Key Insights

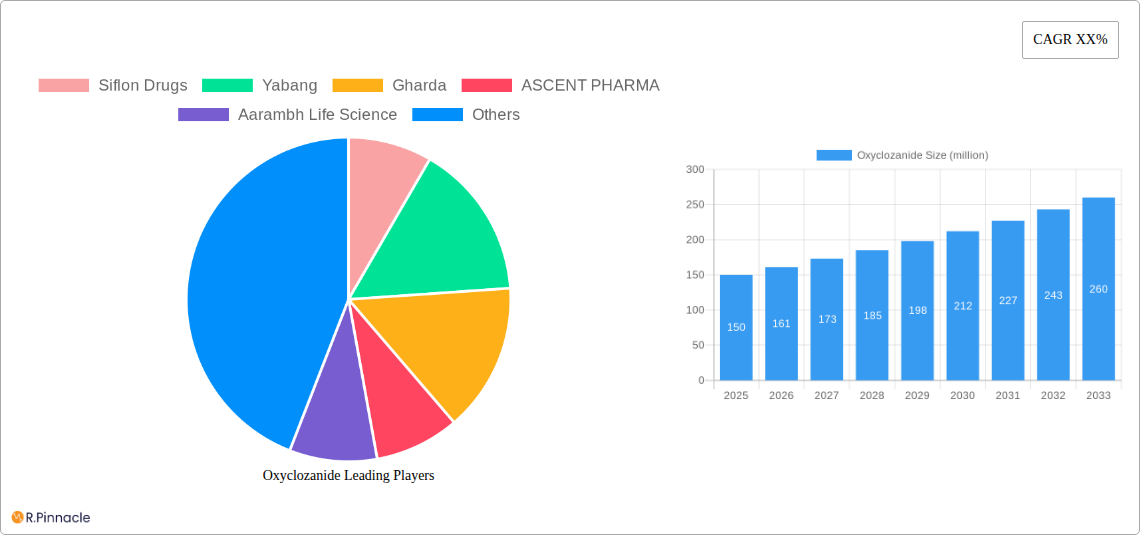

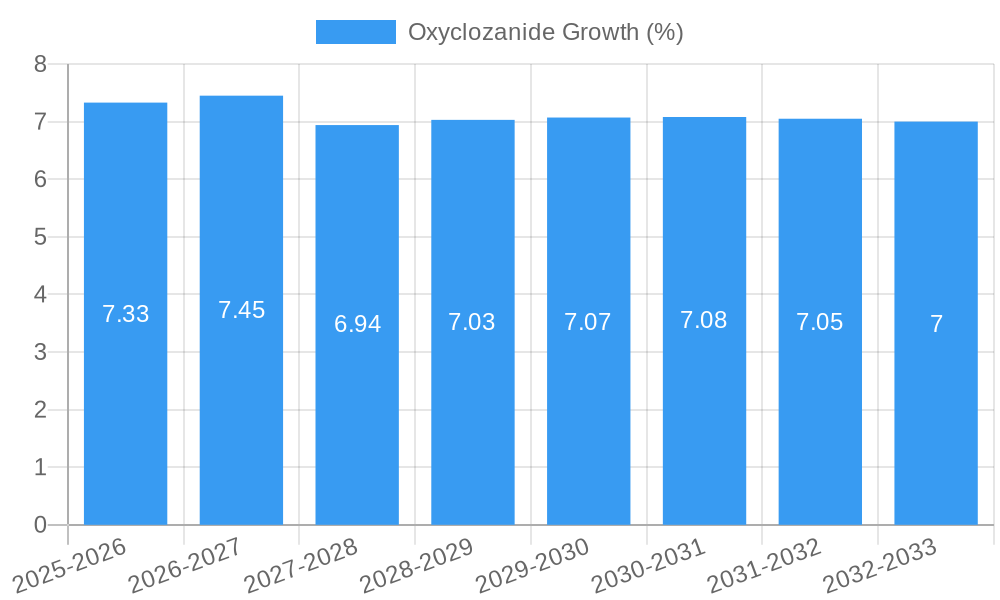

The global Oxyclozanide market is poised for significant expansion, projected to reach approximately $150 million by 2025 and surge to over $250 million by 2033, demonstrating a robust Compound Annual Growth Rate (CAGR) of approximately 7%. This growth is primarily propelled by the escalating demand for effective antiparasitic treatments in the livestock and poultry industries, driven by increasing global meat consumption and a greater emphasis on animal health and productivity. The rising prevalence of parasitic infections in cattle, sheep, and poultry, which lead to substantial economic losses for farmers, further fuels the adoption of Oxyclozanide. Moreover, advancements in veterinary medicine and a growing awareness among stakeholders regarding the benefits of deworming protocols are contributing to market buoyancy. The market's trajectory is further supported by its critical role in ensuring food safety and reducing zoonotic disease transmission, aligning with public health priorities.

The Oxyclozanide market is segmented by application and content. Injectables and Oral Liquids represent dominant application segments due to their efficacy and ease of administration in treating parasitic infestations. Feed additives are also gaining traction as a prophylactic measure, especially in large-scale animal husbandry operations. The market offers Oxyclozanide in both 98% and 99% purity content, catering to diverse formulation requirements and regulatory standards across different regions. Key market players, including Siflon Drugs, Yabang, and Gharda, are actively engaged in research and development to enhance product formulations, expand manufacturing capacities, and penetrate emerging markets. Strategic collaborations and acquisitions are also shaping the competitive landscape, as companies strive to strengthen their market positions and leverage synergies. Despite the positive outlook, potential restraints such as stringent regulatory hurdles for new product approvals and the emergence of alternative antiparasitic agents could pose challenges. However, the inherent effectiveness and established track record of Oxyclozanide are expected to mitigate these concerns.

Oxyclozanide Market Structure & Innovation Trends

The Oxyclozanide market, a critical anthelmintic agent in veterinary medicine, exhibits a moderately concentrated structure with a few key players dominating production and innovation. Leading companies such as Siflon Drugs, Yabang, Gharda, ASCENT PHARMA, Aarambh Life Science, ProVentus, Excel Industries, Konar Organics, Neha Pharma, D. H. Organics, and Neeta Interchem are actively engaged in research and development, driving product innovation. The market's innovation is primarily fueled by the persistent need for effective and broad-spectrum parasitic control in livestock, alongside the development of more convenient and bioavailable formulations. Regulatory frameworks, particularly those governing veterinary drug approvals and efficacy standards in major agricultural economies, play a significant role in shaping market entry and product lifecycles. The threat of product substitutes, though limited for broad-spectrum anthelmintics, exists from newer drug classes or integrated parasite management strategies. End-user demographics are largely concentrated within the global livestock farming sector, including cattle, sheep, and goat industries, where parasitic infections lead to substantial economic losses estimated in the hundreds of millions of dollars annually. Mergers and acquisitions (M&A) activities are relatively infrequent but can significantly impact market consolidation and R&D capabilities, with potential deal values reaching into the tens of millions of dollars for strategic acquisitions.

Oxyclozanide Market Dynamics & Trends

The Oxyclozanide market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% over the forecast period of 2025–2033. This expansion is primarily driven by the increasing global demand for animal protein, necessitating healthier livestock populations and consequently, greater utilization of effective antiparasitic treatments. Technological disruptions, while not revolutionary, are focused on enhancing the formulation and delivery mechanisms of Oxyclozanide. Advancements in controlled-release technologies and novel delivery systems are aimed at improving efficacy, reducing dosage frequency, and minimizing potential resistance development. Consumer preferences are increasingly leaning towards animal welfare and food safety. This translates to a higher demand for veterinary pharmaceuticals that ensure the health of livestock without compromising the safety of animal products. The competitive dynamics within the Oxyclozanide sector are characterized by a blend of established global players and regional manufacturers, all vying for market share through product quality, pricing strategies, and expanding distribution networks. Market penetration is significant in developed agricultural economies and is steadily increasing in emerging markets where livestock farming is undergoing modernization and intensification. The estimated market size for Oxyclozanide is projected to reach over a billion dollars by 2033, driven by these multifaceted dynamics.

Dominant Regions & Segments in Oxyclozanide

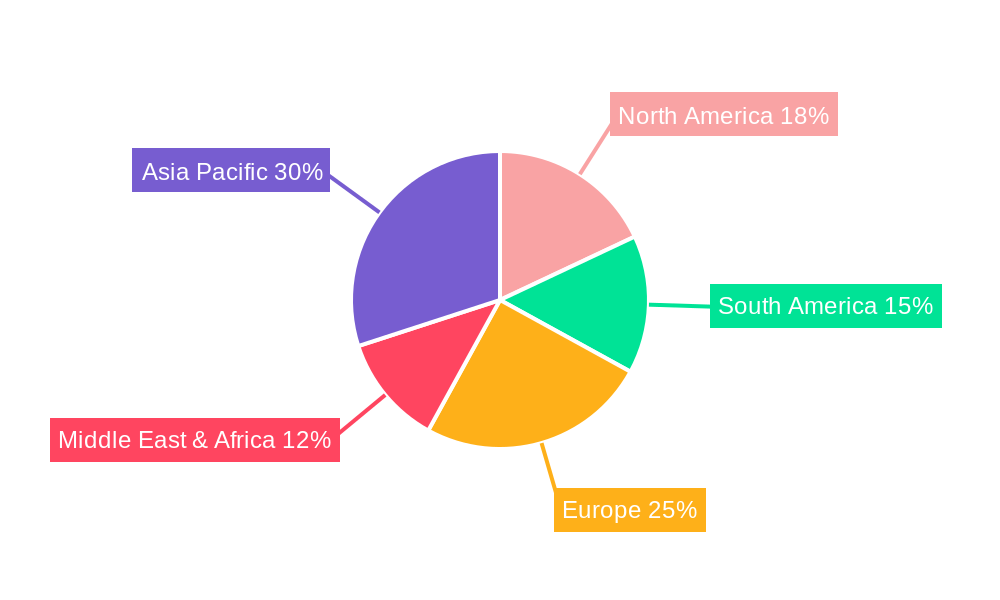

The Asia-Pacific region stands out as the dominant force in the global Oxyclozanide market, with countries like China and India leading consumption and production. This dominance is underpinned by several key drivers, including the presence of a vast livestock population, a rapidly growing animal husbandry sector driven by increasing meat and dairy consumption, and supportive government policies promoting agricultural productivity and veterinary healthcare. The economic policies in these nations, aimed at enhancing food security and export potential, further bolster the demand for animal health products like Oxyclozanide. Significant investments in agricultural infrastructure, including modern farming practices and veterinary service networks, also contribute to the region's leadership.

Within the Application segment, Feed Additives are currently the most dominant, reflecting the widespread practice of incorporating anthelmintics into animal feed for routine parasite control in large-scale farming operations. This application offers ease of administration and ensures consistent dosing across herds and flocks, making it highly cost-effective for producers.

In terms of Type, Content 98% Oxyclozanide holds a commanding market share. This is largely due to its established efficacy, cost-effectiveness, and wide acceptance in various veterinary formulations. While Content 99% represents a premium grade, the prevalent use of 98% purity in existing product lines and its sufficient efficacy for most veterinary applications solidify its current dominance.

The dominance analysis reveals that the Asia-Pacific's extensive agricultural base, coupled with the cost-efficiency and broad applicability of Oxyclozanide in feed additive formulations, particularly at 98% purity, creates a powerful synergy driving regional and segmental leadership. The projected market size for this dominant region is estimated to be over several hundred million dollars within the forecast period.

Oxyclozanide Product Innovations

Oxyclozanide product innovations are centered on enhancing its efficacy and delivery. Key developments include improved suspension formulations for oral administration, ensuring better palatability and bioavailability for livestock. Furthermore, research is exploring synergistic combinations with other anthelmintics to combat emerging resistance and broaden the spectrum of activity. The competitive advantage lies in creating formulations that offer prolonged action, reducing the need for frequent treatments and thereby enhancing cost-effectiveness for farmers. These innovations are crucial in maintaining Oxyclozanide's relevance in a dynamic veterinary pharmaceutical landscape.

Report Scope & Segmentation Analysis

This comprehensive report delves into the global Oxyclozanide market, encompassing a detailed segmentation analysis. The Application segment is dissected into Injectables, Oral Liquids, and Feed Additives. The Injectables segment, though smaller, offers rapid systemic action, crucial for acute parasitic infections. Oral Liquids provide a flexible administration route for individual animal treatment. Feed Additives represent the largest segment due to their widespread use in routine herd and flock management. The Type segmentation includes Content 98% and Content 99% purity grades, each catering to specific formulation requirements and efficacy expectations. Growth projections for each segment indicate varied trajectories, with Feed Additives expected to maintain significant market share.

Key Drivers of Oxyclozanide Growth

Several key factors are propelling the growth of the Oxyclozanide market. The increasing global demand for animal protein is a primary economic driver, necessitating healthier livestock and thus higher consumption of veterinary antiparasitics. Technological advancements in formulation and delivery systems, such as enhanced bioavailability and longer-acting preparations, are critical for market expansion. Regulatory support for animal health initiatives in various countries also plays a pivotal role. Furthermore, the persistent challenge of parasitic infestations in livestock, leading to substantial economic losses, creates a continuous demand for effective treatments like Oxyclozanide, estimated to prevent losses of hundreds of millions of dollars annually.

Challenges in the Oxyclozanide Sector

Despite its robust growth, the Oxyclozanide sector faces several challenges. The increasing development of anthelmintic resistance in parasitic populations is a significant concern, necessitating continuous research into new formulations and parasite management strategies. Stringent regulatory approval processes in different countries can pose barriers to market entry and product development, leading to extended timelines and increased costs, potentially impacting market penetration by tens of percentage points. Supply chain disruptions, exacerbated by geopolitical events or raw material availability, can affect production costs and product availability. Intense competition from both established players and emerging manufacturers also exerts downward pressure on pricing and profit margins, with profit margins potentially reduced by single-digit percentages.

Emerging Opportunities in Oxyclozanide

Emerging opportunities in the Oxyclozanide market lie in the expansion into developing economies with growing livestock sectors and increasing investments in veterinary healthcare infrastructure. The development of novel combination therapies, synergistically combining Oxyclozanide with other antiparasitic agents, presents a significant avenue for enhanced efficacy and combating resistance. Furthermore, the growing consumer demand for ethically sourced and sustainably produced animal products is driving the need for effective and safe animal health solutions, creating opportunities for Oxyclozanide formulations that meet these criteria. Innovations in precision livestock farming technologies could also unlock opportunities for more targeted and efficient administration of Oxyclozanide.

Leading Players in the Oxyclozanide Market

- Siflon Drugs

- Yabang

- Gharda

- ASCENT PHARMA

- Aarambh Life Science

- ProVentus

- Excel Industries

- Konar Organics

- Neha Pharma

- D. H. Organics

- Neeta Interchem

Key Developments in Oxyclozanide Industry

- 2024: Launch of new sustained-release Oxyclozanide formulations by ASCENT PHARMA, enhancing treatment efficacy and reducing administration frequency.

- 2023: Gharda Chemicals announces significant investment in R&D for next-generation anthelmintics, including potential combination therapies involving Oxyclozanide.

- 2023: Yabang Group expands its veterinary drug manufacturing capacity, including Oxyclozanide production, to meet growing global demand.

- 2022: Aarambh Life Science introduces an improved Oxyclozanide oral suspension with enhanced palatability and absorption for cattle.

- 2022: ProVentus focuses on developing novel delivery systems for Oxyclozanide to combat emerging resistance patterns.

- 2021: Neha Pharma secures new regulatory approvals for its Oxyclozanide products in several key emerging markets.

- 2020: Excel Industries explores partnerships to integrate Oxyclozanide into broader animal health management programs.

- 2019: D. H. Organics develops a cost-effective production process for high-purity Oxyclozanide, impacting pricing dynamics.

Future Outlook for Oxyclozanide Market

The future outlook for the Oxyclozanide market remains highly positive, driven by sustained demand from the global livestock industry and continuous innovation. The increasing emphasis on animal welfare and food safety will continue to fuel the need for effective antiparasitic agents. Opportunities for market growth will arise from the expansion of veterinary services in developing regions and the adoption of advanced farming technologies. Strategic collaborations and mergers are anticipated to shape the competitive landscape, fostering further product development and market reach. The market is projected to witness steady growth, with an estimated market size exceeding 1.5 billion dollars by the end of the forecast period, solidifying Oxyclozanide's position as a crucial anthelmintic in veterinary medicine.

Oxyclozanide Segmentation

-

1. Application

- 1.1. Injectables

- 1.2. Oral Liquids

- 1.3. Feed Additives

-

2. Types

- 2.1. Content 98%

- 2.2. Content 99%

Oxyclozanide Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Oxyclozanide REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oxyclozanide Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Injectables

- 5.1.2. Oral Liquids

- 5.1.3. Feed Additives

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Content 98%

- 5.2.2. Content 99%

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Oxyclozanide Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Injectables

- 6.1.2. Oral Liquids

- 6.1.3. Feed Additives

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Content 98%

- 6.2.2. Content 99%

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Oxyclozanide Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Injectables

- 7.1.2. Oral Liquids

- 7.1.3. Feed Additives

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Content 98%

- 7.2.2. Content 99%

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Oxyclozanide Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Injectables

- 8.1.2. Oral Liquids

- 8.1.3. Feed Additives

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Content 98%

- 8.2.2. Content 99%

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Oxyclozanide Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Injectables

- 9.1.2. Oral Liquids

- 9.1.3. Feed Additives

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Content 98%

- 9.2.2. Content 99%

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Oxyclozanide Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Injectables

- 10.1.2. Oral Liquids

- 10.1.3. Feed Additives

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Content 98%

- 10.2.2. Content 99%

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Siflon Drugs

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Yabang

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Gharda

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ASCENT PHARMA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Aarambh Life Science

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ProVentus

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Excel Industries

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Konar Organics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Neha Pharma

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 D. H. Organics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Neeta Interchem

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Siflon Drugs

List of Figures

- Figure 1: Global Oxyclozanide Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Oxyclozanide Revenue (million), by Application 2024 & 2032

- Figure 3: North America Oxyclozanide Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Oxyclozanide Revenue (million), by Types 2024 & 2032

- Figure 5: North America Oxyclozanide Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Oxyclozanide Revenue (million), by Country 2024 & 2032

- Figure 7: North America Oxyclozanide Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Oxyclozanide Revenue (million), by Application 2024 & 2032

- Figure 9: South America Oxyclozanide Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Oxyclozanide Revenue (million), by Types 2024 & 2032

- Figure 11: South America Oxyclozanide Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Oxyclozanide Revenue (million), by Country 2024 & 2032

- Figure 13: South America Oxyclozanide Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Oxyclozanide Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Oxyclozanide Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Oxyclozanide Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Oxyclozanide Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Oxyclozanide Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Oxyclozanide Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Oxyclozanide Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Oxyclozanide Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Oxyclozanide Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Oxyclozanide Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Oxyclozanide Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Oxyclozanide Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Oxyclozanide Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Oxyclozanide Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Oxyclozanide Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Oxyclozanide Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Oxyclozanide Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Oxyclozanide Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Oxyclozanide Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Oxyclozanide Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Oxyclozanide Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Oxyclozanide Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Oxyclozanide Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Oxyclozanide Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Oxyclozanide Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Oxyclozanide Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Oxyclozanide Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Oxyclozanide Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Oxyclozanide Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Oxyclozanide Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Oxyclozanide Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Oxyclozanide Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Oxyclozanide Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Oxyclozanide Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Oxyclozanide Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Oxyclozanide Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Oxyclozanide Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Oxyclozanide Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oxyclozanide?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Oxyclozanide?

Key companies in the market include Siflon Drugs, Yabang, Gharda, ASCENT PHARMA, Aarambh Life Science, ProVentus, Excel Industries, Konar Organics, Neha Pharma, D. H. Organics, Neeta Interchem.

3. What are the main segments of the Oxyclozanide?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 5600.00, USD 8400.00, and USD 11200.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oxyclozanide," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oxyclozanide report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oxyclozanide?

To stay informed about further developments, trends, and reports in the Oxyclozanide, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence