Key Insights

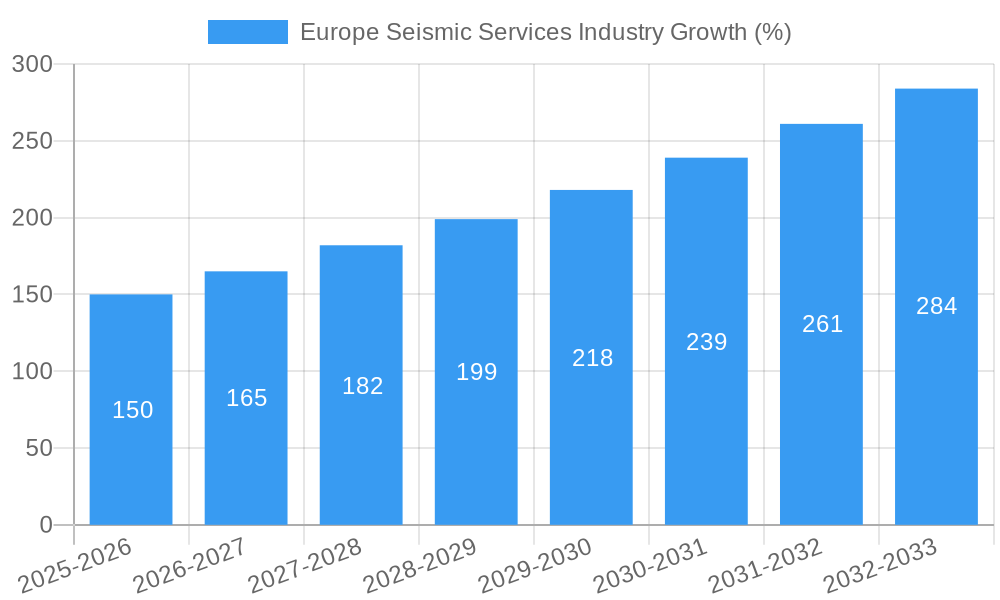

The European seismic services market, while experiencing fluctuations, demonstrates consistent growth driven by increasing infrastructure development, stringent building codes in earthquake-prone regions, and a rising awareness of seismic risks. The period from 2019 to 2024 showed moderate growth, influenced by economic factors and varying levels of investment in seismic monitoring and mitigation technologies across different European nations. However, a projected Compound Annual Growth Rate (CAGR) suggests a significant acceleration in market expansion from 2025 onwards. This upward trend is fueled by substantial governmental investments in resilience infrastructure, growing adoption of advanced seismic monitoring techniques (including AI-powered analysis), and a surge in demand for seismic hazard assessments for urban planning and insurance purposes. The market is segmented based on service type (e.g., site investigation, seismic hazard assessment, instrumentation), technology (e.g., ground penetrating radar, seismic tomography), and end-user (e.g., construction firms, government agencies).

Factors influencing future market growth include technological advancements leading to more efficient and cost-effective seismic services, growing collaboration between research institutions and private companies, and the implementation of stricter regulations regarding seismic safety across the European Union. Despite potential challenges such as economic downturns and variations in government spending, the long-term outlook for the European seismic services market remains positive, anticipating sustained growth throughout the forecast period (2025-2033) driven by the increasing need for earthquake preparedness and the development of resilient infrastructure across the continent. The market's structure is moderately consolidated, with a mix of large multinational companies and smaller specialized firms competing for market share.

Europe Seismic Services Industry Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Europe Seismic Services industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, key players, and future growth potential. The report utilizes data from the historical period (2019-2024) and leverages advanced analytical techniques to deliver accurate and actionable predictions. The market size is estimated at xx Million in 2025 and is expected to reach xx Million by 2033. This report is essential for understanding the complexities and opportunities within the European seismic services landscape.

Europe Seismic Services Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the European seismic services market, focusing on market concentration, innovation drivers, and regulatory influences. The report assesses the market share held by key players such as Schlumberger Ltd, CGG SA, PGS ASA, and Fugro NV, providing a detailed overview of their strategies and market positions. The report also explores the impact of mergers and acquisitions (M&A) activities, analyzing deal values and their implications for market consolidation. Innovation drivers, such as advancements in data acquisition and processing technologies, are examined, along with the role of regulatory frameworks in shaping industry practices. The influence of substitute technologies and evolving end-user demographics are also considered.

- Market Concentration: High, with a few major players dominating. Schlumberger and CGG SA hold a significant combined market share (xx%).

- M&A Activity: Significant M&A activity observed in the historical period, with deal values totaling xx Million.

- Innovation Drivers: Advancements in sensor technology, AI-powered data processing, and automation.

- Regulatory Framework: Varying across European countries, impacting operational costs and permitting processes.

Europe Seismic Services Industry Market Dynamics & Trends

The European seismic services market is experiencing significant growth, driven by a complex interplay of factors. Increased energy demand and the imperative to discover new hydrocarbon reserves are primary catalysts, fueling exploration and production (E&P) activities across the continent. This demand is further amplified by the ongoing energy transition, necessitating detailed subsurface characterization for both traditional fossil fuels and renewable energy sources like geothermal energy. Technological advancements are also playing a crucial role. The adoption of autonomous vessels, improved sensor technology, and sophisticated data processing techniques, including AI-driven analytics, are enhancing data quality, reducing operational costs, and accelerating project timelines. These technological improvements contribute to higher resolution data, enabling more accurate reservoir modeling and optimized resource extraction. Furthermore, evolving regulatory landscapes and government incentives aimed at supporting sustainable E&P practices are shaping market dynamics. The market’s growth trajectory, measured by the Compound Annual Growth Rate (CAGR), is projected at xx% for the forecast period (2025-2033), reflecting a robust and expanding market.

Dominant Regions & Segments in Europe Seismic Services Industry

Within the European seismic services landscape, distinct regional and segmental variations in growth and market share are observed. The North Sea region consistently maintains its position as a dominant area, propelled by sustained exploration activities and established infrastructure. However, emerging opportunities are also visible in other regions with favorable geological conditions and supportive regulatory environments. The offshore segment continues to dominate in terms of market size, driven by the extensive offshore exploration and production activities. Nevertheless, onshore seismic surveys are also experiencing growth, particularly in regions with readily accessible land resources. In terms of service types, data acquisition remains the largest segment, reflecting the fundamental need for high-quality raw data. This is closely followed by data processing and interpretation, underscoring the increasing importance of advanced analytical capabilities in extracting actionable insights from seismic data. This segmentation also reflects the evolving service offerings by seismic companies, who are increasingly offering integrated solutions encompassing all aspects of the seismic workflow.

- Leading Region: The North Sea region, due to ongoing exploration and established infrastructure.

- Dominant Segment (Location of Deployment): Offshore services maintain a larger market share than onshore services, reflecting the prevalence of offshore exploration.

- Dominant Segment (Service): Data acquisition remains the largest segment, with data processing and interpretation services following closely.

- Key Drivers:

- Government support for exploration and production activities, including tax incentives and streamlined permitting processes.

- Significant investments in infrastructure development, supporting efficient operations.

- Continuous technological advancements, improving data quality, efficiency, and cost-effectiveness.

- The need for detailed subsurface characterization for both traditional and renewable energy resources.

Europe Seismic Services Industry Product Innovations

Recent innovations in seismic data acquisition and processing technology have significantly improved the resolution, accuracy, and efficiency of seismic surveys. New acquisition methods, like nodal systems, offer greater flexibility and data density compared to traditional streamer technology. Advancements in processing techniques, including machine learning algorithms, allow for faster and more accurate interpretation of seismic data. These innovations lead to enhanced subsurface imaging, providing critical insights for oil and gas exploration and reducing operational costs. The market is also witnessing increased integration of software and hardware, resulting in streamlined workflows and improved overall efficiency.

Report Scope & Segmentation Analysis

This report comprehensively segments the European seismic services market based on Location of Deployment (Onshore, Offshore) and Service (Data Acquisition, Data Processing and Interpretation). Each segment is analyzed in detail, providing insights into market size, growth projections, and competitive dynamics.

- Location of Deployment:

- Onshore: This segment is expected to witness moderate growth, primarily driven by onshore exploration activities in specific regions.

- Offshore: This segment is anticipated to experience robust growth, fuelled by advancements in technology and exploration in deeper waters.

- Service:

- Data Acquisition: This segment holds the largest market share, with ongoing investments in new technologies.

- Data Processing and Interpretation: This segment is characterized by high technical expertise and is witnessing increasing demand for AI-driven solutions.

Key Drivers of Europe Seismic Services Industry Growth

The expansion of the European seismic services market is propelled by several interconnected factors. The ever-increasing global energy demand necessitates the exploration and development of new hydrocarbon reserves, driving substantial investment in seismic surveys. Simultaneously, the transition towards renewable energy sources, particularly geothermal energy, requires detailed subsurface mapping, further boosting demand for seismic services. Furthermore, significant technological advancements in data acquisition, processing, and interpretation techniques lead to improved data quality, reduced costs, and more efficient workflows. These advancements include the utilization of autonomous survey vessels, advanced sensor technologies, and the implementation of artificial intelligence (AI) and machine learning (ML) algorithms for enhanced data analysis. Supportive regulatory frameworks and government initiatives aimed at fostering exploration and production activities within a sustainable framework also play a vital role in market growth.

Challenges in the Europe Seismic Services Industry Sector

The European seismic services industry faces several challenges. Fluctuations in oil and gas prices directly impact exploration budgets, affecting demand for seismic services. Environmental regulations and concerns regarding offshore operations create hurdles for seismic surveys. Furthermore, intense competition among established and emerging players adds pressure on pricing and profitability. The industry also faces skilled labor shortages, impacting productivity and project timelines.

Emerging Opportunities in Europe Seismic Services Industry

The European seismic services market presents numerous opportunities for growth and innovation. The increasing adoption of 4D seismic technology for reservoir monitoring and enhanced oil recovery (EOR) is a key driver, enabling more efficient and sustainable hydrocarbon extraction. Moreover, the expanding focus on renewable energy sources, such as geothermal energy and carbon capture and storage (CCS) projects, necessitates detailed subsurface characterization, providing new avenues for seismic service providers. The incorporation of advanced data analytics and AI-powered technologies offers the potential to significantly optimize workflows, improve the accuracy of data interpretation, and reduce operational costs. This includes automated data processing, predictive modeling, and real-time monitoring capabilities.

Leading Players in the Europe Seismic Services Industry Market

- CGG SA

- Fugro NV

- Halliburton Company

- ION Geophysical Corporation

- PGS ASA

- Polarcus Ltd

- China Oilfield Services Limited

- BGP Inc China National Petroleum Corporation

- Magseis Fairfield ASA (WGP Group Ltd)

- SeaBird Exploration PLC

- Shearwater GeoServices AS

- Schlumberger Ltd

Key Developments in Europe Seismic Services Industry Industry

- 2022 Q4: Schlumberger announces a new AI-powered seismic interpretation platform.

- 2023 Q1: CGG acquires a smaller seismic data processing company.

- 2023 Q2: Fugro invests in autonomous survey vessels.

- (Further developments to be added based on actual data)

Future Outlook for Europe Seismic Services Industry Market

The future of the European seismic services market looks promising. Continued investment in technology, growing energy demand, and supportive government policies are expected to drive growth. The increasing demand for improved subsurface imaging will fuel the adoption of advanced seismic technologies, creating significant opportunities for industry players. Strategic partnerships and acquisitions will likely shape the competitive landscape in the coming years.

Europe Seismic Services Industry Segmentation

-

1. Service

- 1.1. Data Acquisition

- 1.2. Data Processing and Interpretation

-

2. Location of Deployment

- 2.1. Onshore

- 2.2. Offshore

Europe Seismic Services Industry Segmentation By Geography

- 1. Norway

- 2. United Kingdom

- 3. Russia

- 4. Rest of Europe

Europe Seismic Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Solar PV Installations4.; Supportive Government Policies For Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Penetration of Other Energy Sources

- 3.4. Market Trends

- 3.4.1. Offshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Seismic Services Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Data Acquisition

- 5.1.2. Data Processing and Interpretation

- 5.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.2.1. Onshore

- 5.2.2. Offshore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Norway

- 5.3.2. United Kingdom

- 5.3.3. Russia

- 5.3.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Norway Europe Seismic Services Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Data Acquisition

- 6.1.2. Data Processing and Interpretation

- 6.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.2.1. Onshore

- 6.2.2. Offshore

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. United Kingdom Europe Seismic Services Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Data Acquisition

- 7.1.2. Data Processing and Interpretation

- 7.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.2.1. Onshore

- 7.2.2. Offshore

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Russia Europe Seismic Services Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Data Acquisition

- 8.1.2. Data Processing and Interpretation

- 8.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.2.1. Onshore

- 8.2.2. Offshore

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Rest of Europe Europe Seismic Services Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Data Acquisition

- 9.1.2. Data Processing and Interpretation

- 9.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.2.1. Onshore

- 9.2.2. Offshore

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Germany Europe Seismic Services Industry Analysis, Insights and Forecast, 2019-2031

- 11. France Europe Seismic Services Industry Analysis, Insights and Forecast, 2019-2031

- 12. Italy Europe Seismic Services Industry Analysis, Insights and Forecast, 2019-2031

- 13. United Kingdom Europe Seismic Services Industry Analysis, Insights and Forecast, 2019-2031

- 14. Netherlands Europe Seismic Services Industry Analysis, Insights and Forecast, 2019-2031

- 15. Sweden Europe Seismic Services Industry Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Europe Europe Seismic Services Industry Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 China Oilfield Services Limited

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 ION Geophysical Corporation

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Fugro NV

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Shearwater GeoServices AS

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Schlumberger Ltd

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 CGG SA

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 BGP Inc China National Petroleum Corporation

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Halliburton Company

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 SeaBird Exploration PLC

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Magseis Fairfield ASA (WGP Group Ltd)

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Polarcus Ltd

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 PGS ASA

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.1 China Oilfield Services Limited

List of Figures

- Figure 1: Europe Seismic Services Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Seismic Services Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Seismic Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Seismic Services Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 3: Europe Seismic Services Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 4: Europe Seismic Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Seismic Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Seismic Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Seismic Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Seismic Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Seismic Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Seismic Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Seismic Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Seismic Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Seismic Services Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 14: Europe Seismic Services Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 15: Europe Seismic Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Seismic Services Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 17: Europe Seismic Services Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 18: Europe Seismic Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe Seismic Services Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 20: Europe Seismic Services Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 21: Europe Seismic Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Seismic Services Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 23: Europe Seismic Services Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 24: Europe Seismic Services Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Seismic Services Industry?

The projected CAGR is approximately < 1.00%.

2. Which companies are prominent players in the Europe Seismic Services Industry?

Key companies in the market include China Oilfield Services Limited, ION Geophysical Corporation, Fugro NV, Shearwater GeoServices AS, Schlumberger Ltd, CGG SA, BGP Inc China National Petroleum Corporation, Halliburton Company, SeaBird Exploration PLC, Magseis Fairfield ASA (WGP Group Ltd), Polarcus Ltd, PGS ASA.

3. What are the main segments of the Europe Seismic Services Industry?

The market segments include Service, Location of Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Solar PV Installations4.; Supportive Government Policies For Renewable Energy.

6. What are the notable trends driving market growth?

Offshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Penetration of Other Energy Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Seismic Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Seismic Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Seismic Services Industry?

To stay informed about further developments, trends, and reports in the Europe Seismic Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence