Key Insights

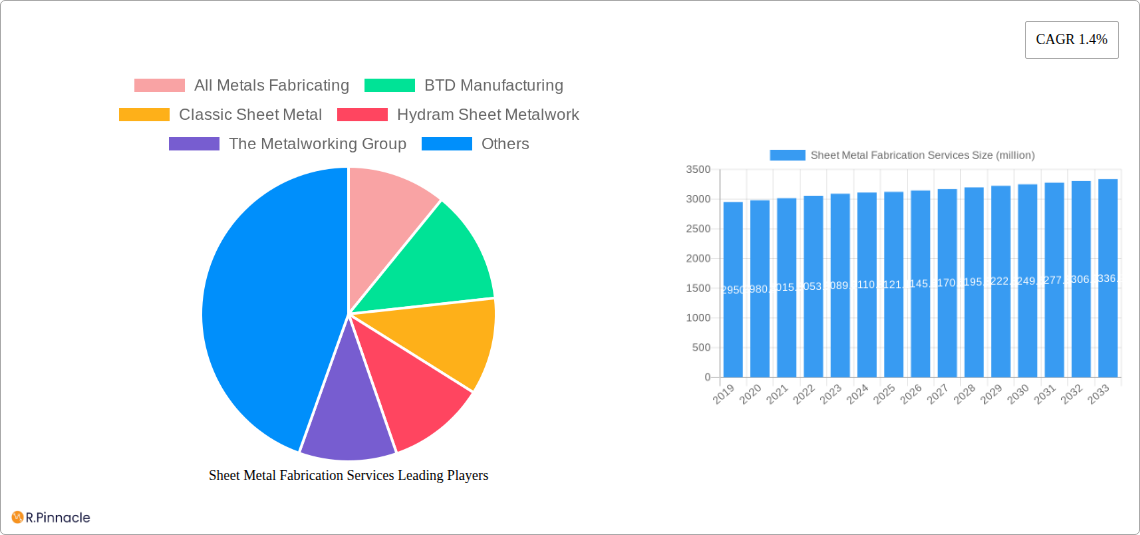

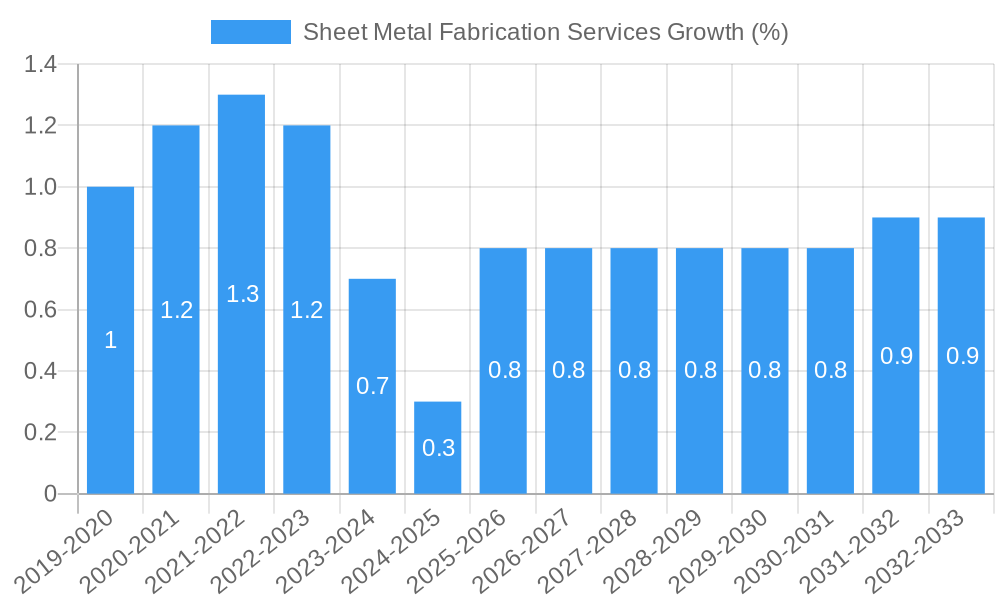

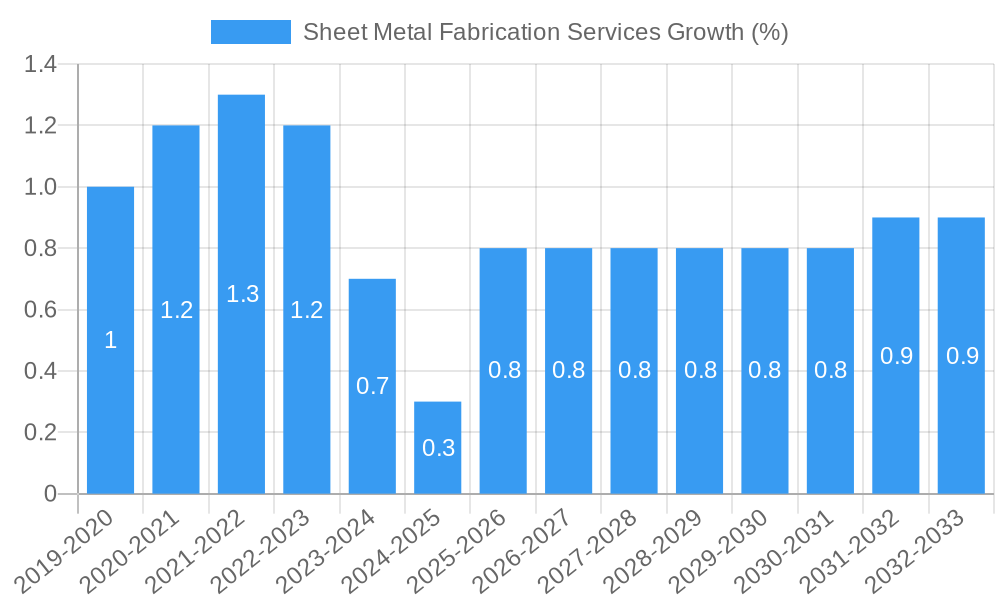

The global sheet metal fabrication services market is poised for steady growth, projected to reach a substantial USD 3121.1 million by 2025. This expansion, while moderate, is driven by the indispensable role of sheet metal fabrication across a diverse range of critical industries. Manufacturing and construction remain the bedrock of demand, requiring precision components for everything from heavy machinery and infrastructure to consumer goods and building envelopes. The automotive sector, with its continuous innovation in vehicle design and the increasing adoption of lightweight materials for fuel efficiency and electric vehicle (EV) development, is a significant growth catalyst. Furthermore, the aerospace industry's stringent demands for high-performance, custom-fabricated parts, coupled with the growing electronics sector's need for specialized enclosures and components, contribute to market resilience. The projected CAGR of 1.4% suggests a mature yet stable market, where efficiency, technological advancements in machinery, and the ability to cater to specialized needs will be key differentiators for service providers.

The trajectory of the sheet metal fabrication services market is shaped by a confluence of factors. Emerging trends include a heightened emphasis on advanced manufacturing techniques such as laser cutting, automated bending, and robotic welding, which enhance precision, speed, and cost-effectiveness. The increasing integration of digital technologies, including CAD/CAM software and IoT for enhanced workflow management and quality control, is also pivotal. While the market enjoys broad demand, certain restraints exist. Fluctuations in raw material costs, particularly for steel and aluminum, can impact profitability and pricing strategies. Intense competition among a large number of service providers, especially in regional markets, can also exert downward pressure on margins. However, the persistent need for bespoke solutions in sectors like architecture, telecommunications, and food processing, alongside the ongoing development of innovative materials and sophisticated fabrication processes, ensures sustained opportunities for growth and specialization within this vital industrial segment.

Sheet Metal Fabrication Services Market Structure & Innovation Trends

The global sheet metal fabrication services market exhibits a moderate to high concentration, driven by the capital-intensive nature of advanced manufacturing technologies and a requirement for specialized expertise. Key innovation drivers include the adoption of automation, laser cutting, and advanced welding techniques, enabling greater precision and efficiency. Regulatory frameworks, particularly concerning environmental compliance and safety standards in sectors like Aerospace and Automotive, play a significant role in shaping market practices. The market is characterized by a limited number of readily available product substitutes, with custom fabrication being the primary offering. End-user demographics span a wide spectrum, from large-scale industrial manufacturers to niche product developers. Mergers and Acquisitions (M&A) activity is moderate, with deal values often reflecting the acquisition of specialized capabilities or market access. For instance, in 2023, an estimated $100 million was invested in strategic acquisitions, further consolidating expertise and expanding service portfolios. The market share of the top five players is estimated to be around 40%, indicating a fragmented landscape with significant room for growth for specialized providers.

Sheet Metal Fabrication Services Market Dynamics & Trends

The sheet metal fabrication services market is projected to experience robust growth over the forecast period of 2025–2033, driven by an escalating demand across diverse industries. The Compound Annual Growth Rate (CAGR) is anticipated to be approximately 6.5%. Key growth drivers include the burgeoning manufacturing sector in emerging economies, a consistent need for precision components in the Automotive industry, and the critical role of fabricated parts in infrastructure development within the Construction sector. Technological advancements are profoundly impacting the market, with the increasing adoption of Industry 4.0 principles, including AI-powered design optimization, robotic automation for repetitive tasks, and advanced quality control systems employing machine vision. This technological disruption leads to enhanced productivity, reduced lead times, and improved product quality, directly influencing competitive dynamics. Consumer preferences are increasingly leaning towards suppliers offering integrated solutions, from design and prototyping to full-scale production and assembly, alongside a strong emphasis on sustainability and reduced environmental impact. Market penetration is deepening as more businesses recognize the cost-effectiveness and flexibility of outsourcing their sheet metal fabrication needs to specialized providers. The estimated market penetration rate for specialized fabrication services is expected to reach 75% by 2033. The intricate interplay of these factors is shaping a dynamic market landscape where agility, technological prowess, and customer-centricity are paramount for success.

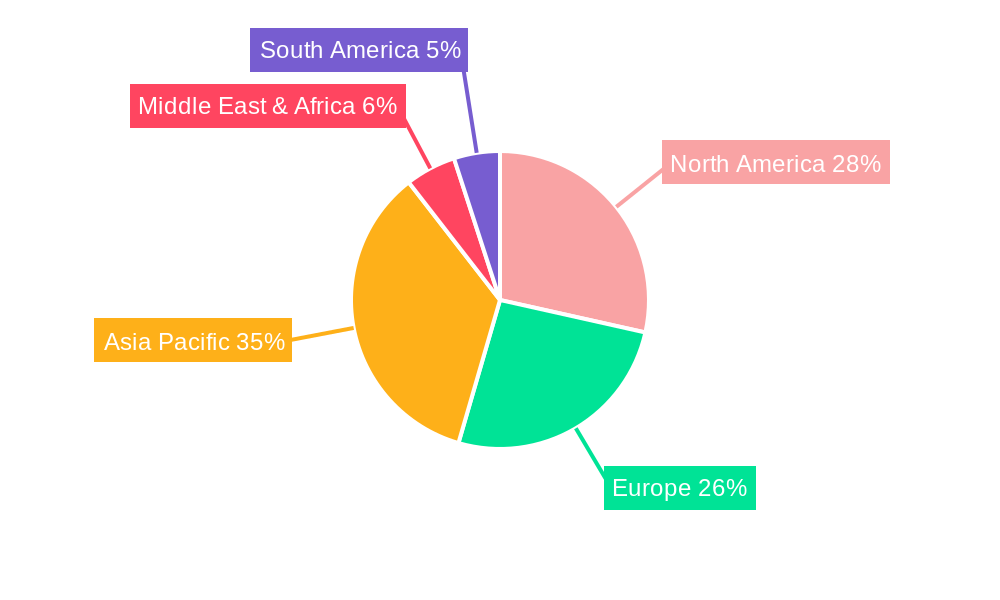

Dominant Regions & Segments in Sheet Metal Fabrication Services

The North American region, specifically the United States, is a dominant force in the global sheet metal fabrication services market, driven by its advanced manufacturing infrastructure, significant investments in R&D, and a strong presence of key end-use industries. Economic policies fostering domestic manufacturing and substantial government spending on infrastructure projects contribute significantly to this dominance. The Application segment of Manufacturing stands out as the largest contributor, accounting for an estimated 40% of the market share. This is due to the continuous need for custom metal parts in the production of machinery, equipment, and various manufactured goods.

- Manufacturing:

- Key Drivers: High demand for custom components for industrial machinery, automation equipment, and consumer goods. Supportive government initiatives for reshoring manufacturing activities.

- Dominance Analysis: The sheer volume of manufacturing operations globally, coupled with the intricate designs and specifications required for modern production, makes this segment a consistent revenue generator. Leading companies in this segment focus on precision, speed, and scalability.

The Automotive industry also represents a substantial segment, fueled by the ongoing evolution in vehicle design, the rise of electric vehicles (EVs) requiring specialized lightweight components, and stringent safety regulations demanding high-quality fabricated parts.

- Automotive:

- Key Drivers: Increasing demand for lightweight and high-strength components for fuel efficiency and EV battery enclosures. Stringent safety regulations requiring precise and durable metal parts.

- Dominance Analysis: This segment is characterized by high-volume production and a need for adherence to strict quality standards. Innovations in laser welding and advanced stamping techniques are crucial for this sector.

In terms of Types, Steel remains the most dominant material, owing to its versatility, strength, and cost-effectiveness across a wide array of applications. However, Aluminum is witnessing significant growth, particularly in the Aerospace and Automotive sectors, due to its lightweight properties.

- Steel:

- Key Drivers: Widespread availability, cost-effectiveness, and high tensile strength making it suitable for a broad range of applications.

- Dominance Analysis: Steel fabrication is foundational to many industries, from construction to heavy machinery, ensuring its continued leadership.

The Construction segment, while not as technology-intensive as Automotive or Aerospace, relies heavily on sheet metal for structural components, cladding, and roofing, making it a steady contributor to market growth.

- Construction:

- Key Drivers: Ongoing infrastructure development and urbanization projects globally, demand for durable and weather-resistant building materials.

- Dominance Analysis: This segment benefits from long-term project cycles and a consistent need for structural metal elements.

Sheet Metal Fabrication Services Product Innovations

Product innovations in sheet metal fabrication are largely centered on enhancing precision, efficiency, and material utilization. Advancements in laser cutting technology allow for intricate designs and tighter tolerances, while 3D printing of metal components is beginning to complement traditional fabrication for highly complex geometries. The development of advanced alloys and composite materials is also influencing fabrication techniques. Competitive advantages are increasingly derived from offering integrated design, prototyping, and production services, along with a strong focus on lean manufacturing principles and sustainable practices. Companies are investing in software solutions for intelligent design and automated manufacturing processes to reduce lead times and optimize material usage.

Report Scope & Segmentation Analysis

The global sheet metal fabrication services market is segmented by Application and Type. Key Application segments include Manufacturing, Construction, Aerospace, Automotive, Architecture, Electronics, Food Processing, and Telecommunication, alongside an "Others" category. Growth projections indicate robust expansion across all these sectors, with Manufacturing and Automotive leading in terms of market size. The Type segmentation primarily categorizes services based on Steel and Aluminum, with "Others" encompassing materials like stainless steel and titanium. Competitive dynamics within each segment are shaped by specialized expertise, technological capabilities, and the ability to meet industry-specific quality and regulatory requirements.

Key Drivers of Sheet Metal Fabrication Services Growth

The growth of the sheet metal fabrication services market is propelled by several key factors. Technologically, the widespread adoption of advanced manufacturing techniques such as CNC machining, laser cutting, and automated welding significantly enhances precision and efficiency. Economically, increasing industrialization in developing nations and a surge in infrastructure development projects worldwide create substantial demand. Regulatory factors, particularly those encouraging domestic manufacturing and promoting sustainable practices, also play a crucial role. For example, the US government's "Made in America" initiative encourages the use of domestically fabricated components, directly boosting the market. Furthermore, the growing trend of outsourcing non-core manufacturing processes by companies across various sectors allows specialized fabrication service providers to capture a larger market share.

Challenges in the Sheet Metal Fabrication Services Sector

Despite its growth, the sheet metal fabrication services sector faces several challenges. Regulatory hurdles, including stringent environmental compliance standards and evolving safety regulations, can increase operational costs and require continuous adaptation. Supply chain disruptions, particularly concerning raw material availability and price volatility, pose a significant risk to production schedules and profitability. Competitive pressures from both established players and emerging low-cost providers can squeeze profit margins. The skilled labor shortage in advanced manufacturing also presents a persistent challenge, impacting the ability of companies to adopt and operate new technologies effectively. The projected impact of raw material price fluctuations on the market is estimated to be a 5-8% variance in cost of goods sold.

Emerging Opportunities in Sheet Metal Fabrication Services

Emerging opportunities within the sheet metal fabrication services market are substantial and diverse. The rapid growth of the electric vehicle (EV) market presents a significant opportunity for fabrication of battery enclosures, lightweight structural components, and specialized charging infrastructure. The increasing demand for custom solutions in niche industries like medical devices and renewable energy (e.g., solar panel frames) also offers avenues for specialized growth. Furthermore, the integration of advanced technologies such as AI-driven design optimization and additive manufacturing (3D printing) for complex metal parts opens new service possibilities. The global push towards sustainability also creates opportunities for fabricators offering eco-friendly processes and materials.

Leading Players in the Sheet Metal Fabrication Services Market

- All Metals Fabricating

- BTD Manufacturing

- Classic Sheet Metal

- Hydram Sheet Metalwork

- The Metalworking Group

- Kapco Metal Stamping

- Marlin Steel Wire Products

- Mayville Engineering Company

- Metcam

- Moreng Meta

- Noble Industries

- Standard Iron & Wire Works

Key Developments in Sheet Metal Fabrication Services Industry

- 2023 October: Introduction of a new high-speed laser cutting system by BTD Manufacturing, increasing production capacity by an estimated 15%.

- 2023 July: Hydram Sheet Metalwork announces significant investment in robotic welding automation to enhance efficiency and precision.

- 2023 March: Mayville Engineering Company (MEC) completes a strategic acquisition, expanding its capabilities in complex assemblies.

- 2022 December: Marlin Steel Wire Products launches an online quoting tool for faster customer service and project turnaround times.

- 2022 August: Metcam invests in advanced ERP system to streamline operations and improve supply chain visibility.

- 2022 April: Kapco Metal Stamping expands its facility to accommodate increased demand for automotive components.

Future Outlook for Sheet Metal Fabrication Services Market

The future outlook for the sheet metal fabrication services market is highly optimistic, characterized by sustained growth accelerators. The continuous evolution of end-use industries, particularly in areas like Aerospace with advancements in aircraft design and Automotive with the transition to EVs, will drive ongoing demand for sophisticated fabricated components. The increasing integration of smart manufacturing technologies, including IoT and AI, will further enhance operational efficiency and enable greater customization. Furthermore, the growing emphasis on sustainable manufacturing practices presents an opportunity for companies that invest in eco-friendly processes and materials. Strategic partnerships and continued investment in advanced equipment and skilled labor will be crucial for companies to capitalize on emerging market trends and maintain a competitive edge in the coming years, with an estimated market value of $300 billion by 2033.

Sheet Metal Fabrication Services Segmentation

-

1. Application

- 1.1. Manufacturing

- 1.2. Construction

- 1.3. Aerospace

- 1.4. Automotive

- 1.5. Architecture

- 1.6. Electronics

- 1.7. Food Processing

- 1.8. Telecommunication

- 1.9. Others

-

2. Types

- 2.1. Steel

- 2.2. Aluminum

- 2.3. Others

Sheet Metal Fabrication Services Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Sheet Metal Fabrication Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.4% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sheet Metal Fabrication Services Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Manufacturing

- 5.1.2. Construction

- 5.1.3. Aerospace

- 5.1.4. Automotive

- 5.1.5. Architecture

- 5.1.6. Electronics

- 5.1.7. Food Processing

- 5.1.8. Telecommunication

- 5.1.9. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Steel

- 5.2.2. Aluminum

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Sheet Metal Fabrication Services Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Manufacturing

- 6.1.2. Construction

- 6.1.3. Aerospace

- 6.1.4. Automotive

- 6.1.5. Architecture

- 6.1.6. Electronics

- 6.1.7. Food Processing

- 6.1.8. Telecommunication

- 6.1.9. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Steel

- 6.2.2. Aluminum

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Sheet Metal Fabrication Services Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Manufacturing

- 7.1.2. Construction

- 7.1.3. Aerospace

- 7.1.4. Automotive

- 7.1.5. Architecture

- 7.1.6. Electronics

- 7.1.7. Food Processing

- 7.1.8. Telecommunication

- 7.1.9. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Steel

- 7.2.2. Aluminum

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Sheet Metal Fabrication Services Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Manufacturing

- 8.1.2. Construction

- 8.1.3. Aerospace

- 8.1.4. Automotive

- 8.1.5. Architecture

- 8.1.6. Electronics

- 8.1.7. Food Processing

- 8.1.8. Telecommunication

- 8.1.9. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Steel

- 8.2.2. Aluminum

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Sheet Metal Fabrication Services Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Manufacturing

- 9.1.2. Construction

- 9.1.3. Aerospace

- 9.1.4. Automotive

- 9.1.5. Architecture

- 9.1.6. Electronics

- 9.1.7. Food Processing

- 9.1.8. Telecommunication

- 9.1.9. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Steel

- 9.2.2. Aluminum

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Sheet Metal Fabrication Services Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Manufacturing

- 10.1.2. Construction

- 10.1.3. Aerospace

- 10.1.4. Automotive

- 10.1.5. Architecture

- 10.1.6. Electronics

- 10.1.7. Food Processing

- 10.1.8. Telecommunication

- 10.1.9. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Steel

- 10.2.2. Aluminum

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 All Metals Fabricating

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BTD Manufacturing

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Classic Sheet Metal

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hydram Sheet Metalwork

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Metalworking Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kapco Metal Stamping

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Marlin Steel Wire Products

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mayville Engineering Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Metcam

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Moreng Meta

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Noble Industries

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Standard Iron & Wire Works

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 All Metals Fabricating

List of Figures

- Figure 1: Global Sheet Metal Fabrication Services Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Sheet Metal Fabrication Services Revenue (million), by Application 2024 & 2032

- Figure 3: North America Sheet Metal Fabrication Services Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Sheet Metal Fabrication Services Revenue (million), by Types 2024 & 2032

- Figure 5: North America Sheet Metal Fabrication Services Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Sheet Metal Fabrication Services Revenue (million), by Country 2024 & 2032

- Figure 7: North America Sheet Metal Fabrication Services Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Sheet Metal Fabrication Services Revenue (million), by Application 2024 & 2032

- Figure 9: South America Sheet Metal Fabrication Services Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Sheet Metal Fabrication Services Revenue (million), by Types 2024 & 2032

- Figure 11: South America Sheet Metal Fabrication Services Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Sheet Metal Fabrication Services Revenue (million), by Country 2024 & 2032

- Figure 13: South America Sheet Metal Fabrication Services Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Sheet Metal Fabrication Services Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Sheet Metal Fabrication Services Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Sheet Metal Fabrication Services Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Sheet Metal Fabrication Services Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Sheet Metal Fabrication Services Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Sheet Metal Fabrication Services Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Sheet Metal Fabrication Services Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Sheet Metal Fabrication Services Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Sheet Metal Fabrication Services Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Sheet Metal Fabrication Services Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Sheet Metal Fabrication Services Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Sheet Metal Fabrication Services Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Sheet Metal Fabrication Services Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Sheet Metal Fabrication Services Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Sheet Metal Fabrication Services Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Sheet Metal Fabrication Services Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Sheet Metal Fabrication Services Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Sheet Metal Fabrication Services Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Sheet Metal Fabrication Services Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Sheet Metal Fabrication Services Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Sheet Metal Fabrication Services Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Sheet Metal Fabrication Services Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Sheet Metal Fabrication Services Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Sheet Metal Fabrication Services Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Sheet Metal Fabrication Services Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Sheet Metal Fabrication Services Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Sheet Metal Fabrication Services Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Sheet Metal Fabrication Services Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Sheet Metal Fabrication Services Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Sheet Metal Fabrication Services Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Sheet Metal Fabrication Services Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Sheet Metal Fabrication Services Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Sheet Metal Fabrication Services Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Sheet Metal Fabrication Services Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Sheet Metal Fabrication Services Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Sheet Metal Fabrication Services Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Sheet Metal Fabrication Services Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Sheet Metal Fabrication Services Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sheet Metal Fabrication Services?

The projected CAGR is approximately 1.4%.

2. Which companies are prominent players in the Sheet Metal Fabrication Services?

Key companies in the market include All Metals Fabricating, BTD Manufacturing, Classic Sheet Metal, Hydram Sheet Metalwork, The Metalworking Group, Kapco Metal Stamping, Marlin Steel Wire Products, Mayville Engineering Company, Metcam, Moreng Meta, Noble Industries, Standard Iron & Wire Works.

3. What are the main segments of the Sheet Metal Fabrication Services?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 3121.1 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sheet Metal Fabrication Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sheet Metal Fabrication Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sheet Metal Fabrication Services?

To stay informed about further developments, trends, and reports in the Sheet Metal Fabrication Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence