Key Insights

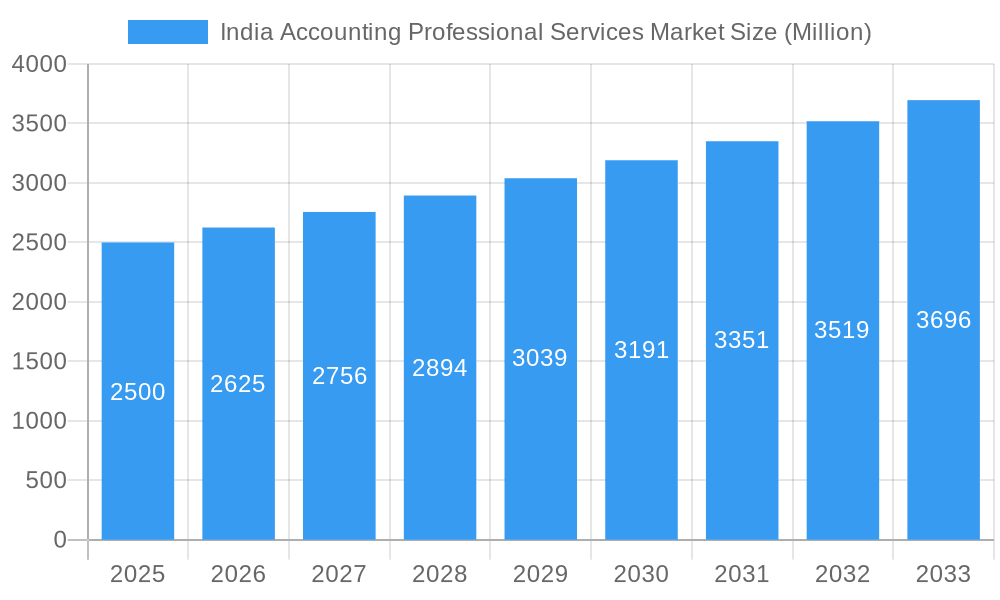

The Indian Accounting Professional Services market is poised for significant expansion, driven by economic growth, evolving regulatory landscapes, and the integration of advanced technologies such as AI and cloud computing. With a projected Compound Annual Growth Rate (CAGR) of 3.32%, the market is estimated to reach 534.21 billion by 2025. Key contributors to this growth include the expanding Indian business ecosystem, particularly in technology and finance, stringent compliance mandates, and the increasing demand for specialized advisory services in taxation, auditing, and risk management. Government initiatives promoting business ease and digitalization further bolster market expansion.

India Accounting Professional Services Market Market Size (In Billion)

The market is segmented by service type (audit, tax, advisory), industry vertical (BFSI, manufacturing, technology), and company size. While specific segment data is limited, the competitive environment features prominent multinational firms alongside a robust network of domestic players catering to niche and regional demands. Potential challenges include the availability of skilled professionals, economic volatility, and competition from technology-driven service providers. However, the overall outlook remains positive, with continued growth anticipated throughout the forecast period (2025-2033), presenting substantial opportunities for both established and emerging entities. Enhanced transparency and corporate governance in India will remain a critical demand driver.

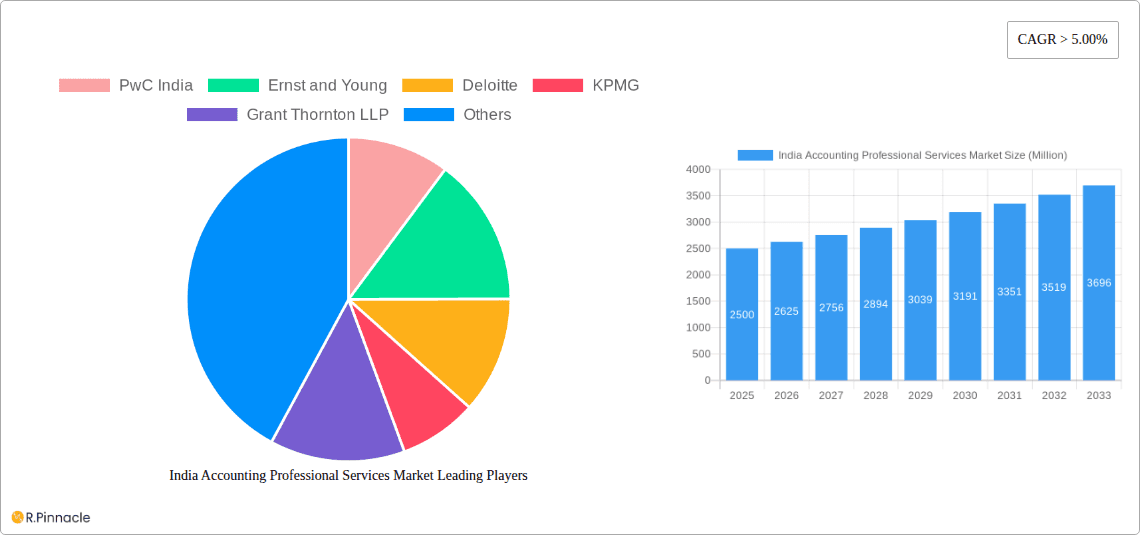

India Accounting Professional Services Market Company Market Share

This comprehensive report offers in-depth analysis of the India Accounting Professional Services Market, providing critical insights for industry stakeholders, investors, and strategic planners. The study spans the period 2019-2033, with a detailed focus on the forecast period 2025-2033 and a base year of 2025. Utilizing historical data (2019-2024) and key performance indicators, the report projects future market trends. Key industry players such as PwC India, Ernst & Young, Deloitte, KPMG, Grant Thornton LLP, BDO India, RSM, SS Kothari Mehta & Co, ASA and Associates, and Nangia and Co. are analyzed extensively.

India Accounting Professional Services Market Structure & Innovation Trends

This section analyzes the market's competitive landscape, highlighting key trends shaping its evolution. We delve into market concentration, examining the market share held by major players and the impact of mergers and acquisitions (M&A). The report explores the influence of regulatory frameworks, technological advancements driving innovation, the presence of substitute products, and the evolving demographics of end-users. The estimated total market size for 2025 is projected at xx Million, while the estimated value of M&A deals in the period 2019-2024 totaled approximately xx Million.

- Market Concentration: A detailed breakdown of market share among leading firms, indicating a moderately concentrated market with significant opportunities for smaller players.

- Innovation Drivers: Discussion of technological advancements (e.g., AI, cloud computing, blockchain) impacting service delivery and efficiency.

- Regulatory Frameworks: Analysis of the influence of government regulations, accounting standards (e.g., Ind AS), and tax policies on market growth.

- Product Substitutes: Exploration of alternative solutions and their impact on the market.

- End-User Demographics: Assessment of the changing needs and preferences of diverse client segments (e.g., SMEs, large corporations, MNCs).

- M&A Activities: Review of significant M&A activity, including deal values and their impact on market consolidation. For instance, PwC India's acquisition of Venerate Solutions in August 2022 exemplifies the trend towards expanding service offerings.

India Accounting Professional Services Market Dynamics & Trends

This section provides a deep dive into the factors driving market growth and evolution. We analyze growth drivers, technological disruptions, evolving consumer preferences, and the dynamics of competition. The Compound Annual Growth Rate (CAGR) is projected at xx% for the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. Factors like increasing regulatory complexity, the rise of digital technologies, and the growth of the Indian economy are discussed in detail.

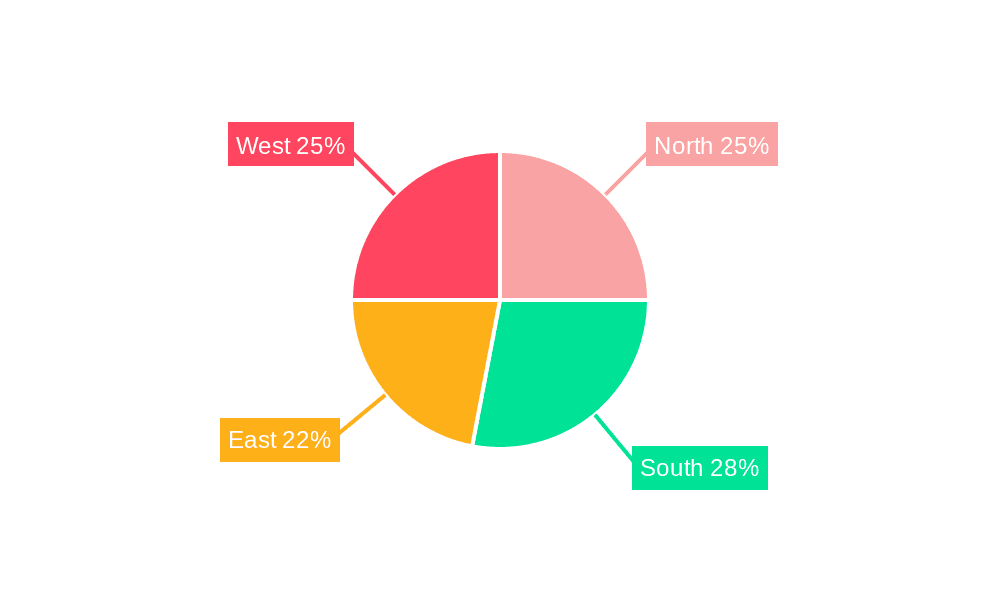

Dominant Regions & Segments in India Accounting Professional Services Market

This section provides an in-depth analysis of the most influential regions and segments shaping the India Accounting Professional Services Market. We identify areas exhibiting significant market share and explore the underlying growth catalysts. Major metropolitan centers such as Mumbai, Delhi, Bangalore, and Hyderabad are poised to continue their dominance due to a high concentration of businesses, a robust pool of accounting talent, and their status as key economic hubs. The following bullet points highlight specific regional drivers, while the detailed paragraphs offer a comprehensive understanding of their market standing and future potential.

- Key Drivers in Leading Regions:

- Mumbai: Esteemed as India's financial capital, it boasts a high density of large corporations, a sophisticated financial services ecosystem, and a deep reservoir of highly skilled accounting and finance professionals, driving demand for specialized services.

- Delhi (National Capital Region): The presence of government bodies, numerous corporate headquarters, and a rapidly expanding IT and startup landscape contribute to a substantial and diverse demand for accounting and advisory services.

- Bangalore: As a global technology and innovation hub, Bangalore's vibrant IT and startup ecosystem, coupled with significant foreign direct investment, creates a unique and dynamic market for accounting services, particularly in areas like compliance and international taxation.

- Hyderabad: Emerging as a formidable business and technology center, Hyderabad's expanding IT sector and its attractiveness to new enterprises are fueling a growing need for comprehensive accounting and financial management solutions.

India Accounting Professional Services Market Product Innovations

This section delves into the latest advancements in products and services within the India Accounting Professional Services Market, with a particular focus on their technological underpinnings and market relevance. The widespread adoption of cutting-edge technologies such as cloud-based accounting software, sophisticated AI-powered audit tools, and advanced data analytics platforms is fundamentally transforming service delivery. These innovations are leading to substantial improvements in operational efficiency, enhanced accuracy, and deeper insights for clients. Concurrently, the market is observing a pronounced trend towards the development and offering of highly specialized services. This includes areas like forensic accounting, business valuation, intricate tax advisory, and specialized compliance services, all of which are seeing increased demand driven by the evolving needs and complexities faced by businesses in India.

Report Scope & Segmentation Analysis

This comprehensive report meticulously segments the India Accounting Professional Services Market to provide granular insights. The analysis is structured across key dimensions including: Service Type (e.g., Audit & Assurance, Taxation, Management Consulting, Bookkeeping, Payroll Processing, Corporate Finance, Forensic Accounting, Valuation Services), Client Size (categorized into Small and Medium-sized Enterprises (SMEs), Mid-Market Companies, and Large Enterprises/Corporations), and Geographic Location (sub-segmented by major regions and tier-1, tier-2, and tier-3 cities). For each of these defined segments, the report offers detailed market size estimations, robust growth projections, an assessment of key market share distributions, and a thorough analysis of the prevailing competitive landscape and strategic dynamics.

Key Drivers of India Accounting Professional Services Market Growth

The India Accounting Professional Services Market is propelled by a confluence of robust growth drivers. The ever-increasing complexity of accounting standards and regulatory frameworks, both domestic and international, necessitates expert guidance, thereby amplifying the demand for professional accounting services. Simultaneously, businesses across all sectors are recognizing the critical importance of efficient and accurate financial management for sustainable growth and strategic decision-making. Technological advancements, particularly the pervasive digital transformation initiatives undertaken by companies, are creating new opportunities for service providers leveraging advanced tools and methodologies. The consistently strong performance of the Indian economy, characterized by its expansion and increasing global integration, further fuels this demand. Additionally, the Indian government's proactive measures aimed at fostering an environment conducive to business operations, including initiatives to improve the ease of doing business and actively attract foreign investment, are significantly contributing to the market's upward trajectory.

Challenges in the India Accounting Professional Services Market Sector

Despite its promising growth, the India Accounting Professional Services Market navigates several significant challenges. Intense market competition, characterized by the presence of numerous domestic and international players, exerts pressure on pricing and service differentiation. The imperative to constantly adapt and maintain stringent compliance with a rapidly evolving landscape of accounting standards, tax laws, and regulatory requirements presents an ongoing hurdle. Furthermore, there is a persistent scarcity of highly skilled and experienced accounting professionals, leading to talent acquisition and retention challenges. Disruptions within global supply chains can indirectly impact client businesses, subsequently affecting demand for accounting services. Fluctuations in currency exchange rates can introduce financial complexities for multinational clients, requiring specialized expertise. Finally, the escalating cost of talent, driven by demand and inflation, poses a continuous financial challenge for service providers in the sector.

Emerging Opportunities in India Accounting Professional Services Market

The market presents opportunities in areas such as specialized advisory services (e.g., ESG reporting, cybersecurity), the adoption of new technologies (e.g., blockchain, AI), and expansion into underserved markets. Growth in the SME sector and the increasing adoption of digital financial services offer significant potential.

Leading Players in the India Accounting Professional Services Market Market

- PwC India

- Ernst & Young

- Deloitte

- KPMG

- Grant Thornton LLP

- BDO India

- RSM

- SS Kothari Mehta & Co

- ASA and Associates

- Nangia and Co

Key Developments in India Accounting Professional Services Market Industry

- October 2022: KPMG in India and IBSFINtech formed an alliance to provide corporate treasury automation solutions.

- August 2022: PwC India acquired Venerate Solutions Private Limited, a Salesforce consulting firm.

Future Outlook for India Accounting Professional Services Market Market

The India Accounting Professional Services Market is poised for continued growth, driven by technological advancements, economic expansion, and increasing regulatory complexity. Strategic partnerships, investments in technology, and a focus on specialized services will be crucial for success in this dynamic market. The market's future trajectory will be significantly shaped by the government's economic policies and the increasing adoption of digital technologies across various business sectors.

India Accounting Professional Services Market Segmentation

-

1. Type Of Service

- 1.1. Tax Preperation Services

- 1.2. Book Keeping Services

- 1.3. Payroll Services

- 1.4. Others

India Accounting Professional Services Market Segmentation By Geography

- 1. India

India Accounting Professional Services Market Regional Market Share

Geographic Coverage of India Accounting Professional Services Market

India Accounting Professional Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Secure Cloud Accounting Solution is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Accounting Professional Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type Of Service

- 5.1.1. Tax Preperation Services

- 5.1.2. Book Keeping Services

- 5.1.3. Payroll Services

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type Of Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PwC India

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ernst and Young

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Deloitte

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 KPMG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Grant Thornton LLP

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BDO India

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 RSM

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SS Kothari Mehta & Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ASA and Associates

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nangia and Co **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 PwC India

List of Figures

- Figure 1: India Accounting Professional Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Accounting Professional Services Market Share (%) by Company 2025

List of Tables

- Table 1: India Accounting Professional Services Market Revenue billion Forecast, by Type Of Service 2020 & 2033

- Table 2: India Accounting Professional Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: India Accounting Professional Services Market Revenue billion Forecast, by Type Of Service 2020 & 2033

- Table 4: India Accounting Professional Services Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Accounting Professional Services Market?

The projected CAGR is approximately 3.32%.

2. Which companies are prominent players in the India Accounting Professional Services Market?

Key companies in the market include PwC India, Ernst and Young, Deloitte, KPMG, Grant Thornton LLP, BDO India, RSM, SS Kothari Mehta & Co, ASA and Associates, Nangia and Co **List Not Exhaustive.

3. What are the main segments of the India Accounting Professional Services Market?

The market segments include Type Of Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 534.21 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Secure Cloud Accounting Solution is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In October 2022, In order to provide their clients with a comprehensive suite of corporate treasury automation solutions and assist them in hastening the digital transformation of their treasury department, KPMG in India and IBSFINtech today established an alliance connection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Accounting Professional Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Accounting Professional Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Accounting Professional Services Market?

To stay informed about further developments, trends, and reports in the India Accounting Professional Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence