Key Insights

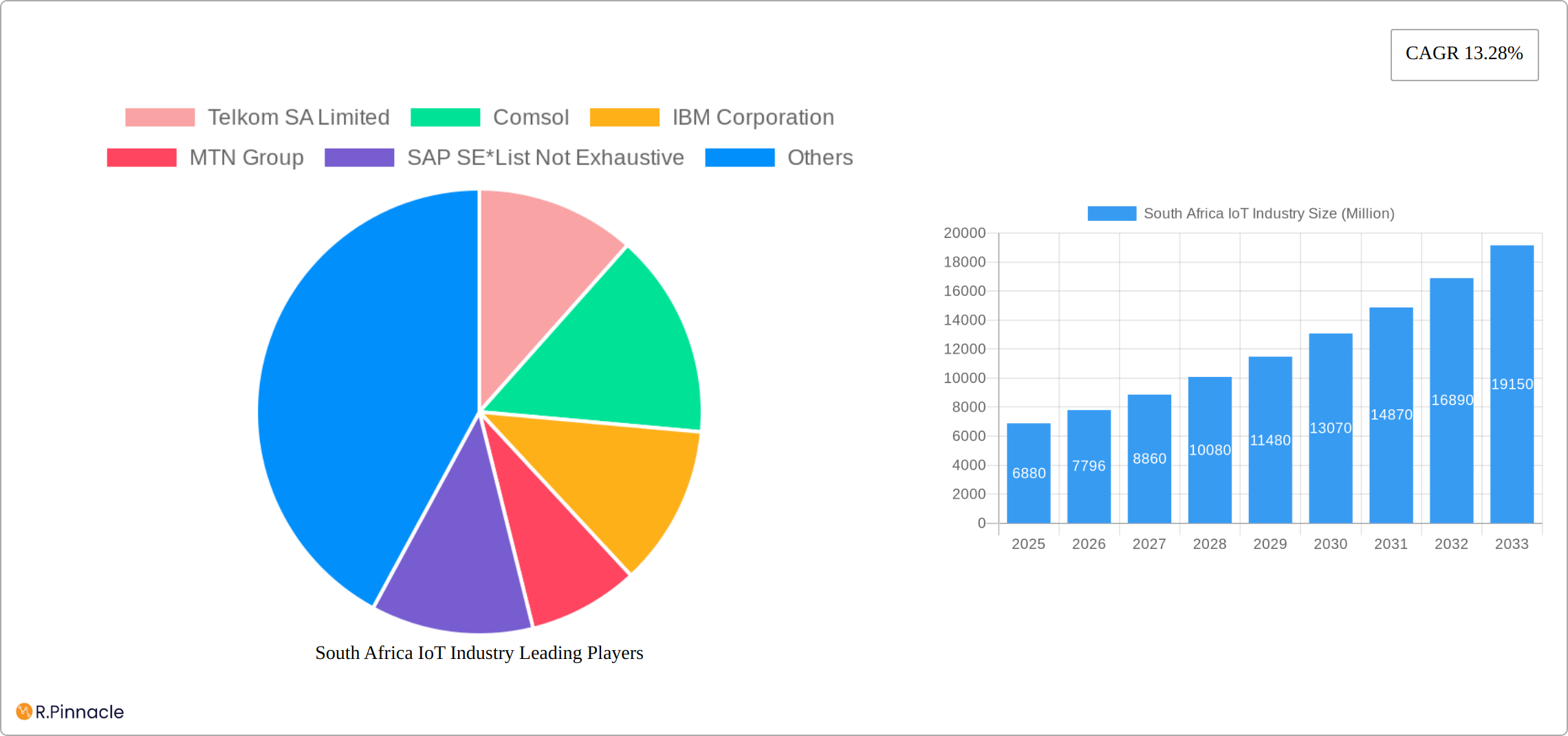

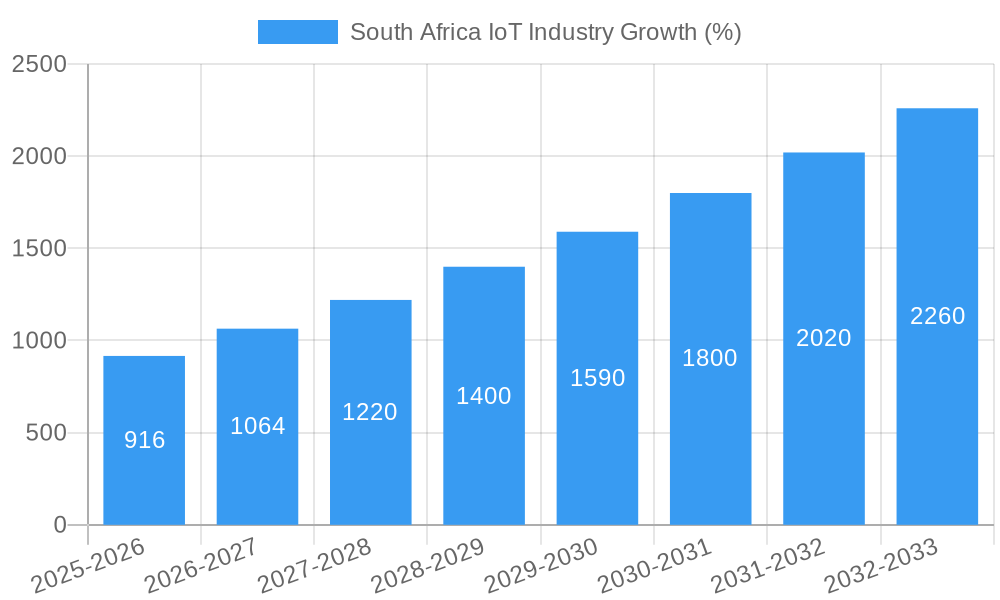

The South African IoT market, valued at $6.88 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 13.28% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing government initiatives promoting digital transformation and smart city projects are creating a favorable environment for IoT adoption across various sectors. Secondly, the burgeoning mobile network infrastructure, particularly in urban areas, provides essential connectivity for IoT devices. Furthermore, the growth of industries like manufacturing, transportation, and healthcare fuels demand for IoT solutions to enhance efficiency, optimize operations, and improve data-driven decision-making. The strong presence of major telecommunication companies like Telkom SA Limited, MTN Group, and Vodacom Group, coupled with the involvement of global technology giants such as IBM, Google, and Microsoft, further strengthens the market's growth trajectory. Significant investments in research and development by these players are expected to drive innovation and the development of more sophisticated IoT applications.

However, challenges remain. Limited digital literacy in certain segments of the population could hinder wider adoption. Addressing cybersecurity concerns associated with interconnected devices will be crucial to build trust and ensure the secure deployment of IoT technologies. Furthermore, overcoming infrastructure limitations in rural areas is essential for realizing the full potential of IoT across the country. Despite these constraints, the positive regulatory environment, ongoing technological advancements, and increasing demand from various sectors suggest that the South African IoT market will continue to flourish, presenting significant opportunities for investors and technology providers in the coming years. Specific segments like smart agriculture and financial services (BFSI) are anticipated to show above-average growth rates due to their increasing reliance on data analytics and automation.

Unlocking Growth in South Africa's IoT Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of South Africa's Internet of Things (IoT) industry, offering invaluable insights for businesses, investors, and industry professionals. We project the market to reach ZAR xx Million by 2033, offering a detailed analysis of market structure, innovation, dynamics, and future outlook. Our study period covers 2019-2033, with a base and estimated year of 2025. This report is essential for navigating the complexities and opportunities within this rapidly expanding sector.

South Africa IoT Industry Market Structure & Innovation Trends

This section provides a comprehensive analysis of the dynamic competitive landscape, key innovation drivers, and the pivotal regulatory environment that is actively shaping South Africa's burgeoning IoT market. We meticulously examine market concentration, identifying a robust ecosystem of both established domestic leaders, including giants like Telkom SA Limited, MTN Group, and Vodacom Group, alongside influential international players such as IBM Corporation, Google, Microsoft Corporation, Cisco Systems, Huawei Technologies, and SAP SE. Our analysis extends to a thorough assessment of mergers and acquisitions (M&A) activity, quantifying deal values (potentially detailing specific ZAR figures where available) and their profound impact on market share distribution. Furthermore, we delve into the critical innovation drivers, considering the catalytic effects of proactive government initiatives, rapid technological advancements across various domains, and the ever-evolving, sophisticated needs of diverse end-user industries. The report also critically investigates the intricate regulatory frameworks in place and their significant influence on overall market growth trajectories. An assessment of the role of product substitutes in shaping the competitive landscape is also included, alongside a detailed examination of end-user demographics and their increasingly sophisticated IoT adoption patterns, reflecting a growing digital maturity.

South Africa IoT Industry Market Dynamics & Trends

This section delves into the key market dynamics driving South Africa's IoT expansion. We analyze market growth drivers, including increasing smartphone penetration, rising government spending on digital infrastructure, and the growing adoption of IoT across various sectors. Technological disruptions, such as the emergence of 5G and advancements in artificial intelligence (AI) are examined, alongside their impact on market growth and consumer preferences. Competitive dynamics are assessed, focusing on market share, pricing strategies, and the competitive intensity of different segments. The report provides key metrics such as the compound annual growth rate (CAGR) and market penetration rates for different IoT segments, highlighting the dynamism and growth potential of the South African IoT market.

Dominant Regions & Segments in South Africa IoT Industry

This section identifies the leading regions and segments within the South African IoT market, examining both component (hardware, software, connectivity, services) and end-user industry (manufacturing, transportation, healthcare, retail, energy and utilities, residential, BFSI, agriculture) perspectives. For each dominant segment, we analyze key drivers, including economic policies, infrastructure development, and specific industry needs.

- Leading Regions: (Detailed analysis of specific provinces/cities contributing most to market growth will be provided.)

- Dominant Components: (Detailed analysis highlighting market share and growth projections for each component will be provided.)

- Leading End-User Industries: (Detailed analysis emphasizing the adoption rates and growth potential in different sectors will be provided.)

South Africa IoT Industry Product Innovations

This section meticulously summarizes recent and impactful product developments within the South African IoT landscape, highlighting key applications and their distinct competitive advantages. We place a significant focus on emerging technological trends, particularly the seamless integration of advanced Artificial Intelligence (AI) and sophisticated Machine Learning (ML) algorithms. Our analysis explores how these cutting-edge innovations are actively reshaping the market landscape, enabling solutions that more effectively cater to evolving customer needs and sophisticated business demands. The core emphasis is on achieving superior market fit and quantifying the overall impact of these novel products on enhancing market competitiveness and driving new revenue streams.

Report Scope & Segmentation Analysis

This section details the report's scope and provides a comprehensive overview of the market segmentation used. Each segment—hardware, software, connectivity, services—across all end-user industries is analyzed, including growth projections, market sizes (in ZAR Million), and competitive dynamics. Specific market sizes and growth projections will be provided for each segment and sub-segment.

Key Drivers of South Africa IoT Industry Growth

This section meticulously identifies and elaborates on the primary factors acting as powerful catalysts for the sustained growth of South Africa's IoT industry. We conduct an in-depth examination of critical technological advancements, with a specific focus on the transformative impact of widespread 5G network deployment. Alongside technological progress, we scrutinize significant economic factors, including substantial government investments in digital infrastructure and supportive policy frameworks, as well as key regulatory changes that are actively facilitating and influencing market expansion and innovation.

Challenges in the South Africa IoT Industry Sector

This section outlines the significant challenges facing the South African IoT market. We address regulatory hurdles, supply chain complexities, and competitive pressures, quantifying their impact on market growth and providing insights into how these challenges might be mitigated.

Emerging Opportunities in South Africa IoT Industry

This section shines a spotlight on the most promising emerging trends and untapped opportunities within the dynamic South African IoT market. We actively identify new and expanding market segments, pinpoint critical technological advancements that are poised to disrupt existing paradigms, and analyze evolving consumer and business preferences that are creating highly promising avenues for substantial growth, strategic innovation, and competitive differentiation.

Leading Players in the South Africa IoT Industry Market

This section profiles key players in South Africa's IoT market:

- Telkom SA Limited

- Comsol

- IBM Corporation

- MTN Group

- SAP SE

- Microsoft Corporation

- Vodacom Group

- Cisco Systems

- Huawei Technologies

Key Developments in South Africa IoT Industry Industry

- March 2023: Sateliot's planned launch of the first 3GPP 5G NB-IoT satellite, partnering with Streamline in South Africa to enable cost-effective livestock monitoring. This signifies a major advancement for IoT connectivity in remote areas.

- December 2022: Qualcomm's "Make in Africa" startup mentorship program, aiming to foster innovation in hardware and end-to-end IoT solutions tailored to African needs.

Future Outlook for South Africa IoT Industry Market

This section provides a clear, concise, and forward-looking outlook on the significant future growth potential of South Africa's IoT market. We identify key accelerators of growth, such as the accelerating pace of digitalization across industries, robust government support and strategic initiatives, and the continued, expansive rollout of advanced 5G networks. Our projections indicate substantial and sustained market expansion, with a keen focus on highlighting strategic opportunities that are ripe for businesses and astute investors alike to capitalize upon.

South Africa IoT Industry Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Connectivity

- 1.4. Services

-

2. End User Industry

- 2.1. Manufacturing

- 2.2. Transportation

- 2.3. Healthcare

- 2.4. Retail

- 2.5. Energy and Utilities

- 2.6. Other En

South Africa IoT Industry Segmentation By Geography

- 1. South Africa

South Africa IoT Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.28% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly increasing urbanization and increasing smart city initiatives; Increasing proliferation of mobile and IoT devices; Growing need for timely decision making and rising importance of data

- 3.3. Market Restrains

- 3.3.1. Consumers Desire for Fine Dining Experience

- 3.4. Market Trends

- 3.4.1. The Retail Segment to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa IoT Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Connectivity

- 5.1.4. Services

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. Manufacturing

- 5.2.2. Transportation

- 5.2.3. Healthcare

- 5.2.4. Retail

- 5.2.5. Energy and Utilities

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. South Africa South Africa IoT Industry Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa IoT Industry Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa IoT Industry Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa IoT Industry Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa IoT Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa IoT Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Telkom SA Limited

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Comsol

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 IBM Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 MTN Group

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 SAP SE*List Not Exhaustive

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Google

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Microsoft Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Vodacom Group

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Cisco Systems

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Huawei Technologies

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Telkom SA Limited

List of Figures

- Figure 1: South Africa IoT Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa IoT Industry Share (%) by Company 2024

List of Tables

- Table 1: South Africa IoT Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa IoT Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 3: South Africa IoT Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 4: South Africa IoT Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South Africa IoT Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa South Africa IoT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Sudan South Africa IoT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Uganda South Africa IoT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tanzania South Africa IoT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kenya South Africa IoT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Africa South Africa IoT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Africa IoT Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 13: South Africa IoT Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 14: South Africa IoT Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa IoT Industry?

The projected CAGR is approximately 13.28%.

2. Which companies are prominent players in the South Africa IoT Industry?

Key companies in the market include Telkom SA Limited, Comsol, IBM Corporation, MTN Group, SAP SE*List Not Exhaustive, Google, Microsoft Corporation, Vodacom Group, Cisco Systems, Huawei Technologies.

3. What are the main segments of the South Africa IoT Industry?

The market segments include Component, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly increasing urbanization and increasing smart city initiatives; Increasing proliferation of mobile and IoT devices; Growing need for timely decision making and rising importance of data.

6. What are the notable trends driving market growth?

The Retail Segment to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

Consumers Desire for Fine Dining Experience.

8. Can you provide examples of recent developments in the market?

March 2023: Sateliot plans to launch the first-ever satellite under 3GPP 5G NB-IoT. After the launch of this satellite, every NB-IoT device is anticipated to be able to quickly connect to cellular or satellite networks, enabling widespread IoT adoption even in the most remote locations. Sateliot's NTN enables widespread IoT deployment, reducing costs and boosting efficiency across various industries. The South African company Streamline is a partner for this mission, and it will assist livestock farmers in being able to monitor the position and health conditions of thousands of cattle with meager connection costs compared to competitors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa IoT Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa IoT Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa IoT Industry?

To stay informed about further developments, trends, and reports in the South Africa IoT Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence