Key Insights

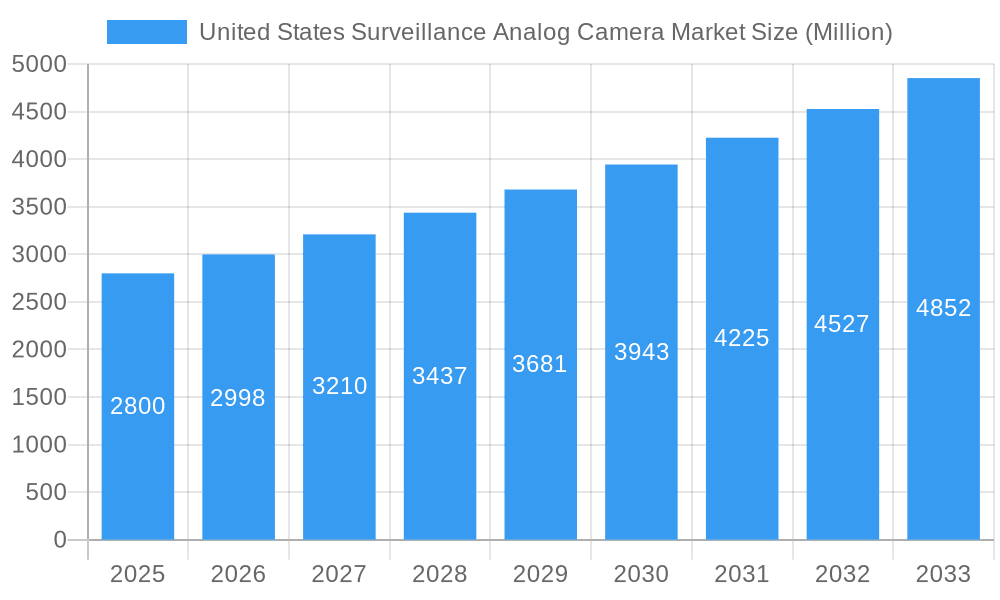

The United States surveillance analog camera market, while facing a decline due to the rise of IP-based systems, still holds a significant, albeit shrinking, market share. The market size in 2025 is estimated at $2.8 billion, reflecting a compound annual growth rate (CAGR) of 7.3% from 2019 to 2024. This growth, however, is projected to decelerate in the coming years as the transition to IP cameras accelerates. Key drivers include the ongoing need for security in various sectors like retail, healthcare, and government, especially in applications where existing analog infrastructure is difficult or expensive to replace immediately. However, limitations such as lower image quality, limited scalability, and higher maintenance costs compared to IP cameras are significant restraints. Market trends show a gradual shift toward hybrid systems that integrate both analog and IP cameras, offering a transitional solution for businesses upgrading their security infrastructure. Major players like Johnson Controls, Bosch, and Hikvision continue to cater to the remaining demand for analog cameras, focusing on cost-effective solutions and niche applications where IP is not yet feasible.

United States Surveillance Analog Camera Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued but slowing market growth. While the overall market is shrinking, the niche demand for low-cost, readily available analog solutions in specific sectors will likely sustain a modest positive growth trajectory. The market segmentation includes camera types (dome, bullet, box), resolutions (low, medium), and application areas (residential, commercial, industrial). Competitive factors include pricing strategies, product innovation (in areas like improved low-light performance), and after-sales services. Regionally, the market is concentrated in densely populated urban areas and areas with established analog infrastructure. Continued technological advancements in IP cameras and declining prices are likely to further accelerate the transition, making the analog market a sunset industry with limited long-term growth potential.

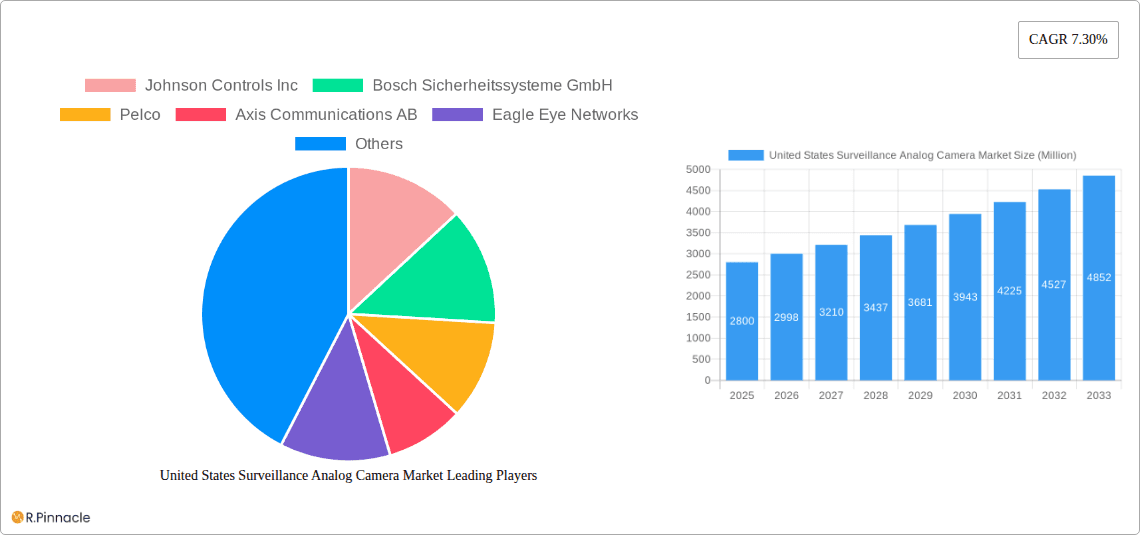

United States Surveillance Analog Camera Market Company Market Share

United States Surveillance Analog Camera Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the United States surveillance analog camera market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, technological advancements, competitive landscapes, and future growth prospects. The report leverages extensive data and analysis to forecast market size and growth trends, providing actionable intelligence for navigating this evolving sector.

United States Surveillance Analog Camera Market Structure & Innovation Trends

This section analyzes the competitive landscape of the US surveillance analog camera market, examining market concentration, innovation drivers, regulatory frameworks, and market dynamics. The report delves into the market share held by key players such as Johnson Controls Inc, Bosch Sicherheitssysteme GmbH, Pelco, Axis Communications AB, Eagle Eye Networks, Hangzhou Hikvision Digital Technology Co Ltd, Panasonic Corporation, Hanwha Vision America, Dahua Technology Co Ltd, Zhejiang Uniview Technologies Co Ltd, IDIS Ltd, ACTi Corporation, Teledyne FLIR LLC, and Honeywell International Inc.

The analysis incorporates:

- Market Concentration: Assessment of the market's competitiveness, identifying dominant players and their respective market shares (exact figures will be detailed within the full report).

- Innovation Drivers: Exploration of factors driving innovation, including technological advancements, evolving consumer needs, and regulatory pressures.

- Regulatory Frameworks: Analysis of relevant regulations and their impact on market growth and product development.

- Product Substitutes: Examination of alternative technologies and their potential to disrupt the analog camera market.

- End-User Demographics: Identification of key end-user segments and their specific needs and preferences.

- M&A Activities: Review of mergers, acquisitions, and strategic partnerships within the market, including deal values (xx Million USD estimated).

United States Surveillance Analog Camera Market Market Dynamics & Trends

This section provides a deep dive into the market's dynamics, growth drivers, and key trends shaping its evolution. The report examines market growth, technological disruptions, consumer preferences, and competitive dynamics. The analysis includes projections for Compound Annual Growth Rate (CAGR) and market penetration rates for specific segments.

The report will detail factors like:

- Market size and value (in Millions) for the historical period (2019-2024), base year (2025), and forecast period (2025-2033).

- Detailed analysis of market growth drivers such as increasing security concerns, rising adoption in various sectors, and government initiatives.

- Impact assessment of technological advancements like improved image quality, enhanced features, and cost reduction.

- Shifting consumer preferences towards advanced functionalities and higher resolutions.

- Competitive analysis encompassing market share, strategies, and competitive rivalry amongst key players.

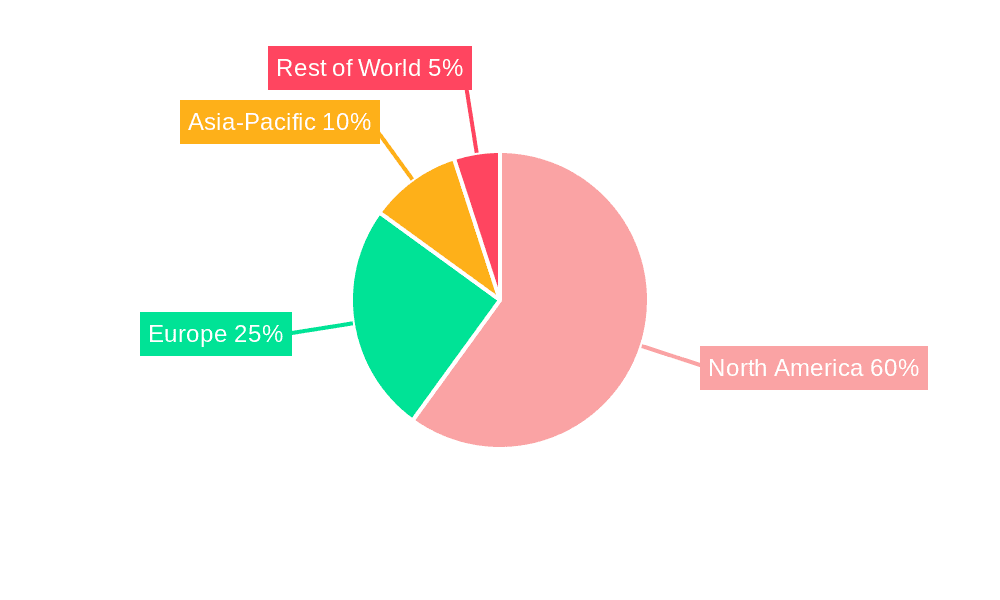

Dominant Regions & Segments in United States Surveillance Analog Camera Market

This section identifies the leading regions and segments within the US surveillance analog camera market. A detailed analysis of the dominant regions will be provided, exploring the factors contributing to their market leadership. This will include a discussion of regional variations in market dynamics, driving factors, and future growth potentials.

Analysis will include:

- Key Drivers:

- Economic policies impacting the security industry.

- Infrastructure development influencing demand.

- Government regulations and initiatives.

- Dominance Analysis: In-depth examination of the leading region(s) and factors contributing to their market share.

United States Surveillance Analog Camera Market Product Innovations

This section summarizes recent product developments, applications, and competitive advantages. It focuses on technological trends and market fit, highlighting new camera features and improved capabilities driving market expansion. The impact of technological advancements on market penetration and customer adoption will be covered.

Report Scope & Segmentation Analysis

This section details all market segmentations based on product type, resolution, technology, application, and end-user. Each segment's analysis will cover growth projections, market size (in Millions), and competitive dynamics.

(Specific segment details and projections will be provided in the full report.)

Key Drivers of United States Surveillance Analog Camera Market Growth

This section outlines the key growth drivers for the US surveillance analog camera market. It includes technological advancements, economic factors, and regulatory changes that are positively impacting market expansion. Specific examples will be provided to support the analysis.

Challenges in the United States Surveillance Analog Camera Market Sector

This section discusses the barriers and restraints hindering market growth. These challenges will include regulatory hurdles, supply chain issues, and competitive pressures. Quantifiable impacts of these challenges will be presented.

Emerging Opportunities in United States Surveillance Analog Camera Market

This section highlights emerging trends and opportunities within the market. It will focus on new markets, technological advancements, and evolving consumer preferences that present growth potentials.

Leading Players in the United States Surveillance Analog Camera Market Market

- Johnson Controls Inc

- Bosch Sicherheitssysteme GmbH

- Pelco

- Axis Communications AB

- Eagle Eye Networks

- Hangzhou Hikvision Digital Technology Co Ltd

- Panasonic Corporation

- Hanwha Vision America

- Dahua Technology Co Ltd

- Zhejiang Uniview Technologies Co Ltd

- IDIS Ltd

- ACTi Corporation

- Teledyne FLIR LLC

- Honeywell International Inc

Key Developments in United States Surveillance Analog Camera Market Industry

- October 2023: Hikvision launched its ColorVu Fixed Turret (DS-2CE70DF0T-MF) and Bullet (DS-2CE10DF0T-F) Cameras featuring an F1.0 aperture, delivering 24/7 full-color imaging with 3D DNR technology.

- July 2023: Hikvision introduced two new 5 MP ColorVu TurboHD camera models (DS-2CE10KF0T-FS and DS-2CE70KF0T-MFS0) enhancing its HD over analog product line.

Future Outlook for United States Surveillance Analog Camera Market Market

The US surveillance analog camera market is poised for continued growth, driven by technological innovations, increasing demand for enhanced security solutions, and expansion into new applications. Strategic opportunities exist for companies to capitalize on emerging trends and meet evolving market needs. Further growth is anticipated, particularly in sectors with high security requirements.

United States Surveillance Analog Camera Market Segmentation

-

1. End-user Industry

- 1.1. Government

- 1.2. Banking

- 1.3. Healthcare

- 1.4. Transportation & Logistics

- 1.5. Industrial

- 1.6. Other End-user Industries

United States Surveillance Analog Camera Market Segmentation By Geography

- 1. United States

United States Surveillance Analog Camera Market Regional Market Share

Geographic Coverage of United States Surveillance Analog Camera Market

United States Surveillance Analog Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost Effectiveness and Affordability; Utilization of Existing Infrastructure

- 3.3. Market Restrains

- 3.3.1. Cost Effectiveness and Affordability; Utilization of Existing Infrastructure

- 3.4. Market Trends

- 3.4.1. Convenience and Cost Effectiveness is Driving the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Surveillance Analog Camera Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Government

- 5.1.2. Banking

- 5.1.3. Healthcare

- 5.1.4. Transportation & Logistics

- 5.1.5. Industrial

- 5.1.6. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Johnson Controls Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bosch Sicherheitssysteme GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pelco

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Axis Communications AB

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eagle Eye Networks

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Panasonic Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hanwha Vision America

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dahua Technology Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zhejiang Uniview Technologies Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 IDIS Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ACTi Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Teledyne FLIR LLC

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Honeywell International Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Johnson Controls Inc

List of Figures

- Figure 1: United States Surveillance Analog Camera Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Surveillance Analog Camera Market Share (%) by Company 2025

List of Tables

- Table 1: United States Surveillance Analog Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 2: United States Surveillance Analog Camera Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 3: United States Surveillance Analog Camera Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United States Surveillance Analog Camera Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: United States Surveillance Analog Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: United States Surveillance Analog Camera Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 7: United States Surveillance Analog Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: United States Surveillance Analog Camera Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Surveillance Analog Camera Market?

The projected CAGR is approximately 7.30%.

2. Which companies are prominent players in the United States Surveillance Analog Camera Market?

Key companies in the market include Johnson Controls Inc, Bosch Sicherheitssysteme GmbH, Pelco, Axis Communications AB, Eagle Eye Networks, Hangzhou Hikvision Digital Technology Co Ltd, Panasonic Corporation, Hanwha Vision America, Dahua Technology Co Ltd, Zhejiang Uniview Technologies Co Ltd, IDIS Ltd, ACTi Corporation, Teledyne FLIR LLC, Honeywell International Inc.

3. What are the main segments of the United States Surveillance Analog Camera Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Cost Effectiveness and Affordability; Utilization of Existing Infrastructure.

6. What are the notable trends driving market growth?

Convenience and Cost Effectiveness is Driving the Demand.

7. Are there any restraints impacting market growth?

Cost Effectiveness and Affordability; Utilization of Existing Infrastructure.

8. Can you provide examples of recent developments in the market?

October 2023: Hikvision unveiled the ColorVu Fixed Turret (DS-2CE70DF0T-MF) and Bullet (DS-2CE10DF0T-F) Cameras, the first of their kind to feature an F1.0 aperture. These 2 MP analog cameras deliver top-notch, full-color imaging 24/7, support HD over analog cabling for seamless upgrades, and come equipped with 3D Digital Noise Reduction (DNR) technology. Notably, the ColorVu Cameras sport an impressive F1.0 aperture, ensuring vibrant color even in dimly lit environments. The inclusion of 3D DNR technology enhances image clarity, effectively minimizing interference and noise. Additionally, boasting a white light distance of up to 65 feet, these cameras excel at capturing bright and detailed night scenes, leaving no corner in the dark unnoticed.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Surveillance Analog Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Surveillance Analog Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Surveillance Analog Camera Market?

To stay informed about further developments, trends, and reports in the United States Surveillance Analog Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence