Key Insights

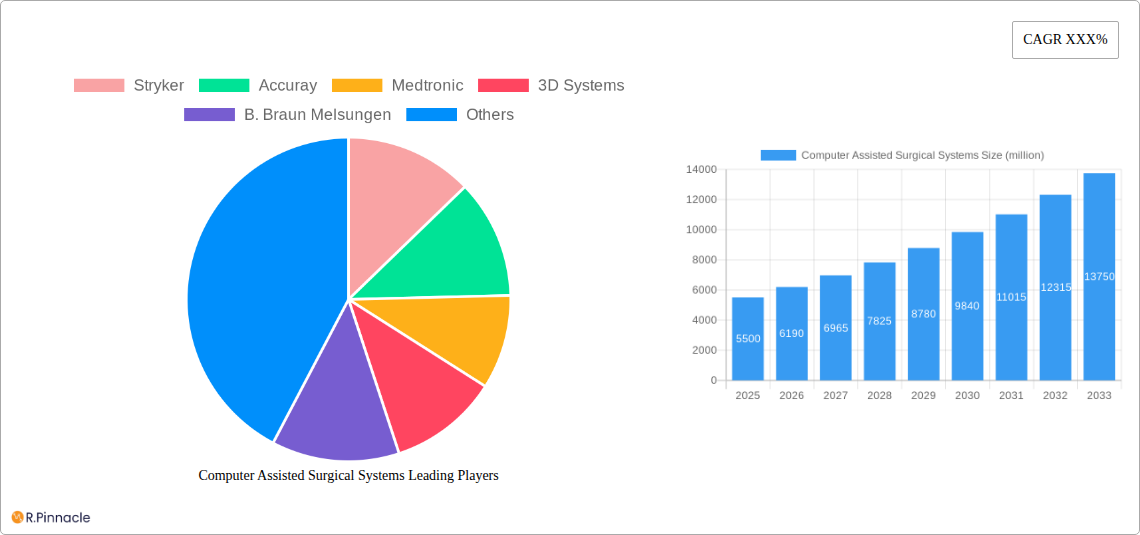

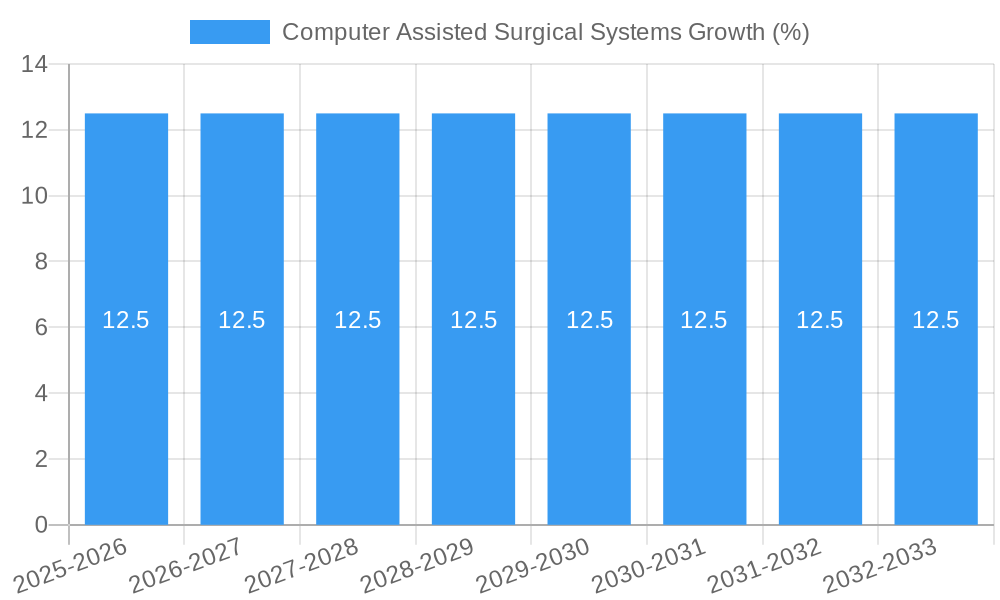

The global Computer Assisted Surgical Systems market is experiencing robust expansion, projected to reach approximately \$5,500 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 12.5% through 2033. This impressive trajectory is primarily fueled by the escalating demand for minimally invasive surgical procedures, driven by their inherent benefits such as reduced patient recovery times, lower complication rates, and enhanced precision. Advancements in robotic surgery, including improved dexterity and real-time imaging capabilities, are revolutionizing operative techniques across various specialties. The integration of artificial intelligence and machine learning is further augmenting surgical decision-making and workflow optimization, contributing significantly to market growth. Furthermore, increasing healthcare expenditure globally, coupled with a growing awareness among both surgeons and patients regarding the advantages of technologically advanced surgical solutions, is creating a fertile ground for market expansion. Government initiatives promoting the adoption of advanced medical technologies and the rising prevalence of chronic diseases requiring surgical intervention are also key contributors to this upward trend.

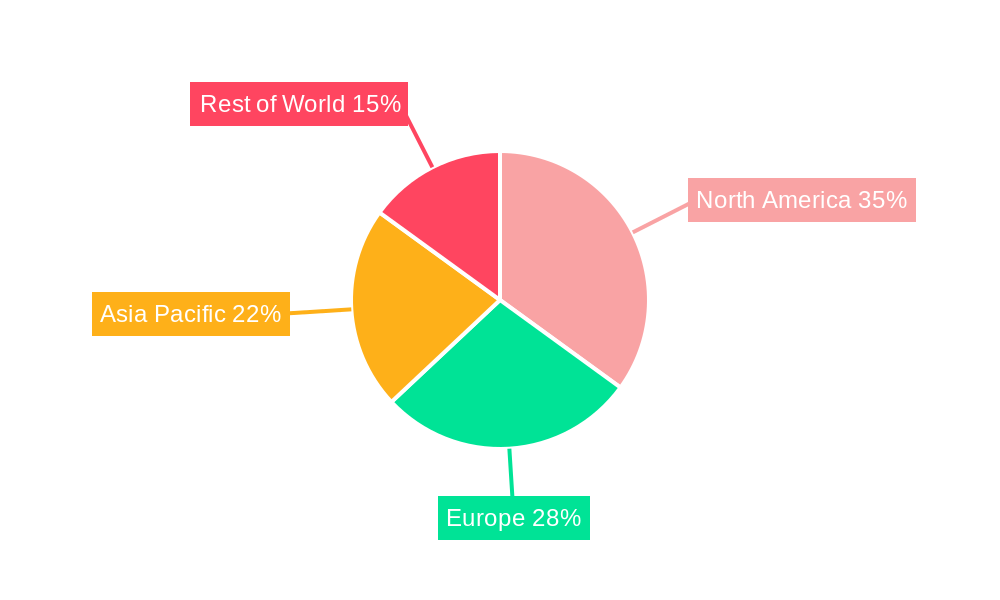

The market is segmented across diverse applications, with Neuro Surgery, ENT Surgery, Cardiac Surgery, and Spine Surgery emerging as dominant segments due to the complexity and precision required in these procedures, often necessitating the advanced capabilities offered by computer-assisted systems. Surgical navigation systems and surgical robots represent the leading type segments, reflecting the significant investment in and adoption of these sophisticated tools. Geographically, North America currently commands the largest market share, driven by early adoption of cutting-edge technologies, well-established healthcare infrastructure, and a high prevalence of complex surgical needs. However, the Asia Pacific region is poised for substantial growth, spurred by rapid economic development, increasing healthcare investments, a large patient population, and a growing number of skilled surgeons embracing these advanced technologies. Restraints, such as the high initial cost of these systems and the need for specialized training for healthcare professionals, are being progressively addressed through technological innovation, declining costs over time, and expanded training programs, paving the way for continued market penetration.

Unlock the Future of Surgery: Comprehensive Report on Computer Assisted Surgical Systems

This in-depth report offers unparalleled insights into the rapidly evolving Computer Assisted Surgical Systems market. Covering the Study Period: 2019–2033, with a Base Year of 2025 and a Forecast Period of 2025–2033, this analysis provides a definitive roadmap for industry professionals seeking to understand market dynamics, innovation trends, and growth opportunities. Dive deep into the strategies of key players like Stryker, Intuitive Surgical, and Medtronic, and understand how advancements in Surgical Navigation Systems and Surgical Robots are transforming patient care across applications like Spine Surgery and Neuro Surgery.

Computer Assisted Surgical Systems Market Structure & Innovation Trends

The Computer Assisted Surgical Systems market exhibits a dynamic structure, characterized by both established giants and agile innovators. Market concentration is moderate, with several key players holding significant market share, estimated to be over 50% collectively. Innovation drivers are primarily fueled by the relentless pursuit of enhanced surgical precision, minimally invasive techniques, and improved patient outcomes. The integration of Artificial Intelligence (AI), advanced robotics, and high-definition imaging are at the forefront of these advancements. Regulatory frameworks, though evolving, are crucial in shaping product development and market access, ensuring patient safety and efficacy.

- Market Concentration: Dominated by a few key players, with an estimated 60% of market share held by the top five companies.

- Innovation Drivers: AI integration, robotic advancements, miniaturization of surgical instruments, and sophisticated imaging technologies.

- Regulatory Landscape: FDA approvals, CE marking, and stringent quality control measures are paramount.

- Product Substitutes: While direct substitutes are limited, advancements in traditional surgical techniques pose indirect competition.

- End-User Demographics: Hospitals, ambulatory surgical centers, and specialized clinics are the primary end-users, with a growing emphasis on academic medical centers for research and adoption.

- M&A Activities: The market has seen significant merger and acquisition activities, with over $5 billion in M&A deal values recorded historically, indicating consolidation and strategic expansion.

Computer Assisted Surgical Systems Market Dynamics & Trends

The Computer Assisted Surgical Systems market is experiencing robust growth, driven by a confluence of technological breakthroughs, increasing demand for minimally invasive procedures, and a growing aging global population with a higher prevalence of surgical conditions. The market penetration of these advanced systems is steadily increasing, projected to reach over 70% in developed economies by 2033. A significant factor contributing to this expansion is the rising adoption of robotic-assisted surgeries, which offer unparalleled precision, reduced recovery times, and lower complication rates. The CAGR is estimated to be around 12% for the forecast period. Technological disruptions, such as the development of advanced haptic feedback systems and the seamless integration of augmented reality (AR) into surgical workflows, are further accelerating market adoption.

Consumer preferences are increasingly leaning towards procedures that minimize patient trauma and shorten hospital stays. This aligns perfectly with the capabilities offered by computer-assisted surgical systems. Furthermore, the growing awareness among both patients and surgeons about the benefits of these technologies is creating a positive feedback loop, encouraging further investment and development. Competitive dynamics are intensifying, with companies vying for market leadership through continuous product innovation, strategic partnerships, and expanding their global reach. The economic feasibility of these systems is also improving, with a gradual decrease in acquisition and maintenance costs, making them more accessible to a wider range of healthcare institutions. The increasing number of skilled professionals trained in operating these systems also plays a crucial role in their widespread adoption.

Dominant Regions & Segments in Computer Assisted Surgical Systems

North America currently leads the Computer Assisted Surgical Systems market, with the United States at the forefront. This dominance is attributed to a strong healthcare infrastructure, high patient expenditure on advanced medical technologies, favorable reimbursement policies, and a significant presence of leading market players like Intuitive Surgical and Stryker. The region's economic policies actively encourage research and development in the medical technology sector, fostering an environment conducive to the adoption of cutting-edge surgical solutions.

- Leading Region: North America.

- Dominant Country: United States.

- Key Drivers in North America:

- Economic Policies: Government funding for medical research and tax incentives for technology adoption.

- Infrastructure: Advanced hospital networks and a high density of specialized surgical centers.

- Reimbursement: Favorable insurance policies and reimbursement rates for robotic-assisted procedures.

- Awareness: High patient and surgeon awareness of the benefits of computer-assisted surgery.

Within the Application segmentation, Spine Surgery and Neuro Surgery are exhibiting the most substantial growth, driven by the increasing incidence of spinal deformities, degenerative diseases, and neurological disorders. The inherent complexity and delicate nature of these surgical fields make them ideal candidates for the precision and control offered by computer-assisted systems.

- Dominant Application Segments:

- Spine Surgery: Driven by an aging population and increased demand for minimally invasive spinal fusions and decompressions.

- Neuro Surgery: Characterized by the need for extreme precision in brain and spinal cord procedures, leading to higher adoption of navigation and robotic systems.

In terms of Type, Surgical Robots represent a significant and rapidly expanding segment. The increasing sophistication of robotic platforms, coupled with their versatility across various surgical specialties, is fueling their market dominance. Surgical Navigation Systems also hold a substantial share, forming the backbone of image-guided interventions.

- Dominant Type Segments:

- Surgical Robots: Characterized by rapid technological advancements, expanding applications, and a growing market presence.

- Surgical Navigation Systems: Essential for pre-operative planning and intra-operative guidance, showing steady growth.

Computer Assisted Surgical Systems Product Innovations

Product innovation in Computer Assisted Surgical Systems is characterized by the miniaturization of robotic instruments, enhanced visualization capabilities through AI-powered image processing, and the development of advanced haptic feedback systems for greater surgeon control. Companies are focusing on creating more intuitive interfaces and integrating AI algorithms to provide real-time surgical guidance. These advancements lead to increased surgical accuracy, reduced invasiveness, and improved patient recovery. Competitive advantages are being gained through proprietary robotic designs, sophisticated software platforms, and comprehensive training programs for surgical teams.

Computer Assisted Surgical Systems Report Scope & Segmentation Analysis

This comprehensive report meticulously segments the Computer Assisted Surgical Systems market across key dimensions, providing granular insights into each area. The Application segmentation includes Neuro Surgery, ENT Surgery, Cardiac Surgery, Colorectal Surgery, Spine Surgery, Craniofacial Surgery, and Other applications, each analyzed for its unique growth trajectory and adoption drivers. The Type segmentation delves into Surgical Navigation Systems, Surgical Robots, Surgical Planners & Stimulators, and Other system types, offering market sizes, growth projections, and competitive landscapes for each.

- Neuro Surgery Segment: Expected to witness a CAGR of approximately 13% due to increasing complexity and demand for precision.

- Spine Surgery Segment: Projected to grow at around 12.5% CAGR, fueled by the rising incidence of degenerative spine conditions.

- Surgical Robots Segment: Dominates the market with a significant share and is anticipated to grow at over 14% CAGR.

- Surgical Navigation Systems Segment: Essential for image-guided procedures, expected to grow at a steady pace of 10% CAGR.

Key Drivers of Computer Assisted Surgical Systems Growth

The growth of the Computer Assisted Surgical Systems market is propelled by a synergistic interplay of technological advancements, economic factors, and evolving healthcare paradigms. The relentless pursuit of precision and minimally invasive techniques in surgery is a primary catalyst.

- Technological Advancements: AI integration for enhanced imaging and decision support, development of more dexterous robotic arms, and miniaturization of surgical instruments.

- Economic Factors: Increasing healthcare expenditure globally, favorable reimbursement policies for advanced surgical procedures, and a growing demand for cost-effective, shorter hospital stays.

- Regulatory Support: Streamlined regulatory pathways for innovative medical devices in key markets.

- Demand for Minimally Invasive Surgery: Growing preference for procedures with reduced patient trauma, faster recovery times, and lower complication rates.

Challenges in the Computer Assisted Surgical Systems Sector

Despite the strong growth trajectory, the Computer Assisted Surgical Systems sector faces several significant challenges that could impede its full potential. High initial capital investment for robotic systems remains a substantial barrier for many healthcare institutions, particularly in emerging economies.

- High Initial Investment: The substantial cost of purchasing and maintaining advanced surgical systems deters widespread adoption in smaller or resource-limited facilities.

- Skilled Workforce Shortage: A limited number of surgeons and technical staff trained to operate and maintain these sophisticated systems.

- Regulatory Hurdles: Stringent and evolving regulatory approval processes can lead to lengthy product launch timelines.

- Integration Complexities: Challenges in integrating new systems with existing hospital IT infrastructure and workflows.

Emerging Opportunities in Computer Assisted Surgical Systems

The Computer Assisted Surgical Systems market is ripe with emerging opportunities, driven by innovation and the expanding scope of surgical applications. The increasing adoption of AI and machine learning within surgical platforms presents a transformative opportunity, enabling predictive analytics and personalized surgical planning.

- AI and Machine Learning Integration: Enhancing surgical precision through real-time data analysis and predictive capabilities.

- Expansion into Emerging Markets: Growing healthcare infrastructure and increasing demand for advanced medical technologies in Asia-Pacific and Latin America.

- Development of Specialized Robotic Systems: Tailoring robotic solutions for niche surgical procedures and specific anatomical regions.

- Tele-robotics and Remote Surgery: Advancements in connectivity enabling remote surgical assistance and procedures.

Leading Players in the Computer Assisted Surgical Systems Market

- Stryker

- Accuray

- Medtronic

- 3D Systems

- B. Braun Melsungen

- MAKO Surgical

- Brainlab AG

- Mazor Robotics

- CONMED

- Renishaw

- Curexo Technology

- Titan Medical

- Blue Belt Technologies

- Think Surgical

- Hocoma

- Hansen Medical

- Intuitive Surgical

- Smith & Nephew

- Hitachi Medical Systems

Key Developments in Computer Assisted Surgical Systems Industry

- 2023: Intuitive Surgical launches its next-generation da Vinci SP surgical system with enhanced single-port capabilities.

- 2023: Stryker receives FDA clearance for its new Mako SmartRobotics system for total knee arthroplasty.

- 2022: Medtronic expands its robotic-assisted surgical portfolio with advancements in spine and general surgery.

- 2022: Accuray announces significant advancements in its CyberKnife M6 platform for advanced radiotherapy.

- 2021: MAKO Surgical sees increased adoption of its robotic-arm assisted surgery systems across various orthopedic procedures.

- 2020: Brainlab AG introduces innovative software solutions for enhanced surgical navigation and planning.

Future Outlook for Computer Assisted Surgical Systems Market

The future outlook for the Computer Assisted Surgical Systems market is exceptionally promising, characterized by accelerated innovation and expanding global adoption. The continuous integration of AI, robotics, and data analytics will redefine surgical paradigms, leading to even greater precision, personalized interventions, and improved patient outcomes. The market is poised for sustained high growth, driven by an increasing demand for minimally invasive procedures, an aging global population, and the ongoing development of more accessible and versatile robotic platforms. Strategic investments in research and development, coupled with expanding market penetration in emerging economies, will be crucial for companies aiming to capitalize on the immense potential of this transformative sector.

Computer Assisted Surgical Systems Segmentation

-

1. Application

- 1.1. Neuro Surgery

- 1.2. ENT Surgery

- 1.3. Cardiac Surgery

- 1.4. Colorectal Surgery

- 1.5. Spine Surgery

- 1.6. Craniofacial Surgery

- 1.7. Other

-

2. Type

- 2.1. Surgical Navigation Systems

- 2.2. Surgical Robots

- 2.3. Surgical Planners & Stimulators

- 2.4. Other

Computer Assisted Surgical Systems Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Computer Assisted Surgical Systems REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Computer Assisted Surgical Systems Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Neuro Surgery

- 5.1.2. ENT Surgery

- 5.1.3. Cardiac Surgery

- 5.1.4. Colorectal Surgery

- 5.1.5. Spine Surgery

- 5.1.6. Craniofacial Surgery

- 5.1.7. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Surgical Navigation Systems

- 5.2.2. Surgical Robots

- 5.2.3. Surgical Planners & Stimulators

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Computer Assisted Surgical Systems Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Neuro Surgery

- 6.1.2. ENT Surgery

- 6.1.3. Cardiac Surgery

- 6.1.4. Colorectal Surgery

- 6.1.5. Spine Surgery

- 6.1.6. Craniofacial Surgery

- 6.1.7. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Surgical Navigation Systems

- 6.2.2. Surgical Robots

- 6.2.3. Surgical Planners & Stimulators

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Computer Assisted Surgical Systems Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Neuro Surgery

- 7.1.2. ENT Surgery

- 7.1.3. Cardiac Surgery

- 7.1.4. Colorectal Surgery

- 7.1.5. Spine Surgery

- 7.1.6. Craniofacial Surgery

- 7.1.7. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Surgical Navigation Systems

- 7.2.2. Surgical Robots

- 7.2.3. Surgical Planners & Stimulators

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Computer Assisted Surgical Systems Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Neuro Surgery

- 8.1.2. ENT Surgery

- 8.1.3. Cardiac Surgery

- 8.1.4. Colorectal Surgery

- 8.1.5. Spine Surgery

- 8.1.6. Craniofacial Surgery

- 8.1.7. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Surgical Navigation Systems

- 8.2.2. Surgical Robots

- 8.2.3. Surgical Planners & Stimulators

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Computer Assisted Surgical Systems Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Neuro Surgery

- 9.1.2. ENT Surgery

- 9.1.3. Cardiac Surgery

- 9.1.4. Colorectal Surgery

- 9.1.5. Spine Surgery

- 9.1.6. Craniofacial Surgery

- 9.1.7. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Surgical Navigation Systems

- 9.2.2. Surgical Robots

- 9.2.3. Surgical Planners & Stimulators

- 9.2.4. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Computer Assisted Surgical Systems Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Neuro Surgery

- 10.1.2. ENT Surgery

- 10.1.3. Cardiac Surgery

- 10.1.4. Colorectal Surgery

- 10.1.5. Spine Surgery

- 10.1.6. Craniofacial Surgery

- 10.1.7. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Surgical Navigation Systems

- 10.2.2. Surgical Robots

- 10.2.3. Surgical Planners & Stimulators

- 10.2.4. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Stryker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Accuray

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Medtronic

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 3D Systems

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 B. Braun Melsungen

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MAKO Surgical

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Brainlab AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mazor Robotics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CONMED

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Renishaw

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Curexo Technology

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Titan Medical

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Blue Belt Technologies

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Think Surgical

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Hocoma

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Hansen Medical

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Intuitive Surgical

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Smith & Nephew

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Hitachi Medical Systems

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Stryker

List of Figures

- Figure 1: Global Computer Assisted Surgical Systems Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Computer Assisted Surgical Systems Revenue (million), by Application 2024 & 2032

- Figure 3: North America Computer Assisted Surgical Systems Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Computer Assisted Surgical Systems Revenue (million), by Type 2024 & 2032

- Figure 5: North America Computer Assisted Surgical Systems Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Computer Assisted Surgical Systems Revenue (million), by Country 2024 & 2032

- Figure 7: North America Computer Assisted Surgical Systems Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Computer Assisted Surgical Systems Revenue (million), by Application 2024 & 2032

- Figure 9: South America Computer Assisted Surgical Systems Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Computer Assisted Surgical Systems Revenue (million), by Type 2024 & 2032

- Figure 11: South America Computer Assisted Surgical Systems Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Computer Assisted Surgical Systems Revenue (million), by Country 2024 & 2032

- Figure 13: South America Computer Assisted Surgical Systems Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Computer Assisted Surgical Systems Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Computer Assisted Surgical Systems Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Computer Assisted Surgical Systems Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Computer Assisted Surgical Systems Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Computer Assisted Surgical Systems Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Computer Assisted Surgical Systems Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Computer Assisted Surgical Systems Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Computer Assisted Surgical Systems Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Computer Assisted Surgical Systems Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Computer Assisted Surgical Systems Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Computer Assisted Surgical Systems Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Computer Assisted Surgical Systems Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Computer Assisted Surgical Systems Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Computer Assisted Surgical Systems Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Computer Assisted Surgical Systems Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Computer Assisted Surgical Systems Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Computer Assisted Surgical Systems Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Computer Assisted Surgical Systems Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Computer Assisted Surgical Systems Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Computer Assisted Surgical Systems Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Computer Assisted Surgical Systems Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Computer Assisted Surgical Systems Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Computer Assisted Surgical Systems Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Computer Assisted Surgical Systems Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Computer Assisted Surgical Systems Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Computer Assisted Surgical Systems Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Computer Assisted Surgical Systems Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Computer Assisted Surgical Systems Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Computer Assisted Surgical Systems Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Computer Assisted Surgical Systems Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Computer Assisted Surgical Systems Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Computer Assisted Surgical Systems Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Computer Assisted Surgical Systems Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Computer Assisted Surgical Systems Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Computer Assisted Surgical Systems Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Computer Assisted Surgical Systems Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Computer Assisted Surgical Systems Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Computer Assisted Surgical Systems Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Computer Assisted Surgical Systems?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Computer Assisted Surgical Systems?

Key companies in the market include Stryker, Accuray, Medtronic, 3D Systems, B. Braun Melsungen, MAKO Surgical, Brainlab AG, Mazor Robotics, CONMED, Renishaw, Curexo Technology, Titan Medical, Blue Belt Technologies, Think Surgical, Hocoma, Hansen Medical, Intuitive Surgical, Smith & Nephew, Hitachi Medical Systems.

3. What are the main segments of the Computer Assisted Surgical Systems?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Computer Assisted Surgical Systems," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Computer Assisted Surgical Systems report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Computer Assisted Surgical Systems?

To stay informed about further developments, trends, and reports in the Computer Assisted Surgical Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence