Key Insights

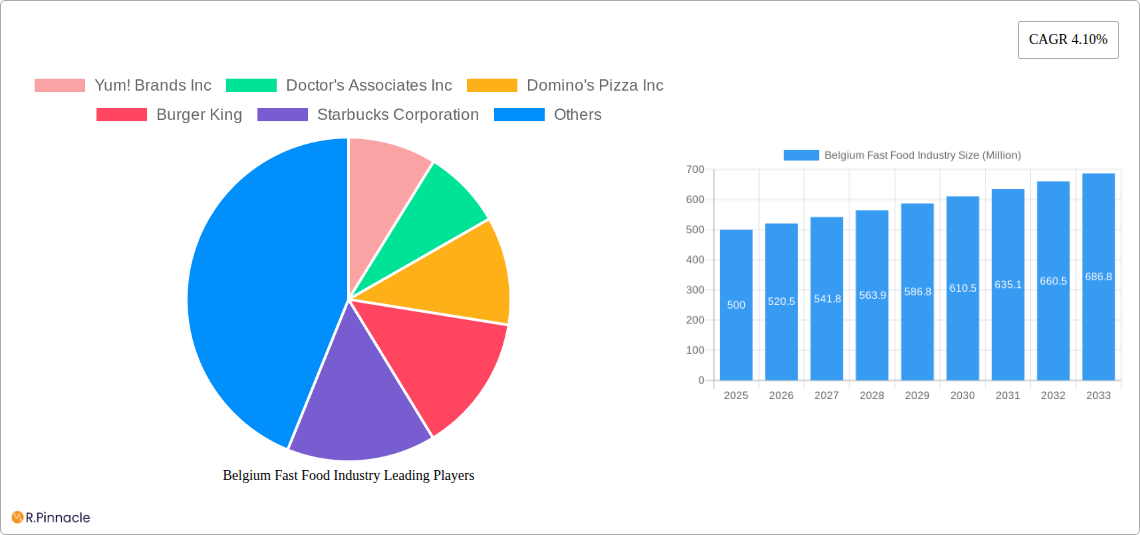

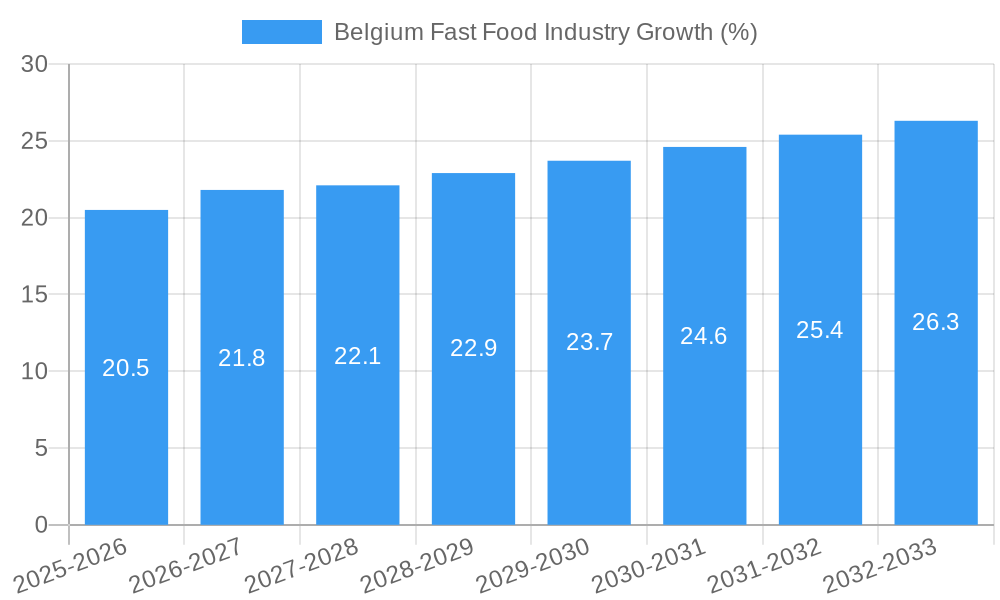

The Belgian fast-food market, valued at approximately €500 million in 2025, is projected to experience steady growth, with a compound annual growth rate (CAGR) of 4.10% from 2025 to 2033. This growth is driven by several factors. Increased urbanization and changing lifestyles are leading to higher demand for convenient and readily available food options. The rising disposable incomes of the Belgian population also contribute significantly, allowing consumers to spend more frequently on dining out, including fast food. Furthermore, the increasing popularity of international fast-food chains and the diversification of menu offerings to cater to local tastes are boosting market expansion. The market is segmented by type (consumer foodservice, street stalls/kiosks, hotels, institutional catering) and structure (independent outlets, chained outlets). The dominance of chained outlets, particularly international players like McDonald's, Burger King, and Domino's, is a significant characteristic, although independent outlets and smaller chains maintain a presence, often specializing in regional cuisine or unique offerings. Competition is intense, with established brands continually innovating to attract and retain customers. While potential restraints such as economic downturns and increasing health consciousness exist, the overall growth trajectory suggests a positive outlook for the Belgian fast-food industry over the forecast period.

The competitive landscape features a mix of international giants and local players. International chains benefit from brand recognition and economies of scale. Local players, however, often capitalize on familiarity with local tastes and preferences, resulting in a dynamic market. Future growth will likely depend on successful adaptation to evolving consumer preferences, such as the increasing demand for healthier options, sustainable practices, and personalized experiences. Investment in technological advancements, including online ordering and delivery platforms, will play a crucial role in maintaining market competitiveness and reaching a wider customer base. The expansion of delivery services and the rise of food aggregators are likely to influence the market's structure in the coming years. Growth in tourist numbers will also provide a positive boost, especially for fast-food outlets located in strategic areas catering to tourists.

Belgium Fast Food Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Belgium fast food industry, offering invaluable insights for industry professionals, investors, and strategists. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers crucial data and actionable intelligence to navigate the dynamic landscape of this thriving market. The report leverages detailed market segmentation, examining key players like McDonald's Corporation, Burger King, Yum! Brands Inc, and Starbucks Corporation, alongside local favorites such as Chez Léon and BigChefs, to provide a holistic understanding of this €XX Million market.

Belgium Fast Food Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the Belgian fast-food market. We examine market concentration, identifying leading players and their respective market shares (e.g., McDonald's holds an estimated xx% market share in 2025). The report details the impact of mergers and acquisitions (M&A) activities, including deal values (estimated at €XX Million in total M&A activity during 2019-2024), and their influence on market consolidation. Innovation drivers, including technological advancements in food preparation and delivery, are examined, alongside the regulatory framework governing food safety and hygiene. Analysis includes the impact of substitute products (e.g., home-cooked meals, healthy alternatives) and end-user demographics, including evolving consumer preferences and dietary trends.

- Market Concentration: High, with major international chains dominating.

- M&A Activity: €XX Million in deal value during the historical period (2019-2024), with a projected €XX Million for the forecast period.

- Innovation Drivers: Technological advancements in ordering, delivery, and kitchen automation.

- Regulatory Framework: Stringent food safety and hygiene regulations.

Belgium Fast Food Industry Market Dynamics & Trends

This section delves into the market's growth trajectory, influenced by factors such as changing consumer preferences (e.g., increasing demand for healthier options and personalized experiences), technological disruptions (e.g., the rise of online ordering and delivery platforms), and competitive dynamics. We analyze the compound annual growth rate (CAGR) of the Belgian fast-food market, projecting a CAGR of xx% during the forecast period (2025-2033). Market penetration of various segments is assessed, highlighting regions and consumer groups showing the strongest growth. The impact of economic factors, such as disposable income levels and tourism, is also considered. Furthermore, we explore the competitive landscape, assessing the strategies employed by leading players to maintain market share and attract customers.

Dominant Regions & Segments in Belgium Fast Food Industry

This section identifies the leading regions and segments within the Belgian fast food market. We examine performance across different types (Consumer Foodservice, Street Stalls/Kiosks, Hotels, Institutional Catering), structures (Independent Outlet, Chained Outlet), and geographic locations. The analysis includes a detailed breakdown of market size and growth projections for each segment.

- Key Drivers of Dominance:

- Economic Policies: Government support for the hospitality industry.

- Infrastructure: Well-developed transportation networks facilitating efficient delivery.

- Tourism: High tourist influx boosting demand in major cities.

(Detailed dominance analysis for each segment will follow in the full report.)

Belgium Fast Food Industry Product Innovations

Recent innovations focus on healthier options, personalized meals, and enhanced convenience through mobile ordering and delivery. Technological trends such as AI-driven personalization and automated kitchen equipment are shaping the industry. The market is seeing increased adoption of plant-based alternatives and customized meal options to cater to evolving consumer preferences.

Report Scope & Segmentation Analysis

This report segments the Belgian fast-food market by Type (Consumer Foodservice, Street Stalls/Kiosks, Hotels, Institutional Catering) and Structure (Independent Outlet, Chained Outlet). Each segment's growth projections, market size (in € Millions), and competitive dynamics are detailed in the full report. For instance, the Consumer Foodservice segment is projected to reach €XX Million by 2033, exhibiting a CAGR of xx%.

Key Drivers of Belgium Fast Food Industry Growth

Growth is driven by rising disposable incomes, increasing urbanization, and the expanding tourism sector. Technological advancements in food delivery and online ordering further fuel market expansion. Government initiatives supporting the hospitality industry also contribute to the industry's positive outlook.

Challenges in the Belgium Fast Food Industry Sector

Challenges include intense competition, rising operational costs (including labor and raw materials), and stringent regulations. Supply chain disruptions and fluctuating food prices pose additional hurdles. The impact of these challenges on profitability and market share is quantified in the full report.

Emerging Opportunities in Belgium Fast Food Industry

Opportunities lie in expanding into underserved regions, introducing innovative food concepts and healthier options, and leveraging technological advancements for enhanced efficiency and customer experience. The growing demand for personalized and sustainable food choices presents further growth prospects.

Leading Players in the Belgium Fast Food Industry Market

- Yum! Brands Inc

- Doctor's Associates Inc

- Domino's Pizza Inc

- Burger King

- Starbucks Corporation

- Restaurant Brands International Inc

- McDonald's Corporation

- BigChefs

- Chez Léon

Key Developments in Belgium Fast Food Industry

- March 2023: BigChefs launched its first branch in Antwerp.

- May 2021: Burger King announced its plans to launch operations in Belgium, emphasizing fresh ingredients and a new ad campaign.

Future Outlook for Belgium Fast Food Industry Market

The Belgian fast-food market is poised for continued growth, driven by evolving consumer preferences, technological innovations, and strategic investments by major players. Opportunities exist for companies to capitalize on the increasing demand for healthy and convenient food options, personalized experiences, and sustainable practices. The market is expected to reach €XX Million by 2033, representing significant growth potential for both established and emerging players.

Belgium Fast Food Industry Segmentation

-

1. Type

-

1.1. Consumer Foodservice

- 1.1.1. Cafes and Bars

- 1.1.2. Full-Service Restaurants

- 1.1.3. Fast Food

- 1.1.4. Pizza Consumer Foodservice

- 1.1.5. Self-Service Cafeterias

- 1.1.6. 100% Home Delivery/Takeaway

- 1.1.7. Street Stalls/Kiosks

- 1.2. Hotels

- 1.3. Institutional (Catering)

-

1.1. Consumer Foodservice

-

2. Structure

- 2.1. Independent Outlet

- 2.2. Chained Outlet

Belgium Fast Food Industry Segmentation By Geography

- 1. Belgium

Belgium Fast Food Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Augmented Demand for Vegan Food in Restaurants; Growing Preference for Out-The-Home Consumption

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Ready Meals

- 3.4. Market Trends

- 3.4.1. Institutional (Catering) is Projected to Record a Significant Growth due to increasing per capita income.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Belgium Fast Food Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Consumer Foodservice

- 5.1.1.1. Cafes and Bars

- 5.1.1.2. Full-Service Restaurants

- 5.1.1.3. Fast Food

- 5.1.1.4. Pizza Consumer Foodservice

- 5.1.1.5. Self-Service Cafeterias

- 5.1.1.6. 100% Home Delivery/Takeaway

- 5.1.1.7. Street Stalls/Kiosks

- 5.1.2. Hotels

- 5.1.3. Institutional (Catering)

- 5.1.1. Consumer Foodservice

- 5.2. Market Analysis, Insights and Forecast - by Structure

- 5.2.1. Independent Outlet

- 5.2.2. Chained Outlet

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Belgium

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Yum! Brands Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Doctor's Associates Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Domino's Pizza Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Burger King

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Starbucks Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Restaurant Brands International Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 McDonald's Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BigChefs

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Chez Léon

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Yum! Brands Inc

List of Figures

- Figure 1: Belgium Fast Food Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Belgium Fast Food Industry Share (%) by Company 2024

List of Tables

- Table 1: Belgium Fast Food Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Belgium Fast Food Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Belgium Fast Food Industry Revenue Million Forecast, by Structure 2019 & 2032

- Table 4: Belgium Fast Food Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Belgium Fast Food Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Belgium Fast Food Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Belgium Fast Food Industry Revenue Million Forecast, by Structure 2019 & 2032

- Table 8: Belgium Fast Food Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Belgium Fast Food Industry?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the Belgium Fast Food Industry?

Key companies in the market include Yum! Brands Inc, Doctor's Associates Inc, Domino's Pizza Inc, Burger King, Starbucks Corporation, Restaurant Brands International Inc, McDonald's Corporation, BigChefs, Chez Léon.

3. What are the main segments of the Belgium Fast Food Industry?

The market segments include Type, Structure.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Augmented Demand for Vegan Food in Restaurants; Growing Preference for Out-The-Home Consumption.

6. What are the notable trends driving market growth?

Institutional (Catering) is Projected to Record a Significant Growth due to increasing per capita income..

7. Are there any restraints impacting market growth?

Increasing Demand for Ready Meals.

8. Can you provide examples of recent developments in the market?

In March 2023, BigChefs launched its first branch in Belgium in Antwerp.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Belgium Fast Food Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Belgium Fast Food Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Belgium Fast Food Industry?

To stay informed about further developments, trends, and reports in the Belgium Fast Food Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence