Key Insights

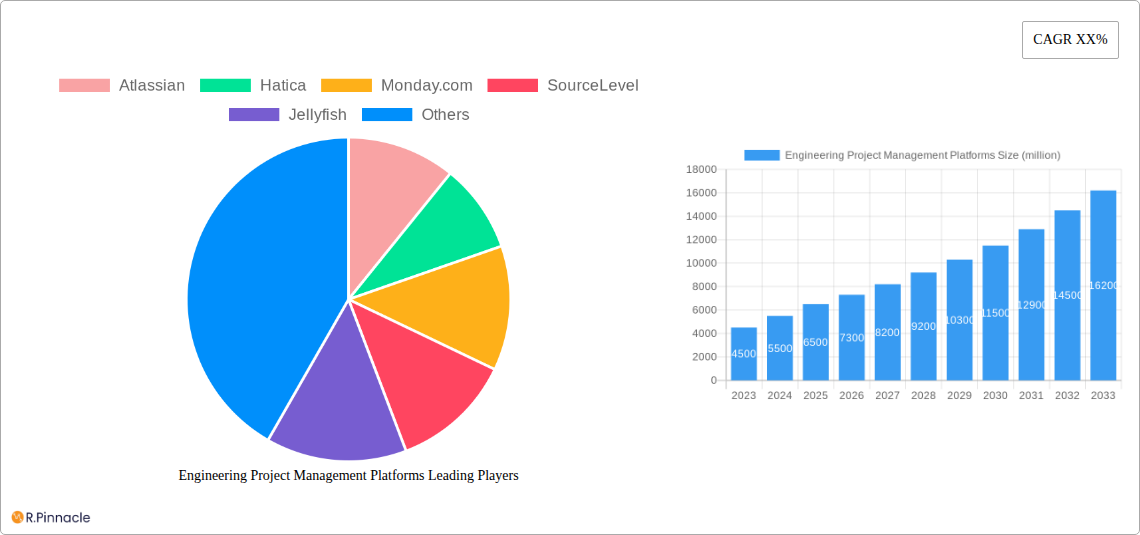

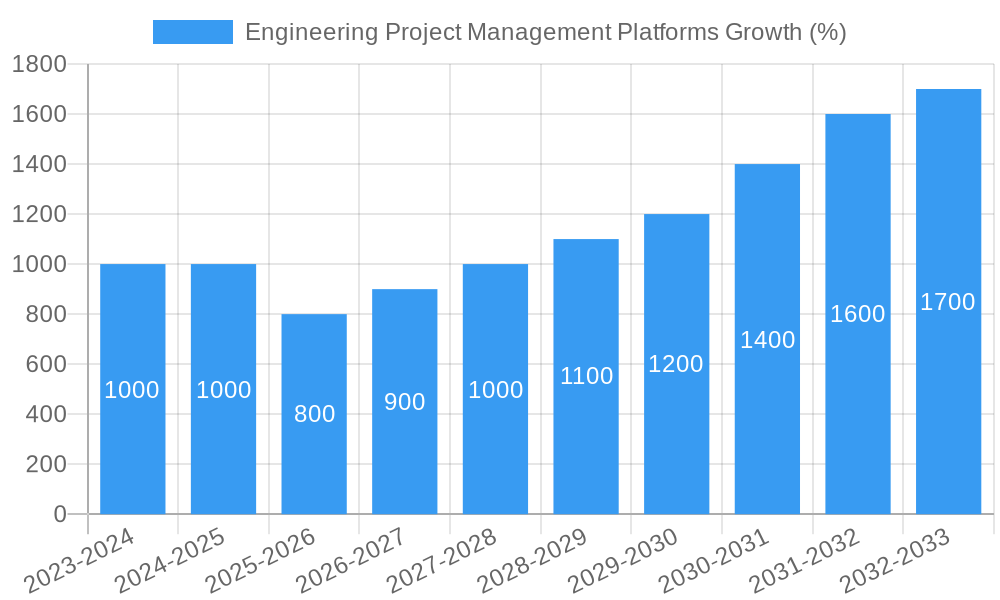

The global Engineering Project Management Platforms market is experiencing robust growth, projected to reach an estimated market size of approximately $6,500 million by 2025. This expansion is fueled by a Compound Annual Growth Rate (CAGR) of around 12.5% over the forecast period of 2025-2033. A primary driver behind this surge is the increasing complexity of engineering projects, demanding sophisticated tools for effective planning, execution, and monitoring. The IT & Software Development sector, in particular, is a significant contributor, leveraging these platforms to streamline agile methodologies and manage intricate development lifecycles. Furthermore, the Building & Construction industry is a cornerstone of this market, as large-scale infrastructure projects necessitate enhanced collaboration, risk management, and resource allocation capabilities that these platforms provide. The rising adoption of cloud-based solutions, offering scalability and accessibility, is further propelling market penetration.

The market is characterized by a dynamic interplay of trends and restraints. Key trends include the integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics and automated task management, enabling better decision-making and proactive issue resolution. The growing emphasis on remote work and distributed teams is also a significant trend, as these platforms facilitate seamless collaboration across geographical boundaries. However, challenges such as the high initial cost of implementation and the need for specialized training can act as restraints for some organizations, particularly Small and Medium Enterprises (SMEs). Despite these hurdles, the undeniable benefits of enhanced project efficiency, cost savings, and improved stakeholder communication are driving widespread adoption across both SMEs and Large Enterprises, solidifying the market's upward trajectory.

Engineering Project Management Platforms Market: Comprehensive Industry Report 2025-2033

This in-depth report offers a strategic analysis of the Engineering Project Management Platforms market, providing critical insights for stakeholders navigating this dynamic sector. Spanning a study period of 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, this research delves into market structure, dynamics, regional dominance, product innovation, and future outlook. We leverage high-ranking keywords to ensure maximum search visibility for industry professionals seeking to understand and capitalize on market trends.

Engineering Project Management Platforms Market Structure & Innovation Trends

The Engineering Project Management Platforms market exhibits a moderate to high concentration, with key players like Atlassian and Monday.com holding significant market share, estimated to be over 30% collectively. Innovation is primarily driven by the integration of AI for predictive analytics, enhanced collaboration features, and robust security protocols, responding to the evolving needs of IT & Software Development and Building & Construction segments. Regulatory frameworks, particularly those concerning data privacy and intellectual property in large-scale infrastructure projects, are increasingly influencing platform development. Product substitutes, such as generic task management tools and custom-built solutions, are present but lack the specialized functionalities required for complex engineering projects. End-user demographics are shifting towards cloud-based solutions and mobile accessibility. Mergers and acquisitions (M&A) activity remains robust, with an estimated deal value of over $500 million in the historical period, aiming to consolidate market presence and expand service offerings.

Engineering Project Management Platforms Market Dynamics & Trends

The Engineering Project Management Platforms market is poised for significant expansion, driven by an estimated Compound Annual Growth Rate (CAGR) of approximately 12%. This growth is fueled by the increasing complexity of engineering projects across sectors like Building & Construction and IT & Software Development, necessitating sophisticated tools for efficient planning, execution, and monitoring. Technological disruptions, including the widespread adoption of cloud computing, the Internet of Things (IoT) for real-time data collection, and advanced analytics, are transforming how engineering projects are managed. Consumer preferences are leaning towards user-friendly interfaces, seamless integration with existing software ecosystems, and customizable workflows that cater to the unique demands of Small and Medium Enterprises (SMEs) and Large Enterprises. Competitive dynamics are intensifying, with established players investing heavily in R&D to maintain their edge and new entrants focusing on niche solutions and disruptive technologies. Market penetration is projected to reach over 70% by 2033 as more organizations recognize the indispensable value of specialized project management platforms. The rising demand for remote work capabilities and the need for enhanced transparency and accountability in project delivery further accelerate this market's upward trajectory.

Dominant Regions & Segments in Engineering Project Management Platforms

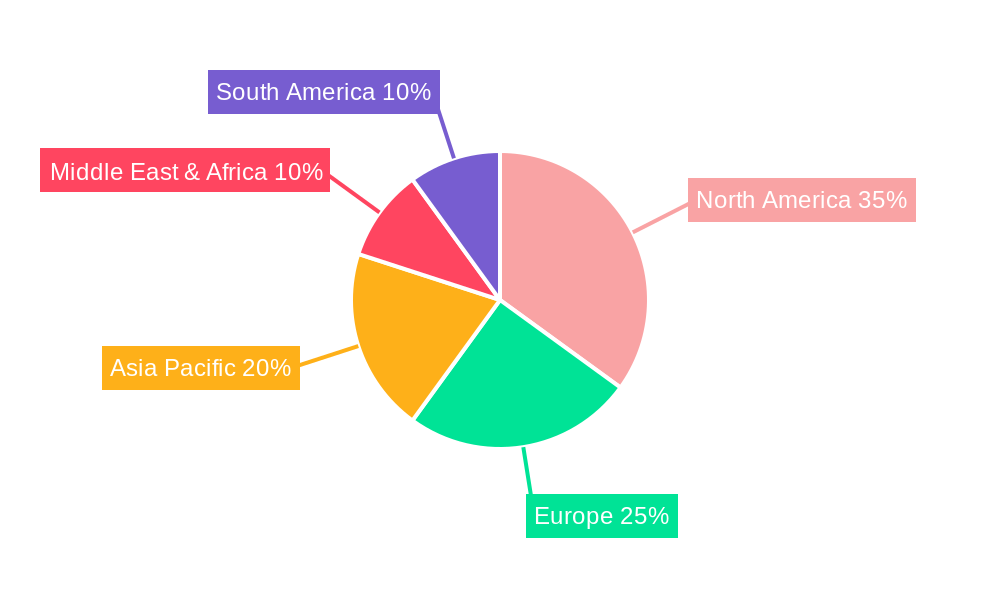

North America currently dominates the Engineering Project Management Platforms market, driven by a strong presence of IT & Software Development companies and substantial investments in the Building & Construction sector. The United States, in particular, showcases high market penetration, supported by favorable economic policies and a mature digital infrastructure. The Building & Construction segment accounts for a significant share, exceeding 35%, due to the inherent complexity of construction projects requiring meticulous planning, resource allocation, and risk management. The IT & Software Development segment follows closely, driven by agile methodologies and the need for streamlined product development lifecycles.

Key Drivers in Dominant Regions & Segments:

North America:

- Economic Policies: Government initiatives supporting infrastructure development and technological innovation.

- Technological Adoption: High readiness for adopting advanced software solutions.

- Skilled Workforce: Availability of skilled professionals adept at utilizing sophisticated project management tools.

Building & Construction Segment:

- Project Complexity: Large-scale infrastructure projects demanding intricate coordination.

- Regulatory Compliance: Strict adherence to safety and environmental regulations necessitating detailed documentation and tracking.

- Cost Containment: Pressure to optimize budgets and mitigate project overruns.

IT & Software Development Segment:

- Agile Methodologies: Need for flexible and iterative project management.

- Product Lifecycle Management: Requirement for efficient tracking from ideation to deployment.

- Remote Collaboration: Essential for globally distributed development teams.

North America:

- Economic Policies: Government initiatives supporting infrastructure development and technological innovation.

- Technological Adoption: High readiness for adopting advanced software solutions.

- Skilled Workforce: Availability of skilled professionals adept at utilizing sophisticated project management tools.

Building & Construction Segment:

- Project Complexity: Large-scale infrastructure projects demanding intricate coordination.

- Regulatory Compliance: Strict adherence to safety and environmental regulations necessitating detailed documentation and tracking.

- Cost Containment: Pressure to optimize budgets and mitigate project overruns.

IT & Software Development Segment:

- Agile Methodologies: Need for flexible and iterative project management.

- Product Lifecycle Management: Requirement for efficient tracking from ideation to deployment.

- Remote Collaboration: Essential for globally distributed development teams.

Large Enterprises represent a substantial portion of the market, accounting for over 55%, due to their complex project portfolios and the significant return on investment (ROI) derived from optimized project management. SMEs, however, are emerging as a growth segment, with an increasing adoption rate driven by the availability of scalable and cost-effective cloud-based solutions, projected to grow at a CAGR of 14% within this segment.

Engineering Project Management Platforms Product Innovations

Recent product innovations in Engineering Project Management Platforms focus on AI-powered task automation, predictive risk assessment, and enhanced visualization tools for project timelines and dependencies. Platforms are increasingly offering integration capabilities with BIM (Building Information Modeling) for construction and CI/CD (Continuous Integration/Continuous Deployment) pipelines for software development, providing a competitive advantage by streamlining workflows and improving data accuracy. Enhanced collaboration features, such as real-time co-editing and centralized document management, are also key differentiators, catering to the growing need for seamless teamwork.

Report Scope & Segmentation Analysis

This report segments the Engineering Project Management Platforms market by Application, Type, and Region. The Application segments include Building & Construction, IT & Software Development, and Others, each with unique project management needs and growth trajectories.

- Building & Construction: Characterized by large-scale projects, regulatory complexities, and a strong emphasis on safety and compliance. Growth projections for this segment are robust, estimated at over $2.5 billion by 2033.

- IT & Software Development: Driven by agile methodologies, rapid product cycles, and the need for efficient collaboration. This segment is expected to witness substantial growth, reaching approximately $2.0 billion by 2033.

- Others: Encompasses diverse industries such as manufacturing, energy, and aerospace, each with specialized project management requirements.

The Type segmentation includes Small and Medium Enterprises (SMEs) and Large Enterprises. Large Enterprises currently dominate but SMEs are showing accelerated adoption due to accessible cloud solutions.

Key Drivers of Engineering Project Management Platforms Growth

The growth of the Engineering Project Management Platforms market is propelled by several key factors. Technologically, the pervasive adoption of cloud computing, AI, and IoT technologies is enabling more sophisticated and data-driven project management. Economically, increased global infrastructure spending and the continuous evolution of the software industry necessitate efficient project execution. Regulatory drivers, such as stringent safety standards in construction and data security mandates in IT, compel organizations to adopt comprehensive management solutions. The rise of remote and hybrid work models also fuels demand for collaborative platforms.

Challenges in the Engineering Project Management Platforms Sector

Despite robust growth, the Engineering Project Management Platforms sector faces several challenges. High initial implementation costs and the need for extensive employee training can be significant barriers, especially for SMEs. Resistance to change and the adoption of new software within established organizational cultures can also impede market penetration. Furthermore, intense competition and the need for continuous innovation to stay ahead of evolving technological trends put pressure on market players. Cybersecurity concerns and data privacy regulations present ongoing challenges that require constant vigilance and investment in robust security measures, with an estimated annual cost of over $100 million in security upgrades across the industry.

Emerging Opportunities in Engineering Project Management Platforms

Emerging opportunities in the Engineering Project Management Platforms market lie in the growing demand for specialized solutions tailored to niche industries within the "Others" application segment, such as renewable energy and biotech. The increasing focus on sustainability and ESG (Environmental, Social, and Governance) factors presents an opportunity for platforms to integrate features that track and manage green project initiatives. Furthermore, the expansion of IoT integration for real-time site monitoring in construction and the development of predictive maintenance modules for engineering assets offer significant growth potential. The burgeoning market for AI-driven insights, such as automated resource allocation and risk mitigation predictions, represents a key area for future innovation and market expansion, potentially adding over $800 million in market value.

Leading Players in the Engineering Project Management Platforms Market

- Atlassian

- Hatica

- Monday.com

- SourceLevel

- Jellyfish

- AVEVA Group Limited

- Total Synergy

Key Developments in Engineering Project Management Platforms Industry

- 2023/01: Atlassian launches new AI-powered features for Jira to enhance project planning and issue resolution.

- 2023/05: Monday.com introduces advanced reporting dashboards for improved project visibility and performance tracking.

- 2023/08: AVEVA Group Limited expands its digital twin capabilities for enhanced asset lifecycle management in industrial projects.

- 2024/02: Hatica announces strategic partnerships to integrate its AI analytics with major construction management software.

- 2024/07: Jellyfish secures Series B funding to accelerate development of its engineering intelligence platform.

Future Outlook for Engineering Project Management Platforms Market

The future outlook for the Engineering Project Management Platforms market is exceptionally promising, driven by sustained demand across key sectors and continuous technological advancements. The increasing adoption of AI and machine learning for predictive analytics and intelligent automation will further optimize project outcomes, reduce risks, and enhance efficiency. The growing emphasis on collaboration and remote work will continue to fuel the demand for cloud-based, accessible platforms. Strategic opportunities exist in expanding into emerging economies and developing specialized modules for emerging industries like quantum computing and advanced materials science. The market is expected to surpass $15 billion in value by 2033, presenting significant avenues for growth and innovation.

Engineering Project Management Platforms Segmentation

-

1. Application

- 1.1. Building & Construction

- 1.2. IT & Software Development

- 1.3. Others

-

2. Types

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

Engineering Project Management Platforms Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Engineering Project Management Platforms REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Engineering Project Management Platforms Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Building & Construction

- 5.1.2. IT & Software Development

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Engineering Project Management Platforms Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Building & Construction

- 6.1.2. IT & Software Development

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Small and Medium Enterprises

- 6.2.2. Large Enterprises

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Engineering Project Management Platforms Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Building & Construction

- 7.1.2. IT & Software Development

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Small and Medium Enterprises

- 7.2.2. Large Enterprises

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Engineering Project Management Platforms Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Building & Construction

- 8.1.2. IT & Software Development

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Small and Medium Enterprises

- 8.2.2. Large Enterprises

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Engineering Project Management Platforms Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Building & Construction

- 9.1.2. IT & Software Development

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Small and Medium Enterprises

- 9.2.2. Large Enterprises

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Engineering Project Management Platforms Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Building & Construction

- 10.1.2. IT & Software Development

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Small and Medium Enterprises

- 10.2.2. Large Enterprises

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Atlassian

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hatica

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Monday.com

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SourceLevel

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Jellyfish

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AVEVA Group Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Total Synergy

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Atlassian

List of Figures

- Figure 1: Global Engineering Project Management Platforms Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Engineering Project Management Platforms Revenue (million), by Application 2024 & 2032

- Figure 3: North America Engineering Project Management Platforms Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Engineering Project Management Platforms Revenue (million), by Types 2024 & 2032

- Figure 5: North America Engineering Project Management Platforms Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Engineering Project Management Platforms Revenue (million), by Country 2024 & 2032

- Figure 7: North America Engineering Project Management Platforms Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Engineering Project Management Platforms Revenue (million), by Application 2024 & 2032

- Figure 9: South America Engineering Project Management Platforms Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Engineering Project Management Platforms Revenue (million), by Types 2024 & 2032

- Figure 11: South America Engineering Project Management Platforms Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Engineering Project Management Platforms Revenue (million), by Country 2024 & 2032

- Figure 13: South America Engineering Project Management Platforms Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Engineering Project Management Platforms Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Engineering Project Management Platforms Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Engineering Project Management Platforms Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Engineering Project Management Platforms Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Engineering Project Management Platforms Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Engineering Project Management Platforms Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Engineering Project Management Platforms Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Engineering Project Management Platforms Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Engineering Project Management Platforms Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Engineering Project Management Platforms Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Engineering Project Management Platforms Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Engineering Project Management Platforms Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Engineering Project Management Platforms Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Engineering Project Management Platforms Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Engineering Project Management Platforms Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Engineering Project Management Platforms Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Engineering Project Management Platforms Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Engineering Project Management Platforms Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Engineering Project Management Platforms Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Engineering Project Management Platforms Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Engineering Project Management Platforms Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Engineering Project Management Platforms Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Engineering Project Management Platforms Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Engineering Project Management Platforms Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Engineering Project Management Platforms Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Engineering Project Management Platforms Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Engineering Project Management Platforms Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Engineering Project Management Platforms Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Engineering Project Management Platforms Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Engineering Project Management Platforms Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Engineering Project Management Platforms Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Engineering Project Management Platforms Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Engineering Project Management Platforms Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Engineering Project Management Platforms Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Engineering Project Management Platforms Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Engineering Project Management Platforms Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Engineering Project Management Platforms Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Engineering Project Management Platforms Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Engineering Project Management Platforms?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Engineering Project Management Platforms?

Key companies in the market include Atlassian, Hatica, Monday.com, SourceLevel, Jellyfish, AVEVA Group Limited, Total Synergy.

3. What are the main segments of the Engineering Project Management Platforms?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Engineering Project Management Platforms," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Engineering Project Management Platforms report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Engineering Project Management Platforms?

To stay informed about further developments, trends, and reports in the Engineering Project Management Platforms, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence