Key Insights

The European Air Separation Unit (ASU) market is experiencing robust growth, driven by increasing demand from key industries like oil and gas, iron and steel, and chemicals. The market's expansion is fueled by several factors. Firstly, the burgeoning need for industrial gases, particularly nitrogen and oxygen, across various sectors is a significant driver. The chemical industry, for example, relies heavily on these gases for numerous processes, while the oil and gas sector utilizes them extensively in refining and processing operations. Furthermore, the growing emphasis on energy efficiency and the adoption of advanced cryogenic distillation techniques are contributing to market expansion. The transition to cleaner energy sources and the rising adoption of sustainable industrial practices further bolster demand for efficient ASU technologies. While the market faces some restraints, such as fluctuating raw material prices and the need for substantial capital investments in ASU infrastructure, the overall outlook remains positive. Growth is particularly strong in countries like Germany, France, and the UK, which are significant industrial hubs within Europe. The market is segmented by process (cryogenic and non-cryogenic distillation), gas type (nitrogen, oxygen, argon, and others), and end-user industry. Cryogenic distillation currently dominates the process segment due to its higher efficiency in producing high-purity gases.

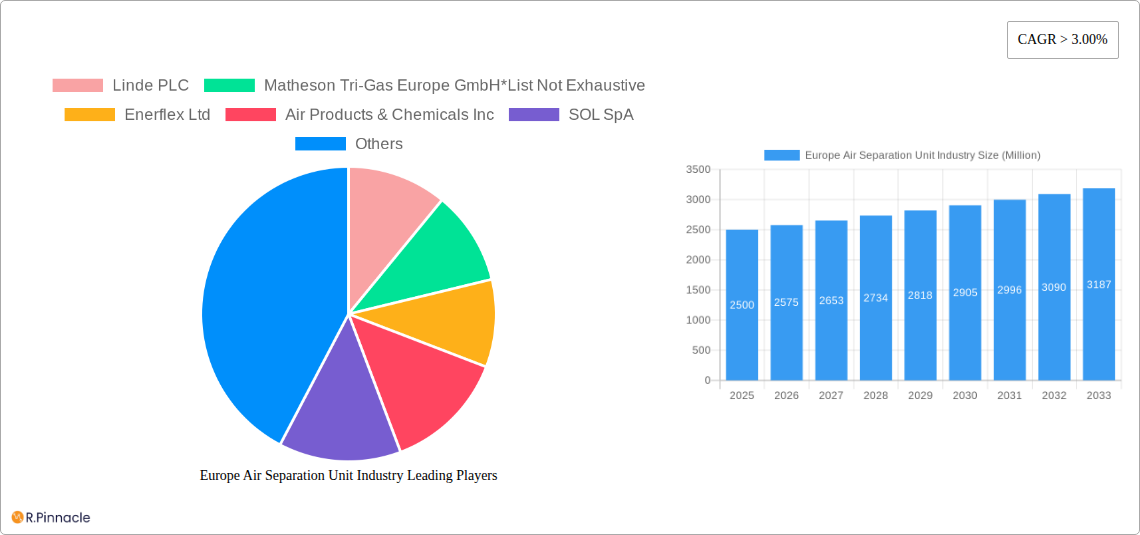

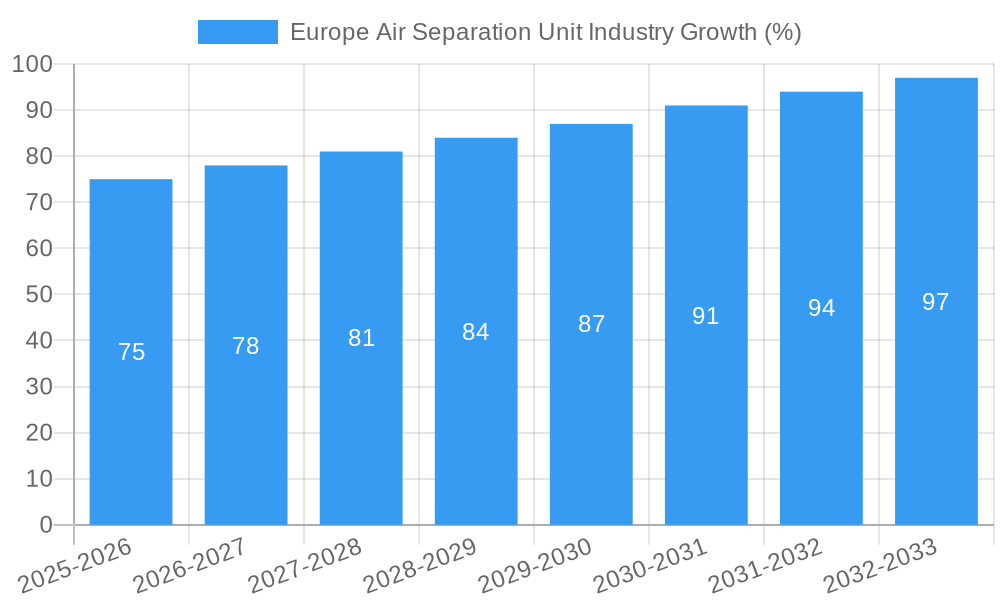

The competitive landscape features both established multinational players and regional specialists. Companies like Linde PLC, Air Products & Chemicals Inc., Air Liquide SA, and Messer Group GmbH are key players, leveraging their extensive experience and global reach. However, smaller companies specializing in niche applications or regional markets are also contributing significantly to the overall market growth. The forecast period (2025-2033) anticipates continued growth, driven by the factors mentioned above. Considering a CAGR of over 3% and a 2025 market size (estimated at €X billion based on available information and industry reports), the market is projected to reach a significant size by 2033. This growth will be further shaped by technological advancements, regulatory changes promoting sustainability, and the evolving needs of end-user industries. Future market analysis should monitor these dynamics closely to anticipate shifts in market size and share.

Europe Air Separation Unit (ASU) Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Air Separation Unit (ASU) industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's dynamics, growth drivers, challenges, and future outlook. The report utilizes data from the historical period (2019-2024) to project future market trends.

Europe Air Separation Unit Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the European ASU market, focusing on market concentration, innovation drivers, regulatory influences, and mergers & acquisitions (M&A) activity. The report details the market share of key players like Linde PLC, Air Liquide SA, Air Products & Chemicals Inc., and Messer Group GmbH, among others. The estimated market concentration is xx%, indicating a [concentrated/fragmented] market. Innovation drivers, such as the increasing demand for high-purity gases and stringent environmental regulations, are explored, alongside analysis of product substitutes and their market penetration (estimated at xx%). The report also includes an analysis of recent M&A activities, with estimated deal values totaling xx Million in the period 2019-2024. Examples of these activities and their impact on market dynamics will be provided.

Europe Air Separation Unit Industry Market Dynamics & Trends

The European Air Separation Unit (ASU) industry is on a robust growth trajectory, propelled by significant advancements in technology and a burgeoning demand across critical sectors. The market is projected to experience a substantial Compound Annual Growth Rate (CAGR) of [Insert specific CAGR]% during the forecast period (2025-2033). This expansion is primarily fueled by the escalating needs of key end-use industries, including the oil & gas sector, steel manufacturing, and the ever-growing chemical industry. Our comprehensive analysis delves into the transformative impact of technological innovations, such as the integration of sophisticated cryogenic distillation techniques and the widespread adoption of highly energy-efficient ASU designs. These advancements are not only enhancing market penetration but also reshaping the competitive landscape. Furthermore, we explore the increasing consumer preference for sustainable and optimized industrial gas supply solutions, alongside a detailed examination of strategic initiatives undertaken by market participants. The market size is currently estimated at [Insert specific market size] Million in 2025.

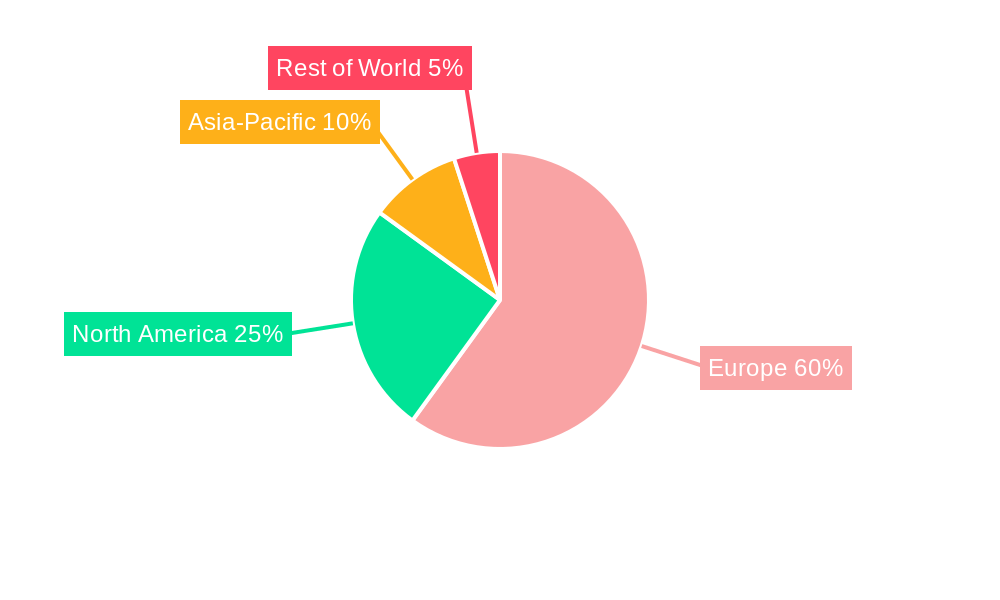

Dominant Regions & Segments in Europe Air Separation Unit Industry

This section meticulously identifies the leading geographical regions, individual countries, and key segments that are shaping the European ASU market. We provide an in-depth analysis of dominant segments and their respective growth drivers, presented through detailed discussions and clear bullet points:

- By Process: Cryogenic distillation continues to command the largest market share, estimated at [Insert specific percentage]%, owing to its proven reliability, established technological maturity, and inherent cost-effectiveness for large-scale production. Non-cryogenic distillation technologies, while advancing, are exhibiting a more moderate growth rate, with a projected market share of [Insert specific percentage]%.

- By Gas: Nitrogen remains the most significant segment, holding a market share of [Insert specific percentage]%, closely followed by oxygen at [Insert specific percentage]% and argon at [Insert specific percentage]%. The growth in demand for other industrial gases is being spurred by increasingly specialized niche applications across various industries.

- By End User: The oil and gas industry consistently represents the largest end-user segment, accounting for approximately [Insert specific percentage]% of the market. The iron and steel industry follows as the second-largest consumer at [Insert specific percentage]%, with the chemical industry also being a major contributor at [Insert specific percentage]%. Projections indicate promising growth in several other emerging end-user segments.

We meticulously explore the underlying drivers behind each segment's dominance, including favorable economic policies, the presence of robust industrial infrastructure, and specific industry-driven demands. Regional market leadership is further analyzed, pinpointing key countries and their respective market shares to provide a granular understanding of the European ASU landscape.

Europe Air Separation Unit Industry Product Innovations

This section highlights recent product innovations within the ASU industry, focusing on advancements in cryogenic distillation technology, energy efficiency improvements, and the development of compact and modular ASU systems. The report also analyzes the competitive advantages of these new products and their market fit, highlighting trends towards automation, digitalization, and the integration of renewable energy sources.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation analysis covering the following aspects:

- By Process: Cryogenic Distillation and Non-cryogenic Distillation, including projected market sizes and growth rates for each segment during the forecast period.

- By Gas: Nitrogen, Oxygen, Argon, and Other Gases, examining the market dynamics and competitive landscape of each gas segment.

- By End User: Oil and Gas Industry, Iron and Steel Industry, Chemical Industry, and Other End Users, outlining growth projections and competitive dynamics for each sector.

Each segment analysis includes detailed insights into its market size, growth potential, and competitive dynamics.

Key Drivers of Europe Air Separation Unit Industry Growth

Several factors are driving the growth of the European ASU industry, including:

- Increasing demand from key end-use industries: The rising consumption of industrial gases across sectors such as oil & gas, steel, and chemicals fuels market expansion.

- Technological advancements: Innovations in ASU technology, such as improved efficiency and modular designs, are enhancing the market.

- Stringent environmental regulations: Regulations promoting cleaner industrial processes are creating demand for high-purity gases and prompting investment in efficient ASU systems.

Challenges in the Europe Air Separation Unit Industry Sector

The European ASU industry navigates a complex terrain characterized by several key challenges:

- Volatile Raw Material and Energy Costs: Fluctuations in global energy prices and the cost of essential raw materials significantly impact the operational expenditures of ASU facilities, necessitating robust cost management strategies.

- Intensified Market Competition: The presence of a dynamic mix of well-established industry giants and agile emerging players creates a highly competitive environment, demanding continuous innovation and strategic differentiation.

- Stringent Environmental Regulations: While environmental consciousness fuels the demand for efficient gas supply solutions, the evolving landscape of stricter environmental regulations can potentially lead to increased compliance costs and operational adjustments.

Emerging Opportunities in Europe Air Separation Unit Industry

Opportunities for growth within the European ASU industry include:

- Expansion into emerging markets: Growth in the overall industrial sector, particularly in Eastern Europe, presents significant opportunities.

- Development of innovative technologies: Advancements in cryogenic distillation, energy efficiency, and digitalization offer new market avenues.

- Focus on sustainability: Emphasis on reducing carbon emissions and using cleaner energy sources will enhance the demand for high-purity gases and efficient ASU systems.

Leading Players in the Europe Air Separation Unit Industry Market

- Linde PLC

- Matheson Tri-Gas Europe GmbH

- Enerflex Ltd

- Air Products & Chemicals Inc

- SOL SpA

- Air Liquide SA

- Messer Group GmbH

- Universal Industrial Plants Mfg Co Private Limited

- Taiyo Nippon Sanso Corporation

- SIAD Macchine Impianti SpA

Key Developments in Europe Air Separation Unit Industry Industry

- [Month, Year]: Linde PLC announced a significant strategic investment in establishing a new, state-of-the-art large-scale ASU facility in [Country], reinforcing its commitment to the European market.

- [Month, Year]: Air Liquide SA unveiled its latest groundbreaking energy-efficient ASU technology, designed to significantly reduce operational carbon footprints and enhance cost-effectiveness for clients.

- [Month, Year]: Messer Group GmbH strategically expanded its operational footprint by acquiring a prominent smaller ASU producer located in [Country], further consolidating its market presence.

- (A more exhaustive compilation of pivotal developments, including strategic partnerships, technological breakthroughs, and significant project milestones, will be presented in the full, detailed report)

Future Outlook for Europe Air Separation Unit Industry Market

The European ASU market is poised for sustained growth, driven by increasing industrial gas demand and ongoing technological innovation. The focus on sustainability and the development of energy-efficient ASU systems will create substantial opportunities for market players. Strategic partnerships, mergers and acquisitions, and investment in advanced technologies will define future market competitiveness. The market is expected to reach xx Million by 2033.

Europe Air Separation Unit Industry Segmentation

-

1. Process

- 1.1. Cryogenic Distillation

- 1.2. Non-cryogenic Distillation

-

2. Gas

- 2.1. Nitrogen

- 2.2. Oxygen

- 2.3. Argon

- 2.4. Other Gases

-

3. End User

- 3.1. Oil and Gas Industry

- 3.2. Iron and Steel Industry

- 3.3. Chemical Industry

- 3.4. Other End Users

Europe Air Separation Unit Industry Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Italy

- 5. Rest of Europe

Europe Air Separation Unit Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Focus on the Decarbonization of Global Energy4.; Expansion of Automobile Industry

- 3.3. Market Restrains

- 3.3.1. 4.; High Costs Associated with Transportation of Liquid Hydrogen

- 3.4. Market Trends

- 3.4.1. Cryogenic Distillation Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Air Separation Unit Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. Cryogenic Distillation

- 5.1.2. Non-cryogenic Distillation

- 5.2. Market Analysis, Insights and Forecast - by Gas

- 5.2.1. Nitrogen

- 5.2.2. Oxygen

- 5.2.3. Argon

- 5.2.4. Other Gases

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Oil and Gas Industry

- 5.3.2. Iron and Steel Industry

- 5.3.3. Chemical Industry

- 5.3.4. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.4.2. Germany

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. United Kingdom Europe Air Separation Unit Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Process

- 6.1.1. Cryogenic Distillation

- 6.1.2. Non-cryogenic Distillation

- 6.2. Market Analysis, Insights and Forecast - by Gas

- 6.2.1. Nitrogen

- 6.2.2. Oxygen

- 6.2.3. Argon

- 6.2.4. Other Gases

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Oil and Gas Industry

- 6.3.2. Iron and Steel Industry

- 6.3.3. Chemical Industry

- 6.3.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Process

- 7. Germany Europe Air Separation Unit Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Process

- 7.1.1. Cryogenic Distillation

- 7.1.2. Non-cryogenic Distillation

- 7.2. Market Analysis, Insights and Forecast - by Gas

- 7.2.1. Nitrogen

- 7.2.2. Oxygen

- 7.2.3. Argon

- 7.2.4. Other Gases

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Oil and Gas Industry

- 7.3.2. Iron and Steel Industry

- 7.3.3. Chemical Industry

- 7.3.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Process

- 8. France Europe Air Separation Unit Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Process

- 8.1.1. Cryogenic Distillation

- 8.1.2. Non-cryogenic Distillation

- 8.2. Market Analysis, Insights and Forecast - by Gas

- 8.2.1. Nitrogen

- 8.2.2. Oxygen

- 8.2.3. Argon

- 8.2.4. Other Gases

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Oil and Gas Industry

- 8.3.2. Iron and Steel Industry

- 8.3.3. Chemical Industry

- 8.3.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Process

- 9. Italy Europe Air Separation Unit Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Process

- 9.1.1. Cryogenic Distillation

- 9.1.2. Non-cryogenic Distillation

- 9.2. Market Analysis, Insights and Forecast - by Gas

- 9.2.1. Nitrogen

- 9.2.2. Oxygen

- 9.2.3. Argon

- 9.2.4. Other Gases

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Oil and Gas Industry

- 9.3.2. Iron and Steel Industry

- 9.3.3. Chemical Industry

- 9.3.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Process

- 10. Rest of Europe Europe Air Separation Unit Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Process

- 10.1.1. Cryogenic Distillation

- 10.1.2. Non-cryogenic Distillation

- 10.2. Market Analysis, Insights and Forecast - by Gas

- 10.2.1. Nitrogen

- 10.2.2. Oxygen

- 10.2.3. Argon

- 10.2.4. Other Gases

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Oil and Gas Industry

- 10.3.2. Iron and Steel Industry

- 10.3.3. Chemical Industry

- 10.3.4. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Process

- 11. Germany Europe Air Separation Unit Industry Analysis, Insights and Forecast, 2019-2031

- 12. France Europe Air Separation Unit Industry Analysis, Insights and Forecast, 2019-2031

- 13. Italy Europe Air Separation Unit Industry Analysis, Insights and Forecast, 2019-2031

- 14. United Kingdom Europe Air Separation Unit Industry Analysis, Insights and Forecast, 2019-2031

- 15. Netherlands Europe Air Separation Unit Industry Analysis, Insights and Forecast, 2019-2031

- 16. Sweden Europe Air Separation Unit Industry Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Europe Air Separation Unit Industry Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Linde PLC

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Matheson Tri-Gas Europe GmbH*List Not Exhaustive

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Enerflex Ltd

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Air Products & Chemicals Inc

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 SOL SpA

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Air Liquide SA

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Messer Group GmbH

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Universal Industrial Plants Mfg Co Private Limited

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Taiyo Nippon Sanso Corporation

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 SIAD Macchine Impianti SpA

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Linde PLC

List of Figures

- Figure 1: Europe Air Separation Unit Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Air Separation Unit Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Air Separation Unit Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Air Separation Unit Industry Revenue Million Forecast, by Process 2019 & 2032

- Table 3: Europe Air Separation Unit Industry Revenue Million Forecast, by Gas 2019 & 2032

- Table 4: Europe Air Separation Unit Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Europe Air Separation Unit Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Air Separation Unit Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Air Separation Unit Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Air Separation Unit Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Air Separation Unit Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Air Separation Unit Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Air Separation Unit Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Air Separation Unit Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Air Separation Unit Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Air Separation Unit Industry Revenue Million Forecast, by Process 2019 & 2032

- Table 15: Europe Air Separation Unit Industry Revenue Million Forecast, by Gas 2019 & 2032

- Table 16: Europe Air Separation Unit Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 17: Europe Air Separation Unit Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Air Separation Unit Industry Revenue Million Forecast, by Process 2019 & 2032

- Table 19: Europe Air Separation Unit Industry Revenue Million Forecast, by Gas 2019 & 2032

- Table 20: Europe Air Separation Unit Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 21: Europe Air Separation Unit Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Air Separation Unit Industry Revenue Million Forecast, by Process 2019 & 2032

- Table 23: Europe Air Separation Unit Industry Revenue Million Forecast, by Gas 2019 & 2032

- Table 24: Europe Air Separation Unit Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 25: Europe Air Separation Unit Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Europe Air Separation Unit Industry Revenue Million Forecast, by Process 2019 & 2032

- Table 27: Europe Air Separation Unit Industry Revenue Million Forecast, by Gas 2019 & 2032

- Table 28: Europe Air Separation Unit Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 29: Europe Air Separation Unit Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Air Separation Unit Industry Revenue Million Forecast, by Process 2019 & 2032

- Table 31: Europe Air Separation Unit Industry Revenue Million Forecast, by Gas 2019 & 2032

- Table 32: Europe Air Separation Unit Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 33: Europe Air Separation Unit Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Air Separation Unit Industry?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Europe Air Separation Unit Industry?

Key companies in the market include Linde PLC, Matheson Tri-Gas Europe GmbH*List Not Exhaustive, Enerflex Ltd, Air Products & Chemicals Inc, SOL SpA, Air Liquide SA, Messer Group GmbH, Universal Industrial Plants Mfg Co Private Limited, Taiyo Nippon Sanso Corporation, SIAD Macchine Impianti SpA.

3. What are the main segments of the Europe Air Separation Unit Industry?

The market segments include Process, Gas, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Focus on the Decarbonization of Global Energy4.; Expansion of Automobile Industry.

6. What are the notable trends driving market growth?

Cryogenic Distillation Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Costs Associated with Transportation of Liquid Hydrogen.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Air Separation Unit Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Air Separation Unit Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Air Separation Unit Industry?

To stay informed about further developments, trends, and reports in the Europe Air Separation Unit Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence