Key Insights

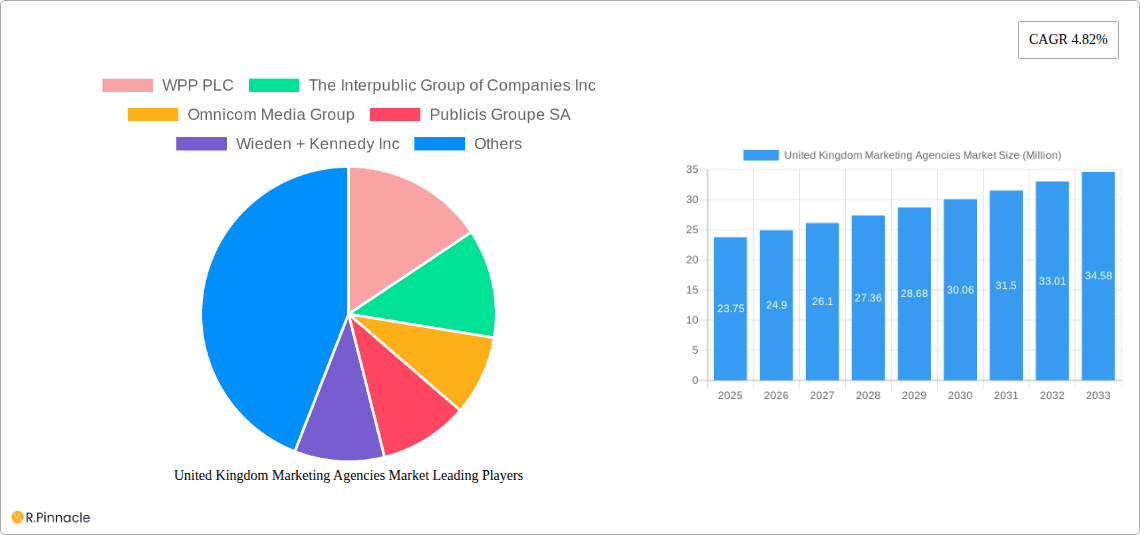

The United Kingdom marketing agencies market is a dynamic and rapidly evolving sector, exhibiting robust growth potential. With a 2025 market size of £23.75 million and a projected Compound Annual Growth Rate (CAGR) of 4.82% from 2025 to 2033, the market is poised for significant expansion. This growth is fueled by several key drivers, including the increasing adoption of digital marketing strategies by businesses of all sizes, the rising demand for data-driven marketing solutions, and the growing need for integrated marketing communications. The market is segmented by service type (digital, traditional, full-service), mode of operation (online, offline), application (large enterprises, SMEs), and end-user industry (BFSI, IT & Telecom, Retail & Consumer Goods, Public Services, Manufacturing & Logistics). The competitive landscape is characterized by a mix of large multinational agencies like WPP PLC, Omnicom Media Group, and Publicis Groupe SA, alongside smaller, specialized agencies catering to niche market segments. The UK's robust economy and advanced digital infrastructure provide a fertile ground for marketing agency growth, while challenges such as intense competition and evolving client demands necessitate continuous innovation and adaptation.

United Kingdom Marketing Agencies Market Market Size (In Million)

The dominance of digital marketing services within the UK market is undeniable, reflecting the global trend towards online engagement and data-driven strategies. While traditional marketing still holds relevance, particularly for certain industries and target audiences, its share is likely to gradually decrease in favour of digital solutions. The SME segment represents a significant portion of the market, driven by their increasing recognition of the value of professional marketing support for growth and competitive advantage. Furthermore, the BFSI and Retail & Consumer Goods sectors are major contributors to market demand, investing heavily in marketing and advertising to reach their target audiences effectively. Future growth will likely depend on the agencies' ability to embrace emerging technologies like AI, machine learning, and programmatic advertising, fostering client relationships built on data-driven insights and measurable results. Sustained economic growth in the UK will also remain crucial for maintaining the current growth trajectory.

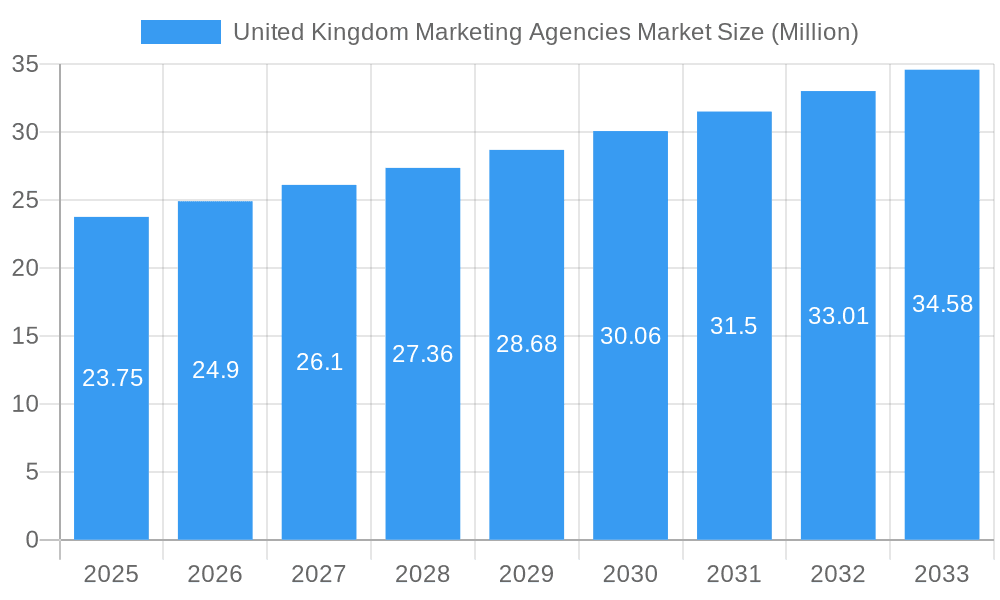

United Kingdom Marketing Agencies Market Company Market Share

United Kingdom Marketing Agencies Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the United Kingdom Marketing Agencies Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, key players, and future outlook. The report leverages extensive data analysis to deliver actionable intelligence, empowering businesses to navigate the evolving landscape of UK marketing. The market is projected to reach xx Million by 2033.

United Kingdom Marketing Agencies Market Structure & Innovation Trends

The UK marketing agencies market is characterized by a moderately concentrated structure, with a few large multinational players like WPP PLC, The Interpublic Group of Companies Inc, Omnicom Media Group, and Publicis Groupe SA holding significant market share. However, a vibrant ecosystem of smaller, specialized agencies also contributes significantly. Innovation is driven by technological advancements, particularly in digital marketing, AI, and data analytics. Regulatory frameworks, such as those related to data privacy (GDPR), significantly influence market practices. Product substitutes, such as in-house marketing departments and freelance professionals, exert competitive pressure. The market demonstrates diverse end-user demographics, catering to large enterprises, SMEs, and various industry sectors. M&A activity is frequent, with deal values varying greatly depending on the size and specialization of the acquired agency. For example, recent deals have seen values ranging from xx Million to xx Million.

- Market Concentration: Moderate, with leading players holding significant but not dominant market share.

- Innovation Drivers: Digital marketing technologies, AI, data analytics.

- Regulatory Frameworks: GDPR and other data privacy regulations.

- M&A Activity: Frequent, with deal values ranging from xx Million to xx Million.

United Kingdom Marketing Agencies Market Market Dynamics & Trends

The UK marketing agencies market exhibits robust growth, driven by several factors. Increasing digital adoption by businesses across all sectors fuels demand for specialized digital marketing services. The rising importance of data-driven marketing strategies and the need for sophisticated analytics capabilities further bolster market expansion. Technological disruptions, such as the rise of artificial intelligence (AI) and programmatic advertising, continuously reshape the competitive landscape. Consumer preferences are shifting towards personalized and engaging experiences, demanding innovative marketing approaches. Competitive dynamics are intense, with agencies constantly striving for differentiation through specialized services, technological expertise, and creative innovation. The market is expected to achieve a CAGR of xx% during the forecast period (2025-2033), with market penetration reaching xx% by 2033.

Dominant Regions & Segments in United Kingdom Marketing Agencies Market

While London remains the dominant region due to its concentration of large corporations and agency headquarters, other major cities like Manchester, Birmingham, and Edinburgh also contribute significantly. Within segments, Digital Marketing Services is the fastest-growing area, driven by the increasing adoption of online channels. Large Enterprises represent the largest segment in terms of revenue, while SMEs present a significant growth opportunity. The BFSI (Banking, Financial Services, and Insurance) and IT & Telecom sectors are key end-users, demanding sophisticated marketing solutions.

- Key Drivers for Dominant Segments:

- Digital Marketing Services: Increased online adoption, data-driven marketing.

- Large Enterprises: Higher budgets, complex marketing needs.

- BFSI & IT & Telecom: High demand for specialized services.

- Regional Dominance: London, followed by other major cities.

United Kingdom Marketing Agencies Market Product Innovations

Recent product innovations focus on leveraging AI-powered tools for improved campaign targeting, content creation, and performance measurement. Agencies are integrating AI-driven analytics platforms to optimize campaign performance and gain deeper insights into consumer behavior. These innovations offer competitive advantages by increasing efficiency, enhancing personalization, and delivering measurable ROI for clients. The market shows strong fit for AI-driven solutions and data-centric approaches, reflecting the evolving needs of modern marketing.

Report Scope & Segmentation Analysis

This report segments the UK marketing agencies market by service type (Digital Marketing Services, Traditional Marketing Services, Full-Service Agencies), mode (Online, Offline), application (Large Enterprises, SMEs), and end-user industry (BFSI, IT & Telecom, Retail & Consumer Goods, Public Services, Manufacturing and Logistics). Each segment is analyzed in terms of its market size, growth rate, and competitive dynamics. For example, the digital marketing services segment is projected to experience significant growth, driven by increasing digital adoption. The large enterprise segment holds the largest market share, while SMEs show strong growth potential.

Key Drivers of United Kingdom Marketing Agencies Market Growth

Growth is fueled by increased digital adoption across sectors, the growing importance of data-driven marketing, and technological advancements in AI and automation. Government initiatives promoting digitalization and favorable economic conditions also contribute. The increasing demand for personalized marketing experiences further fuels market expansion.

Challenges in the United Kingdom Marketing Agencies Market Sector

Challenges include intense competition, fluctuating economic conditions, and the need to adapt to rapidly evolving technologies. Maintaining client relationships and demonstrating measurable ROI are crucial aspects. Regulatory compliance, particularly around data privacy, poses significant hurdles. These factors can lead to reduced profitability and increased competition for a limited pool of clients.

Emerging Opportunities in United Kingdom Marketing Agencies Market

Opportunities exist in the rising adoption of AI-powered marketing solutions, the growth of the influencer marketing sector, and the increasing demand for personalized and data-driven marketing strategies. Expansion into new geographical markets and the development of specialized services in niche sectors also present promising avenues for growth.

Leading Players in the United Kingdom Marketing Agencies Market Market

- WPP PLC

- The Interpublic Group of Companies Inc

- Omnicom Media Group

- Publicis Groupe SA

- Wieden + Kennedy Inc

- Havas SA

- Ogilvy

- Stagwell Group

- Zeninth Media

- PHD Media

- List Not Exhaustive

Key Developments in United Kingdom Marketing Agencies Market Industry

- February 2024: IPG partnered with Adobe, integrating Adobe GenStudio for AI-driven content creation.

- April 2024: WPP and Google Cloud collaborated to advance generative AI in marketing.

Future Outlook for United Kingdom Marketing Agencies Market Market

The UK marketing agencies market is poised for sustained growth, driven by ongoing digital transformation, the increasing importance of data-driven marketing, and the emergence of new technologies. Agencies that embrace innovation, adapt to changing consumer preferences, and deliver measurable results will be best positioned for success. The market is expected to witness significant consolidation through M&A activity, with larger agencies acquiring smaller, specialized firms to expand their service offerings and market reach.

United Kingdom Marketing Agencies Market Segmentation

-

1. Service Type

- 1.1. Digital Marketing Services

- 1.2. Traditional Marketing Services

- 1.3. Full-Service Agencies

-

2. Mode

- 2.1. Online

- 2.2. Offline

-

3. Application

- 3.1. Large Enterprises

- 3.2. Small and Mid-sized Enterprises (SMEs)

-

4. End-User

- 4.1. BFSI

- 4.2. IT & Telecom

- 4.3. Retail & Consumer Goods

- 4.4. Public Services

- 4.5. Manufacturing and Logistics

United Kingdom Marketing Agencies Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Marketing Agencies Market Regional Market Share

Geographic Coverage of United Kingdom Marketing Agencies Market

United Kingdom Marketing Agencies Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Digital Dominance; Changing Landscape of Marketing

- 3.3. Market Restrains

- 3.3.1. Growing Digital Dominance; Changing Landscape of Marketing

- 3.4. Market Trends

- 3.4.1. Growing Digital Dominance is Fuelling the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Marketing Agencies Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Digital Marketing Services

- 5.1.2. Traditional Marketing Services

- 5.1.3. Full-Service Agencies

- 5.2. Market Analysis, Insights and Forecast - by Mode

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Large Enterprises

- 5.3.2. Small and Mid-sized Enterprises (SMEs)

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. BFSI

- 5.4.2. IT & Telecom

- 5.4.3. Retail & Consumer Goods

- 5.4.4. Public Services

- 5.4.5. Manufacturing and Logistics

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 WPP PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Interpublic Group of Companies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Omnicom Media Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Publicis Groupe SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wieden + Kennedy Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Havas SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ogilvy

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Stagwell Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Zeninth Media

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PHD Media**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 WPP PLC

List of Figures

- Figure 1: United Kingdom Marketing Agencies Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Kingdom Marketing Agencies Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 3: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 4: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Mode 2020 & 2033

- Table 5: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Application 2020 & 2033

- Table 7: United Kingdom Marketing Agencies Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: United Kingdom Marketing Agencies Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 9: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 12: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 13: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 14: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Mode 2020 & 2033

- Table 15: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Application 2020 & 2033

- Table 16: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Marketing Agencies Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 18: United Kingdom Marketing Agencies Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 19: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Marketing Agencies Market?

The projected CAGR is approximately 4.82%.

2. Which companies are prominent players in the United Kingdom Marketing Agencies Market?

Key companies in the market include WPP PLC, The Interpublic Group of Companies Inc, Omnicom Media Group, Publicis Groupe SA, Wieden + Kennedy Inc, Havas SA, Ogilvy, Stagwell Group, Zeninth Media, PHD Media**List Not Exhaustive.

3. What are the main segments of the United Kingdom Marketing Agencies Market?

The market segments include Service Type, Mode, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.75 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Digital Dominance; Changing Landscape of Marketing.

6. What are the notable trends driving market growth?

Growing Digital Dominance is Fuelling the Market.

7. Are there any restraints impacting market growth?

Growing Digital Dominance; Changing Landscape of Marketing.

8. Can you provide examples of recent developments in the market?

April 2024: WPP and Google Cloud announced a pioneering collaboration to propel generative AI-driven marketing to new heights. This partnership is poised to redefine marketing's efficacy and impact by leveraging Google's prowess in data analytics, generative AI technology, and cybersecurity alongside WPP's comprehensive marketing solutions, vast creative reach, and deep brand insights.February 2024: IPG made waves by unveiling a strategic collaboration with Adobe. The partnership aims to revolutionize content creation and activation within IPG's global operations. IPG stands out as the inaugural corporation to seamlessly incorporate Adobe GenStudio, a cutting-edge tool leveraging generative AI. This integration empowers brands to accelerate their content ideation, creation, production, and activation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Marketing Agencies Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Marketing Agencies Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Marketing Agencies Market?

To stay informed about further developments, trends, and reports in the United Kingdom Marketing Agencies Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence