Key Insights

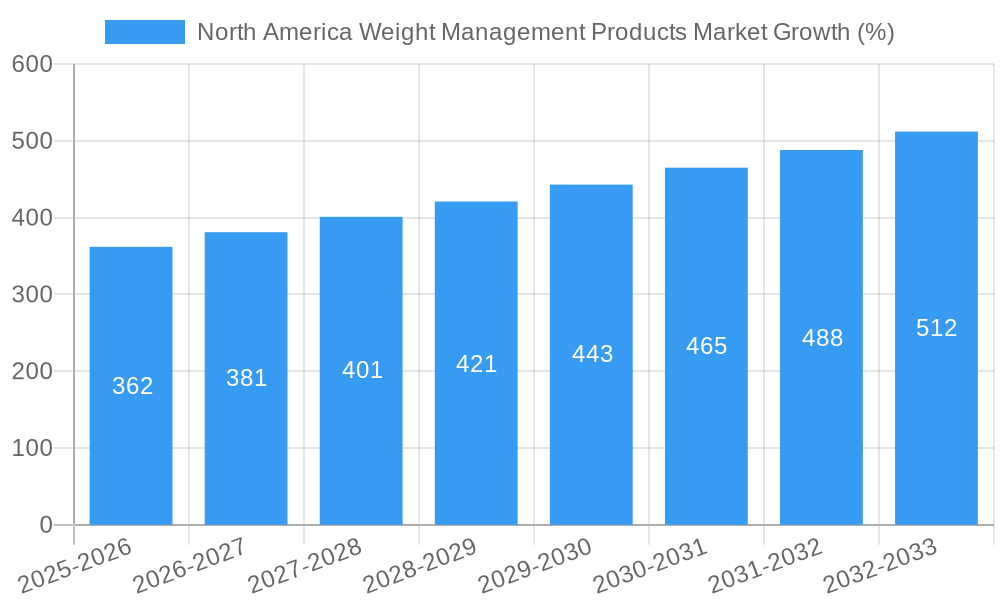

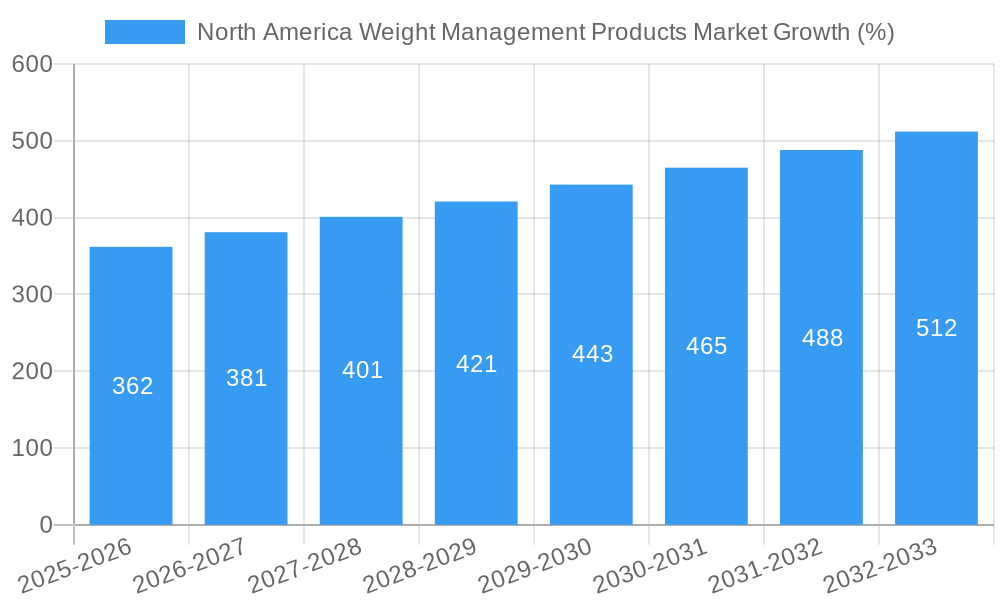

The North America weight management products market, valued at $8.12 billion in 2025, is projected to experience steady growth, driven by increasing health consciousness and rising obesity rates across the region. A Compound Annual Growth Rate (CAGR) of 4.38% is anticipated from 2025 to 2033, indicating a significant market expansion. Key drivers include a growing awareness of the health risks associated with obesity, increased adoption of healthy lifestyles, and the expanding availability of diverse weight management products such as meal replacements, beverages, and supplements. The market segmentation reveals that meal replacements and supplements currently hold significant market share due to their convenience and effectiveness. Hypermarkets and supermarkets dominate the distribution channels, reflecting consumer preference for established retail outlets. Leading companies like Abbott Laboratories, Nestle S.A., and Herbalife Nutrition Ltd. are leveraging innovation and brand recognition to maintain their market positions. However, challenges remain, including consumer concerns about product safety and efficacy, potential side effects of some supplements, and the need for effective regulatory oversight to ensure product quality and transparency. Future growth will be influenced by factors such as increasing consumer demand for personalized weight management solutions, the development of technologically advanced products, and a continued focus on healthy eating and active lifestyles.

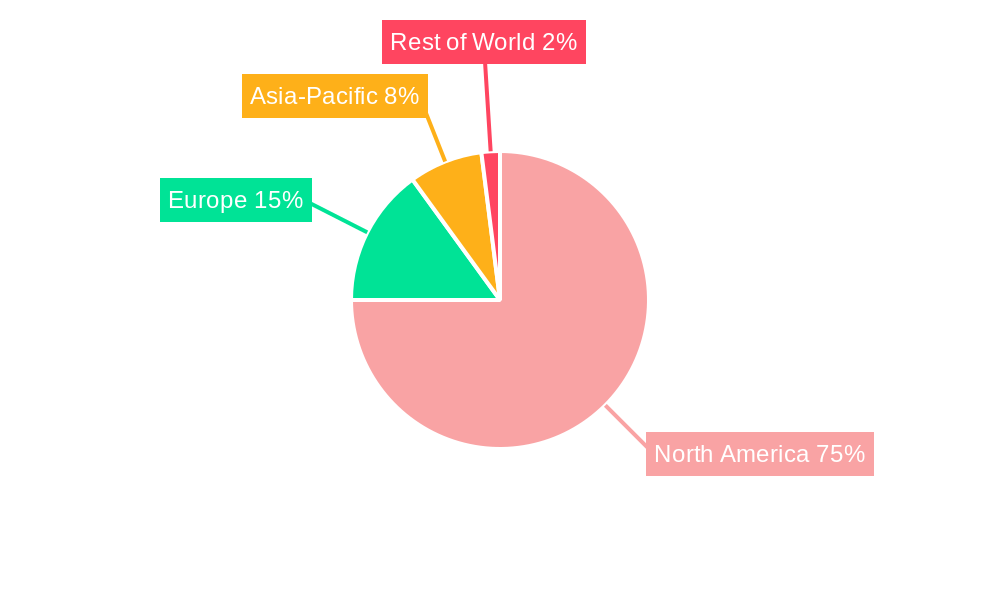

The competitive landscape is highly dynamic, with established players facing competition from smaller, niche companies specializing in innovative and targeted weight management solutions. The United States is expected to retain its dominant position within the North American market, owing to its larger population and greater awareness of health and wellness. Canada and Mexico will also contribute significantly to regional growth. The success of companies will depend on their ability to effectively cater to consumer needs, including personalized product offerings, convenient distribution channels, and transparent communication about product efficacy and safety. Furthermore, addressing consumer concerns regarding long-term sustainability and the potential for rebound weight gain will be crucial for market expansion and sustained growth. The market is anticipated to see a shift toward more personalized, science-backed solutions, with a focus on preventative healthcare and holistic wellness approaches.

North America Weight Management Products Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America weight management products market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a holistic view of market dynamics, trends, and future projections. The market size is estimated at XX Million in 2025 and is projected to reach XX Million by 2033, exhibiting a CAGR of XX%.

North America Weight Management Products Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory factors shaping the North American weight management products market. We examine market concentration, identifying key players and their market share. The report also explores M&A activities, highlighting significant deals and their impact on market structure. Innovation drivers, such as technological advancements in formulation and delivery systems, are scrutinized, alongside regulatory frameworks and their influence on product development and market access. Finally, we analyze the impact of substitute products and evolving end-user demographics on market dynamics.

- Market Concentration: The market exhibits a moderately concentrated structure, with key players holding significant market share. For example, [Insert estimated market share data if available, otherwise use "xx%"].

- M&A Activity: Significant M&A activity has been observed in recent years, with deal values ranging from XX Million to XX Million. [Insert examples of M&A activity if available] This consolidation trend is expected to continue, driving further market concentration.

- Innovation Drivers: The demand for convenient, effective, and safe weight management solutions fuels innovation in product formulation, including the development of targeted supplements, technologically advanced meal replacements, and personalized nutrition plans.

- Regulatory Landscape: Stringent regulations concerning labeling, ingredient safety, and marketing claims significantly impact product development and market entry.

- Product Substitutes: The market faces competition from alternative weight management approaches, such as lifestyle modifications and surgical procedures.

- End-User Demographics: The increasing prevalence of obesity and related health issues among various demographic groups drives market growth.

North America Weight Management Products Market Dynamics & Trends

This section delves into the key drivers and trends shaping the market's evolution. We explore the factors propelling market growth, such as rising obesity rates, increasing health consciousness, and expanding consumer preference for convenient and effective weight management solutions. The influence of technological disruptions, including advancements in personalized nutrition and digital health technologies, is also analyzed. Furthermore, we assess the impact of evolving consumer preferences, such as a growing demand for natural and organic products, on market dynamics. Finally, the section explores competitive dynamics, focusing on strategies adopted by key players to maintain market share and drive growth.

[Insert 600 words of detailed analysis on market growth drivers, technological disruptions, consumer preferences, and competitive dynamics, including specific metrics like CAGR and market penetration. Include details on pricing strategies, distribution channels, and marketing efforts of leading companies.]

Dominant Regions & Segments in North America Weight Management Products Market

This section identifies the leading regions and segments within the North American weight management products market. We analyze the performance of various regions and segments based on factors such as market size, growth rate, and key drivers. The analysis will identify the dominant region, providing insights into the factors contributing to its leading position.

By Type:

- Supplements: This segment is expected to dominate due to [explain reasons, e.g., ease of use, targeted benefits, and extensive marketing].

- Meal Replacements: Growing demand for convenient options contributes to significant growth in this segment.

- Beverages: [Explain factors affecting the growth of this segment]

By Distribution Channel:

- Hypermarkets/Supermarkets: This channel holds a substantial market share due to its wide reach and established presence.

- Convenience Stores: This segment is growing, driven by consumer demand for on-the-go solutions.

- Other Distribution Channels: [Discuss online channels, direct-to-consumer sales, etc]

[Insert detailed analysis of each segment, including bullet points on key drivers and paragraphs for detailed dominance analysis. For each segment, elaborate on economic policies, infrastructure and other factors.]

North America Weight Management Products Market Product Innovations

Recent product innovations in the North American weight management products market reflect a growing focus on personalized nutrition, natural ingredients, and enhanced efficacy. Companies are increasingly leveraging technological advancements to develop products with improved formulations and delivery systems, tailored to meet specific consumer needs. This includes incorporating advanced technologies such as AI-powered personalized nutrition recommendations and smart devices for tracking and monitoring progress. For example, the launch of MuscleTech's EUPHORiQ and BURN iQ in October 2022 showcases the adoption of innovative formulations. These advancements contribute to increased market competitiveness and drive market growth.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the North American weight management products market. The market is segmented by product type (Meal Replacements, Beverages, Supplements) and distribution channel (Hypermarkets/Supermarkets, Convenience Stores, Other Distribution Channels). Each segment is analyzed in detail, including growth projections, market sizes, and competitive dynamics.

- By Type: Growth rates and market sizes for each type (Meal, Beverage, Supplements) will be provided, analyzing the competitive dynamics within each segment.

- By Distribution Channel: Growth projections, market sizes, and competitive dynamics are provided for each distribution channel (Hypermarkets/Supermarkets, Convenience Stores, Other Distribution Channels).

Key Drivers of North America Weight Management Products Market Growth

Several key factors drive the growth of the North America weight management products market. The rising prevalence of obesity and related health issues is a primary driver, alongside increasing consumer awareness of health and wellness. The demand for convenient and effective weight management solutions is another key factor, with consumers seeking products that fit easily into their lifestyles. Technological advancements in product formulation and delivery systems also fuel market growth, enabling the development of more effective and personalized products. Furthermore, supportive government regulations and initiatives promoting healthy lifestyles contribute to market expansion.

Challenges in the North America Weight Management Products Market Sector

The North America weight management products market faces several challenges. Stringent regulatory hurdles related to product safety and marketing claims increase costs and complexity for product launches. Supply chain disruptions and fluctuating raw material costs can impact profitability and product availability. Intense competition from established players and new entrants creates price pressures and necessitates continuous innovation. Concerns about the efficacy and safety of certain weight management products also pose a challenge. These challenges require strategic adaptations by companies to maintain market competitiveness.

Emerging Opportunities in North America Weight Management Products Market

Emerging opportunities in the market include the growth of personalized nutrition, leveraging technological advancements like AI and genetic testing. The expansion of e-commerce and direct-to-consumer sales channels provides new avenues for growth. Growing demand for natural and organic products, as well as functional foods and beverages with added health benefits, presents further opportunities. Finally, the increasing awareness of the link between gut health and weight management opens new possibilities for product development.

Leading Players in the North America Weight Management Products Market Market

- Premier Nutrition Company LLC

- Abbott Laboratories (Abbott Laboratories)

- Herbalife Nutrition Ltd (Herbalife Nutrition)

- Nestle S.A (Nestle)

- Woodbolt Distribution LLC

- The Simply Good Foods Company (The Simply Good Foods Company)

- Iovate Health Sciences International

- Glanbia PLC (Glanbia)

- Ultimate Nutrition Inc

- Kellogg Company (Kellogg Company)

Key Developments in North America Weight Management Products Market Industry

- July 2022: Herbalife Nutrition launched a new weight management product in the US, featuring litramine for fat absorption reduction.

- July 2022: Six Star Pro Nutrition partnered with Sierra Canyon School, providing whey protein to athletes.

- October 2022: MuscleTech released two pre-workout formulations (EUPHORiQ and BURN iQ) with a paroxetine caffeine metabolite, available online.

Future Outlook for North America Weight Management Products Market Market

The future of the North America weight management products market is promising, driven by sustained growth in the obesity prevalence, increased health consciousness, and ongoing technological innovation. The market is expected to witness continued product diversification, with an increased emphasis on personalized nutrition and functional foods. Strategic partnerships and acquisitions are anticipated to shape the competitive landscape, further consolidating the market. The expansion of e-commerce and direct-to-consumer channels will provide new avenues for market penetration and growth. Overall, the market's future trajectory appears positive, with significant potential for growth and innovation.

North America Weight Management Products Market Segmentation

-

1. Type

- 1.1. Meal

- 1.2. Beverage

- 1.3. Supplements

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Convenience Stores

- 2.3. Other Distribution Channels

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of the North America

North America Weight Management Products Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of the North America

North America Weight Management Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.38% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population

- 3.3. Market Restrains

- 3.3.1. Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products

- 3.4. Market Trends

- 3.4.1. Increasing Prevalence of Obesity Across the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Weight Management Products Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Meal

- 5.1.2. Beverage

- 5.1.3. Supplements

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of the North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of the North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Weight Management Products Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Meal

- 6.1.2. Beverage

- 6.1.3. Supplements

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarkets/Supermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of the North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Weight Management Products Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Meal

- 7.1.2. Beverage

- 7.1.3. Supplements

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarkets/Supermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of the North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Weight Management Products Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Meal

- 8.1.2. Beverage

- 8.1.3. Supplements

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarkets/Supermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of the North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the North America North America Weight Management Products Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Meal

- 9.1.2. Beverage

- 9.1.3. Supplements

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hypermarkets/Supermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of the North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. United States North America Weight Management Products Market Analysis, Insights and Forecast, 2019-2031

- 11. Canada North America Weight Management Products Market Analysis, Insights and Forecast, 2019-2031

- 12. Mexico North America Weight Management Products Market Analysis, Insights and Forecast, 2019-2031

- 13. Rest of North America North America Weight Management Products Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Premier Nutrition Company LLC

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Abott Laboratories

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Herbalife Nutrition Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Nestle S A

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Woodbolt Distribution LLC

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 The Simply Good Foods Company

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Iovate Health Sciences International

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Glanbia PLC*List Not Exhaustive

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Ultimate Nutrition Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Kellogg Company

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Premier Nutrition Company LLC

List of Figures

- Figure 1: North America Weight Management Products Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Weight Management Products Market Share (%) by Company 2024

List of Tables

- Table 1: North America Weight Management Products Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Weight Management Products Market Volume K Units Forecast, by Region 2019 & 2032

- Table 3: North America Weight Management Products Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America Weight Management Products Market Volume K Units Forecast, by Type 2019 & 2032

- Table 5: North America Weight Management Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: North America Weight Management Products Market Volume K Units Forecast, by Distribution Channel 2019 & 2032

- Table 7: North America Weight Management Products Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: North America Weight Management Products Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 9: North America Weight Management Products Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America Weight Management Products Market Volume K Units Forecast, by Region 2019 & 2032

- Table 11: North America Weight Management Products Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America Weight Management Products Market Volume K Units Forecast, by Country 2019 & 2032

- Table 13: United States North America Weight Management Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States North America Weight Management Products Market Volume (K Units ) Forecast, by Application 2019 & 2032

- Table 15: Canada North America Weight Management Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Weight Management Products Market Volume (K Units ) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Weight Management Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America Weight Management Products Market Volume (K Units ) Forecast, by Application 2019 & 2032

- Table 19: Rest of North America North America Weight Management Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of North America North America Weight Management Products Market Volume (K Units ) Forecast, by Application 2019 & 2032

- Table 21: North America Weight Management Products Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: North America Weight Management Products Market Volume K Units Forecast, by Type 2019 & 2032

- Table 23: North America Weight Management Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: North America Weight Management Products Market Volume K Units Forecast, by Distribution Channel 2019 & 2032

- Table 25: North America Weight Management Products Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Weight Management Products Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 27: North America Weight Management Products Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: North America Weight Management Products Market Volume K Units Forecast, by Country 2019 & 2032

- Table 29: North America Weight Management Products Market Revenue Million Forecast, by Type 2019 & 2032

- Table 30: North America Weight Management Products Market Volume K Units Forecast, by Type 2019 & 2032

- Table 31: North America Weight Management Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 32: North America Weight Management Products Market Volume K Units Forecast, by Distribution Channel 2019 & 2032

- Table 33: North America Weight Management Products Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Weight Management Products Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 35: North America Weight Management Products Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Weight Management Products Market Volume K Units Forecast, by Country 2019 & 2032

- Table 37: North America Weight Management Products Market Revenue Million Forecast, by Type 2019 & 2032

- Table 38: North America Weight Management Products Market Volume K Units Forecast, by Type 2019 & 2032

- Table 39: North America Weight Management Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: North America Weight Management Products Market Volume K Units Forecast, by Distribution Channel 2019 & 2032

- Table 41: North America Weight Management Products Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 42: North America Weight Management Products Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 43: North America Weight Management Products Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: North America Weight Management Products Market Volume K Units Forecast, by Country 2019 & 2032

- Table 45: North America Weight Management Products Market Revenue Million Forecast, by Type 2019 & 2032

- Table 46: North America Weight Management Products Market Volume K Units Forecast, by Type 2019 & 2032

- Table 47: North America Weight Management Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 48: North America Weight Management Products Market Volume K Units Forecast, by Distribution Channel 2019 & 2032

- Table 49: North America Weight Management Products Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 50: North America Weight Management Products Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 51: North America Weight Management Products Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: North America Weight Management Products Market Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Weight Management Products Market?

The projected CAGR is approximately 4.38%.

2. Which companies are prominent players in the North America Weight Management Products Market?

Key companies in the market include Premier Nutrition Company LLC, Abott Laboratories, Herbalife Nutrition Ltd, Nestle S A, Woodbolt Distribution LLC, The Simply Good Foods Company, Iovate Health Sciences International, Glanbia PLC*List Not Exhaustive, Ultimate Nutrition Inc, Kellogg Company.

3. What are the main segments of the North America Weight Management Products Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population.

6. What are the notable trends driving market growth?

Increasing Prevalence of Obesity Across the Region.

7. Are there any restraints impacting market growth?

Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products.

8. Can you provide examples of recent developments in the market?

October 2022: Two pre-workout formulations featuring the carefully formulated paroxetine caffeine metabolite were released by Muscle Tech. The brand made two new products, EUPHORiQand BURN iQ. These products are made available on MuscleTech.com and through online stores like Amazon.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Weight Management Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Weight Management Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Weight Management Products Market?

To stay informed about further developments, trends, and reports in the North America Weight Management Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence