Key Insights

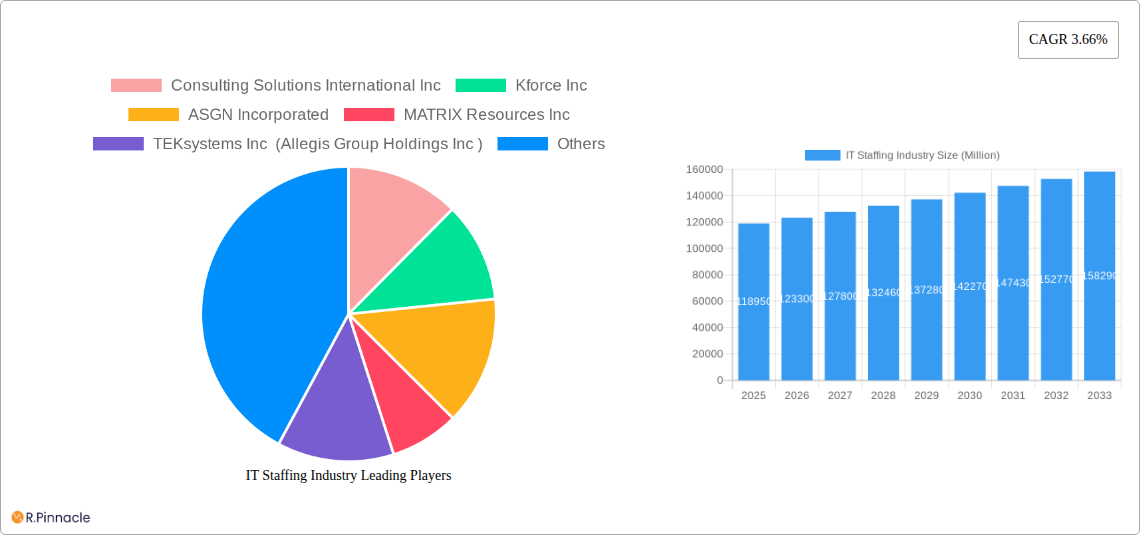

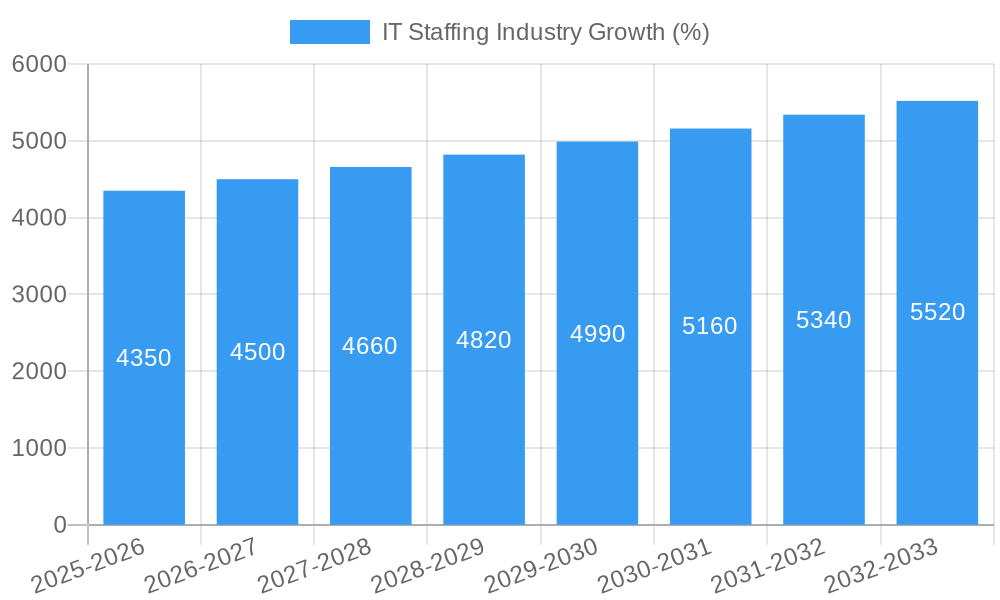

The IT staffing industry, valued at $118.95 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 3.66% from 2025 to 2033. This growth is fueled by several key factors. The increasing digital transformation initiatives across various sectors, including telecom, BFSI (Banking, Financial Services, and Insurance), healthcare, manufacturing, and retail, are driving significant demand for skilled IT professionals. The shortage of qualified talent in areas like software development, data science, cybersecurity, and cloud computing further intensifies this demand, creating lucrative opportunities for IT staffing firms. Technological advancements, such as the rise of artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT), are also contributing to the expanding market, necessitating specialized expertise and driving the need for flexible staffing solutions.

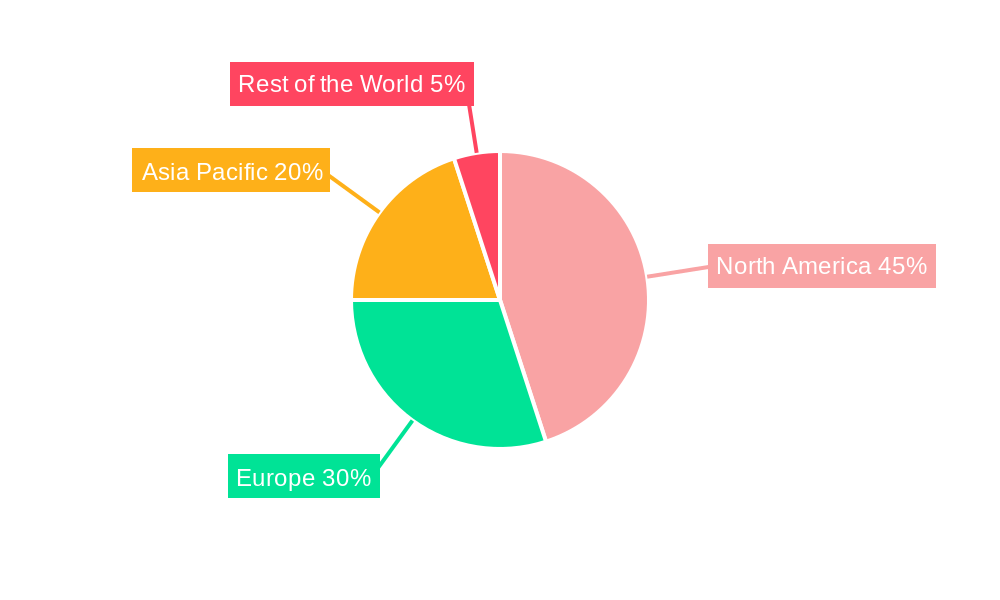

Competition within the industry is fierce, with established players like Consulting Solutions International Inc., Kforce Inc., and TEKsystems Inc. vying for market share alongside numerous smaller, specialized firms. Geographic distribution shows a significant presence in North America and Europe, while the Asia-Pacific region is experiencing rapid growth, presenting a promising market for expansion. However, challenges remain. Fluctuations in the global economy and potential skill gaps in emerging technologies could impact growth. Moreover, the increasing adoption of automation and AI in recruitment processes could affect the traditional IT staffing model, necessitating adaptation and innovation from industry players. The ability to leverage data analytics, improve candidate sourcing, and offer value-added services, such as training and upskilling programs, will be crucial for success in this dynamic market.

IT Staffing Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the IT staffing industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a focus on market size, segmentation, competitive landscape, and future trends, this report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The report analyzes a market valued at over $XX Million in 2025, expected to reach $XX Million by 2033.

IT Staffing Industry Market Structure & Innovation Trends

The IT staffing industry is characterized by a moderately concentrated market structure, with a handful of major players commanding significant market share. Companies like Consulting Solutions International Inc, Kforce Inc, ASGN Incorporated, MATRIX Resources Inc, TEKsystems Inc (Allegis Group Holdings Inc), Randstad NV, NTT DATA Corporation, Artech Information Systems LLC, Insight Global LLC, and Beacon Hill Staffing Group represent a significant portion of the market, although the industry also houses numerous smaller, specialized firms. Market share data varies across segments and regions, with some players dominating specific skill sets or end-user industries. Innovation is driven by technological advancements, particularly in areas like AI-driven recruitment tools, remote work solutions, and specialized skills development programs. The regulatory landscape influences practices related to data privacy, fair employment, and contractor classification. Product substitutes include internal recruitment efforts and freelance platforms, which pose a competitive threat, while mergers and acquisitions (M&A) are frequent, often involving significant deal values in the $XX Million range, reflecting industry consolidation and expansion strategies.

- Market Concentration: Moderately concentrated, with top 10 players holding xx% market share (2025 estimate).

- M&A Activity: Significant; Recent deals valued at $XX Million.

- Innovation Drivers: AI, remote work solutions, skills development programs.

- Regulatory Framework: Data privacy, fair employment, contractor classification.

IT Staffing Industry Market Dynamics & Trends

The IT staffing market exhibits robust growth, driven by the increasing demand for skilled IT professionals across various sectors. The Compound Annual Growth Rate (CAGR) is projected at xx% during the forecast period (2025-2033). Technological disruptions, such as cloud computing, big data analytics, and cybersecurity, continue to fuel demand for specialized skill sets, impacting market penetration rates. Consumer preferences, particularly for flexible work arrangements and specialized expertise, are reshaping the industry. Competitive dynamics are marked by innovation, strategic partnerships, and acquisitions. Key factors like global economic growth and government investment in IT infrastructure also contribute to overall market expansion. The increasing adoption of digital transformation initiatives across various industries is a prominent driver for this consistent growth.

Dominant Regions & Segments in IT Staffing Industry

The IT staffing market demonstrates regional variations in growth and dominance. While North America holds a significant share due to a robust IT sector and high technological adoption, Asia-Pacific is witnessing rapid expansion fueled by economic growth and a burgeoning tech industry.

By Skill Set:

- Software Developers: High demand, driven by digital transformation initiatives.

- Testers: Strong growth, driven by the need for quality assurance.

- Systems Analysts: Consistent demand, driven by business process optimization.

- Technical Support Professionals: High demand, fueled by the increasing reliance on technology.

- Networking and Security Experts: Rapid growth, driven by cybersecurity threats.

By End-user Industry:

- Telecom: High demand for specialized skills in network infrastructure and cybersecurity.

- BFSI (Banking, Financial Services, and Insurance): Strong growth, driven by digital transformation and regulatory compliance needs.

- Healthcare: Significant demand, particularly in areas such as electronic health records and telehealth.

- Manufacturing: Growing demand, driven by automation and Industry 4.0 initiatives.

Key drivers include government policies promoting IT development, technological advancements, and the robust economic growth in specific regions. The dominance of certain regions and segments is attributed to factors such as robust IT infrastructure, a skilled workforce, and high technological adoption rates.

IT Staffing Industry Product Innovations

Recent innovations include AI-powered recruitment platforms that optimize candidate matching and streamline the hiring process. These platforms improve efficiency and reduce time-to-hire. Furthermore, the rise of specialized staffing agencies focusing on niche skills like AI, machine learning, and cybersecurity demonstrates the adaptation to market demands. This increased specialization allows for a better fit between candidate skill sets and employer requirements, leading to better retention rates and project successes.

Report Scope & Segmentation Analysis

This report segments the IT staffing market by skill set (Software Developers, Testers, Systems Analysts, Technical Support Professionals, Networking and Security Experts, Other Skill Sets) and by end-user industry (Telecom, BFSI, Healthcare, Manufacturing, Retail, Other End-user Industries). Each segment’s growth projections, market size, and competitive dynamics are analyzed. Market size projections are provided for each segment, highlighting growth rates and competitive intensities.

Key Drivers of IT Staffing Industry Growth

Several factors propel the IT staffing industry's growth. Technological advancements consistently create demand for specialized skills. Economic expansion in key regions fuels investment in IT infrastructure and digital transformation initiatives. Government regulations, particularly those related to data privacy and cybersecurity, further drive the demand for specialized professionals. The rapid adoption of cloud computing and the ongoing digitalization of various industries, particularly healthcare and BFSI, also significantly contribute to the sector’s growth.

Challenges in the IT Staffing Industry Sector

The IT staffing industry faces challenges such as a global shortage of skilled professionals, leading to increased competition for talent and upward pressure on salaries. Supply chain disruptions can impact the availability of certain skill sets. Regulatory changes and evolving compliance requirements also add to operational complexities. Finally, intense competition from both established players and emerging players adds another layer of complexity. These challenges lead to increased operational costs and potential for reduced profit margins.

Emerging Opportunities in IT Staffing Industry

Emerging opportunities lie in the growing demand for specialized skills in emerging technologies, like AI, machine learning, blockchain, and cybersecurity. The expansion of the gig economy presents opportunities for flexible staffing solutions. The increased focus on diversity, equity, and inclusion presents opportunities for agencies to leverage diverse talent pools and improve ethical recruitment practices. Expanding into new and developing markets also presents significant opportunities for expansion and market diversification.

Leading Players in the IT Staffing Industry Market

- Consulting Solutions International Inc

- Kforce Inc (Kforce Inc)

- ASGN Incorporated (ASGN Incorporated)

- MATRIX Resources Inc

- TEKsystems Inc (Allegis Group Holdings Inc) (TEKsystems)

- Randstad NV (Randstad)

- NTT DATA Corporation (NTT DATA)

- Artech Information Systems LLC

- Insight Global LLC

- Beacon Hill Staffing Group

Key Developments in IT Staffing Industry

- October 2022: ASGN Incorporated acquired Iron Vine Security, expanding its cybersecurity capabilities.

- July 2022: Major IT companies in India hired 59,700 IT professionals, indicating strong regional growth.

- January 2022: Kelly Services partnered with Toyota, implementing DEI initiatives and a second-chance program for job applicants.

Future Outlook for IT Staffing Industry Market

The IT staffing industry is poised for sustained growth, driven by continued technological advancements and the increasing reliance on technology across all sectors. Strategic opportunities exist in specializing in emerging technologies, expanding into new markets, and leveraging data-driven recruitment strategies. The market's future hinges on adapting to evolving technological landscapes, addressing skills gaps, and capitalizing on the increasing demand for specialized IT expertise.

IT Staffing Industry Segmentation

-

1. Skill Set

- 1.1. Software Developer

- 1.2. Testers

- 1.3. Systems Analyst

- 1.4. Technical Support Professionals

- 1.5. Networking and Security Experts

- 1.6. Other Skill Sets

-

2. End-user Industry

- 2.1. Telecom

- 2.2. BFSI

- 2.3. Healthcare

- 2.4. Manufacturing

- 2.5. Retail

- 2.6. Other End-user Industries

IT Staffing Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

IT Staffing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.66% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The emergence of Technologies(AI and IoT); Increasing Outsourcing of HR activities

- 3.3. Market Restrains

- 3.3.1. Talent Shortages in Specific Technologies

- 3.4. Market Trends

- 3.4.1. Software Developers Segment Expected to Generate Considerable Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global IT Staffing Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Skill Set

- 5.1.1. Software Developer

- 5.1.2. Testers

- 5.1.3. Systems Analyst

- 5.1.4. Technical Support Professionals

- 5.1.5. Networking and Security Experts

- 5.1.6. Other Skill Sets

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Telecom

- 5.2.2. BFSI

- 5.2.3. Healthcare

- 5.2.4. Manufacturing

- 5.2.5. Retail

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Skill Set

- 6. North America IT Staffing Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Skill Set

- 6.1.1. Software Developer

- 6.1.2. Testers

- 6.1.3. Systems Analyst

- 6.1.4. Technical Support Professionals

- 6.1.5. Networking and Security Experts

- 6.1.6. Other Skill Sets

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Telecom

- 6.2.2. BFSI

- 6.2.3. Healthcare

- 6.2.4. Manufacturing

- 6.2.5. Retail

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Skill Set

- 7. Europe IT Staffing Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Skill Set

- 7.1.1. Software Developer

- 7.1.2. Testers

- 7.1.3. Systems Analyst

- 7.1.4. Technical Support Professionals

- 7.1.5. Networking and Security Experts

- 7.1.6. Other Skill Sets

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Telecom

- 7.2.2. BFSI

- 7.2.3. Healthcare

- 7.2.4. Manufacturing

- 7.2.5. Retail

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Skill Set

- 8. Asia Pacific IT Staffing Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Skill Set

- 8.1.1. Software Developer

- 8.1.2. Testers

- 8.1.3. Systems Analyst

- 8.1.4. Technical Support Professionals

- 8.1.5. Networking and Security Experts

- 8.1.6. Other Skill Sets

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Telecom

- 8.2.2. BFSI

- 8.2.3. Healthcare

- 8.2.4. Manufacturing

- 8.2.5. Retail

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Skill Set

- 9. Rest of the World IT Staffing Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Skill Set

- 9.1.1. Software Developer

- 9.1.2. Testers

- 9.1.3. Systems Analyst

- 9.1.4. Technical Support Professionals

- 9.1.5. Networking and Security Experts

- 9.1.6. Other Skill Sets

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Telecom

- 9.2.2. BFSI

- 9.2.3. Healthcare

- 9.2.4. Manufacturing

- 9.2.5. Retail

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Skill Set

- 10. North America IT Staffing Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe IT Staffing Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific IT Staffing Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World IT Staffing Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Consulting Solutions International Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Kforce Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 ASGN Incorporated

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 MATRIX Resources Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 TEKsystems Inc (Allegis Group Holdings Inc )

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Randstad NV

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 NTT DATA Corporation

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Artech Information Systems LLC

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Insight Global LLC

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Beacon Hill Staffing Group*List Not Exhaustive

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Consulting Solutions International Inc

List of Figures

- Figure 1: Global IT Staffing Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America IT Staffing Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America IT Staffing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe IT Staffing Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe IT Staffing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific IT Staffing Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific IT Staffing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World IT Staffing Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World IT Staffing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America IT Staffing Industry Revenue (Million), by Skill Set 2024 & 2032

- Figure 11: North America IT Staffing Industry Revenue Share (%), by Skill Set 2024 & 2032

- Figure 12: North America IT Staffing Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 13: North America IT Staffing Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 14: North America IT Staffing Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America IT Staffing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe IT Staffing Industry Revenue (Million), by Skill Set 2024 & 2032

- Figure 17: Europe IT Staffing Industry Revenue Share (%), by Skill Set 2024 & 2032

- Figure 18: Europe IT Staffing Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 19: Europe IT Staffing Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 20: Europe IT Staffing Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe IT Staffing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific IT Staffing Industry Revenue (Million), by Skill Set 2024 & 2032

- Figure 23: Asia Pacific IT Staffing Industry Revenue Share (%), by Skill Set 2024 & 2032

- Figure 24: Asia Pacific IT Staffing Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 25: Asia Pacific IT Staffing Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 26: Asia Pacific IT Staffing Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific IT Staffing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World IT Staffing Industry Revenue (Million), by Skill Set 2024 & 2032

- Figure 29: Rest of the World IT Staffing Industry Revenue Share (%), by Skill Set 2024 & 2032

- Figure 30: Rest of the World IT Staffing Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 31: Rest of the World IT Staffing Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 32: Rest of the World IT Staffing Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World IT Staffing Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global IT Staffing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global IT Staffing Industry Revenue Million Forecast, by Skill Set 2019 & 2032

- Table 3: Global IT Staffing Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global IT Staffing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global IT Staffing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: IT Staffing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global IT Staffing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: IT Staffing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global IT Staffing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: IT Staffing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global IT Staffing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: IT Staffing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global IT Staffing Industry Revenue Million Forecast, by Skill Set 2019 & 2032

- Table 14: Global IT Staffing Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Global IT Staffing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global IT Staffing Industry Revenue Million Forecast, by Skill Set 2019 & 2032

- Table 17: Global IT Staffing Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 18: Global IT Staffing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global IT Staffing Industry Revenue Million Forecast, by Skill Set 2019 & 2032

- Table 20: Global IT Staffing Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 21: Global IT Staffing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global IT Staffing Industry Revenue Million Forecast, by Skill Set 2019 & 2032

- Table 23: Global IT Staffing Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 24: Global IT Staffing Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the IT Staffing Industry?

The projected CAGR is approximately 3.66%.

2. Which companies are prominent players in the IT Staffing Industry?

Key companies in the market include Consulting Solutions International Inc, Kforce Inc, ASGN Incorporated, MATRIX Resources Inc, TEKsystems Inc (Allegis Group Holdings Inc ), Randstad NV, NTT DATA Corporation, Artech Information Systems LLC, Insight Global LLC, Beacon Hill Staffing Group*List Not Exhaustive.

3. What are the main segments of the IT Staffing Industry?

The market segments include Skill Set, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 118.95 Million as of 2022.

5. What are some drivers contributing to market growth?

The emergence of Technologies(AI and IoT); Increasing Outsourcing of HR activities.

6. What are the notable trends driving market growth?

Software Developers Segment Expected to Generate Considerable Demand.

7. Are there any restraints impacting market growth?

Talent Shortages in Specific Technologies.

8. Can you provide examples of recent developments in the market?

October 2022 - ASGN Incorporated, one of the leading providers of IT services and solutions in the commercial and government sectors, including technology and creative digital marketing, announced the acquisition of Iron Vine Security, one of the leading cybersecurity company designs, implements, and executes cybersecurity programs for federal customers. ECS Federal, LLC, ASGN's Federal Government Segment, will integrate Iron Vine's staff of approximately 230 specialists.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "IT Staffing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the IT Staffing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the IT Staffing Industry?

To stay informed about further developments, trends, and reports in the IT Staffing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence