Key Insights

The North America Digital Diabetes Management Market is poised for significant expansion, projected to reach $27.52 million by 2025 with a robust Compound Annual Growth Rate (CAGR) of 6.21% over the forecast period of 2025-2033. This growth is primarily fueled by the increasing prevalence of diabetes across the region, coupled with a growing awareness and adoption of advanced digital solutions for better patient outcomes. Key market drivers include the technological advancements in monitoring and management devices, the growing demand for personalized healthcare, and supportive government initiatives aimed at improving chronic disease management. The market is experiencing a notable shift towards continuous glucose monitoring (CGM) systems, driven by their ability to provide real-time data and reduce the burden of frequent fingerpricks. Furthermore, the integration of artificial intelligence and machine learning in diabetes management platforms is enhancing predictive analytics and personalized treatment plans, further stimulating market growth.

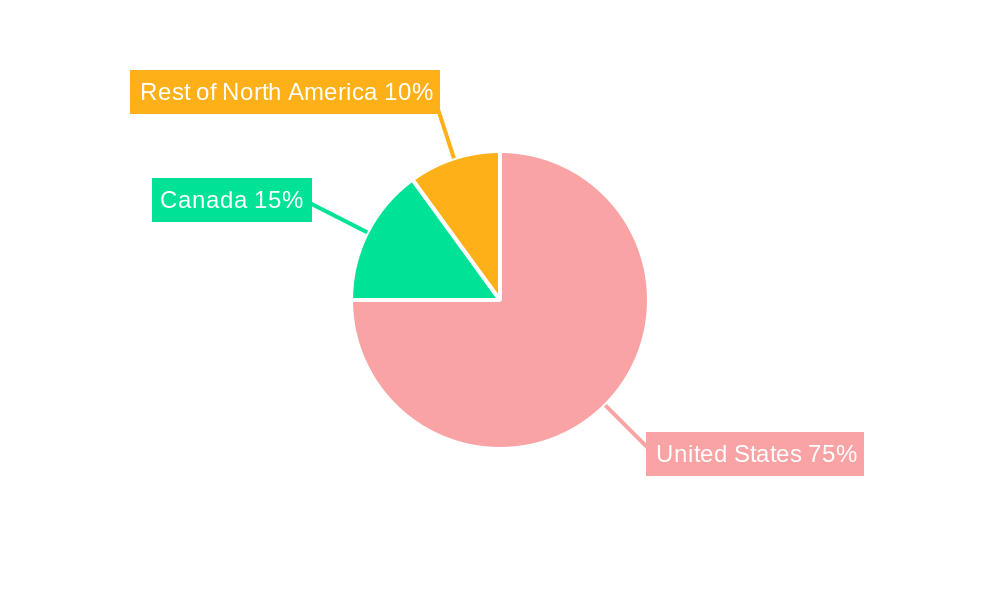

The digital diabetes management landscape in North America is characterized by innovation across its diverse segments. The Monitoring Devices segment, encompassing self-monitoring blood glucose devices and continuous glucose monitoring systems, is witnessing rapid evolution with a focus on user-friendliness and data accuracy. Within management devices, insulin pumps and advanced delivery systems like insulin pens and jet injectors are gaining traction, offering greater convenience and improved glycemic control for patients. The market’s geographical segmentation highlights the United States as the dominant region, followed by Canada and the Rest of North America, reflecting varying levels of technological adoption and healthcare infrastructure. Despite the promising growth trajectory, the market faces certain restraints, including the high cost of some advanced devices, concerns around data privacy and security, and the need for greater patient and healthcare provider education to ensure widespread adoption of these digital tools.

Unlock critical insights into the rapidly evolving North American Digital Diabetes Management Market. This in-depth report provides a data-driven analysis of market dynamics, segmentation, competitive landscape, and future growth trajectory from 2019 to 2033. Gain actionable intelligence for strategic decision-making in this high-impact sector.

The North America Digital Diabetes Management Market is experiencing significant expansion, driven by increasing diabetes prevalence, technological advancements, and a growing emphasis on proactive health management. This report offers a detailed examination of market size, CAGR, segmentation, key players, and emerging trends, empowering stakeholders with the knowledge to navigate this dynamic landscape.

North America Digital Diabetes Management Market Market Structure & Innovation Trends

The North America Digital Diabetes Management Market is characterized by a moderate to high level of concentration, with a few key players dominating significant market share. This concentration is driven by substantial R&D investments, established distribution networks, and strong brand recognition. Innovation is a critical differentiator, fueled by advancements in wearable technology, AI-driven analytics, and personalized treatment plans. The regulatory landscape, overseen by bodies like the FDA, plays a crucial role in shaping product approvals and market entry, ensuring the safety and efficacy of digital diabetes solutions. While direct product substitutes are limited, traditional diabetes management methods still represent a form of indirect competition. End-user demographics are diverse, encompassing individuals with Type 1 and Type 2 diabetes, gestational diabetes, and pre-diabetes, with an increasing adoption among tech-savvy younger generations and proactive older adults. Mergers and Acquisitions (M&A) are a prominent feature, with deal values in the tens to hundreds of millions, indicative of strategic consolidation and market expansion efforts by established companies seeking to acquire innovative technologies and broaden their product portfolios. For instance, recent M&A activities have focused on integrating advanced CGM technologies and AI-powered coaching platforms.

North America Digital Diabetes Management Market Market Dynamics & Trends

The North America Digital Diabetes Management Market is poised for substantial growth, projected to experience a Compound Annual Growth Rate (CAGR) of approximately 10-12% during the forecast period (2025-2033). This robust expansion is propelled by a confluence of powerful growth drivers. The escalating prevalence of diabetes across North America, fueled by sedentary lifestyles and dietary changes, creates an ever-expanding patient pool actively seeking effective management solutions. Technological disruptions are at the forefront, with the continuous evolution of Continuous Glucose Monitoring (CGM) systems, smart insulin pens, and integrated diabetes management platforms offering unprecedented accuracy, convenience, and real-time data for both patients and healthcare providers. These innovations are not only improving glycemic control but also enhancing the quality of life for individuals living with diabetes. Consumer preferences are rapidly shifting towards proactive, personalized, and data-driven health management. Patients are increasingly demanding tools that empower them to understand their condition better, make informed decisions, and actively participate in their treatment journey. The desire for remote monitoring, telehealth integration, and user-friendly interfaces is a significant trend.

Competitive dynamics within the market are intense, with both established pharmaceutical and medical device companies and agile tech startups vying for market share. This competition fosters a rapid pace of innovation and drives down costs, making advanced digital solutions more accessible. Strategic partnerships between technology providers, healthcare institutions, and insurance companies are becoming increasingly common, aiming to facilitate wider adoption and reimbursement of digital diabetes management tools. The market penetration of digital diabetes management solutions is steadily increasing, moving beyond early adopters to a broader consumer base. Government initiatives promoting digital health adoption and reimbursement policies favoring innovative diabetes care further bolster market expansion. The focus is shifting from reactive treatment to preventative care and long-term disease management, aligning perfectly with the capabilities offered by digital solutions. The increasing adoption of smartphones and wearable devices, coupled with advancements in connectivity and data analytics, provides a fertile ground for the growth of this sector. The market is witnessing a strong trend towards interoperability, where different devices and platforms can seamlessly exchange data, creating a holistic view of a patient's health.

Dominant Regions & Segments in North America Digital Diabetes Management Market

The United States unequivocally dominates the North America Digital Diabetes Management Market, accounting for a substantial majority of market share, estimated to be around 85-90%. This dominance is attributable to several key factors.

- Economic Policies and Healthcare Infrastructure: The U.S. boasts a highly developed healthcare system with significant investment in medical technology and research. Favorable reimbursement policies for diabetes management devices and services, coupled with a strong presence of private health insurance, facilitate the adoption of advanced digital solutions. Government initiatives aimed at promoting digital health and value-based care further accelerate market penetration.

- High Diabetes Prevalence and Awareness: The U.S. has one of the highest rates of diabetes prevalence globally, creating a vast and persistent demand for effective management tools. There is also a high level of patient and physician awareness regarding the benefits of proactive and technology-assisted diabetes care.

- Technological Innovation and R&D Hubs: The concentration of leading medical device manufacturers, pharmaceutical companies, and technology innovators in the U.S. drives continuous product development and market introduction of cutting-edge digital diabetes management solutions.

Within the Product segmentation, Monitoring Devices are the leading segment, primarily driven by the burgeoning Continuous Glucose Monitoring (CGM) market. The segment's dominance stems from the increasing clinical evidence supporting CGM's superiority in improving glycemic control, reducing hypoglycemia, and enhancing patient engagement. The advancements in sensor technology, miniaturization, and data transmission have made CGMs more accessible and user-friendly.

- Continuous Glucose Monitoring (CGM): This sub-segment is experiencing exponential growth.

- Sensors: Innovations in sensor accuracy, longevity, and ease of insertion are key growth drivers.

- Durables: The development of longer-lasting sensor components and more advanced reader/transmitter devices contributes to market expansion.

- Self-monitoring Blood Glucose Devices (SMBG): While CGM is gaining traction, SMBG devices like glucometers and test strips remain crucial for a significant portion of the population due to their lower cost and established usage.

Management Devices, particularly Insulin Pumps, are also significant contributors to market revenue, driven by their ability to offer more sophisticated insulin delivery and automation.

- Insulin Pump:

- Insulin Pump Device:ancements in closed-loop systems and patch pumps are driving adoption.

- Insulin Pump Reservoir and Infusion Set: These recurring consumables represent a steady revenue stream.

Canada represents a significant, albeit smaller, market within North America. Its growth is supported by a universal healthcare system that increasingly recognizes the value of digital health interventions for chronic disease management, alongside increasing patient adoption of advanced diabetes technologies.

North America Digital Diabetes Management Market Product Innovations

The North America Digital Diabetes Management Market is consistently enriched by product innovations focused on enhancing user experience, accuracy, and integration. Continuous Glucose Monitoring (CGM) systems are at the forefront, with advancements in smaller, thinner, and more discreet sensors like Abbott's FreeStyle Libre 3 offering unparalleled comfort and wearability. The integration of these sensors with smart algorithms provides real-time glucose trend data, empowering users with proactive insights. Smart insulin pens and automated insulin delivery systems (insulin pumps) are evolving with enhanced connectivity and personalized dosing algorithms, simplifying insulin management. The development of AI-powered analytics platforms that interpret glucose data and offer personalized lifestyle recommendations is another key trend, promising to transform diabetes self-management. These innovations aim to reduce the burden of diabetes, improve glycemic control, and ultimately enhance the quality of life for millions.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the North America Digital Diabetes Management Market, segmented by Product and Geography. The Product segmentation includes Monitoring Devices, further divided into Self-monitoring Blood Glucose Devices (Glucometer Devices, Blood Glucose Test Strips, Lancets) and Continuous Glucose Monitoring (Sensors, Durables). The Management Devices segment encompasses Insulin Pumps (Insulin Pump Device, Insulin Pump Reservoir, Infusion Set), Insulin Syringes, Cartridges in Reusable pens, Insulin Disposable Pens, and Jet Injectors. The Geographical segmentation covers the United States, Canada, and the Rest of North America. The United States is projected to maintain its leading position due to high adoption rates and a robust technological ecosystem. The CGM segment is expected to witness the highest growth rate within the product categories.

Key Drivers of North America Digital Diabetes Management Market Growth

The North America Digital Diabetes Management Market growth is propelled by several critical factors. The increasing global prevalence of diabetes, driven by lifestyle changes, is creating a vast and growing patient base. Technological advancements in wearable sensors, AI-powered analytics, and connected devices are leading to more accurate, convenient, and personalized diabetes management solutions. Growing patient awareness and demand for proactive self-management tools are pushing individuals to adopt digital health technologies. Furthermore, favorable reimbursement policies and government initiatives promoting digital health adoption and chronic disease management are significantly accelerating market penetration. The shift towards value-based healthcare models also encourages the use of digital tools that can improve patient outcomes and reduce long-term healthcare costs.

Challenges in the North America Digital Diabetes Management Market Sector

Despite its promising growth, the North America Digital Diabetes Management Market faces several challenges. High upfront costs of some advanced digital devices, particularly certain insulin pumps and continuous glucose monitors, can be a barrier to widespread adoption, especially for uninsured or underinsured populations. Regulatory hurdles and lengthy approval processes for new devices and software updates can slow down market entry and innovation. Data security and privacy concerns associated with handling sensitive health information require robust cybersecurity measures and public trust. Interoperability issues between different devices, platforms, and electronic health records can hinder seamless data integration and comprehensive patient care. Lastly, resistance to change among some healthcare providers and patients, coupled with a need for adequate training and education on using these technologies, presents ongoing challenges for market penetration and effective utilization.

Emerging Opportunities in North America Digital Diabetes Management Market

The North America Digital Diabetes Management Market presents numerous emerging opportunities. The expansion of telehealth and remote patient monitoring services offers significant potential for digital diabetes solutions to be integrated into virtual care models, improving accessibility and patient engagement. The development of more affordable and accessible CGM systems and smart insulin pens will cater to a broader patient demographic. Advancements in AI and machine learning algorithms are creating opportunities for predictive analytics, personalized coaching, and automated insulin delivery that can further optimize diabetes management. The increasing focus on preventive care and pre-diabetes management opens avenues for digital tools that can identify at-risk individuals and provide early interventions. Furthermore, partnerships between technology companies, healthcare providers, and insurance payers are creating collaborative ecosystems that can drive innovation, facilitate reimbursement, and expand market reach. The growing interest in integrating diabetes management with other chronic condition management platforms also represents a significant growth avenue.

Leading Players in the North America Digital Diabetes Management Market Market

- Becton Dickinson and Company

- Ypsomed

- Sanofi

- Medtronic

- Tandem

- Insulet

- F Hoffmann-La Roche AG

- Abbott

- Novo Nordisk

- Dexcom

- Eli Lilly

Key Developments in North America Digital Diabetes Management Market Industry

- April 2023: Abbott announced the clearance of its FreeStyle Libre 3 integrated continuous glucose monitoring (iCGM) system by the U.S. Food and Drug Administration (FDA). This system includes a reader that has been approved as a standalone device. Notably, the glucose sensor used in this system is the smallest, thinnest, and most discreet in the world. Abbott is now focused on expediting the process of getting the FreeStyle Libre 3 system included in Medicare's list of covered systems.

- March 2022: Dexcom released G7 first in the U.K. and will expand the launch across Europe throughout 2022. Meanwhile, the CGM system currently is under review by the Food and Drug Administration for an eventual U.S. release.

Future Outlook for North America Digital Diabetes Management Market Market

- April 2023: Abbott announced the clearance of its FreeStyle Libre 3 integrated continuous glucose monitoring (iCGM) system by the U.S. Food and Drug Administration (FDA). This system includes a reader that has been approved as a standalone device. Notably, the glucose sensor used in this system is the smallest, thinnest, and most discreet in the world. Abbott is now focused on expediting the process of getting the FreeStyle Libre 3 system included in Medicare's list of covered systems.

- March 2022: Dexcom released G7 first in the U.K. and will expand the launch across Europe throughout 2022. Meanwhile, the CGM system currently is under review by the Food and Drug Administration for an eventual U.S. release.

Future Outlook for North America Digital Diabetes Management Market Market

The future outlook for the North America Digital Diabetes Management Market is exceptionally bright, marked by continued innovation and increasing adoption. The convergence of advanced sensor technology, artificial intelligence, and personalized medicine will lead to highly sophisticated and automated diabetes management solutions. We anticipate a significant rise in closed-loop insulin delivery systems that mimic the function of a healthy pancreas, offering near-perfect glycemic control. The market will witness greater integration of digital diabetes tools with broader health and wellness platforms, enabling a holistic approach to chronic disease management. Furthermore, increasing regulatory support and expanding reimbursement coverage will make these advanced technologies more accessible to a wider patient population. The growing emphasis on preventive healthcare and early intervention will also drive the demand for digital solutions that can identify individuals at risk and provide proactive support. Strategic collaborations and M&A activities are expected to continue, consolidating the market and fostering the development of comprehensive diabetes care ecosystems, ultimately improving health outcomes and reducing the global burden of diabetes.

North America Digital Diabetes Management Market Segmentation

-

1. Product

-

1.1. Monitoring Devices

-

1.1.1. Self-monitoring Blood Glucose Devices

- 1.1.1.1. Glucometer Devices

- 1.1.1.2. Blood Glucose Test Strips

- 1.1.1.3. Lancets

-

1.1.2. Continuous Glucose Monitoring

- 1.1.2.1. Sensors

- 1.1.2.2. Durables

-

1.1.1. Self-monitoring Blood Glucose Devices

-

1.2. Management Devices

-

1.2.1. Insulin Pump

- 1.2.1.1. Insulin Pump Device

- 1.2.1.2. Insulin Pump Reservoir

- 1.2.1.3. Infusion Set

- 1.2.2. Insulin Syringes

- 1.2.3. Cartridges in Reusable pens

- 1.2.4. Insulin Disposable Pens

- 1.2.5. Jet Injectors

-

1.2.1. Insulin Pump

-

1.1. Monitoring Devices

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America Digital Diabetes Management Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Digital Diabetes Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Preterm and Low-weight Births; Advanced Technology in Fetal and Prenatal Monitoring

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Procedures

- 3.4. Market Trends

- 3.4.1. Monitoring Devices is Having the Highest Market Share in Current Year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Digital Diabetes Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Monitoring Devices

- 5.1.1.1. Self-monitoring Blood Glucose Devices

- 5.1.1.1.1. Glucometer Devices

- 5.1.1.1.2. Blood Glucose Test Strips

- 5.1.1.1.3. Lancets

- 5.1.1.2. Continuous Glucose Monitoring

- 5.1.1.2.1. Sensors

- 5.1.1.2.2. Durables

- 5.1.1.1. Self-monitoring Blood Glucose Devices

- 5.1.2. Management Devices

- 5.1.2.1. Insulin Pump

- 5.1.2.1.1. Insulin Pump Device

- 5.1.2.1.2. Insulin Pump Reservoir

- 5.1.2.1.3. Infusion Set

- 5.1.2.2. Insulin Syringes

- 5.1.2.3. Cartridges in Reusable pens

- 5.1.2.4. Insulin Disposable Pens

- 5.1.2.5. Jet Injectors

- 5.1.2.1. Insulin Pump

- 5.1.1. Monitoring Devices

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America Digital Diabetes Management Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Monitoring Devices

- 6.1.1.1. Self-monitoring Blood Glucose Devices

- 6.1.1.1.1. Glucometer Devices

- 6.1.1.1.2. Blood Glucose Test Strips

- 6.1.1.1.3. Lancets

- 6.1.1.2. Continuous Glucose Monitoring

- 6.1.1.2.1. Sensors

- 6.1.1.2.2. Durables

- 6.1.1.1. Self-monitoring Blood Glucose Devices

- 6.1.2. Management Devices

- 6.1.2.1. Insulin Pump

- 6.1.2.1.1. Insulin Pump Device

- 6.1.2.1.2. Insulin Pump Reservoir

- 6.1.2.1.3. Infusion Set

- 6.1.2.2. Insulin Syringes

- 6.1.2.3. Cartridges in Reusable pens

- 6.1.2.4. Insulin Disposable Pens

- 6.1.2.5. Jet Injectors

- 6.1.2.1. Insulin Pump

- 6.1.1. Monitoring Devices

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Canada North America Digital Diabetes Management Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Monitoring Devices

- 7.1.1.1. Self-monitoring Blood Glucose Devices

- 7.1.1.1.1. Glucometer Devices

- 7.1.1.1.2. Blood Glucose Test Strips

- 7.1.1.1.3. Lancets

- 7.1.1.2. Continuous Glucose Monitoring

- 7.1.1.2.1. Sensors

- 7.1.1.2.2. Durables

- 7.1.1.1. Self-monitoring Blood Glucose Devices

- 7.1.2. Management Devices

- 7.1.2.1. Insulin Pump

- 7.1.2.1.1. Insulin Pump Device

- 7.1.2.1.2. Insulin Pump Reservoir

- 7.1.2.1.3. Infusion Set

- 7.1.2.2. Insulin Syringes

- 7.1.2.3. Cartridges in Reusable pens

- 7.1.2.4. Insulin Disposable Pens

- 7.1.2.5. Jet Injectors

- 7.1.2.1. Insulin Pump

- 7.1.1. Monitoring Devices

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Rest of North America North America Digital Diabetes Management Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Monitoring Devices

- 8.1.1.1. Self-monitoring Blood Glucose Devices

- 8.1.1.1.1. Glucometer Devices

- 8.1.1.1.2. Blood Glucose Test Strips

- 8.1.1.1.3. Lancets

- 8.1.1.2. Continuous Glucose Monitoring

- 8.1.1.2.1. Sensors

- 8.1.1.2.2. Durables

- 8.1.1.1. Self-monitoring Blood Glucose Devices

- 8.1.2. Management Devices

- 8.1.2.1. Insulin Pump

- 8.1.2.1.1. Insulin Pump Device

- 8.1.2.1.2. Insulin Pump Reservoir

- 8.1.2.1.3. Infusion Set

- 8.1.2.2. Insulin Syringes

- 8.1.2.3. Cartridges in Reusable pens

- 8.1.2.4. Insulin Disposable Pens

- 8.1.2.5. Jet Injectors

- 8.1.2.1. Insulin Pump

- 8.1.1. Monitoring Devices

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. United States North America Digital Diabetes Management Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Digital Diabetes Management Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Digital Diabetes Management Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Digital Diabetes Management Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Becton Dickinson and Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Ypsomed

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Sanofi

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Medtronic

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Tandem

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Insulet

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 F Hoffmann-La Roche AG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Abbott

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Novo Nordisk

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Dexcom

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Eli Lilly*List Not Exhaustive 7 2 Company Share Analysi

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: North America Digital Diabetes Management Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Digital Diabetes Management Market Share (%) by Company 2024

List of Tables

- Table 1: North America Digital Diabetes Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Digital Diabetes Management Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: North America Digital Diabetes Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: North America Digital Diabetes Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Digital Diabetes Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Digital Diabetes Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Digital Diabetes Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Digital Diabetes Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Digital Diabetes Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Digital Diabetes Management Market Revenue Million Forecast, by Product 2019 & 2032

- Table 11: North America Digital Diabetes Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: North America Digital Diabetes Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: North America Digital Diabetes Management Market Revenue Million Forecast, by Product 2019 & 2032

- Table 14: North America Digital Diabetes Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: North America Digital Diabetes Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North America Digital Diabetes Management Market Revenue Million Forecast, by Product 2019 & 2032

- Table 17: North America Digital Diabetes Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Digital Diabetes Management Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Digital Diabetes Management Market?

The projected CAGR is approximately 6.21%.

2. Which companies are prominent players in the North America Digital Diabetes Management Market?

Key companies in the market include Becton Dickinson and Company, Ypsomed, Sanofi, Medtronic, Tandem, Insulet, F Hoffmann-La Roche AG, Abbott, Novo Nordisk, Dexcom, Eli Lilly*List Not Exhaustive 7 2 Company Share Analysi.

3. What are the main segments of the North America Digital Diabetes Management Market?

The market segments include Product, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Preterm and Low-weight Births; Advanced Technology in Fetal and Prenatal Monitoring.

6. What are the notable trends driving market growth?

Monitoring Devices is Having the Highest Market Share in Current Year.

7. Are there any restraints impacting market growth?

Stringent Regulatory Procedures.

8. Can you provide examples of recent developments in the market?

April 2023: Abbott has announced the clearance of its FreeStyle Libre 3 integrated continuous glucose monitoring (iCGM) system by the U.S. Food and Drug Administration (FDA). This system includes a reader that has been approved as a standalone device. Notably, the glucose sensor used in this system is the smallest, thinnest, and most discreet in the world. Abbott is now focused on expediting the process of getting the FreeStyle Libre 3 system included in Medicare's list of covered systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Digital Diabetes Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Digital Diabetes Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Digital Diabetes Management Market?

To stay informed about further developments, trends, and reports in the North America Digital Diabetes Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence