Key Insights

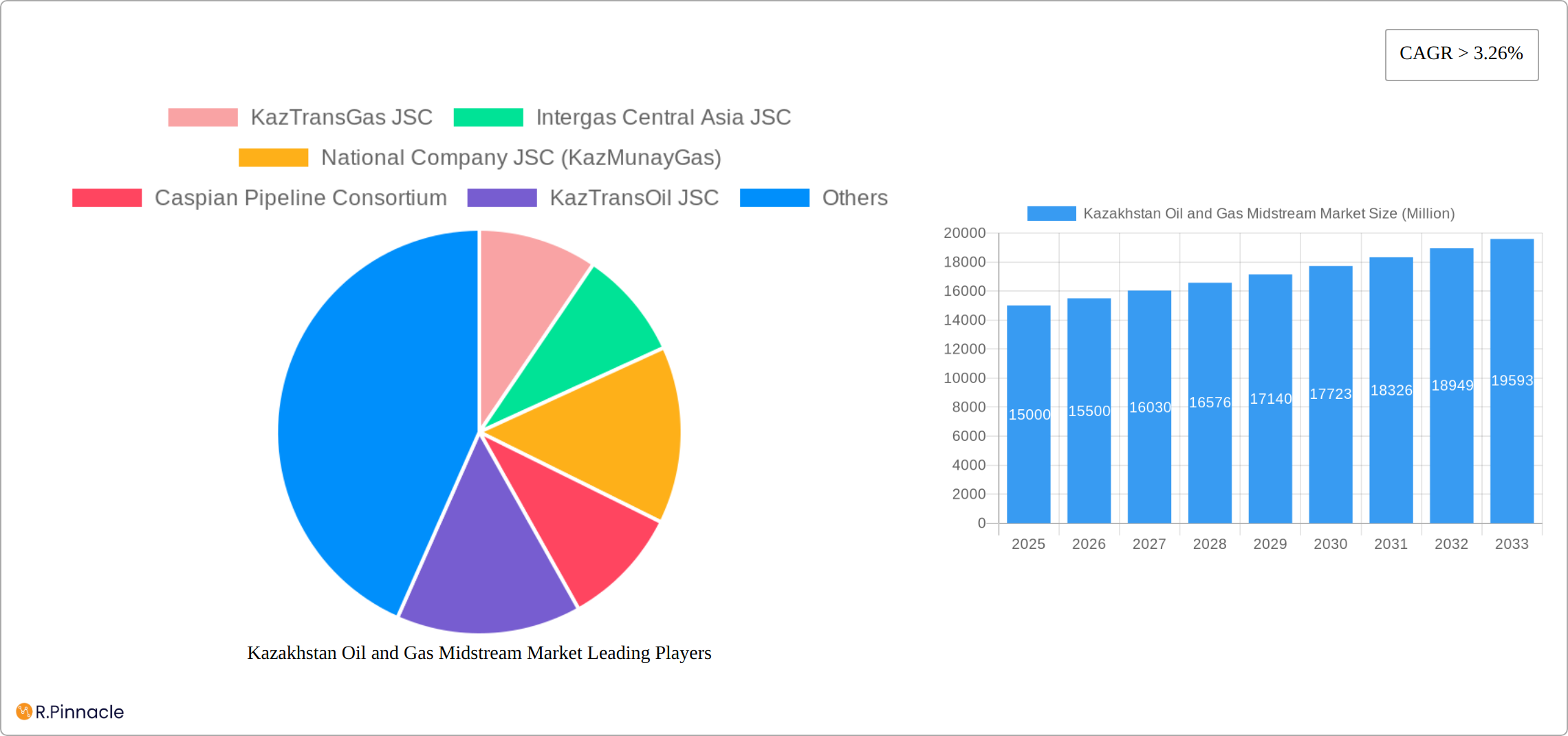

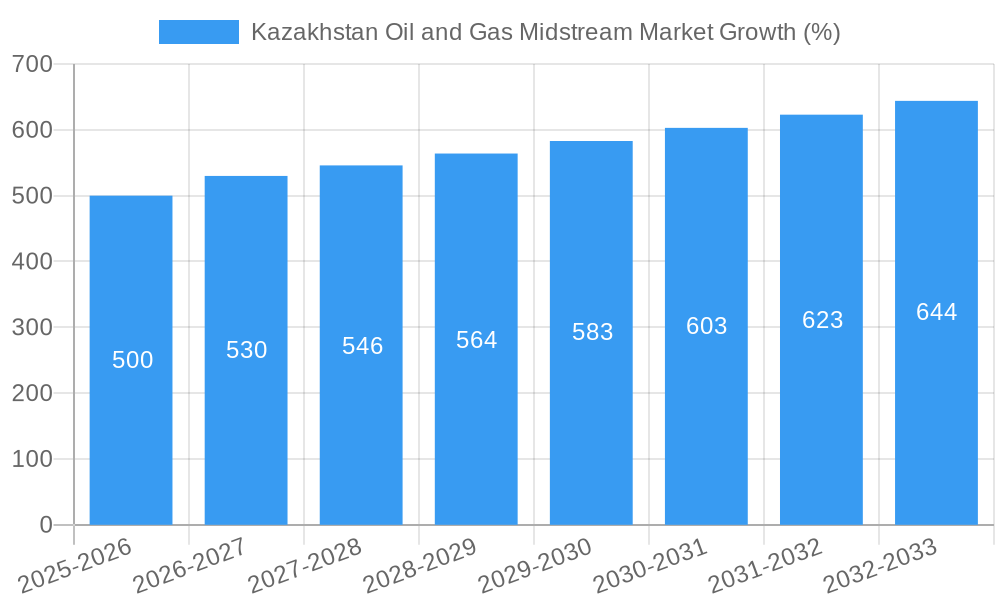

The Kazakhstan oil and gas midstream market, encompassing pipelines, storage facilities, and gas processing plants for oil and gas, presents a significant investment opportunity. Driven by increasing domestic energy consumption and robust export demand from neighboring countries in Asia, particularly China, the market is experiencing substantial growth. A Compound Annual Growth Rate (CAGR) exceeding 3.26% from 2019 to 2024 suggests a strong historical trajectory. This growth is fueled by ongoing investments in infrastructure modernization and expansion, aimed at improving transportation efficiency and capacity to meet rising energy needs. Key players like KazTransGas JSC, Intergas Central Asia JSC, and KazMunayGas are actively involved in this expansion, further solidifying the market's position. However, geopolitical factors and the global energy transition towards renewables pose potential restraints. While the market's future growth trajectory depends on global energy demand and government policies, the existing infrastructure and the strategic location of Kazakhstan within the Eurasian energy landscape position the country favorably. The increasing focus on natural gas as a cleaner alternative to coal in regional energy mixes and the ongoing development of new pipelines to serve international markets are likely to accelerate future growth.

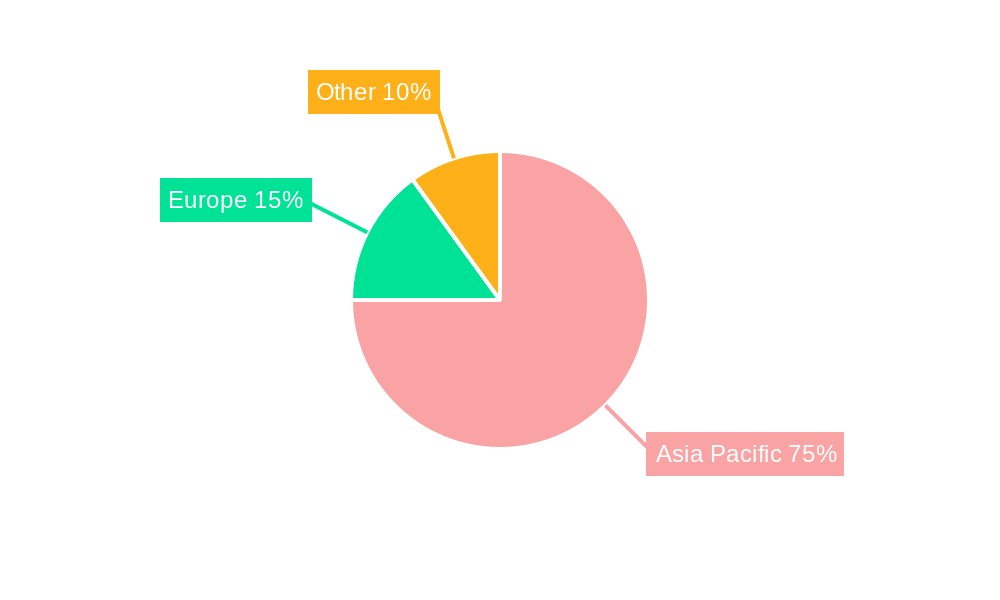

The segmentation of the Kazakhstan oil and gas midstream market reveals the pipeline infrastructure segment as currently dominant, given the significant role it plays in transporting oil and gas both domestically and internationally. Growth in the gas processing plants segment is anticipated to be particularly robust, driven by increased demand for natural gas and the development of associated petrochemical industries. The storage facilities segment is expected to experience moderate growth, driven primarily by the need to maintain reliable supply security. The Asia-Pacific region, specifically China, Japan, India, and South Korea, serves as the primary export market for Kazakhstani oil and gas, providing a key driver for midstream expansion. Market size estimations for 2025 and beyond must consider the CAGR, current market size (estimated based on industry knowledge), and potential impacts of both positive (infrastructure investments, increased export demand) and negative (geopolitical uncertainty, renewable energy adoption) factors. This necessitates continuous monitoring of the geopolitical landscape, as well as the implementation of new technologies that may influence the sector's future development.

Kazakhstan Oil and Gas Midstream Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Kazakhstan oil and gas midstream market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, growth drivers, challenges, and opportunities. The report leverages extensive data and analysis to project a xx Million market size by 2033, providing a clear roadmap for navigating this dynamic sector.

Kazakhstan Oil and Gas Midstream Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Kazakhstan oil and gas midstream market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. We delve into the market share of key players, including KazTransGas JSC, Intergas Central Asia JSC, National Company JSC (KazMunayGas), Caspian Pipeline Consortium, and KazTransOil JSC, quantifying their influence on the overall market.

- Market Concentration: The market exhibits a [Describe the level of market concentration - e.g., high, moderate, low] concentration, with [mention percentage] market share controlled by the top three players.

- Innovation Drivers: Technological advancements in pipeline management, automation of gas processing plants, and the adoption of smart storage solutions are key innovation drivers. Government initiatives promoting energy efficiency also play a significant role.

- Regulatory Framework: The regulatory environment significantly impacts market dynamics, influencing investment decisions and operational strategies. We analyze the impact of current regulations and forecast potential changes.

- Product Substitutes: The report explores potential substitutes for traditional oil and gas midstream infrastructure, analyzing their potential impact on market share.

- End-User Demographics: The report identifies key end-users of midstream services, analyzing their demand patterns and preferences.

- M&A Activities: We analyze recent M&A activities, including deal values and their implications for market consolidation, with estimated M&A deal values totaling xx Million in the past five years.

Kazakhstan Oil and Gas Midstream Market Dynamics & Trends

This section explores the key dynamics shaping the Kazakhstan oil and gas midstream market. We analyze market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The report projects a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by factors such as [mention specific drivers, e.g., increasing energy demand, government investments in infrastructure]. Market penetration for [mention specific service or technology] is projected to reach xx% by 2033. Detailed analysis of evolving consumer preferences and competitive strategies will be provided, including discussions on pricing strategies, capacity expansion plans, and market entry strategies of key players.

Dominant Regions & Segments in Kazakhstan Oil and Gas Midstream Market

This section pinpoints the dominant regions and segments within the Kazakhstan oil and gas midstream market. Analysis considers type of product (oil and gas) and type of infrastructure (pipelines, storage facilities, and gas processing plants).

Dominant Region: [Specify the dominant region – e.g., West Kazakhstan]

- Key Drivers:

- Favorable government policies supporting infrastructure development.

- Abundant oil and gas reserves.

- Existing robust pipeline network.

- Proximity to major export routes.

Dominant Segment: [Specify dominant segment, considering both product and infrastructure - e.g., Oil Pipelines]

- Key Drivers:

- High demand for oil exports.

- Significant investments in pipeline expansion projects.

- Strategic location facilitating export to global markets.

Further detailed analysis will cover dominance in other segments (gas pipelines, gas processing plants, oil storage facilities, etc.), incorporating aspects of regional distribution of infrastructure and output.

Kazakhstan Oil and Gas Midstream Market Product Innovations

The Kazakhstan oil and gas midstream sector is experiencing a wave of innovative product development, driven by the imperative to enhance operational efficiency, reduce costs, and bolster safety standards. Key advancements include the widespread adoption of smart pipeline monitoring systems that leverage AI and IoT for real-time leak detection and integrity assessment, thereby minimizing downtime and environmental risks. In gas processing, the integration of modular and automated processing plants is gaining traction, allowing for flexible capacity expansion and optimized hydrocarbon recovery. Furthermore, advancements in advanced materials for pipeline construction are improving durability and reducing maintenance needs. These technological leaps are not only strengthening the competitive position of midstream operators but are also instrumental in supporting Kazakhstan's role as a significant energy producer and transit hub.

Report Scope & Segmentation Analysis

This comprehensive report offers an in-depth analysis of the Kazakhstan oil and gas midstream market, meticulously segmented to provide granular insights. The segmentation encompasses:

- Type of Product: Analyzing the distinct growth trajectories and market dynamics for both Crude Oil Midstream (transportation, storage, and terminaling) and Natural Gas Midstream (gathering, processing, transportation, and storage). Projections will detail market size, key players, and competitive advantages within each product segment.

- Type of Infrastructure: A detailed examination of the market for Pipelines (oil, gas, and product), Storage Facilities (terminals, tank farms, underground storage), and Gas Processing Plants (NGL extraction, treatment, and fractionation). The analysis will highlight market size, growth forecasts, and the competitive landscape for each infrastructure type, with a specific focus on how technological advancements are reshaping their development and operation.

- Value Chain Stage: Further segmentation into Gathering and Processing, Transportation, and Storage and Distribution, allowing for a nuanced understanding of market dynamics at each critical stage of the midstream value chain.

Key Drivers of Kazakhstan Oil and Gas Midstream Market Growth

Several potent forces are propelling the expansion of Kazakhstan's oil and gas midstream market. Foremost among these are sustained and significant investments in critical infrastructure development, driven by both national strategic imperatives and increasing foreign direct investment. The robust growth in domestic energy consumption, fueled by industrialization and population increase, alongside the country's continued role as a vital oil and gas exporter, creates an insatiable demand for efficient midstream services. Moreover, Kazakhstan's proactive government policies and a continually refined regulatory framework are fostering an environment that is highly conducive to market expansion, attracting both domestic and international players and encouraging the adoption of best practices and cutting-edge technologies.

Challenges in the Kazakhstan Oil and Gas Midstream Market Sector

The Kazakhstan oil and gas midstream market faces several challenges, including the geographical constraints of transporting oil and gas, regulatory hurdles impacting investment and operational efficiency, and fluctuating global energy prices impacting profitability. These challenges are projected to impose a xx% reduction in projected output by 2033 if left unaddressed.

Emerging Opportunities in Kazakhstan Oil and Gas Midstream Market

Significant opportunities exist for expansion into new markets, leveraging technological advancements such as renewable gas integration into pipelines, and adapting to evolving consumer preferences, such as growing demand for cleaner energy solutions.

Leading Players in the Kazakhstan Oil and Gas Midstream Market Market

- KazTransGas JSC

- Intergas Central Asia JSC

- National Company JSC (KazMunayGas)

- Caspian Pipeline Consortium

- KazTransOil JSC

Key Developments in Kazakhstan Oil and Gas Midstream Market Industry

- [Month, Year]: Announcement of a major new pipeline expansion project aimed at increasing export capacity to [specific region/country], significantly impacting transportation volumes and requiring advanced monitoring technologies.

- [Month, Year]: Launch of a pilot program for AI-driven predictive maintenance on existing pipeline networks, demonstrating substantial reductions in operational expenditures and enhanced safety metrics.

- [Month, Year]: Inauguration of a state-of-the-art liquefied petroleum gas (LPG) storage facility, catering to growing domestic demand and improving energy security.

- …and so on. (A comprehensive list of further key developments, including strategic partnerships, regulatory changes, and technological adoptions, will be detailed in the full report).

Future Outlook for Kazakhstan Oil and Gas Midstream Market Market

The Kazakhstan oil and gas midstream market holds substantial potential for growth, driven by planned infrastructure upgrades and expanding domestic and international demand. Strategic partnerships, investment in innovative technologies, and adaptations to the evolving energy landscape will be critical for future success. The market is expected to experience robust growth, with significant opportunities for players who can effectively manage risks and capitalize on emerging trends.

Kazakhstan Oil and Gas Midstream Market Segmentation

-

1. Transportation

-

1.1. Overview

- 1.1.1. Existing Infrastructure

- 1.1.2. Projects in pipeline

- 1.1.3. Upcoming projects

-

1.1. Overview

-

2. Storage

-

2.1. Overview

- 2.1.1. Existing Infrastructure

- 2.1.2. Projects in pipeline

- 2.1.3. Upcoming projects

-

2.1. Overview

Kazakhstan Oil and Gas Midstream Market Segmentation By Geography

- 1. Kazakhstan

Kazakhstan Oil and Gas Midstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Adoption of Industrial Automation across Various Industrial Sectors4.; Rising Sales for Automobiles across the World

- 3.3. Market Restrains

- 3.3.1. 4.; Slow Down in Economic and Industrial Activities

- 3.4. Market Trends

- 3.4.1. Transportation Sector to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kazakhstan Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 5.1.1. Overview

- 5.1.1.1. Existing Infrastructure

- 5.1.1.2. Projects in pipeline

- 5.1.1.3. Upcoming projects

- 5.1.1. Overview

- 5.2. Market Analysis, Insights and Forecast - by Storage

- 5.2.1. Overview

- 5.2.1.1. Existing Infrastructure

- 5.2.1.2. Projects in pipeline

- 5.2.1.3. Upcoming projects

- 5.2.1. Overview

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Kazakhstan

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 6. China Kazakhstan Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Kazakhstan Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 8. India Kazakhstan Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Kazakhstan Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 10. Southeast Asia Kazakhstan Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Kazakhstan Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 12. Indonesia Kazakhstan Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 13. Phillipes Kazakhstan Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 14. Singapore Kazakhstan Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 15. Thailandc Kazakhstan Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Asia Pacific Kazakhstan Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 KazTransGas JSC

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Intergas Central Asia JSC

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 National Company JSC (KazMunayGas)

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Caspian Pipeline Consortium

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 KazTransOil JSC

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.1 KazTransGas JSC

List of Figures

- Figure 1: Kazakhstan Oil and Gas Midstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Kazakhstan Oil and Gas Midstream Market Share (%) by Company 2024

List of Tables

- Table 1: Kazakhstan Oil and Gas Midstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Kazakhstan Oil and Gas Midstream Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Kazakhstan Oil and Gas Midstream Market Revenue Million Forecast, by Transportation 2019 & 2032

- Table 4: Kazakhstan Oil and Gas Midstream Market Volume K Tons Forecast, by Transportation 2019 & 2032

- Table 5: Kazakhstan Oil and Gas Midstream Market Revenue Million Forecast, by Storage 2019 & 2032

- Table 6: Kazakhstan Oil and Gas Midstream Market Volume K Tons Forecast, by Storage 2019 & 2032

- Table 7: Kazakhstan Oil and Gas Midstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Kazakhstan Oil and Gas Midstream Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Kazakhstan Oil and Gas Midstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Kazakhstan Oil and Gas Midstream Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: China Kazakhstan Oil and Gas Midstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China Kazakhstan Oil and Gas Midstream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Japan Kazakhstan Oil and Gas Midstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Kazakhstan Oil and Gas Midstream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: India Kazakhstan Oil and Gas Midstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Kazakhstan Oil and Gas Midstream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: South Korea Kazakhstan Oil and Gas Midstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Kazakhstan Oil and Gas Midstream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Southeast Asia Kazakhstan Oil and Gas Midstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Southeast Asia Kazakhstan Oil and Gas Midstream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Australia Kazakhstan Oil and Gas Midstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Kazakhstan Oil and Gas Midstream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Indonesia Kazakhstan Oil and Gas Midstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Indonesia Kazakhstan Oil and Gas Midstream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Phillipes Kazakhstan Oil and Gas Midstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Phillipes Kazakhstan Oil and Gas Midstream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 27: Singapore Kazakhstan Oil and Gas Midstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Singapore Kazakhstan Oil and Gas Midstream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 29: Thailandc Kazakhstan Oil and Gas Midstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Thailandc Kazakhstan Oil and Gas Midstream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific Kazakhstan Oil and Gas Midstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Asia Pacific Kazakhstan Oil and Gas Midstream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 33: Kazakhstan Oil and Gas Midstream Market Revenue Million Forecast, by Transportation 2019 & 2032

- Table 34: Kazakhstan Oil and Gas Midstream Market Volume K Tons Forecast, by Transportation 2019 & 2032

- Table 35: Kazakhstan Oil and Gas Midstream Market Revenue Million Forecast, by Storage 2019 & 2032

- Table 36: Kazakhstan Oil and Gas Midstream Market Volume K Tons Forecast, by Storage 2019 & 2032

- Table 37: Kazakhstan Oil and Gas Midstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Kazakhstan Oil and Gas Midstream Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kazakhstan Oil and Gas Midstream Market?

The projected CAGR is approximately > 3.26%.

2. Which companies are prominent players in the Kazakhstan Oil and Gas Midstream Market?

Key companies in the market include KazTransGas JSC, Intergas Central Asia JSC, National Company JSC (KazMunayGas), Caspian Pipeline Consortium, KazTransOil JSC.

3. What are the main segments of the Kazakhstan Oil and Gas Midstream Market?

The market segments include Transportation, Storage.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Adoption of Industrial Automation across Various Industrial Sectors4.; Rising Sales for Automobiles across the World.

6. What are the notable trends driving market growth?

Transportation Sector to Witness Growth.

7. Are there any restraints impacting market growth?

4.; Slow Down in Economic and Industrial Activities.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kazakhstan Oil and Gas Midstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kazakhstan Oil and Gas Midstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kazakhstan Oil and Gas Midstream Market?

To stay informed about further developments, trends, and reports in the Kazakhstan Oil and Gas Midstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence