Key Insights

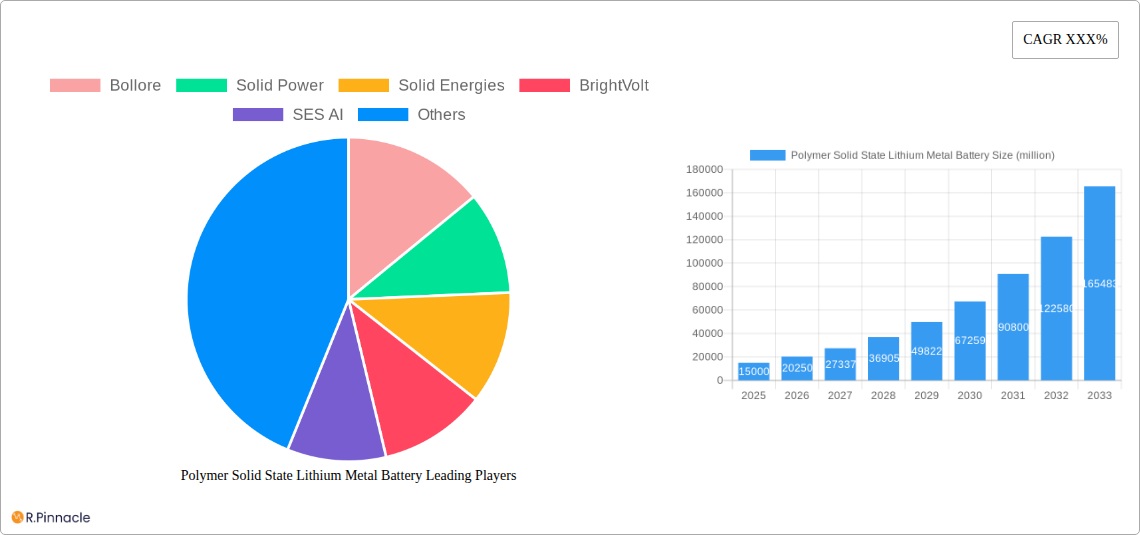

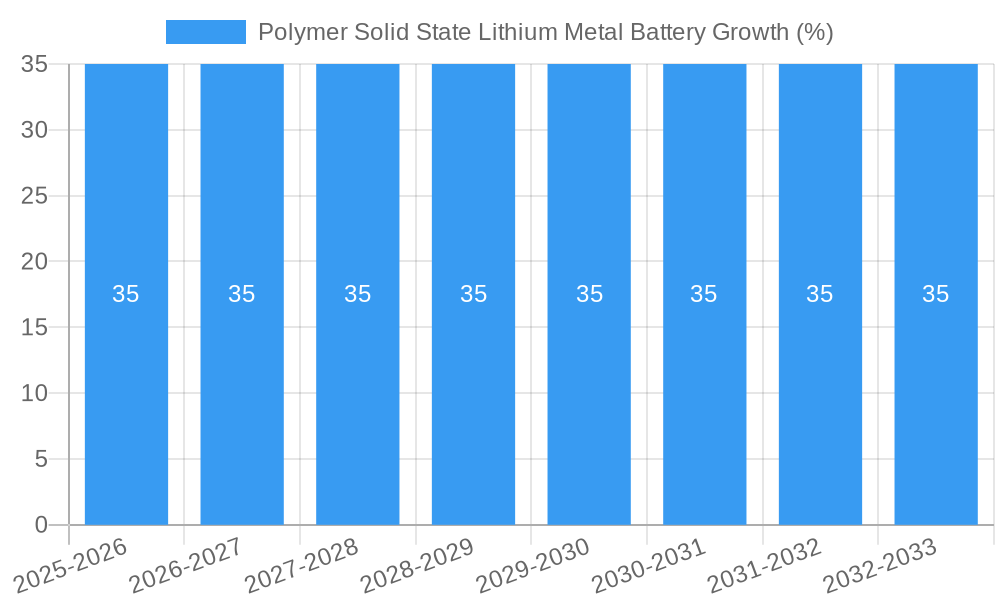

The Polymer Solid State Lithium Metal Battery market is poised for remarkable expansion, projected to reach an estimated $15,000 million by 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 35% through 2033. This surge is primarily fueled by the insatiable demand for enhanced safety, superior energy density, and faster charging capabilities in consumer electronics, electric vehicles (EVs), and grid storage solutions. The inherent advantages of solid-state electrolytes, such as non-flammability and the elimination of liquid electrolyte leakage, address critical safety concerns that have plagued traditional lithium-ion batteries. Furthermore, the potential for thinner, more flexible battery designs opens up new avenues for product innovation and miniaturization across various sectors.

The market's trajectory is being propelled by significant advancements in polymer electrolyte development, leading to improved ionic conductivity and mechanical stability. Key applications driving this growth include next-generation smartphones and wearables, where compact and safe power sources are paramount. In the burgeoning electric vehicle sector, polymer solid-state lithium metal batteries promise longer ranges and quicker charging times, directly addressing consumer adoption barriers. Major industry players like CATL, BYD, LG Energy Solution, and emerging innovators such as Solid Power and SES AI are heavily investing in research and development to overcome manufacturing challenges and achieve commercial scalability. While high production costs and the need for robust manufacturing infrastructure currently present some restraints, the overwhelming benefits and continuous technological innovation indicate a bright future for this transformative battery technology.

This comprehensive report delves into the rapidly evolving Polymer Solid State Lithium Metal Battery market, a pivotal segment within the advanced energy storage landscape. With a projected market size expected to reach millions by 2025 and exhibiting significant growth throughout the forecast period of 2025–2033, this study offers deep insights into the drivers, trends, and future trajectory of this transformative technology. Covering the historical period from 2019–2024, the report provides a robust foundation for understanding market dynamics.

Polymer Solid State Lithium Metal Battery Market Structure & Innovation Trends

The Polymer Solid State Lithium Metal Battery market is characterized by a dynamic structure influenced by a blend of established battery manufacturers and innovative startups. Market concentration is gradually shifting as technological advancements pave the way for new entrants to challenge incumbents. Innovation drivers are primarily focused on enhancing energy density, improving safety profiles, and achieving faster charging capabilities, critical for widespread adoption. Regulatory frameworks, particularly those concerning battery safety and environmental impact, are playing an increasingly influential role. Product substitutes, such as advanced liquid electrolyte lithium-ion batteries and other solid-state battery chemistries, continue to present competitive pressures, necessitating continuous innovation. End-user demographics are broad, encompassing electric vehicles (EVs), consumer electronics, and grid storage solutions, each with distinct performance requirements. Mergers and acquisition (M&A) activities are on the rise as companies seek to consolidate expertise, secure supply chains, and accelerate commercialization. M&A deal values are anticipated to scale into the millions, reflecting the strategic importance of this sector. Key players like CATL, BYD, and LG Energy Solution are actively investing in solid-state technology, alongside specialized firms such as Solid Power, SES AI, and Imec.

Polymer Solid State Lithium Metal Battery Market Dynamics & Trends

The Polymer Solid State Lithium Metal Battery market is poised for explosive growth, driven by a confluence of powerful forces. The escalating demand for higher energy density and enhanced safety in energy storage solutions serves as a primary growth accelerator. As the global push towards electrification intensifies, particularly in the electric vehicle (EV) sector, the need for batteries that offer longer ranges and quicker charging times becomes paramount. Polymer solid-state technology, with its inherent safety advantages over traditional liquid electrolyte batteries and the potential for significantly higher energy densities, is perfectly positioned to meet these evolving demands. Technological disruptions are a constant feature, with ongoing research and development efforts yielding breakthroughs in solid electrolyte materials, electrode formulations, and cell design. These advancements are leading to improved ionic conductivity, reduced interface resistance, and enhanced mechanical stability, all crucial for commercial viability. Consumer preferences are increasingly leaning towards safer, more durable, and longer-lasting battery solutions, especially in portable electronics and wearable devices. The perception of enhanced safety offered by solid-state batteries is a significant draw for consumers and regulatory bodies alike. Competitive dynamics are intensifying, with a clear trend of strategic partnerships, joint ventures, and significant R&D investments. Established giants like CATL, BYD, and LG Energy Solution are vying for market leadership against agile innovators like Solid Power and SES AI. The race to achieve mass production at competitive price points is a key battleground. Market penetration is expected to surge as manufacturing scalability improves and production costs decline, making these advanced batteries more accessible across various applications. The CAGR for the Polymer Solid State Lithium Metal Battery market is projected to be substantial, indicating a rapid expansion over the forecast period.

Dominant Regions & Segments in Polymer Solid State Lithium Metal Battery

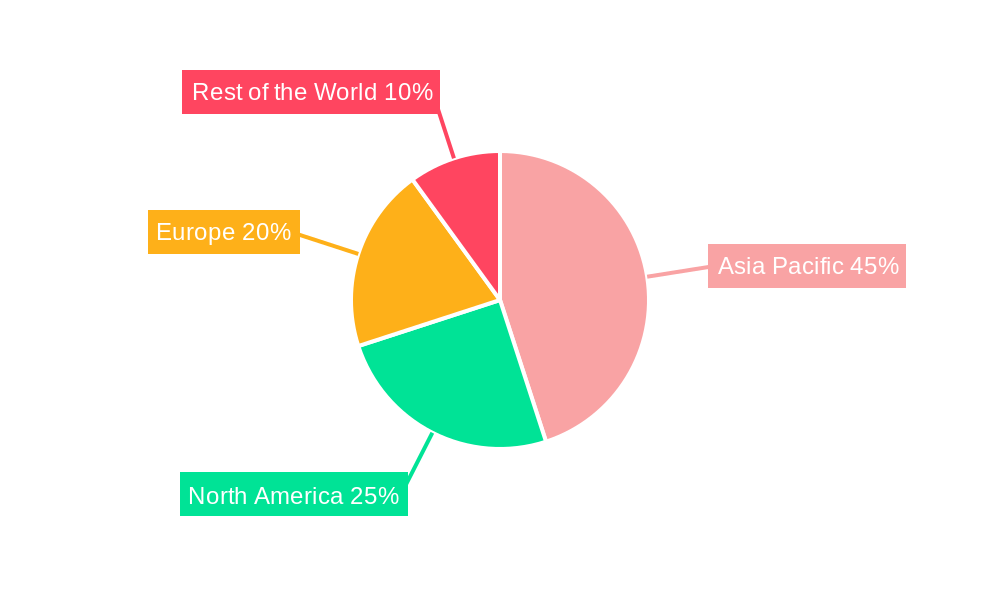

The Polymer Solid State Lithium Metal Battery market exhibits distinct regional dominance and segment leadership, driven by a combination of economic policies, industrial infrastructure, and technological adoption rates.

Leading Region: Asia-Pacific

The Asia-Pacific region is emerging as the undisputed leader in the Polymer Solid State Lithium Metal Battery market. This dominance is fueled by several key factors:

- Robust EV Manufacturing Ecosystem: Countries like China, South Korea, and Japan are global powerhouses in EV production, creating a massive and immediate demand for advanced battery technologies. Major players such as CATL and BYD are headquartered here, driving significant investment and innovation.

- Government Support and Incentives: Proactive government policies, including subsidies, tax breaks, and stringent emission standards, are encouraging the adoption of EVs and, by extension, advanced battery solutions.

- Extensive Research and Development Infrastructure: The region boasts a strong presence of leading research institutions like Imec and numerous universities actively engaged in cutting-edge battery research.

- Established Supply Chain Networks: A well-developed supply chain for battery materials and components provides a significant advantage for manufacturing and scaling production.

- Growing Consumer Adoption: Increasing consumer awareness and demand for sustainable transportation and energy storage solutions are further propelling market growth.

Dominant Segment: Application - Electric Vehicles (EVs)

Within the diverse applications for polymer solid-state lithium metal batteries, the Electric Vehicle (EV) segment stands out as the primary driver of market expansion.

- Critical Performance Demands: EVs require batteries with high energy density for extended range, fast charging capabilities for convenience, and unparalleled safety to mitigate risks associated with battery packs. Polymer solid-state lithium metal batteries directly address these critical performance demands.

- Range Anxiety Mitigation: The potential for significantly higher energy densities offered by these batteries directly tackles the issue of "range anxiety," a major barrier to EV adoption.

- Enhanced Safety Features: The inherent safety of solid electrolytes, which are non-flammable, is a crucial selling point for automotive applications, where passenger safety is paramount.

- Fast Charging Potential: Advancements in polymer solid-state technology promise faster charging times, bringing EV refueling closer to that of internal combustion engine vehicles.

- Government Mandates and Corporate Sustainability Goals: Increasingly stringent emission regulations and the ambitious sustainability targets of automotive manufacturers are accelerating the transition to electric mobility, thereby boosting demand for superior battery technologies.

Dominant Segment: Type - Polymer Electrolyte Solid State Batteries

Among the types of solid-state batteries, those utilizing polymer electrolytes are demonstrating significant traction in the Polymer Solid State Lithium Metal Battery market.

- Flexibility and Manufacturability: Polymer electrolytes offer inherent flexibility, allowing for easier integration into various battery form factors, including flexible and thin-film designs. This also aids in simpler, potentially lower-cost manufacturing processes compared to some inorganic solid electrolytes.

- Room Temperature Operation: Many polymer electrolytes can function effectively at room temperature, reducing the need for complex thermal management systems.

- Improved Interfacial Contact: Polymer electrolytes can conform to electrode surfaces, leading to better interfacial contact and reduced resistance, thereby enhancing ionic conductivity.

- Safety Advantages: Similar to other solid-state electrolytes, polymers are generally non-flammable, contributing to an enhanced safety profile.

- Scalability: The potential for roll-to-roll manufacturing processes makes polymer-based solid-state batteries more amenable to large-scale production, a critical factor for meeting the burgeoning demand from the EV sector. Companies like Bollore have historically focused on polymer-based technologies, demonstrating their potential.

Polymer Solid State Lithium Metal Battery Product Innovations

Recent product innovations in polymer solid-state lithium metal batteries are focused on enhancing energy density, improving cycle life, and ensuring robust safety. Developments include novel polymer electrolyte formulations with higher ionic conductivity, such as those incorporating advanced ceramic fillers or ionic liquids, enabling faster charging and discharging. Researchers are also exploring new anode and cathode materials that are compatible with solid electrolytes and can withstand lithium metal plating. These advancements are leading to batteries with potential energy densities exceeding millions of Wh/kg and extended cycle lives, crucial for demanding applications like electric vehicles and grid-scale energy storage. Competitive advantages are being carved out through superior safety, lightweight designs, and improved performance metrics.

Report Scope & Segmentation Analysis

This report provides an in-depth analysis of the Polymer Solid State Lithium Metal Battery market, segmented by Application and Type.

- Application Segmentation: The analysis covers key applications including Electric Vehicles (EVs), Consumer Electronics, Aerospace & Defense, and Grid Storage. The EV segment is projected to hold the largest market share, driven by rapid electrification trends. Consumer electronics and grid storage are also expected to witness substantial growth due to demand for safer and more powerful energy solutions.

- Type Segmentation: The report further segments the market by Type, focusing on Polymer Electrolyte Solid State Batteries and Inorganic Electrolyte Solid State Batteries. Polymer electrolyte-based batteries are anticipated to dominate due to their flexibility and potential for cost-effective manufacturing. Inorganic electrolyte batteries will also see growth, particularly in high-performance applications. Market size projections and competitive dynamics within each segment are thoroughly detailed.

Key Drivers of Polymer Solid State Lithium Metal Battery Growth

The growth of the Polymer Solid State Lithium Metal Battery market is propelled by a confluence of technological, economic, and regulatory factors. The relentless pursuit of higher energy density and enhanced safety is a primary technological driver, directly addressing critical limitations of current lithium-ion batteries. Economically, the burgeoning electric vehicle industry is a massive demand generator, as automakers seek superior battery solutions for longer range and faster charging. Supportive government policies, including subsidies for EV adoption and investments in battery research and development, are creating a favorable market environment. Furthermore, the increasing focus on renewable energy integration and grid stability is driving demand for efficient and safe energy storage systems, a role well-suited for solid-state batteries. The potential for reduced manufacturing costs as scalability improves is also a significant economic enabler.

Challenges in the Polymer Solid State Lithium Metal Battery Sector

Despite its immense potential, the Polymer Solid State Lithium Metal Battery sector faces several significant challenges. Scaling up production to meet the anticipated demand remains a key hurdle, with current manufacturing processes still requiring significant optimization to achieve cost-competitiveness. Achieving high ionic conductivity in polymer electrolytes at room temperature without compromising mechanical strength or safety is an ongoing research challenge. The high initial cost of materials and manufacturing processes presents a barrier to widespread adoption, particularly in cost-sensitive applications. Furthermore, the integration of solid-state batteries with existing manufacturing infrastructure and supply chains requires substantial investment and adaptation. Intense competition from continuously improving liquid electrolyte lithium-ion battery technology also poses a threat.

Emerging Opportunities in Polymer Solid State Lithium Metal Battery

The Polymer Solid State Lithium Metal Battery market is rife with emerging opportunities driven by technological advancements and evolving consumer and industrial needs. The development of flexible and conformable solid-state batteries opens up new application possibilities in wearable electronics, medical devices, and Internet of Things (IoT) sensors. The potential for ultra-fast charging and discharging capabilities presents opportunities in high-performance sectors like electric racing and specialized industrial equipment. Furthermore, the inherent safety of these batteries makes them ideal for applications where fire risk is a major concern, such as in aviation and potentially in residential energy storage. Partnerships between battery manufacturers and original equipment manufacturers (OEMs) are crucial for co-developing tailored solutions and accelerating market entry. Exploration of new material chemistries and manufacturing techniques will unlock further performance gains and cost reductions.

Leading Players in the Polymer Solid State Lithium Metal Battery Market

- Bollore

- Solid Power

- Solid Energies

- BrightVolt

- SES AI

- Imec

- Dongchi Energy

- LNE Technology

- CATL

- BYD

- LG Energy Solution

Key Developments in Polymer Solid State Lithium Metal Battery Industry

- 2023: Significant breakthroughs reported in polymer electrolyte conductivity, enabling faster charge/discharge rates.

- 2023: Several startups secured substantial funding rounds for scaling up pilot production lines.

- 2024: Major automotive manufacturers announced accelerated timelines for integrating solid-state batteries into their EV models.

- 2024: Advancement in manufacturing techniques aimed at reducing the cost of polymer solid-state battery production.

- 2025: Expectation of early-stage commercialization for specific niche applications.

- 2025-2033: Projected widespread adoption across the automotive sector and expansion into other high-value markets.

Future Outlook for Polymer Solid State Lithium Metal Battery Market

- 2023: Significant breakthroughs reported in polymer electrolyte conductivity, enabling faster charge/discharge rates.

- 2023: Several startups secured substantial funding rounds for scaling up pilot production lines.

- 2024: Major automotive manufacturers announced accelerated timelines for integrating solid-state batteries into their EV models.

- 2024: Advancement in manufacturing techniques aimed at reducing the cost of polymer solid-state battery production.

- 2025: Expectation of early-stage commercialization for specific niche applications.

- 2025-2033: Projected widespread adoption across the automotive sector and expansion into other high-value markets.

Future Outlook for Polymer Solid State Lithium Metal Battery Market

The future outlook for the Polymer Solid State Lithium Metal Battery market is exceptionally bright, driven by anticipated technological maturation and increasing market penetration. As manufacturing processes become more refined and economies of scale are realized, the cost of these advanced batteries is expected to decline significantly, making them competitive with current lithium-ion technologies. The relentless pursuit of higher energy density will continue to unlock new possibilities for longer-range electric vehicles and more powerful portable electronics. Furthermore, the inherent safety advantages will drive adoption in applications where safety is paramount, such as in transportation and residential energy storage. Strategic collaborations between material suppliers, battery manufacturers, and end-users will be crucial for navigating the path to mass commercialization and solidifying the dominance of polymer solid-state lithium metal batteries in the next generation of energy storage.

Polymer Solid State Lithium Metal Battery Segmentation

-

1. Application

- 1.1. undefined

-

2. Type

- 2.1. undefined

Polymer Solid State Lithium Metal Battery Segmentation By Geography

- 1. undefined

- 2. undefined

- 3. undefined

- 4. undefined

- 5. undefined

Polymer Solid State Lithium Metal Battery REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Polymer Solid State Lithium Metal Battery Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1.

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1.

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1.

- 5.3.2.

- 5.3.3.

- 5.3.4.

- 5.3.5.

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. undefined Polymer Solid State Lithium Metal Battery Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1.

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1.

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. undefined Polymer Solid State Lithium Metal Battery Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1.

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1.

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. undefined Polymer Solid State Lithium Metal Battery Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1.

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1.

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. undefined Polymer Solid State Lithium Metal Battery Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1.

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1.

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. undefined Polymer Solid State Lithium Metal Battery Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1.

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1.

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Bollore

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Solid Power

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Solid Energies

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BrightVolt

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SES AI

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Imec

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dongchi Energy

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LNE Technology

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CATL

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BYD

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 LG Energy Solution

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Bollore

List of Figures

- Figure 1: Global Polymer Solid State Lithium Metal Battery Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Polymer Solid State Lithium Metal Battery Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: undefined Polymer Solid State Lithium Metal Battery Revenue (million), by Application 2024 & 2032

- Figure 4: undefined Polymer Solid State Lithium Metal Battery Volume (K), by Application 2024 & 2032

- Figure 5: undefined Polymer Solid State Lithium Metal Battery Revenue Share (%), by Application 2024 & 2032

- Figure 6: undefined Polymer Solid State Lithium Metal Battery Volume Share (%), by Application 2024 & 2032

- Figure 7: undefined Polymer Solid State Lithium Metal Battery Revenue (million), by Type 2024 & 2032

- Figure 8: undefined Polymer Solid State Lithium Metal Battery Volume (K), by Type 2024 & 2032

- Figure 9: undefined Polymer Solid State Lithium Metal Battery Revenue Share (%), by Type 2024 & 2032

- Figure 10: undefined Polymer Solid State Lithium Metal Battery Volume Share (%), by Type 2024 & 2032

- Figure 11: undefined Polymer Solid State Lithium Metal Battery Revenue (million), by Country 2024 & 2032

- Figure 12: undefined Polymer Solid State Lithium Metal Battery Volume (K), by Country 2024 & 2032

- Figure 13: undefined Polymer Solid State Lithium Metal Battery Revenue Share (%), by Country 2024 & 2032

- Figure 14: undefined Polymer Solid State Lithium Metal Battery Volume Share (%), by Country 2024 & 2032

- Figure 15: undefined Polymer Solid State Lithium Metal Battery Revenue (million), by Application 2024 & 2032

- Figure 16: undefined Polymer Solid State Lithium Metal Battery Volume (K), by Application 2024 & 2032

- Figure 17: undefined Polymer Solid State Lithium Metal Battery Revenue Share (%), by Application 2024 & 2032

- Figure 18: undefined Polymer Solid State Lithium Metal Battery Volume Share (%), by Application 2024 & 2032

- Figure 19: undefined Polymer Solid State Lithium Metal Battery Revenue (million), by Type 2024 & 2032

- Figure 20: undefined Polymer Solid State Lithium Metal Battery Volume (K), by Type 2024 & 2032

- Figure 21: undefined Polymer Solid State Lithium Metal Battery Revenue Share (%), by Type 2024 & 2032

- Figure 22: undefined Polymer Solid State Lithium Metal Battery Volume Share (%), by Type 2024 & 2032

- Figure 23: undefined Polymer Solid State Lithium Metal Battery Revenue (million), by Country 2024 & 2032

- Figure 24: undefined Polymer Solid State Lithium Metal Battery Volume (K), by Country 2024 & 2032

- Figure 25: undefined Polymer Solid State Lithium Metal Battery Revenue Share (%), by Country 2024 & 2032

- Figure 26: undefined Polymer Solid State Lithium Metal Battery Volume Share (%), by Country 2024 & 2032

- Figure 27: undefined Polymer Solid State Lithium Metal Battery Revenue (million), by Application 2024 & 2032

- Figure 28: undefined Polymer Solid State Lithium Metal Battery Volume (K), by Application 2024 & 2032

- Figure 29: undefined Polymer Solid State Lithium Metal Battery Revenue Share (%), by Application 2024 & 2032

- Figure 30: undefined Polymer Solid State Lithium Metal Battery Volume Share (%), by Application 2024 & 2032

- Figure 31: undefined Polymer Solid State Lithium Metal Battery Revenue (million), by Type 2024 & 2032

- Figure 32: undefined Polymer Solid State Lithium Metal Battery Volume (K), by Type 2024 & 2032

- Figure 33: undefined Polymer Solid State Lithium Metal Battery Revenue Share (%), by Type 2024 & 2032

- Figure 34: undefined Polymer Solid State Lithium Metal Battery Volume Share (%), by Type 2024 & 2032

- Figure 35: undefined Polymer Solid State Lithium Metal Battery Revenue (million), by Country 2024 & 2032

- Figure 36: undefined Polymer Solid State Lithium Metal Battery Volume (K), by Country 2024 & 2032

- Figure 37: undefined Polymer Solid State Lithium Metal Battery Revenue Share (%), by Country 2024 & 2032

- Figure 38: undefined Polymer Solid State Lithium Metal Battery Volume Share (%), by Country 2024 & 2032

- Figure 39: undefined Polymer Solid State Lithium Metal Battery Revenue (million), by Application 2024 & 2032

- Figure 40: undefined Polymer Solid State Lithium Metal Battery Volume (K), by Application 2024 & 2032

- Figure 41: undefined Polymer Solid State Lithium Metal Battery Revenue Share (%), by Application 2024 & 2032

- Figure 42: undefined Polymer Solid State Lithium Metal Battery Volume Share (%), by Application 2024 & 2032

- Figure 43: undefined Polymer Solid State Lithium Metal Battery Revenue (million), by Type 2024 & 2032

- Figure 44: undefined Polymer Solid State Lithium Metal Battery Volume (K), by Type 2024 & 2032

- Figure 45: undefined Polymer Solid State Lithium Metal Battery Revenue Share (%), by Type 2024 & 2032

- Figure 46: undefined Polymer Solid State Lithium Metal Battery Volume Share (%), by Type 2024 & 2032

- Figure 47: undefined Polymer Solid State Lithium Metal Battery Revenue (million), by Country 2024 & 2032

- Figure 48: undefined Polymer Solid State Lithium Metal Battery Volume (K), by Country 2024 & 2032

- Figure 49: undefined Polymer Solid State Lithium Metal Battery Revenue Share (%), by Country 2024 & 2032

- Figure 50: undefined Polymer Solid State Lithium Metal Battery Volume Share (%), by Country 2024 & 2032

- Figure 51: undefined Polymer Solid State Lithium Metal Battery Revenue (million), by Application 2024 & 2032

- Figure 52: undefined Polymer Solid State Lithium Metal Battery Volume (K), by Application 2024 & 2032

- Figure 53: undefined Polymer Solid State Lithium Metal Battery Revenue Share (%), by Application 2024 & 2032

- Figure 54: undefined Polymer Solid State Lithium Metal Battery Volume Share (%), by Application 2024 & 2032

- Figure 55: undefined Polymer Solid State Lithium Metal Battery Revenue (million), by Type 2024 & 2032

- Figure 56: undefined Polymer Solid State Lithium Metal Battery Volume (K), by Type 2024 & 2032

- Figure 57: undefined Polymer Solid State Lithium Metal Battery Revenue Share (%), by Type 2024 & 2032

- Figure 58: undefined Polymer Solid State Lithium Metal Battery Volume Share (%), by Type 2024 & 2032

- Figure 59: undefined Polymer Solid State Lithium Metal Battery Revenue (million), by Country 2024 & 2032

- Figure 60: undefined Polymer Solid State Lithium Metal Battery Volume (K), by Country 2024 & 2032

- Figure 61: undefined Polymer Solid State Lithium Metal Battery Revenue Share (%), by Country 2024 & 2032

- Figure 62: undefined Polymer Solid State Lithium Metal Battery Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Polymer Solid State Lithium Metal Battery Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Polymer Solid State Lithium Metal Battery Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Polymer Solid State Lithium Metal Battery Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Polymer Solid State Lithium Metal Battery Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Polymer Solid State Lithium Metal Battery Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Polymer Solid State Lithium Metal Battery Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Polymer Solid State Lithium Metal Battery Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Polymer Solid State Lithium Metal Battery Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Polymer Solid State Lithium Metal Battery Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Polymer Solid State Lithium Metal Battery Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Polymer Solid State Lithium Metal Battery Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Polymer Solid State Lithium Metal Battery Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Polymer Solid State Lithium Metal Battery Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Polymer Solid State Lithium Metal Battery Volume K Forecast, by Country 2019 & 2032

- Table 15: Global Polymer Solid State Lithium Metal Battery Revenue million Forecast, by Application 2019 & 2032

- Table 16: Global Polymer Solid State Lithium Metal Battery Volume K Forecast, by Application 2019 & 2032

- Table 17: Global Polymer Solid State Lithium Metal Battery Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Polymer Solid State Lithium Metal Battery Volume K Forecast, by Type 2019 & 2032

- Table 19: Global Polymer Solid State Lithium Metal Battery Revenue million Forecast, by Country 2019 & 2032

- Table 20: Global Polymer Solid State Lithium Metal Battery Volume K Forecast, by Country 2019 & 2032

- Table 21: Global Polymer Solid State Lithium Metal Battery Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Polymer Solid State Lithium Metal Battery Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Polymer Solid State Lithium Metal Battery Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Polymer Solid State Lithium Metal Battery Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Polymer Solid State Lithium Metal Battery Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Polymer Solid State Lithium Metal Battery Volume K Forecast, by Country 2019 & 2032

- Table 27: Global Polymer Solid State Lithium Metal Battery Revenue million Forecast, by Application 2019 & 2032

- Table 28: Global Polymer Solid State Lithium Metal Battery Volume K Forecast, by Application 2019 & 2032

- Table 29: Global Polymer Solid State Lithium Metal Battery Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Polymer Solid State Lithium Metal Battery Volume K Forecast, by Type 2019 & 2032

- Table 31: Global Polymer Solid State Lithium Metal Battery Revenue million Forecast, by Country 2019 & 2032

- Table 32: Global Polymer Solid State Lithium Metal Battery Volume K Forecast, by Country 2019 & 2032

- Table 33: Global Polymer Solid State Lithium Metal Battery Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Polymer Solid State Lithium Metal Battery Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Polymer Solid State Lithium Metal Battery Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Polymer Solid State Lithium Metal Battery Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Polymer Solid State Lithium Metal Battery Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Polymer Solid State Lithium Metal Battery Volume K Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Polymer Solid State Lithium Metal Battery?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Polymer Solid State Lithium Metal Battery?

Key companies in the market include Bollore, Solid Power, Solid Energies, BrightVolt, SES AI, Imec, Dongchi Energy, LNE Technology, CATL, BYD, LG Energy Solution.

3. What are the main segments of the Polymer Solid State Lithium Metal Battery?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Polymer Solid State Lithium Metal Battery," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Polymer Solid State Lithium Metal Battery report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Polymer Solid State Lithium Metal Battery?

To stay informed about further developments, trends, and reports in the Polymer Solid State Lithium Metal Battery, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence