Key Insights

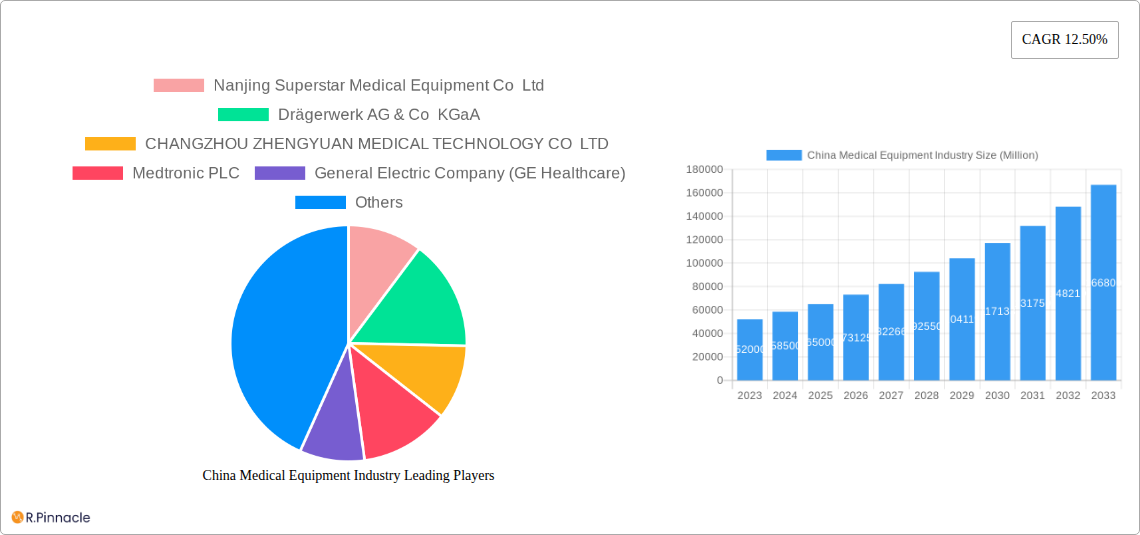

The China Medical Equipment Industry is poised for robust expansion, projected to reach a market size of approximately $65,000 million by 2025 and achieve a Compound Annual Growth Rate (CAGR) of 12.50% through 2033. This impressive growth is fueled by a confluence of factors, including an aging population, increasing disposable incomes, and a growing emphasis on advanced healthcare solutions. The "Made in China 2025" initiative continues to propel domestic innovation and manufacturing capabilities, driving the demand for both diagnostic and monitoring devices, as well as therapeutic equipment. Furthermore, significant investments in healthcare infrastructure, particularly in underserved rural areas, are creating substantial opportunities for market players. The rising prevalence of chronic diseases such as cardiovascular conditions and diabetes necessitates advanced medical technologies for diagnosis, monitoring, and treatment, further underpinning market expansion.

The market segmentation reveals a dynamic landscape with strong performance anticipated across various applications and device types. Respiratory care and cardiovascular care segments are expected to lead the growth trajectory, driven by the increasing burden of related diseases. The anesthesia and critical care segment will also witness steady progress, influenced by advancements in intensive care and surgical procedures. In terms of device types, diagnostic and monitoring devices are in high demand due to the growing need for early disease detection and personalized treatment. Therapeutic devices are also seeing significant uptake as China focuses on improving patient outcomes and rehabilitation. The competitive landscape features both global giants like Medtronic, GE Healthcare, and Philips, alongside formidable domestic players such as Nanjing Superstar Medical Equipment Co Ltd and Drägerwerk AG & Co KGaA, indicating a vibrant and evolving market characterized by innovation and strategic collaborations.

China Medical Equipment Industry: Market Insights, Innovations, and Growth Projections (2019-2033)

This comprehensive report offers an in-depth analysis of the China Medical Equipment Industry, a rapidly expanding and strategically vital sector. Leveraging high-ranking keywords such as "medical devices China," "healthcare technology Asia," "diagnostic equipment market," and "therapeutic devices China," this report provides industry professionals with actionable insights, market forecasts, and a deep understanding of the competitive landscape. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period of 2025-2033, this analysis is meticulously designed to guide strategic decision-making in this dynamic market.

China Medical Equipment Industry Market Structure & Innovation Trends

The China Medical Equipment Industry exhibits a moderately concentrated market structure, with a growing emphasis on innovation driven by increasing healthcare expenditure and a burgeoning demand for advanced medical solutions. Key innovation drivers include the national drive for self-sufficiency in high-end medical devices, favorable government policies supporting R&D, and the growing presence of multinational corporations alongside robust domestic players. Regulatory frameworks are evolving, with an increasing focus on product quality, safety, and market access, influencing both domestic and international companies. Product substitutes are becoming more sophisticated, particularly with advancements in digital health and telemedicine, pushing traditional device manufacturers to innovate. End-user demographics are shifting towards an aging population and a rising middle class with greater purchasing power and awareness of healthcare needs. Mergers and Acquisitions (M&A) activities are on the rise, as companies seek to expand their product portfolios, gain market share, and acquire cutting-edge technologies. M&A deal values are expected to grow significantly, with substantial investments in areas like AI-powered diagnostics and advanced surgical robotics. Market share is gradually consolidating among key players, but opportunities remain for niche innovators.

China Medical Equipment Industry Market Dynamics & Trends

The China Medical Equipment Industry is poised for robust growth, propelled by a confluence of powerful market dynamics and evolving trends. A primary growth driver is the significant increase in government healthcare spending, coupled with rising disposable incomes that enhance the affordability of medical devices for a larger segment of the population. The ongoing demographic shifts, particularly the aging population and the increasing prevalence of chronic diseases such as cardiovascular conditions, respiratory ailments, and diabetes, create sustained demand for both diagnostic and therapeutic medical equipment. Technological disruptions are rapidly transforming the industry, with the integration of artificial intelligence (AI), machine learning, big data analytics, and the Internet of Medical Things (IoMT) enabling the development of smarter, more connected, and personalized healthcare solutions. This includes advancements in remote patient monitoring, AI-driven diagnostic imaging, and robotic surgery. Consumer preferences are increasingly leaning towards minimally invasive procedures, preventative care, and home-based healthcare solutions, necessitating the development of portable, user-friendly, and technologically advanced devices. The competitive dynamics are intensifying, with both established global players and ambitious domestic manufacturers vying for market share. The government's "Made in China 2025" initiative continues to foster domestic innovation and encourage local production of high-value medical devices, creating both opportunities and challenges for international companies. Market penetration is deep across major urban centers, with significant potential for expansion into Tier 2 and Tier 3 cities and rural areas as infrastructure and healthcare access improve. The compound annual growth rate (CAGR) for the China medical equipment market is projected to be approximately 12.5% from 2025 to 2033, reflecting its significant growth trajectory.

Dominant Regions & Segments in China Medical Equipment Industry

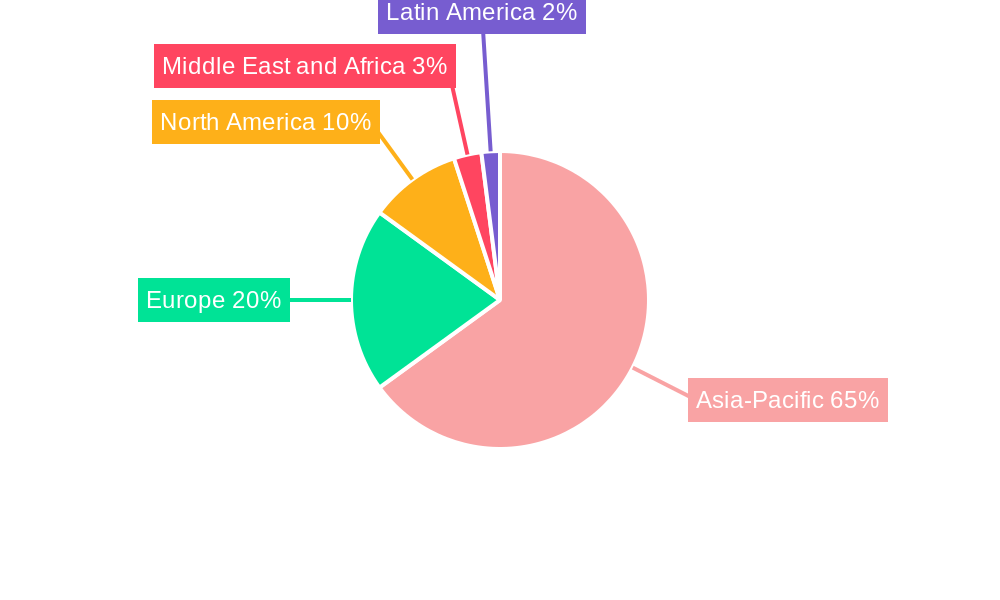

The Asia-Pacific region, with China as its powerhouse, stands as the dominant force in the global medical equipment market. Within China, the Eastern coastal regions, including Jiangsu, Guangdong, and Zhejiang provinces, are leading the charge due to their robust manufacturing capabilities, advanced research infrastructure, and significant concentration of healthcare facilities.

Dominant Segments by Type:

- Diagnostic and Monitoring Devices: This segment holds the largest market share, driven by the increasing focus on early disease detection and continuous patient monitoring. The demand for advanced imaging equipment, in-vitro diagnostic (IVD) devices, and wearable health trackers is particularly strong. Key drivers include growing awareness of preventative healthcare, the rising incidence of chronic diseases, and technological advancements enabling more accurate and faster diagnostics.

- Therapeutic Devices: This segment is also experiencing substantial growth, fueled by an aging population requiring chronic disease management and an increasing number of complex surgical procedures. Innovations in surgical robotics, advanced implantable devices, and respiratory support systems are key contributors.

- Disposables: While a steady segment, the demand for medical disposables is intrinsically linked to the volume of procedures and patient care, making it a consistent performer.

Dominant Segments by Application:

- Cardiovascular Care: This application dominates due to the high prevalence of cardiovascular diseases in China, making it a critical area for investment in diagnostic tools, interventional devices, and therapeutic equipment. Government initiatives to tackle heart disease further boost this segment.

- Respiratory Care: With increasing air pollution and the growing burden of respiratory illnesses like COPD, this segment is witnessing significant expansion. The development of advanced ventilators, oxygen concentrators, and nebulizers, alongside novel treatments, is a key trend.

- Anesthesia and Critical Care: The ongoing expansion of hospital infrastructure and the increasing complexity of critical care cases drive demand for sophisticated anesthesia machines, patient monitors, and other critical care equipment.

- Diabetes Management: The surging rates of diabetes in China create a massive market for blood glucose monitors, insulin pumps, and related consumables.

- Orthopedics and Traumatology: An aging population and a rise in sports-related injuries contribute to the growth of this segment, with demand for implants, surgical instruments, and rehabilitation devices.

The dominance of these segments is underpinned by supportive government policies, substantial investments in healthcare infrastructure, a growing pool of skilled medical professionals, and an increasing emphasis on improving healthcare outcomes for the vast Chinese population.

China Medical Equipment Industry Product Innovations

Product innovations in the China Medical Equipment Industry are characterized by a strong emphasis on miniaturization, AI integration, and user-friendliness. Companies are developing advanced diagnostic imaging systems with enhanced resolution and reduced scan times, alongside intelligent monitoring devices that leverage AI for predictive analytics and personalized treatment recommendations. In therapeutic devices, innovations are focused on minimally invasive surgical instruments, advanced robotic systems for precision surgery, and smart prosthetics. The competitive advantage lies in developing devices that offer superior clinical outcomes, cost-effectiveness, and seamless integration into existing healthcare workflows. Technological trends such as 5G connectivity and cloud computing are enabling remote diagnostics and tele-rehabilitation, expanding market reach and patient accessibility.

Report Scope & Segmentation Analysis

This report provides a granular analysis of the China Medical Equipment Industry, encompassing detailed segmentations by product type, application, and region.

- By Type: The market is segmented into Diagnostic and Monitoring Devices, Therapeutic Devices, and Disposables. Each segment is analyzed for its current market size, projected growth, and competitive landscape.

- By Application: Key applications covered include Respiratory Care, Cardiovascular Care, Anesthesia and Critical Care, Diabetes Management, and Orthopedics and Traumatology. Growth projections and market dynamics for each application are meticulously detailed.

- By Region: The report offers insights into the performance and potential of the Asia-Pacific (with a focus on China), Europe, North America, Latin America, and Middle East and Africa markets, highlighting regional specificities and competitive dynamics.

This comprehensive segmentation allows for a detailed understanding of market opportunities and challenges across various facets of the China medical equipment ecosystem.

Key Drivers of China Medical Equipment Industry Growth

The growth of the China Medical Equipment Industry is propelled by several key drivers. Technological advancements are paramount, with the adoption of AI, IoT, and big data analytics leading to smarter, more efficient devices. Increasing healthcare expenditure, both by the government and private entities, is a significant catalyst, improving access and demand for advanced equipment. Favorable government policies, including initiatives promoting domestic manufacturing and R&D, are fostering innovation and investment. Furthermore, the growing burden of chronic diseases and an aging population are creating sustained demand for a wide range of medical devices. The rising disposable income of the Chinese population also contributes to a greater willingness and ability to invest in advanced healthcare solutions.

Challenges in the China Medical Equipment Industry Sector

Despite its robust growth, the China Medical Equipment Industry faces several challenges. Stringent regulatory hurdles and lengthy approval processes can hinder the market entry of new products and technologies. Intense competition, both from domestic and international players, puts pressure on pricing and profit margins. Supply chain disruptions, as witnessed globally, can impact the availability of critical components and raw materials. Furthermore, the need for skilled healthcare professionals to operate and maintain advanced medical equipment presents an ongoing challenge, particularly in less developed regions. Intellectual property protection remains a concern for some innovators, and the cost of R&D for highly specialized devices can be substantial.

Emerging Opportunities in China Medical Equipment Industry

Emerging opportunities in the China Medical Equipment Industry lie in several key areas. The burgeoning telemedicine and remote patient monitoring market offers significant potential for companies developing connected devices and digital health platforms. The increasing focus on preventative healthcare and wellness is creating demand for innovative diagnostic tools and wearable health trackers. There is also substantial opportunity in AI-driven medical diagnostics, where artificial intelligence can significantly improve accuracy and efficiency. The continuous expansion of healthcare infrastructure in rural and underserved areas presents a vast market for more affordable and accessible medical equipment. Furthermore, the growing demand for personalized medicine opens avenues for advanced therapeutic devices and companion diagnostics.

Leading Players in the China Medical Equipment Industry Market

- Nanjing Superstar Medical Equipment Co Ltd

- Drägerwerk AG & Co KGaA

- CHANGZHOU ZHENGYUAN MEDICAL TECHNOLOGY CO LTD

- Medtronic PLC

- General Electric Company (GE Healthcare)

- Koninklijke Philips NV

- ResMed Inc

- Teleflex Incorporated

- Fisher & Paykel Healthcare Ltd

Key Developments in China Medical Equipment Industry Industry

- August 2022: Nuance Pharma received the Center for Drug Evaluation (CDE) approval for its Investigational New Drug (IND) application supporting its pivotal clinical trial of Ensifentrine for the maintenance treatment of chronic obstructive pulmonary disease (COPD) in mainland China.

- June 2022: AstraZeneca planned to build a manufacturing facility in Qingdao, China, to produce its Breztri aerosol inhalant COPD treatment, which was recently added to the country's National Reimbursement Drug List.

Future Outlook for China Medical Equipment Industry Market

The future outlook for the China Medical Equipment Industry is exceptionally bright, driven by sustained economic growth, escalating healthcare demands, and a commitment to technological innovation. The market is expected to witness accelerated growth in segments like AI-enabled diagnostics, robotic surgery, and personalized therapeutic devices. Increased government investment in healthcare infrastructure and a continued push for self-sufficiency in high-end medical technologies will further fuel domestic production and R&D. The growing emphasis on preventative care and home-based healthcare solutions will also create new avenues for market expansion. Strategic partnerships, M&A activities, and a focus on addressing unmet clinical needs will be critical for players aiming to capitalize on the vast opportunities presented by this dynamic and rapidly evolving market.

China Medical Equipment Industry Segmentation

-

1. Type

- 1.1. Diagnostic and Monitoring Devices

- 1.2. Therapeutic Devices

- 1.3. Disposables

-

2. Application

- 2.1. Respiratory Care

- 2.2. Cardiovascular Care

- 2.3. Anesthesia and Critical Care

- 2.4. Diabetes Management

- 2.5. Orthopedics and Traumatology

-

3. Region

- 3.1. Asia-Pacific

- 3.2. Europe

- 3.3. North America

- 3.4. Latin America

- 3.5. Middle East and Africa

China Medical Equipment Industry Segmentation By Geography

- 1. China

China Medical Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Prevalence of Respiratory Disorders

- 3.2.2 such as COPD

- 3.2.3 TB

- 3.2.4 and Asthma; Technological Advancements and Increasing Applications in Homecare Setting

- 3.3. Market Restrains

- 3.3.1. High Cost of Devices

- 3.4. Market Trends

- 3.4.1. The Pulse Oximeters Segment is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Medical Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Diagnostic and Monitoring Devices

- 5.1.2. Therapeutic Devices

- 5.1.3. Disposables

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Respiratory Care

- 5.2.2. Cardiovascular Care

- 5.2.3. Anesthesia and Critical Care

- 5.2.4. Diabetes Management

- 5.2.5. Orthopedics and Traumatology

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia-Pacific

- 5.3.2. Europe

- 5.3.3. North America

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Nanjing Superstar Medical Equipment Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Drägerwerk AG & Co KGaA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CHANGZHOU ZHENGYUAN MEDICAL TECHNOLOGY CO LTD

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Medtronic PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Electric Company (GE Healthcare)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Koninklijke Philips NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ResMed Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Teleflex Incorporated

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fisher & Paykel Healthcare Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Nanjing Superstar Medical Equipment Co Ltd

List of Figures

- Figure 1: China Medical Equipment Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Medical Equipment Industry Share (%) by Company 2024

List of Tables

- Table 1: China Medical Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Medical Equipment Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: China Medical Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: China Medical Equipment Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: China Medical Equipment Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: China Medical Equipment Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: China Medical Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: China Medical Equipment Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: China Medical Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: China Medical Equipment Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: China Medical Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: China Medical Equipment Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: China Medical Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: China Medical Equipment Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 15: China Medical Equipment Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 16: China Medical Equipment Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 17: China Medical Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 18: China Medical Equipment Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 19: China Medical Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China Medical Equipment Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Medical Equipment Industry?

The projected CAGR is approximately 12.50%.

2. Which companies are prominent players in the China Medical Equipment Industry?

Key companies in the market include Nanjing Superstar Medical Equipment Co Ltd, Drägerwerk AG & Co KGaA, CHANGZHOU ZHENGYUAN MEDICAL TECHNOLOGY CO LTD , Medtronic PLC, General Electric Company (GE Healthcare), Koninklijke Philips NV, ResMed Inc, Teleflex Incorporated, Fisher & Paykel Healthcare Ltd.

3. What are the main segments of the China Medical Equipment Industry?

The market segments include Type, Application, Region.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Respiratory Disorders. such as COPD. TB. and Asthma; Technological Advancements and Increasing Applications in Homecare Setting.

6. What are the notable trends driving market growth?

The Pulse Oximeters Segment is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Devices.

8. Can you provide examples of recent developments in the market?

In August 2022, Nuance Pharma received the Center for Drug Evaluation (CDE) approval for its Investigational New Drug (IND) application supporting its pivotal clinical trial of Ensifentrine for the maintenance treatment of chronic obstructive pulmonary disease (COPD) in mainland China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Medical Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Medical Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Medical Equipment Industry?

To stay informed about further developments, trends, and reports in the China Medical Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence