Key Insights

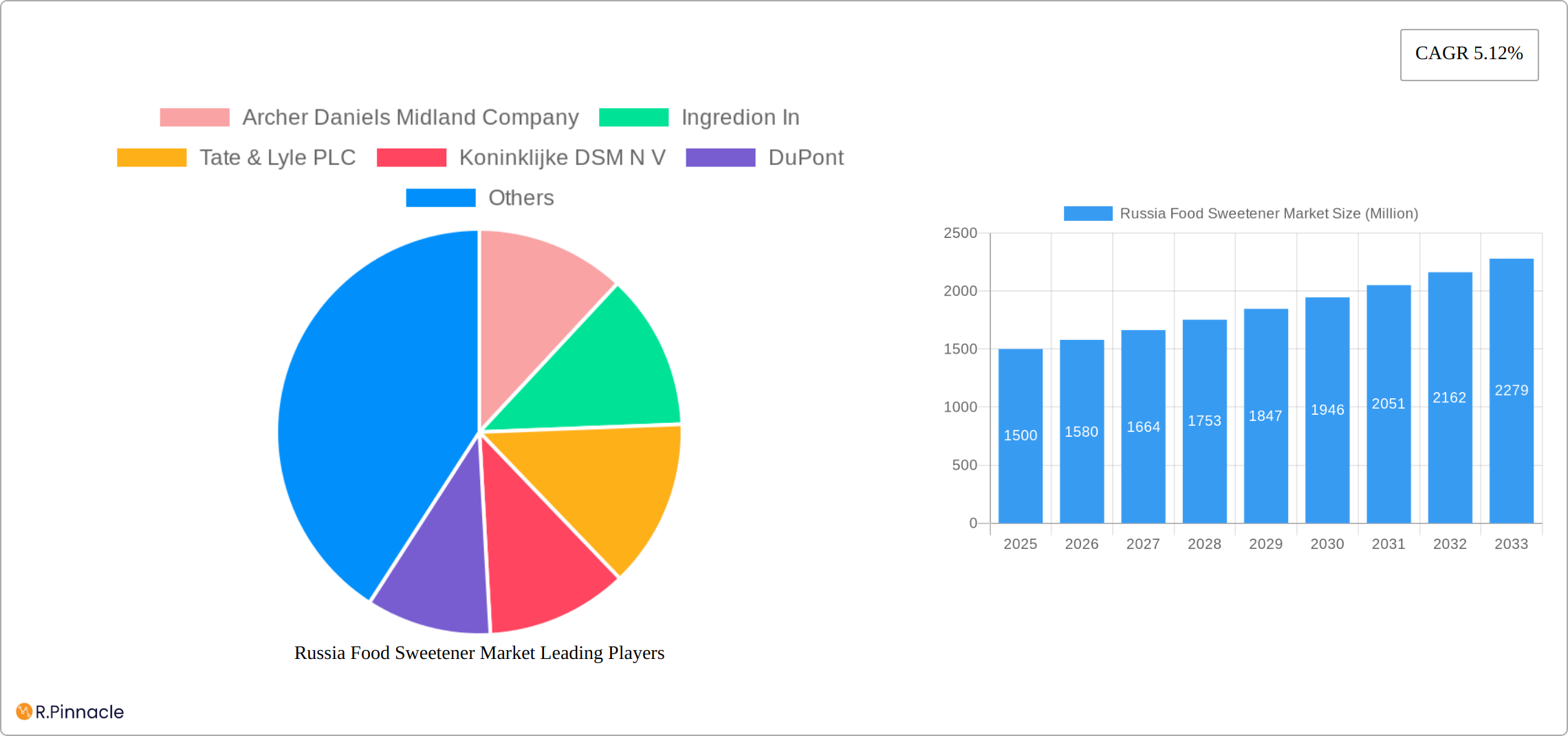

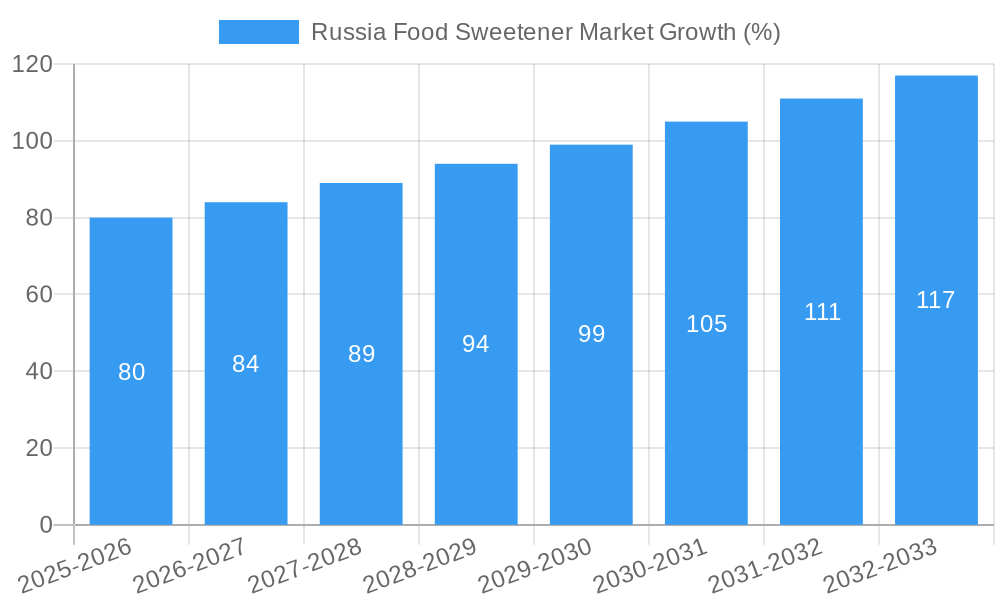

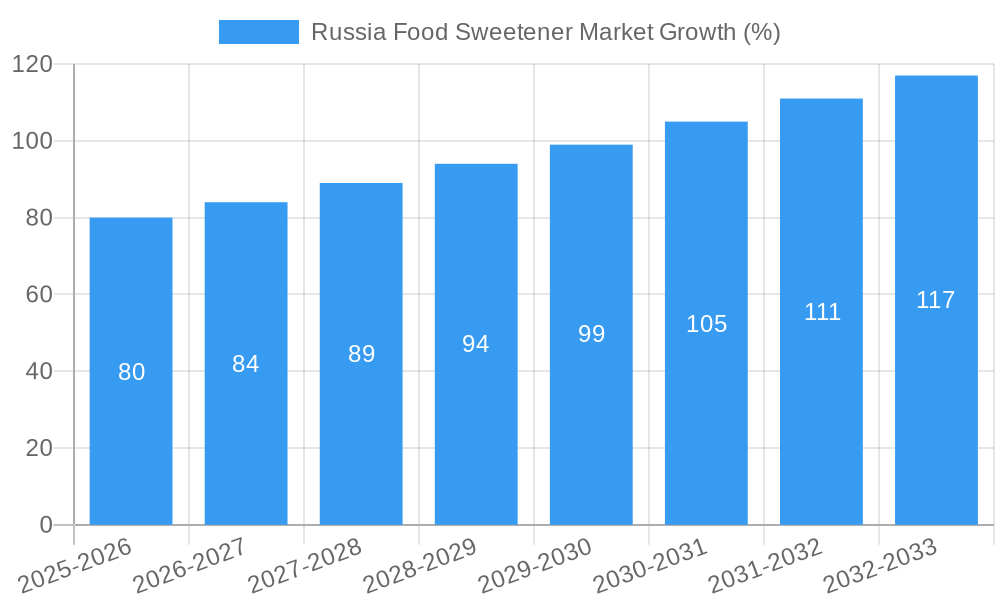

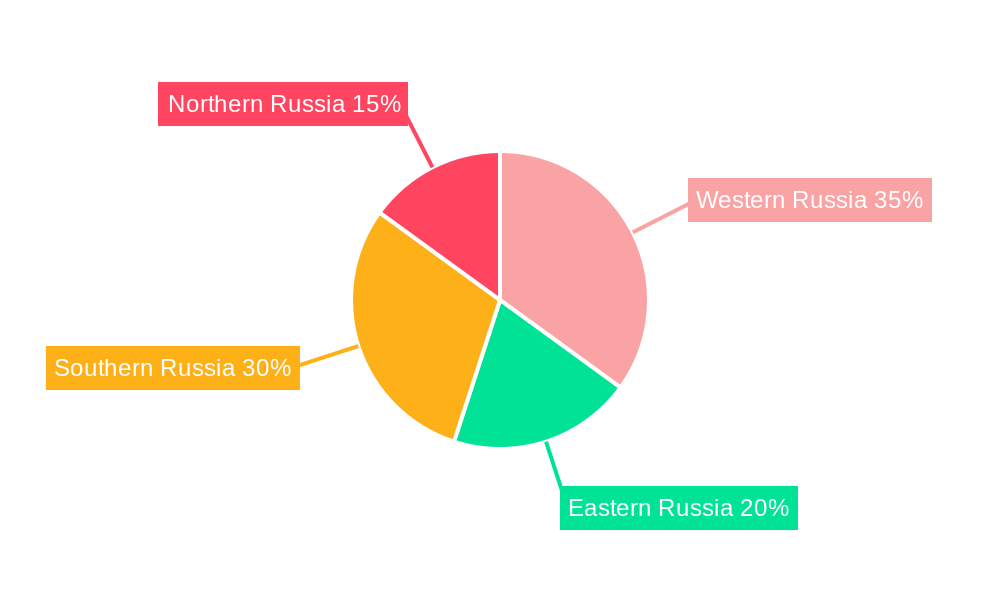

The Russia food sweetener market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.12% from 2025 to 2033. This expansion is driven by several key factors. The rising prevalence of processed foods and beverages, coupled with increasing consumer demand for convenient and ready-to-eat options, significantly fuels the market's growth. Furthermore, evolving consumer preferences towards healthier alternatives, such as sugar alcohols and high-intensity sweeteners (HIS), are shaping market dynamics. The confectionery and beverage sectors remain major application areas, while the dairy and bakery segments are showing promising growth potential. However, fluctuating raw material prices and evolving health regulations pose challenges to market expansion. The market is segmented by product type (sucrose, starch sweeteners, sugar alcohols, HIS) and application (dairy, bakery, soups, sauces, confectionery, beverages, others). Key players like Archer Daniels Midland Company, Ingredion Incorporated, Tate & Lyle PLC, and others are actively competing in this dynamic market, striving for market share through product innovation and strategic partnerships. Regional variations exist within Russia, with Western and Southern regions potentially exhibiting stronger growth due to higher consumption levels and established food processing industries.

Growth in the Russian food sweetener market will likely be influenced by shifts in consumer behavior. Increasing health consciousness may drive demand for sugar substitutes, while economic factors will impact the affordability and accessibility of different sweetener types. The success of market players will hinge on their ability to adapt to these changing dynamics, offering diversified product portfolios that cater to specific consumer needs and preferences. Government policies related to food safety and sugar consumption may also influence market trajectory. Expansion into emerging markets within Russia, coupled with innovative product development and strategic marketing initiatives, will be critical for companies seeking sustained growth in this evolving market. Analysis suggests that the segments with the most potential for growth are High Intensity Sweeteners, driven by health concerns, and the Bakery and Beverage applications, reflecting changing consumer preferences in these sectors.

Russia Food Sweetener Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Russia food sweetener market, offering crucial insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The market is segmented by product type (Sucrose (Common Sugar), Starch Sweeteners and Sugar Alcohols, High Intensity Sweeteners (HIS)) and application (Dairy, Bakery, Soups, Sauces and Dressings, Confectionery, Beverages, Others). Key players analyzed include Archer Daniels Midland Company, Ingredion Incorporated, Tate & Lyle PLC, Koninklijke DSM N.V., DuPont, Cargill Inc, and JK Sucralose Inc. The report projects a market value of XX Million by 2033, demonstrating substantial growth opportunities.

Russia Food Sweetener Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory environment of the Russian food sweetener market. We examine market concentration, revealing the market share held by leading players like Cargill and ADM. The report details M&A activities, including deal values (estimated at XX Million in total for the period 2019-2024), highlighting the increasing consolidation within the industry. Furthermore, we delve into the influence of regulatory frameworks on product innovation, focusing on government initiatives promoting sugar reduction and the impact on product formulation. The analysis also explores the role of technological advancements and the emergence of substitutes, influencing consumer preferences and shaping market dynamics. We analyze end-user demographics and their evolving dietary habits and assess their impact on market demand.

- Market Concentration: High (XX%), with top 5 players holding approximately XX% market share in 2024.

- M&A Activity: XX deals recorded between 2019 and 2024, totaling an estimated value of XX Million.

- Innovation Drivers: Growing demand for healthier options, government regulations on sugar content, and technological advancements in sweetener production.

- Regulatory Frameworks: Stringent regulations on labeling and sugar content are driving innovation in sugar reduction technologies.

Russia Food Sweetener Market Dynamics & Trends

This section explores the key factors driving market growth, including evolving consumer preferences towards healthier and low-sugar food products, technological disruptions shaping production and distribution, and the intense competitive dynamics amongst market players. We examine the CAGR (Compound Annual Growth Rate) of the market during the historical period (2019-2024) and project the CAGR for the forecast period (2025-2033). The impact of economic factors, such as fluctuations in commodity prices and consumer spending, is also assessed. Market penetration of various sweetener types is analyzed, revealing the shifting preferences among consumers towards specific products.

(Paragraphs detailing market growth drivers, technological disruptions, consumer preferences, and competitive dynamics with specific metrics like CAGR and market penetration would be inserted here. This section would be approximately 600 words.)

Dominant Regions & Segments in Russia Food Sweetener Market

This section identifies the leading regions and market segments within the Russian food sweetener market. We analyze the performance of each segment (Sucrose, Starch Sweeteners, Sugar Alcohols, HIS) and application (Dairy, Bakery, etc.) in terms of revenue, growth rate, and market share. The dominant regions are identified, and the factors contributing to their dominance are highlighted.

Key Drivers for Dominant Segments/Regions (Examples):

- High Intensity Sweeteners (HIS): Growing consumer demand for low-calorie and sugar-free products.

- Beverages Segment: High consumption of beverages and increasing adoption of sugar-reduced options.

- (Specific Region): Strong economic growth, favorable regulatory environment, established distribution networks.

(Paragraphs providing detailed dominance analysis for the leading segments and regions, including economic factors and infrastructure development contributing to their dominance, would be inserted here. This section would be approximately 600 words.)

Russia Food Sweetener Market Product Innovations

The Russian food sweetener market is experiencing a dynamic wave of product innovation, driven by a heightened consumer focus on health and wellness, alongside evolving regulatory landscapes. Manufacturers are actively introducing novel sweeteners that cater to the growing demand for sugar-free and low-calorie alternatives. This includes leveraging advancements in high-intensity sweeteners like stevia and sucralose, as well as expanding the portfolio of sugar alcohols such as erythritol and xylitol. Beyond individual sweetener types, there's a significant emphasis on developing integrated sugar reduction solutions. This often involves strategic collaborations between food and beverage companies and leading sweetener manufacturers. These partnerships aim to not only improve the taste and texture of reduced-sugar products but also to effectively address consumer concerns about artificial ingredients and provide a more natural sweetness profile. The overarching trend is towards creating enjoyable and healthier food and beverage options that align with the market's push for healthier lifestyles and compliance with potential or existing government regulations on sugar content.

Report Scope & Segmentation Analysis

This report comprehensively segments the Russia food sweetener market by product type (Sucrose (Common Sugar), Starch Sweeteners and Sugar Alcohols, High Intensity Sweeteners (HIS)) and application (Dairy, Bakery, Soups, Sauces and Dressings, Confectionery, Beverages, Others). Each segment's growth projections, market size (in Million), and competitive dynamics are analyzed, providing a granular view of the market landscape. (Paragraphs detailing each segment, including growth projections, market sizes, and competitive dynamics, would be inserted here. This section would be approximately 150 words.)

Key Drivers of Russia Food Sweetener Market Growth

The Russia food sweetener market's growth is propelled by several factors. The rising preference for low-calorie and sugar-free options amongst health-conscious consumers is a significant driver. Government regulations promoting reduced sugar intake in processed foods further stimulate demand for alternative sweeteners. Technological advancements, particularly in the production of high-intensity sweeteners, are also contributing to growth. Furthermore, the increasing availability of diverse food and beverage products is creating new market opportunities.

Challenges in the Russia Food Sweetener Market Sector

The Russian food sweetener market faces a complex set of challenges that can impact its growth trajectory. Volatile raw material prices, coupled with ongoing global supply chain disruptions, pose significant risks to production costs and ultimately, profitability for manufacturers. Adhering to the stringent and often evolving regulatory compliance requirements adds another layer of complexity and potential cost for businesses operating within this sector. Furthermore, the market is characterized by intense competition. Established global players and nimble local competitors vie for market share, leading to considerable pressure on pricing and demanding constant innovation to maintain a competitive edge. These combined factors create an environment of uncertainty and complexity, requiring companies to be agile and strategic in their operations and market engagement.

Emerging Opportunities in Russia Food Sweetener Market

Despite the challenges, the Russian food sweetener market is ripe with emerging opportunities for growth and expansion. The most prominent opportunity lies in the surging demand for functional foods and beverages. Consumers are increasingly seeking products that offer health benefits beyond basic nutrition, and this trend directly translates to a higher demand for natural and healthy sweeteners. The continuous expansion of the food processing and manufacturing sectors within Russia also creates a robust and growing demand for a diverse range of sweetener types. Moreover, ongoing technological advancements in sweetener production are continuously opening new avenues for developing innovative, cost-effective, and potentially more sustainable sweetener options. Successfully capitalizing on these opportunities will necessitate astute strategic planning, a deep understanding of consumer preferences, and a proactive approach to adapting to the dynamic market changes.

Leading Players in the Russia Food Sweetener Market Market

- Archer Daniels Midland Company (ADM)

- Ingredion Incorporated (Ingredion)

- Tate & Lyle PLC (Tate & Lyle)

- Koninklijke DSM N.V. (DSM)

- DuPont (DuPont)

- Cargill Inc (Cargill)

- JK Sucralose Inc

- PTT Global Chemical Public Company Limited (PTTGC)

- Anhui Jinhe Industrial Co., Ltd.

- Shandong Sanyuan Biotechnology Co., Ltd.

Key Developments in Russia Food Sweetener Market Industry

- 2022 Q4: A prominent Russian dairy producer successfully launched a new line of sugar-free yogurts, meeting growing consumer demand for healthier dessert options.

- 2023 Q1: The implementation of stricter government regulations targeting the sugar content in children's beverages came into effect, prompting manufacturers to reformulate their products.

- 2021 Q2: A significant acquisition saw a multinational food ingredient company purchase a Russian sugar alcohol producer, indicating consolidation and expansion within the market.

- 2024 Q3: A strategic collaboration was formed between a leading sweetener manufacturer and a major bakery chain to develop and introduce innovative bread formulations with significantly reduced sugar content.

- 2023 Q4: Several companies announced investments in research and development for novel natural sweeteners derived from plant-based sources to cater to the clean-label trend.

- 2024 Q1: An increase in the adoption of erythritol as a preferred sugar substitute was observed across various beverage categories due to its favorable taste profile and caloric value.

Future Outlook for Russia Food Sweetener Market Market

The future outlook for the Russia food sweetener market remains positive, driven by continued growth in health consciousness, government support for healthier food options, and ongoing innovations in sweetener technology. Strategic partnerships and investments in research and development will be key to navigating market challenges and capitalizing on emerging opportunities. The market is projected to show robust growth in the coming years, presenting lucrative prospects for businesses operating in this sector.

Russia Food Sweetener Market Segmentation

-

1. Product Type

- 1.1. Sucrose (Common Sugar)

- 1.2. Starch Sweeteners and Sugar Alcohols

- 1.3. High Intensity Sweeteners (HIS)

-

2. Application

- 2.1. Dairy

- 2.2. Bakery

- 2.3. Soups, Sauces and Dressings

- 2.4. Confectionery

- 2.5. Beverages

- 2.6. Others

Russia Food Sweetener Market Segmentation By Geography

- 1. Russia

Russia Food Sweetener Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Augmented demand for Natural Sweeteners; Rising Consumer Inclination Toward Clean Label and Organic Stevia

- 3.3. Market Restrains

- 3.3.1. Side Effects and Challenges with Stevia

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Food Sweetener from Emerging Countries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Food Sweetener Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Sucrose (Common Sugar)

- 5.1.2. Starch Sweeteners and Sugar Alcohols

- 5.1.3. High Intensity Sweeteners (HIS)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dairy

- 5.2.2. Bakery

- 5.2.3. Soups, Sauces and Dressings

- 5.2.4. Confectionery

- 5.2.5. Beverages

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Western Russia Russia Food Sweetener Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russia Food Sweetener Market Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russia Food Sweetener Market Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russia Food Sweetener Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Archer Daniels Midland Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Ingredion In

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Tate & Lyle PLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Koninklijke DSM N V

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 DuPont

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Cargill Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 JK Sucralose Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Archer Daniels Midland Company

List of Figures

- Figure 1: Russia Food Sweetener Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Food Sweetener Market Share (%) by Company 2024

List of Tables

- Table 1: Russia Food Sweetener Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Food Sweetener Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Russia Food Sweetener Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Russia Food Sweetener Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Russia Food Sweetener Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Western Russia Russia Food Sweetener Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Eastern Russia Russia Food Sweetener Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Russia Russia Food Sweetener Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Northern Russia Russia Food Sweetener Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Russia Food Sweetener Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 11: Russia Food Sweetener Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: Russia Food Sweetener Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Food Sweetener Market?

The projected CAGR is approximately 5.12%.

2. Which companies are prominent players in the Russia Food Sweetener Market?

Key companies in the market include Archer Daniels Midland Company, Ingredion In, Tate & Lyle PLC, Koninklijke DSM N V, DuPont, Cargill Inc, JK Sucralose Inc.

3. What are the main segments of the Russia Food Sweetener Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Augmented demand for Natural Sweeteners; Rising Consumer Inclination Toward Clean Label and Organic Stevia.

6. What are the notable trends driving market growth?

Increasing Demand for Food Sweetener from Emerging Countries.

7. Are there any restraints impacting market growth?

Side Effects and Challenges with Stevia.

8. Can you provide examples of recent developments in the market?

1. Launch of new sugar-free products by major food and beverage companies 2. Government regulations on sugar content in certain food products 3. Acquisition of Russian sweetener producers by international players 4. Collaboration between sweetener manufacturers and food and beverage companies to develop innovative sugar reduction solutions

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Food Sweetener Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Food Sweetener Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Food Sweetener Market?

To stay informed about further developments, trends, and reports in the Russia Food Sweetener Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence