Key Insights

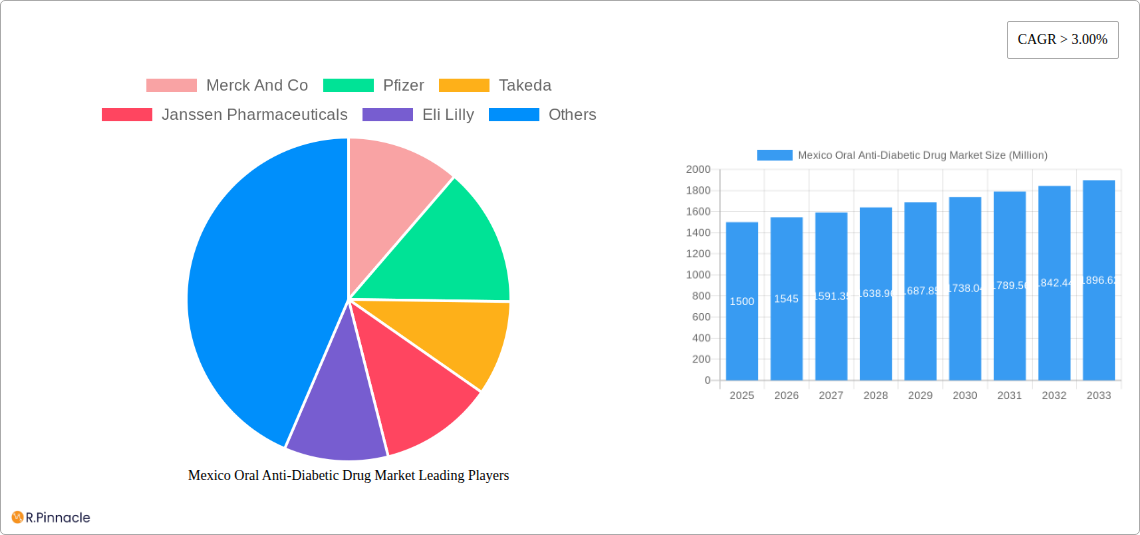

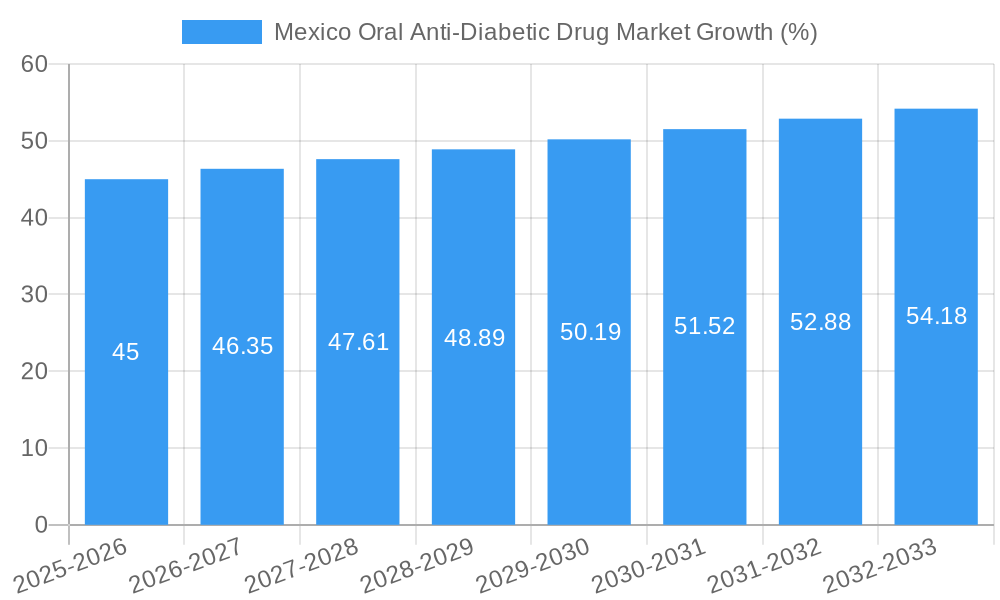

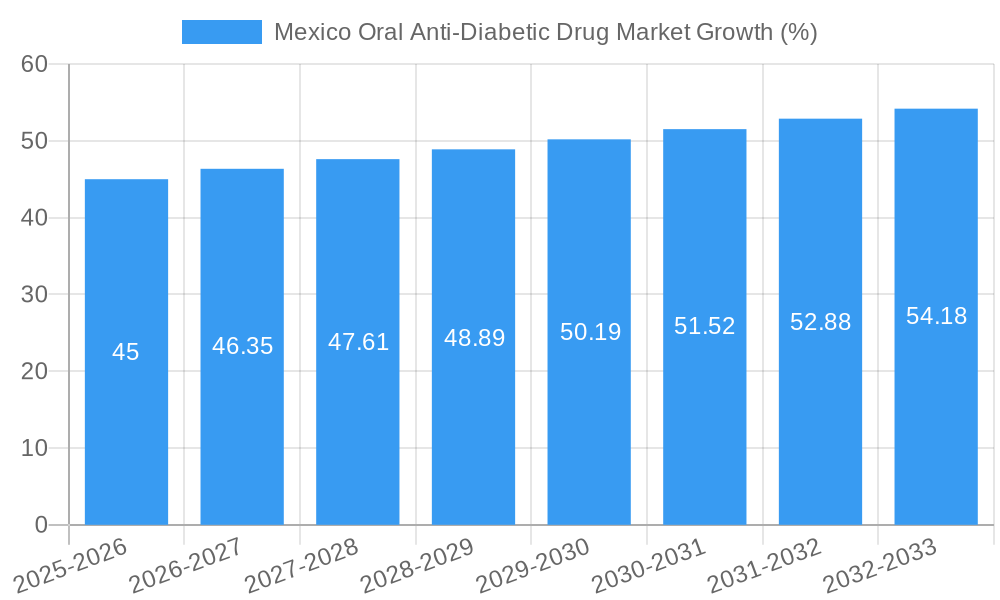

The Mexico oral anti-diabetic drug market, valued at $1.5 billion in 2025, exhibits robust growth potential, driven by a rising prevalence of type 2 diabetes fueled by lifestyle changes and an aging population. A Compound Annual Growth Rate (CAGR) exceeding 3% is projected through 2033, indicating a significant expansion of this market. Key drivers include increased healthcare expenditure, growing awareness of diabetes management, and the launch of innovative drugs offering improved efficacy and safety profiles. Market segmentation reveals strong demand across various drug classes, including DPP-4 inhibitors (like Ipragliflozin), SGLT-2 inhibitors, sulfonylureas, metformin, meglitinides, alpha-glucosidase inhibitors, and biguanides. The competitive landscape is characterized by the presence of major pharmaceutical players such as Merck, Pfizer, Novo Nordisk, and Sanofi, all vying for market share through aggressive marketing, clinical trials, and strategic partnerships. While the market faces restraints like high drug costs and the potential for side effects associated with certain medications, the overall outlook remains positive due to the escalating diabetes burden in Mexico and ongoing advancements in therapeutic approaches.

The substantial market expansion is expected to be fueled by government initiatives promoting diabetes awareness and preventative measures. Furthermore, the increasing availability of generic drugs could influence market dynamics by increasing affordability and access. However, challenges such as ensuring consistent medication adherence and addressing health disparities within the population need to be considered for sustainable market growth. Pharmaceutical companies are likely to invest in targeted marketing campaigns and patient support programs to mitigate these challenges and capitalize on the market's growth trajectory. Future growth may also be shaped by the introduction of novel oral anti-diabetic agents with improved efficacy and reduced adverse effects. Analysis of specific drug segment performance and regional variations within Mexico will provide further insights for strategic decision-making within the industry.

Mexico Oral Anti-Diabetic Drug Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Mexico oral anti-diabetic drug market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and growth opportunities. The report covers key segments, dominant players, and emerging trends shaping this dynamic market.

Mexico Oral Anti-Diabetic Drug Market Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Mexican oral anti-diabetic drug market, exploring market concentration, innovation drivers, regulatory frameworks, and market dynamics. The report assesses the market share of key players such as Merck And Co, Pfizer, Takeda, Janssen Pharmaceuticals, Eli Lilly, Novartis, Sanofi, AstraZeneca, Bristol Myers Squibb, Novo Nordisk, Boehringer Ingelheim, and Astellas. It examines the impact of mergers and acquisitions (M&A) activities, quantifying deal values where possible (e.g., xx Million) and their influence on market consolidation. The analysis also delves into the regulatory environment, including approval processes and their impact on market entry and innovation. Furthermore, the report explores the role of product substitutes and their market penetration, alongside an analysis of end-user demographics and their treatment preferences. The impact of innovation drivers, such as technological advancements in drug delivery and formulation, is also assessed, providing a holistic view of market structure and its evolution. For example, the market share for Metformin in 2025 is estimated to be xx%. The total M&A deal value within the period 2019-2024 is estimated at xx Million.

Mexico Oral Anti-Diabetic Drug Market Market Dynamics & Trends

This section provides a detailed examination of the key factors driving the growth of the Mexican oral anti-diabetic drug market. The report explores the market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033), projecting a value of xx Million by 2033. The analysis encompasses an in-depth assessment of market growth drivers, such as the rising prevalence of type 2 diabetes, increased healthcare expenditure, and growing awareness of diabetes management. It further explores the impact of technological disruptions, including advancements in drug development and delivery systems, on market dynamics. Consumer preferences, including the demand for more convenient and effective treatment options, are also examined. A detailed competitive analysis assesses the strategies employed by major players, highlighting competitive dynamics such as pricing strategies, product differentiation, and market penetration tactics. The changing consumer preferences and the increasing adoption of newer drugs also contribute significantly to the market growth. The market penetration of SGLT-2 inhibitors is expected to reach xx% by 2033.

Dominant Regions & Segments in Mexico Oral Anti-Diabetic Drug Market

This section identifies the leading regions and segments within the Mexican oral anti-diabetic drug market. The report offers a detailed analysis of market dominance for each segment: Suglat (Ipragliflozin): DPP-4 inhibitors; Galvus (Vildagliptin): Sulfonylureas; Sulfonylureas: Meglitinides; Oral Anti-diabetic drugs: Biguanides; Metformin: Alpha-Glucosidase Inhibitors; Alpha-Glucosidase Inhibitors: Dopamine D2 receptor agonist; Bromocriptin: SGLT-2 inhibitors. Key drivers contributing to the dominance of specific regions or segments are highlighted using bullet points.

- Economic policies: Government initiatives supporting diabetes management programs.

- Infrastructure: Availability of healthcare facilities and trained professionals.

- Demographic factors: Age and prevalence of diabetes within specific regions.

The analysis will provide a comprehensive overview of the market share and growth potential of each segment, detailing the factors that contribute to their success. For example, the Metformin segment is projected to maintain its dominance owing to its cost-effectiveness and widespread availability.

Mexico Oral Anti-Diabetic Drug Market Product Innovations

This section summarizes recent product developments, highlighting technological advancements and their market impact. The analysis will focus on innovative drug formulations, delivery systems, and combination therapies designed to improve efficacy and patient compliance. The competitive advantages offered by these novel products will be assessed, including factors such as improved safety profiles, reduced side effects, and enhanced convenience. The report will also touch upon technological trends that are shaping the future of oral anti-diabetic drugs in Mexico.

Report Scope & Segmentation Analysis

This section details the market segmentation across all drug classes and their subcategories mentioned above (Suglat (Ipragliflozin): DPP-4 inhibitors; Galvus (Vildagliptin): Sulfonylureas; Sulfonylureas: Meglitinides; Oral Anti-diabetic drugs: Biguanides; Metformin: Alpha-Glucosidase Inhibitors; Alpha-Glucosidase Inhibitors: Dopamine D2 receptor agonist; Bromocriptin: SGLT-2 inhibitors). Each segment will have a dedicated paragraph outlining its growth projections, market size in Millions, and competitive dynamics. For example, the SGLT-2 inhibitor segment is expected to witness significant growth due to its demonstrated cardiovascular benefits.

Key Drivers of Mexico Oral Anti-Diabetic Drug Market Growth

This section outlines the key factors driving market growth, focusing on technological advancements, economic factors, and regulatory influences. Specific examples of technological innovations, such as the development of novel drug classes and improved delivery systems, will be provided. The analysis will also include an examination of the economic factors driving market expansion, including rising healthcare expenditure and increasing health insurance coverage. Finally, the impact of regulatory changes on market dynamics will be discussed.

Challenges in the Mexico Oral Anti-Diabetic Drug Market Sector

This section identifies and analyzes challenges hindering market growth. The report will discuss regulatory hurdles, supply chain issues, and competitive pressures, quantifying their impact whenever possible. Examples might include pricing regulations, import restrictions, and the competitive intensity among pharmaceutical companies.

Emerging Opportunities in Mexico Oral Anti-Diabetic Drug Market

This section highlights promising new avenues for market expansion. The analysis will focus on emerging markets, technological advancements, and evolving consumer preferences that present significant opportunities for growth within the Mexican oral anti-diabetic drug market.

Leading Players in the Mexico Oral Anti-Diabetic Drug Market Market

- Merck And Co

- Pfizer

- Takeda

- Janssen Pharmaceuticals

- Eli Lilly

- Novartis

- Sanofi

- AstraZeneca

- Bristol Myers Squibb

- Novo Nordisk

- Boehringer Ingelheim

- Astellas

Key Developments in Mexico Oral Anti-Diabetic Drug Market Industry

- June 2023: The FDA approved Jardiance and Synjardy for children ages 10 and older with type 2 diabetes. This significantly expands the addressable market for these drugs.

- March 2022: Eli Lilly and Boehringer Ingelheim received EU approval for Jardiance (empagliflozin) to treat heart failure. This approval broadens the therapeutic application and market potential of Jardiance.

Future Outlook for Mexico Oral Anti-Diabetic Drug Market Market

This section summarizes the future growth potential of the Mexican oral anti-diabetic drug market. It highlights growth accelerators such as continued advancements in drug development, increasing prevalence of diabetes, and supportive government policies. The analysis will identify strategic opportunities for market players and provide a forward-looking perspective on market trends.

Mexico Oral Anti-Diabetic Drug Market Segmentation

-

1. Drug Class

- 1.1. Biguanides

- 1.2. Alpha-Glucosidase Inhibitors

- 1.3. Dopamine D2 Receptor Agonist

- 1.4. SGLT-2 Inhibitors

- 1.5. DPP-4 Inhibitors

- 1.6. Sulfonylureas

- 1.7. Meglitinides

-

2. Indication

- 2.1. Type 1 Diabetes

- 2.2. Type 2 Diabetes

-

3. Route of Administration

- 3.1. Oral

-

4. Distribution Channel

- 4.1. Hospitals

- 4.2. Retail Pharmacies

- 4.3. Online Pharmacies

-

5. End-User

- 5.1. Type 1 Diabetes Patients

- 5.2. Type 2 Diabetes Patients

Mexico Oral Anti-Diabetic Drug Market Segmentation By Geography

- 1. Mexico

Mexico Oral Anti-Diabetic Drug Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures

- 3.3. Market Restrains

- 3.3.1. Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs

- 3.4. Market Trends

- 3.4.1. Sulfonylureas Segment Occupied the Highest Market Share in the Mexico Oral Anti-Diabetic Drugs Market in the current year.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 5.1.1. Biguanides

- 5.1.2. Alpha-Glucosidase Inhibitors

- 5.1.3. Dopamine D2 Receptor Agonist

- 5.1.4. SGLT-2 Inhibitors

- 5.1.5. DPP-4 Inhibitors

- 5.1.6. Sulfonylureas

- 5.1.7. Meglitinides

- 5.2. Market Analysis, Insights and Forecast - by Indication

- 5.2.1. Type 1 Diabetes

- 5.2.2. Type 2 Diabetes

- 5.3. Market Analysis, Insights and Forecast - by Route of Administration

- 5.3.1. Oral

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Hospitals

- 5.4.2. Retail Pharmacies

- 5.4.3. Online Pharmacies

- 5.5. Market Analysis, Insights and Forecast - by End-User

- 5.5.1. Type 1 Diabetes Patients

- 5.5.2. Type 2 Diabetes Patients

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Merck And Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pfizer

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Takeda

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Janssen Pharmaceuticals

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eli Lilly

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Novartis

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sanofi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AstraZeneca

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bristol Myers Squibb

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Novo Nordisk

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Boehringer Ingelheim

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Astellas

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Merck And Co

List of Figures

- Figure 1: Mexico Oral Anti-Diabetic Drug Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Oral Anti-Diabetic Drug Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Mexico Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Drug Class 2019 & 2032

- Table 4: Mexico Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Drug Class 2019 & 2032

- Table 5: Mexico Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Indication 2019 & 2032

- Table 6: Mexico Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Indication 2019 & 2032

- Table 7: Mexico Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 8: Mexico Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Route of Administration 2019 & 2032

- Table 9: Mexico Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 10: Mexico Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 11: Mexico Oral Anti-Diabetic Drug Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 12: Mexico Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 13: Mexico Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Mexico Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 15: Mexico Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Mexico Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Mexico Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Drug Class 2019 & 2032

- Table 18: Mexico Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Drug Class 2019 & 2032

- Table 19: Mexico Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Indication 2019 & 2032

- Table 20: Mexico Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Indication 2019 & 2032

- Table 21: Mexico Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 22: Mexico Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Route of Administration 2019 & 2032

- Table 23: Mexico Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: Mexico Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 25: Mexico Oral Anti-Diabetic Drug Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 26: Mexico Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 27: Mexico Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Mexico Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Oral Anti-Diabetic Drug Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Mexico Oral Anti-Diabetic Drug Market?

Key companies in the market include Merck And Co, Pfizer, Takeda, Janssen Pharmaceuticals, Eli Lilly, Novartis, Sanofi, AstraZeneca, Bristol Myers Squibb, Novo Nordisk, Boehringer Ingelheim, Astellas.

3. What are the main segments of the Mexico Oral Anti-Diabetic Drug Market?

The market segments include Drug Class, Indication, Route of Administration, Distribution Channel, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures.

6. What are the notable trends driving market growth?

Sulfonylureas Segment Occupied the Highest Market Share in the Mexico Oral Anti-Diabetic Drugs Market in the current year..

7. Are there any restraints impacting market growth?

Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs.

8. Can you provide examples of recent developments in the market?

June 2023: The FDA has approved the drugs Jardiance and Synjardy to be taken by children ages 10 and older who have type 2 diabetes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Oral Anti-Diabetic Drug Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Oral Anti-Diabetic Drug Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Oral Anti-Diabetic Drug Market?

To stay informed about further developments, trends, and reports in the Mexico Oral Anti-Diabetic Drug Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence