Key Insights

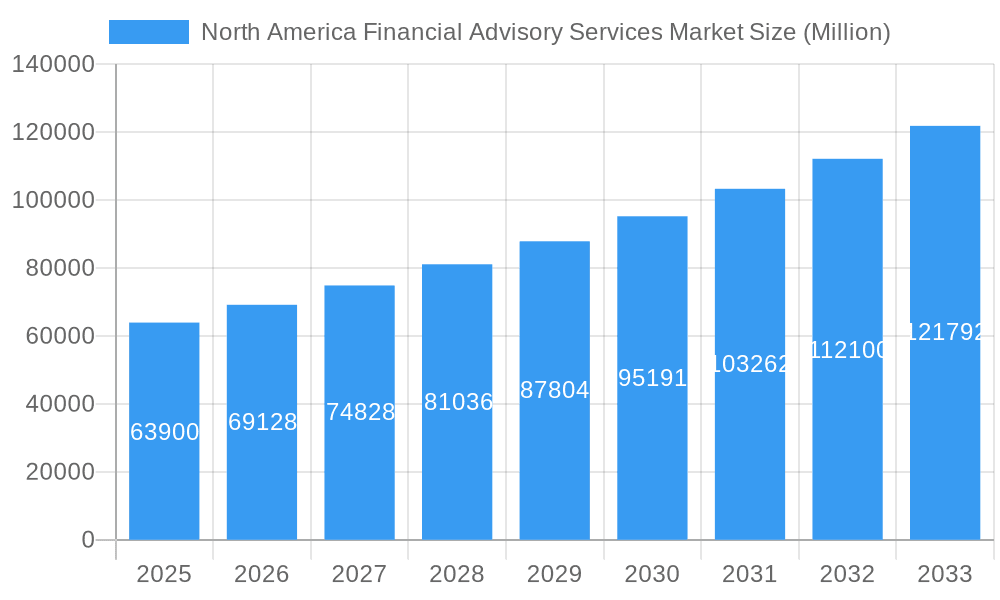

The North America financial advisory services market, valued at $63.90 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing complexity of financial instruments, coupled with a growing affluent population seeking personalized wealth management solutions, fuels demand for sophisticated advisory services. Technological advancements, such as robo-advisors and AI-powered platforms, are streamlining processes and increasing accessibility, further stimulating market expansion. Regulatory changes promoting financial literacy and transparency also contribute positively. While competition among established players like BlackRock, Vanguard, Fidelity, and State Street remains intense, the market offers significant opportunities for niche players specializing in areas like sustainable investing or impact investing, catering to evolving investor preferences. The high concentration of wealth in North America and a strong emphasis on retirement planning ensure continued market momentum.

North America Financial Advisory Services Market Market Size (In Billion)

Furthermore, the market's growth is not uniform across all segments. We anticipate higher growth in areas like retirement planning and wealth management, fueled by an aging population and the increasing need for secure retirement solutions. Conversely, segments focused solely on traditional investment advice might experience slower growth as clients seek more comprehensive and personalized offerings. The market’s expansion is geographically concentrated in major financial hubs like New York and Boston but is witnessing a gradual shift towards other regions as awareness and accessibility of financial advisory services increase. Continued economic stability and positive investor sentiment are crucial factors supporting the market's projected Compound Annual Growth Rate (CAGR) of 8.12% through 2033. The market is also expected to see increased consolidation as larger firms acquire smaller players to enhance their service offerings and market share.

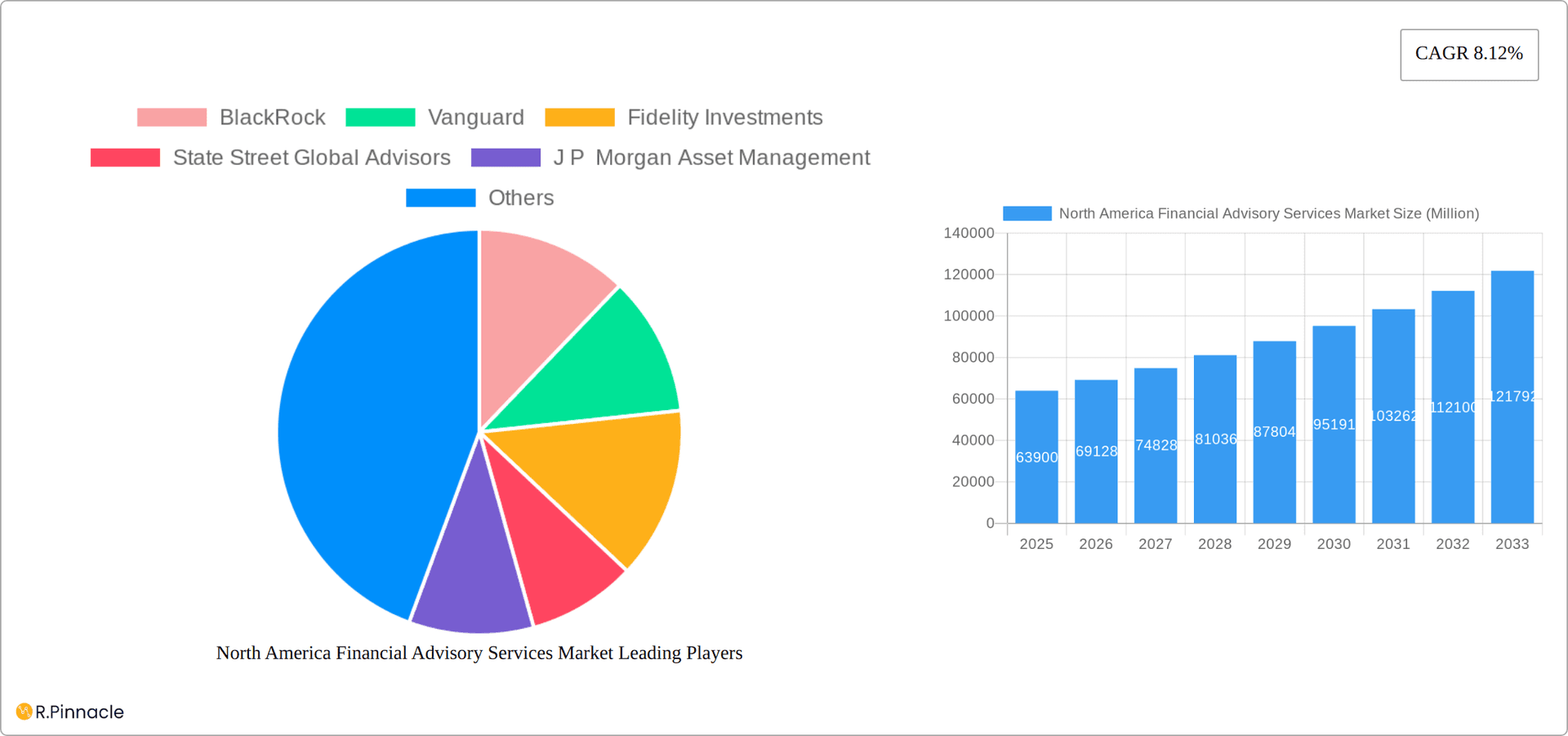

North America Financial Advisory Services Market Company Market Share

North America Financial Advisory Services Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Financial Advisory Services Market, covering the period 2019-2033. It offers actionable insights for industry professionals, investors, and strategic decision-makers seeking to understand market dynamics, growth opportunities, and competitive landscapes. The report analyzes market size, segmentation, key players, and future trends, providing a robust foundation for informed business strategies. The base year for this analysis is 2025, with estimations for 2025 and forecasts extending to 2033. The historical period covered is 2019-2024.

North America Financial Advisory Services Market Structure & Innovation Trends

This section analyzes the market's competitive landscape, identifying key players and their market share. We examine innovation drivers, regulatory frameworks, and market trends influencing the industry. The analysis includes an assessment of mergers and acquisitions (M&A) activity, highlighting deal values and their impact on market consolidation.

- Market Concentration: The North American financial advisory services market is moderately concentrated, with major players such as BlackRock, Vanguard, Fidelity Investments, State Street Global Advisors, and J P Morgan Asset Management holding significant market share. Exact figures are detailed within the report, but a xx% concentration is observed among the top 5 players in 2025.

- Innovation Drivers: Technological advancements in data analytics, AI, and robo-advisory are driving innovation, enhancing efficiency, and expanding service offerings.

- Regulatory Framework: Stringent regulatory compliance requirements, such as those imposed by the SEC, significantly impact market operations and necessitate substantial investments in compliance technologies and expertise.

- M&A Activity: The market has witnessed significant M&A activity in recent years, with deals valued at xx Million in 2024. These activities indicate a trend towards consolidation and expansion of service portfolios. Examples detailed in the report.

- Product Substitutes: The rise of fintech companies and robo-advisors presents a growing number of substitutes, challenging traditional advisory firms.

- End-User Demographics: High-net-worth individuals, institutional investors, and corporations are the primary end-users, with varying needs and preferences shaping the market.

North America Financial Advisory Services Market Dynamics & Trends

This section delves into the factors driving market growth, technological disruptions, consumer preferences, and competitive dynamics. We analyze historical trends, providing a clear picture of the market's evolution and projecting future growth using key metrics. The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration for various segments is also analyzed to showcase the different growth prospects across distinct customer groups.

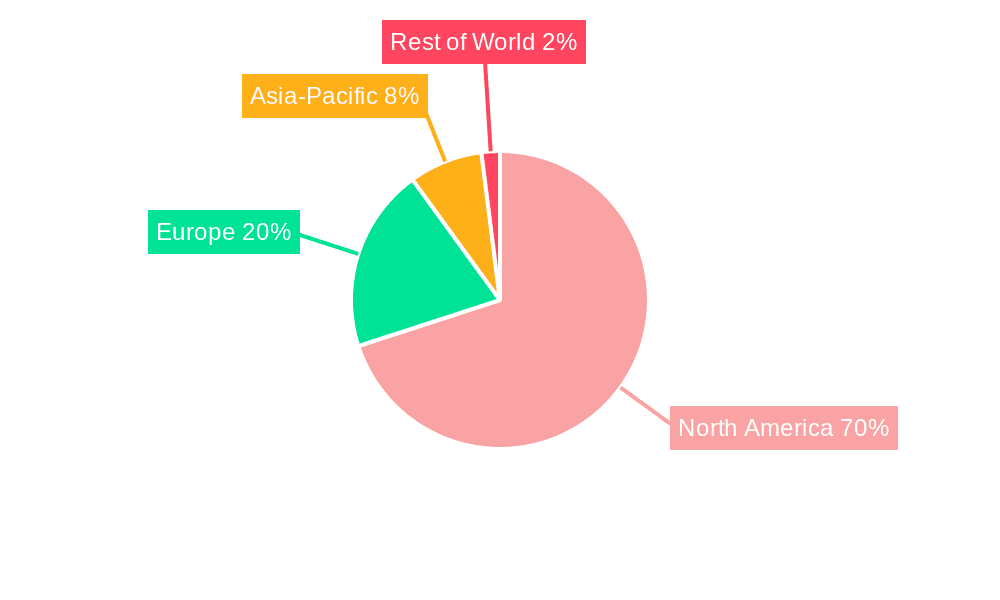

Dominant Regions & Segments in North America Financial Advisory Services Market

This section identifies the leading regions and segments within the North American financial advisory services market. Key drivers behind the dominance of specific regions are detailed, analyzing economic factors, regulatory frameworks, and infrastructure.

- Dominant Region: [Insert dominant region, e.g., The Northeast] leads the market due to a higher concentration of financial institutions, a robust regulatory framework and a substantial high-net-worth individual population.

- Key Drivers (Northeast Region):

- Strong presence of major financial institutions.

- Well-established regulatory framework facilitating financial services.

- High concentration of high-net-worth individuals seeking investment advice.

- Advanced financial technology infrastructure supporting sophisticated advisory services.

- Other Key Regions and Segments: This section provides detailed analysis of other significant regions and segments.

North America Financial Advisory Services Market Product Innovations

The North American financial advisory services market is experiencing a period of significant transformation, driven by rapid technological advancements and evolving client needs. Recent product developments showcase a strong emphasis on personalized, efficient, and data-driven solutions. This includes the rise of robo-advisory platforms offering automated portfolio management at lower costs, AI-powered tools providing sophisticated investment analysis and personalized recommendations, and the development of specialized investment strategies catering to specific demographic groups, risk profiles, and investment goals (e.g., sustainable investing, impact investing). Furthermore, the integration of blockchain technology is enhancing security and transparency in transactions, while advanced data analytics are enabling more accurate risk assessments and improved portfolio performance. This convergence of technology and financial expertise is reshaping the competitive landscape, pushing firms to innovate continuously to meet the demands of a more sophisticated and digitally-savvy clientele.

Report Scope & Segmentation Analysis

This report segments the North America Financial Advisory Services Market based on several criteria, including service type, client type, and geographic location. Each segment’s market size, growth projections, and competitive dynamics are analyzed.

- [Segment 1, e.g., By Service Type]: This segment includes [details of segment 1 and its projected growth].

- [Segment 2, e.g., By Client Type]: This segment includes [details of segment 2 and its projected growth].

- [Segment 3, e.g., By Geographic Location]: This segment includes [details of segment 3 and its projected growth].

Key Drivers of North America Financial Advisory Services Market Growth

Several factors contribute to the growth of the North America financial advisory services market. These include the increasing demand for personalized financial advice, advancements in financial technology, favorable regulatory environments in certain regions, and a growing affluent population seeking expert investment guidance. The rising complexity of financial markets also pushes more individuals and institutions towards professional advice.

Challenges in the North America Financial Advisory Services Market Sector

The North America financial advisory services market faces various challenges, including stringent regulatory compliance requirements, intensifying competition from fintech companies and robo-advisors, and the need to adapt to rapidly evolving technological advancements. Maintaining client trust amidst economic uncertainties and adapting to evolving market trends are also crucial for long-term sustainability.

Emerging Opportunities in North America Financial Advisory Services Market

This market offers exciting opportunities, including the expansion of sustainable and impact investing, the growth of personalized financial planning solutions tailored to specific demographic groups, and the increasing demand for specialized advisory services focusing on niche sectors. The adoption of advanced technologies like AI and machine learning is transforming the industry, opening up new avenues for growth and market expansion.

Leading Players in the North America Financial Advisory Services Market Market

Key Developments in North America Financial Advisory Services Market Industry

- February 2023: Deloitte significantly expanded its services for start-ups and scale-ups through the acquisition of 27 pilots, a German incubator, a venture capitalist, and a matchmaker. This strategic move broadened Deloitte's service offerings and strengthened its position within the burgeoning start-up ecosystem.

- January 2023: Fidelity Investments acquired Shoobx, a leading provider of automated equity management operations and financing software for private companies. This acquisition enhanced Fidelity's technological capabilities and broadened its service offerings to include sophisticated equity management solutions for private companies.

- [Add more recent developments here with dates and brief descriptions. Include mergers, acquisitions, new product launches, regulatory changes, and significant market trends.]

Future Outlook for North America Financial Advisory Services Market Market

The North America financial advisory services market is poised for continued growth, driven by technological innovation, increasing demand for personalized financial solutions, and evolving investor preferences. The market's future potential lies in leveraging advanced technologies to enhance efficiency, personalization, and access to financial advisory services, catering to a broader range of clients with varied financial needs. Strategic partnerships and acquisitions will continue to shape the industry landscape.

North America Financial Advisory Services Market Segmentation

-

1. Type

- 1.1. Corporate Finance

- 1.2. Accounting Advisory

- 1.3. Tax Advisory

- 1.4. Transaction Services

- 1.5. Risk Management

- 1.6. Others

-

2. Organization Size

- 2.1. Large Enterprises

- 2.2. Small & Medium-Sized Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT And Telecom

- 3.3. Manufacturing

- 3.4. Retail And E-Commerce

- 3.5. Public Sector

- 3.6. Healthcare

- 3.7. Others

North America Financial Advisory Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Financial Advisory Services Market Regional Market Share

Geographic Coverage of North America Financial Advisory Services Market

North America Financial Advisory Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Use of Robot Advisory Services is Growing in North America.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Corporate Finance

- 5.1.2. Accounting Advisory

- 5.1.3. Tax Advisory

- 5.1.4. Transaction Services

- 5.1.5. Risk Management

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Large Enterprises

- 5.2.2. Small & Medium-Sized Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT And Telecom

- 5.3.3. Manufacturing

- 5.3.4. Retail And E-Commerce

- 5.3.5. Public Sector

- 5.3.6. Healthcare

- 5.3.7. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BlackRock

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vanguard

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fidelity Investments

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 State Street Global Advisors

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 J P Morgan Asset Management

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Boston Consulting Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ernst & Young Global Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bain & Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PWC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Deloitte**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BlackRock

List of Figures

- Figure 1: North America Financial Advisory Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Financial Advisory Services Market Share (%) by Company 2025

List of Tables

- Table 1: North America Financial Advisory Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Financial Advisory Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: North America Financial Advisory Services Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 4: North America Financial Advisory Services Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 5: North America Financial Advisory Services Market Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 6: North America Financial Advisory Services Market Volume Billion Forecast, by Industry Vertical 2020 & 2033

- Table 7: North America Financial Advisory Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Financial Advisory Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: North America Financial Advisory Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: North America Financial Advisory Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: North America Financial Advisory Services Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 12: North America Financial Advisory Services Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 13: North America Financial Advisory Services Market Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 14: North America Financial Advisory Services Market Volume Billion Forecast, by Industry Vertical 2020 & 2033

- Table 15: North America Financial Advisory Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Financial Advisory Services Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States North America Financial Advisory Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States North America Financial Advisory Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada North America Financial Advisory Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada North America Financial Advisory Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America Financial Advisory Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America Financial Advisory Services Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Financial Advisory Services Market?

The projected CAGR is approximately 8.12%.

2. Which companies are prominent players in the North America Financial Advisory Services Market?

Key companies in the market include BlackRock, Vanguard, Fidelity Investments, State Street Global Advisors, J P Morgan Asset Management, Boston Consulting Group, Ernst & Young Global Limited, Bain & Company, PWC, Deloitte**List Not Exhaustive.

3. What are the main segments of the North America Financial Advisory Services Market?

The market segments include Type, Organization Size, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.90 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Use of Robot Advisory Services is Growing in North America..

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Deloitte boosted its start-up and scale-up capabilities by acquiring 27 pilots, a Germany-based incubator, a venture capitalist, and a matchmaker. With 27 pilots as part of its portfolio, Deloitte can better serve its base of start-ups and scale-ups with a full range of services, from incubation and growth to technology, infrastructure, and venture capital solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Financial Advisory Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Financial Advisory Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Financial Advisory Services Market?

To stay informed about further developments, trends, and reports in the North America Financial Advisory Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence