Key Insights

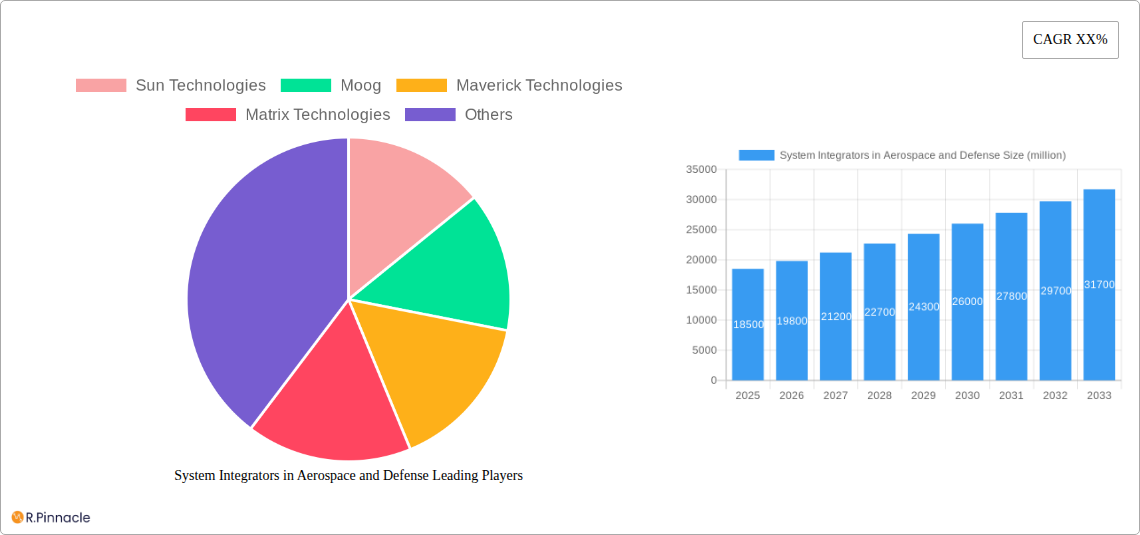

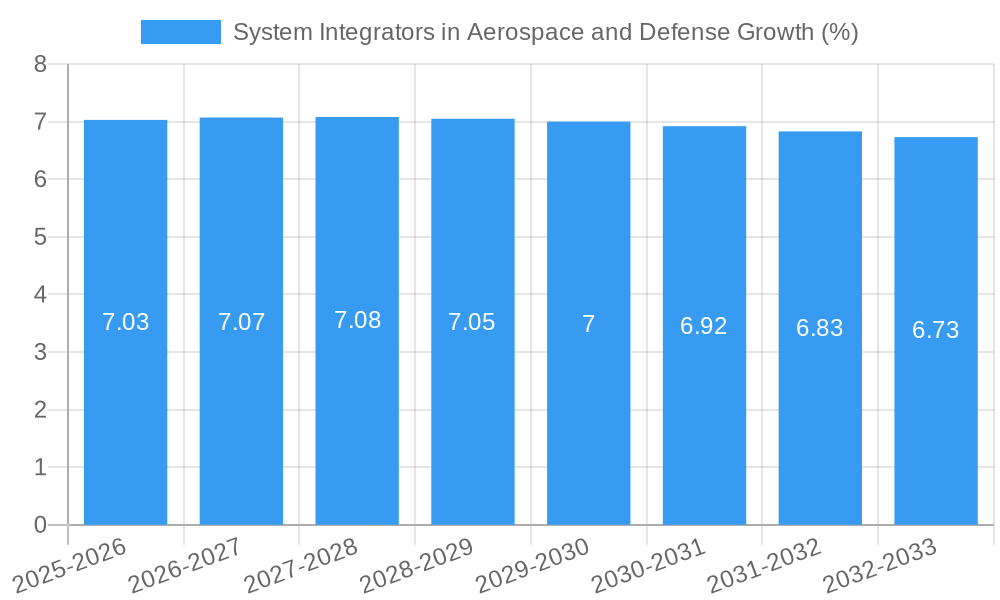

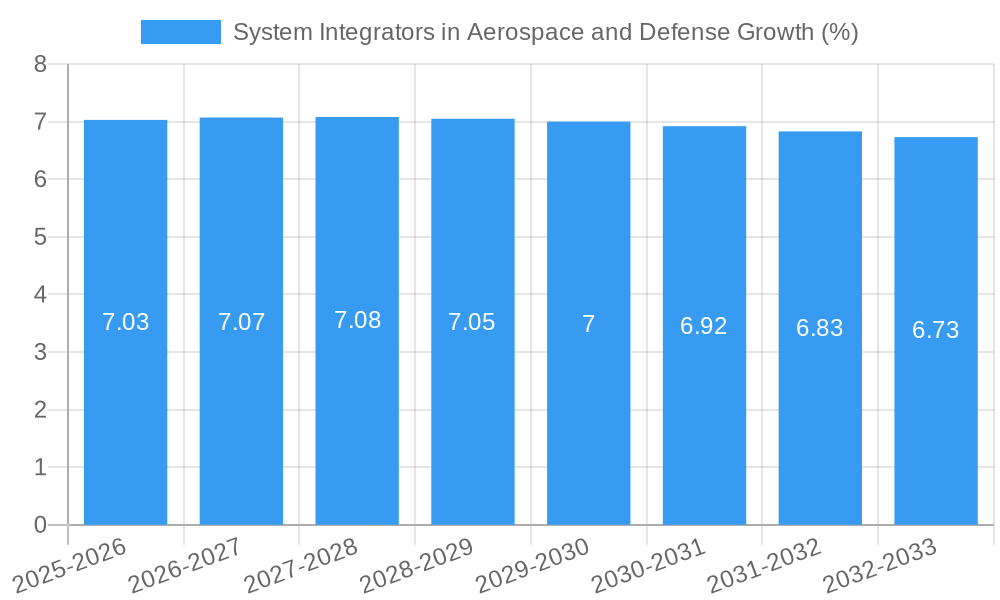

The global System Integrators in Aerospace and Defense market is experiencing robust expansion, projected to reach a substantial market size of approximately $18,500 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of roughly 7.5% anticipated throughout the forecast period extending to 2033. This significant growth is propelled by a confluence of factors, most notably the escalating demand for sophisticated and interconnected defense systems, driven by evolving geopolitical landscapes and the need for enhanced national security. The aerospace sector also contributes substantially, fueled by advancements in commercial aviation, satellite technology, and space exploration initiatives. System integrators play a pivotal role in harmonizing complex, multi-vendor technologies, ensuring interoperability and delivering end-to-end solutions that meet stringent performance and security requirements. Key drivers include the increasing adoption of digitalization across defense platforms, the development of next-generation aircraft and unmanned aerial vehicles (UAVs), and the ongoing modernization of existing defense infrastructure. The rise of cybersecurity as a critical concern within both sectors further amplifies the need for specialized system integration services to safeguard sensitive data and critical operations.

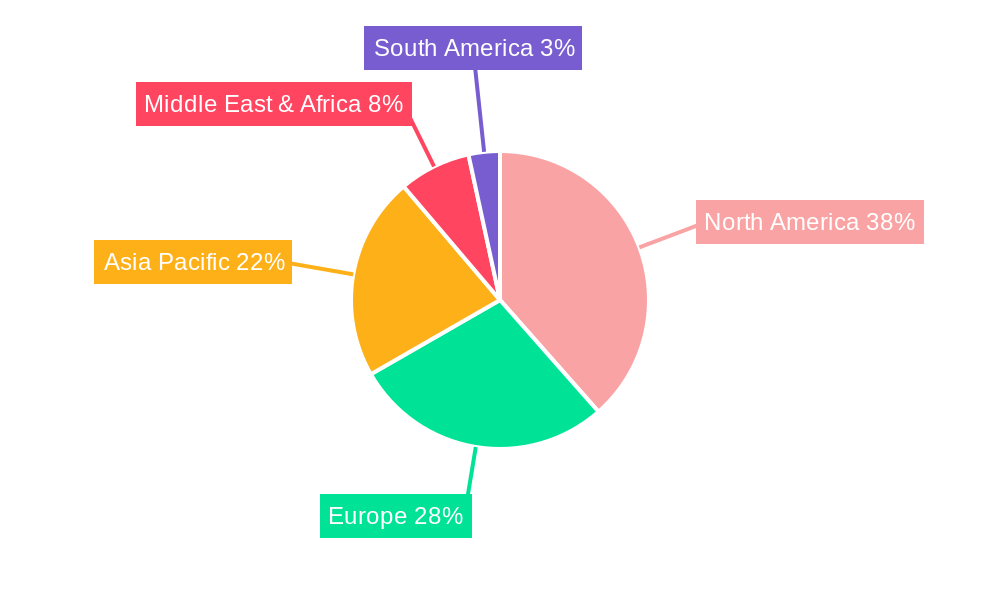

The market is characterized by a clear bifurcation between horizontal and vertical integration strategies, each catering to distinct industry needs. Horizontal integration focuses on consolidating multiple functionalities and systems across a broader platform, while vertical integration emphasizes deep specialization within specific domains. In terms of applications, the Aerospace and Defense segments remain the primary focus, with the "Others" category likely encompassing emerging applications in areas like homeland security and critical infrastructure protection. Geographically, North America, particularly the United States, is expected to dominate the market share due to its substantial defense spending and advanced aerospace industry. Europe and Asia Pacific are also poised for significant growth, driven by ongoing military modernizations and expanding commercial aviation sectors. However, the market faces certain restraints, including the high cost of advanced technology integration, stringent regulatory compliance, and the long development cycles inherent in both aerospace and defense projects. Despite these challenges, the persistent need for cutting-edge, secure, and interoperable systems ensures a dynamic and expanding future for system integrators in this critical industry.

System Integrators in Aerospace and Defense Market Report: Unlocking Next-Gen Capabilities

This comprehensive report offers an in-depth analysis of the global System Integrators in Aerospace and Defense market, a critical sector driving innovation and national security. Spanning a study period from 2019 to 2033, with a base year of 2025, this report provides actionable insights for stakeholders navigating this complex landscape. We delve into market structure, dynamics, dominant regions, product innovations, and future outlook, leveraging high-ranking keywords like "aerospace system integration," "defense technology solutions," "system integration for military," "avionics integration," and "command and control systems" to ensure maximum search visibility and engagement with industry professionals.

System Integrators in Aerospace and Defense Market Structure & Innovation Trends

The System Integrators in Aerospace and Defense market exhibits a moderate to high concentration, with key players like Sun Technologies, Moog, Maverick Technologies, and Matrix Technologies holding significant market share. Innovation is primarily driven by the relentless pursuit of advanced technologies, including artificial intelligence (AI), machine learning (ML), cybersecurity, and the Internet of Things (IoT) for enhanced operational efficiency and mission readiness. Regulatory frameworks, particularly stringent in defense, focus on security, interoperability, and reliability, influencing product development and system deployment. While direct product substitutes are limited due to the specialized nature of aerospace and defense applications, advancements in software-defined systems and modular architectures can be considered indirect disruptors. End-user demographics are dominated by government defense agencies and major aerospace manufacturers. Merger and acquisition (M&A) activities are strategic, often aimed at acquiring specialized capabilities or expanding market reach. For instance, M&A deal values are estimated to have ranged from tens of millions to several hundred million dollars annually over the historical period. Sun Technologies has been actively involved in strategic partnerships to enhance its offering in this space.

System Integrators in Aerospace and Defense Market Dynamics & Trends

The System Integrators in Aerospace and Defense market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This expansion is propelled by several key market growth drivers. Increased global geopolitical tensions and evolving threat landscapes necessitate continuous upgrades and modernization of defense platforms, driving demand for sophisticated system integration solutions. The rapid advancement of aerospace technology, including the development of next-generation aircraft, unmanned aerial vehicles (UAVs), and space exploration initiatives, also fuels market expansion. Technological disruptions are transforming the sector, with AI and ML enabling predictive maintenance, enhanced situational awareness, and autonomous operations. The increasing adoption of cloud computing and edge computing further facilitates real-time data processing and decision-making. Consumer preferences, though less direct in the defense sector, are influenced by the demand for greater interoperability, reduced lifecycle costs, and enhanced operational effectiveness from government clients. Competitive dynamics are characterized by intense innovation, strategic alliances, and a focus on providing end-to-end solutions. Market penetration for advanced system integration services is steadily increasing across both defense and commercial aerospace segments. The integration of advanced sensors and secure communication networks is a critical trend, underpinning the market's trajectory. Estimated market penetration for advanced integration services is expected to exceed 60% by 2033.

Dominant Regions & Segments in System Integrators in Aerospace and Defense

The System Integrators in Aerospace and Defense market is experiencing significant dominance from North America, particularly the United States, owing to its substantial defense spending, advanced aerospace industry, and the presence of leading integrators. Key drivers for this dominance include robust government investment in defense modernization programs, substantial R&D funding for aerospace innovation, and a well-established ecosystem of technology providers and research institutions.

Application: Aerospace

- Key Drivers: The commercial aerospace segment is driven by the need for fuel efficiency, enhanced passenger safety, and the development of new aircraft models. The space exploration sector, fueled by both governmental agencies and private companies, presents a growing demand for complex system integration in satellite systems, launch vehicles, and deep-space missions. Economic policies supporting the aerospace industry, such as tax incentives and export promotion, further bolster growth.

- Dominance Analysis: North America and Europe are the primary hubs for aerospace system integration, with significant contributions from companies like Sun Technologies in supporting complex avionics and software integration for commercial aircraft and advanced space missions.

Application: Defense

- Key Drivers: National security imperatives, the need for next-generation defense platforms, and the modernization of existing military hardware are paramount. The increasing threat of cyber warfare and the demand for secure, resilient command and control (C2) systems are significant accelerators. Investments in advanced military aircraft, naval vessels, and ground combat systems require intricate integration of sensors, communication, and weapon systems.

- Dominance Analysis: Defense system integration sees a strong demand across North America, Europe, and Asia-Pacific, with countries like the United States, China, and Russia investing heavily. Companies like Moog are crucial in providing specialized systems for military applications.

Application: Others

- Key Drivers: This segment encompasses broader applications such as air traffic management, homeland security, and critical infrastructure protection. The increasing need for integrated surveillance, communication, and response systems across civilian and semi-military organizations drives demand.

- Dominance Analysis: While smaller than dedicated aerospace and defense, this segment is growing with a focus on interoperability and advanced analytics.

Types: Horizontal Integration

- Key Drivers: Horizontal integration focuses on integrating diverse systems and technologies across different platforms and domains, enabling seamless data flow and interoperability. The demand for unified command and control, shared situational awareness, and cross-domain operations is a primary driver.

- Dominance Analysis: This type of integration is crucial for modern defense forces and is seeing significant uptake globally, with North America leading in implementation for complex defense networks.

Types: Vertical Integration

- Key Drivers: Vertical integration involves integrating systems within a single platform or product line to optimize performance and functionality. This is critical for the development of highly specialized aircraft, weapon systems, or space components where every element must work in perfect synergy.

- Dominance Analysis: Both commercial aerospace and defense sectors extensively utilize vertical integration for developing and manufacturing complex platforms. Companies like Maverick Technologies often excel in providing integrated solutions for specific platform needs.

System Integrators in Aerospace and Defense Product Innovations

- Key Drivers: National security imperatives, the need for next-generation defense platforms, and the modernization of existing military hardware are paramount. The increasing threat of cyber warfare and the demand for secure, resilient command and control (C2) systems are significant accelerators. Investments in advanced military aircraft, naval vessels, and ground combat systems require intricate integration of sensors, communication, and weapon systems.

- Dominance Analysis: Defense system integration sees a strong demand across North America, Europe, and Asia-Pacific, with countries like the United States, China, and Russia investing heavily. Companies like Moog are crucial in providing specialized systems for military applications.

Application: Others

- Key Drivers: This segment encompasses broader applications such as air traffic management, homeland security, and critical infrastructure protection. The increasing need for integrated surveillance, communication, and response systems across civilian and semi-military organizations drives demand.

- Dominance Analysis: While smaller than dedicated aerospace and defense, this segment is growing with a focus on interoperability and advanced analytics.

Types: Horizontal Integration

- Key Drivers: Horizontal integration focuses on integrating diverse systems and technologies across different platforms and domains, enabling seamless data flow and interoperability. The demand for unified command and control, shared situational awareness, and cross-domain operations is a primary driver.

- Dominance Analysis: This type of integration is crucial for modern defense forces and is seeing significant uptake globally, with North America leading in implementation for complex defense networks.

Types: Vertical Integration

- Key Drivers: Vertical integration involves integrating systems within a single platform or product line to optimize performance and functionality. This is critical for the development of highly specialized aircraft, weapon systems, or space components where every element must work in perfect synergy.

- Dominance Analysis: Both commercial aerospace and defense sectors extensively utilize vertical integration for developing and manufacturing complex platforms. Companies like Maverick Technologies often excel in providing integrated solutions for specific platform needs.

System Integrators in Aerospace and Defense Product Innovations

- Key Drivers: Horizontal integration focuses on integrating diverse systems and technologies across different platforms and domains, enabling seamless data flow and interoperability. The demand for unified command and control, shared situational awareness, and cross-domain operations is a primary driver.

- Dominance Analysis: This type of integration is crucial for modern defense forces and is seeing significant uptake globally, with North America leading in implementation for complex defense networks.

Types: Vertical Integration

- Key Drivers: Vertical integration involves integrating systems within a single platform or product line to optimize performance and functionality. This is critical for the development of highly specialized aircraft, weapon systems, or space components where every element must work in perfect synergy.

- Dominance Analysis: Both commercial aerospace and defense sectors extensively utilize vertical integration for developing and manufacturing complex platforms. Companies like Maverick Technologies often excel in providing integrated solutions for specific platform needs.

System Integrators in Aerospace and Defense Product Innovations

Recent product innovations in the System Integrators in Aerospace and Defense market are focused on enhancing situational awareness, improving cybersecurity, and enabling autonomous operations. Advanced AI-powered decision support systems, secure multi-domain communication platforms, and modular, open-architecture avionics are gaining traction. These innovations offer competitive advantages by reducing complexity, increasing operational flexibility, and improving the overall effectiveness of aerospace and defense systems. The integration of real-time data analytics and predictive maintenance capabilities is also a key trend, ensuring system reliability and minimizing downtime.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the System Integrators in Aerospace and Defense market across key segments.

Application: Aerospace

This segment encompasses the integration of systems within commercial and military aircraft, spacecraft, and related aerospace infrastructure. Expected market size in 2025 is approximately $50 billion, with growth driven by new aircraft development and modernization programs. Competitive dynamics are influenced by major aerospace manufacturers and their chosen integration partners.

Application: Defense

This segment covers the integration of systems for military platforms, including land, sea, air, and space assets, as well as command and control networks. Projected market size in 2025 is around $75 billion, with growth fueled by geopolitical factors and defense modernization. Leading integrators focus on interoperability and advanced defense technologies.

Application: Others

This segment includes system integration for non-traditional defense and aerospace applications such as air traffic control, homeland security, and critical infrastructure. The market size is estimated at $15 billion in 2025, with increasing demand for integrated surveillance and response solutions.

Types: Horizontal Integration

This segment focuses on the integration of disparate systems across different platforms and domains, enhancing interoperability. The market size is estimated at $80 billion in 2025, with significant growth expected due to the need for unified command and control.

Types: Vertical Integration

This segment pertains to the integration of systems within a single platform or product line for optimized performance. The market size is estimated at $60 billion in 2025, driven by the development of highly specialized aerospace and defense assets.

Key Drivers of System Integrators in Aerospace and Defense Growth

The growth of the System Integrators in Aerospace and Defense market is propelled by several critical factors. Geopolitical instability and increasing defense spending worldwide are major catalysts, demanding advanced military capabilities. The rapid evolution of aerospace technology, including the rise of unmanned systems and space exploration, necessitates sophisticated integration solutions. Furthermore, the continuous drive for operational efficiency, cost reduction, and enhanced interoperability across complex systems plays a pivotal role. Government initiatives supporting indigenous defense manufacturing and technological advancement also contribute significantly to market expansion.

Challenges in the System Integrators in Aerospace and Defense Sector

Despite its strong growth, the System Integrators in Aerospace and Defense sector faces significant challenges. Stringent regulatory requirements and complex certification processes for safety-critical systems can lead to extended development timelines and increased costs. Supply chain disruptions, particularly for specialized components, can impact project delivery. Intense competition among established players and emerging agile technology providers exerts pressure on pricing and innovation. Furthermore, the evolving nature of cyber threats demands constant vigilance and adaptation, requiring substantial investment in cybersecurity integration.

Emerging Opportunities in System Integrators in Aerospace and Defense

The System Integrators in Aerospace and Defense market presents numerous emerging opportunities. The growing demand for AI and ML-powered solutions for autonomous systems, predictive maintenance, and advanced analytics offers significant growth potential. The expansion of the space sector, including commercial space ventures and satellite constellations, creates new avenues for system integration. The increasing focus on cybersecurity and resilient communication networks presents a strong opportunity for specialized integration services. Furthermore, the trend towards digital transformation and the adoption of Industry 4.0 principles within aerospace and defense manufacturing opens doors for integrated smart factory solutions.

Leading Players in the System Integrators in Aerospace and Defense Market

- Sun Technologies

- Moog

- Maverick Technologies

- Matrix Technologies

Key Developments in System Integrators in Aerospace and Defense Industry

- 2023: Sun Technologies announced a strategic partnership to enhance its AI-driven predictive maintenance solutions for military aircraft.

- 2023: Moog unveiled a new generation of advanced flight control systems for next-generation fighter jets, emphasizing enhanced maneuverability and reduced pilot workload.

- 2022: Maverick Technologies successfully integrated a comprehensive command and control system for a major naval defense program, improving inter-fleet communication.

- 2022: Matrix Technologies secured a significant contract for the integration of advanced sensor suites on unmanned aerial vehicles (UAVs) for defense applications.

- 2021: The aerospace industry saw a surge in R&D for autonomous navigation systems, impacting system integration requirements.

- 2020: Increased global focus on cybersecurity led to significant advancements in secure communication system integration for defense networks.

Future Outlook for System Integrators in Aerospace and Defense Market

The future outlook for the System Integrators in Aerospace and Defense market is highly promising, driven by continued technological advancements and evolving global security landscapes. The increasing adoption of AI, machine learning, and edge computing will revolutionize operational capabilities, enabling smarter and more autonomous systems. The sustained growth in both commercial aerospace, fueled by demand for new aircraft, and defense modernization efforts worldwide will ensure a robust pipeline of integration projects. Strategic opportunities lie in providing end-to-end solutions that address the complex interplay of hardware, software, and cybersecurity, fostering greater interoperability and enhancing overall mission effectiveness for decades to come.

System Integrators in Aerospace and Defense Segmentation

-

1. Application

- 1.1. Aerospace

- 1.2. Defense

- 1.3. Others

-

2. Types

- 2.1. Horizontal Integration

- 2.2. Vertical Integration

System Integrators in Aerospace and Defense Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

System Integrators in Aerospace and Defense REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global System Integrators in Aerospace and Defense Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Aerospace

- 5.1.2. Defense

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Horizontal Integration

- 5.2.2. Vertical Integration

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America System Integrators in Aerospace and Defense Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Aerospace

- 6.1.2. Defense

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Horizontal Integration

- 6.2.2. Vertical Integration

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America System Integrators in Aerospace and Defense Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Aerospace

- 7.1.2. Defense

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Horizontal Integration

- 7.2.2. Vertical Integration

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe System Integrators in Aerospace and Defense Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Aerospace

- 8.1.2. Defense

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Horizontal Integration

- 8.2.2. Vertical Integration

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa System Integrators in Aerospace and Defense Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Aerospace

- 9.1.2. Defense

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Horizontal Integration

- 9.2.2. Vertical Integration

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific System Integrators in Aerospace and Defense Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Aerospace

- 10.1.2. Defense

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Horizontal Integration

- 10.2.2. Vertical Integration

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Sun Technologies

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Moog

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Maverick Technologies

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Matrix Technologies

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.1 Sun Technologies

List of Figures

- Figure 1: Global System Integrators in Aerospace and Defense Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America System Integrators in Aerospace and Defense Revenue (million), by Application 2024 & 2032

- Figure 3: North America System Integrators in Aerospace and Defense Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America System Integrators in Aerospace and Defense Revenue (million), by Types 2024 & 2032

- Figure 5: North America System Integrators in Aerospace and Defense Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America System Integrators in Aerospace and Defense Revenue (million), by Country 2024 & 2032

- Figure 7: North America System Integrators in Aerospace and Defense Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America System Integrators in Aerospace and Defense Revenue (million), by Application 2024 & 2032

- Figure 9: South America System Integrators in Aerospace and Defense Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America System Integrators in Aerospace and Defense Revenue (million), by Types 2024 & 2032

- Figure 11: South America System Integrators in Aerospace and Defense Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America System Integrators in Aerospace and Defense Revenue (million), by Country 2024 & 2032

- Figure 13: South America System Integrators in Aerospace and Defense Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe System Integrators in Aerospace and Defense Revenue (million), by Application 2024 & 2032

- Figure 15: Europe System Integrators in Aerospace and Defense Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe System Integrators in Aerospace and Defense Revenue (million), by Types 2024 & 2032

- Figure 17: Europe System Integrators in Aerospace and Defense Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe System Integrators in Aerospace and Defense Revenue (million), by Country 2024 & 2032

- Figure 19: Europe System Integrators in Aerospace and Defense Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa System Integrators in Aerospace and Defense Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa System Integrators in Aerospace and Defense Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa System Integrators in Aerospace and Defense Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa System Integrators in Aerospace and Defense Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa System Integrators in Aerospace and Defense Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa System Integrators in Aerospace and Defense Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific System Integrators in Aerospace and Defense Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific System Integrators in Aerospace and Defense Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific System Integrators in Aerospace and Defense Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific System Integrators in Aerospace and Defense Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific System Integrators in Aerospace and Defense Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific System Integrators in Aerospace and Defense Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global System Integrators in Aerospace and Defense Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global System Integrators in Aerospace and Defense Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global System Integrators in Aerospace and Defense Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global System Integrators in Aerospace and Defense Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global System Integrators in Aerospace and Defense Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global System Integrators in Aerospace and Defense Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global System Integrators in Aerospace and Defense Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global System Integrators in Aerospace and Defense Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global System Integrators in Aerospace and Defense Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global System Integrators in Aerospace and Defense Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global System Integrators in Aerospace and Defense Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global System Integrators in Aerospace and Defense Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global System Integrators in Aerospace and Defense Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global System Integrators in Aerospace and Defense Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global System Integrators in Aerospace and Defense Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global System Integrators in Aerospace and Defense Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global System Integrators in Aerospace and Defense Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global System Integrators in Aerospace and Defense Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global System Integrators in Aerospace and Defense Revenue million Forecast, by Country 2019 & 2032

- Table 41: China System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific System Integrators in Aerospace and Defense Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the System Integrators in Aerospace and Defense?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the System Integrators in Aerospace and Defense?

Key companies in the market include Sun Technologies, Moog, Maverick Technologies, Matrix Technologies.

3. What are the main segments of the System Integrators in Aerospace and Defense?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "System Integrators in Aerospace and Defense," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the System Integrators in Aerospace and Defense report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the System Integrators in Aerospace and Defense?

To stay informed about further developments, trends, and reports in the System Integrators in Aerospace and Defense, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence