Key Insights

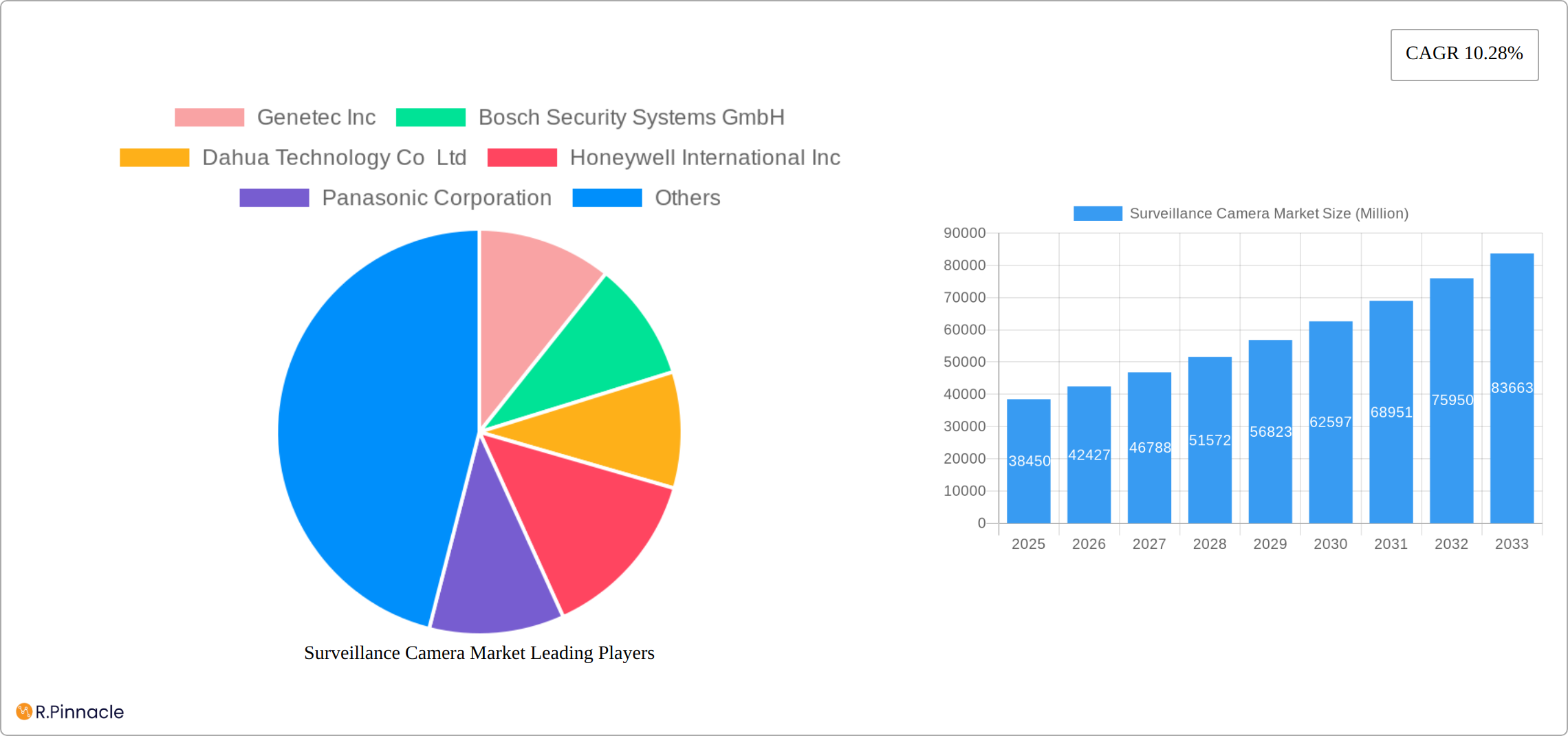

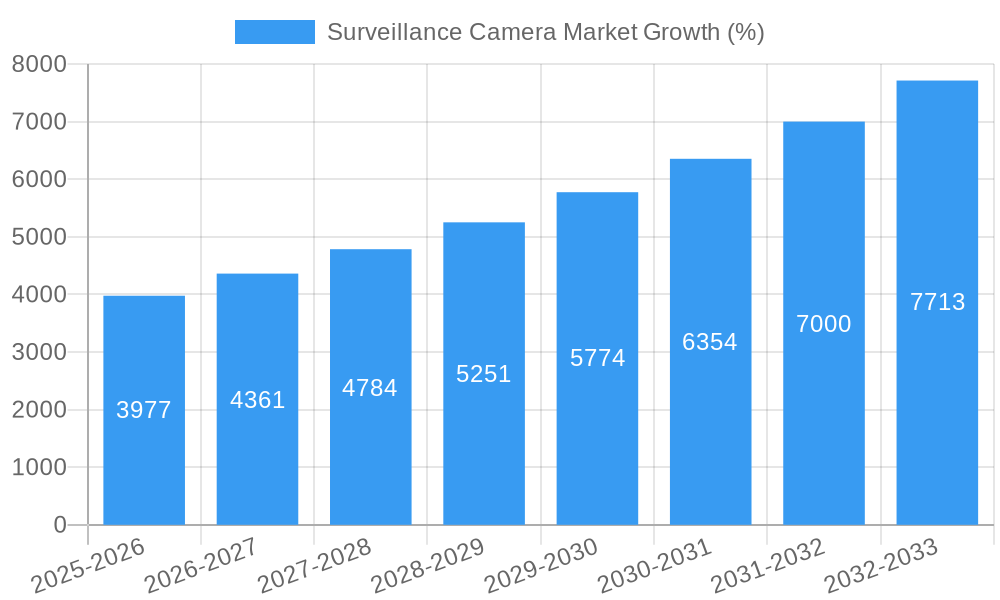

The global surveillance camera market is experiencing robust growth, projected to reach \$38.45 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 10.28% from 2025 to 2033. This expansion is fueled by several key factors. Increasing concerns about security and safety across residential, commercial, and public sectors are driving demand for advanced surveillance solutions. The proliferation of smart cities initiatives, coupled with the rising adoption of Internet of Things (IoT) devices and cloud-based video management systems (VMS), is significantly contributing to market growth. Furthermore, technological advancements such as higher resolution cameras, improved analytics capabilities (e.g., facial recognition, object detection), and the integration of artificial intelligence (AI) are enhancing the functionality and appeal of surveillance cameras, attracting both individual consumers and large-scale deployments. The market is segmented by camera type (IP, Analog, PTZ), application (residential, commercial, government), and technology (AI-powered, non-AI). Competition is fierce among established players like Genetec, Bosch, Dahua, Honeywell, Panasonic, and emerging companies, fostering innovation and price competitiveness.

The market's growth trajectory is influenced by several trends. The shift toward higher-resolution cameras (4K and beyond) is a prominent trend, providing greater detail and improved image quality. The integration of AI and machine learning capabilities is enhancing the effectiveness of surveillance systems by enabling automated threat detection, anomaly identification, and predictive analytics. The increasing adoption of cloud-based VMS is streamlining data management, storage, and accessibility, improving scalability and cost-efficiency for users. However, challenges such as data privacy concerns, high initial investment costs for advanced systems, and the complexities associated with data analytics could potentially restrain market growth. Nevertheless, the overall outlook remains positive, driven by the continuous demand for enhanced security and the ongoing technological advancements within the surveillance camera industry.

Surveillance Camera Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global Surveillance Camera Market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market structure, dynamics, dominant regions, product innovations, and key players, forecasting future growth trajectories. The report includes detailed analysis of market size (in Millions) and growth projections across various segments.

Surveillance Camera Market Structure & Innovation Trends

The global surveillance camera market exhibits a moderately consolidated structure, with key players vying for market share. Leading companies such as Genetec Inc, Bosch Security Systems GmbH, Dahua Technology Co Ltd, Honeywell International Inc, Panasonic Corporation, CP Plus, NEC Corporation, Axis Communications AB, Cisco Systems Inc, Nice Systems Limited, Avigilon Corporation (Motorola Solutions Inc), Axon Enterprise Inc, and Verint System Inc. contribute significantly to the overall market value. Market share varies considerably among these players, influenced by factors like technological advancements, strategic partnerships, and regional expansion. Recent M&A activities in the sector, although not publicly disclosed with exact values for this report, have had a noticeable impact on market consolidation, with deal values estimated at approximately xx Million. Innovation is driven by the demand for higher resolution, improved analytics capabilities, and enhanced cybersecurity features. Regulatory frameworks, such as the recent changes in India's Compulsory Registration Order (CRO) for CCTV cameras, significantly impact market dynamics. Product substitutes, such as advanced sensor technologies, exist but haven't yet significantly challenged the dominance of traditional surveillance cameras. The end-user demographics are diverse, spanning government, commercial, and residential sectors.

Surveillance Camera Market Dynamics & Trends

The global surveillance camera market is experiencing robust growth, driven by increasing security concerns across various sectors, the proliferation of smart city initiatives, and the rising adoption of advanced video analytics. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated at xx%. Technological disruptions, particularly the integration of Artificial Intelligence (AI) and Internet of Things (IoT) technologies, are reshaping the market landscape, enhancing functionalities and driving adoption. Consumer preferences are shifting toward higher-resolution cameras, cloud-based storage solutions, and user-friendly interfaces. Competitive dynamics are intense, characterized by both organic growth through product innovation and inorganic growth through acquisitions and strategic partnerships. Market penetration is highest in developed regions but is rapidly expanding in emerging markets due to increasing urbanization and infrastructure development.

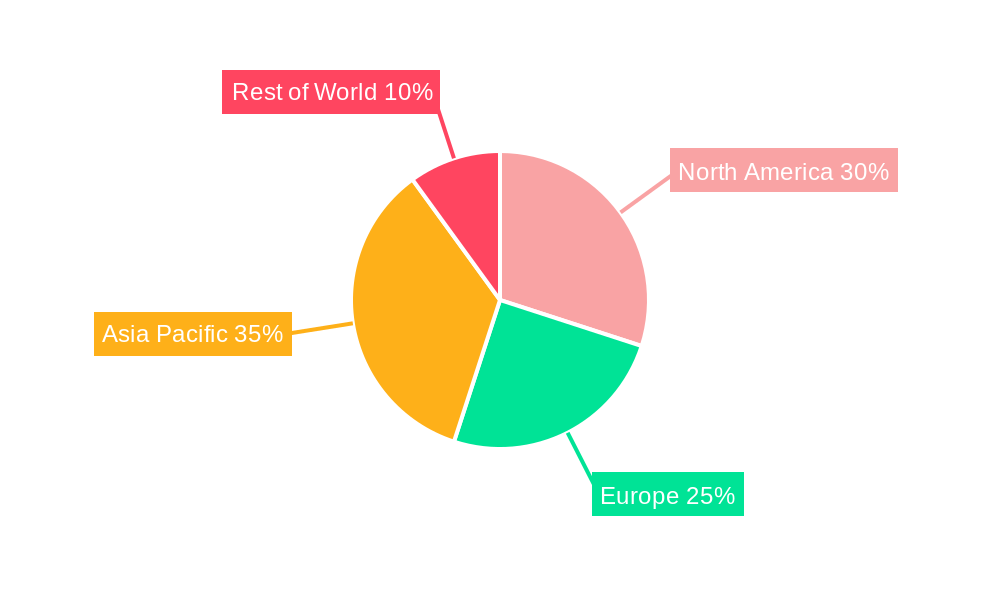

Dominant Regions & Segments in Surveillance Camera Market

The Asia-Pacific region currently dominates the surveillance camera market, holding the largest market share. This leadership is driven by a confluence of factors, primarily the significant contributions of China and India. Their vast populations, ambitious infrastructure development projects, and supportive government policies create an exceptionally high demand for surveillance solutions.

- Key Growth Catalysts in Asia-Pacific:

- Rapid Urbanization and Infrastructure Expansion: The surge in urbanization necessitates robust security measures, fueling demand for surveillance cameras across diverse applications.

- Increased Government Investment in Security: Significant government spending on security and surveillance infrastructure is a key driver of market expansion.

- Adoption of Advanced Technologies: The increasing adoption of AI-powered analytics, high-resolution imaging, and IoT integration enhances system capabilities and fuels market growth.

- High Population Density: The densely populated regions of Asia-Pacific necessitate sophisticated surveillance systems for effective monitoring and security.

- Favorable Economic Conditions: Strong economic growth in many Asia-Pacific nations fuels increased investment in security technologies.

While North America and Europe also demonstrate substantial growth, the sheer scale and rapid economic expansion within the Asia-Pacific region solidify its leading position. A detailed breakdown of segment-specific dominance within the market can be found in the comprehensive report.

Surveillance Camera Market Product Innovations

Recent advancements in surveillance camera technology are focused on enhancing performance and capabilities. Higher resolution imaging provides greater clarity and detail, while advanced analytics, such as facial recognition and object detection, enable proactive threat identification. Improved cybersecurity features safeguard against vulnerabilities and data breaches. The integration of AI and IoT technologies is revolutionizing the sector, facilitating real-time threat detection, predictive analytics, and seamless integration with other security systems. Furthermore, the market is seeing a rise in compact, energy-efficient cameras with superior night vision capabilities, improving accessibility and affordability. The market's positive reception to these innovations is reflected in their widespread adoption across diverse sectors.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the surveillance camera market based on several key parameters: camera type (IP cameras, Analog cameras, and others), technology (Network Video Recorders (NVRs), Digital Video Recorders (DVRs), and others), resolution (High definition, Standard Definition), application (Commercial, Residential, Government, and others), and geography. The full report offers detailed analyses of growth projections, market sizes, and competitive landscapes for each segment.

Key Drivers of Surveillance Camera Market Growth

The growth of the surveillance camera market is primarily driven by several factors: the increasing need for enhanced security across various sectors (government, commercial, and residential), the growing adoption of advanced technologies such as AI and IoT, the increasing demand for high-resolution video surveillance solutions, and favorable government policies and regulations. The rise of smart cities also significantly boosts market demand.

Challenges in the Surveillance Camera Market Sector

The surveillance camera market faces challenges, including stringent data privacy regulations, concerns about data security and ethical implications of facial recognition, supply chain disruptions affecting component availability, and intense competition amongst numerous players. These issues lead to price volatility and impact overall market expansion.

Emerging Opportunities in Surveillance Camera Market

Significant opportunities are emerging in several key areas. The increasing adoption of cloud-based solutions offers scalability and remote management capabilities. The integration of advanced analytics for predictive policing enables proactive security measures. Expansion into underserved markets presents substantial untapped potential. Moreover, the integration of surveillance camera systems with other IoT devices to create comprehensive smart security ecosystems is a significant growth driver.

Leading Players in the Surveillance Camera Market Market

- Genetec Inc

- Bosch Security Systems GmbH

- Dahua Technology Co Ltd

- Honeywell International Inc

- Panasonic Corporation

- CP Plus

- NEC Corporation

- Axis Communications AB

- Cisco Systems Inc

- Nice Systems Limited

- Avigilon Corporation (Motorola Solutions Inc)

- Axon Enterprise Inc

- Verint System Inc

Key Developments in Surveillance Camera Market Industry

- October 2023: Hikvision launched the industry's first 2 MP analog cameras with an F1.0 aperture, significantly advancing color imaging capabilities.

- April 2024: India's MeitY revised the CRO for CCTV cameras, mandating STQC certification for all CCTV products sold in the country.

Future Outlook for Surveillance Camera Market Market

The future of the surveillance camera market is exceptionally promising. Continuous technological innovation, escalating security concerns globally, and increased government investment in smart city initiatives are key drivers of growth. The market is poised for substantial expansion, fueled by the adoption of cutting-edge solutions and the penetration of new markets. Strategic partnerships and mergers and acquisitions (M&A) activity will further shape the evolving market landscape.

Surveillance Camera Market Segmentation

-

1. Type

- 1.1. Analog Cameras

- 1.2. IP Based Cameras

-

2. End-user Industry

- 2.1. Banking and Financial Institutions

- 2.2. Transportation and Infrastructure

- 2.3. Government and Defense

- 2.4. Healthcare

- 2.5. Industrial

- 2.6. Retail

- 2.7. Enterprises

- 2.8. Residential

- 2.9. Others

Surveillance Camera Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 4. Latin America

- 5. Middle East and Africa

Surveillance Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.28% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Concerns Regarding the Safety and Security of the Public; Smart City Growth are Prompting the Governments for Advanced Surveillance Solutions; Diminishing IP Camera Prices

- 3.3. Market Restrains

- 3.3.1. Growing Concerns Regarding the Safety and Security of the Public; Smart City Growth are Prompting the Governments for Advanced Surveillance Solutions; Diminishing IP Camera Prices

- 3.4. Market Trends

- 3.4.1. IP Camera Segment to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Surveillance Camera Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analog Cameras

- 5.1.2. IP Based Cameras

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Banking and Financial Institutions

- 5.2.2. Transportation and Infrastructure

- 5.2.3. Government and Defense

- 5.2.4. Healthcare

- 5.2.5. Industrial

- 5.2.6. Retail

- 5.2.7. Enterprises

- 5.2.8. Residential

- 5.2.9. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Surveillance Camera Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Analog Cameras

- 6.1.2. IP Based Cameras

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Banking and Financial Institutions

- 6.2.2. Transportation and Infrastructure

- 6.2.3. Government and Defense

- 6.2.4. Healthcare

- 6.2.5. Industrial

- 6.2.6. Retail

- 6.2.7. Enterprises

- 6.2.8. Residential

- 6.2.9. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Surveillance Camera Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Analog Cameras

- 7.1.2. IP Based Cameras

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Banking and Financial Institutions

- 7.2.2. Transportation and Infrastructure

- 7.2.3. Government and Defense

- 7.2.4. Healthcare

- 7.2.5. Industrial

- 7.2.6. Retail

- 7.2.7. Enterprises

- 7.2.8. Residential

- 7.2.9. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Surveillance Camera Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Analog Cameras

- 8.1.2. IP Based Cameras

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Banking and Financial Institutions

- 8.2.2. Transportation and Infrastructure

- 8.2.3. Government and Defense

- 8.2.4. Healthcare

- 8.2.5. Industrial

- 8.2.6. Retail

- 8.2.7. Enterprises

- 8.2.8. Residential

- 8.2.9. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Surveillance Camera Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Analog Cameras

- 9.1.2. IP Based Cameras

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Banking and Financial Institutions

- 9.2.2. Transportation and Infrastructure

- 9.2.3. Government and Defense

- 9.2.4. Healthcare

- 9.2.5. Industrial

- 9.2.6. Retail

- 9.2.7. Enterprises

- 9.2.8. Residential

- 9.2.9. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Surveillance Camera Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Analog Cameras

- 10.1.2. IP Based Cameras

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Banking and Financial Institutions

- 10.2.2. Transportation and Infrastructure

- 10.2.3. Government and Defense

- 10.2.4. Healthcare

- 10.2.5. Industrial

- 10.2.6. Retail

- 10.2.7. Enterprises

- 10.2.8. Residential

- 10.2.9. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Genetec Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bosch Security Systems GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dahua Technology Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Honeywell International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Panasonic Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CP Plus

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NEC Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Axis Communications AB

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cisco Systems Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nice Systems Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Avigilon Corporation (Motorola Solutions Inc )

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Axon Enterprise Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Verint System Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Genetec Inc

List of Figures

- Figure 1: Global Surveillance Camera Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Surveillance Camera Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: North America Surveillance Camera Market Revenue (Million), by Type 2024 & 2032

- Figure 4: North America Surveillance Camera Market Volume (Billion), by Type 2024 & 2032

- Figure 5: North America Surveillance Camera Market Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Surveillance Camera Market Volume Share (%), by Type 2024 & 2032

- Figure 7: North America Surveillance Camera Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 8: North America Surveillance Camera Market Volume (Billion), by End-user Industry 2024 & 2032

- Figure 9: North America Surveillance Camera Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 10: North America Surveillance Camera Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 11: North America Surveillance Camera Market Revenue (Million), by Country 2024 & 2032

- Figure 12: North America Surveillance Camera Market Volume (Billion), by Country 2024 & 2032

- Figure 13: North America Surveillance Camera Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Surveillance Camera Market Volume Share (%), by Country 2024 & 2032

- Figure 15: Europe Surveillance Camera Market Revenue (Million), by Type 2024 & 2032

- Figure 16: Europe Surveillance Camera Market Volume (Billion), by Type 2024 & 2032

- Figure 17: Europe Surveillance Camera Market Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Surveillance Camera Market Volume Share (%), by Type 2024 & 2032

- Figure 19: Europe Surveillance Camera Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 20: Europe Surveillance Camera Market Volume (Billion), by End-user Industry 2024 & 2032

- Figure 21: Europe Surveillance Camera Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: Europe Surveillance Camera Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 23: Europe Surveillance Camera Market Revenue (Million), by Country 2024 & 2032

- Figure 24: Europe Surveillance Camera Market Volume (Billion), by Country 2024 & 2032

- Figure 25: Europe Surveillance Camera Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Surveillance Camera Market Volume Share (%), by Country 2024 & 2032

- Figure 27: Asia Surveillance Camera Market Revenue (Million), by Type 2024 & 2032

- Figure 28: Asia Surveillance Camera Market Volume (Billion), by Type 2024 & 2032

- Figure 29: Asia Surveillance Camera Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Surveillance Camera Market Volume Share (%), by Type 2024 & 2032

- Figure 31: Asia Surveillance Camera Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 32: Asia Surveillance Camera Market Volume (Billion), by End-user Industry 2024 & 2032

- Figure 33: Asia Surveillance Camera Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Asia Surveillance Camera Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 35: Asia Surveillance Camera Market Revenue (Million), by Country 2024 & 2032

- Figure 36: Asia Surveillance Camera Market Volume (Billion), by Country 2024 & 2032

- Figure 37: Asia Surveillance Camera Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Asia Surveillance Camera Market Volume Share (%), by Country 2024 & 2032

- Figure 39: Latin America Surveillance Camera Market Revenue (Million), by Type 2024 & 2032

- Figure 40: Latin America Surveillance Camera Market Volume (Billion), by Type 2024 & 2032

- Figure 41: Latin America Surveillance Camera Market Revenue Share (%), by Type 2024 & 2032

- Figure 42: Latin America Surveillance Camera Market Volume Share (%), by Type 2024 & 2032

- Figure 43: Latin America Surveillance Camera Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 44: Latin America Surveillance Camera Market Volume (Billion), by End-user Industry 2024 & 2032

- Figure 45: Latin America Surveillance Camera Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 46: Latin America Surveillance Camera Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 47: Latin America Surveillance Camera Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Latin America Surveillance Camera Market Volume (Billion), by Country 2024 & 2032

- Figure 49: Latin America Surveillance Camera Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Latin America Surveillance Camera Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Middle East and Africa Surveillance Camera Market Revenue (Million), by Type 2024 & 2032

- Figure 52: Middle East and Africa Surveillance Camera Market Volume (Billion), by Type 2024 & 2032

- Figure 53: Middle East and Africa Surveillance Camera Market Revenue Share (%), by Type 2024 & 2032

- Figure 54: Middle East and Africa Surveillance Camera Market Volume Share (%), by Type 2024 & 2032

- Figure 55: Middle East and Africa Surveillance Camera Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 56: Middle East and Africa Surveillance Camera Market Volume (Billion), by End-user Industry 2024 & 2032

- Figure 57: Middle East and Africa Surveillance Camera Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 58: Middle East and Africa Surveillance Camera Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 59: Middle East and Africa Surveillance Camera Market Revenue (Million), by Country 2024 & 2032

- Figure 60: Middle East and Africa Surveillance Camera Market Volume (Billion), by Country 2024 & 2032

- Figure 61: Middle East and Africa Surveillance Camera Market Revenue Share (%), by Country 2024 & 2032

- Figure 62: Middle East and Africa Surveillance Camera Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Surveillance Camera Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Surveillance Camera Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Surveillance Camera Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Surveillance Camera Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Global Surveillance Camera Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: Global Surveillance Camera Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 7: Global Surveillance Camera Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Surveillance Camera Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Global Surveillance Camera Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Global Surveillance Camera Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: Global Surveillance Camera Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: Global Surveillance Camera Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 13: Global Surveillance Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Surveillance Camera Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: United States Surveillance Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States Surveillance Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 17: Canada Surveillance Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada Surveillance Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 19: Global Surveillance Camera Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global Surveillance Camera Market Volume Billion Forecast, by Type 2019 & 2032

- Table 21: Global Surveillance Camera Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 22: Global Surveillance Camera Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 23: Global Surveillance Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Surveillance Camera Market Volume Billion Forecast, by Country 2019 & 2032

- Table 25: United Kingdom Surveillance Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United Kingdom Surveillance Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Germany Surveillance Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Germany Surveillance Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: France Surveillance Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France Surveillance Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Global Surveillance Camera Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Global Surveillance Camera Market Volume Billion Forecast, by Type 2019 & 2032

- Table 33: Global Surveillance Camera Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 34: Global Surveillance Camera Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 35: Global Surveillance Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Global Surveillance Camera Market Volume Billion Forecast, by Country 2019 & 2032

- Table 37: China Surveillance Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: China Surveillance Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 39: Japan Surveillance Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Japan Surveillance Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 41: India Surveillance Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India Surveillance Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 43: Global Surveillance Camera Market Revenue Million Forecast, by Type 2019 & 2032

- Table 44: Global Surveillance Camera Market Volume Billion Forecast, by Type 2019 & 2032

- Table 45: Global Surveillance Camera Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 46: Global Surveillance Camera Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 47: Global Surveillance Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Global Surveillance Camera Market Volume Billion Forecast, by Country 2019 & 2032

- Table 49: Global Surveillance Camera Market Revenue Million Forecast, by Type 2019 & 2032

- Table 50: Global Surveillance Camera Market Volume Billion Forecast, by Type 2019 & 2032

- Table 51: Global Surveillance Camera Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 52: Global Surveillance Camera Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 53: Global Surveillance Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Global Surveillance Camera Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Surveillance Camera Market?

The projected CAGR is approximately 10.28%.

2. Which companies are prominent players in the Surveillance Camera Market?

Key companies in the market include Genetec Inc, Bosch Security Systems GmbH, Dahua Technology Co Ltd, Honeywell International Inc, Panasonic Corporation, CP Plus, NEC Corporation, Axis Communications AB, Cisco Systems Inc, Nice Systems Limited, Avigilon Corporation (Motorola Solutions Inc ), Axon Enterprise Inc, Verint System Inc.

3. What are the main segments of the Surveillance Camera Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Concerns Regarding the Safety and Security of the Public; Smart City Growth are Prompting the Governments for Advanced Surveillance Solutions; Diminishing IP Camera Prices.

6. What are the notable trends driving market growth?

IP Camera Segment to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Growing Concerns Regarding the Safety and Security of the Public; Smart City Growth are Prompting the Governments for Advanced Surveillance Solutions; Diminishing IP Camera Prices.

8. Can you provide examples of recent developments in the market?

April 2024 - India's Ministry of Electronics and Information Technology (MeitY) has revised the Compulsory Registration Order (CRO) for CCTV cameras, citing heightened public security concerns. The amendments now mandate Standardisation Testing and Quality Certification (STQC) for all CCTV products, whether manufactured, imported, or sold in India. STQC, known for upholding top-tier quality and reliability in the IT and electronics domains, plays a pivotal role in ensuring the dependability of these products, a critical need in our rapidly advancing technological landscape.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Surveillance Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Surveillance Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Surveillance Camera Market?

To stay informed about further developments, trends, and reports in the Surveillance Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence