dynamics, geopolitical factors, and technological innovations. Furthermore, the development of alternative battery chemistries, such as solid-state batteries, presents both opportunities and challenges for existing market participants.

China Electric Vehicle Battery Materials Market Market Size (In Billion)

The growth trajectory is, however, subject to certain constraints. These include fluctuating raw material prices, potential supply chain bottlenecks, and the need for sustainable sourcing practices to address environmental concerns associated with battery material extraction and processing. Regional variations within China itself are also expected, with certain provinces experiencing faster growth due to favorable government policies and established manufacturing hubs. Competition among market players is intense, pushing companies to innovate and optimize their operations to maintain a competitive edge. The ongoing development of advanced battery technologies and the emergence of new players will shape the market landscape in the coming years. The forecast period of 2025-2033 indicates a significant expansion of the market size, likely exceeding $50 billion by 2033, driven by the continued penetration of EVs in China’s transportation sector.

China Electric Vehicle Battery Materials Market Company Market Share

China Electric Vehicle Battery Materials Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic China Electric Vehicle Battery Materials market, covering the period 2019-2033. It offers actionable insights for industry professionals, investors, and strategic decision-makers seeking to navigate this rapidly evolving landscape. With a focus on market size, segmentation, key players, and future trends, this report is an essential resource for understanding the current state and future potential of this crucial sector. The base year for this analysis is 2025, with estimations for 2025 and a forecast period extending to 2033.

China Electric Vehicle Battery Materials Market Structure & Innovation Trends

This section analyzes the market concentration, innovation drivers, regulatory landscape, and competitive dynamics within the Chinese EV battery materials sector. We delve into the impact of mergers and acquisitions (M&A) activity, examining deal values and their influence on market share.

- Market Concentration: The market is characterized by a mix of large multinational corporations and rapidly growing domestic players. Contemporary Amperex Technology Co Limited (CATL) and BYD Auto Co Ltd currently hold significant market share, but the landscape is dynamic with increasing competition. We provide a detailed analysis of market share percentages for key players.

- Innovation Drivers: Government initiatives promoting electric vehicle adoption and advancements in battery technology are key drivers of innovation. The focus on next-generation batteries, such as all-solid-state batteries (ASSBs), fuels significant R&D investment.

- Regulatory Framework: China's supportive regulatory environment, including subsidies and policies favoring EV adoption, significantly influences market growth. We analyze the impact of these regulations on market dynamics.

- Product Substitutes: The emergence of alternative battery chemistries and advancements in energy storage technologies represent potential substitutes and competitive pressures.

- End-User Demographics: The expanding consumer base for electric vehicles, driven by increasing environmental awareness and government incentives, fuels the demand for battery materials. We examine the profile of the end-users and their impact on market demand.

- M&A Activity: The report documents significant M&A activities within the sector, analyzing their impact on market consolidation and innovation. xx Million USD in M&A deals were recorded during the historical period.

China Electric Vehicle Battery Materials Market Market Dynamics & Trends

This section explores the key market growth drivers, technological disruptions, consumer preferences, and competitive dynamics shaping the Chinese EV battery materials market. We provide a comprehensive analysis of CAGR and market penetration rates.

[Insert 600 words of detailed analysis focusing on market growth drivers (e.g., government policies, rising EV sales), technological disruptions (e.g., advancements in battery chemistry, solid-state batteries), consumer preferences (e.g., range anxiety, charging infrastructure), and competitive dynamics (e.g., pricing strategies, innovation race). Include specific metrics like CAGR and market penetration rates. Example: The market is projected to experience a CAGR of xx% during the forecast period, driven by increasing EV sales and government support for the industry.]

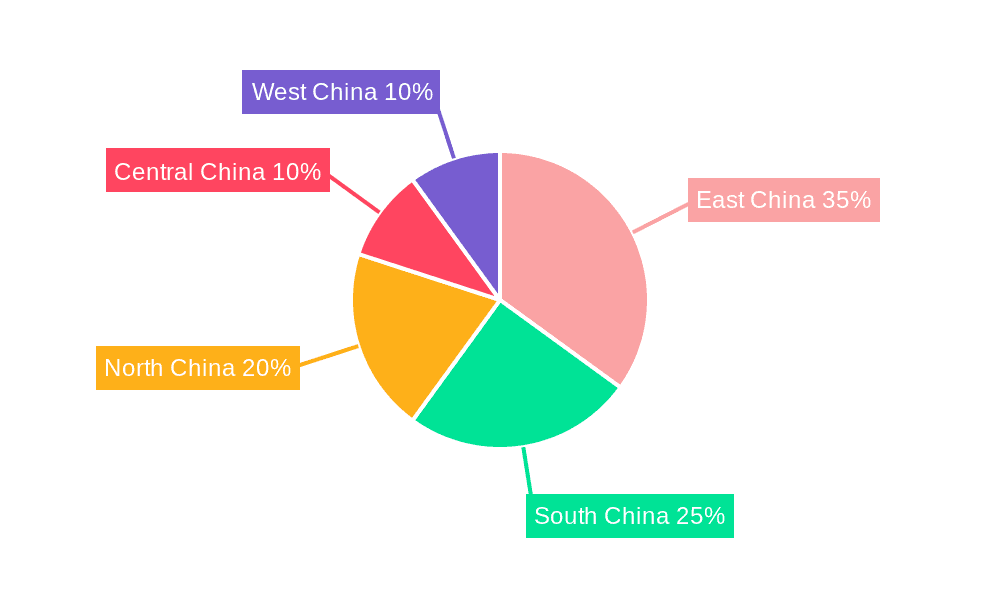

Dominant Regions & Segments in China Electric Vehicle Battery Materials Market

This section identifies the leading regions and segments within the Chinese EV battery materials market. We provide a detailed analysis of the factors driving their dominance.

- Leading Region/Segment: [Specify the leading region, e.g., Guangdong Province]

- Key Drivers:

- Favorable government policies and subsidies.

- Well-established EV manufacturing infrastructure.

- Strong presence of major battery material manufacturers.

- Access to raw materials and skilled labor.

[Insert 600 words of detailed dominance analysis for the leading region/segment. Explain its leading position and its unique strengths compared to other regions or segments.]

China Electric Vehicle Battery Materials Market Product Innovations

This section summarizes recent product developments and technological advancements in the Chinese EV battery materials sector.

The market is witnessing significant innovation in battery chemistries, with a strong focus on developing high-energy density, cost-effective, and safer batteries. Advancements in cathode materials, anode materials, and electrolytes are driving improvements in battery performance and lifespan. The emergence of solid-state batteries holds immense potential to revolutionize the EV battery landscape, offering faster charging times, improved safety, and higher energy density. This innovation directly addresses market needs for longer driving ranges and faster charging times, enhancing the consumer appeal of electric vehicles.

Report Scope & Segmentation Analysis

This report segments the China Electric Vehicle Battery Materials market based on [Specify the segmentation criteria, e.g., material type, battery chemistry, application]. Each segment's growth projections, market sizes, and competitive dynamics are analyzed.

[Insert 100-150 words with a paragraph for each segment. For example: The Lithium-ion battery segment holds the largest market share due to its established technology and widespread adoption. The segment is projected to grow at a CAGR of xx% during the forecast period. The Nickel Manganese Cobalt (NMC) cathode material segment is another significant segment, driven by its high energy density and performance characteristics.]

Key Drivers of China Electric Vehicle Battery Materials Market Growth

Several factors contribute to the growth of the China Electric Vehicle Battery Materials market. These include:

- Government support: Substantial government investment in EV infrastructure and technology development. The recent USD 845 Million investment in next-generation battery technologies is a prime example.

- Rising EV sales: The increasing popularity of electric vehicles in China is driving a surge in demand for battery materials.

- Technological advancements: Innovation in battery chemistries and manufacturing processes are improving battery performance and reducing costs.

Challenges in the China Electric Vehicle Battery Materials Market Sector

The China EV battery materials market faces several challenges:

- Raw material price volatility: Fluctuations in the prices of key raw materials, such as lithium and cobalt, impact the cost of battery production.

- Supply chain disruptions: Geopolitical factors and disruptions in the supply chain can affect the availability of critical materials.

- Intense competition: The market is characterized by intense competition among both domestic and international players.

Emerging Opportunities in China Electric Vehicle Battery Materials Market

The China EV battery materials market presents several opportunities:

- Development of next-generation batteries: Investment in all-solid-state batteries and other advanced battery technologies offers significant potential for growth.

- Expansion into new applications: Battery materials are finding applications beyond EVs, creating new market opportunities.

- Focus on sustainable and ethical sourcing: Growing consumer demand for environmentally friendly and ethically sourced materials creates opportunities for companies committed to sustainable practices.

Leading Players in the China Electric Vehicle Battery Materials Market Market

- Contemporary Amperex Technology Co Limited

- BYD Auto Co Ltd

- Ganfeng Lithium

- BASF SE

- Mitsubishi Chemical Group Corporation

- UBE Corporation

- Umicore SA

- Sumitomo Chemical Co Ltd

- BTR New Material Group Co Ltd

- Shanshan Co

- [List of Other Prominent Companies]

Key Developments in China Electric Vehicle Battery Materials Market Industry

- May 2024: China announces a 6 billion yuan (USD 845 million) investment in next-generation EV battery technologies, focusing on all-solid-state batteries (ASSBs) and supporting companies like CATL, BYD, and Geely. This signals a strong government commitment to advancing battery technology and strengthening the domestic industry.

- July 2024: Chinese researchers unveil a low-cost solid-state lithium battery with performance comparable to leading next-generation contenders. This breakthrough has the potential to accelerate the adoption of ASSBs and significantly impact the market competitiveness.

Future Outlook for China Electric Vehicle Battery Materials Market Market

The future of the China Electric Vehicle Battery Materials market is bright. Continued government support, rising EV sales, and technological advancements will drive significant market growth. The focus on developing next-generation battery technologies, such as all-solid-state batteries, promises further innovation and efficiency gains. Strategic partnerships and investments will play a key role in shaping the market landscape and fostering sustainable growth. The market is poised for substantial expansion, driven by both domestic demand and the potential for exports.

China Electric Vehicle Battery Materials Market Segmentation

-

1. Battery Type

- 1.1. Lithium-ion Battery

- 1.2. Lead-Acid Battery

- 1.3. Others

-

2. Material

- 2.1. Cathode

- 2.2. Anode

- 2.3. Electrolyte

- 2.4. Separator

- 2.5. Others

China Electric Vehicle Battery Materials Market Segmentation By Geography

- 1. China

China Electric Vehicle Battery Materials Market Regional Market Share

Geographic Coverage of China Electric Vehicle Battery Materials Market

China Electric Vehicle Battery Materials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations

- 3.4. Market Trends

- 3.4.1. Lithium-ion Battery Type to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Electric Vehicle Battery Materials Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lithium-ion Battery

- 5.1.2. Lead-Acid Battery

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Cathode

- 5.2.2. Anode

- 5.2.3. Electrolyte

- 5.2.4. Separator

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Contemporary Amperex Technology Co Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BYD Auto Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ganfeng Lithium

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BASF SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mitsubishi Chemical Group Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 UBE Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Umicore SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sumitomo Chemical Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BTR New Material Group Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Shanshan Co *List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share (%) Analysi

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Contemporary Amperex Technology Co Limited

List of Figures

- Figure 1: China Electric Vehicle Battery Materials Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Electric Vehicle Battery Materials Market Share (%) by Company 2025

List of Tables

- Table 1: China Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 2: China Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 3: China Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2020 & 2033

- Table 4: China Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2020 & 2033

- Table 5: China Electric Vehicle Battery Materials Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: China Electric Vehicle Battery Materials Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: China Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 8: China Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 9: China Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2020 & 2033

- Table 10: China Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2020 & 2033

- Table 11: China Electric Vehicle Battery Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: China Electric Vehicle Battery Materials Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Electric Vehicle Battery Materials Market?

The projected CAGR is approximately 13.64%.

2. Which companies are prominent players in the China Electric Vehicle Battery Materials Market?

Key companies in the market include Contemporary Amperex Technology Co Limited, BYD Auto Co Ltd, Ganfeng Lithium, BASF SE, Mitsubishi Chemical Group Corporation, UBE Corporation, Umicore SA, Sumitomo Chemical Co Ltd, BTR New Material Group Co Ltd, Shanshan Co *List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share (%) Analysi.

3. What are the main segments of the China Electric Vehicle Battery Materials Market?

The market segments include Battery Type, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.02 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations.

6. What are the notable trends driving market growth?

Lithium-ion Battery Type to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations.

8. Can you provide examples of recent developments in the market?

May 2024: China plans to invest approximately 6 billion yuan (USD 845 million) in advancing next-generation battery technologies for electric vehicles (EVs). The country is planning to support six companies, including CATL, BYD, and Geely, to pioneer the development of all-solid-state batteries (ASSBs). Notably, EV battery manufacturer CATL stands out as a key recipient of government support for its next-generation technology initiatives.July 2024: Chinese researchers unveiled a solid-state lithium battery, achieving performance levels comparable to leading next-gen battery contenders, yet costing under 10% of their price. This advancement aligns with China's strategic plan to spearhead the future of rechargeable battery technology, a shift poised to transform the electric vehicle landscape. By substituting the liquid electrolytes found in traditional lithium batteries with a solid-state variant, the potential emerges for quicker charging, enhanced performance, and heightened safety standards.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Electric Vehicle Battery Materials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Electric Vehicle Battery Materials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Electric Vehicle Battery Materials Market?

To stay informed about further developments, trends, and reports in the China Electric Vehicle Battery Materials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence