Key Insights

The North American fats and oils market, valued at approximately $XX million in 2025, is projected to experience steady growth, driven primarily by increasing demand from the food and beverage sector. This sector's reliance on oils and fats for processing, flavor enhancement, and shelf-life extension fuels significant market consumption. The animal feed industry also contributes substantially, with fats and oils serving as crucial nutritional components for livestock. Growth within personal care and cosmetics, albeit a smaller segment, reflects rising consumer interest in natural and plant-based ingredients. While the market faces restraints such as fluctuating commodity prices and concerns regarding saturated fat consumption, innovation in sustainable sourcing practices and the development of healthier oil alternatives are expected to mitigate these challenges. The expanding health-conscious consumer base is driving demand for healthier options like plant-based oils and sustainably sourced products, which are becoming increasingly prevalent across all application segments. Major players, including Cargill, ADM, and Bunge, are strategically investing in research and development, mergers and acquisitions, and supply chain optimization to solidify their market positions and capitalize on emerging opportunities within this dynamic market. The United States, as the largest economy in North America, dominates the regional market share, followed by Canada and Mexico.

The forecast period (2025-2033) anticipates a continuation of the growth trajectory, with a compound annual growth rate (CAGR) of 3.20%. This growth will likely be fueled by a combination of population growth, increasing disposable incomes, and shifting dietary habits. The segmentation of the market into oils, fats, and diverse applications provides several avenues for market expansion. Further growth is expected from the increased adoption of oils and fats in specialized applications, such as biofuels and industrial lubricants, although these sectors currently represent smaller market shares compared to food and beverage or animal feed. Strategic partnerships, technological advancements in oil extraction and processing, and expanding e-commerce channels will all contribute to the market's continued expansion. However, regulatory changes regarding food labeling and health concerns related to certain types of fats could present challenges to consistent, uninterrupted growth.

North America Fats and Oils Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America Fats and Oils market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period spans 2025-2033, while the historical period encompasses 2019-2024. The market is segmented by product (Oils, Fats) and application (Food and Beverage, Animal Feed, Personal Care and Cosmetics, Other Applications). Key players include Arista Industries, Cargill Incorporated, Archer Daniels Midland Company, Bunge Limited, Ag Processing Inc, Olam International, Wilmar International Ltd, and Richardson International Limited. The report projects a market value of xx Million by 2033.

North America Fats and Oils Market Structure & Innovation Trends

This section analyzes the competitive landscape of the North American fats and oils market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. We explore the impact of product substitutes and end-user demographics on market dynamics. The report assesses the market share of key players and provides insights into the value of recent mergers and acquisitions (M&A).

- Market Concentration: The market exhibits a moderately concentrated structure, with a few large players holding significant market share. Specific market share data for each major player will be provided in the full report.

- Innovation Drivers: Key innovation drivers include the growing demand for healthier and sustainable fats and oils, technological advancements in extraction and processing, and increasing focus on product diversification.

- Regulatory Frameworks: Government regulations regarding food safety, labeling, and sustainability significantly impact market operations. The report will detail specific regulations and their implications.

- Product Substitutes: The availability of alternative ingredients and the rise of plant-based alternatives present challenges and opportunities for the market.

- M&A Activities: The report analyzes recent M&A activities, including the acquisition of ADM's oilseeds business by Bunge, detailing the deal value and its implications for market consolidation. The total value of M&A deals within the period will be quantified.

- End-User Demographics: Changing consumer preferences and dietary habits drive demand for specific types of fats and oils, impacting market segmentation and growth.

North America Fats and Oils Market Dynamics & Trends

This section delves into the key factors influencing market growth, including technological advancements, evolving consumer preferences, and the competitive landscape. We examine market growth drivers, technological disruptions, and competitive dynamics, providing a comprehensive overview of the market's trajectory. The report projects a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Market penetration rates for key segments will also be provided.

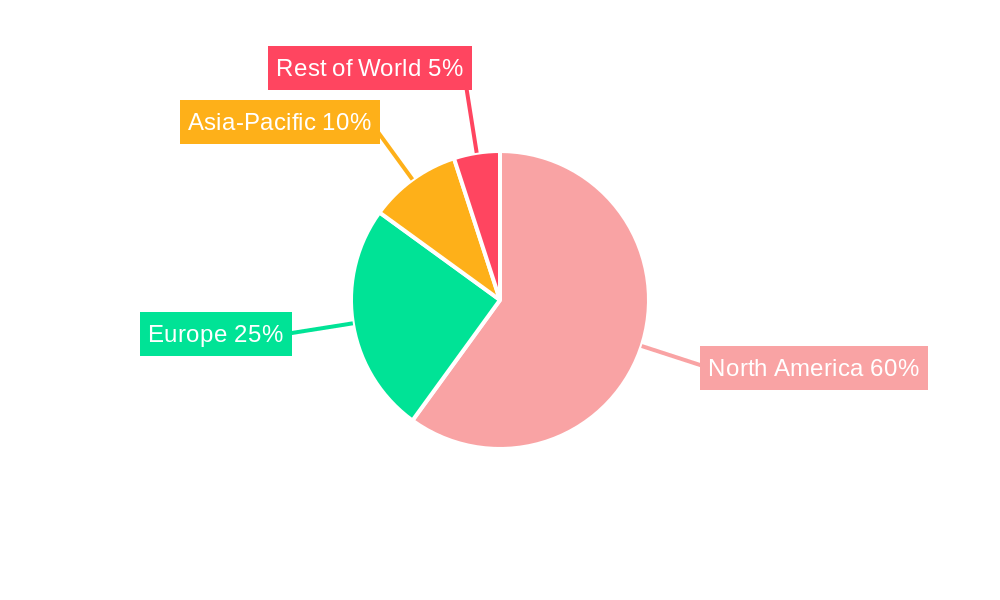

Dominant Regions & Segments in North America Fats and Oils Market

This section details the leading regions, countries, and segments within the dynamic North America fats and oils market. We provide a comprehensive overview of the market landscape, identifying key players and growth drivers.

Dominant Segments: A Detailed Look

- Product Type: While oils and fats currently hold a nearly equal market share (based on 2025 projections), our report offers granular data showcasing the nuanced performance of individual oil and fat types, including their respective growth trajectories and market penetration.

- Application: The food and beverage sector remains the dominant application, driven by strong demand for cooking oils, margarine, and other essential food ingredients. Animal feed represents a substantial second segment, fueled by a growing livestock population and increasing demand for high-quality animal feed. Personal care and cosmetics are also significant contributors, reflecting the rising incorporation of oils and fats into beauty and personal care products. The report provides detailed forecasts and analysis for each application segment, outlining projected growth rates and market share evolution.

Key Drivers Fueling Segment Growth:

- Food and Beverage: The robust demand for healthy cooking oils, versatile margarines, and other essential food-grade fats and oils is the primary driver for this sector. Consumer preferences for specific types of oils, based on health concerns and culinary trends, also greatly influence market dynamics.

- Animal Feed: The expansion of the livestock industry and the associated demand for cost-effective and nutritious animal feed are significant contributors to this segment's growth. Furthermore, increasing awareness of animal welfare and the need for sustainable feed sources is driving innovation in this area.

- Personal Care and Cosmetics: The rising popularity of natural and organic cosmetics and personal care products, coupled with increasing consumer awareness of the benefits of specific oils and fats for skin and hair health, are key factors driving this market.

Our comprehensive report includes a thorough geographical analysis, identifying dominant regions and exploring the influence of economic factors, infrastructural development, and evolving consumer preferences on market growth. Precise market size data and projections for each segment are provided for the specified study period, allowing for informed strategic decision-making.

North America Fats and Oils Market Product Innovations

This section summarizes recent product developments, focusing on technological advancements that are improving product quality, functionality and sustainability. Innovations in extraction and refining technologies are leading to higher yields and improved product quality. New product formulations are catering to the increasing demand for healthier and sustainable fats and oils, driving innovation in the market.

Report Scope & Segmentation Analysis

This report offers a meticulous segmentation analysis of the North America Fats and Oils market based on product type (Oils and Fats) and application (Food and Beverage, Animal Feed, Personal Care and Cosmetics, and Other Applications). Each segment's growth projections, market sizes, and competitive landscape are thoroughly examined. The report provides precise quantitative data, including detailed market size and projection breakdowns for each segment, enabling a deep understanding of market dynamics.

Key Drivers of North America Fats and Oils Market Growth

Several factors fuel the growth of the North America fats and oils market. Growing demand from the food and beverage industry, expanding animal feed sector, and the increasing use of fats and oils in personal care products drive market expansion. Technological advancements leading to more efficient production processes and the development of sustainable and healthy products also boost growth.

Challenges in the North America Fats and Oils Market Sector

Despite significant growth potential, the North America fats and oils market faces several challenges. Fluctuations in raw material prices, stringent regulatory requirements, and the rise of substitute products pose considerable risks to market participants. Supply chain disruptions caused by various factors, including geopolitical instability, could impact production and distribution. Increased competition from both domestic and international players also puts pressure on profitability.

Emerging Opportunities in North America Fats and Oils Market

The North America fats and oils market is ripe with exciting growth opportunities. The increasing demand for specialized oils tailored for functional foods, alongside the growing consumer preference for plant-based alternatives and personalized nutrition plans, presents significant growth potential. Expansion into new and niche markets, particularly within the burgeoning health and wellness sector, is anticipated to stimulate innovation and propel further market expansion. We explore specific emerging trends and opportunities within the report.

Leading Players in the North America Fats and Oils Market Market

- Arista Industries

- Cargill Incorporated

- Archer Daniels Midland Company

- Bunge Limited

- Ag Processing Inc

- Olam International

- Wilmar International Ltd

- Richardson International Limited

Key Developments in North America Fats and Oils Market Industry

- Acquisition of ADM's oilseeds business by Bunge: (Year/Month) - This merger significantly reshaped the market landscape, leading to increased market concentration and potential changes in pricing and supply.

- Launch of Sustainable Palm Oil Coalition: (Year/Month) - This initiative highlights the growing emphasis on sustainable sourcing and production practices within the industry, impacting consumer preferences and regulatory frameworks.

- Investment in advanced extraction technologies: (Year/Month) - Ongoing investments in advanced technologies are enhancing efficiency and sustainability, impacting production costs and product quality.

Future Outlook for North America Fats and Oils Market Market

The North America fats and oils market is poised for continued growth, driven by evolving consumer preferences, increasing demand from key application segments, and ongoing innovations in production and processing technologies. The market is expected to witness further consolidation through mergers and acquisitions, leading to a more concentrated but also more efficient industry structure. Strategic partnerships and collaborations aimed at improving sustainability and developing innovative products are likely to further shape the market’s future.

North America Fats and Oils Market Segmentation

-

1. Product

-

1.1. Oils

- 1.1.1. Soybean Oil

- 1.1.2. Canola Oil

- 1.1.3. Palm Oil

- 1.1.4. Olive Oil

- 1.1.5. Sunflower Seed Oil

- 1.1.6. Other Oils

-

1.2. Fats

- 1.2.1. Butter(Excluding Dairy Butter)

- 1.2.2. Lard

- 1.2.3. Other Fats

-

1.1. Oils

-

2. Application

-

2.1. Food and Beverage

- 2.1.1. Bakery and Confectionary

- 2.1.2. Savory Snacks

- 2.1.3. Dairy

- 2.1.4. Other Food and Beverage

- 2.2. Animal Feed

- 2.3. Personal Care and Cosmetics

- 2.4. Other Applications

-

2.1. Food and Beverage

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Fats and Oils Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Fats and Oils Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Augmented demand for Natural Sweeteners; Rising Consumer Inclination Toward Clean Label and Organic Stevia

- 3.3. Market Restrains

- 3.3.1. Side Effects and Challenges with Stevia

- 3.4. Market Trends

- 3.4.1. Rise in the Consumption of Olive Oil

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fats and Oils Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Oils

- 5.1.1.1. Soybean Oil

- 5.1.1.2. Canola Oil

- 5.1.1.3. Palm Oil

- 5.1.1.4. Olive Oil

- 5.1.1.5. Sunflower Seed Oil

- 5.1.1.6. Other Oils

- 5.1.2. Fats

- 5.1.2.1. Butter(Excluding Dairy Butter)

- 5.1.2.2. Lard

- 5.1.2.3. Other Fats

- 5.1.1. Oils

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverage

- 5.2.1.1. Bakery and Confectionary

- 5.2.1.2. Savory Snacks

- 5.2.1.3. Dairy

- 5.2.1.4. Other Food and Beverage

- 5.2.2. Animal Feed

- 5.2.3. Personal Care and Cosmetics

- 5.2.4. Other Applications

- 5.2.1. Food and Beverage

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America Fats and Oils Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Oils

- 6.1.1.1. Soybean Oil

- 6.1.1.2. Canola Oil

- 6.1.1.3. Palm Oil

- 6.1.1.4. Olive Oil

- 6.1.1.5. Sunflower Seed Oil

- 6.1.1.6. Other Oils

- 6.1.2. Fats

- 6.1.2.1. Butter(Excluding Dairy Butter)

- 6.1.2.2. Lard

- 6.1.2.3. Other Fats

- 6.1.1. Oils

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food and Beverage

- 6.2.1.1. Bakery and Confectionary

- 6.2.1.2. Savory Snacks

- 6.2.1.3. Dairy

- 6.2.1.4. Other Food and Beverage

- 6.2.2. Animal Feed

- 6.2.3. Personal Care and Cosmetics

- 6.2.4. Other Applications

- 6.2.1. Food and Beverage

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Canada North America Fats and Oils Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Oils

- 7.1.1.1. Soybean Oil

- 7.1.1.2. Canola Oil

- 7.1.1.3. Palm Oil

- 7.1.1.4. Olive Oil

- 7.1.1.5. Sunflower Seed Oil

- 7.1.1.6. Other Oils

- 7.1.2. Fats

- 7.1.2.1. Butter(Excluding Dairy Butter)

- 7.1.2.2. Lard

- 7.1.2.3. Other Fats

- 7.1.1. Oils

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food and Beverage

- 7.2.1.1. Bakery and Confectionary

- 7.2.1.2. Savory Snacks

- 7.2.1.3. Dairy

- 7.2.1.4. Other Food and Beverage

- 7.2.2. Animal Feed

- 7.2.3. Personal Care and Cosmetics

- 7.2.4. Other Applications

- 7.2.1. Food and Beverage

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Mexico North America Fats and Oils Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Oils

- 8.1.1.1. Soybean Oil

- 8.1.1.2. Canola Oil

- 8.1.1.3. Palm Oil

- 8.1.1.4. Olive Oil

- 8.1.1.5. Sunflower Seed Oil

- 8.1.1.6. Other Oils

- 8.1.2. Fats

- 8.1.2.1. Butter(Excluding Dairy Butter)

- 8.1.2.2. Lard

- 8.1.2.3. Other Fats

- 8.1.1. Oils

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food and Beverage

- 8.2.1.1. Bakery and Confectionary

- 8.2.1.2. Savory Snacks

- 8.2.1.3. Dairy

- 8.2.1.4. Other Food and Beverage

- 8.2.2. Animal Feed

- 8.2.3. Personal Care and Cosmetics

- 8.2.4. Other Applications

- 8.2.1. Food and Beverage

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Rest of North America North America Fats and Oils Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Oils

- 9.1.1.1. Soybean Oil

- 9.1.1.2. Canola Oil

- 9.1.1.3. Palm Oil

- 9.1.1.4. Olive Oil

- 9.1.1.5. Sunflower Seed Oil

- 9.1.1.6. Other Oils

- 9.1.2. Fats

- 9.1.2.1. Butter(Excluding Dairy Butter)

- 9.1.2.2. Lard

- 9.1.2.3. Other Fats

- 9.1.1. Oils

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food and Beverage

- 9.2.1.1. Bakery and Confectionary

- 9.2.1.2. Savory Snacks

- 9.2.1.3. Dairy

- 9.2.1.4. Other Food and Beverage

- 9.2.2. Animal Feed

- 9.2.3. Personal Care and Cosmetics

- 9.2.4. Other Applications

- 9.2.1. Food and Beverage

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. United States North America Fats and Oils Market Analysis, Insights and Forecast, 2019-2031

- 11. Canada North America Fats and Oils Market Analysis, Insights and Forecast, 2019-2031

- 12. Mexico North America Fats and Oils Market Analysis, Insights and Forecast, 2019-2031

- 13. Rest of North America North America Fats and Oils Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Arista Industries*List Not Exhaustive

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Cargill Incorporated

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Archer Daniels Midland Company

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Bunge Limited

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Ag Processing Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Olam International

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Wilmar International Ltd

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Richardson International Limited

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.1 Arista Industries*List Not Exhaustive

List of Figures

- Figure 1: North America Fats and Oils Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Fats and Oils Market Share (%) by Company 2024

List of Tables

- Table 1: North America Fats and Oils Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Fats and Oils Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: North America Fats and Oils Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: North America Fats and Oils Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Fats and Oils Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Fats and Oils Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Fats and Oils Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Fats and Oils Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Fats and Oils Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Fats and Oils Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Fats and Oils Market Revenue Million Forecast, by Product 2019 & 2032

- Table 12: North America Fats and Oils Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: North America Fats and Oils Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Fats and Oils Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Fats and Oils Market Revenue Million Forecast, by Product 2019 & 2032

- Table 16: North America Fats and Oils Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: North America Fats and Oils Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Fats and Oils Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Fats and Oils Market Revenue Million Forecast, by Product 2019 & 2032

- Table 20: North America Fats and Oils Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: North America Fats and Oils Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Fats and Oils Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: North America Fats and Oils Market Revenue Million Forecast, by Product 2019 & 2032

- Table 24: North America Fats and Oils Market Revenue Million Forecast, by Application 2019 & 2032

- Table 25: North America Fats and Oils Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Fats and Oils Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fats and Oils Market?

The projected CAGR is approximately 3.20%.

2. Which companies are prominent players in the North America Fats and Oils Market?

Key companies in the market include Arista Industries*List Not Exhaustive, Cargill Incorporated, Archer Daniels Midland Company, Bunge Limited, Ag Processing Inc, Olam International, Wilmar International Ltd, Richardson International Limited.

3. What are the main segments of the North America Fats and Oils Market?

The market segments include Product, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Augmented demand for Natural Sweeteners; Rising Consumer Inclination Toward Clean Label and Organic Stevia.

6. What are the notable trends driving market growth?

Rise in the Consumption of Olive Oil.

7. Are there any restraints impacting market growth?

Side Effects and Challenges with Stevia.

8. Can you provide examples of recent developments in the market?

1. Acquisition of ADM's oilseeds business by Bunge 2. Launch of Sustainable Palm Oil Coalition 3. Investment in advanced extraction technologies

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fats and Oils Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fats and Oils Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fats and Oils Market?

To stay informed about further developments, trends, and reports in the North America Fats and Oils Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence