Key Insights

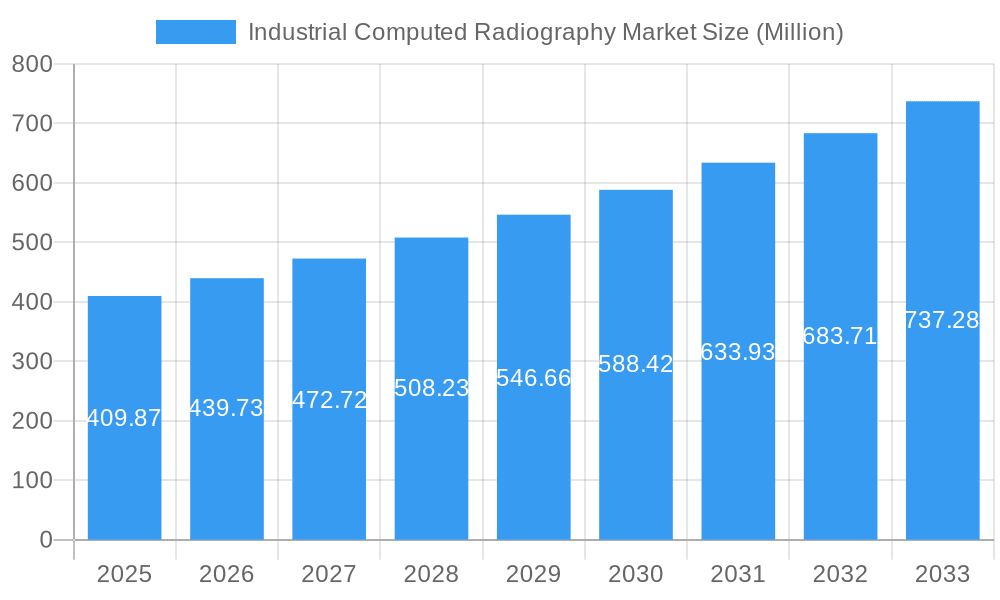

The Industrial Computed Radiography (ICR) market is experiencing robust growth, projected to reach \$409.87 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 6.93% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for non-destructive testing (NDT) in critical industries like oil and gas, petrochemicals, and aerospace, fuels market growth. Stringent quality control regulations and the need for precise defect detection in manufactured components are further propelling adoption. Advancements in ICR technology, including improved image resolution, faster processing speeds, and enhanced software capabilities, are also contributing to market expansion. The integration of digital imaging and data analysis tools is streamlining workflows and improving efficiency, attracting a wider range of users. The market's segmentation reflects the diverse application areas, with oil and gas and petrochemicals remaining dominant sectors due to their reliance on rigorous inspection processes. However, growth is also witnessed in foundries and aerospace & defense sectors driven by increasing safety and quality standards. The competitive landscape comprises established players and emerging companies offering a range of solutions from hardware to software and services. Geographic growth is expected across regions, with North America and Europe maintaining significant market share due to the presence of established industries and a robust regulatory framework. However, the Asia-Pacific region presents a promising growth avenue owing to rapid industrialization and infrastructure development.

Industrial Computed Radiography Market Market Size (In Million)

The projected CAGR indicates a consistent market expansion, anticipated to continue through 2033. While precise regional breakdowns are unavailable, we can infer that North America and Europe will retain a larger share, but rapid industrialization in Asia-Pacific will likely contribute to significantly higher growth percentages in that region. The continued emphasis on safety and quality control across industries ensures the sustained relevance of ICR technology, making it a valuable asset in various sectors. The market is expected to further consolidate, with larger players potentially acquiring smaller companies or expanding their service offerings. This will likely lead to more streamlined, integrated solutions and potentially better pricing structures for end-users. Overall, the ICR market is poised for considerable expansion, driven by technological advancements, increasing regulatory scrutiny, and burgeoning demand across diverse industries.

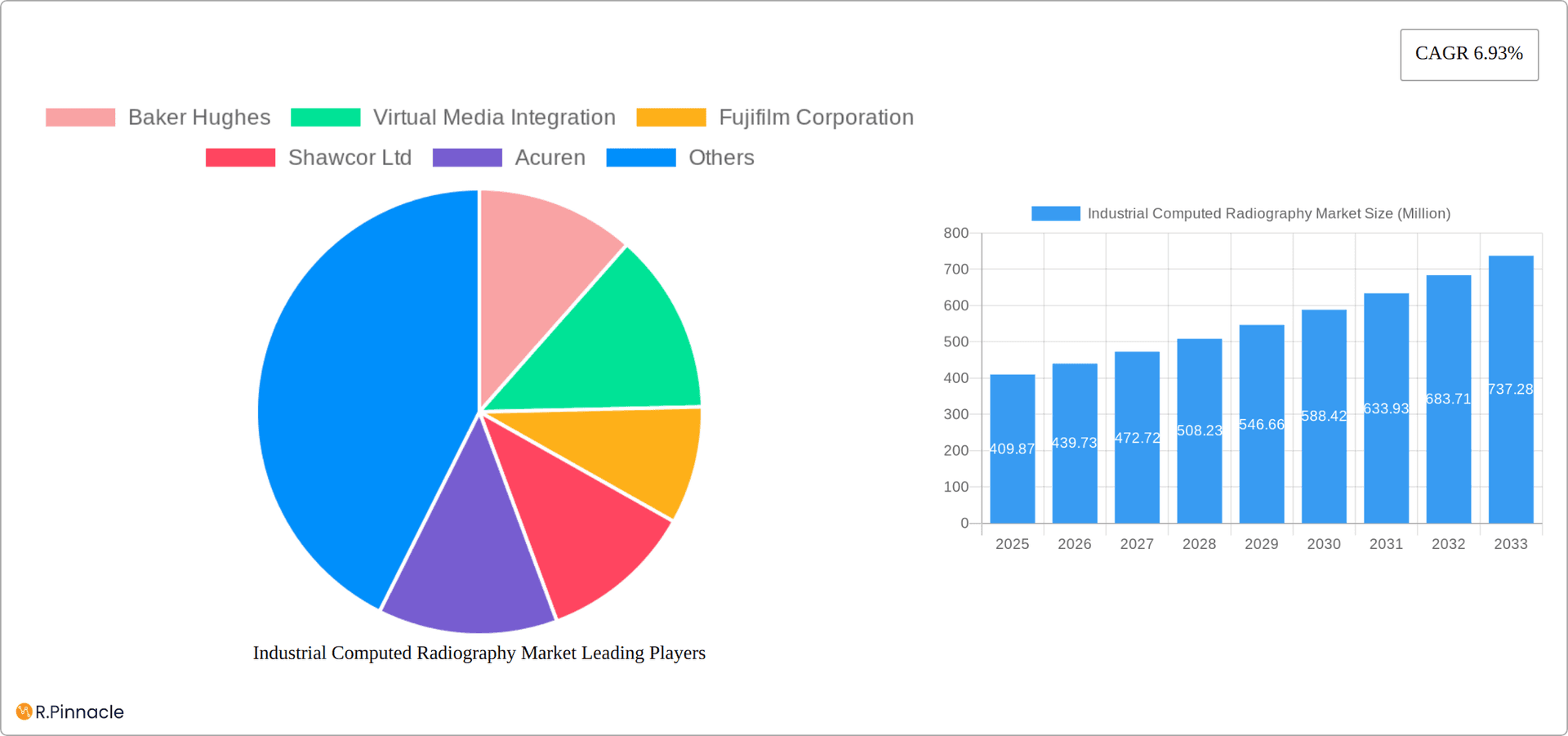

Industrial Computed Radiography Market Company Market Share

This in-depth report provides a comprehensive analysis of the Industrial Computed Radiography (ICR) market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the forecast period (2025-2033) and a base year of 2025. The report is meticulously structured to offer actionable intelligence, utilizing data-driven analysis and incorporating key market developments. Expected market size values are provided in Millions (USD).

Industrial Computed Radiography Market Market Structure & Innovation Trends

The Industrial Computed Radiography (ICR) market presents a dynamic landscape shaped by competitive intensity, technological innovation, regulatory compliance, and evolving market dynamics. While moderately concentrated, with key players commanding significant market share, the sector witnesses growing competition from agile newcomers. This competitive pressure fuels innovation and drives market evolution.

- Market Concentration and Consolidation: The leading five players currently hold approximately [Insert Precise Percentage]% of the market share, indicating a moderately consolidated market. Further consolidation is anticipated through mergers and acquisitions (M&A), driven by strategic advantages and economies of scale. [Insert details on recent M&A activity and projected future activity]

- Innovation Drivers: A Technological Revolution: Advancements in detector technology, sophisticated software algorithms, and powerful data analytics are the primary catalysts for market growth. These innovations translate to improved image quality, faster processing speeds, enhanced remote diagnostics, and more efficient workflow processes. [Include specifics about the latest advancements in each area]

- Regulatory Frameworks and Compliance: Stringent safety and quality standards, especially within sectors like aerospace and defense, significantly influence technological development and market penetration. Meeting compliance requirements entails substantial costs, impacting market dynamics and creating opportunities for providers offering compliant solutions. [Cite specific regulations or standards affecting ICR]

- Competitive Landscape and Product Substitutes: Other non-destructive testing (NDT) methods, such as ultrasonic testing and traditional radiographic film, represent competitive alternatives. However, ICR's superior image quality, efficiency gains, and robust digital data management capabilities often make it the preferred choice across diverse applications. [Provide a comparative analysis of ICR vs. competing NDT methods]

- End-User Demographics and Market Segmentation: Key end-users span various sectors including oil and gas, petrochemicals, foundries, aerospace, defense, and manufacturing. Industry-specific regulatory mandates and operational needs heavily influence market demand. [Elaborate on the specific needs and drivers within each end-user sector]

- M&A Activity and Strategic Partnerships: The past five years have seen notable strategic acquisitions, with an estimated value of [Insert Precise Value] Million. This trend of consolidation is projected to continue, reshaping the competitive landscape and potentially leading to increased pricing power for larger players. [Include details of significant M&A deals and their impact]

Industrial Computed Radiography Market Market Dynamics & Trends

The Industrial Computed Radiography market is experiencing robust growth, driven by increasing demand for efficient and accurate non-destructive testing methods across various industries. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%. This growth is attributed to several key factors:

- Rising demand for enhanced inspection techniques in safety-critical industries: Stringent quality control regulations and safety concerns in sectors like aerospace and oil & gas propel adoption.

- Technological advancements resulting in improved image quality, speed, and data analysis capabilities: This significantly improves efficiency and diagnostic accuracy, leading to higher acceptance.

- Increasing adoption of digitalization and automation across industrial processes: ICR's digital data management capabilities streamline workflows and facilitate remote diagnostics, boosting its appeal.

- Competitive landscape characterized by both established players and emerging entrants: This fosters innovation and competition, resulting in more affordable and feature-rich systems.

Market penetration of ICR is currently at approximately xx% in the global NDT market. This suggests substantial untapped potential for market expansion in the years to come.

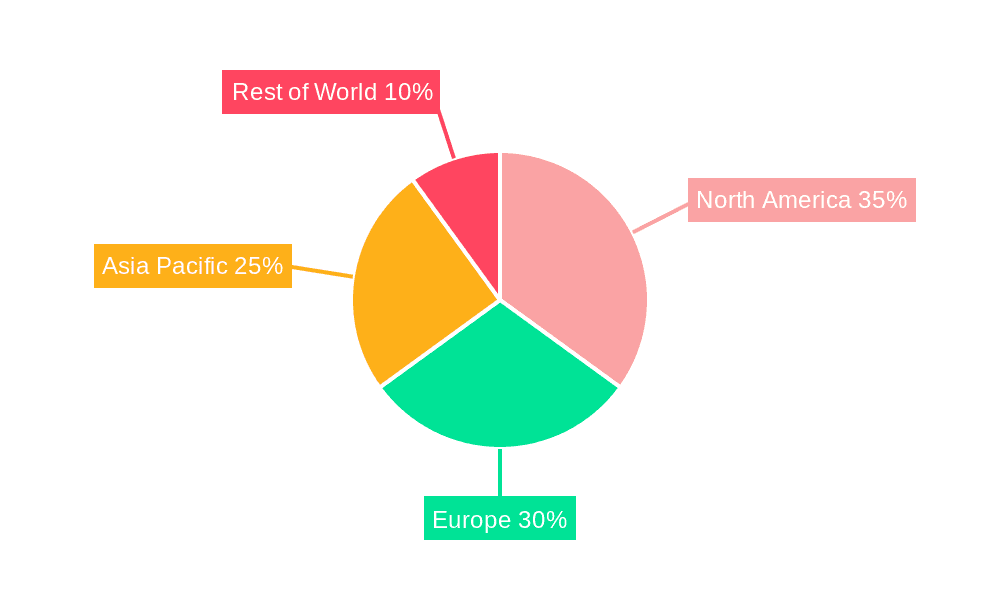

Dominant Regions & Segments in Industrial Computed Radiography Market

The North American region is currently the leading market for Industrial Computed Radiography. The strong presence of major players, stringent industry regulations demanding high-quality inspection processes and significant investment in infrastructure and technology support this dominance.

Key Drivers in North America:

- Robust oil and gas industry with substantial investment in infrastructure maintenance and safety.

- Stringent regulatory frameworks mandating sophisticated NDT techniques.

- Advanced technological infrastructure and skilled workforce.

Other Significant Regions: Europe and Asia-Pacific regions demonstrate significant growth potential, driven by factors such as increasing industrialization, infrastructure development, and government initiatives promoting industrial safety.

The Oil and Gas segment holds the largest market share among applications, due to the demanding safety and regulatory requirements of the industry. However, the Aerospace and Defense segment is experiencing faster growth due to the increasing demand for high-quality inspection and quality control in these safety-critical sectors.

Industrial Computed Radiography Market Product Innovations

Recent product developments focus on enhanced image resolution, faster processing speed, and improved software capabilities. These improvements are enabling more precise defect detection and streamlined workflows. The integration of AI and machine learning algorithms is rapidly improving the automation of image analysis, resulting in higher efficiency and reduced human error. This is making ICR more cost-effective and attractive to a wider range of industries.

Report Scope & Segmentation Analysis

The report segments the Industrial Computed Radiography market primarily by application, providing a granular view of growth drivers and market opportunities within each sector:

- Oil and Gas: This segment exhibits a substantial market size driven by rigorous safety and regulatory standards in both onshore and offshore operations. Growth is projected at [Insert Precise Percentage]% CAGR over the forecast period. [Explain factors driving growth in more detail]

- Petrochemical and Chemical: Quality control and safety necessities within processing and manufacturing facilities underpin the growth of this segment. The CAGR is projected at [Insert Precise Percentage]% during the forecast period. [Provide a detailed explanation for growth projections]

- Foundries: The critical need for defect detection in castings fuels significant growth in this segment, projected at [Insert Precise Percentage]% CAGR. [Provide detailed insights about the foundry sector's growth drivers]

- Aerospace and Defense: Safety-critical applications in aerospace and defense drive robust growth, with a projected [Insert Precise Percentage]% CAGR. [Elaborate on the factors driving this significant growth]

- Other Applications: This encompasses diverse sectors including power generation, automotive, and general manufacturing, with an expected CAGR of [Insert Precise Percentage]%. [Provide a summary of growth drivers in the other applications segment]

Key Drivers of Industrial Computed Radiography Market Growth

The Industrial Computed Radiography market's growth is driven by factors such as stringent safety regulations in various industries, growing demand for efficient NDT methods, and technological advancements leading to improved image quality and processing speed. The increasing adoption of digitalization across industrial processes further accelerates market growth. Government initiatives promoting industrial safety in several regions are also contributing positively.

Challenges in the Industrial Computed Radiography Market Sector

Significant hurdles to market growth include the substantial initial investment required for ICR systems, the need for specialized personnel proficient in system operation and image interpretation, and competition from other NDT methods. Furthermore, supply chain disruptions and fluctuating prices of essential components pose additional challenges. The overall estimated impact of these challenges on market growth is [Insert Precise Percentage]%. [Discuss strategies for mitigating these challenges]

Emerging Opportunities in Industrial Computed Radiography Market

Emerging opportunities lie in the integration of AI and machine learning for automated defect detection, expansion into new applications, and the development of portable and more user-friendly systems. The growing adoption of cloud-based solutions for image storage and analysis also presents significant opportunities. Advancements in detector technology can provide further enhancements in image resolution and speed.

Leading Players in the Industrial Computed Radiography Market Market

- Baker Hughes

- Virtual Media Integration

- Fujifilm Corporation

- Shawcor Ltd

- Acuren

- Applus Services Sa

- Bluestar Limited

- Durr Ndt Gmbh & Co Kg

- Rigaku Corporation

Key Developments in Industrial Computed Radiography Market Industry

- February 2022: Carestream Health India's launch of the DRX Compass digital radiology solution significantly impacted the market by introducing enhanced efficiency and greater configuration flexibility, catering to diverse needs of radiology facilities. [Add further details on the impact and market reception]

- March 2022: While not directly related to ICR, Blue Star's launch of new air conditioning models reflects a broader trend of technological advancement and product diversification within the Indian market. This suggests a potential for parallel innovations within the ICR sector, highlighting opportunities for related technological integrations and improvements. [Explain the relevance of this development to the ICR market]

- [Add more recent key developments with detailed descriptions and impact analysis]

Future Outlook for Industrial Computed Radiography Market Market

The Industrial Computed Radiography market is poised for sustained growth, propelled by technological advancements, increasing demand for superior NDT solutions across industries, and supportive regulatory environments. Strategic alliances, investments in research and development (R&D), and expansion into novel applications will be pivotal for companies aiming to capitalize on emerging opportunities. The market anticipates considerable expansion across all segments, fueled by the adoption of advanced digital technologies and ongoing industry consolidation. [Add projections for future market size and potential growth areas]

Industrial Computed Radiography Market Segmentation

-

1. Applications

- 1.1. Oil and Gas

- 1.2. Petrochemical and Chemical

- 1.3. Foundries

- 1.4. Aerospace and Defense

- 1.5. Other Applications

Industrial Computed Radiography Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Industrial Computed Radiography Market Regional Market Share

Geographic Coverage of Industrial Computed Radiography Market

Industrial Computed Radiography Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.93% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increasing Demand for Decreasing the Exposure to Radiation; Growing Need for Nondestructive Testing

- 3.3. Market Restrains

- 3.3.1. High Installation Costs

- 3.4. Market Trends

- 3.4.1. Nondestructive Testing Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Computed Radiography Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Applications

- 5.1.1. Oil and Gas

- 5.1.2. Petrochemical and Chemical

- 5.1.3. Foundries

- 5.1.4. Aerospace and Defense

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Applications

- 6. North America Industrial Computed Radiography Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Applications

- 6.1.1. Oil and Gas

- 6.1.2. Petrochemical and Chemical

- 6.1.3. Foundries

- 6.1.4. Aerospace and Defense

- 6.1.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Applications

- 7. Europe Industrial Computed Radiography Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Applications

- 7.1.1. Oil and Gas

- 7.1.2. Petrochemical and Chemical

- 7.1.3. Foundries

- 7.1.4. Aerospace and Defense

- 7.1.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Applications

- 8. Asia Pacific Industrial Computed Radiography Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Applications

- 8.1.1. Oil and Gas

- 8.1.2. Petrochemical and Chemical

- 8.1.3. Foundries

- 8.1.4. Aerospace and Defense

- 8.1.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Applications

- 9. Rest of the World Industrial Computed Radiography Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Applications

- 9.1.1. Oil and Gas

- 9.1.2. Petrochemical and Chemical

- 9.1.3. Foundries

- 9.1.4. Aerospace and Defense

- 9.1.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Applications

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Baker Hughes

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Virtual Media Integration

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Fujifilm Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Shawcor Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Acuren

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Applus Services Sa

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Bluestar Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Durr Ndt Gmbh & Co Kg

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Rigaku Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Baker Hughes

List of Figures

- Figure 1: Global Industrial Computed Radiography Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Industrial Computed Radiography Market Revenue (Million), by Applications 2025 & 2033

- Figure 3: North America Industrial Computed Radiography Market Revenue Share (%), by Applications 2025 & 2033

- Figure 4: North America Industrial Computed Radiography Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Industrial Computed Radiography Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Industrial Computed Radiography Market Revenue (Million), by Applications 2025 & 2033

- Figure 7: Europe Industrial Computed Radiography Market Revenue Share (%), by Applications 2025 & 2033

- Figure 8: Europe Industrial Computed Radiography Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Industrial Computed Radiography Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Industrial Computed Radiography Market Revenue (Million), by Applications 2025 & 2033

- Figure 11: Asia Pacific Industrial Computed Radiography Market Revenue Share (%), by Applications 2025 & 2033

- Figure 12: Asia Pacific Industrial Computed Radiography Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Industrial Computed Radiography Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Industrial Computed Radiography Market Revenue (Million), by Applications 2025 & 2033

- Figure 15: Rest of the World Industrial Computed Radiography Market Revenue Share (%), by Applications 2025 & 2033

- Figure 16: Rest of the World Industrial Computed Radiography Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Industrial Computed Radiography Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Computed Radiography Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 2: Global Industrial Computed Radiography Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Industrial Computed Radiography Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 4: Global Industrial Computed Radiography Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Industrial Computed Radiography Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 6: Global Industrial Computed Radiography Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Industrial Computed Radiography Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 8: Global Industrial Computed Radiography Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Industrial Computed Radiography Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 10: Global Industrial Computed Radiography Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Computed Radiography Market?

The projected CAGR is approximately 6.93%.

2. Which companies are prominent players in the Industrial Computed Radiography Market?

Key companies in the market include Baker Hughes, Virtual Media Integration, Fujifilm Corporation, Shawcor Ltd, Acuren, Applus Services Sa, Bluestar Limited, Durr Ndt Gmbh & Co Kg, Rigaku Corporation.

3. What are the main segments of the Industrial Computed Radiography Market?

The market segments include Applications.

4. Can you provide details about the market size?

The market size is estimated to be USD 409.87 Million as of 2022.

5. What are some drivers contributing to market growth?

The Increasing Demand for Decreasing the Exposure to Radiation; Growing Need for Nondestructive Testing.

6. What are the notable trends driving market growth?

Nondestructive Testing Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

High Installation Costs.

8. Can you provide examples of recent developments in the market?

March 2022 - Blue Star, India's premier air conditioning brand, released cheap yet best-in-class distinctive' split ACs. The company has released over 50 models in the inverter, fixed speed, and window AC categories.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Computed Radiography Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Computed Radiography Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Computed Radiography Market?

To stay informed about further developments, trends, and reports in the Industrial Computed Radiography Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence