Key Insights

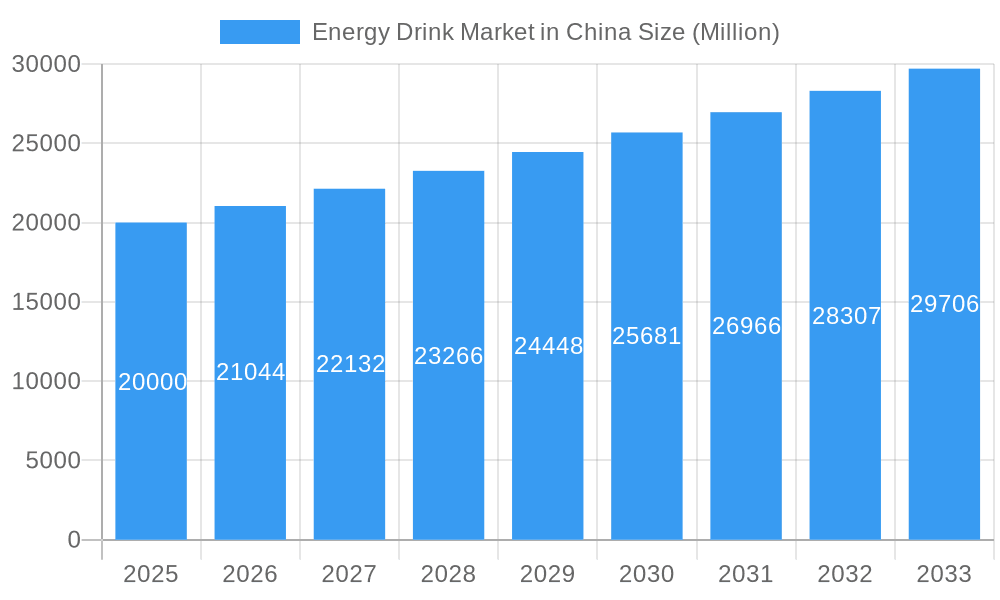

The Chinese energy drink market, valued at approximately $9.65 billion in 2024, is projected for significant expansion, with a projected Compound Annual Growth Rate (CAGR) of 8.9% from 2025 to 2033. This growth is primarily driven by a large, young adult demographic with increasing disposable income, actively seeking convenient, high-energy beverages. Evolving lifestyles, characterized by longer working hours and a greater emphasis on sports and fitness, are also boosting consumption. Supermarkets and hypermarkets currently lead distribution, but online retail is rapidly gaining traction, aligning with China's broader e-commerce surge. The competitive landscape features prominent international brands alongside strong local players and emerging names, necessitating innovation and effective digital marketing for market success.

Energy Drink Market in China Market Size (In Billion)

Key challenges include potential regulatory hurdles related to sugar content and consumer health concerns, which may moderate growth. Intense competition demands continuous product development and differentiated marketing strategies to retain consumer loyalty. Future success will depend on adapting to changing preferences, navigating regulatory environments, and optimizing distribution across China's diverse regions. Strategic alliances with local partners and a commitment to sustainable practices will further enhance competitive positioning.

Energy Drink Market in China Company Market Share

Energy Drink Market in China: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic Energy Drink Market in China, covering the period 2019-2033. It offers invaluable insights for industry professionals, investors, and strategists seeking to navigate this rapidly evolving market. The report leverages robust data and expert analysis to illuminate key trends, opportunities, and challenges within the Chinese energy drink landscape. With a focus on actionable intelligence, this report will equip you to make informed decisions and gain a competitive edge.

Energy Drink Market in China: Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Chinese energy drink market, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities. The study period is 2019-2024, with 2025 as the base year and a forecast period of 2025-2033.

Market Concentration: The market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. Red Bull and Coca-Cola, for instance, hold substantial positions. However, smaller, niche players also contribute significantly to overall market volume, particularly in regional markets. The market share of the top 5 players is estimated at xx% in 2025.

Innovation Drivers: Product innovation is a key driver, with companies focusing on functional ingredients (e.g., herbal extracts, vitamins), unique flavors catering to local preferences, and sustainable packaging solutions. The push for healthier alternatives and functional energy drinks fuels significant innovation.

Regulatory Framework: China's regulatory environment for food and beverages, including energy drinks, influences product formulation, labeling, and marketing claims. Changes in regulations can significantly impact market dynamics.

Product Substitutes: Other caffeinated beverages (coffee, tea) and functional drinks pose competition. The market also sees increased presence of "healthy" energy alternatives.

End-User Demographics: The primary consumer base skews towards young adults (18-35 years), with increasing interest from health-conscious consumers driving the demand for healthier options.

M&A Activities: The market has witnessed several M&A activities in recent years, with deal values ranging from xx Million to xx Million USD. These activities reflect strategic attempts by larger players to expand their market presence and product portfolios.

Energy Drink Market in China: Market Dynamics & Trends

This section delves into the market's growth drivers, technological disruptions, evolving consumer preferences, and competitive dynamics. The report uses data from 2019 to 2024 to project market trends until 2033.

The Chinese energy drink market exhibits robust growth, fueled by rising disposable incomes, a growing young population, increasing urbanization, and a shift towards westernized lifestyles. The market's CAGR during the historical period (2019-2024) was estimated at xx%, and it's projected to maintain a CAGR of xx% during the forecast period (2025-2033). Market penetration is estimated at xx% in 2025. Technological advancements in product formulation, packaging, and distribution channels contribute to market expansion. Changing consumer preferences towards healthier options, functional ingredients, and unique flavors influence product development strategies. Intense competition among established and emerging players shapes pricing strategies and marketing initiatives.

Dominant Regions & Segments in Energy Drink Market in China

This section identifies the leading regions and distribution channels within the Chinese energy drink market.

Dominant Region: The coastal regions (e.g., Guangdong, Jiangsu, Zhejiang) represent the largest market share due to higher population density, economic development, and consumer spending. However, growth is evident in other regions too.

Dominant Distribution Channels:

- Convenience/Grocery Stores: This channel holds the largest market share, benefiting from its extensive reach and convenience.

- Supermarkets/Hypermarkets: This channel is crucial for larger volume purchases and offers a wide range of brands and sizes.

- Online Retail Stores: This segment is rapidly growing, driven by e-commerce expansion and consumer preference for online shopping.

- Pharmacies and Drug Stores: A smaller but stable segment, driven by the association of some energy drinks with functional benefits.

- Other Distribution Channels: This includes vending machines, food service establishments, and direct-to-consumer sales.

Key Drivers: Rapid urbanization, expanding retail infrastructure, rising disposable incomes, and increasing e-commerce penetration are pivotal drivers for growth across all channels.

Energy Drink Market in China: Product Innovations

The Chinese energy drink market witnesses continuous product innovation. New product launches often focus on incorporating functional ingredients like herbal extracts, vitamins, and antioxidants, catering to the health-conscious consumer. There's a significant emphasis on unique flavors and customized packaging appealing to diverse consumer preferences. The integration of technology, from improved manufacturing processes to enhanced packaging, further contributes to innovation. These trends aim to create a competitive advantage and cater to the evolving demand for healthier, more functional energy drinks.

Report Scope & Segmentation Analysis

This report segments the Chinese energy drink market based on distribution channels: Supermarkets/Hypermarkets, Pharmacies and Drug Stores, Convenience/Grocery Stores, Online Retail Stores, and Other Distribution Channels. Each segment's growth projections, market sizes, and competitive dynamics are analyzed, offering a granular view of the market.

- Supermarkets/Hypermarkets: This segment displays steady growth, driven by increasing consumer preference for branded products and bulk purchases.

- Pharmacies and Drug Stores: This niche segment experiences moderate growth, influenced by energy drinks with claimed health benefits.

- Convenience/Grocery Stores: This segment demonstrates the highest growth rate, leveraging wide reach and impulse buying.

- Online Retail Stores: This rapidly expanding segment benefits from e-commerce penetration and convenience.

- Other Distribution Channels: This segment's growth mirrors overall market expansion.

Key Drivers of Energy Drink Market in China Growth

Several factors propel the growth of China's energy drink market. Rising disposable incomes empower consumers to spend more on discretionary items, including energy drinks. A burgeoning young adult population, with its active lifestyle and inclination towards Western-style products, fuels demand. The rapid expansion of e-commerce and sophisticated logistics networks facilitates wider product accessibility. Government policies fostering economic growth and promoting consumption contribute significantly to market expansion.

Challenges in the Energy Drink Market in China Sector

Despite robust growth, the energy drink market faces several challenges. Stringent regulations on food and beverage products, including labeling requirements and health claims, require considerable compliance efforts. Maintaining a stable and efficient supply chain can be problematic, given the market's geographic scale and logistical complexities. Intense competition among established brands and emerging players creates pressure on pricing strategies and marketing efforts. Concerns about the health impacts of excessive energy drink consumption can dampen demand among health-conscious consumers.

Emerging Opportunities in Energy Drink Market in China

The Chinese energy drink market presents several promising opportunities. The increasing demand for healthier and functional energy drinks opens avenues for new product development. The growing popularity of online retail channels offers potential for expansion into new markets. The development of sustainable and eco-friendly packaging solutions creates a niche for differentiation. Targeting niche demographics, like athletes or health-conscious consumers, provides opportunities for specialized product lines.

Leading Players in the Energy Drink Market in China Market

- Eastroc Super drink

- Otsuka Pharmaceutical

- Red Bull

- PepsiCo

- Southland Trade Company Ltd

- Taisho Pharmaceutical California Inc

- Coca-Cola

- Hangzhou Wahaha Group Co Ltd

- Daly Foods Group

- Monster Energy Company

Key Developments in Energy Drink Market in China Industry

- November 2021: Jianlibao Group launched a "super energy drink" featuring small molecular peptides, emphasizing health and immunity benefits. This reflects the increasing demand for functional energy drinks.

- April 2021: Tonino Lamborghini launched an energy drink in China, leveraging its brand recognition to tap into the premium segment of the market. This highlights the strategy of established brands entering the energy drink sector.

Future Outlook for Energy Drink Market in China Market

The future of China's energy drink market looks promising. Continued economic growth, rising disposable incomes, and evolving consumer preferences will contribute to market expansion. The focus on functional ingredients, health benefits, and sustainable packaging will define product development. The penetration of e-commerce channels and improved logistics will expand market access. The market is expected to witness continued growth, driven by innovation and strategic positioning by key players.

Energy Drink Market in China Segmentation

-

1. Distribution Channels

- 1.1. Supermarkets/ Hypermarkets

- 1.2. Pharmacies and Drug Stores

- 1.3. Convenience/Grocery Stores

- 1.4. Online Retail Stores

- 1.5. Other Distribution Channels

Energy Drink Market in China Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Energy Drink Market in China Regional Market Share

Geographic Coverage of Energy Drink Market in China

Energy Drink Market in China REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits

- 3.3. Market Restrains

- 3.3.1. Affordability of the Product is Restraining the Market's Growth

- 3.4. Market Trends

- 3.4.1. Rising Health Awareness Supporting Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Energy Drink Market in China Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channels

- 5.1.1. Supermarkets/ Hypermarkets

- 5.1.2. Pharmacies and Drug Stores

- 5.1.3. Convenience/Grocery Stores

- 5.1.4. Online Retail Stores

- 5.1.5. Other Distribution Channels

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channels

- 6. North America Energy Drink Market in China Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channels

- 6.1.1. Supermarkets/ Hypermarkets

- 6.1.2. Pharmacies and Drug Stores

- 6.1.3. Convenience/Grocery Stores

- 6.1.4. Online Retail Stores

- 6.1.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channels

- 7. South America Energy Drink Market in China Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channels

- 7.1.1. Supermarkets/ Hypermarkets

- 7.1.2. Pharmacies and Drug Stores

- 7.1.3. Convenience/Grocery Stores

- 7.1.4. Online Retail Stores

- 7.1.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channels

- 8. Europe Energy Drink Market in China Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channels

- 8.1.1. Supermarkets/ Hypermarkets

- 8.1.2. Pharmacies and Drug Stores

- 8.1.3. Convenience/Grocery Stores

- 8.1.4. Online Retail Stores

- 8.1.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channels

- 9. Middle East & Africa Energy Drink Market in China Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channels

- 9.1.1. Supermarkets/ Hypermarkets

- 9.1.2. Pharmacies and Drug Stores

- 9.1.3. Convenience/Grocery Stores

- 9.1.4. Online Retail Stores

- 9.1.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channels

- 10. Asia Pacific Energy Drink Market in China Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channels

- 10.1.1. Supermarkets/ Hypermarkets

- 10.1.2. Pharmacies and Drug Stores

- 10.1.3. Convenience/Grocery Stores

- 10.1.4. Online Retail Stores

- 10.1.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channels

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Eastroc Super drink*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Otsuka Pharmaceutical

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Red Bull

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PepsiCo

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Southland Trade Company Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Taisho Pharmaceutical California Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Coca-Cola

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hangzhou Wahaha Group Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Daly Foods Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Monster Energy Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Eastroc Super drink*List Not Exhaustive

List of Figures

- Figure 1: Global Energy Drink Market in China Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Energy Drink Market in China Revenue (billion), by Distribution Channels 2025 & 2033

- Figure 3: North America Energy Drink Market in China Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 4: North America Energy Drink Market in China Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Energy Drink Market in China Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Energy Drink Market in China Revenue (billion), by Distribution Channels 2025 & 2033

- Figure 7: South America Energy Drink Market in China Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 8: South America Energy Drink Market in China Revenue (billion), by Country 2025 & 2033

- Figure 9: South America Energy Drink Market in China Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Energy Drink Market in China Revenue (billion), by Distribution Channels 2025 & 2033

- Figure 11: Europe Energy Drink Market in China Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 12: Europe Energy Drink Market in China Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Energy Drink Market in China Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Energy Drink Market in China Revenue (billion), by Distribution Channels 2025 & 2033

- Figure 15: Middle East & Africa Energy Drink Market in China Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 16: Middle East & Africa Energy Drink Market in China Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa Energy Drink Market in China Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Energy Drink Market in China Revenue (billion), by Distribution Channels 2025 & 2033

- Figure 19: Asia Pacific Energy Drink Market in China Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 20: Asia Pacific Energy Drink Market in China Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific Energy Drink Market in China Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Energy Drink Market in China Revenue billion Forecast, by Distribution Channels 2020 & 2033

- Table 2: Global Energy Drink Market in China Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Energy Drink Market in China Revenue billion Forecast, by Distribution Channels 2020 & 2033

- Table 4: Global Energy Drink Market in China Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Energy Drink Market in China Revenue billion Forecast, by Distribution Channels 2020 & 2033

- Table 9: Global Energy Drink Market in China Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Energy Drink Market in China Revenue billion Forecast, by Distribution Channels 2020 & 2033

- Table 14: Global Energy Drink Market in China Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Energy Drink Market in China Revenue billion Forecast, by Distribution Channels 2020 & 2033

- Table 25: Global Energy Drink Market in China Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Energy Drink Market in China Revenue billion Forecast, by Distribution Channels 2020 & 2033

- Table 33: Global Energy Drink Market in China Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Energy Drink Market in China Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Energy Drink Market in China?

The projected CAGR is approximately 8.9%.

2. Which companies are prominent players in the Energy Drink Market in China?

Key companies in the market include Eastroc Super drink*List Not Exhaustive, Otsuka Pharmaceutical, Red Bull, PepsiCo, Southland Trade Company Ltd, Taisho Pharmaceutical California Inc, Coca-Cola, Hangzhou Wahaha Group Co Ltd, Daly Foods Group, Monster Energy Company.

3. What are the main segments of the Energy Drink Market in China?

The market segments include Distribution Channels.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.65 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits.

6. What are the notable trends driving market growth?

Rising Health Awareness Supporting Market Demand.

7. Are there any restraints impacting market growth?

Affordability of the Product is Restraining the Market's Growth.

8. Can you provide examples of recent developments in the market?

November 2021: Jianlibao Group launched a "super energy drink" in China, jointly developed with China Food Fermentation Industry Research Institute (CFFIRI). The company claims that the product includes small molecular peptides, including collagen peptides, wheat oligopeptides, and soybean peptides, that enhance immunity, promote and maintain normal cell metabolism, repair damaged cells, and help athletes add sports vitality and return to a good state.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Energy Drink Market in China," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Energy Drink Market in China report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Energy Drink Market in China?

To stay informed about further developments, trends, and reports in the Energy Drink Market in China, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence