Key Insights

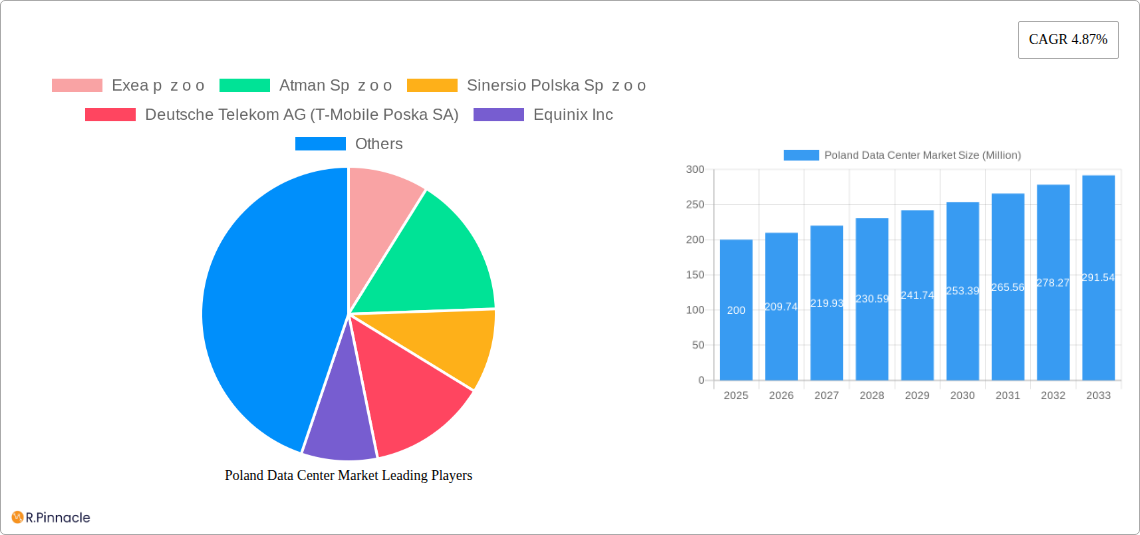

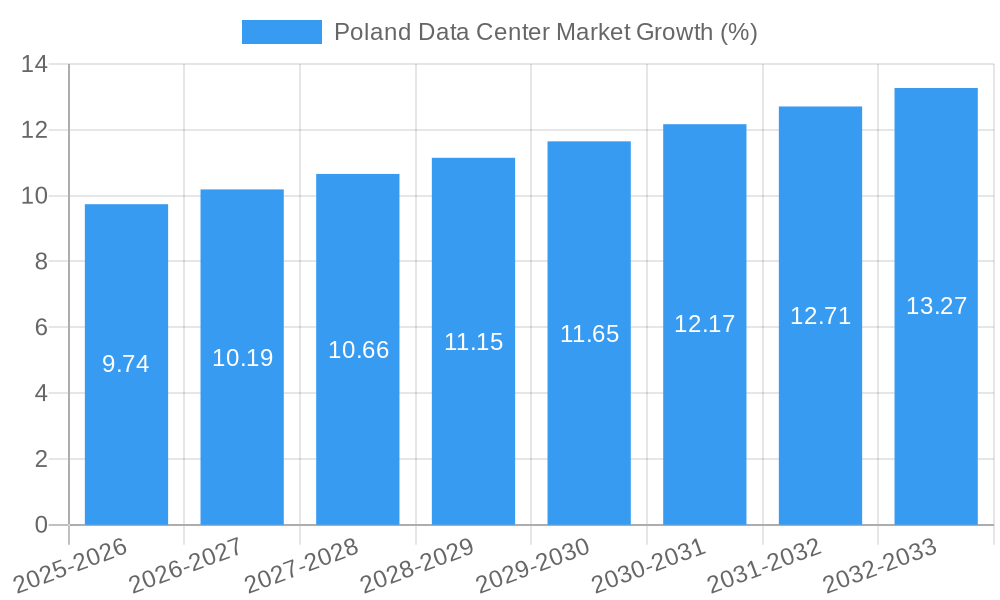

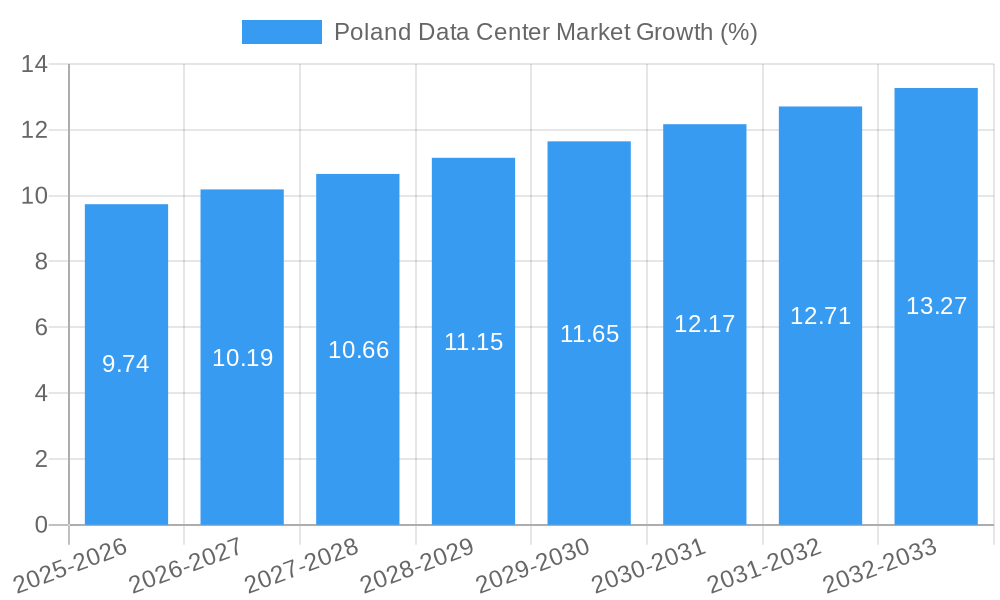

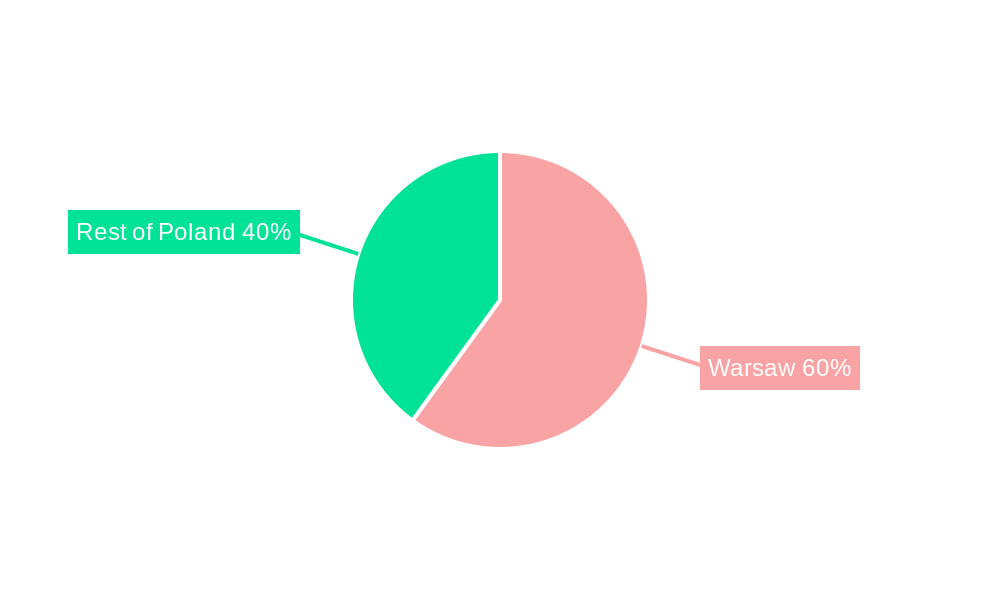

The Poland data center market, valued at approximately €XX million in 2025, is projected to experience robust growth, driven by a 4.87% CAGR from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing digitalization of Polish businesses and the rising adoption of cloud computing services necessitate substantial data storage and processing capabilities. Secondly, Warsaw, as a major economic hub, acts as a primary hotspot for data center development, attracting significant investments and fostering competition. Thirdly, the expanding telecommunications infrastructure and government initiatives promoting digital transformation create a favorable environment for data center growth. The market is segmented by data center size (small, medium, mega, massive, large), tier type (Tier 1, Tier 2, Tier 3, Tier 4), and utilization (utilized, non-utilized). The presence of major players like Equinix, Deutsche Telekom, and several domestic companies signifies a competitive landscape, driving innovation and investment in advanced data center technologies. Furthermore, the increasing demand for edge computing solutions to reduce latency and improve responsiveness will further propel market expansion throughout the forecast period.

However, challenges remain. Competition among existing and emerging players could lead to price pressures. The availability of skilled workforce needed to manage and maintain sophisticated data centers could also be a limiting factor. Furthermore, the market may face certain regulatory hurdles and potential infrastructure limitations, particularly outside of major urban centers. Despite these restraints, the long-term outlook for the Poland data center market remains positive, driven by consistent economic growth, increasing digital adoption, and supportive government policies. The forecast period (2025-2033) suggests a significant expansion, with a likely increase in the overall market value and the continued dominance of Warsaw as a key location. We anticipate higher demand for larger, higher-tier data centers.

Poland Data Center Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Poland data center market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's structure, dynamics, key players, and future outlook. The analysis incorporates detailed segmentation by region (Warsaw and Rest of Poland), data center size (Small, Medium, Mega, Massive, Large), tier type (Tier 1 and Tier III), and absorption (Utilized, Non-Utilized, Other End User).

Poland Data Center Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory environment of the Polish data center market. The report examines market concentration, revealing the market share held by key players like Exea p z o o, Atman Sp z o o, Sinersio Polska Sp z o o, Deutsche Telekom AG (T-Mobile Poska SA), Equinix Inc, Comarch SA, 3S Data Center SA (P4 Sp z o o), LIMDC, Beyond pl Sp z o o, Vantage Data Centers LLC, S-NET Sp z o o (TOYA Group), and Polcom SA. It further explores innovation drivers, such as increasing digitalization and cloud adoption, and assesses the impact of regulatory frameworks on market growth. The analysis also incorporates an overview of M&A activities, including deal values and their influence on market consolidation. The report quantifies the market size in Millions, providing a clear picture of market share distribution and outlining significant trends affecting the sector. For example, the xx Million spent on M&A activities in the last five years highlights the considerable interest and investment in the market.

Poland Data Center Market Market Dynamics & Trends

This section delves into the dynamic forces shaping the Polish data center market, examining market growth drivers, technological advancements, consumer preferences, and competitive dynamics. The report provides a detailed analysis of the market's Compound Annual Growth Rate (CAGR) and market penetration rates, projecting a xx% CAGR over the forecast period. Factors contributing to this growth are explored, including increasing demand for cloud services, the expansion of 5G networks, and the growing adoption of digital technologies across various industries. The analysis also considers technological disruptions, such as the rise of edge computing and hyperscale data centers, and their impact on market evolution. The competitive landscape is meticulously examined, highlighting the strategies employed by major players to maintain their market position and attract new customers. Specific metrics on market penetration in various segments are provided, illustrating the evolving preferences of end-users.

Dominant Regions & Segments in Poland Data Center Market

Warsaw stands as the dominant region in the Poland data center market, fueled by its established infrastructure, skilled workforce, and proximity to key businesses. The “Rest of Poland” segment shows significant but slower growth compared to Warsaw.

Key Drivers for Warsaw's Dominance:

- Superior infrastructure, including readily available power and connectivity.

- Concentration of major businesses and government agencies.

- Established talent pool skilled in data center operations and management.

- Pro-business government policies encouraging investment.

Data Center Size: The Large and Mega segments are currently the largest, however the Massive segment shows the highest growth potential driven by hyperscale cloud providers.

Tier Type: Tier III data centers dominate the market due to their enhanced reliability and redundancy.

Absorption: Utilized capacity is high in Warsaw, with Non-Utilized capacity representing a considerable opportunity for new entrants.

The report provides a detailed analysis of the growth potential and market size for each segment, including competitive dynamics and projected market shares.

Poland Data Center Market Product Innovations

The Poland data center market is witnessing significant product innovations, driven by technological advancements in areas like AI, machine learning, and edge computing. New data center designs emphasize higher efficiency, sustainability, and improved security features. These innovations are designed to cater to the evolving needs of businesses, addressing concerns related to power consumption, operational costs, and data security. The competitive landscape is marked by the introduction of innovative services and solutions, each striving to offer unique value propositions and competitive advantages.

Report Scope & Segmentation Analysis

This report offers a detailed segmentation of the Poland data center market across several key dimensions:

Region: Warsaw and Rest of Poland. Warsaw shows significant growth potential due to its concentrated business activity. The Rest of Poland segment is expanding with the development of regional data centers.

Data Center Size: Small, Medium, Mega, Massive, and Large. Market sizes and growth projections for each size category are provided, showing the dominance of Large and Mega data centers.

Tier Type: Tier I and Tier III. The report analyzes the market share and growth of each tier type, highlighting the preference for Tier III facilities.

Absorption: Utilized, Non-Utilized, and Other End User. Detailed analysis of capacity utilization provides valuable insights into market saturation and investment opportunities.

Each segment's growth projections, market sizes, and competitive dynamics are comprehensively analyzed.

Key Drivers of Poland Data Center Market Growth

Several factors are driving the growth of the Poland data center market. These include increasing digitalization across various sectors, government initiatives promoting digital transformation, the growing adoption of cloud computing and colocation services, and the expansion of high-speed internet infrastructure. Further fueling growth is the influx of foreign investment and the strategic location of Poland within the European Union.

Challenges in the Poland Data Center Market Sector

The Poland data center market faces certain challenges. These include securing sufficient power supply for rapidly expanding data centers, navigating complex regulatory frameworks, and managing competition from established and emerging players. Supply chain disruptions and the need for skilled workforce are also significant factors affecting the industry's growth.

Emerging Opportunities in Poland Data Center Market

Significant opportunities exist in the Poland data center market. These include the growth of edge computing, the increasing demand for sustainable data centers, and the expansion into new regions beyond Warsaw. The potential for specialized data centers focusing on particular industries and the increasing adoption of advanced technologies like AI and IoT present lucrative avenues for market expansion.

Leading Players in the Poland Data Center Market Market

- Exea p z o o

- Atman Sp z o o

- Sinersio Polska Sp z o o

- Deutsche Telekom AG (T-Mobile Poska SA)

- Equinix Inc

- Comarch SA

- 3S Data Center SA (P4 Sp z o o)

- LIMDC

- Beyond pl Sp z o o

- Vantage Data Centers LLC

- S-NET Sp z o o (TOYA Group)

- Polcom SA

Key Developments in Poland Data Center Market Industry

- June 2022: Vantage completed its first facility in Warsaw, offering 48MW of capacity.

- August 2022: Atman expanded its Warsaw-1 data center, adding 7.2 MW of capacity.

- December 2022: Atman acquired land for a new 43 MW data center in Duchnice, opening in Q4 2024.

Future Outlook for Poland Data Center Market Market

The Poland data center market is poised for continued growth, driven by ongoing digital transformation and increased demand for cloud services. The expansion of 5G networks and the growing adoption of innovative technologies will further accelerate market expansion. Strategic investments in infrastructure and the development of sustainable data center solutions will play a key role in shaping the future of the market. The report projects a continued strong growth trajectory over the next decade.

Poland Data Center Market Segmentation

-

1. Hotspot

- 1.1. Warsaw

- 1.2. Rest of Poland

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

4.2. By Colocation Type

- 4.2.1. Hyperscale

- 4.2.2. Retail

- 4.2.3. Wholesale

-

4.3. By End User

- 4.3.1. BFSI

- 4.3.2. Cloud

- 4.3.3. E-Commerce

- 4.3.4. Government

- 4.3.5. Manufacturing

- 4.3.6. Media & Entertainment

- 4.3.7. Telecom

- 4.3.8. Other End User

Poland Data Center Market Segmentation By Geography

- 1. Poland

Poland Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Automation in the Security Screening Industry

- 3.2.2 Especially to Detect Advanced Threats

- 3.2.3 etc.; Upsurge in Terror Activities Across the Region; Increasing Government Initiatives on Security Inspection in Schools and Colleges; Increasing Government Initiatives for Smart Cities

- 3.3. Market Restrains

- 3.3.1 Supply Chain Issues Caused By Geopolitical Scenario and the COVID-19 Pandemic

- 3.3.2 etc.; High Installation and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Warsaw

- 5.1.2. Rest of Poland

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.4.2. By Colocation Type

- 5.4.2.1. Hyperscale

- 5.4.2.2. Retail

- 5.4.2.3. Wholesale

- 5.4.3. By End User

- 5.4.3.1. BFSI

- 5.4.3.2. Cloud

- 5.4.3.3. E-Commerce

- 5.4.3.4. Government

- 5.4.3.5. Manufacturing

- 5.4.3.6. Media & Entertainment

- 5.4.3.7. Telecom

- 5.4.3.8. Other End User

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Exea p z o o

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Atman Sp z o o

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sinersio Polska Sp z o o

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Deutsche Telekom AG (T-Mobile Poska SA)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Equinix Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Comarch SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 3S Data Center SA (P4 Sp z o o)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 LIMDC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Beyond pl Sp z o o

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vantage Data Centers LLC5 4 LIST OF COMPANIES STUDIE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 S-NET Sp z o o (TOYA Group)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Polcom SA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Exea p z o o

List of Figures

- Figure 1: Poland Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Poland Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Poland Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Poland Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 3: Poland Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 4: Poland Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 5: Poland Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 6: Poland Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Poland Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Poland Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 9: Poland Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 10: Poland Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 11: Poland Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 12: Poland Data Center Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Data Center Market?

The projected CAGR is approximately 4.87%.

2. Which companies are prominent players in the Poland Data Center Market?

Key companies in the market include Exea p z o o, Atman Sp z o o, Sinersio Polska Sp z o o, Deutsche Telekom AG (T-Mobile Poska SA), Equinix Inc, Comarch SA, 3S Data Center SA (P4 Sp z o o), LIMDC, Beyond pl Sp z o o, Vantage Data Centers LLC5 4 LIST OF COMPANIES STUDIE, S-NET Sp z o o (TOYA Group), Polcom SA.

3. What are the main segments of the Poland Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Automation in the Security Screening Industry. Especially to Detect Advanced Threats. etc.; Upsurge in Terror Activities Across the Region; Increasing Government Initiatives on Security Inspection in Schools and Colleges; Increasing Government Initiatives for Smart Cities.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Supply Chain Issues Caused By Geopolitical Scenario and the COVID-19 Pandemic. etc.; High Installation and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

December 2022: Atman purchased land, the 5.5-hectare site in Duchnice near Ożarów Mazowiecki, to build another data center. The Atman Data Center Warsaw-3 campus was scheduled to open in Q4 2024 with a target IT capacity of 43 MW.August 2022: A new colocation facility would expand Atman Data Center Warsaw-1. The F7 building would have a dedicated power capacity of 7.2 MW for customers’ IT equipment. The new server rooms of 2,916 sq. m were planned to be commissioned in February 2024.June 2022: Vantage completed the first facility on its 12-acre (five-hectare) Warsaw campus. Once fully developed, the two-data center campus would offer 48MW of critical IT capacity across 390,000 square feet (36,000 square meters).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Data Center Market?

To stay informed about further developments, trends, and reports in the Poland Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence