Key Insights

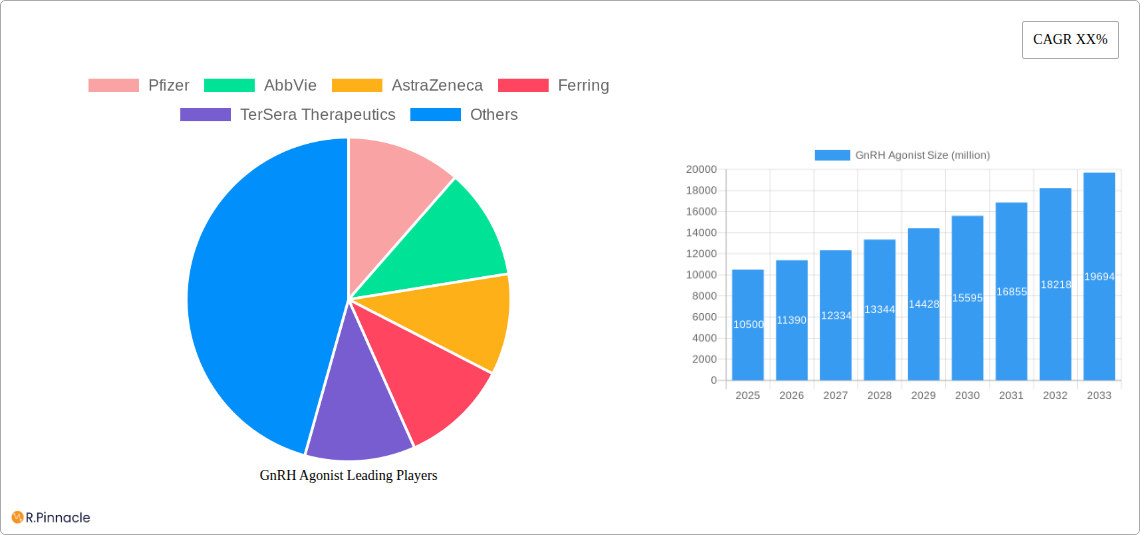

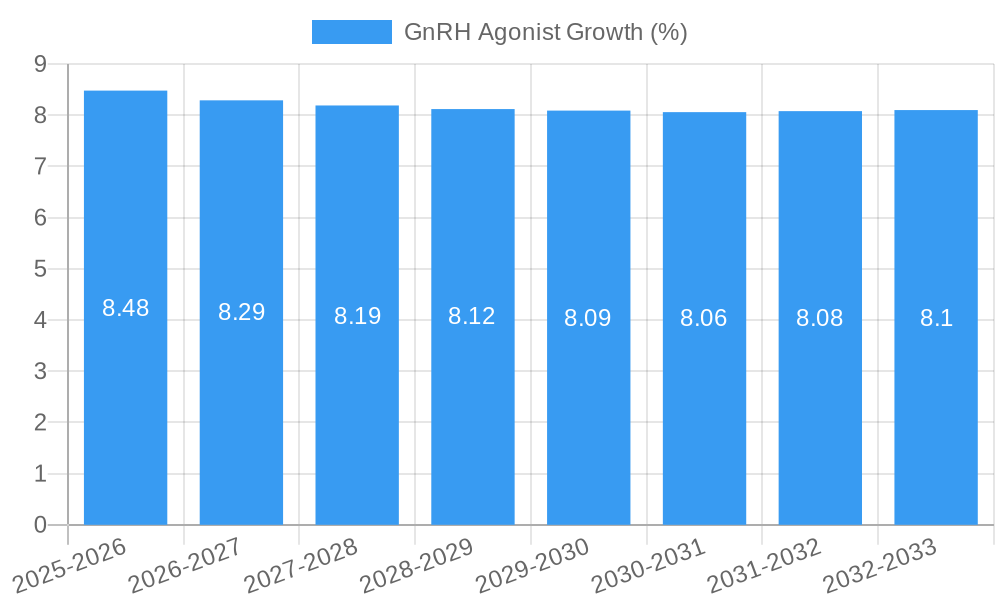

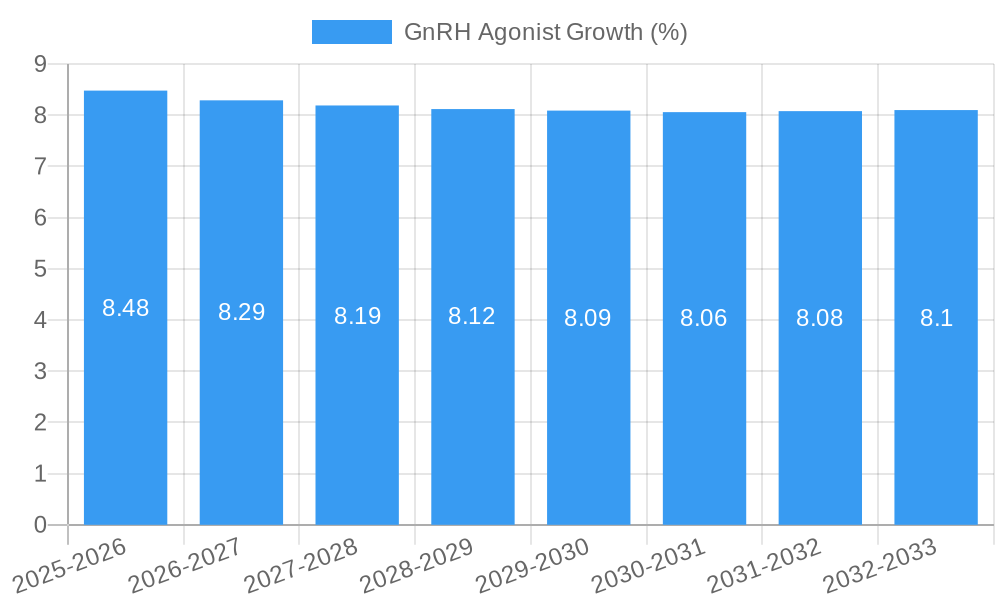

The global GnRH agonist market is experiencing robust growth, projected to reach an estimated $10,500 million in 2025 and expand at a Compound Annual Growth Rate (CAGR) of approximately 8.5% through 2033. This significant expansion is primarily driven by the increasing prevalence of hormone-dependent cancers such as prostate and breast cancer, as well as the rising incidence of endometriosis and uterine fibroids. The growing awareness and adoption of advanced treatment options for these conditions, coupled with favorable reimbursement policies in developed regions, are further propelling market growth. The veterinary application segment is also contributing to market expansion due to the use of GnRH agonists in animal reproduction management and cancer treatment. Key players in the market are actively engaged in research and development to introduce novel formulations and expand the therapeutic applications of GnRH agonists, ensuring a continuous pipeline of innovative treatments.

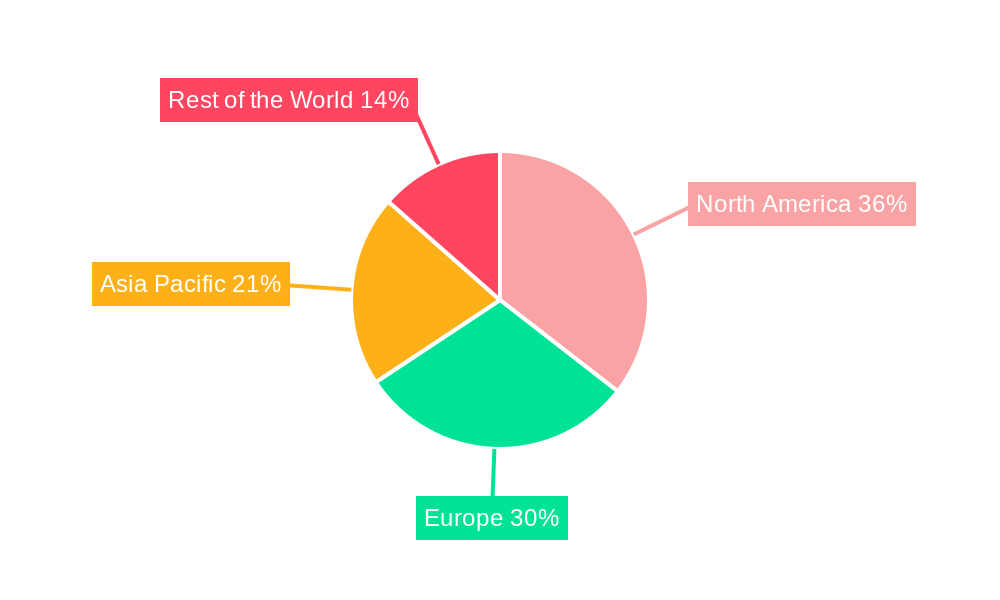

The market landscape is characterized by intense competition among established pharmaceutical giants and emerging players, fostering innovation and driving down treatment costs. Geographically, North America currently holds the largest market share, driven by high healthcare spending and early adoption of advanced medical technologies. Europe follows closely, with a strong focus on research and development and a growing patient population requiring GnRH agonist therapies. Asia Pacific is anticipated to witness the fastest growth due to increasing healthcare infrastructure, rising disposable incomes, and a growing patient pool. However, challenges such as high treatment costs and the availability of alternative therapies pose restraints to market growth. Despite these hurdles, the inherent efficacy of GnRH agonists in managing chronic and debilitating conditions ensures their continued importance and sustained market demand.

Here is your SEO-optimized, reader-centric report description for the GnRH Agonist market, designed for immediate use:

GnRH Agonist Market Structure & Innovation Trends

The GnRH Agonist market is characterized by a moderate to high level of concentration, with key players like Pfizer, AbbVie, and AstraZeneca holding significant market shares. Innovation is a primary driver, fueled by ongoing research into novel formulations, delivery systems, and expanded therapeutic applications. Regulatory frameworks, established by bodies such as the FDA and EMA, play a crucial role in market access and product approval, influencing the pace of new product introductions. The threat of product substitutes is relatively low, given the specific therapeutic mechanisms of GnRH agonists. End-user demographics primarily include adult patients with hormone-sensitive conditions, with a growing focus on the veterinary segment for animal health applications. Mergers and acquisitions (M&A) are strategic tools for market consolidation and portfolio expansion, with recent deal values estimated in the range of hundreds of millions of dollars. For instance, a recent M&A transaction involved a value of approximately $500 million, aiming to strengthen market presence in oncology.

- Market Concentration: Moderate to High

- Innovation Drivers: Novel formulations, advanced delivery systems, expanded therapeutic indications.

- Regulatory Impact: Crucial for market entry and product lifecycle management.

- Product Substitutes: Low threat due to specialized action.

- End-User Focus: Human oncology and reproductive health, growing veterinary applications.

- M&A Activity: Strategic for market share acquisition and technology integration, with deal values in the hundreds of millions of dollars.

GnRH Agonist Market Dynamics & Trends

The global GnRH Agonist market is experiencing robust growth, driven by an increasing prevalence of hormone-dependent diseases such as prostate cancer, breast cancer, and endometriosis, alongside rising awareness and improved diagnostic capabilities. Technological advancements in drug delivery, including long-acting injectable formulations and implantable devices, are significantly enhancing patient compliance and treatment efficacy, contributing to market penetration. Consumer preferences are shifting towards less invasive and more convenient treatment options, which GnRH agonists are increasingly offering. The competitive landscape is dynamic, with established pharmaceutical giants and emerging biotechnology firms vying for market share through product differentiation, strategic partnerships, and research and development investments. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period, expanding from an estimated market size of $4,000 million in the base year of 2025 to over $7,000 million by 2033. Market penetration in developed regions is already high, but significant growth opportunities exist in emerging economies due to improving healthcare infrastructure and increasing access to advanced treatments. Continuous innovation in peptide synthesis and formulation science is expected to unlock new therapeutic avenues and further solidify the market's expansion. The market's trajectory is also influenced by evolving treatment guidelines and the development of combination therapies.

Dominant Regions & Segments in GnRH Agonist

North America is the dominant region in the GnRH Agonist market, primarily driven by the high prevalence of hormone-sensitive cancers, advanced healthcare infrastructure, and significant R&D investments. The United States, in particular, accounts for a substantial portion of regional market share, fueled by widespread adoption of advanced therapies and favorable reimbursement policies. Within the Applications segment, "For Human" applications hold the largest market share, driven by the extensive use of GnRH agonists in treating prostate cancer, breast cancer, uterine fibroids, and endometriosis. The "For Veterinary" segment, while smaller, is demonstrating a promising growth trajectory due to increasing awareness of animal health and the application of these agonists in reproductive management and certain animal cancers.

Regarding Types, Prostap and Zoladex (Goserelin) are currently leading segments, benefiting from their established efficacy, long history of use, and broad clinical acceptance in treating various hormone-dependent conditions. Triptorelin also holds a significant market position, particularly with its availability in different formulations and its application in pediatric endocrinology.

- Dominant Region: North America (USA leading)

- Key Drivers: High disease prevalence, advanced healthcare, robust R&D, favorable reimbursement.

- Dominant Application Segment: For Human

- Key Drivers: Widespread use in oncology (prostate, breast), gynecology (endometriosis, fibroids), and pediatric endocrinology.

- Growing Application Segment: For Veterinary

- Key Drivers: Increasing focus on animal health, reproductive management, and veterinary oncology.

- Leading Type Segments: Prostap, Zoladex (Goserelin)

- Key Drivers: Established efficacy, broad clinical adoption, diverse formulations.

- Significant Type Segment: Triptorelin

- Key Drivers: Versatile applications, pediatric use, formulation variety.

GnRH Agonist Product Innovations

Recent product innovations in the GnRH Agonist market focus on improving patient convenience and treatment outcomes. Advancements include the development of novel long-acting depot formulations, such as one-year implants and monthly injections, which reduce the frequency of administration and enhance adherence. Research into targeted delivery systems and combination therapies aims to optimize efficacy and minimize side effects. For instance, new formulations are being explored to provide sustained therapeutic levels for extended periods, offering a distinct competitive advantage. These innovations address unmet clinical needs and expand the therapeutic potential of GnRH agonists across various indications.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the GnRH Agonist market, segmented by Application and Type.

Application Segment:

- For Human: This segment encompasses GnRH agonists used in human medicine for conditions like prostate cancer, breast cancer, endometriosis, uterine fibroids, and precocious puberty. Projections indicate continued strong growth due to increasing disease incidence and wider acceptance of hormonal therapies, with an estimated market size of $3,800 million in 2025.

- For Veterinary: This segment includes GnRH agonists used in animal health for reproductive management, fertility control, and treatment of certain cancers in animals. Expected to witness a significant CAGR of approximately 8%, driven by a growing pet population and advancements in veterinary care, reaching an estimated $200 million in 2025.

Type Segment:

- Prostap: A well-established segment with strong market presence, particularly in oncology. Expected to maintain its leadership with continued demand and ongoing clinical use.

- Zoladex (Goserelin): A leading GnRH agonist with a broad range of applications and a strong global footprint. Expected to see steady growth due to its proven efficacy and widespread physician adoption.

- Triptorelin: A versatile segment with applications in both human and veterinary medicine, including pediatric use. Expected to experience robust growth driven by new formulations and expanded indications.

- Histrelin: Primarily used for precocious puberty and prostate cancer, this segment is projected to grow steadily with increasing diagnosis rates.

- Nafarelin: Primarily used for endometriosis and precocious puberty, this segment is expected to see moderate growth.

- Others: This category includes other GnRH agonists and emerging compounds, representing a potential growth area as research and development continue.

Key Drivers of GnRH Agonist Growth

The GnRH Agonist market is propelled by several key drivers. The increasing incidence of hormone-dependent cancers, such as prostate and breast cancer, directly fuels demand for GnRH agonists as a primary therapeutic intervention. Advancements in drug delivery technologies, leading to longer-acting formulations and improved patient compliance, are significantly expanding market reach and patient acceptance. Furthermore, the growing understanding of GnRH agonist applications beyond oncology, including in reproductive health and other endocrine disorders, is opening new avenues for market growth. Favorable regulatory approvals and evolving treatment guidelines supporting the use of these agents also contribute to market expansion.

Challenges in the GnRH Agonist Sector

Despite its growth, the GnRH Agonist sector faces several challenges. High manufacturing costs associated with complex peptide synthesis can impact pricing and accessibility, especially in emerging markets. Stringent regulatory hurdles for new drug approvals, requiring extensive clinical trials, can delay market entry and increase development expenses. Competitive pressures from alternative therapies, including newer targeted treatments and immunotherapies, pose a threat to market share. Moreover, managing the side effects associated with GnRH agonist therapy, such as hot flashes and bone density loss, remains a critical concern for both patients and healthcare providers, necessitating careful patient monitoring and management strategies. Supply chain complexities and potential disruptions can also impact market stability.

Emerging Opportunities in GnRH Agonist

Emerging opportunities in the GnRH Agonist market lie in the development of novel, next-generation agonists with improved efficacy and reduced side effect profiles. The expanding application in veterinary medicine for reproductive health management and the potential for treating rare endocrine disorders present significant untapped markets. Furthermore, the exploration of combination therapies, integrating GnRH agonists with other treatment modalities, offers a promising avenue for enhanced therapeutic outcomes. Geographic expansion into underserved emerging markets, where the prevalence of hormone-dependent diseases is rising, also represents a substantial growth opportunity.

Leading Players in the GnRH Agonist Market

- Pfizer

- AbbVie

- AstraZeneca

- Ferring Pharmaceuticals

- TerSera Therapeutics

- Astellas Pharma

- Takeda Pharmaceutical Company

- LIVZON Pharmaceutical Group

- Ipsen

- Sanofi

- Endo International plc

- Tocris Bioscience

- Sigma-Aldrich

- MedChem Express

- Arbor Pharmaceuticals

Key Developments in GnRH Agonist Industry

- 2024 (Q1): Launch of a new extended-release formulation of Triptorelin for endometriosis by Ferring Pharmaceuticals, improving patient convenience.

- 2023 (Q4): AbbVie announced positive Phase III trial results for a novel GnRH antagonist in prostate cancer, potentially offering a new treatment paradigm.

- 2023 (Q3): AstraZeneca acquired a stake in a biotech firm focusing on novel peptide delivery systems, signaling strategic interest in GnRH agonist advancements.

- 2023 (Q2): Astellas Pharma secured regulatory approval for an expanded indication of its GnRH agonist in pediatric oncology in key European markets.

- 2023 (Q1): TerSera Therapeutics entered into a strategic partnership to enhance the manufacturing capabilities of its GnRH agonist portfolio.

- 2022 (Q4): LIVZON launched a biosimilar GnRH agonist in China, increasing market competition and accessibility.

- 2022 (Q3): Ipsen reported significant growth in its endocrinology division, driven by strong sales of its GnRH agonist products.

- 2022 (Q2): Sanofi announced a collaboration to explore novel applications of GnRH agonists in neurodegenerative diseases.

Future Outlook for GnRH Agonist Market

The future outlook for the GnRH Agonist market remains exceptionally positive, driven by an aging global population and the persistent rise in hormone-sensitive diseases. Continued investment in research and development will undoubtedly lead to more refined and targeted therapies, potentially expanding the therapeutic utility of GnRH agonists to new disease areas. The increasing focus on personalized medicine and the development of companion diagnostics will further enhance treatment efficacy and patient outcomes. Strategic collaborations and potential acquisitions will continue to shape the competitive landscape, leading to market consolidation and innovation. The growth acceleration is expected to be sustained by advancements in drug delivery, increased access in emerging markets, and the development of combination therapies, projecting a market size exceeding $10,000 million by 2033.

GnRH Agonist Segmentation

-

1. Application

- 1.1. For Human

- 1.2. For Veterinary

-

2. Types

- 2.1. Prostap

- 2.2. Zoladex

- 2.3. Triptorelin

- 2.4. Histrelin

- 2.5. Nafarelin

- 2.6. Others

GnRH Agonist Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

GnRH Agonist REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GnRH Agonist Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. For Human

- 5.1.2. For Veterinary

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Prostap

- 5.2.2. Zoladex

- 5.2.3. Triptorelin

- 5.2.4. Histrelin

- 5.2.5. Nafarelin

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America GnRH Agonist Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. For Human

- 6.1.2. For Veterinary

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Prostap

- 6.2.2. Zoladex

- 6.2.3. Triptorelin

- 6.2.4. Histrelin

- 6.2.5. Nafarelin

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America GnRH Agonist Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. For Human

- 7.1.2. For Veterinary

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Prostap

- 7.2.2. Zoladex

- 7.2.3. Triptorelin

- 7.2.4. Histrelin

- 7.2.5. Nafarelin

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe GnRH Agonist Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. For Human

- 8.1.2. For Veterinary

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Prostap

- 8.2.2. Zoladex

- 8.2.3. Triptorelin

- 8.2.4. Histrelin

- 8.2.5. Nafarelin

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa GnRH Agonist Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. For Human

- 9.1.2. For Veterinary

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Prostap

- 9.2.2. Zoladex

- 9.2.3. Triptorelin

- 9.2.4. Histrelin

- 9.2.5. Nafarelin

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific GnRH Agonist Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. For Human

- 10.1.2. For Veterinary

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Prostap

- 10.2.2. Zoladex

- 10.2.3. Triptorelin

- 10.2.4. Histrelin

- 10.2.5. Nafarelin

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Pfizer

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AbbVie

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AstraZeneca

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ferring

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TerSera Therapeutics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Astellas Pharma

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Takeda

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LIVZON

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ipsen

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sanofi

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Endo

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Tocris Bioscience

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sigma-Aldrich

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 MedChem Express

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Arbor Pharmaceuticals

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Pfizer

List of Figures

- Figure 1: Global GnRH Agonist Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America GnRH Agonist Revenue (million), by Application 2024 & 2032

- Figure 3: North America GnRH Agonist Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America GnRH Agonist Revenue (million), by Types 2024 & 2032

- Figure 5: North America GnRH Agonist Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America GnRH Agonist Revenue (million), by Country 2024 & 2032

- Figure 7: North America GnRH Agonist Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America GnRH Agonist Revenue (million), by Application 2024 & 2032

- Figure 9: South America GnRH Agonist Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America GnRH Agonist Revenue (million), by Types 2024 & 2032

- Figure 11: South America GnRH Agonist Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America GnRH Agonist Revenue (million), by Country 2024 & 2032

- Figure 13: South America GnRH Agonist Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe GnRH Agonist Revenue (million), by Application 2024 & 2032

- Figure 15: Europe GnRH Agonist Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe GnRH Agonist Revenue (million), by Types 2024 & 2032

- Figure 17: Europe GnRH Agonist Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe GnRH Agonist Revenue (million), by Country 2024 & 2032

- Figure 19: Europe GnRH Agonist Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa GnRH Agonist Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa GnRH Agonist Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa GnRH Agonist Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa GnRH Agonist Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa GnRH Agonist Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa GnRH Agonist Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific GnRH Agonist Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific GnRH Agonist Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific GnRH Agonist Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific GnRH Agonist Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific GnRH Agonist Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific GnRH Agonist Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global GnRH Agonist Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global GnRH Agonist Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global GnRH Agonist Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global GnRH Agonist Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global GnRH Agonist Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global GnRH Agonist Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global GnRH Agonist Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global GnRH Agonist Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global GnRH Agonist Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global GnRH Agonist Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global GnRH Agonist Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global GnRH Agonist Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global GnRH Agonist Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global GnRH Agonist Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global GnRH Agonist Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global GnRH Agonist Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global GnRH Agonist Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global GnRH Agonist Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global GnRH Agonist Revenue million Forecast, by Country 2019 & 2032

- Table 41: China GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific GnRH Agonist Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GnRH Agonist?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the GnRH Agonist?

Key companies in the market include Pfizer, AbbVie, AstraZeneca, Ferring, TerSera Therapeutics, Astellas Pharma, Takeda, LIVZON, Ipsen, Sanofi, Endo, Tocris Bioscience, Sigma-Aldrich, MedChem Express, Arbor Pharmaceuticals.

3. What are the main segments of the GnRH Agonist?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GnRH Agonist," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GnRH Agonist report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GnRH Agonist?

To stay informed about further developments, trends, and reports in the GnRH Agonist, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence