Key Insights

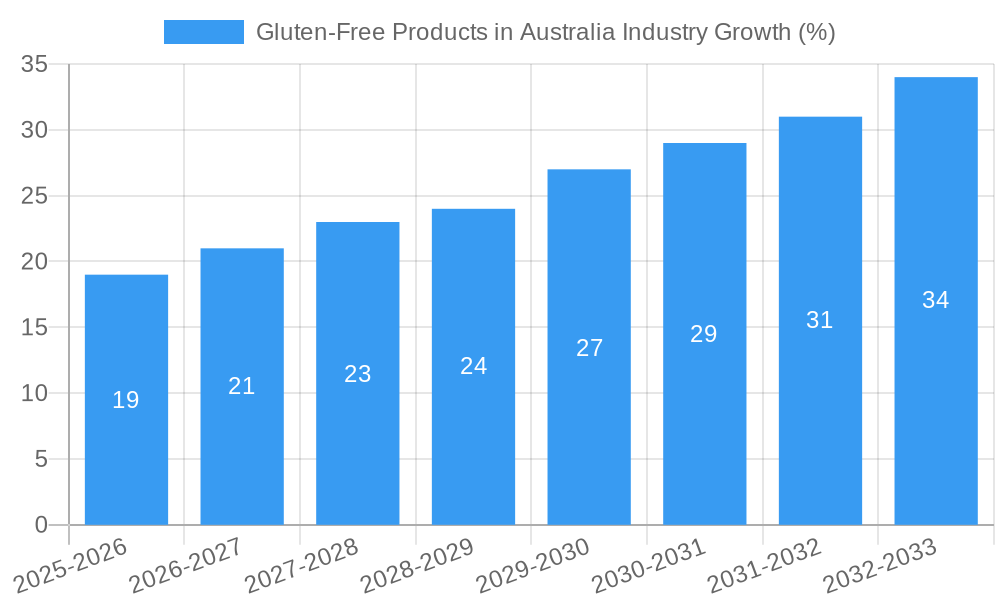

The Australian gluten-free products market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to maintain a 7.82% CAGR from 2025 to 2033. This expansion is fueled by several key drivers. The rising prevalence of celiac disease and gluten sensitivity within the Australian population significantly boosts demand. Furthermore, increasing consumer awareness of the health benefits associated with gluten-free diets, including improved digestion and reduced inflammation, is driving adoption across a broader demographic. Growing consumer preference for convenient and readily available gluten-free alternatives in various food categories—bakery products, pizzas and pastas, cereals and snacks, meat alternatives, and beverages—further contributes to market expansion. The increasing availability of these products across diverse distribution channels, encompassing supermarkets, specialty stores, and online retailers, enhances market accessibility and fuels sales growth. While challenges such as the relatively higher cost of gluten-free products compared to their conventional counterparts exist, innovative product development focusing on affordability and improved taste is mitigating this restraint. The market is segmented by product type (bakery, pizzas/pastas, cereals/snacks, meat/meat products, beverages, others) and distribution channel (supermarkets/hypermarkets, convenience/grocery stores, specialty stores, online retail, others), providing insights into distinct market dynamics within these categories. Companies like Unilever, Sanitarium, General Mills, and smaller specialized brands are competing in this dynamic market.

The forecast period (2025-2033) anticipates continued market expansion driven by sustained consumer demand and product innovation. Growth will likely be concentrated in product categories offering convenient, healthy, and palatable options. The increasing prevalence of online retail channels presents significant opportunities for market expansion, particularly in reaching geographically dispersed consumers. However, maintaining competitive pricing and ensuring product quality will remain crucial for continued success. The market's trajectory suggests a strong future for gluten-free products in Australia, driven by a combination of health-conscious consumers, technological advancements in gluten-free food production, and diverse distribution strategies. Further research into specific market segment performances within the product and distribution categories will provide a more granular understanding of growth opportunities.

Gluten-Free Products in Australia: Industry Report 2019-2033

This comprehensive report provides an in-depth analysis of the Australian gluten-free products market, offering valuable insights for industry professionals, investors, and strategists. With a focus on market size, segmentation, growth drivers, and competitive dynamics, this report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033. The report leverages extensive data analysis to provide actionable insights and predictions for this rapidly expanding market.

Gluten-Free Products in Australia Industry Market Structure & Innovation Trends

This section analyzes the market concentration, innovation drivers, regulatory landscape, product substitutes, and M&A activities within the Australian gluten-free products industry. The Australian gluten-free market shows a moderately concentrated structure, with key players like Unilever, The Sanitarium Health and Wellbeing Company, General Mills Inc, and Kellogg Company holding significant market share. However, smaller, specialized companies like Two Bays Brewing Co, Genius Foods Ltd, and Bob's Red Mill Natural Foods also contribute significantly, particularly in niche segments. Market share data for 2025 is estimated at xx Million for Unilever, xx Million for Sanitarium, xx Million for General Mills, and xx Million for Kellogg's.

Innovation is driven by increasing consumer demand for healthier and more convenient gluten-free options. Regulatory frameworks, such as food labeling regulations, influence product development and marketing. The rise of alternative ingredients and production technologies fuels innovation. The substitution of traditional wheat-based products with gluten-free alternatives is also a key trend, while the growing awareness of celiac disease and gluten sensitivity fuels market expansion. M&A activity is expected to be moderate, with predicted deal values totaling approximately xx Million in the forecast period (2025-2033). These mergers and acquisitions will predominantly focus on consolidating market share and expanding product portfolios.

Gluten-Free Products in Australia Industry Market Dynamics & Trends

The Australian gluten-free products market is experiencing significant and sustained growth, fueled by a dynamic interplay of factors. A heightened consumer awareness regarding gluten-related disorders, such as celiac disease and non-celiac gluten sensitivity, is a primary catalyst, driving a conscious shift towards gluten-free dietary choices for perceived health benefits. Technological advancements have played a crucial role, enabling manufacturers to develop gluten-free products that not only meet dietary needs but also rival traditional counterparts in taste and texture. Consumer preferences are evolving, with a clear leaning towards products that are perceived as healthier, more convenient, and ethically produced, emphasizing natural ingredients and minimal processing. The competitive arena is vibrant, characterized by a mix of established industry leaders and agile new entrants vying for market dominance through continuous product innovation, strategic collaborations, and compelling brand narratives. The market is projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately [Insert specific CAGR percentage here]% during the forecast period of 2025-2033, with an anticipated market penetration reaching around [Insert specific market penetration percentage here]% by 2033.

Dominant Regions & Segments in Gluten-Free Products in Australia Industry

While precise regional market data for Australia is still developing, it is anticipated that the gluten-free product market will be most concentrated in major metropolitan areas. These regions typically boast higher population densities and greater disposable incomes, facilitating a stronger demand for specialized food products. The Cereals and Snack Foods segment currently leads the market share, closely followed by Bakery Products. This dominance is largely attributable to the consistent and high consumer demand for convenient, readily available, and health-conscious breakfast options and snacks that cater to a gluten-free lifestyle.

- Key Drivers for Cereals & Snack Foods: Sustained high consumer demand, ongoing product innovation (exemplified by offerings like Kellogg's Coco Pops Gluten-Free), paramount convenience, and a growing emphasis on health and wellness.

- Key Drivers for Bakery Products: A burgeoning demand for a wider variety of gluten-free bread, cakes, and pastries, coupled with significant advancements in product formulation leading to improved taste profiles and textures.

In terms of distribution channels, Supermarkets/Hypermarkets remain the dominant force, capturing a substantial share of sales due to their extensive reach and well-established logistical networks. However, the Online Retail Stores segment is demonstrating exceptional growth, propelled by the increasing adoption of e-commerce platforms and the unparalleled convenience of home delivery services.

- Key Drivers for Supermarkets/Hypermarkets: Extensive consumer reach, robust and reliable distribution infrastructure, and established consumer trust and familiarity.

- Key Drivers for Online Retail Stores: Accelerated e-commerce adoption, superior convenience through home delivery, and access to a broader and more diverse product selection.

Gluten-Free Products in Australia Industry Product Innovations

Recent innovations in the Australian gluten-free market focus on improving taste, texture, and nutritional value. Companies are investing in research and development to create products that closely mimic the characteristics of their gluten-containing counterparts. Technological advancements, such as the use of alternative flours and binding agents, are playing a crucial role in enhancing product quality. This includes the development of low-gluten oat porridges (as seen with Good Food Partners' launch) and gluten-free cereals (like Kellogg's Coco Pops Gluten-Free). The focus is on creating products that not only meet the dietary needs of consumers but also satisfy their taste preferences, leading to increased market acceptance and expansion.

Report Scope & Segmentation Analysis

This report segments the Australian gluten-free products market by product type (Bakery Products, Pizzas and Pastas, Cereals and Snack Foods, Meat and Meat Products, Beverages, Other Product Types) and distribution channel (Supermarkets/Hypermarkets, Convenience/Grocery Stores, Specialty Stores, Online Retail Stores, Other Distribution Channels). Each segment is analyzed for market size, growth projections, and competitive dynamics. For example, the Bakery Products segment is projected to grow at a CAGR of xx% during the forecast period, while the online retail channel is anticipated to witness the fastest growth. The competitive landscape varies across segments, with some experiencing higher levels of competition than others.

Key Drivers of Gluten-Free Products in Australia Industry Growth

The growth of the Australian gluten-free products market is fueled by several key drivers. The rising prevalence of celiac disease and gluten intolerance is a primary factor, leading to increased consumer demand. Growing health awareness and the adoption of healthier lifestyles also contribute significantly. Technological advancements in food processing and ingredient development have resulted in better-tasting and more appealing gluten-free products. Furthermore, favorable government regulations and supportive industry initiatives promote market expansion.

Challenges in the Gluten-Free Products in Australia Industry Sector

Despite its promising growth trajectory, the Australian gluten-free products market is not without its obstacles. The inherent complexity of gluten-free formulations can pose significant challenges in consistently achieving optimal product quality and texture. Furthermore, the gluten-free industry is susceptible to supply chain volatilities and fluctuations in the availability and cost of specialized raw materials, which can impact production schedules and pricing strategies. The intensely competitive market landscape, featuring both established corporations and emerging innovators, exerts considerable pressure on profit margins. Nevertheless, these challenges are addressable through strategic innovation, the implementation of efficient supply chain management practices, and targeted marketing efforts. It is estimated that these challenges may collectively lead to a reduction of approximately [Insert specific percentage here]% in the overall market CAGR.

Emerging Opportunities in Gluten-Free Products in Australia Industry

The Australian gluten-free market presents significant opportunities for growth. The expanding demand for convenient, ready-to-eat gluten-free meals and snacks offers a key area for product development. The increasing interest in organic and ethically sourced ingredients opens up new avenues for premium products. Furthermore, the growth of online retail provides opportunities for businesses to reach a wider customer base. Exploring new product categories, such as gluten-free ready meals, could significantly expand market reach.

Leading Players in the Gluten-Free Products in Australia Industry Market

- Two Bays Brewing Co

- Unilever

- The Sanitarium Health and Wellbeing Company

- General Mills Inc

- Genius Foods Ltd

- Bob's Red Mill Natural Foods

- Kellogg Company

- QuestNutrition

Key Developments in Gluten-Free Products in Australia Industry Industry

- July 2021: Kellogg's Australia launched a new Coco Pops Gluten-Free cereal, expanding its product range and catering to the growing demand for gluten-free breakfast options. This launch significantly boosted market visibility for gluten-free cereals.

- May 2022: Good Food Partners (GFP) launched a range of low-gluten oat porridges, tapping into the increasing consumer preference for convenient and healthy gluten-free options. This highlights a growing trend toward low-gluten products rather than strictly gluten-free.

Future Outlook for Gluten-Free Products in Australia Industry Market

The outlook for the Australian gluten-free products market remains exceptionally bright. Continued expansion is anticipated, underpinned by enduring trends such as heightened health consciousness among consumers, the persistent rise in diagnoses of gluten-related disorders, and the relentless pace of product innovation. Significant opportunities exist for market participants to capitalize on emerging consumer demands, including the growing preference for convenient, ready-to-eat gluten-free meal solutions and snacks. Furthermore, catering to evolving consumer values, such as the increasing demand for organic and ethically sourced products, will be a key differentiator. Strategic alliances, substantial investments in research and development, and a keen understanding of evolving consumer preferences will be paramount for companies aiming to sustain a competitive edge and achieve enduring growth in this dynamic and promising market.

Gluten-Free Products in Australia Industry Segmentation

-

1. Product Type

- 1.1. Bakery Products

- 1.2. Pizzas and Pastas

- 1.3. Cereals and Snack Foods

- 1.4. Meat and Meat Products

- 1.5. Beverages

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience/Grocery Stores

- 2.3. Specialty Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

Gluten-Free Products in Australia Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Gluten-Free Products in Australia Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.82% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Alternative Proteins

- 3.4. Market Trends

- 3.4.1. Rising Celiac Disease and Gluten Intolerance to Support Gluten-free Product Consumption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gluten-Free Products in Australia Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bakery Products

- 5.1.2. Pizzas and Pastas

- 5.1.3. Cereals and Snack Foods

- 5.1.4. Meat and Meat Products

- 5.1.5. Beverages

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience/Grocery Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Gluten-Free Products in Australia Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Bakery Products

- 6.1.2. Pizzas and Pastas

- 6.1.3. Cereals and Snack Foods

- 6.1.4. Meat and Meat Products

- 6.1.5. Beverages

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience/Grocery Stores

- 6.2.3. Specialty Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Gluten-Free Products in Australia Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Bakery Products

- 7.1.2. Pizzas and Pastas

- 7.1.3. Cereals and Snack Foods

- 7.1.4. Meat and Meat Products

- 7.1.5. Beverages

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience/Grocery Stores

- 7.2.3. Specialty Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Gluten-Free Products in Australia Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Bakery Products

- 8.1.2. Pizzas and Pastas

- 8.1.3. Cereals and Snack Foods

- 8.1.4. Meat and Meat Products

- 8.1.5. Beverages

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience/Grocery Stores

- 8.2.3. Specialty Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Gluten-Free Products in Australia Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Bakery Products

- 9.1.2. Pizzas and Pastas

- 9.1.3. Cereals and Snack Foods

- 9.1.4. Meat and Meat Products

- 9.1.5. Beverages

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience/Grocery Stores

- 9.2.3. Specialty Stores

- 9.2.4. Online Retail Stores

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Gluten-Free Products in Australia Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Bakery Products

- 10.1.2. Pizzas and Pastas

- 10.1.3. Cereals and Snack Foods

- 10.1.4. Meat and Meat Products

- 10.1.5. Beverages

- 10.1.6. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience/Grocery Stores

- 10.2.3. Specialty Stores

- 10.2.4. Online Retail Stores

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Two Bays Brewing Co *List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Unilever

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Sanitarium Health and Wellbeing Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 General Mills Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Genius Foods Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bob's Red Mill Natural Foods

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kellogg Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 QuestNutrition

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Two Bays Brewing Co *List Not Exhaustive

List of Figures

- Figure 1: Global Gluten-Free Products in Australia Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Australia Gluten-Free Products in Australia Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: Australia Gluten-Free Products in Australia Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Gluten-Free Products in Australia Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 5: North America Gluten-Free Products in Australia Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 6: North America Gluten-Free Products in Australia Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 7: North America Gluten-Free Products in Australia Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 8: North America Gluten-Free Products in Australia Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Gluten-Free Products in Australia Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Gluten-Free Products in Australia Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 11: South America Gluten-Free Products in Australia Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 12: South America Gluten-Free Products in Australia Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 13: South America Gluten-Free Products in Australia Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 14: South America Gluten-Free Products in Australia Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Gluten-Free Products in Australia Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Gluten-Free Products in Australia Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 17: Europe Gluten-Free Products in Australia Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 18: Europe Gluten-Free Products in Australia Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 19: Europe Gluten-Free Products in Australia Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 20: Europe Gluten-Free Products in Australia Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Gluten-Free Products in Australia Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Gluten-Free Products in Australia Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 23: Middle East & Africa Gluten-Free Products in Australia Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 24: Middle East & Africa Gluten-Free Products in Australia Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: Middle East & Africa Gluten-Free Products in Australia Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: Middle East & Africa Gluten-Free Products in Australia Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Gluten-Free Products in Australia Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Gluten-Free Products in Australia Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Asia Pacific Gluten-Free Products in Australia Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Asia Pacific Gluten-Free Products in Australia Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 31: Asia Pacific Gluten-Free Products in Australia Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 32: Asia Pacific Gluten-Free Products in Australia Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Gluten-Free Products in Australia Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Gluten-Free Products in Australia Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Gluten-Free Products in Australia Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Gluten-Free Products in Australia Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Gluten-Free Products in Australia Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Gluten-Free Products in Australia Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global Gluten-Free Products in Australia Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Global Gluten-Free Products in Australia Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Global Gluten-Free Products in Australia Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Gluten-Free Products in Australia Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: Global Gluten-Free Products in Australia Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: Global Gluten-Free Products in Australia Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Gluten-Free Products in Australia Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Global Gluten-Free Products in Australia Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: Global Gluten-Free Products in Australia Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Gluten-Free Products in Australia Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 31: Global Gluten-Free Products in Australia Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 32: Global Gluten-Free Products in Australia Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Gluten-Free Products in Australia Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 40: Global Gluten-Free Products in Australia Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 41: Global Gluten-Free Products in Australia Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Gluten-Free Products in Australia Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gluten-Free Products in Australia Industry?

The projected CAGR is approximately 7.82%.

2. Which companies are prominent players in the Gluten-Free Products in Australia Industry?

Key companies in the market include Two Bays Brewing Co *List Not Exhaustive, Unilever, The Sanitarium Health and Wellbeing Company, General Mills Inc, Genius Foods Ltd, Bob's Red Mill Natural Foods, Kellogg Company, QuestNutrition.

3. What are the main segments of the Gluten-Free Products in Australia Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

Rising Celiac Disease and Gluten Intolerance to Support Gluten-free Product Consumption.

7. Are there any restraints impacting market growth?

Presence of Alternative Proteins.

8. Can you provide examples of recent developments in the market?

In May 2022, Good Food Partners (GFP) launched a range of low-gluten oat porridges in Australia. The company claims that the products are low in gluten, dairy-free, naturally sweet, and are packaged in fully kerbside recyclable portion-controlled sachets. The product range was launched due to the rising demand from consumers with varied levels of intolerance or those avoiding gluten.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gluten-Free Products in Australia Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gluten-Free Products in Australia Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gluten-Free Products in Australia Industry?

To stay informed about further developments, trends, and reports in the Gluten-Free Products in Australia Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence