Key Insights

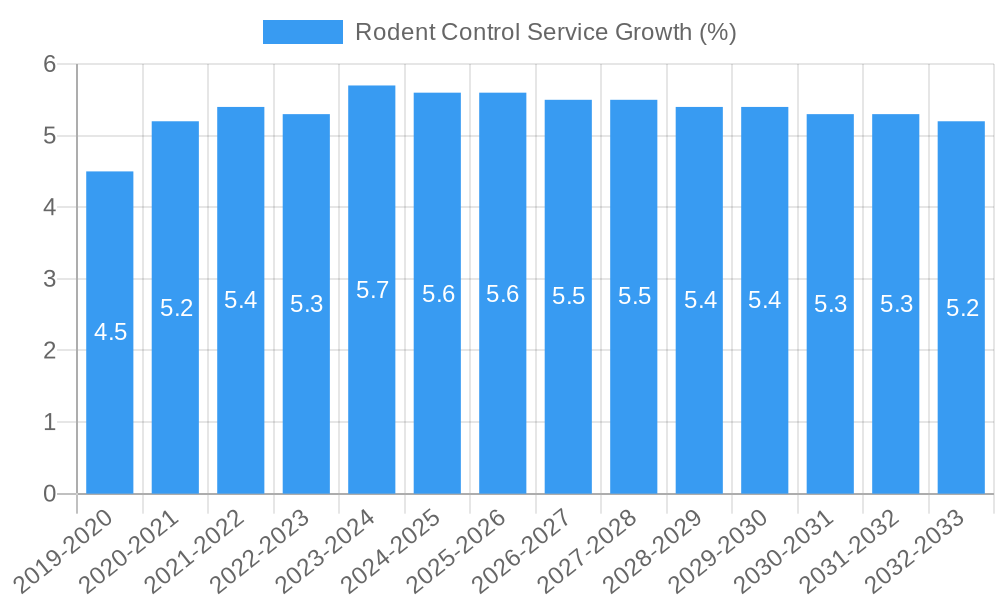

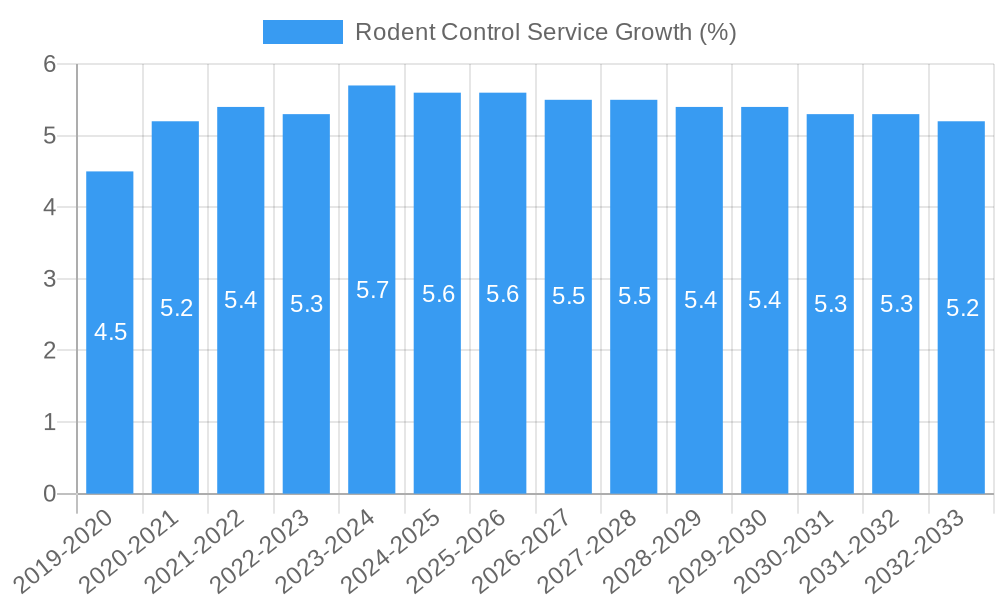

The global rodent control service market is projected to experience robust growth, reaching an estimated market size of approximately $7,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of around 6.5% anticipated from 2025 to 2033. This expansion is largely propelled by increasing urbanization, leading to higher population densities and a greater prevalence of rodent-related issues in both residential and commercial environments. Growing awareness among consumers and businesses about the health risks associated with rodent infestations, including the spread of diseases and damage to property and infrastructure, is a significant driver. Furthermore, stringent health and safety regulations in food processing, hospitality, and healthcare sectors necessitate consistent and effective rodent management programs, further fueling market demand. The commercial segment, encompassing businesses and public facilities, is expected to dominate the market due to the critical need for maintaining hygiene standards and protecting brand reputation, while the residential segment also shows steady growth as homeowners become more proactive in pest management.

Several key trends are shaping the rodent control service market. There's a noticeable shift towards more environmentally friendly and integrated pest management (IPM) approaches, emphasizing prevention, non-chemical methods, and targeted treatments over broad-spectrum applications. Advanced technologies, such as smart sensors, remote monitoring systems, and AI-powered predictive analytics, are being integrated into rodent control services to enhance efficiency and effectiveness. These innovations allow for real-time detection, precise application of treatments, and proactive management, reducing the need for reactive extermination. However, challenges remain. The high cost associated with advanced pest control technologies and professional services can be a restraint for some segments of the market. Additionally, the development of rodent resistance to certain traditional pesticides requires continuous innovation and adaptation of control strategies by service providers. The Asia Pacific region, with its rapidly growing economies and increasing disposable incomes, is emerging as a significant growth area, alongside established markets in North America and Europe.

This in-depth report offers a strategic overview of the global Rodent Control Service market, providing critical insights for industry professionals seeking to navigate this dynamic sector. Leveraging extensive data analysis spanning from 2019 to 2033, this report details market structure, key trends, regional dominance, product innovations, and future outlook. With a base year of 2025 and an estimated forecast for 2025-2033, it delivers actionable intelligence on market dynamics, growth drivers, challenges, and emerging opportunities. This analysis is crucial for stakeholders including pest control companies, investment firms, and regulatory bodies aiming to capitalize on the evolving landscape of rodent management solutions.

Rodent Control Service Market Structure & Innovation Trends

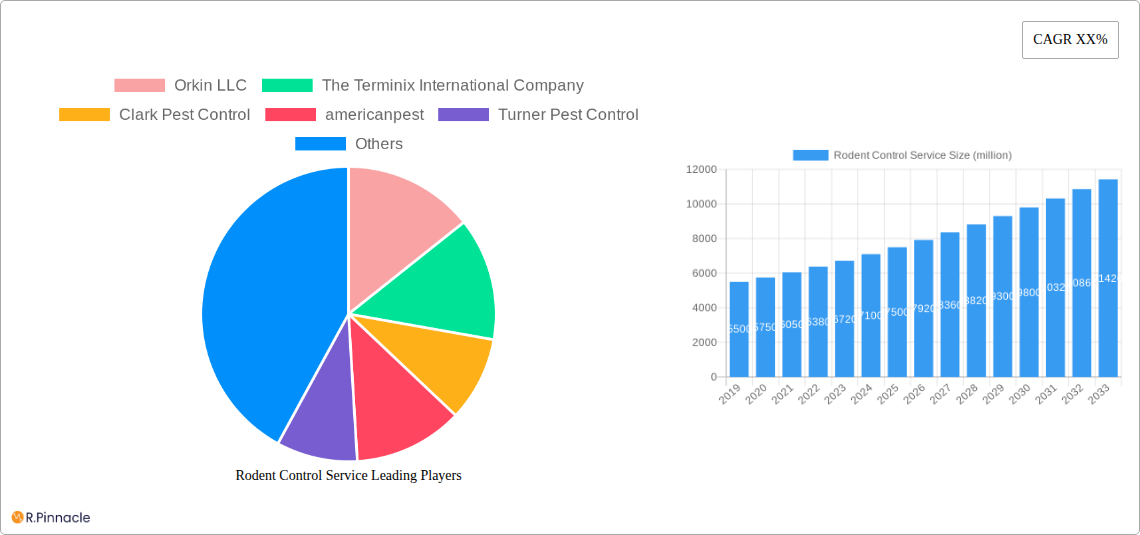

The Rodent Control Service market exhibits a moderate to high level of concentration, with a significant presence of established players alongside a growing number of regional and specialized service providers. Innovation is primarily driven by the development of more effective and environmentally friendly rodenticides, advanced trapping technologies, and integrated pest management (IPM) strategies. Regulatory frameworks, such as those governing the use of chemical treatments and waste disposal, significantly influence market operations and product development.

- Market Concentration: Dominated by a few key global players, with significant contributions from mid-sized and niche service providers. Market share for leading companies is estimated to be in the hundreds of millions.

- Innovation Drivers:

- Development of targeted rodent control solutions.

- Emphasis on sustainable and eco-friendly pest management.

- Integration of smart technologies for monitoring and early detection.

- Regulatory Frameworks: Stringent regulations regarding pesticide use, safety protocols, and environmental impact are shaping product formulations and service delivery methods.

- Product Substitutes: While chemical baits and traps remain dominant, there is growing interest in biological control methods and physical exclusion techniques.

- End-User Demographics: A broad demographic base, encompassing both commercial establishments (food processing, hospitality, warehousing) and residential properties, with increasing demand from urban and suburban areas.

- M&A Activities: Mergers and acquisitions are a recurring theme, with deal values often reaching into the tens of millions, aimed at expanding service portfolios, geographic reach, and technological capabilities.

Rodent Control Service Market Dynamics & Trends

The Rodent Control Service market is experiencing robust growth, fueled by increasing awareness of the health and economic risks associated with rodent infestations. Urbanization, coupled with rising hygiene standards, is a significant catalyst. Technological advancements are revolutionizing how rodent control services are delivered, moving towards more proactive, data-driven, and less intrusive methods. Consumer preferences are shifting towards integrated pest management (IPM) approaches that prioritize non-chemical solutions and long-term prevention strategies. The competitive landscape is characterized by a blend of global giants and agile local operators, each vying for market share through service quality, innovation, and competitive pricing. The market penetration for professional rodent control services is steadily increasing, particularly in developing economies where awareness and disposable income are on the rise.

The market's compound annual growth rate (CAGR) is projected to remain strong throughout the forecast period. Factors such as climate change, which can influence rodent populations and their habitats, also play a role in market dynamics. The increasing complexity of commercial pest management, particularly in the food and pharmaceutical industries, necessitates sophisticated and highly regulated rodent control solutions. Residential demand is propelled by a desire for safe and healthy living environments, with homeowners becoming more informed about the potential consequences of rodent presence, including structural damage, contamination of food supplies, and the transmission of diseases. This heightened awareness, coupled with the convenience and efficacy of professional services, underpins sustained market expansion. Furthermore, the growing adoption of smart technologies, such as sensor-based monitoring systems and AI-powered analytics, is enabling service providers to offer more efficient and targeted interventions, further differentiating themselves in a competitive marketplace. This trend towards technological integration is expected to become a dominant feature of the market in the coming years.

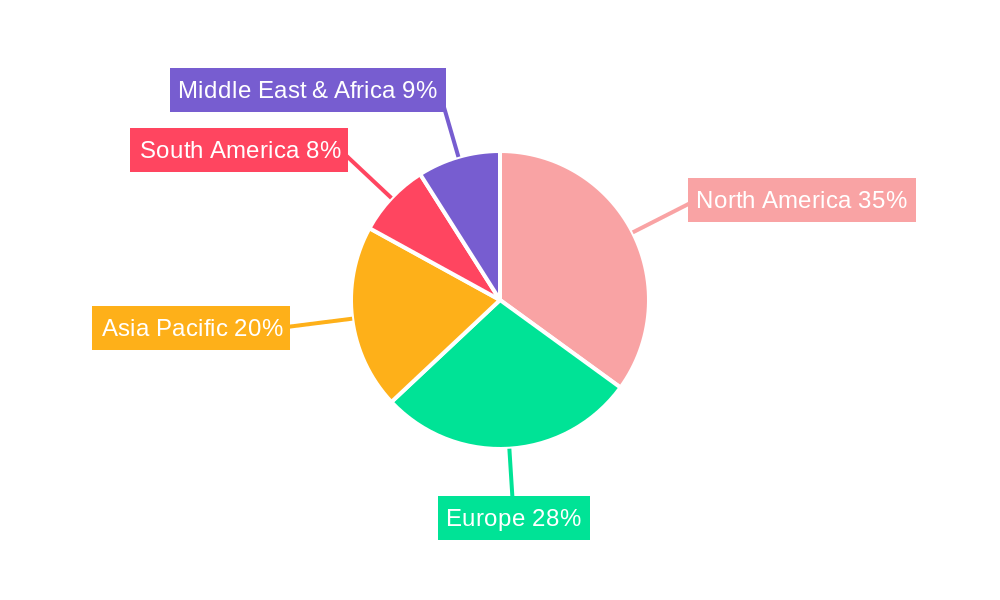

Dominant Regions & Segments in Rodent Control Service

North America is currently the dominant region in the Rodent Control Service market, driven by a combination of high population density, stringent health and safety regulations, and a well-established infrastructure for professional pest management services. The United States, in particular, represents a substantial portion of the global market share.

Leading Region: North America

- Key Drivers:

- High disposable income and consumer spending on home maintenance and health.

- Strict government regulations and public health initiatives mandating rodent control in commercial and public spaces.

- Well-developed infrastructure and a mature market for pest control services.

- Prevalence of both commercial and residential rodent issues.

- Strong presence of leading companies like Orkin LLC and The Terminix International Company.

Dominant Segments:

- Application: Residential

- This segment is a significant contributor due to homeowners' increasing concern for health and property protection. The desire for a rodent-free living environment, especially in areas prone to infestations, drives consistent demand. Economic stability and discretionary spending on home services further bolster this segment.

- Types: Rats Control

- Rats, due to their size and potential for extensive damage to property and food supplies, often command higher service fees and require more intensive control measures. Their ability to adapt to various environments makes them a persistent challenge, ensuring sustained demand for rat control services.

Emerging Regions and Segments:

While North America leads, the Asia-Pacific region is exhibiting rapid growth. Factors such as increasing urbanization, a growing middle class, and a rising awareness of hygiene standards are propelling demand. Countries like China and India are becoming increasingly important markets. In terms of applications, the Commercial segment, particularly in food processing, hospitality, and warehousing, consistently demands sophisticated rodent control solutions to meet regulatory compliance and maintain brand reputation.

Rodent Control Service Product Innovations

Product innovation in Rodent Control Service is increasingly focused on developing smarter, safer, and more sustainable solutions. This includes advanced bait formulations with reduced environmental impact, sophisticated rodent trapping systems employing non-lethal or highly targeted methods, and the integration of IoT devices for real-time monitoring and predictive analytics. These innovations aim to offer enhanced efficacy, improved user safety, and greater convenience, providing competitive advantages through reduced recurrence rates and minimized disruption for clients. The market is witnessing a shift towards integrated pest management (IPM) approaches, where technological advancements complement traditional methods.

Report Scope & Segmentation Analysis

This report provides a granular analysis of the Rodent Control Service market, segmented by application and type. The Application segment includes Commercial, Residential, and Other (e.g., industrial, agricultural). The Types segment covers Rats Control, Mice Control, and Other (e.g., squirrels, other small mammals).

- Commercial Application: This segment encompasses businesses across various sectors requiring professional rodent management to maintain hygiene, comply with regulations, and prevent product contamination. Projected growth is strong due to increasing emphasis on food safety and workplace standards.

- Residential Application: Driven by homeowner concerns about health and property damage, this segment continues to be a significant market. Growth is anticipated as awareness of the risks posed by rodents increases.

- Other Application: This broad category includes specialized services for sectors like agriculture, public health initiatives, and industrial facilities, each with unique rodent control challenges.

- Rats Control: This segment is characterized by the need for robust solutions to manage larger rodents, often involving specialized baiting, trapping, and exclusion techniques. It is expected to maintain steady growth.

- Mice Control: Mice infestations, being more common and often requiring more frequent intervention, represent a substantial and consistent market. The demand for discreet and effective solutions is high.

- Other Types: This segment addresses the control of other nuisance animals, often requiring customized approaches and specialized expertise.

Key Drivers of Rodent Control Service Growth

The Rodent Control Service market is propelled by several interconnected drivers. Increasing urbanization leads to higher population densities and greater interaction between humans and rodents, amplifying the need for professional intervention. Growing awareness of the health risks, including disease transmission and allergic reactions associated with rodent infestations, is a significant factor. Economic development and a rising middle class in emerging economies are increasing disposable incomes, allowing more households and businesses to invest in pest control services.

Furthermore, stringent regulations concerning hygiene and safety in commercial sectors, such as food processing and hospitality, mandate effective rodent management programs. Technological advancements, including the development of more effective and eco-friendly control methods, are also enhancing service offerings and customer satisfaction, thereby driving market expansion.

Challenges in the Rodent Control Service Sector

Despite robust growth, the Rodent Control Service sector faces several challenges. The development of rodent resistance to commonly used rodenticides poses an ongoing challenge, requiring continuous innovation in product formulations and control strategies. Stringent environmental regulations regarding the use of chemical pesticides can limit treatment options and increase compliance costs.

Supply chain disruptions, particularly for specialized equipment and chemical ingredients, can impact service delivery timelines and profitability. Moreover, intense competition from a large number of service providers, both local and international, can lead to price pressures and necessitate significant investment in marketing and customer retention. The perceived DIY nature of some rodent control tasks by consumers can also be a barrier to market penetration for professional services.

Emerging Opportunities in Rodent Control Service

Emerging opportunities in the Rodent Control Service market lie in several key areas. The growing demand for integrated pest management (IPM) strategies that emphasize prevention and non-chemical methods presents a significant avenue for growth. The development and adoption of smart technologies, such as sensor-based monitoring systems and data analytics, offer opportunities to provide more proactive, efficient, and customized services.

Expansion into underserved markets, particularly in developing regions experiencing rapid urbanization, presents a substantial growth potential. Furthermore, the increasing focus on public health and the prevention of zoonotic diseases is creating new service niches and regulatory drivers for professional rodent control. Strategic partnerships and acquisitions can also unlock new markets and service capabilities.

Leading Players in the Rodent Control Service Market

- Orkin LLC

- The Terminix International Company

- Clark Pest Control

- americanpest

- Turner Pest Control

- Rentokil

- Critter Control

- Miche Pest Control

- BOG Pest Control

- Corbett Exterminating

- Public Advertising Agency, Inc.

- Abell Group

- All-Safe Pest & Termite

- ASM Pest Control

- Best Pest Solutions, LLC

- Ameri Care Services

- A-Better Exterminators

- Standard Pest Management

- Pest Control Center, Inc.

- KY-KO Pest Prevention

- Optimum Services Pest Control

- The Best Bug & Pest Protection Inc.

- Accurate Pest Control, Inc.

- Payne Pest Management, Inc.

- Pestlink

- Neutocrete Systems, Inc.

- Antex Exterminating

Key Developments in Rodent Control Service Industry

- 2023/01: Launch of new, low-toxicity rodent bait formulations by leading manufacturers, addressing environmental concerns and regulatory pressures.

- 2022/07: Major pest control companies are increasingly investing in IoT-enabled rodent monitoring systems, allowing for real-time data collection and predictive analytics.

- 2022/03: Several mergers and acquisitions occurred, with larger companies acquiring smaller, specialized service providers to expand geographic reach and service portfolios. For example, Rentokil acquired multiple regional pest control businesses.

- 2021/11: Increased focus on integrated pest management (IPM) strategies, with a greater emphasis on non-chemical control methods and preventative measures being adopted by industry leaders.

- 2020/05: The COVID-19 pandemic led to a temporary slowdown in some commercial services but highlighted the essential nature of rodent control for public health and food security, driving increased demand in residential sectors.

- 2019/08: Advancements in rodent trapping technology, including smarter traps with remote notification capabilities, began to gain traction in the market.

Future Outlook for Rodent Control Service Market

- 2023/01: Launch of new, low-toxicity rodent bait formulations by leading manufacturers, addressing environmental concerns and regulatory pressures.

- 2022/07: Major pest control companies are increasingly investing in IoT-enabled rodent monitoring systems, allowing for real-time data collection and predictive analytics.

- 2022/03: Several mergers and acquisitions occurred, with larger companies acquiring smaller, specialized service providers to expand geographic reach and service portfolios. For example, Rentokil acquired multiple regional pest control businesses.

- 2021/11: Increased focus on integrated pest management (IPM) strategies, with a greater emphasis on non-chemical control methods and preventative measures being adopted by industry leaders.

- 2020/05: The COVID-19 pandemic led to a temporary slowdown in some commercial services but highlighted the essential nature of rodent control for public health and food security, driving increased demand in residential sectors.

- 2019/08: Advancements in rodent trapping technology, including smarter traps with remote notification capabilities, began to gain traction in the market.

Future Outlook for Rodent Control Service Market

The future outlook for the Rodent Control Service market remains highly positive, driven by sustained urbanization, increasing health consciousness, and ongoing technological innovation. The growing demand for integrated pest management (IPM) and eco-friendly solutions will shape product development and service delivery. Smart technologies are poised to play a transformative role, enabling more proactive and data-driven rodent control strategies. Emerging markets, particularly in the Asia-Pacific region, are expected to witness significant growth as awareness and economic development increase. Strategic expansions, technological adoption, and a continued focus on regulatory compliance and customer satisfaction will be key to navigating the evolving landscape and capitalizing on future growth accelerators in this essential service sector.

Rodent Control Service Segmentation

-

1. Application

- 1.1. Commercial

- 1.2. Residential

- 1.3. Other

-

2. Types

- 2.1. Rats Control

- 2.2. Mice Control

- 2.3. Other

Rodent Control Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Rodent Control Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rodent Control Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial

- 5.1.2. Residential

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Rats Control

- 5.2.2. Mice Control

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Rodent Control Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial

- 6.1.2. Residential

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Rats Control

- 6.2.2. Mice Control

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Rodent Control Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial

- 7.1.2. Residential

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Rats Control

- 7.2.2. Mice Control

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Rodent Control Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial

- 8.1.2. Residential

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Rats Control

- 8.2.2. Mice Control

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Rodent Control Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial

- 9.1.2. Residential

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Rats Control

- 9.2.2. Mice Control

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Rodent Control Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial

- 10.1.2. Residential

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Rats Control

- 10.2.2. Mice Control

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Orkin LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Terminix International Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Clark Pest Control

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 americanpest

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Turner Pest Control

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rentokil

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Critter Control

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Miche Pest Control

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BOG Pest Control

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Corbett Exterminating

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Public Advertising Agency

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Inc.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Abell Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 All-Safe Pest & Termite

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 ASM Pest Control

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Best Pest Solutions

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 LLC

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Ameri Care Services

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 A-Better Exterminators

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Standard Pest Management

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Pest Control Center

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Inc.

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 KY-KO Pest Prevention

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Optimum Services Pest Control

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 The Best Bug & Pest Protection Inc.

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Accurate Pest Control

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Inc.

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 Payne Pest Management

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 Inc.

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 Pestlink

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.31 Neutocrete Systems

- 11.2.31.1. Overview

- 11.2.31.2. Products

- 11.2.31.3. SWOT Analysis

- 11.2.31.4. Recent Developments

- 11.2.31.5. Financials (Based on Availability)

- 11.2.32 Inc.

- 11.2.32.1. Overview

- 11.2.32.2. Products

- 11.2.32.3. SWOT Analysis

- 11.2.32.4. Recent Developments

- 11.2.32.5. Financials (Based on Availability)

- 11.2.33 Antex Exterminating

- 11.2.33.1. Overview

- 11.2.33.2. Products

- 11.2.33.3. SWOT Analysis

- 11.2.33.4. Recent Developments

- 11.2.33.5. Financials (Based on Availability)

- 11.2.1 Orkin LLC

List of Figures

- Figure 1: Global Rodent Control Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Rodent Control Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Rodent Control Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Rodent Control Service Revenue (million), by Types 2024 & 2032

- Figure 5: North America Rodent Control Service Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Rodent Control Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Rodent Control Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Rodent Control Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Rodent Control Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Rodent Control Service Revenue (million), by Types 2024 & 2032

- Figure 11: South America Rodent Control Service Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Rodent Control Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Rodent Control Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Rodent Control Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Rodent Control Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Rodent Control Service Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Rodent Control Service Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Rodent Control Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Rodent Control Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Rodent Control Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Rodent Control Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Rodent Control Service Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Rodent Control Service Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Rodent Control Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Rodent Control Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Rodent Control Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Rodent Control Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Rodent Control Service Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Rodent Control Service Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Rodent Control Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Rodent Control Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Rodent Control Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Rodent Control Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Rodent Control Service Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Rodent Control Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Rodent Control Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Rodent Control Service Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Rodent Control Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Rodent Control Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Rodent Control Service Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Rodent Control Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Rodent Control Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Rodent Control Service Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Rodent Control Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Rodent Control Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Rodent Control Service Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Rodent Control Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Rodent Control Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Rodent Control Service Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Rodent Control Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Rodent Control Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rodent Control Service?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Rodent Control Service?

Key companies in the market include Orkin LLC, The Terminix International Company, Clark Pest Control, americanpest, Turner Pest Control, Rentokil, Critter Control, Miche Pest Control, BOG Pest Control, Corbett Exterminating, Public Advertising Agency, Inc., Abell Group, All-Safe Pest & Termite, ASM Pest Control, Best Pest Solutions, LLC, Ameri Care Services, A-Better Exterminators, Standard Pest Management, Pest Control Center, Inc., KY-KO Pest Prevention, Optimum Services Pest Control, The Best Bug & Pest Protection Inc., Accurate Pest Control, Inc., Payne Pest Management, Inc., Pestlink, Neutocrete Systems, Inc., Antex Exterminating.

3. What are the main segments of the Rodent Control Service?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rodent Control Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rodent Control Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rodent Control Service?

To stay informed about further developments, trends, and reports in the Rodent Control Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence