Key Insights

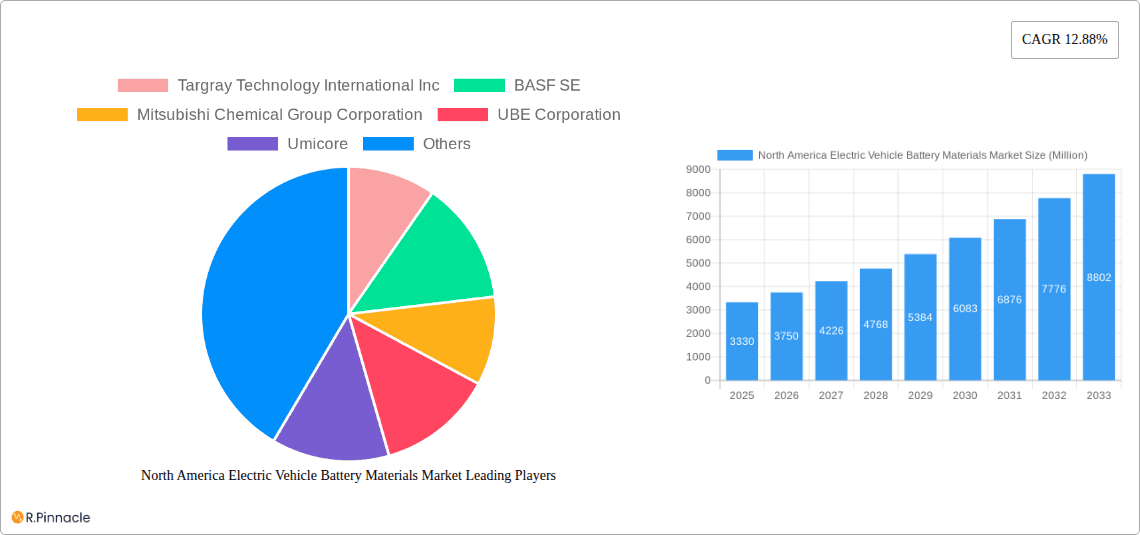

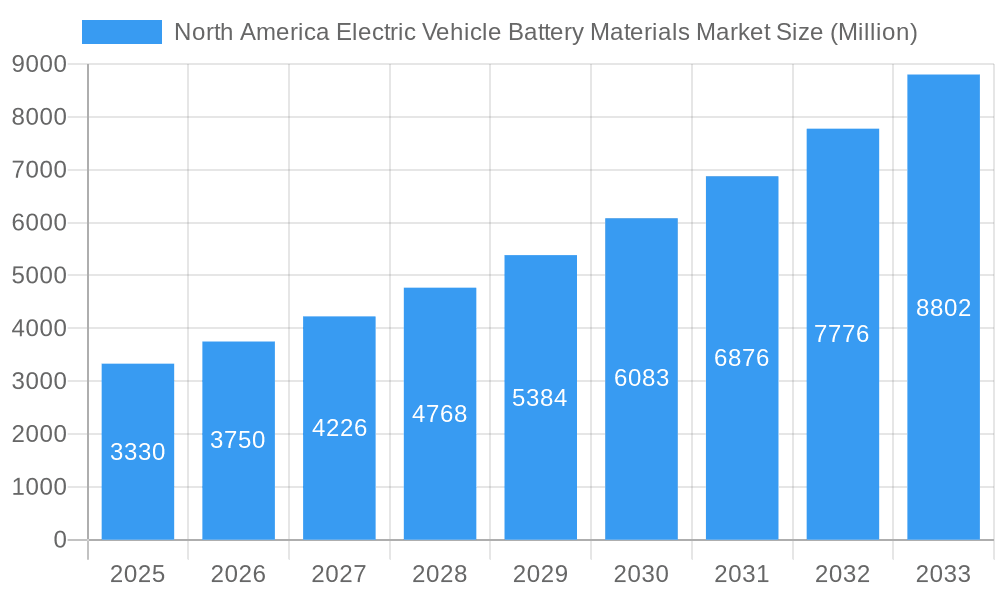

The North American Electric Vehicle (EV) battery materials market is experiencing robust growth, driven by the escalating demand for electric vehicles and supportive government policies promoting EV adoption. The market, valued at approximately $3.33 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 12.88% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing environmental concerns and stringent emission regulations are compelling automakers to prioritize electric vehicle production. Secondly, advancements in battery technology, leading to improved energy density, longer lifespan, and reduced costs, are further stimulating market growth. Finally, substantial investments in battery manufacturing facilities and raw material sourcing within North America are solidifying the region's position as a key player in the global EV battery supply chain. Companies like Targray, BASF, Mitsubishi Chemical, and others are actively participating in this expansion, contributing to the development and supply of crucial materials such as lithium, cobalt, nickel, and graphite.

North America Electric Vehicle Battery Materials Market Market Size (In Billion)

Despite the positive outlook, the market faces some challenges. Fluctuations in raw material prices, particularly for lithium and cobalt, can impact profitability and production costs. Concerns regarding the ethical sourcing of these materials and the environmental impact of mining activities are also emerging as significant factors influencing market dynamics. To mitigate these challenges, industry players are increasingly focusing on developing sustainable sourcing strategies and exploring alternative battery chemistries that reduce reliance on critical and expensive materials. The focus on innovation in battery technology, along with concerted efforts toward responsible sourcing and supply chain management, will be crucial in ensuring the long-term sustainable growth of the North American EV battery materials market.

North America Electric Vehicle Battery Materials Market Company Market Share

North America Electric Vehicle Battery Materials Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Electric Vehicle (EV) Battery Materials market, offering crucial insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's dynamics, growth drivers, challenges, and future outlook. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

North America Electric Vehicle Battery Materials Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, regulatory environment, and market dynamics within the North American EV battery materials market. We examine market concentration, highlighting key players like Targray Technology International Inc, BASF SE, Mitsubishi Chemical Group Corporation, UBE Corporation, Umicore, Sumitomo Chemical Co Ltd, Nichia Corporation, ENTEK International LLC, Arkema SA, and Kureha Corporation, among others. The report includes a detailed market share analysis revealing the competitive positioning of leading companies. Furthermore, we explore the impact of mergers and acquisitions (M&A) activities, quantifying deal values where possible and assessing their influence on market structure. Innovation drivers, including advancements in battery chemistry and sustainable sourcing initiatives, are also examined, along with an analysis of regulatory frameworks and their impact on market growth. The substitution of existing materials with more efficient and sustainable alternatives is also explored, offering a clear picture of emerging trends and future market possibilities. End-user demographics and their evolving needs are also analyzed to provide a comprehensive understanding of the market's evolution.

North America Electric Vehicle Battery Materials Market Dynamics & Trends

This section delves into the key factors shaping the North American EV battery materials market's trajectory. We analyze market growth drivers, including the surging demand for electric vehicles fueled by government incentives and environmental concerns. Technological advancements, such as improvements in battery energy density and lifespan, are explored, alongside their impact on market penetration and consumer preferences. The report meticulously examines the competitive dynamics, including pricing strategies, product differentiation, and the strategic alliances shaping the market landscape. The analysis includes specific metrics such as CAGR and market penetration rates for various segments, providing a clear picture of growth trajectory and market share distribution across different product categories.

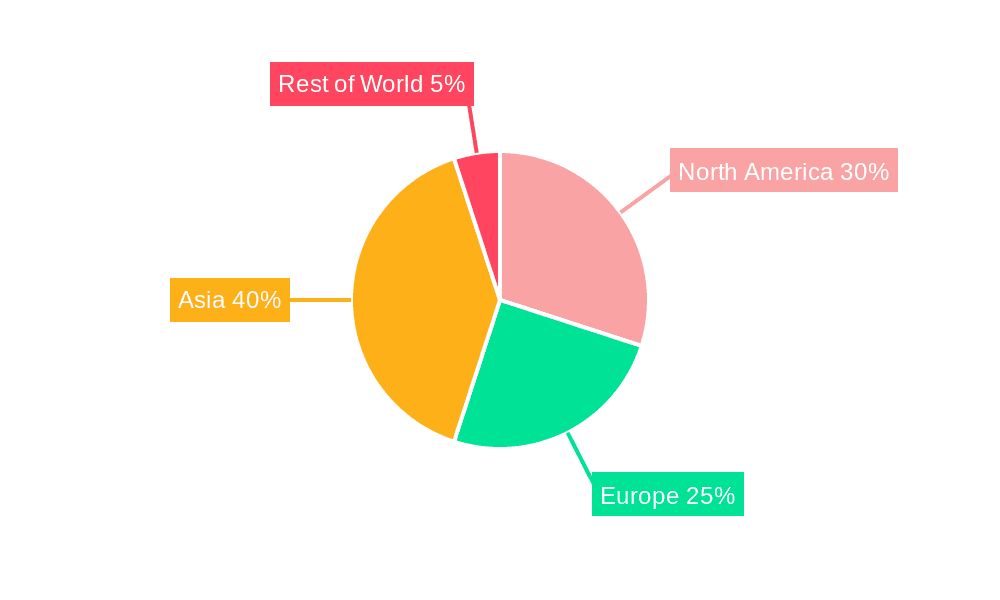

Dominant Regions & Segments in North America Electric Vehicle Battery Materials Market

This section identifies the leading regions and segments within the North American EV battery materials market. A detailed analysis pinpoints the dominant region(s) and country(ies), examining the factors contributing to their market leadership.

- Key Drivers (Examples):

- Favorable government policies and incentives.

- Robust infrastructure supporting EV manufacturing.

- High concentration of EV manufacturers and battery producers.

- Abundant availability of raw materials.

The dominance analysis goes beyond simply identifying the leading regions; it delves into the underlying reasons for their success, providing actionable insights for businesses seeking to capitalize on market opportunities.

North America Electric Vehicle Battery Materials Market Product Innovations

This section summarizes recent advancements in EV battery materials, including new product developments, applications, and their competitive advantages. The analysis emphasizes technological trends, focusing on improved performance, cost-effectiveness, and sustainability aspects. We highlight how these innovations meet the evolving demands of the market and the competitive landscape.

Report Scope & Segmentation Analysis

The report segments the North American EV battery materials market along several key parameters, including material type (e.g., cathode materials, anode materials, electrolytes), battery chemistry (e.g., lithium-ion, solid-state), and application (e.g., passenger vehicles, commercial vehicles). Each segment's growth projections, market size, and competitive dynamics are thoroughly analyzed, providing a detailed understanding of the market's structure and future prospects.

Key Drivers of North America Electric Vehicle Battery Materials Market Growth

The growth of the North American EV battery materials market is propelled by several key factors. The increasing adoption of electric vehicles driven by environmental regulations and government incentives is a major driver. Technological advancements leading to improved battery performance and cost reductions also contribute significantly to market expansion. Furthermore, investments in battery manufacturing facilities and the development of a robust supply chain further fuel the market's growth.

Challenges in the North America Electric Vehicle Battery Materials Market Sector

The North American EV battery materials market faces challenges, including the dependence on raw material imports, leading to supply chain vulnerabilities and price fluctuations. Regulatory hurdles and the complexities of navigating environmental regulations can also pose significant challenges. Intense competition among established players and new entrants further complicates the market dynamics. These challenges are analyzed with quantifiable impacts where possible, providing a realistic assessment of market risks.

Emerging Opportunities in North America Electric Vehicle Battery Materials Market

Despite the challenges, the North American EV battery materials market presents significant opportunities. The growth of the EV market opens up new avenues for material suppliers. Advancements in battery technology, such as solid-state batteries, offer promising prospects. Furthermore, the increasing focus on sustainability and responsible sourcing creates opportunities for companies committed to environmental responsibility.

Leading Players in the North America Electric Vehicle Battery Materials Market Market

- Targray Technology International Inc

- BASF SE (BASF SE)

- Mitsubishi Chemical Group Corporation (Mitsubishi Chemical Group Corporation)

- UBE Corporation (UBE Corporation)

- Umicore (Umicore)

- Sumitomo Chemical Co Ltd (Sumitomo Chemical Co Ltd)

- Nichia Corporation (Nichia Corporation)

- ENTEK International LLC

- Arkema SA (Arkema SA)

- Kureha Corporation (Kureha Corporation)

- List Not Exhaustive

Key Developments in North America Electric Vehicle Battery Materials Industry

- September 2023: Umicore and AESC signed a decade-long deal for Umicore to supply high-nickel battery materials to AESC's US manufacturing plants. This strengthens AESC's position and secures a significant market share for Umicore.

- April 2024: Syensqo began construction of a large-scale battery-grade PVDF facility in Augusta, Georgia. This will significantly increase North America's PVDF production capacity, crucial for lithium-ion battery manufacturing.

Future Outlook for North America Electric Vehicle Battery Materials Market Market

The future of the North American EV battery materials market is promising, driven by sustained growth in EV adoption and ongoing technological advancements. Strategic partnerships, investments in R&D, and a focus on sustainable practices will shape the market's trajectory. Opportunities exist for companies that can efficiently produce high-quality materials while meeting stringent environmental standards. The market is poised for continued expansion, presenting significant opportunities for growth and innovation.

North America Electric Vehicle Battery Materials Market Segmentation

-

1. Battery Type

- 1.1. Lithium-ion Battery

- 1.2. Lead-Acid Battery

- 1.3. Others

-

2. Material

- 2.1. Cathode

- 2.2. Anode

- 2.3. Electrolyte

- 2.4. Separator

- 2.5. Others

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

North America Electric Vehicle Battery Materials Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Electric Vehicle Battery Materials Market Regional Market Share

Geographic Coverage of North America Electric Vehicle Battery Materials Market

North America Electric Vehicle Battery Materials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.88% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations

- 3.4. Market Trends

- 3.4.1. Lithium-ion Batteries to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North America Electric Vehicle Battery Materials Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lithium-ion Battery

- 5.1.2. Lead-Acid Battery

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Cathode

- 5.2.2. Anode

- 5.2.3. Electrolyte

- 5.2.4. Separator

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. United States North America Electric Vehicle Battery Materials Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Battery Type

- 6.1.1. Lithium-ion Battery

- 6.1.2. Lead-Acid Battery

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Cathode

- 6.2.2. Anode

- 6.2.3. Electrolyte

- 6.2.4. Separator

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Battery Type

- 7. Canada North America Electric Vehicle Battery Materials Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Battery Type

- 7.1.1. Lithium-ion Battery

- 7.1.2. Lead-Acid Battery

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Cathode

- 7.2.2. Anode

- 7.2.3. Electrolyte

- 7.2.4. Separator

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Battery Type

- 8. Rest of North America North America Electric Vehicle Battery Materials Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Battery Type

- 8.1.1. Lithium-ion Battery

- 8.1.2. Lead-Acid Battery

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Cathode

- 8.2.2. Anode

- 8.2.3. Electrolyte

- 8.2.4. Separator

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Battery Type

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Targray Technology International Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 BASF SE

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Mitsubishi Chemical Group Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 UBE Corporation

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Umicore

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Sumitomo Chemical Co Ltd

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Nichia Corporation

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 ENTEK International LLC

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Arkema SA

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Kureha Corporation*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share (%) Analysi

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Targray Technology International Inc

List of Figures

- Figure 1: Global North America Electric Vehicle Battery Materials Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global North America Electric Vehicle Battery Materials Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: United States North America Electric Vehicle Battery Materials Market Revenue (Million), by Battery Type 2025 & 2033

- Figure 4: United States North America Electric Vehicle Battery Materials Market Volume (Billion), by Battery Type 2025 & 2033

- Figure 5: United States North America Electric Vehicle Battery Materials Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 6: United States North America Electric Vehicle Battery Materials Market Volume Share (%), by Battery Type 2025 & 2033

- Figure 7: United States North America Electric Vehicle Battery Materials Market Revenue (Million), by Material 2025 & 2033

- Figure 8: United States North America Electric Vehicle Battery Materials Market Volume (Billion), by Material 2025 & 2033

- Figure 9: United States North America Electric Vehicle Battery Materials Market Revenue Share (%), by Material 2025 & 2033

- Figure 10: United States North America Electric Vehicle Battery Materials Market Volume Share (%), by Material 2025 & 2033

- Figure 11: United States North America Electric Vehicle Battery Materials Market Revenue (Million), by Geography 2025 & 2033

- Figure 12: United States North America Electric Vehicle Battery Materials Market Volume (Billion), by Geography 2025 & 2033

- Figure 13: United States North America Electric Vehicle Battery Materials Market Revenue Share (%), by Geography 2025 & 2033

- Figure 14: United States North America Electric Vehicle Battery Materials Market Volume Share (%), by Geography 2025 & 2033

- Figure 15: United States North America Electric Vehicle Battery Materials Market Revenue (Million), by Country 2025 & 2033

- Figure 16: United States North America Electric Vehicle Battery Materials Market Volume (Billion), by Country 2025 & 2033

- Figure 17: United States North America Electric Vehicle Battery Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: United States North America Electric Vehicle Battery Materials Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Canada North America Electric Vehicle Battery Materials Market Revenue (Million), by Battery Type 2025 & 2033

- Figure 20: Canada North America Electric Vehicle Battery Materials Market Volume (Billion), by Battery Type 2025 & 2033

- Figure 21: Canada North America Electric Vehicle Battery Materials Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 22: Canada North America Electric Vehicle Battery Materials Market Volume Share (%), by Battery Type 2025 & 2033

- Figure 23: Canada North America Electric Vehicle Battery Materials Market Revenue (Million), by Material 2025 & 2033

- Figure 24: Canada North America Electric Vehicle Battery Materials Market Volume (Billion), by Material 2025 & 2033

- Figure 25: Canada North America Electric Vehicle Battery Materials Market Revenue Share (%), by Material 2025 & 2033

- Figure 26: Canada North America Electric Vehicle Battery Materials Market Volume Share (%), by Material 2025 & 2033

- Figure 27: Canada North America Electric Vehicle Battery Materials Market Revenue (Million), by Geography 2025 & 2033

- Figure 28: Canada North America Electric Vehicle Battery Materials Market Volume (Billion), by Geography 2025 & 2033

- Figure 29: Canada North America Electric Vehicle Battery Materials Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Canada North America Electric Vehicle Battery Materials Market Volume Share (%), by Geography 2025 & 2033

- Figure 31: Canada North America Electric Vehicle Battery Materials Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Canada North America Electric Vehicle Battery Materials Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Canada North America Electric Vehicle Battery Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Canada North America Electric Vehicle Battery Materials Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Rest of North America North America Electric Vehicle Battery Materials Market Revenue (Million), by Battery Type 2025 & 2033

- Figure 36: Rest of North America North America Electric Vehicle Battery Materials Market Volume (Billion), by Battery Type 2025 & 2033

- Figure 37: Rest of North America North America Electric Vehicle Battery Materials Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 38: Rest of North America North America Electric Vehicle Battery Materials Market Volume Share (%), by Battery Type 2025 & 2033

- Figure 39: Rest of North America North America Electric Vehicle Battery Materials Market Revenue (Million), by Material 2025 & 2033

- Figure 40: Rest of North America North America Electric Vehicle Battery Materials Market Volume (Billion), by Material 2025 & 2033

- Figure 41: Rest of North America North America Electric Vehicle Battery Materials Market Revenue Share (%), by Material 2025 & 2033

- Figure 42: Rest of North America North America Electric Vehicle Battery Materials Market Volume Share (%), by Material 2025 & 2033

- Figure 43: Rest of North America North America Electric Vehicle Battery Materials Market Revenue (Million), by Geography 2025 & 2033

- Figure 44: Rest of North America North America Electric Vehicle Battery Materials Market Volume (Billion), by Geography 2025 & 2033

- Figure 45: Rest of North America North America Electric Vehicle Battery Materials Market Revenue Share (%), by Geography 2025 & 2033

- Figure 46: Rest of North America North America Electric Vehicle Battery Materials Market Volume Share (%), by Geography 2025 & 2033

- Figure 47: Rest of North America North America Electric Vehicle Battery Materials Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Rest of North America North America Electric Vehicle Battery Materials Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Rest of North America North America Electric Vehicle Battery Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of North America North America Electric Vehicle Battery Materials Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global North America Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 2: Global North America Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 3: Global North America Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2020 & 2033

- Table 4: Global North America Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2020 & 2033

- Table 5: Global North America Electric Vehicle Battery Materials Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global North America Electric Vehicle Battery Materials Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 7: Global North America Electric Vehicle Battery Materials Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global North America Electric Vehicle Battery Materials Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global North America Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 10: Global North America Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 11: Global North America Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2020 & 2033

- Table 12: Global North America Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2020 & 2033

- Table 13: Global North America Electric Vehicle Battery Materials Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Global North America Electric Vehicle Battery Materials Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 15: Global North America Electric Vehicle Battery Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global North America Electric Vehicle Battery Materials Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global North America Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 18: Global North America Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 19: Global North America Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2020 & 2033

- Table 20: Global North America Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2020 & 2033

- Table 21: Global North America Electric Vehicle Battery Materials Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Global North America Electric Vehicle Battery Materials Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 23: Global North America Electric Vehicle Battery Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global North America Electric Vehicle Battery Materials Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global North America Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 26: Global North America Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 27: Global North America Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2020 & 2033

- Table 28: Global North America Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2020 & 2033

- Table 29: Global North America Electric Vehicle Battery Materials Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Global North America Electric Vehicle Battery Materials Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 31: Global North America Electric Vehicle Battery Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global North America Electric Vehicle Battery Materials Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Electric Vehicle Battery Materials Market?

The projected CAGR is approximately 12.88%.

2. Which companies are prominent players in the North America Electric Vehicle Battery Materials Market?

Key companies in the market include Targray Technology International Inc, BASF SE, Mitsubishi Chemical Group Corporation, UBE Corporation, Umicore, Sumitomo Chemical Co Ltd, Nichia Corporation, ENTEK International LLC, Arkema SA, Kureha Corporation*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share (%) Analysi.

3. What are the main segments of the North America Electric Vehicle Battery Materials Market?

The market segments include Battery Type, Material, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.33 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations.

6. What are the notable trends driving market growth?

Lithium-ion Batteries to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations.

8. Can you provide examples of recent developments in the market?

April 2024: Syensqo initiated the construction of its cutting-edge battery-grade polyvinylidene fluoride (PVDF) facility in Augusta, Georgia. Upon completion, this site will stand as the largest PVDF production facility in North America, catering to the escalating demands of the domestic energy storage markets. Representing a pivotal step in Syensqo's global electrification blueprint, this facility is poised to play a crucial role in producing the essential battery materials that are instrumental in driving widespread electrification and the adoption of electric vehicles (EVs). PVDF, a thermoplastic fluoropolymer, finds its application as a lithium-ion binder and separator coating in batteries.September 2023: Umicore, in collaboration with AESC, a prominent player in high-performance battery development for EVs and energy storage, inked a decade-long deal. Under this agreement, Umicore will be the key supplier of high-nickel battery materials for EV battery production at AESC's US manufacturing plants. This strategic partnership not only bolsters AESC's regional growth aspirations but also ensures a steady supply of these crucial, sustainably sourced materials. For Umicore, this deal not only secures a significant portion of the North American EV battery material demand but also diversifies its ties within the EV value chain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Electric Vehicle Battery Materials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Electric Vehicle Battery Materials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Electric Vehicle Battery Materials Market?

To stay informed about further developments, trends, and reports in the North America Electric Vehicle Battery Materials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence