Key Insights

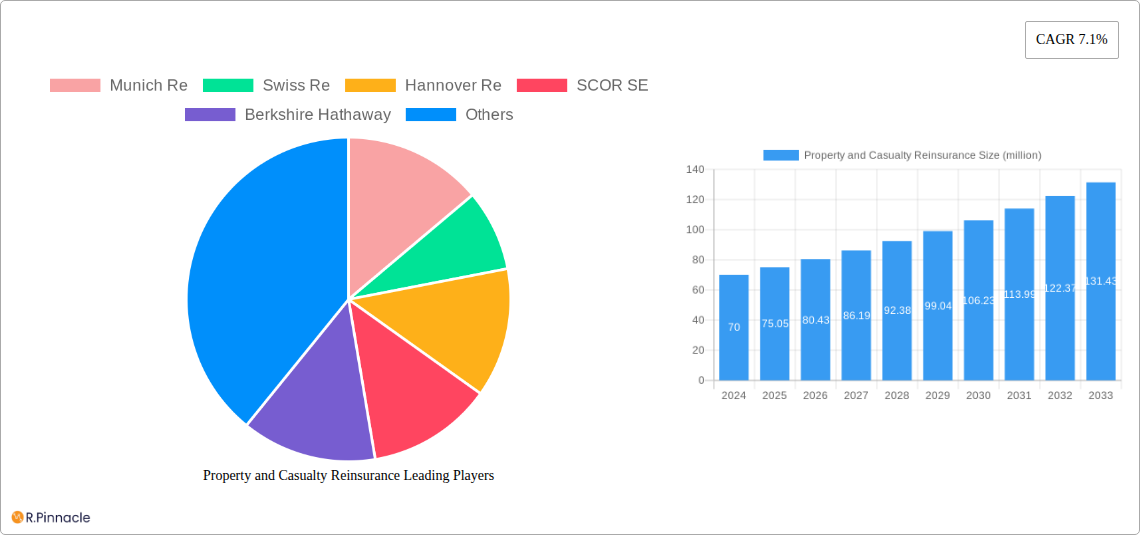

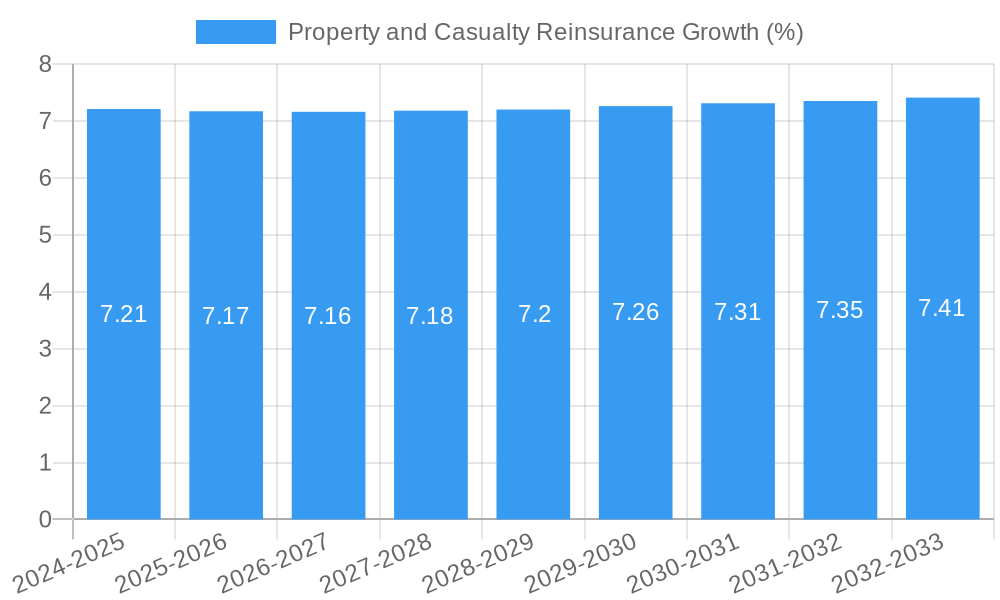

The global Property and Casualty (P&C) Reinsurance market is poised for robust expansion, projected to reach an estimated market size of $70 million in 2024 and exhibiting a Compound Annual Growth Rate (CAGR) of 7.1% from 2025 to 2033. This sustained growth is primarily driven by an increasing volume of complex and high-value risks, amplified by the escalating frequency and severity of natural catastrophes, cyber threats, and emerging risks such as climate change impacts. Insurers are strategically leveraging reinsurance to manage their capital more efficiently, enhance their underwriting capacity, and stabilize their financial results against unpredictable events. The market's dynamism is also fueled by regulatory shifts that encourage greater risk transfer and the growing need for specialized reinsurance solutions to cover novel and evolving perils.

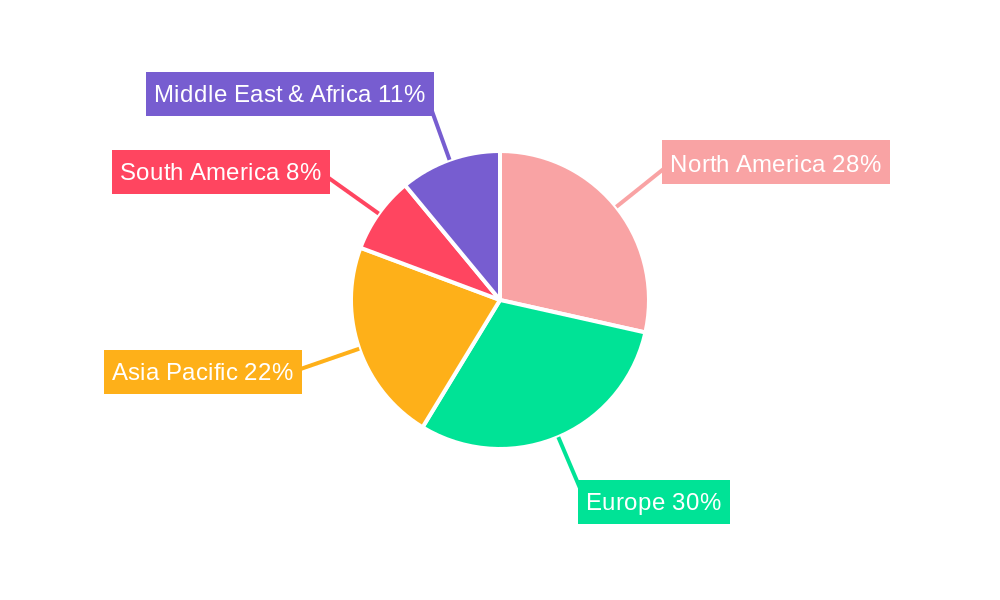

The market segmentation reveals a bifurcated landscape, with both Small and Midsized Reinsurers playing crucial roles in distributing capacity and expertise. Distribution channels are primarily divided between Intermediary Selling, where brokers facilitate transactions, and Direct Selling, highlighting the diverse approaches to market access. Key industry players like Munich Re, Swiss Re, and Hannover Re continue to dominate the landscape, showcasing strong financial resilience and innovative product development. Geographically, North America, with its significant insurance penetration and complex risk profile, along with Europe, characterized by sophisticated regulatory frameworks and established markets, are anticipated to be major contributors to market growth. The Asia Pacific region, driven by rapid economic development and increasing insurance awareness, presents substantial untapped potential, further contributing to the overall positive outlook for the P&C reinsurance sector.

This in-depth report provides a definitive analysis of the global Property and Casualty (P&C) Reinsurance market, meticulously examining its structure, dynamics, and future trajectory from 2019 to 2033. Leveraging high-ranking keywords and offering actionable insights, this report is an indispensable resource for reinsurance professionals, insurance executives, investors, and market analysts seeking to navigate the evolving landscape of P&C reinsurance. With a base year of 2025 and an estimated year of 2025, the forecast period from 2025 to 2033 offers strategic guidance on market growth, segmentation, and key trends.

Property and Casualty Reinsurance Market Structure & Innovation Trends

The global Property and Casualty Reinsurance market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. In 2025, the market share of top players is estimated to exceed xx%. Innovation in this sector is primarily driven by advancements in underwriting technology, data analytics, and parametric insurance solutions, aimed at enhancing risk assessment and product customization. Regulatory frameworks across different jurisdictions play a crucial role in shaping market access and product development, with ongoing efforts to harmonize international standards. Product substitutes, while limited in core offerings, can emerge from alternative risk transfer mechanisms and captive insurance solutions. End-user demographics are increasingly influenced by a demand for tailored coverage, particularly from growing emerging markets and sophisticated commercial enterprises. Mergers and acquisitions (M&A) activities are a key feature of market consolidation, with estimated M&A deal values in the P&C reinsurance sector reaching xx million annually in recent years. Key M&A activities are closely monitored for their impact on market concentration and competitive intensity.

Property and Casualty Reinsurance Market Dynamics & Trends

The Property and Casualty Reinsurance market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of xx% between 2025 and 2033. This expansion is propelled by a confluence of factors, including increasing global insured losses from natural catastrophes, a growing awareness of the importance of risk transfer among primary insurers, and the continuous expansion of emerging economies that require sophisticated insurance solutions. Technological disruptions are fundamentally reshaping market dynamics. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing underwriting, claims processing, and risk modeling, leading to greater efficiency and accuracy. Furthermore, the rise of InsurTech startups is fostering innovation in product design and distribution channels, challenging traditional business models. Consumer preferences are evolving, with a heightened demand for personalized and flexible insurance products that can adapt to changing risk profiles. This shift necessitates a more agile and responsive approach from reinsurers. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants. The market penetration for specialized P&C reinsurance products continues to increase, driven by the need to cover complex and emerging risks such as cyber threats and climate change impacts. The increasing frequency and severity of geopolitical events and climate-related disasters are also significant market drivers, creating a sustained demand for reinsurance capacity. The penetration of advanced analytics and IoT devices is further enabling more granular risk assessment, leading to more accurate pricing and product development. The overall market penetration is expected to reach xx% by 2033, indicating a substantial growth opportunity.

Dominant Regions & Segments in Property and Casualty Reinsurance

The North America region stands as a dominant force in the global Property and Casualty Reinsurance market, driven by its mature insurance industry, significant economic activity, and a high frequency of large-scale insured events. Within North America, the United States spearheads market dominance, supported by robust regulatory frameworks and a vast pool of primary insurers requiring substantial reinsurance support. In terms of Application, Midsized Reinsurers represent a significant segment, benefiting from a growing need for specialized coverage and risk management solutions that larger reinsurers may not offer with the same flexibility. These reinsurers are crucial in filling capacity gaps and providing tailored products for a broad range of risks. For Types, Intermediary Selling remains the prevailing distribution channel, with reinsurance brokers playing a vital role in connecting primary insurers with reinsurers, facilitating complex negotiations, and ensuring optimal coverage placement. Key drivers for this regional dominance include strong economic policies that foster business growth, substantial infrastructure development leading to increased insurable assets, and a high level of natural disaster preparedness and response, necessitating significant reinsurance backing.

- North America's Dominance: Characterized by a highly developed financial services sector and a strong appetite for risk management.

- United States' Leading Role: Benefitting from the world's largest insurance market and a sophisticated regulatory environment.

- Midsized Reinsurers Segment: Vital for providing specialized capacity and customized solutions to a diverse client base, often catering to risks not fully addressed by larger players.

- Intermediary Selling Channel: The backbone of the reinsurance market, with brokers facilitating essential connections and expertise.

- Economic Policies and Infrastructure: Favorable government policies and continuous infrastructure investments in North America contribute to a large insurable asset base.

- Catastrophe Risk Exposure: The region's susceptibility to natural disasters fuels a continuous demand for robust P&C reinsurance solutions.

Property and Casualty Reinsurance Product Innovations

Product innovations in P&C Reinsurance are increasingly focused on data-driven underwriting, parametric solutions, and coverage for emerging risks. For instance, parametric insurance products, which trigger payouts based on pre-defined event parameters rather than actual losses, are gaining traction for their speed and transparency, particularly in areas like natural catastrophe coverage. Competitive advantages are being realized through the development of more sophisticated modeling capabilities, allowing reinsurers to offer tailored risk transfer solutions with improved pricing accuracy. Technological trends such as AI and blockchain are facilitating faster claims processing and enhanced fraud detection, leading to greater operational efficiency and market fit for new product offerings.

Report Scope & Segmentation Analysis

This report comprehensively segments the Property and Casualty Reinsurance market across key applications and types. The Application segmentation includes Small Reinsurers and Midsized Reinsurers. Small Reinsurers, while representing a smaller market share, are vital for niche markets and highly specialized risks, with an estimated market size of xx million and a projected CAGR of xx%. Midsized Reinsurers hold a more substantial market share, estimated at xx million, with a projected CAGR of xx%, benefiting from their ability to offer a balance of capacity and flexibility. For Types, the market is divided into Intermediary Selling and Direct Selling. Intermediary Selling commands the larger market share, estimated at xx million with a projected CAGR of xx%, driven by the broker's expertise in complex transactions. Direct Selling, with an estimated market size of xx million and a projected CAGR of xx%, is gaining traction in specific markets and for standardized products.

Key Drivers of Property and Casualty Reinsurance Growth

Several key factors are driving the growth of the Property and Casualty Reinsurance market:

- Increasing Frequency and Severity of Natural Catastrophes: Climate change and evolving weather patterns are leading to more frequent and intense natural disasters, escalating insured losses and thus increasing the demand for reinsurance. For example, recent years have seen record-breaking insured losses from hurricanes, wildfires, and floods, directly impacting reinsurance needs.

- Growing Sophistication of Primary Insurers: As primary insurers face more complex risk landscapes and strive to optimize their capital, their reliance on reinsurance to manage their exposure and maintain solvency is growing.

- Expansion of Emerging Markets: Rapid economic development in emerging economies is leading to an increase in insurable assets and a greater demand for sophisticated risk management solutions, including P&C reinsurance.

- Technological Advancements in Underwriting and Risk Modeling: Innovations in AI, big data analytics, and IoT enable more accurate risk assessment and pricing, making reinsurance more accessible and attractive.

- Regulatory Mandates and Solvency Requirements: Stringent regulatory requirements for primary insurers to maintain adequate capital reserves often necessitate the purchase of reinsurance to mitigate large-scale risks.

Challenges in the Property and Casualty Reinsurance Sector

The Property and Casualty Reinsurance sector faces several significant challenges:

- Persistent Low Interest Rate Environment: Historically low interest rates continue to compress investment income for reinsurers, impacting profitability and capital accumulation. This forces a greater reliance on underwriting profits.

- Intensifying Competition and Capacity Availability: An increase in the availability of reinsurance capital, coupled with new entrants, can lead to pricing pressures and reduced profit margins, particularly for traditional lines of business.

- Regulatory Complexity and Fragmentation: Navigating diverse and evolving regulatory landscapes across different jurisdictions presents a significant hurdle, increasing compliance costs and operational complexity.

- Cybersecurity Risks: The escalating threat of cyberattacks poses a significant and evolving risk for both insurers and reinsurers, requiring substantial investment in risk mitigation and new coverage solutions.

- Geopolitical Instability and Emerging Risks: Global geopolitical tensions and the emergence of novel risks like pandemics and climate change-related liabilities create uncertainty and can lead to unforeseen and significant claims.

Emerging Opportunities in Property and Casualty Reinsurance

The P&C Reinsurance market is ripe with emerging opportunities:

- Parametric Insurance for Climate Resilience: The growing impact of climate change presents a significant opportunity for parametric insurance products, offering rapid payouts based on pre-defined triggers, thus aiding in disaster recovery and resilience.

- Growth in Emerging Markets: As developing economies continue to expand, so does their need for comprehensive insurance and reinsurance solutions, creating vast untapped markets.

- InsurTech Collaboration and Innovation: Partnerships with InsurTech companies can unlock new efficiencies, product development capabilities, and distribution channels, enhancing market reach and customer engagement.

- Coverage for Emerging Risks (e.g., Cyber, ESG): The increasing prevalence of cyber threats and the growing focus on Environmental, Social, and Governance (ESG) factors are creating demand for specialized reinsurance products.

- Data Analytics and AI-driven Solutions: Leveraging advanced analytics and AI for enhanced underwriting, risk modeling, and claims processing offers a competitive edge and improved profitability.

Leading Players in the Property and Casualty Reinsurance Market

- Munich Re

- Swiss Re

- Hannover Re

- SCOR SE

- Berkshire Hathaway

- Lloyd's of London

- Reinsurance Group of America

- China Reinsurance (Group)

- Korean Re

Key Developments in Property and Casualty Reinsurance Industry

- 2019 - Q4: Launch of innovative parametric insurance solutions for agricultural risks in emerging markets, boosting farmer resilience.

- 2020 - Q2: Significant increase in natural catastrophe claims driven by widespread wildfires and hurricanes, impacting reinsurer profitability and prompting a review of risk models.

- 2021 - Q1: Major reinsurers invest heavily in AI and machine learning capabilities to enhance underwriting efficiency and predictive modeling.

- 2022 - Q3: Consolidation through mergers and acquisitions among mid-sized reinsurers to achieve greater scale and market penetration.

- 2023 - Q4: Growing demand for cyber reinsurance as businesses face increasing sophisticated cyber threats.

- 2024 - Q1: Increased focus on ESG-related risks and the development of new reinsurance products to cover environmental liabilities.

- 2024 - Q3: Introduction of blockchain technology in reinsurance to improve transparency and streamline claims processing.

Future Outlook for Property and Casualty Reinsurance Market

- 2019 - Q4: Launch of innovative parametric insurance solutions for agricultural risks in emerging markets, boosting farmer resilience.

- 2020 - Q2: Significant increase in natural catastrophe claims driven by widespread wildfires and hurricanes, impacting reinsurer profitability and prompting a review of risk models.

- 2021 - Q1: Major reinsurers invest heavily in AI and machine learning capabilities to enhance underwriting efficiency and predictive modeling.

- 2022 - Q3: Consolidation through mergers and acquisitions among mid-sized reinsurers to achieve greater scale and market penetration.

- 2023 - Q4: Growing demand for cyber reinsurance as businesses face increasing sophisticated cyber threats.

- 2024 - Q1: Increased focus on ESG-related risks and the development of new reinsurance products to cover environmental liabilities.

- 2024 - Q3: Introduction of blockchain technology in reinsurance to improve transparency and streamline claims processing.

Future Outlook for Property and Casualty Reinsurance Market

The future outlook for the Property and Casualty Reinsurance market is exceptionally robust, driven by an ongoing increase in global insured losses and a growing recognition of the necessity for risk transfer. The continuous evolution of technology, particularly AI and big data analytics, will further refine underwriting processes, enhance risk prediction, and enable the creation of highly customized reinsurance products. The expanding coverage for emerging risks, such as climate-related events and cyber threats, represents a significant growth accelerator. Emerging markets are poised to become increasingly important contributors to market growth, as their economies develop and their demand for comprehensive insurance solutions rises. Strategic opportunities lie in fostering deeper collaborations with InsurTech firms and investing in sustainable and resilient risk management practices to capitalize on evolving global challenges and demands. The market is expected to witness sustained growth driven by these transformative trends and strategic initiatives.

Property and Casualty Reinsurance Segmentation

-

1. Application

- 1.1. Small Reinsurers

- 1.2. Midsized Reinsurers

-

2. Types

- 2.1. Intermediary Selling

- 2.2. Direct Selling

Property and Casualty Reinsurance Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Property and Casualty Reinsurance REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.1% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Property and Casualty Reinsurance Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Small Reinsurers

- 5.1.2. Midsized Reinsurers

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Intermediary Selling

- 5.2.2. Direct Selling

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Property and Casualty Reinsurance Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Small Reinsurers

- 6.1.2. Midsized Reinsurers

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Intermediary Selling

- 6.2.2. Direct Selling

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Property and Casualty Reinsurance Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Small Reinsurers

- 7.1.2. Midsized Reinsurers

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Intermediary Selling

- 7.2.2. Direct Selling

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Property and Casualty Reinsurance Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Small Reinsurers

- 8.1.2. Midsized Reinsurers

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Intermediary Selling

- 8.2.2. Direct Selling

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Property and Casualty Reinsurance Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Small Reinsurers

- 9.1.2. Midsized Reinsurers

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Intermediary Selling

- 9.2.2. Direct Selling

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Property and Casualty Reinsurance Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Small Reinsurers

- 10.1.2. Midsized Reinsurers

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Intermediary Selling

- 10.2.2. Direct Selling

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Munich Re

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Swiss Re

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hannover Re

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SCOR SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Berkshire Hathaway

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lloyd's of London

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Reinsurance Group of America

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 China Reinsurance (Group)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Korean Re

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Munich Re

List of Figures

- Figure 1: Global Property and Casualty Reinsurance Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Property and Casualty Reinsurance Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Property and Casualty Reinsurance Revenue (million), by Application 2024 & 2032

- Figure 4: North America Property and Casualty Reinsurance Volume (K), by Application 2024 & 2032

- Figure 5: North America Property and Casualty Reinsurance Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Property and Casualty Reinsurance Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Property and Casualty Reinsurance Revenue (million), by Types 2024 & 2032

- Figure 8: North America Property and Casualty Reinsurance Volume (K), by Types 2024 & 2032

- Figure 9: North America Property and Casualty Reinsurance Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Property and Casualty Reinsurance Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Property and Casualty Reinsurance Revenue (million), by Country 2024 & 2032

- Figure 12: North America Property and Casualty Reinsurance Volume (K), by Country 2024 & 2032

- Figure 13: North America Property and Casualty Reinsurance Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Property and Casualty Reinsurance Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Property and Casualty Reinsurance Revenue (million), by Application 2024 & 2032

- Figure 16: South America Property and Casualty Reinsurance Volume (K), by Application 2024 & 2032

- Figure 17: South America Property and Casualty Reinsurance Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Property and Casualty Reinsurance Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Property and Casualty Reinsurance Revenue (million), by Types 2024 & 2032

- Figure 20: South America Property and Casualty Reinsurance Volume (K), by Types 2024 & 2032

- Figure 21: South America Property and Casualty Reinsurance Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Property and Casualty Reinsurance Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Property and Casualty Reinsurance Revenue (million), by Country 2024 & 2032

- Figure 24: South America Property and Casualty Reinsurance Volume (K), by Country 2024 & 2032

- Figure 25: South America Property and Casualty Reinsurance Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Property and Casualty Reinsurance Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Property and Casualty Reinsurance Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Property and Casualty Reinsurance Volume (K), by Application 2024 & 2032

- Figure 29: Europe Property and Casualty Reinsurance Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Property and Casualty Reinsurance Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Property and Casualty Reinsurance Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Property and Casualty Reinsurance Volume (K), by Types 2024 & 2032

- Figure 33: Europe Property and Casualty Reinsurance Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Property and Casualty Reinsurance Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Property and Casualty Reinsurance Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Property and Casualty Reinsurance Volume (K), by Country 2024 & 2032

- Figure 37: Europe Property and Casualty Reinsurance Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Property and Casualty Reinsurance Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Property and Casualty Reinsurance Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Property and Casualty Reinsurance Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Property and Casualty Reinsurance Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Property and Casualty Reinsurance Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Property and Casualty Reinsurance Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Property and Casualty Reinsurance Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Property and Casualty Reinsurance Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Property and Casualty Reinsurance Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Property and Casualty Reinsurance Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Property and Casualty Reinsurance Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Property and Casualty Reinsurance Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Property and Casualty Reinsurance Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Property and Casualty Reinsurance Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Property and Casualty Reinsurance Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Property and Casualty Reinsurance Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Property and Casualty Reinsurance Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Property and Casualty Reinsurance Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Property and Casualty Reinsurance Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Property and Casualty Reinsurance Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Property and Casualty Reinsurance Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Property and Casualty Reinsurance Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Property and Casualty Reinsurance Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Property and Casualty Reinsurance Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Property and Casualty Reinsurance Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Property and Casualty Reinsurance Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Property and Casualty Reinsurance Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Property and Casualty Reinsurance Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Property and Casualty Reinsurance Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Property and Casualty Reinsurance Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Property and Casualty Reinsurance Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Property and Casualty Reinsurance Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Property and Casualty Reinsurance Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Property and Casualty Reinsurance Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Property and Casualty Reinsurance Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Property and Casualty Reinsurance Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Property and Casualty Reinsurance Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Property and Casualty Reinsurance Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Property and Casualty Reinsurance Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Property and Casualty Reinsurance Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Property and Casualty Reinsurance Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Property and Casualty Reinsurance Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Property and Casualty Reinsurance Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Property and Casualty Reinsurance Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Property and Casualty Reinsurance Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Property and Casualty Reinsurance Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Property and Casualty Reinsurance Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Property and Casualty Reinsurance Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Property and Casualty Reinsurance Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Property and Casualty Reinsurance Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Property and Casualty Reinsurance Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Property and Casualty Reinsurance Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Property and Casualty Reinsurance Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Property and Casualty Reinsurance Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Property and Casualty Reinsurance Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Property and Casualty Reinsurance Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Property and Casualty Reinsurance Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Property and Casualty Reinsurance Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Property and Casualty Reinsurance Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Property and Casualty Reinsurance Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Property and Casualty Reinsurance Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Property and Casualty Reinsurance Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Property and Casualty Reinsurance Volume K Forecast, by Country 2019 & 2032

- Table 81: China Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Property and Casualty Reinsurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Property and Casualty Reinsurance Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Property and Casualty Reinsurance?

The projected CAGR is approximately 7.1%.

2. Which companies are prominent players in the Property and Casualty Reinsurance?

Key companies in the market include Munich Re, Swiss Re, Hannover Re, SCOR SE, Berkshire Hathaway, Lloyd's of London, Reinsurance Group of America, China Reinsurance (Group), Korean Re.

3. What are the main segments of the Property and Casualty Reinsurance?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 202470 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Property and Casualty Reinsurance," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Property and Casualty Reinsurance report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Property and Casualty Reinsurance?

To stay informed about further developments, trends, and reports in the Property and Casualty Reinsurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence