Key Insights

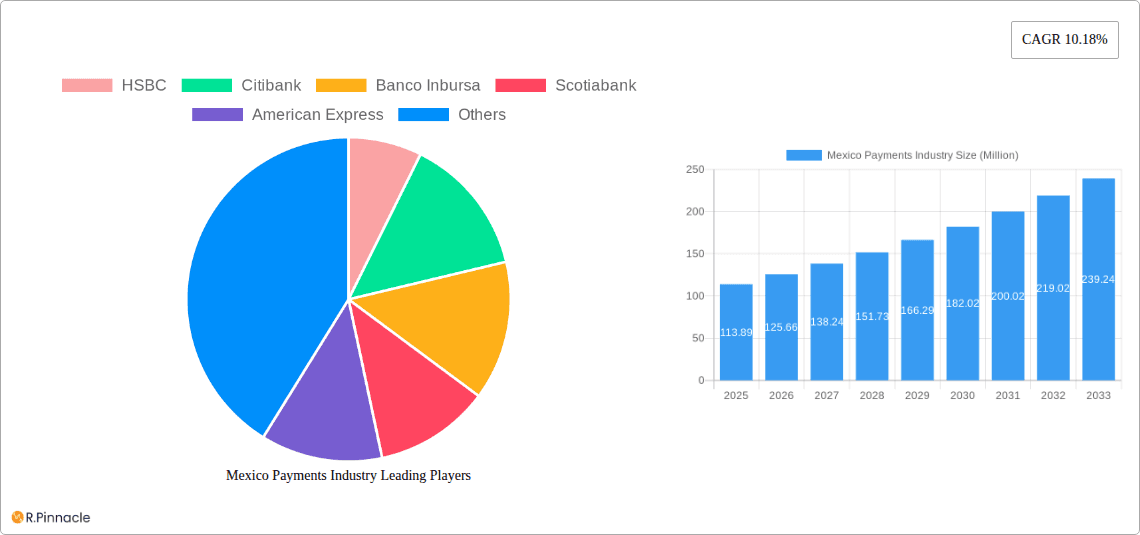

The Mexico payments industry is experiencing robust growth, projected to reach a market size of $113.89 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 10.18% from 2025 to 2033. This expansion is fueled by several key factors. Increasing smartphone penetration and internet access are driving the adoption of digital payment methods, particularly among younger demographics. The burgeoning e-commerce sector in Mexico is significantly contributing to the growth of online payment solutions. Furthermore, government initiatives promoting financial inclusion and digitalization are creating a more favorable environment for the industry's expansion. The retail, entertainment, and hospitality sectors are major contributors to the overall market volume, with point-of-sale (POS) transactions remaining dominant while online sales exhibit significant growth potential. Competition is fierce, with both international giants like Visa, Mastercard, and American Express, and major domestic banks like HSBC, Banorte, and Banco Azteca vying for market share. The increasing preference for contactless payments and the integration of innovative technologies like mobile wallets and biometric authentication further propel market growth.

Mexico Payments Industry Market Size (In Million)

However, challenges remain. While digital penetration is increasing, a significant portion of the population still relies on cash transactions, presenting an obstacle to complete digital transformation. Concerns about data security and fraud prevention are also hindering wider adoption of online payment methods. Regulatory changes and the need for robust infrastructure are also crucial factors that will shape the industry's trajectory. Overcoming these hurdles will be key for the sustained growth and stability of the Mexico payments industry. The forecast period suggests a continuous upward trend, with the market poised to significantly expand as these challenges are addressed through technological advancements and governmental support. The presence of both international and domestic players fuels innovation and competition, resulting in a dynamic and evolving market landscape.

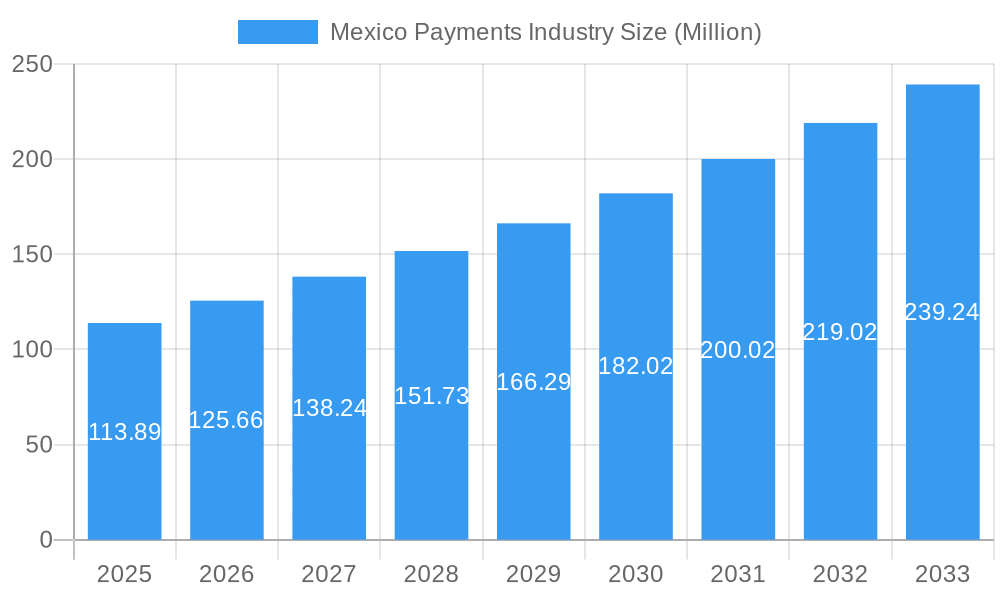

Mexico Payments Industry Company Market Share

Mexico Payments Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Mexico payments industry, covering market dynamics, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report is an indispensable resource for industry professionals, investors, and strategic decision-makers. The report leverages a wealth of data to paint a detailed picture of this dynamic market, encompassing both historical performance (2019-2024) and future projections.

Mexico Payments Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Mexican payments market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, and mergers and acquisitions (M&A) activity. The market is characterized by a mix of large multinational players and domestic banks, leading to a moderately concentrated market structure.

Market Share: HSBC, Citibank, and Banorte collectively hold an estimated xx% market share in 2025, while smaller players like Banco Inbursa and Banco Azteca account for the remaining xx%. Visa and Mastercard maintain significant market share in the card payments segment.

Innovation Drivers: The rise of fintechs, increasing smartphone penetration, and government initiatives promoting financial inclusion are driving innovation. The adoption of real-time payment systems is also a key trend.

Regulatory Framework: The Mexican government's regulatory framework is evolving to support innovation while ensuring financial stability. This includes initiatives to promote open banking and enhance cybersecurity.

Product Substitutes: The emergence of digital wallets and mobile payment apps is creating competition for traditional payment methods like cash and checks.

M&A Activity: The M&A landscape is active, with significant deals involving both domestic and international players. Total M&A deal value in the sector during the historical period (2019-2024) is estimated at approximately USD xx Million.

Mexico Payments Industry Market Dynamics & Trends

This section delves into the market's growth trajectory, examining key drivers, technological disruptions, consumer preferences, and competitive dynamics. The Mexican payments market is expected to experience significant growth over the forecast period (2025-2033).

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period, driven by factors such as rising e-commerce adoption, increasing financial inclusion, and the expanding use of digital payment solutions. Market penetration of digital payments is expected to reach xx% by 2033. Technological disruptions, particularly the adoption of open banking APIs and embedded finance, are reshaping the competitive landscape. Consumer preferences are shifting towards contactless payments and mobile wallets. The increasing competition among traditional banks and fintech companies is also driving innovation and efficiency.

Dominant Regions & Segments in Mexico Payments Industry

This section identifies the leading regions and segments within the Mexican payments market.

By Mode of Payment:

Point of Sale (POS): Remains the dominant segment, driven by the widespread adoption of debit and credit cards in retail settings. Key drivers include increasing retail spending and infrastructure development.

Online Sale: Experiencing rapid growth fueled by the rising popularity of e-commerce and online shopping. Factors contributing to its dominance include improved internet access and growing consumer trust in online transactions.

By End-user Industry:

Retail: The largest segment due to high transaction volumes and the widespread adoption of digital payment solutions. Growth is driven by the increasing number of retail establishments and e-commerce expansion.

Other End-user Industries (e.g., Entertainment, Healthcare, Hospitality): These segments are growing steadily, driven by increased adoption of digital payment solutions and improved infrastructure.

Mexico Payments Industry Product Innovations

The Mexican payments industry is witnessing significant product innovations, particularly in areas like real-time payments, mobile wallets, and contactless payments. These innovations are enhancing the speed, convenience, and security of transactions, leading to increased adoption rates. Fintech companies are playing a leading role in developing and deploying these innovative payment solutions, often partnering with traditional banks to reach broader market segments. The integration of biometrics and AI-powered fraud detection systems is further enhancing the security and efficiency of payment systems.

Report Scope & Segmentation Analysis

This report segments the Mexican payments market by mode of payment (Point of Sale and Online Sale) and end-user industry (Retail, Entertainment, Healthcare, Hospitality, and Other End-user Industries). Growth projections, market sizes, and competitive dynamics are analyzed for each segment. The POS segment is expected to grow at a xx% CAGR, while online sales are projected to grow at a faster rate of xx% CAGR during the forecast period. Retail is the largest end-user segment, followed by other key segments with varied growth rates. Competitive dynamics vary across segments, with different levels of concentration and competition among key players.

Key Drivers of Mexico Payments Industry Growth

Several factors contribute to the growth of the Mexico payments industry. Technological advancements, such as the rise of mobile wallets and real-time payment systems, are increasing convenience and efficiency. The expansion of e-commerce and online retail is further driving transaction volumes. Government initiatives promoting financial inclusion are also expanding access to financial services, leading to an increase in payment transactions. Furthermore, a growing middle class and rising disposable incomes are fueling consumer spending and driving the demand for advanced payment solutions.

Challenges in the Mexico Payments Industry Sector

The Mexico payments industry faces several challenges. Regulatory hurdles can hinder innovation and market expansion. Supply chain issues can disrupt payment processing, impacting businesses and consumers alike. Competition among established players and emerging fintech companies is intense, creating price pressures and the need for constant innovation. Additionally, cybersecurity threats and the risk of fraud pose significant challenges, demanding continuous improvements in security measures. The overall impact of these challenges on market growth is estimated at a reduction in CAGR by approximately xx% compared to a hypothetical scenario without these constraints.

Emerging Opportunities in Mexico Payments Industry

The Mexican payments industry presents several emerging opportunities. The increasing adoption of open banking APIs and embedded finance creates opportunities for innovative payment solutions. The growth of the underbanked population provides a significant market for inclusive financial services. The expansion of e-commerce creates ongoing demand for secure and efficient online payment solutions. The development of new technologies, such as biometric authentication and AI-powered fraud detection, offers opportunities for enhanced security and efficiency in payment processing. Moreover, the increasing demand for contactless payments and mobile wallets create opportunities for providers to offer a broader range of solutions to consumers.

Leading Players in the Mexico Payments Industry Market

- HSBC

- Citibank

- Banco Inbursa

- Scotiabank

- American Express

- Mastercard

- Banco Azteca

- Banorte

- BanCoppel

- Visa

Key Developments in Mexico Payments Industry

November 2023: ACI Worldwide and Mexipay partnered to promote real-time payments in Mexico using ACI's ISO 20022 platform. This will expand access to smaller banks and merchants.

September 2023: Mexican fintech Clara acquired a central bank license and plans to expand into Brazil, significantly boosting its growth. Its current monthly transaction volume in Brazil is approximately USD 20 Million.

Future Outlook for Mexico Payments Industry Market

The future of the Mexico payments industry looks bright. Continued growth in e-commerce, increasing smartphone penetration, and the ongoing adoption of digital payment solutions will drive market expansion. Government initiatives promoting financial inclusion and the rise of innovative fintech companies will further fuel market growth. The focus on real-time payments and the expansion of open banking will provide new avenues for growth and innovation. The market is poised for continued growth and transformation, driven by technological advancements and changing consumer preferences. Strategic opportunities abound for both established players and innovative startups.

Mexico Payments Industry Segmentation

-

1. Mode of Payment

-

1.1. Point of Sale

- 1.1.1. Card Pay

- 1.1.2. Digital Wallet (includes Mobile Wallets)

- 1.1.3. Cash

- 1.1.4. Other Points of Sale

-

1.2. Online Sale

- 1.2.1. Other

-

1.1. Point of Sale

-

2. End-user Industry

- 2.1. Retail

- 2.2. Entertainment

- 2.3. Healthcare

- 2.4. Hospitality

- 2.5. Other End-user Industries

Mexico Payments Industry Segmentation By Geography

- 1. Mexico

Mexico Payments Industry Regional Market Share

Geographic Coverage of Mexico Payments Industry

Mexico Payments Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Growth of Digital Payments; Increase in Internet Penetration

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Personnel and Training Facilities

- 3.4. Market Trends

- 3.4.1. Increase in Internet Penetration is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Payments Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 5.1.1. Point of Sale

- 5.1.1.1. Card Pay

- 5.1.1.2. Digital Wallet (includes Mobile Wallets)

- 5.1.1.3. Cash

- 5.1.1.4. Other Points of Sale

- 5.1.2. Online Sale

- 5.1.2.1. Other

- 5.1.1. Point of Sale

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Retail

- 5.2.2. Entertainment

- 5.2.3. Healthcare

- 5.2.4. Hospitality

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 HSBC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Citibank

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Banco Inbursa

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Scotiabank

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 American Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mastercard

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Banco Azteca

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Banorte

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BanCoppel

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Visa

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 HSBC

List of Figures

- Figure 1: Mexico Payments Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Mexico Payments Industry Share (%) by Company 2025

List of Tables

- Table 1: Mexico Payments Industry Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 2: Mexico Payments Industry Volume K Unit Forecast, by Mode of Payment 2020 & 2033

- Table 3: Mexico Payments Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Mexico Payments Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 5: Mexico Payments Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Mexico Payments Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Mexico Payments Industry Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 8: Mexico Payments Industry Volume K Unit Forecast, by Mode of Payment 2020 & 2033

- Table 9: Mexico Payments Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Mexico Payments Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 11: Mexico Payments Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Mexico Payments Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Payments Industry?

The projected CAGR is approximately 10.18%.

2. Which companies are prominent players in the Mexico Payments Industry?

Key companies in the market include HSBC, Citibank, Banco Inbursa, Scotiabank, American Express, Mastercard, Banco Azteca, Banorte, BanCoppel, Visa.

3. What are the main segments of the Mexico Payments Industry?

The market segments include Mode of Payment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 113.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Growth of Digital Payments; Increase in Internet Penetration.

6. What are the notable trends driving market growth?

Increase in Internet Penetration is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Lack of Skilled Personnel and Training Facilities.

8. Can you provide examples of recent developments in the market?

November 2023: ACI Worldwide and Mexipay have joined forces to encourage the adoption of real-time payments in Mexico. Through this partnership, Mexipay will utilize ACI's payment platform to offer ISO 20022 real-time payments and other payment services in Mexico. This collaboration will enable Mexipay to access smaller banks and merchants, delivering managed services to the market by implementing and operating our platform built around ACI's solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Payments Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Payments Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Payments Industry?

To stay informed about further developments, trends, and reports in the Mexico Payments Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence