Key Insights

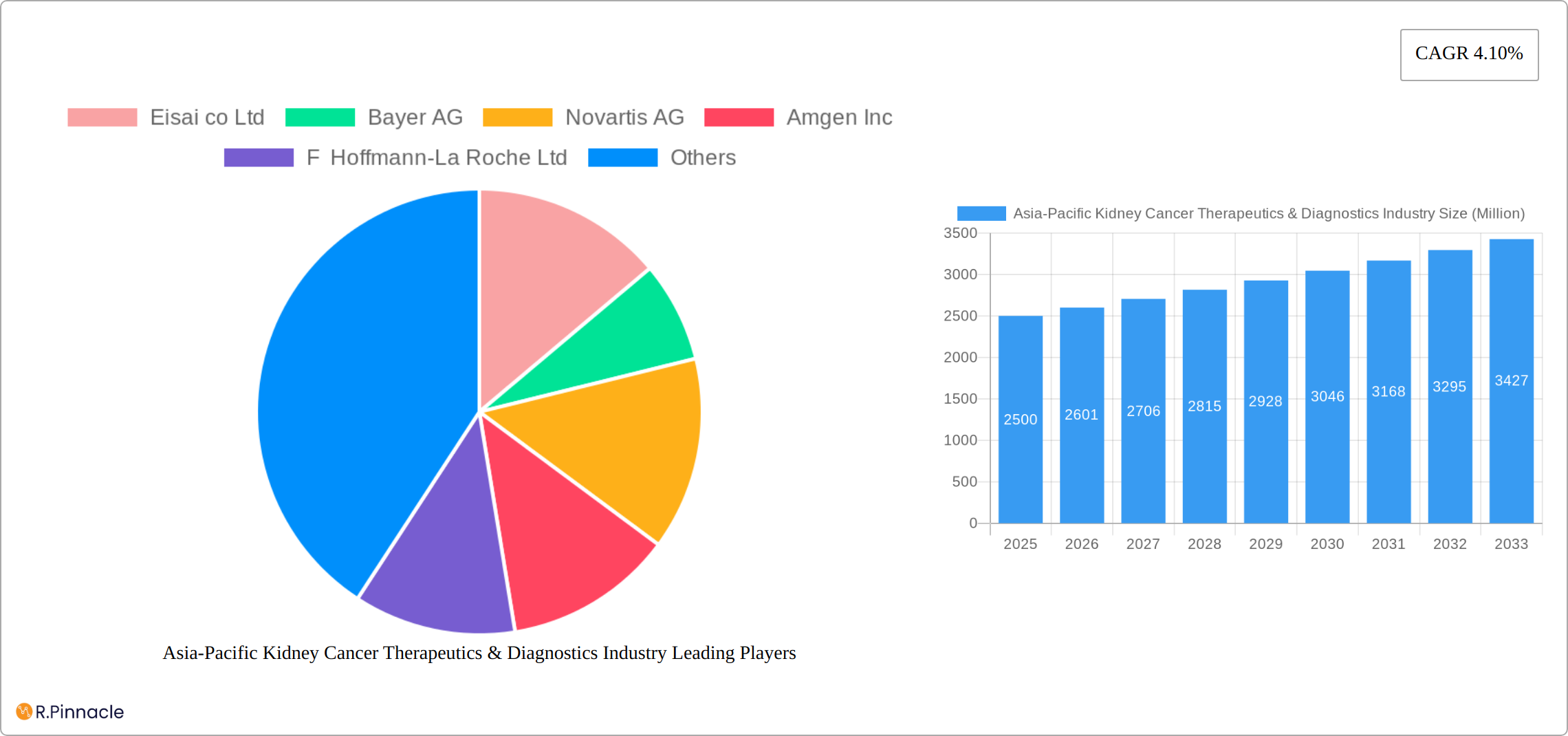

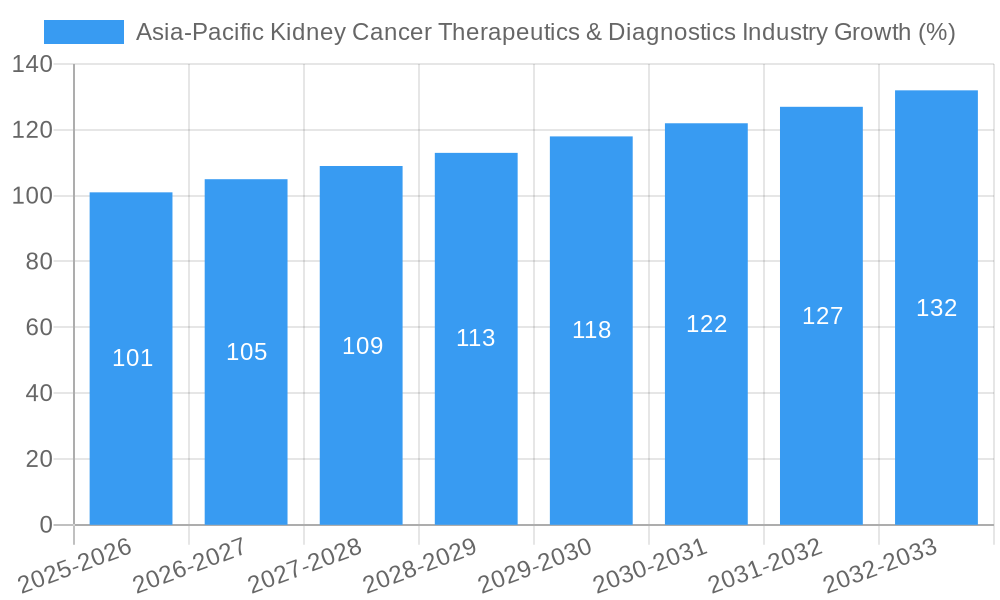

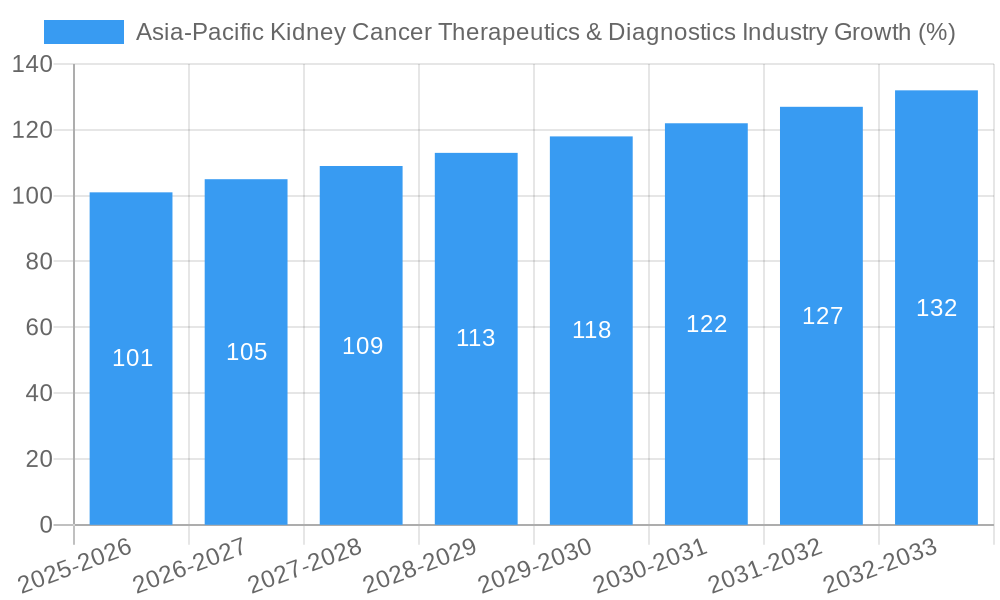

The Asia-Pacific kidney cancer therapeutics and diagnostics market is experiencing robust growth, driven by increasing prevalence of renal cell carcinoma (RCC), the most common type of kidney cancer, and rising awareness among the population about kidney cancer. The market, currently valued at approximately $XX million (estimated based on global market size and regional market share estimations – specific values are unavailable but can be estimated by market research firms), is projected to exhibit a compound annual growth rate (CAGR) of 4.10% from 2025 to 2033. This growth is fueled by several key factors, including advancements in targeted therapies, such as angiogenesis inhibitors and mTOR inhibitors, the increasing adoption of immunotherapy, and the expansion of diagnostic capabilities. Improved diagnostic techniques like CT scans and biopsies lead to earlier detection and more effective treatment strategies, contributing to the market's expansion. However, high treatment costs, particularly for advanced therapies like immunotherapy, and the complexities associated with clinical trials for new treatments pose significant challenges. The market is further segmented by cancer type (clear cell, papillary, chromophobe, etc.), therapeutic class (targeted therapy, immunotherapy), pharmacologic class (angiogenesis inhibitors, monoclonal antibodies, etc.), and diagnostic methods (biopsy, CT scan, etc.). Major players like Eisai, Bayer, Novartis, Amgen, Roche, Abbott, Seattle Genetics, and Pfizer are actively involved in developing and marketing innovative therapies, contributing to market competition and driving advancements in treatment options. The diverse patient population across various countries in the Asia-Pacific region, coupled with evolving healthcare infrastructure, creates both opportunities and complexities for market expansion. Rapidly expanding healthcare infrastructure in nations like China and India is a significant driver of growth in the region.

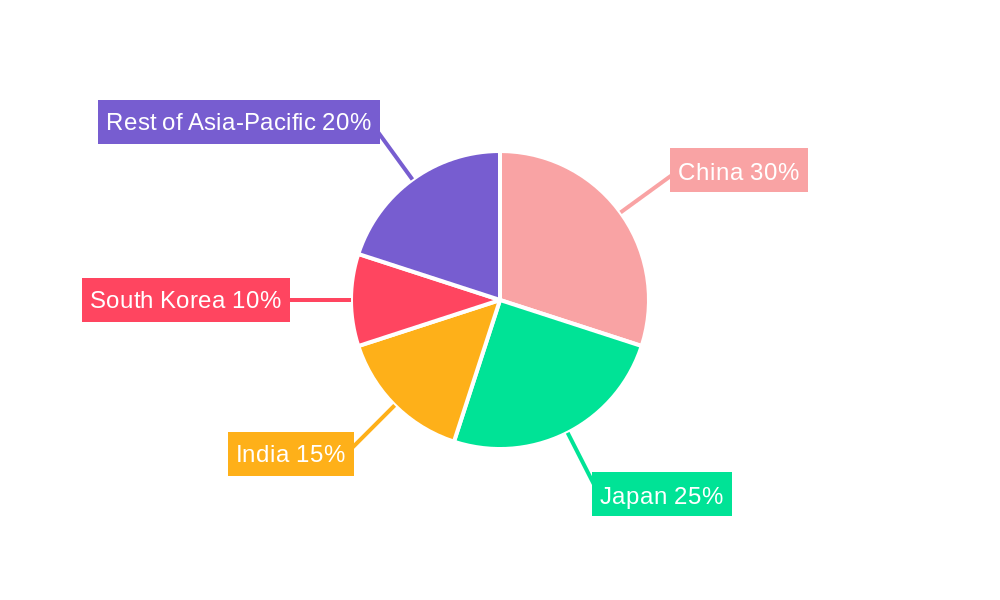

The regional disparity within the Asia-Pacific market is notable. Countries like Japan and South Korea, with well-established healthcare systems, currently hold a larger market share, while emerging economies like India and China present significant growth potential due to rising incomes and improving access to healthcare. Further expansion within this market is anticipated due to an aging population increasing susceptibility to kidney cancer and the ongoing research and development efforts focusing on novel therapies and improved diagnostics. The future trajectory of the market will strongly depend on the continued innovation in drug development, regulatory approvals, reimbursement policies, and the accessibility of advanced treatments across different countries within the Asia-Pacific region.

Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific kidney cancer therapeutics and diagnostics industry, offering valuable insights for industry professionals, investors, and researchers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, growth drivers, challenges, and future opportunities. The report leverages extensive data analysis to project market size and growth, segmenting the market by cancer type, therapeutic class, pharmacologic class, and diagnostic methods.

Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory factors shaping the Asia-Pacific kidney cancer therapeutics and diagnostics market. The market exhibits a moderately concentrated structure, with key players such as Eisai co Ltd, Bayer AG, Novartis AG, Amgen Inc, F Hoffmann-La Roche Ltd, Abbott Laboratories, Seattle Genetics, and Pfizer Inc holding significant market share. However, the presence of numerous smaller players indicates a dynamic and competitive environment. The estimated combined market share of the top 5 players in 2025 is xx%.

Market Concentration & Innovation Drivers:

- High R&D investment by major pharmaceutical companies fuels innovation in targeted therapies and immunotherapies.

- Stringent regulatory frameworks in several Asia-Pacific countries drive the adoption of advanced diagnostic techniques.

- Growing awareness about kidney cancer and improved access to healthcare are contributing factors to market growth.

- Strategic partnerships and mergers and acquisitions (M&A) activities are reshaping the competitive landscape. The total value of M&A deals in the sector between 2019 and 2024 was approximately xx Million.

Product Substitutes & End-User Demographics:

- The availability of alternative treatment options influences treatment decisions and market share.

- The aging population and rising prevalence of kidney cancer are key demographic drivers.

- The increasing affordability and accessibility of diagnostic tools are expanding market reach.

Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Market Dynamics & Trends

The Asia-Pacific kidney cancer therapeutics and diagnostics market is experiencing robust growth, driven by several factors. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated at xx%. This growth is fueled by rising prevalence of kidney cancer, increasing healthcare expenditure, technological advancements in diagnostics and therapeutics, and government initiatives to improve cancer care. The market penetration of targeted therapies is increasing steadily, while immunotherapy is emerging as a promising treatment modality. Competitive dynamics are intense, with companies focusing on product innovation, strategic partnerships, and market expansion to gain a competitive edge.

Dominant Regions & Segments in Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry

Leading Regions & Countries:

The Asia-Pacific kidney cancer therapeutics and diagnostics market is characterized by a dynamic landscape, with established hubs and rapidly growing contenders. Currently, Japan, Australia, and South Korea stand out as market leaders. This dominance is attributed to their sophisticated healthcare infrastructure, substantial healthcare expenditure, and a comparatively higher reported incidence of kidney cancer. These nations are at the forefront of adopting advanced diagnostic technologies and novel therapeutic interventions.

However, significant growth potential is being observed in emerging economies, most notably China and India. The expanding reach of healthcare services, coupled with a growing emphasis on public health awareness and education regarding kidney cancer, is fueling this upward trajectory. As these regions continue to invest in their healthcare systems, they are poised to become increasingly influential players in the market.

Dominant Segments:

- By Cancer Type: Clear cell renal cell carcinoma (ccRCC) remains the most prevalent and consequently the largest segment within the kidney cancer market. It is estimated to account for a substantial share, projected to be around 65-70% of the market in 2025, underscoring its significance in therapeutic and diagnostic development.

- By Therapeutic Class: Targeted therapy continues to be the dominant therapeutic class, holding a significant market share estimated at 45-50% in 2025. This dominance is driven by the development of precision medicines that target specific molecular pathways involved in cancer growth. Immunotherapy is a rapidly growing segment, projected to capture approximately 30-35% of the market share in 2025, reflecting the increasing success of harnessing the immune system to fight cancer. Other classes, including chemotherapy, are also present but represent smaller portions of the market.

- By Pharmacologic Class: Within targeted therapies, angiogenesis inhibitors have historically been key players, and continue to hold a significant market share due to their efficacy in blocking tumor blood vessel formation. Alongside these, monoclonal antibodies, particularly those used in immunotherapy, are experiencing robust growth and represent a major pharmacologic class. The market also sees the increasing prominence of other targeted agents and immune checkpoint inhibitors.

- By Diagnostics: In the realm of diagnostics, established imaging techniques such as CT scans remain the most widely utilized methods for diagnosis and staging due to their accessibility and established reliability. Biopsies are crucial for definitive diagnosis and molecular profiling. However, there is a growing adoption of advanced imaging modalities like MRI and PET-CT scans, as well as molecular diagnostic techniques, for more precise detection, risk stratification, and treatment selection.

Key Drivers of Regional & Segment Dominance:

- Japan: Characterized by its exceptionally well-developed healthcare infrastructure, high per capita healthcare spending, and a proactive approach to the early adoption of cutting-edge medical technologies and treatments.

- Australia: Benefits from strong government commitment to public health, significant investment in medical research and development, and a well-established clinical trial ecosystem.

- South Korea: Exhibits a relatively high incidence of kidney cancer, coupled with a sophisticated healthcare system that rapidly integrates innovative treatment options and advanced diagnostic tools.

- China & India: Driven by rapid economic development, leading to substantial expansion of their healthcare infrastructure, increased accessibility to medical services, and a growing middle class with greater purchasing power for advanced diagnostics and treatments. Government focus on improving healthcare access is also a major contributor.

Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Product Innovations

The Asia-Pacific landscape for kidney cancer therapeutics and diagnostics is being profoundly reshaped by a wave of innovative product development. In therapeutics, the focus is shifting towards more targeted and personalized approaches. The development and refinement of novel targeted therapies, including advanced immune checkpoint inhibitors (e.g., PD-1 and PD-L1 inhibitors) and next-generation tyrosine kinase inhibitors (TKIs), are significantly improving treatment efficacy and patient outcomes, leading to higher response rates and improved survival. Furthermore, the exploration of combination therapies, synergizing different drug classes, is showing promising results in overcoming treatment resistance.

On the diagnostics front, significant advancements are enhancing early detection, precise staging, and personalized treatment selection. Advanced imaging techniques such as PET/CT scans with novel radiotracers are offering improved visualization and characterization of tumors, aiding in earlier diagnosis and more accurate monitoring of disease progression. The integration of liquid biopsies, which analyze circulating tumor DNA (ctDNA) in the blood, is emerging as a powerful tool for non-invasive disease detection, monitoring treatment response, and identifying resistance mechanisms. The burgeoning field of genomic profiling is also central, enabling the identification of specific genetic mutations and biomarkers that guide the selection of the most effective targeted therapies, thereby ushering in an era of truly personalized medicine. These innovations collectively aim to enhance patient survival rates, improve the quality of life, and minimize treatment-related toxicities.

Report Scope & Segmentation Analysis

This report comprehensively segments the Asia-Pacific kidney cancer therapeutics and diagnostics market based on cancer type (Renal Cancer Carcinoma, Clear Cell Renal Cell Carcinoma, Papillary Renal Cell Carcinoma, Chromophobe Renal Cell Carcinoma, Other Cancer Types), therapeutic class (Targeted Therapy, Immunotherapy), pharmacologic class (Angiogenesis Inhibitors, Monoclonal Antibodies, mTOR Inhibitors, Cytokine Immunotherapy (IL-2)), and diagnostics (Biopsy, Intravenous Pyelogram, CT Scan, Nephro-Ureteroscopy, Ultrasound, Other Diagnostics). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. For example, the targeted therapy segment is projected to grow at a CAGR of xx% during the forecast period, driven by the increasing efficacy and adoption of novel targeted agents.

Key Drivers of Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Growth

The growth trajectory of the Asia-Pacific kidney cancer therapeutics and diagnostics market is propelled by a confluence of interconnected factors:

- Rising Incidence & Aging Population: An increasing prevalence of kidney cancer, significantly influenced by a growing aging population across the region and evolving lifestyle factors such as dietary habits and obesity, is creating a larger patient pool requiring advanced medical interventions.

- Expanding Healthcare Expenditure & Access: Steadily increasing healthcare spending, both by governments and individuals, coupled with the continuous expansion and improvement of healthcare infrastructure, particularly in emerging economies, is enhancing access to both diagnostic services and advanced treatment options.

- Technological Advancements: Continuous innovation in diagnostic imaging, molecular diagnostics, and the development of novel therapeutic agents, including targeted therapies and immunotherapies, are offering more effective and less toxic treatment modalities, thereby driving market demand.

- Government Initiatives & Awareness Campaigns: Proactive government policies supporting healthcare development, coupled with escalating public awareness campaigns focused on early detection, screening programs, and the importance of timely medical consultation, are crucial in driving the adoption of diagnostic and therapeutic solutions.

- Growing Adoption of Advanced Therapies: The increasing clinical evidence supporting the efficacy of targeted therapies and immunotherapies, leading to improved patient outcomes, is fostering their wider adoption by healthcare providers and increased demand from patients.

- Focus on Precision Medicine: A growing emphasis on personalized treatment approaches, driven by advancements in genomic and biomarker research, is stimulating the development and uptake of targeted drugs and companion diagnostics.

Challenges in the Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Sector

Despite the significant growth, several challenges exist. These include:

- High cost of advanced therapies, limiting accessibility for a large segment of the population.

- Uneven distribution of healthcare resources across the region.

- Regulatory hurdles and lengthy approval processes for new drugs and diagnostics.

- Intellectual property challenges and competition among pharmaceutical companies. The impact of these challenges results in a xx Million loss annually in revenue for the market.

Emerging Opportunities in Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry

The Asia-Pacific market for kidney cancer therapeutics and diagnostics is ripe with emerging opportunities, offering significant potential for innovation and expansion:

- Penetration into Underserved Markets: Significant opportunities lie in expanding access to advanced diagnostics and therapies in developing nations and rural areas within larger countries, where healthcare infrastructure is still evolving but demand is growing.

- Development of Cost-Effective Solutions: The creation of more affordable yet highly effective diagnostic tools and therapeutic agents is crucial for broader market penetration, particularly in price-sensitive economies. This includes exploring biosimil options and optimizing manufacturing processes.

- Advancements in Personalized Medicine: The continued development of targeted therapies tailored to specific genetic mutations and molecular profiles of kidney cancer, along with their associated companion diagnostics, presents a major growth avenue.

- Leveraging Digital Health & Telemedicine: The integration of telemedicine platforms for remote consultations, diagnostics, and patient monitoring, alongside digital health solutions for data management and patient engagement, offers innovative ways to improve healthcare delivery and reach.

- Biomarker Discovery & Validation: Significant opportunities exist in the identification and validation of novel biomarkers for earlier and more accurate detection of kidney cancer, prediction of treatment response, and monitoring of disease recurrence, paving the way for more precise therapeutic strategies.

- Focus on Rare Subtypes & Refractory Cases: Research and development efforts aimed at addressing less common subtypes of kidney cancer and developing novel treatment strategies for patients who are refractory to existing therapies represent unmet needs and emerging markets.

Leading Players in the Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Market

- Eisai co Ltd

- Bayer AG

- Novartis AG

- Amgen Inc

- F Hoffmann-La Roche Ltd

- Abbott Laboratories

- Seattle Genetics

- Pfizer Inc

Key Developments in Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Industry

- 2023: Launch of a novel immunotherapy drug by Company X.

- 2022: Acquisition of Company Y by Company Z for xx Million.

- 2021: Approval of a new diagnostic test by regulatory authorities in Country A.

- (Further details to be added based on specific developments).

Future Outlook for Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Market

The future outlook for the Asia-Pacific kidney cancer therapeutics and diagnostics market is exceptionally promising and poised for robust growth. This optimistic trajectory is underpinned by a sustained surge in technological advancements, consistent increases in healthcare expenditure across the region, and a heightened global and regional awareness of kidney cancer, its risk factors, and the critical importance of early detection. The market is projected to experience significant expansion, creating lucrative opportunities for both established global pharmaceutical and diagnostic companies, as well as agile emerging players.

Success in this dynamic market will increasingly hinge on strategic collaborations, mergers and acquisitions that foster innovation and market reach, and the relentless pursuit of groundbreaking therapies and diagnostic tools. The ongoing refinement of targeted therapies, the expanding role of immunotherapies, and the development of more sophisticated diagnostic capabilities will continue to shape the competitive landscape. Furthermore, the growing emphasis on value-based healthcare and patient-centric outcomes will drive the adoption of treatments that offer superior efficacy and quality of life. The market is anticipated to witness substantial growth, with projections indicating it could reach upwards of USD 8-10 Billion by 2033, signifying a considerable increase from current estimates and underscoring its strategic importance in the global oncology market.

Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Segmentation

-

1. Cancer Type

- 1.1. Renal Cancer Carcinoma

- 1.2. Clear Cell Renal Cell Carcinoma

- 1.3. Papillary Renal Cell Carcinoma

- 1.4. Chromophobe Renal Cell Carcinoma

- 1.5. Other Cancer Types

-

2. Therapeutic Class

- 2.1. Targeted Therapy

- 2.2. Immunotherapy

-

3. Pharmacologic Class

- 3.1. Angiogenesis Inhibitors

- 3.2. Monoclonal Antibodies

- 3.3. mTOR Inhibitors

- 3.4. Cytokine Immunotherapy (IL-2)

-

4. Diagnostics

- 4.1. Biopsy

- 4.2. Intravenous Pyelogram

- 4.3. CT Scan

- 4.4. Nephro-Ureteroscopy

- 4.5. Ultrasound

- 4.6. Other Diagnostics

-

5. Geography

-

5.1. Asia-Pacific

- 5.1.1. China

- 5.1.2. Japan

- 5.1.3. India

- 5.1.4. Australia

- 5.1.5. South Korea

- 5.1.6. Rest of Asia-Pacific

-

5.1. Asia-Pacific

Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. India

- 1.4. Australia

- 1.5. South Korea

- 1.6. Rest of Asia Pacific

Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Number of Kidney Cancer Cases; Increased R&D Expenditure of Pharmaceutical Companies

- 3.3. Market Restrains

- 3.3.1. ; High Cost Associated with Treatment; Preference for Generic Drugs

- 3.4. Market Trends

- 3.4.1. Renal Cancer Carcinoma is Expected to be the Largest Growing Segment in the Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cancer Type

- 5.1.1. Renal Cancer Carcinoma

- 5.1.2. Clear Cell Renal Cell Carcinoma

- 5.1.3. Papillary Renal Cell Carcinoma

- 5.1.4. Chromophobe Renal Cell Carcinoma

- 5.1.5. Other Cancer Types

- 5.2. Market Analysis, Insights and Forecast - by Therapeutic Class

- 5.2.1. Targeted Therapy

- 5.2.2. Immunotherapy

- 5.3. Market Analysis, Insights and Forecast - by Pharmacologic Class

- 5.3.1. Angiogenesis Inhibitors

- 5.3.2. Monoclonal Antibodies

- 5.3.3. mTOR Inhibitors

- 5.3.4. Cytokine Immunotherapy (IL-2)

- 5.4. Market Analysis, Insights and Forecast - by Diagnostics

- 5.4.1. Biopsy

- 5.4.2. Intravenous Pyelogram

- 5.4.3. CT Scan

- 5.4.4. Nephro-Ureteroscopy

- 5.4.5. Ultrasound

- 5.4.6. Other Diagnostics

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. Asia-Pacific

- 5.5.1.1. China

- 5.5.1.2. Japan

- 5.5.1.3. India

- 5.5.1.4. Australia

- 5.5.1.5. South Korea

- 5.5.1.6. Rest of Asia-Pacific

- 5.5.1. Asia-Pacific

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Cancer Type

- 6. China Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Eisai co Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Bayer AG

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Novartis AG

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Amgen Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 F Hoffmann-La Roche Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Abbott Laboratories

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Seattle Genetics*List Not Exhaustive

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Pfizer Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Eisai co Ltd

List of Figures

- Figure 1: Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue Million Forecast, by Cancer Type 2019 & 2032

- Table 3: Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue Million Forecast, by Therapeutic Class 2019 & 2032

- Table 4: Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue Million Forecast, by Pharmacologic Class 2019 & 2032

- Table 5: Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue Million Forecast, by Diagnostics 2019 & 2032

- Table 6: Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 7: Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: China Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Japan Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Korea Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Taiwan Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Australia Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Asia-Pacific Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue Million Forecast, by Cancer Type 2019 & 2032

- Table 17: Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue Million Forecast, by Therapeutic Class 2019 & 2032

- Table 18: Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue Million Forecast, by Pharmacologic Class 2019 & 2032

- Table 19: Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue Million Forecast, by Diagnostics 2019 & 2032

- Table 20: Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: India Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Australia Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: South Korea Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Asia Pacific Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry?

Key companies in the market include Eisai co Ltd, Bayer AG, Novartis AG, Amgen Inc, F Hoffmann-La Roche Ltd, Abbott Laboratories, Seattle Genetics*List Not Exhaustive, Pfizer Inc.

3. What are the main segments of the Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry?

The market segments include Cancer Type, Therapeutic Class, Pharmacologic Class, Diagnostics, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Rising Number of Kidney Cancer Cases; Increased R&D Expenditure of Pharmaceutical Companies.

6. What are the notable trends driving market growth?

Renal Cancer Carcinoma is Expected to be the Largest Growing Segment in the Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Market.

7. Are there any restraints impacting market growth?

; High Cost Associated with Treatment; Preference for Generic Drugs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Kidney Cancer Therapeutics & Diagnostics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence