Key Insights

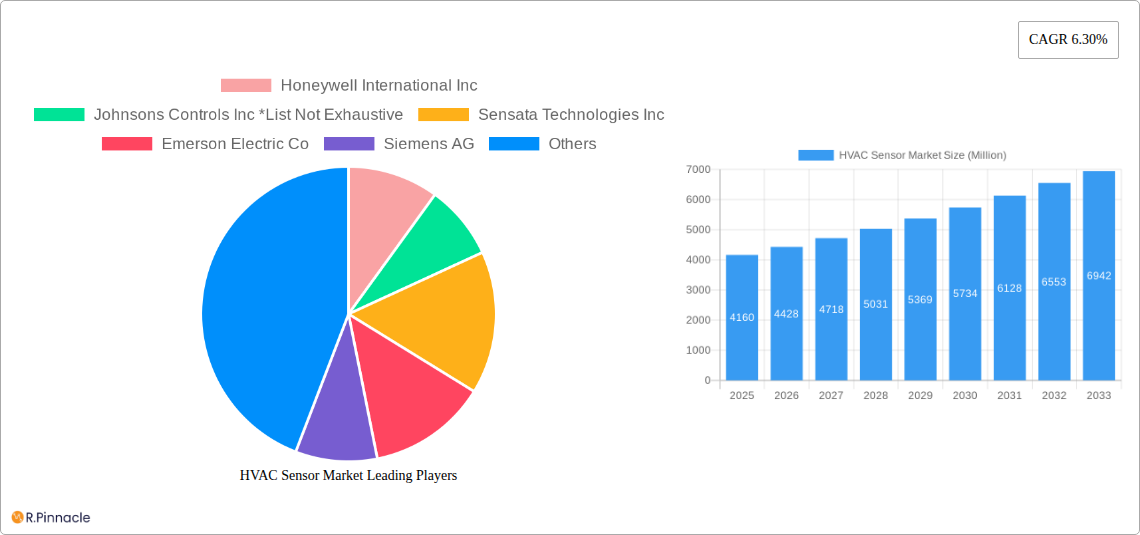

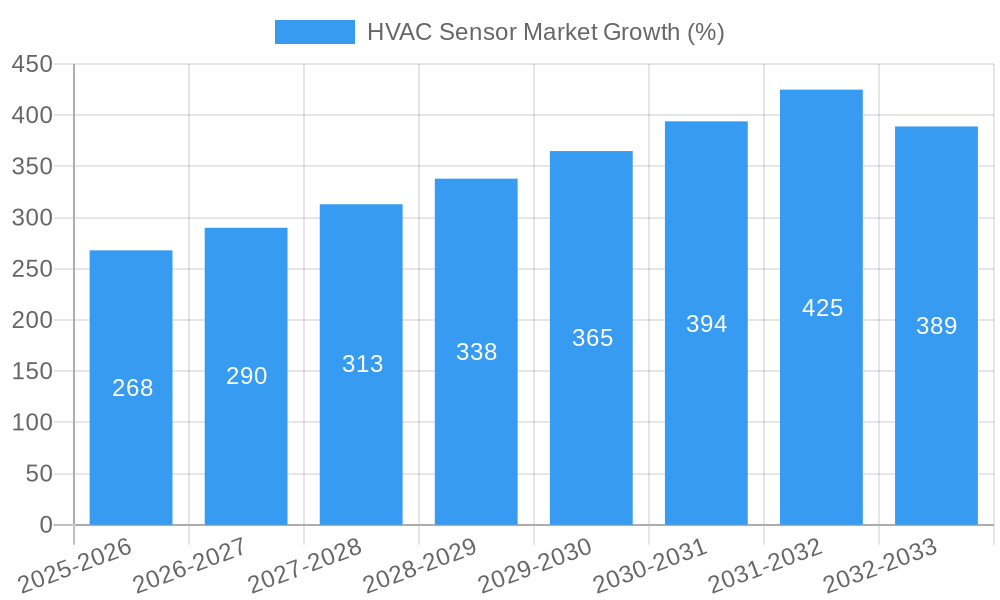

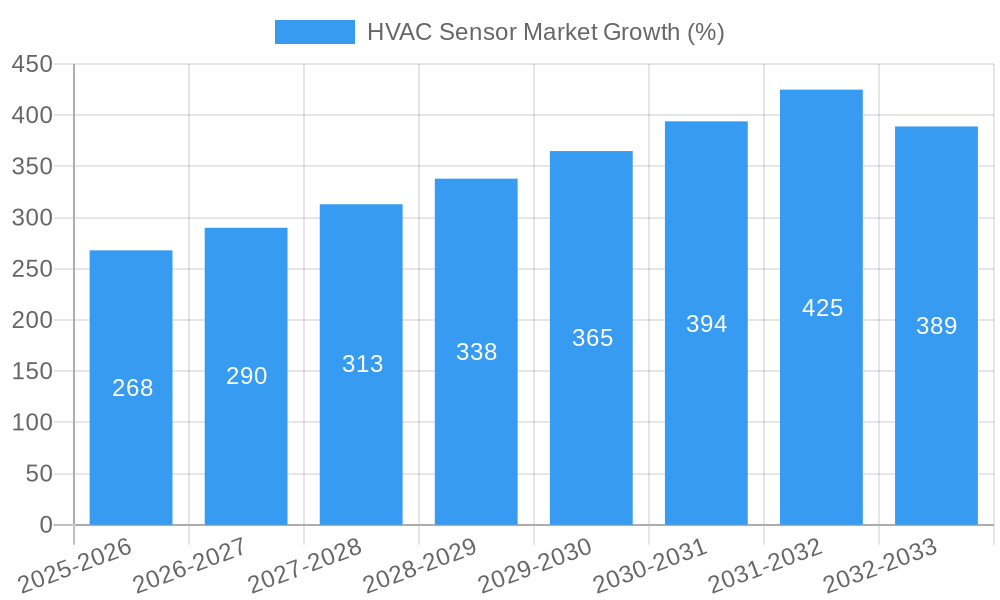

The HVAC sensor market, valued at $4.16 billion in 2025, is projected to experience robust growth, driven by increasing demand for energy-efficient and smart building technologies. A compound annual growth rate (CAGR) of 6.30% from 2025 to 2033 indicates a significant expansion, reaching an estimated market value exceeding $7 billion by 2033. This growth is fueled by several key factors. The rising adoption of smart thermostats and building automation systems (BAS) in both residential and commercial sectors is a primary driver. Furthermore, stringent government regulations promoting energy efficiency and reducing carbon emissions are compelling building owners and operators to integrate advanced HVAC sensor technology. Technological advancements leading to smaller, more accurate, and cost-effective sensors are also contributing to market expansion. Growth is particularly strong in the Asia-Pacific region, driven by rapid urbanization and infrastructure development. The market segmentation reveals significant demand across various sensor types, including temperature, humidity, pressure & flow, motion, and smoke & gas sensors, with temperature and humidity sensors dominating the market share. The commercial and industrial segments are expected to witness faster growth compared to the residential sector due to the larger-scale implementation of advanced building management systems.

Competitive rivalry among established players like Honeywell, Johnson Controls, and Siemens, alongside emerging technology providers, fosters innovation and drives down prices, making HVAC sensor technology accessible to a broader range of applications. However, challenges remain, including the initial investment costs associated with upgrading existing HVAC systems and concerns around data security and privacy related to connected sensor networks. Despite these restraints, the overall market outlook remains positive, driven by the long-term trends towards smart buildings, energy conservation, and improved building performance. The continuous development of sophisticated sensor technologies with enhanced capabilities and functionalities will further propel market expansion throughout the forecast period.

HVAC Sensor Market Report: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the HVAC sensor market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, growth drivers, competitive landscapes, and future projections. The global HVAC sensor market is poised for significant expansion, driven by technological advancements, increasing demand for energy-efficient solutions, and stringent environmental regulations. This report will equip you with the data and analysis you need to navigate this dynamic market successfully.

HVAC Sensor Market Market Structure & Innovation Trends

The HVAC sensor market is moderately concentrated, with key players like Honeywell International Inc, Johnson Controls Inc, Sensata Technologies Inc, Emerson Electric Co, Siemens AG, Belimo Aircontrols (USA) Inc, Senmatic A/S, Sensirion AG, TE Connectivity Ltd, and Schneider Electric holding significant market share. However, the market also features several smaller, specialized players, leading to a dynamic competitive landscape. Market share data for 2024 indicates that Honeywell and Johnson Controls together hold approximately xx% of the market, while the remaining share is distributed amongst other players. Innovation is a key driver, with continuous advancements in sensor technology, such as improved accuracy, miniaturization, and connectivity. Stringent environmental regulations, particularly around energy efficiency, are further pushing innovation. Product substitution is minimal, with existing technologies continuously improving rather than being fully replaced. The market sees frequent M&A activity, with deal values exceeding $xx Million annually in recent years. These activities reflect the strategic importance of sensor technology and the desire to expand market reach and technological capabilities.

- Market Concentration: Moderately concentrated, with top players holding xx% of the market.

- Innovation Drivers: Improved sensor accuracy, miniaturization, IoT integration, and energy efficiency regulations.

- Regulatory Framework: Stringent environmental regulations drive demand for energy-efficient HVAC systems and sensors.

- M&A Activity: Significant M&A activity observed, with annual deal values exceeding $xx Million.

HVAC Sensor Market Market Dynamics & Trends

The HVAC sensor market exhibits robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors. The increasing adoption of smart homes and buildings is a significant driver, with smart thermostats and HVAC controllers integrating various sensors for optimized energy management and comfort. Furthermore, the rising awareness of energy efficiency and sustainability is prompting homeowners and businesses to invest in advanced HVAC systems equipped with sophisticated sensors. Technological advancements, such as the development of more accurate and reliable sensors at lower costs, are also boosting market growth. The market penetration of smart HVAC systems is steadily increasing, with xx% of new installations in 2024 incorporating smart sensor technology. Competitive dynamics are intense, with companies focusing on innovation, strategic partnerships, and cost optimization to gain market share.

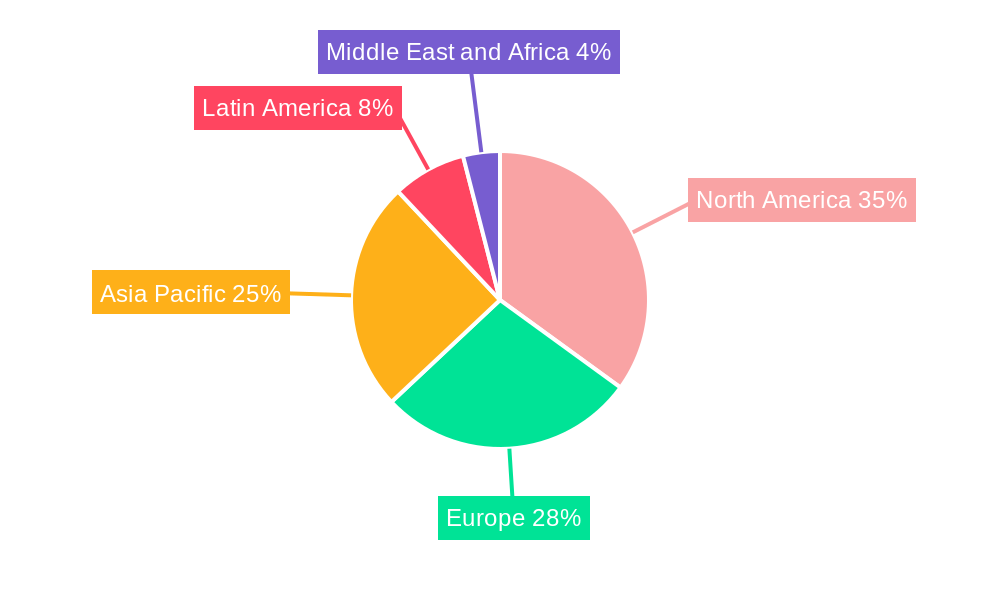

Dominant Regions & Segments in HVAC Sensor Market

The North American region currently dominates the HVAC sensor market, driven by strong demand from the residential and commercial sectors. This is largely attributed to the high adoption rate of energy-efficient technologies and well-established infrastructure. Europe and Asia-Pacific are also experiencing significant growth, though at a slightly slower pace. Within the segment breakdown:

By Type:

- Temperature Sensors: This segment holds the largest market share due to its fundamental role in HVAC control.

- Humidity Sensors: Growing demand for comfort and health-conscious environments fuels this segment's growth.

- Pressure & Flow Sensors: Essential for efficient operation, this segment is crucial for HVAC system optimization.

- Motion Sensors: Increasing adoption in smart home applications drives growth in this niche market.

- Smoke & Gas Sensors: Safety regulations and growing concerns about indoor air quality are major drivers.

- Other Types: This segment includes other specialized sensors with increasing adoption in smart building technologies.

By End-user:

Commercial & Industrial: This segment dominates due to the large number of HVAC systems in commercial buildings and industrial facilities.

Residential: The growing adoption of smart home technology is driving growth in this segment.

Key Drivers (North America): High adoption of smart home technology, robust infrastructure, stringent energy efficiency regulations.

Key Drivers (Europe): Growing awareness of energy efficiency, supportive government policies, high adoption of green building technologies.

Key Drivers (Asia-Pacific): Rapid urbanization, rising disposable incomes, and increasing adoption of advanced building technologies.

HVAC Sensor Market Product Innovations

Recent product innovations focus on enhancing sensor accuracy, miniaturization, connectivity, and energy efficiency. Smart sensors with integrated microprocessors enable advanced functionalities such as predictive maintenance and remote diagnostics. Wireless sensor networks provide real-time data for optimized HVAC system performance. The market is moving towards smaller, more cost-effective sensors, increasing accessibility across diverse applications. These innovations address the market need for improved energy efficiency, enhanced system reliability, and remote control capabilities.

Report Scope & Segmentation Analysis

This report segments the HVAC sensor market by type (Temperature Sensors, Humidity Sensors, Pressure & Flow Sensors, Motion Sensors, Smoke & Gas Sensors, Other Types) and end-user (Residential, Commercial & Industrial). Each segment is analyzed in detail, providing insights into market size, growth projections, and competitive dynamics. The market size for each segment is projected to grow significantly by 2033. For example, the temperature sensor segment is expected to reach $xx Million, while the commercial and industrial end-user segment is projected to reach $xx Million. Competitive pressures vary across segments, with some experiencing intense competition while others have more niche players.

Key Drivers of HVAC Sensor Market Growth

The HVAC sensor market is propelled by several key factors. Technological advancements, like the development of miniaturized, low-cost, and high-accuracy sensors, are central. Growing environmental concerns and increasing energy costs are driving demand for energy-efficient HVAC systems. Stringent government regulations promoting energy efficiency in buildings further accelerate market growth. The rising popularity of smart homes and buildings adds significantly to the demand for sensors for smart HVAC systems.

Challenges in the HVAC Sensor Market Sector

The market faces challenges, including supply chain disruptions impacting sensor production and availability. High initial investment costs for advanced sensor technology can deter some consumers. Competitive pressure from established players and new entrants can impact profitability. Furthermore, regulatory hurdles and varying standards across different regions pose complexities for manufacturers.

Emerging Opportunities in HVAC Sensor Market

Emerging opportunities include the growing adoption of building automation systems (BAS) and the Internet of Things (IoT) in commercial buildings. The rising demand for smart home solutions and the development of new sensor technologies for enhanced energy management are promising avenues. The integration of artificial intelligence (AI) and machine learning (ML) for predictive maintenance and optimized energy consumption presents significant growth opportunities.

Leading Players in the HVAC Sensor Market Market

- Honeywell International Inc

- Johnsons Controls Inc

- Sensata Technologies Inc

- Emerson Electric Co

- Siemens AG

- Belimo Aircontrols (USA) Inc

- Senmatic A/S

- Sensirion AG

- TE Connectivity Ltd

- Schneider Electric

Key Developments in HVAC Sensor Market Industry

- February 2023: Danfoss announced a new compressor and sensor manufacturing facility in Mexico, boosting production of pressure sensors for HVAC/R by 1.6 Million units annually.

- January 2023: Lennox Industries launched the Lennox S40 Smart Thermostat and accompanying accessories, enhancing the smart home market and driving demand for related sensors.

- August 2022: Levoit introduced the OasisMist Smart Humidifier, showcasing the increasing integration of sensors into consumer appliances.

Future Outlook for HVAC Sensor Market Market

The HVAC sensor market is projected to experience strong growth in the coming years, driven by continued advancements in sensor technology, increasing demand for energy-efficient HVAC systems, and the expanding adoption of smart building technologies. The integration of AI and IoT will further revolutionize the industry, creating new opportunities for growth and innovation. The focus on sustainable solutions and improvements in indoor air quality will also continue to be key drivers of growth.

HVAC Sensor Market Segmentation

-

1. Type

- 1.1. Temperature Sensors

- 1.2. Humidity Sensors

- 1.3. Pressure & Flow Sensors

- 1.4. Motion Sensors

- 1.5. Smoke & Gas Sensors

- 1.6. Other Types

-

2. End-user

- 2.1. Residential

- 2.2. Commercial & Industrial

HVAC Sensor Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

HVAC Sensor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Construction Sector; Growing Demand for HVAC Sensors in the Automotive Sector

- 3.3. Market Restrains

- 3.3.1. Issues Related to Motion-Activated Air Conditioners

- 3.4. Market Trends

- 3.4.1. Increased Construction and Retrofit Activity to Aid the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global HVAC Sensor Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Temperature Sensors

- 5.1.2. Humidity Sensors

- 5.1.3. Pressure & Flow Sensors

- 5.1.4. Motion Sensors

- 5.1.5. Smoke & Gas Sensors

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Residential

- 5.2.2. Commercial & Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America HVAC Sensor Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Temperature Sensors

- 6.1.2. Humidity Sensors

- 6.1.3. Pressure & Flow Sensors

- 6.1.4. Motion Sensors

- 6.1.5. Smoke & Gas Sensors

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Residential

- 6.2.2. Commercial & Industrial

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe HVAC Sensor Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Temperature Sensors

- 7.1.2. Humidity Sensors

- 7.1.3. Pressure & Flow Sensors

- 7.1.4. Motion Sensors

- 7.1.5. Smoke & Gas Sensors

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Residential

- 7.2.2. Commercial & Industrial

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific HVAC Sensor Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Temperature Sensors

- 8.1.2. Humidity Sensors

- 8.1.3. Pressure & Flow Sensors

- 8.1.4. Motion Sensors

- 8.1.5. Smoke & Gas Sensors

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Residential

- 8.2.2. Commercial & Industrial

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America HVAC Sensor Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Temperature Sensors

- 9.1.2. Humidity Sensors

- 9.1.3. Pressure & Flow Sensors

- 9.1.4. Motion Sensors

- 9.1.5. Smoke & Gas Sensors

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Residential

- 9.2.2. Commercial & Industrial

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa HVAC Sensor Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Temperature Sensors

- 10.1.2. Humidity Sensors

- 10.1.3. Pressure & Flow Sensors

- 10.1.4. Motion Sensors

- 10.1.5. Smoke & Gas Sensors

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Residential

- 10.2.2. Commercial & Industrial

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America HVAC Sensor Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe HVAC Sensor Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific HVAC Sensor Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America HVAC Sensor Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa HVAC Sensor Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Honeywell International Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Johnsons Controls Inc *List Not Exhaustive

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Sensata Technologies Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Emerson Electric Co

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Siemens AG

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Belimo Aircontrols (USA) Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Senmatic A/S

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Sensirion AG

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 TE Connectivity Ltd

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Schneider Electric

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global HVAC Sensor Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America HVAC Sensor Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America HVAC Sensor Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe HVAC Sensor Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe HVAC Sensor Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific HVAC Sensor Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific HVAC Sensor Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America HVAC Sensor Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America HVAC Sensor Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa HVAC Sensor Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa HVAC Sensor Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America HVAC Sensor Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America HVAC Sensor Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America HVAC Sensor Market Revenue (Million), by End-user 2024 & 2032

- Figure 15: North America HVAC Sensor Market Revenue Share (%), by End-user 2024 & 2032

- Figure 16: North America HVAC Sensor Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America HVAC Sensor Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe HVAC Sensor Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe HVAC Sensor Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe HVAC Sensor Market Revenue (Million), by End-user 2024 & 2032

- Figure 21: Europe HVAC Sensor Market Revenue Share (%), by End-user 2024 & 2032

- Figure 22: Europe HVAC Sensor Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe HVAC Sensor Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific HVAC Sensor Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Asia Pacific HVAC Sensor Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Asia Pacific HVAC Sensor Market Revenue (Million), by End-user 2024 & 2032

- Figure 27: Asia Pacific HVAC Sensor Market Revenue Share (%), by End-user 2024 & 2032

- Figure 28: Asia Pacific HVAC Sensor Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific HVAC Sensor Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America HVAC Sensor Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Latin America HVAC Sensor Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Latin America HVAC Sensor Market Revenue (Million), by End-user 2024 & 2032

- Figure 33: Latin America HVAC Sensor Market Revenue Share (%), by End-user 2024 & 2032

- Figure 34: Latin America HVAC Sensor Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America HVAC Sensor Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa HVAC Sensor Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East and Africa HVAC Sensor Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East and Africa HVAC Sensor Market Revenue (Million), by End-user 2024 & 2032

- Figure 39: Middle East and Africa HVAC Sensor Market Revenue Share (%), by End-user 2024 & 2032

- Figure 40: Middle East and Africa HVAC Sensor Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa HVAC Sensor Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global HVAC Sensor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global HVAC Sensor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global HVAC Sensor Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 4: Global HVAC Sensor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global HVAC Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: HVAC Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global HVAC Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: HVAC Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global HVAC Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: HVAC Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global HVAC Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: HVAC Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global HVAC Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: HVAC Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global HVAC Sensor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global HVAC Sensor Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 17: Global HVAC Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global HVAC Sensor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global HVAC Sensor Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 20: Global HVAC Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global HVAC Sensor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global HVAC Sensor Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 23: Global HVAC Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global HVAC Sensor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Global HVAC Sensor Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 26: Global HVAC Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global HVAC Sensor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global HVAC Sensor Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 29: Global HVAC Sensor Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the HVAC Sensor Market?

The projected CAGR is approximately 6.30%.

2. Which companies are prominent players in the HVAC Sensor Market?

Key companies in the market include Honeywell International Inc, Johnsons Controls Inc *List Not Exhaustive, Sensata Technologies Inc, Emerson Electric Co, Siemens AG, Belimo Aircontrols (USA) Inc, Senmatic A/S, Sensirion AG, TE Connectivity Ltd, Schneider Electric.

3. What are the main segments of the HVAC Sensor Market?

The market segments include Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.16 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Construction Sector; Growing Demand for HVAC Sensors in the Automotive Sector.

6. What are the notable trends driving market growth?

Increased Construction and Retrofit Activity to Aid the Market's Growth.

7. Are there any restraints impacting market growth?

Issues Related to Motion-Activated Air Conditioners.

8. Can you provide examples of recent developments in the market?

February 2023: Danfoss announced the construction of a new compressor and sensor manufacturing facility in Apodaca, Mexico. The new expansion is expected to produce medium and large scroll compressors, pressure sensors for HVAC/R, and A2L leak detection sensors for residential and commercial air conditioning and refrigeration. The facility is expected to be ready by the end of 2024, starting with a capacity for 100,000 compressor units, 1.6 million pressure sensors, and 1 million A2L leak detection sensors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "HVAC Sensor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the HVAC Sensor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the HVAC Sensor Market?

To stay informed about further developments, trends, and reports in the HVAC Sensor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence