Key Insights

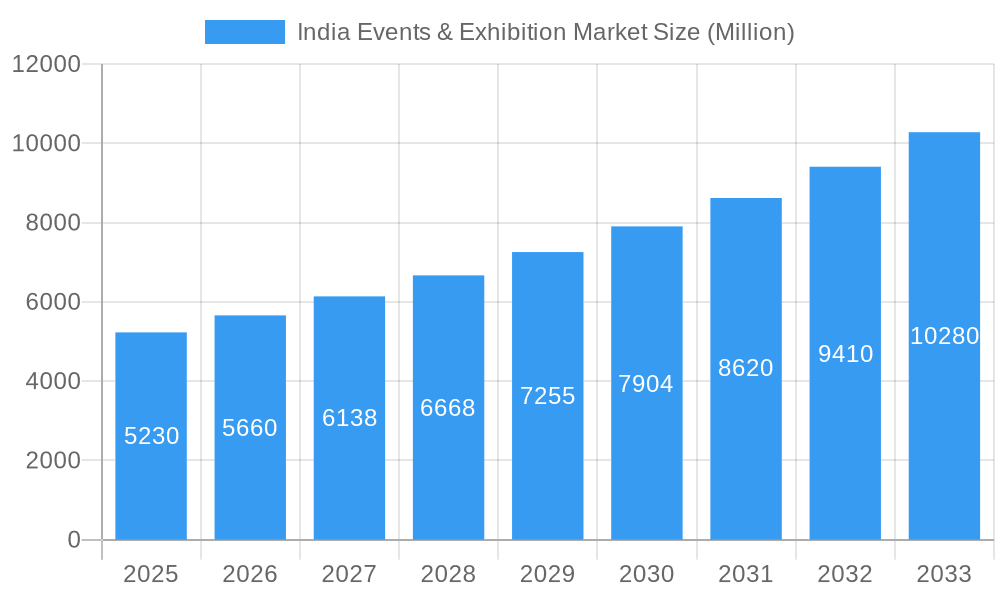

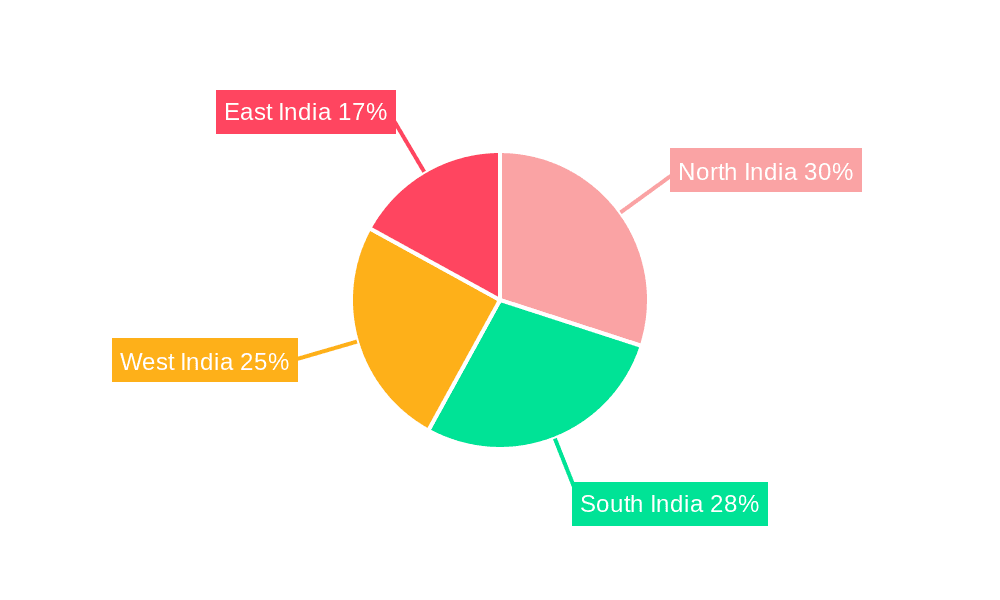

The India events and exhibition market is experiencing robust growth, projected to reach a market size of 5.23 million USD in 2025, with a Compound Annual Growth Rate (CAGR) of 8.31% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning Indian economy, coupled with increasing disposable incomes and a young, aspirational population, creates a fertile ground for the events sector. Furthermore, the government's initiatives to promote tourism and infrastructure development are further bolstering growth. The rising adoption of technology, including virtual and hybrid event formats, is enhancing accessibility and participation, while also contributing to cost optimization and broadened reach. Segmentation within the market reflects diversified demand, with significant contributions from consumer goods and retail, automotive and transportation, and the entertainment industries. B2B events maintain a strong presence, while the adoption of B2C and hybrid models is accelerating, demonstrating adaptability to evolving consumer preferences. Competitive intensity is evident, with numerous players ranging from large established companies like Wizcraft and Percept Limited to smaller, niche event organizers. The market's geographical distribution reveals varying levels of development across North, South, East, and West India, presenting opportunities for targeted expansion and growth in less saturated regions.

India Events & Exhibition Market Market Size (In Billion)

Looking ahead, the India events and exhibition market is expected to witness sustained growth, driven by the continued expansion of the Indian economy and the increasing adoption of innovative event formats. Challenges remain, however, including potential economic volatility and the need for ongoing adaptation to changing consumer preferences. Competition will remain fierce, requiring event organizers to consistently innovate and offer unique value propositions to attract exhibitors and attendees. The successful players will be those who effectively leverage technology, understand evolving consumer needs, and strategically target specific market segments to maximize ROI and market share. The continued development of infrastructure and supportive government policies will further influence the overall market trajectory. The forecast period of 2025-2033 presents a significant opportunity for growth and investment within the dynamic Indian events and exhibition landscape.

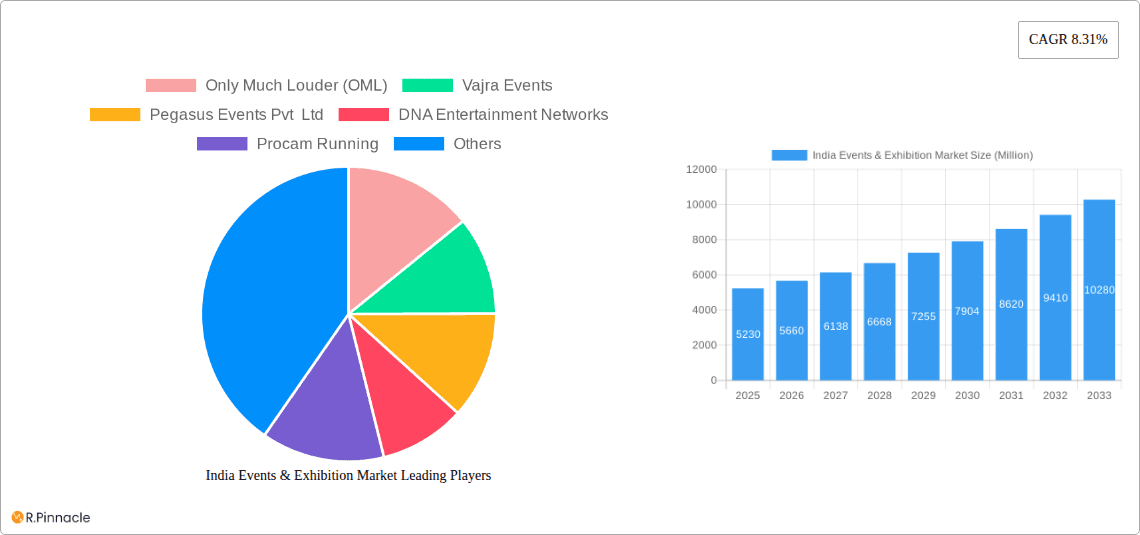

India Events & Exhibition Market Company Market Share

India Events & Exhibition Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Events & Exhibition Market, offering invaluable insights for industry professionals, investors, and strategists. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report forecasts market trends up to 2033. It leverages historical data (2019-2024) and incorporates key developments to paint a vivid picture of this dynamic sector. The market is segmented by end-user, type, and revenue stream, providing a granular understanding of its diverse landscape. The report features a robust analysis of key players, including OML, Vajra Events, Pegasus Events Pvt Ltd, and many more, offering crucial competitive intelligence. The total market size in 2025 is estimated at xx Million.

India Events & Exhibition Market Market Structure & Innovation Trends

The Indian events and exhibition market is characterized by a moderately fragmented structure, with a few large players dominating certain segments. While giants like Wizcraft and Percept Limited command significant market share, numerous smaller and specialized firms cater to niche needs. The market share of the top 5 players is estimated at xx%, indicating room for both organic growth and consolidation. Innovation is driven by the adoption of digital technologies, including virtual and hybrid events, enhancing engagement and accessibility. Government initiatives aimed at promoting tourism and infrastructure development are also positive contributors. The regulatory framework, while generally supportive, needs streamlining to encourage further growth. Product substitutes, primarily in the form of online marketing and virtual conferences, pose a competitive challenge. Mergers and acquisitions (M&A) activity is moderate, with deal values averaging xx Million in recent years. Notable M&A activities include [Insert specific examples if available, otherwise state "Data unavailable for specific M&A activities"]. End-user demographics are shifting, with a growing emphasis on younger, digitally savvy audiences.

India Events & Exhibition Market Market Dynamics & Trends

The Indian events and exhibition market is experiencing robust growth, driven by a burgeoning middle class, rising disposable incomes, and increasing corporate spending on marketing and brand building. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fuelled by several factors, including the increasing adoption of hybrid and virtual event formats, which expand reach and reduce costs. Consumer preferences are shifting towards more immersive and experiential events. Competitive dynamics are intense, with firms vying for market share through innovative offerings, strategic partnerships, and technological advancements. Market penetration of hybrid/virtual events is estimated to reach xx% by 2033. Technological disruptions, such as the metaverse and Web3 technologies, are creating new opportunities for innovative event experiences.

Dominant Regions & Segments in India Events & Exhibition Market

The dominance of specific regions and segments is influenced by factors such as economic activity, infrastructure, and consumer preferences. Metropolitan areas like Mumbai, Delhi, Bangalore, and Chennai are leading hubs for events and exhibitions, benefiting from robust infrastructure and a high concentration of businesses and consumers.

Key Drivers:

- Economic Growth: Strong economic performance drives corporate spending on marketing and events.

- Infrastructure Development: Improved infrastructure facilitates the organization of large-scale events.

- Government Initiatives: Supportive government policies promote tourism and business events.

Dominant Segments:

- By End User: Consumer Goods and Retail consistently leads in terms of event participation and revenue generation due to India's large consumer market and competitive retail sector.

- By Type: B2C events dominate owing to the large consumer base and the nature of many events in the country, attracting large crowds.

- By Revenue Stream: Exhibitor fees form a significant portion of the revenue stream for most event organizers, although sponsorship and entrance fees are also substantial contributors, making up xx% of the total market revenue.

India Events & Exhibition Market Product Innovations

The market is witnessing significant innovation, particularly in the adoption of digital technologies to enhance the event experience. Virtual reality (VR), augmented reality (AR), and artificial intelligence (AI) are being integrated into events to offer immersive and interactive experiences. Hybrid event models combine the benefits of physical and virtual events, broadening reach and accessibility. These innovations are improving engagement, enhancing data analytics, and streamlining event management processes. The market fit for these innovations is strong, aligning with consumer demand for engaging and convenient experiences.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the India Events & Exhibition Market, segmenting it by end-user, type, and revenue stream.

By End User: Consumer Goods and Retail, Automotive and Transportation, Industrial, Entertainment, Real Estate and Property, Hospitality, Healthcare and Pharmaceutical, Other End Users. Each segment exhibits unique growth trajectories and competitive dynamics.

By Type: B2B, B2C, and Mixed/Hybrid events are analyzed, showcasing differing market sizes and growth prospects.

By Revenue Stream: Exhibitor Fee, Sponsorship Fee, Entrance Fee, and Services revenue streams are examined, providing a comprehensive understanding of the revenue generation landscape. Each segment presents distinct growth projections, market sizes, and competitive landscapes.

Key Drivers of India Events & Exhibition Market Growth

Several factors contribute to the India Events & Exhibition Market's robust growth. Firstly, rapid economic growth is leading to higher disposable incomes and increased spending on leisure activities and business events. Secondly, government initiatives promoting tourism and infrastructure development create a favorable environment for events. Thirdly, technological advancements, such as digital event platforms and immersive technologies, are enhancing the event experience and expanding market reach. Finally, a burgeoning middle class with a growing appetite for entertainment and networking opportunities further fuels market expansion.

Challenges in the India Events & Exhibition Market Sector

The sector faces challenges including intense competition, infrastructure limitations in certain regions, and regulatory complexities. Economic downturns can impact corporate spending on events, leading to reduced revenue. Furthermore, the rise of alternative marketing channels poses a threat to the traditional events industry. The impact of these challenges is estimated to reduce the overall market growth by approximately xx% in challenging economic conditions.

Emerging Opportunities in India Events & Exhibition Market

The market presents significant opportunities, particularly in leveraging emerging technologies like the metaverse and Web3 to create unique and immersive event experiences. Growth is anticipated in niche segments, such as sustainable and eco-friendly events. Expansion into Tier 2 and Tier 3 cities holds promise, tapping into underserved markets. The integration of AI-powered analytics can improve event management and optimize ROI.

Leading Players in the India Events & Exhibition Market Market

- Only Much Louder (OML)

- Vajra Events

- Pegasus Events Pvt Ltd

- DNA Entertainment Networks

- Procam Running

- Oxygen Entertainment

- Atrri Events

- Showtime Event

- WoodCraft Event and Entertainment

- ABEC Ltd

- Mex Exhibitions Private Limited

- Informa

- Wow Events

- Cineyug Entertainment Private Limited

- Percept Limited

- 70 EVENT MEDIA GROUP

- Bharat Exhibitions

- HostIndia Events

- E factor Entertainment Pvt Ltd

- Messe Muenchen

- Wizcraft

- TAFCON Projects (India) Pvt Ltd

Key Developments in India Events & Exhibition Market Industry

- April 2023: Qala India launched a fashion exhibition in Indore, showcasing womenswear, menswear, textiles, and lifestyle goods. This event highlights the expanding market for fashion exhibitions in tier-2 cities.

- May 2023: Globe-Tech Media Solutions organized a four-day engineering expo in Pune, demonstrating the growing importance of industry-specific exhibitions.

Future Outlook for India Events & Exhibition Market Market

The India Events & Exhibition Market is poised for continued strong growth, driven by robust economic expansion, technological innovation, and a growing demand for experiential events. Strategic partnerships and investments in digital technologies will be key success factors. The market will witness further diversification with the emergence of niche event formats and expansion into new geographic areas. The market is predicted to reach xx Million by 2033.

India Events & Exhibition Market Segmentation

-

1. Type

- 1.1. B2B

- 1.2. B2C

- 1.3. Mixed/Hybrid

-

2. Reveue Stream

- 2.1. Exhibitor Fee

- 2.2. Sponsorship Fee

- 2.3. Entrance Fee

- 2.4. Services

-

3. End User

- 3.1. Consumer Goods and Retail

- 3.2. Automotive and Transportation

- 3.3. Industrial

- 3.4. Entertainment

- 3.5. Real Estate and Property

- 3.6. Hospitality

- 3.7. Healthcare and Pharmaceutical

- 3.8. Other End Users

India Events & Exhibition Market Segmentation By Geography

- 1. India

India Events & Exhibition Market Regional Market Share

Geographic Coverage of India Events & Exhibition Market

India Events & Exhibition Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Geo-cloning for Exhibition Organizers; Increasing Growth of Consumer Goods Penetrating B2C Exhibition

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Energy-efficient Pumps; Fluctuations in the Price of Raw Materials

- 3.4. Market Trends

- 3.4.1. Growing Adoption of Geo-cloning for Exhibition Organizers is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Events & Exhibition Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. B2B

- 5.1.2. B2C

- 5.1.3. Mixed/Hybrid

- 5.2. Market Analysis, Insights and Forecast - by Reveue Stream

- 5.2.1. Exhibitor Fee

- 5.2.2. Sponsorship Fee

- 5.2.3. Entrance Fee

- 5.2.4. Services

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Consumer Goods and Retail

- 5.3.2. Automotive and Transportation

- 5.3.3. Industrial

- 5.3.4. Entertainment

- 5.3.5. Real Estate and Property

- 5.3.6. Hospitality

- 5.3.7. Healthcare and Pharmaceutical

- 5.3.8. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Only Much Louder (OML)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vajra Events

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pegasus Events Pvt Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DNA Entertainment Networks

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Procam Running

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oxygen Entertainment

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Atrri Events

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Showtime Event

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 WoodCraft Event and Entertainment

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ABEC Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Mex Exhibitions Private Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Informa*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Wow Events

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Cineyug Entertainment Private Limited

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Percept Limited

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 70 EVENT MEDIA GROUP

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Bharat Exhibitions

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 HostIndia Events

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 E factor Entertainment Pvt Ltd

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Messe Muenchen

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Wizcraft

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 TAFCON Projects (India) Pvt Ltd

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.1 Only Much Louder (OML)

List of Figures

- Figure 1: India Events & Exhibition Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Events & Exhibition Market Share (%) by Company 2025

List of Tables

- Table 1: India Events & Exhibition Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Events & Exhibition Market Revenue Million Forecast, by Reveue Stream 2020 & 2033

- Table 3: India Events & Exhibition Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: India Events & Exhibition Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: India Events & Exhibition Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: India Events & Exhibition Market Revenue Million Forecast, by Reveue Stream 2020 & 2033

- Table 7: India Events & Exhibition Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: India Events & Exhibition Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Events & Exhibition Market?

The projected CAGR is approximately 8.31%.

2. Which companies are prominent players in the India Events & Exhibition Market?

Key companies in the market include Only Much Louder (OML), Vajra Events, Pegasus Events Pvt Ltd, DNA Entertainment Networks, Procam Running, Oxygen Entertainment, Atrri Events, Showtime Event, WoodCraft Event and Entertainment, ABEC Ltd, Mex Exhibitions Private Limited, Informa*List Not Exhaustive, Wow Events, Cineyug Entertainment Private Limited, Percept Limited, 70 EVENT MEDIA GROUP, Bharat Exhibitions, HostIndia Events, E factor Entertainment Pvt Ltd, Messe Muenchen, Wizcraft, TAFCON Projects (India) Pvt Ltd.

3. What are the main segments of the India Events & Exhibition Market?

The market segments include Type, Reveue Stream, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.23 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Geo-cloning for Exhibition Organizers; Increasing Growth of Consumer Goods Penetrating B2C Exhibition.

6. What are the notable trends driving market growth?

Growing Adoption of Geo-cloning for Exhibition Organizers is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

; High Cost of Energy-efficient Pumps; Fluctuations in the Price of Raw Materials.

8. Can you provide examples of recent developments in the market?

May 2023 - Globe-Tech Media Solutions announced a four-day-long engineering expo at the Auto Cluster Exhibition Centre in Pune. The Engineering Expo aims to bring together innovative and dynamic stakeholders from the engineering and manufacturing industries, providing industry professionals and buyers with a unique opportunity to exchange ideas and explore the latest trends and technologies in the field.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Events & Exhibition Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Events & Exhibition Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Events & Exhibition Market?

To stay informed about further developments, trends, and reports in the India Events & Exhibition Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence