Key Insights

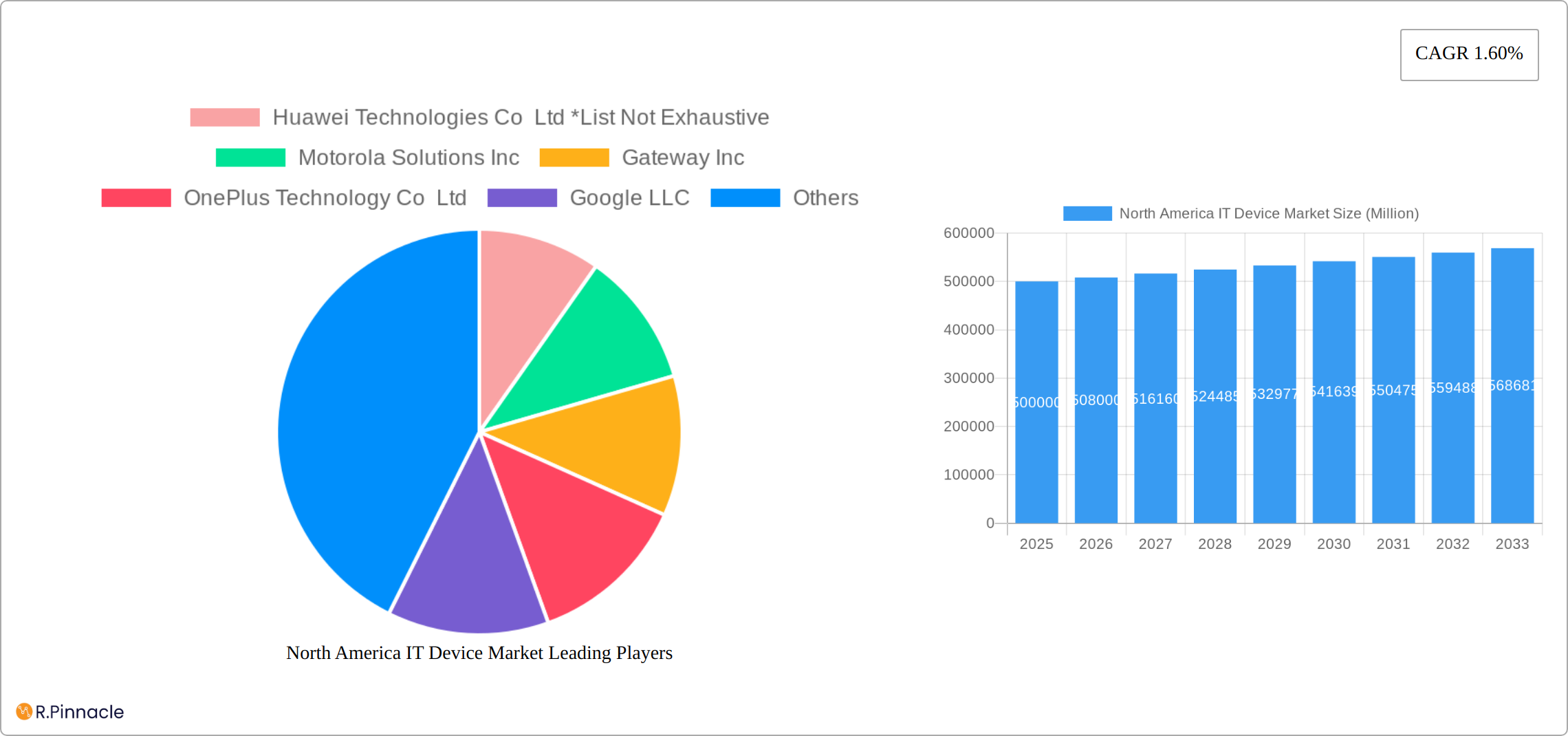

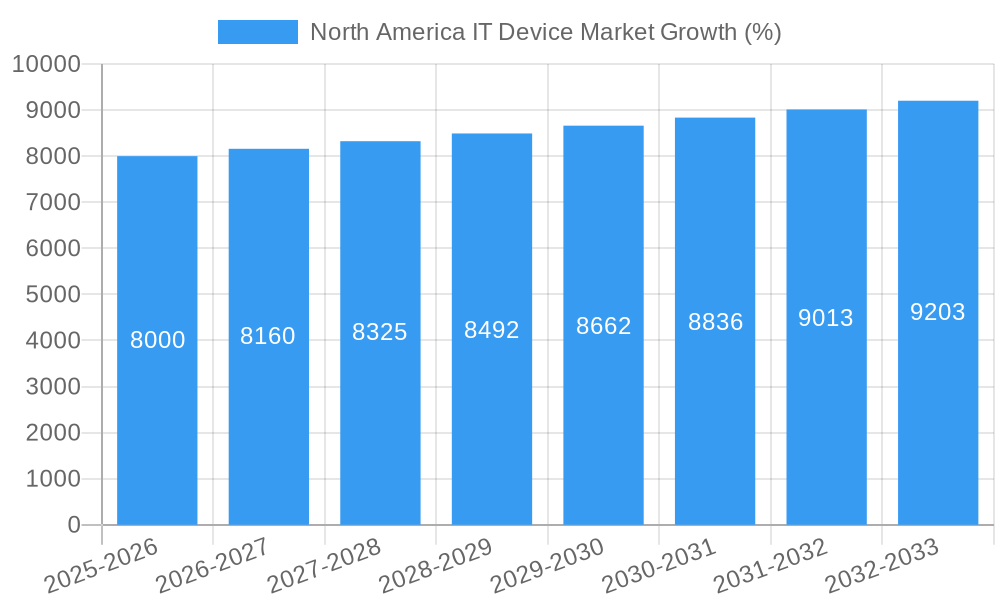

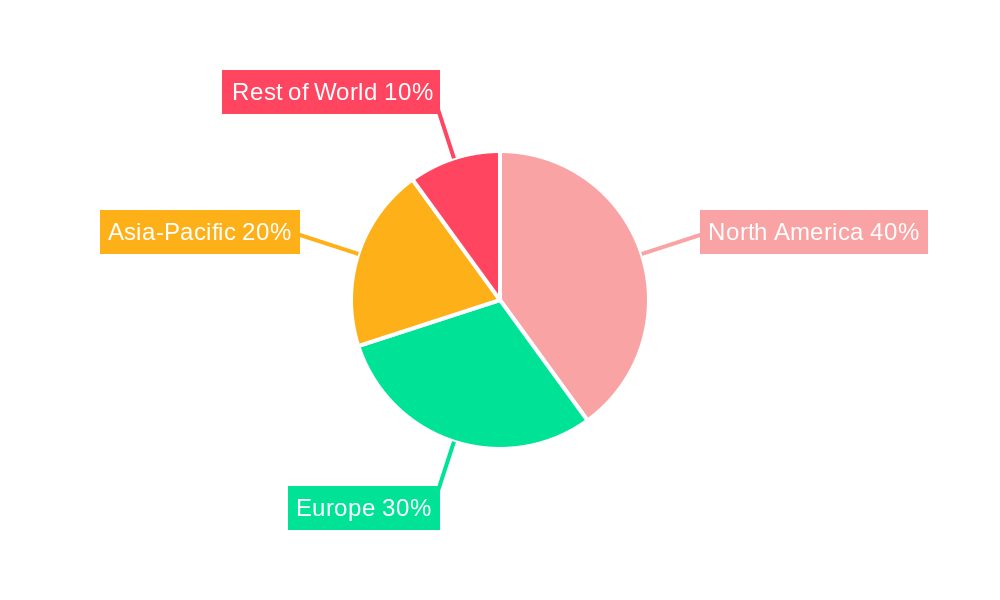

The North American IT device market, encompassing PCs, tablets, and phones, exhibits a moderate yet consistent growth trajectory. While precise market size figures for 2025 are not provided, we can extrapolate a reasonable estimate based on the given CAGR of 1.60% and a stated study period of 2019-2033. Assuming a base year market size of $X million in 2025 (where X represents a realistic estimate given current market conditions; a figure would need to be inserted here based on publicly available market reports from firms such as Gartner or IDC), the market is expected to reach approximately $Y million by 2033. (Y is calculated using the CAGR over the forecast period). This growth is propelled by several key drivers, including the increasing adoption of cloud computing and remote work solutions, which necessitate a wider range of devices for seamless connectivity and productivity. Furthermore, continuous technological advancements, leading to improved device performance, longer battery life, and enhanced features, fuel consumer demand. However, potential restraints include economic fluctuations that could impact consumer spending on electronics, and the saturation of certain market segments, particularly smartphones, leading to slowing replacement cycles. The segment breakdown suggests a significant contribution from PCs, reflecting the persistent demand for high-performance computing, particularly in the professional and educational sectors. Tablets and phones likely represent larger volume segments but with potentially lower average selling prices, impacting overall market valuation. Key players like Apple, Samsung, and Microsoft are expected to dominate market share, driven by brand recognition, robust ecosystems, and innovative product launches. The competition is fierce, however, with rising Chinese manufacturers challenging the established players. The North American market itself is expected to retain a substantial share of the global IT device market, driven by high per capita income and advanced technological adoption rates.

The North American IT device market landscape is characterized by a dynamic interplay of established and emerging players. Competitive strategies focus heavily on innovation, strategic partnerships, and effective supply chain management. Companies are investing heavily in research and development to enhance device functionality and user experience. The market is also witnessing a trend towards increased customization and personalization of devices to cater to specific consumer needs. Furthermore, growing concerns about data privacy and security are influencing the development and adoption of advanced security features in IT devices. The market is expected to continue to evolve, shaped by shifting consumer preferences, technological advancements, and evolving business models. A careful monitoring of macroeconomic conditions, changing regulatory landscape and emerging technologies will be vital for businesses seeking sustainable growth in this competitive environment.

This comprehensive report provides an in-depth analysis of the North America IT device market, covering the period from 2019 to 2033. It offers valuable insights into market dynamics, growth drivers, challenges, and future opportunities, making it an essential resource for industry professionals, investors, and strategic decision-makers. The report leverages extensive data and analysis to forecast robust market growth, highlighting key trends and segment performances within the PC, tablet, and phone sectors. With a base year of 2025 and an estimated year of 2025, this report projects the market's trajectory through 2033.

North America IT Device Market Structure & Innovation Trends

This section analyzes the competitive landscape of the North American IT device market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and mergers and acquisitions (M&A) activities. The market is highly competitive, with several major players holding significant market share. For example, Apple and Samsung dominate the smartphone segment, while Dell and Lenovo are key players in the PC market. However, the market also features numerous smaller companies that contribute to innovation and niche market growth.

Market Concentration: The North American IT device market exhibits moderate concentration, with a few dominant players and a significant number of smaller, specialized companies. The top 5 players collectively hold an estimated xx% market share in 2025, a slight decrease from xx% in 2019, indicating increasing competition.

Innovation Drivers: Continuous advancements in processing power, display technology, and connectivity are key drivers of innovation. The increasing demand for lightweight, portable, and feature-rich devices fuels innovation across different segments.

Regulatory Frameworks: Government regulations concerning data privacy, cybersecurity, and environmental standards impact the market. Compliance costs and evolving regulations shape business strategies.

Product Substitutes: The emergence of alternative technologies (e.g., smartwatches for basic communication) presents challenges to traditional IT devices.

End-User Demographics: The market is driven by diverse demographics, including individual consumers, businesses, educational institutions, and government agencies. Understanding these varying needs and preferences is crucial for market success.

M&A Activities: M&A activity in the sector has remained moderate in recent years, with deal values averaging approximately xx Million in 2024. Strategic acquisitions often involve smaller companies specializing in specific technologies or niche markets.

North America IT Device Market Market Dynamics & Trends

The North American IT device market is experiencing robust growth, propelled by a confluence of factors. Significant technological advancements, such as the widespread adoption of 5G networks and the continuous improvement of processing power, are driving demand for cutting-edge devices. Evolving consumer preferences, including the escalating popularity of mobile devices and cloud-based services, are profoundly reshaping the market landscape. This dynamic is further amplified by rising consumer disposable incomes and substantial government investments in bolstering digital infrastructure across the region. The market projects a CAGR of xx% during the forecast period (2025-2033), primarily driven by strong smartphone sales, steady PC growth, and ongoing tablet market penetration. The competitive landscape is intensely competitive, featuring established industry giants vying for market share alongside a continuous influx of innovative newcomers. Market saturation is increasing, prompting leading players to prioritize product differentiation through unique features, premium branding strategies, and strategic partnerships to maintain a competitive edge.

Dominant Regions & Segments in North America IT Device Market

The United States dominates the North American IT device market, accounting for xx% of total market value in 2025. This dominance is attributed to several factors:

Strong Economic Growth: A robust economy fuels high consumer spending on IT devices.

Advanced Infrastructure: Well-developed infrastructure enables seamless access to technology and digital services.

High Technological Adoption: The U.S. is a leading adopter of new technologies and trends, driving high demand for advanced devices.

Within the segments, the smartphone segment holds the largest market share (xx%), followed by the PC segment (xx%) and tablets (xx%). The smartphone segment's dominance is driven by increasing consumer preference for mobile devices and technological innovations in mobile computing and connectivity. The PC market is largely driven by business demand and the ongoing need for robust computing power in various professional settings. The tablet market shows a slower growth rate compared to smartphones and PCs, due to the emergence of larger-screened smartphones and improved laptop portability.

North America IT Device Market Product Innovations

Recent product innovations are significantly impacting the market. The emergence of foldable smartphones, substantial improvements in PC processing power, and advancements in tablet display technology are enhancing user experiences, performance, and functionality. The integration of artificial intelligence (AI) and machine learning (ML) across various devices is gaining momentum, enabling personalized user experiences and expanding device capabilities. Furthermore, the adoption of new materials and manufacturing techniques is resulting in lighter, more durable, and environmentally conscious devices. The ongoing pursuit of extended battery life, faster processors, and advanced camera systems continues to drive innovation within the North American IT device market.

Report Scope & Segmentation Analysis

This report segments the North America IT device market by type: PCs, Tablets, and Phones.

PCs: This segment is projected to grow at a CAGR of xx% from 2025 to 2033. The market is characterized by intense competition, with key players constantly innovating to maintain market share.

Tablets: The tablet segment is expected to grow at a CAGR of xx% during the forecast period. The growth is moderated by the increased screen size of smartphones.

Phones: This segment is anticipated to experience a CAGR of xx% from 2025 to 2033, driven by increasing smartphone penetration and ongoing innovations in mobile technology. The market is dominated by a few key players.

Key Drivers of North America IT Device Market Growth

Several factors contribute to the growth of the North America IT device market. Technological advancements, such as 5G technology and improved processing power, fuel demand for newer, faster devices. The increasing adoption of cloud computing and mobile applications drives the need for mobile devices capable of seamless integration. Government initiatives to promote digitalization and improved infrastructure contribute to market growth. Moreover, increased disposable income among consumers fuels spending on these devices.

Challenges in the North America IT Device Market Sector

Despite the robust growth, the North American IT device market faces several notable challenges. Supply chain disruptions, escalating component costs, and fierce competition among established and emerging players are impacting profitability and growth projections. Trade regulations and tariffs pose further obstacles to market expansion. Additionally, growing concerns regarding electronic waste (e-waste) and environmental sustainability are placing increasing pressure on manufacturers to embrace more eco-friendly manufacturing practices and sustainable product lifecycles. Addressing these challenges will be crucial for sustained market growth.

Emerging Opportunities in North America IT Device Market

Opportunities exist in the development of more sustainable, energy-efficient devices and the exploration of niche applications (e.g., specialized devices for specific industries). Growing demand for augmented and virtual reality (AR/VR) devices and the integration of IoT (Internet of Things) technology into IT devices present additional opportunities.

Leading Players in the North America IT Device Market Market

- Huawei Technologies Co Ltd

- Motorola Solutions Inc

- Gateway Inc

- OnePlus Technology Co Ltd

- Google LLC

- Lenovo Group Limited

- Samsung Electronics Co Ltd

- Microsoft Corporation

- Xiaomi Corporation

- Dell Inc

- The International Business Machines Corporation (IBM)

- Intel Corp

- Oracle Corp

- Apple Inc

- LG Corporation

Key Developments in North America IT Device Market Industry

November 2022: Apple's launch of a satellite-enabled SOS service in the U.S. and Canada for iPhone 14 users marks a significant advancement in emergency communication, enhancing safety and potentially boosting iPhone sales by offering a unique safety feature even without cellular network access.

April 2022: Microsoft's expanded collaboration with MediaKind to accelerate the transition to digital video strengthens its cloud offerings and reinforces its position within the media and entertainment sector, signifying a strategic move into this growing market segment.

[Add another recent key development here with date and brief description]

Future Outlook for North America IT Device Market Market

The North America IT device market is poised for continued growth, driven by technological advancements, increasing consumer demand, and supportive government policies. The market will see continued innovation in areas such as AI, 5G connectivity, and enhanced user experiences. Companies will need to focus on differentiation, sustainability, and the development of innovative products and services to maintain competitiveness in this dynamic market.

North America IT Device Market Segmentation

-

1. Type

-

1.1. PC's

- 1.1.1. Laptops

- 1.1.2. Desktop PCs

- 1.1.3. Tablets

-

1.2. Phones

- 1.2.1. Landline Phones

- 1.2.2. Smartphones

- 1.2.3. Feature Phones

-

1.1. PC's

-

2. Geography

-

2.1. North America

- 2.1.1. United States

- 2.1.2. Canada

-

2.1. North America

North America IT Device Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

North America IT Device Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Demand for Smartphones; Signidicant 5G Coverage in the Region

- 3.3. Market Restrains

- 3.3.1. Shortage of Semiconductor (Chip)

- 3.4. Market Trends

- 3.4.1. Stellar Smart Phone Penetration

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. PC's

- 5.1.1.1. Laptops

- 5.1.1.2. Desktop PCs

- 5.1.1.3. Tablets

- 5.1.2. Phones

- 5.1.2.1. Landline Phones

- 5.1.2.2. Smartphones

- 5.1.2.3. Feature Phones

- 5.1.1. PC's

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. North America

- 5.2.1.1. United States

- 5.2.1.2. Canada

- 5.2.1. North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Huawei Technologies Co Ltd *List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Motorola Solutions Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Gateway Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 OnePlus Technology Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Google LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Lenovo Group Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Samsung Electronics Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Microsoft Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Xiaomi Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Dell Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 The International Business Machines Corporation(IBM)

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Intel Corp

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Oracle Corp

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Apple Inc

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 LG Corporation

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Huawei Technologies Co Ltd *List Not Exhaustive

List of Figures

- Figure 1: North America IT Device Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America IT Device Market Share (%) by Company 2024

List of Tables

- Table 1: North America IT Device Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: North America IT Device Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: North America IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: North America IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America IT Device Market?

The projected CAGR is approximately 1.60%.

2. Which companies are prominent players in the North America IT Device Market?

Key companies in the market include Huawei Technologies Co Ltd *List Not Exhaustive, Motorola Solutions Inc, Gateway Inc, OnePlus Technology Co Ltd, Google LLC, Lenovo Group Limited, Samsung Electronics Co Ltd, Microsoft Corporation, Xiaomi Corporation, Dell Inc, The International Business Machines Corporation(IBM), Intel Corp, Oracle Corp, Apple Inc, LG Corporation.

3. What are the main segments of the North America IT Device Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Demand for Smartphones; Signidicant 5G Coverage in the Region.

6. What are the notable trends driving market growth?

Stellar Smart Phone Penetration.

7. Are there any restraints impacting market growth?

Shortage of Semiconductor (Chip).

8. Can you provide examples of recent developments in the market?

November 2022: Apple, the leading telephone brand in the world, introduced a satellite-enabled SOS service in the United States and Canada. Only iPhone 14 owners may utilize the service, which enables the device to transmit SOS signals in an emergency from a distance even if cellular networks are not accessible.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America IT Device Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America IT Device Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America IT Device Market?

To stay informed about further developments, trends, and reports in the North America IT Device Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence